Get Tax POA form dp-2848 Form

Empowering someone to handle tax matters on one's behalf is a significant step that involves the delegation of substantial responsibility and trust. The Tax Power of Attorney (POA) Form, known as DP-2848, is designed for this very purpose. It serves as a legal document through which an individual, the principal, authorizes a trusted representative, often referred to as an agent or attorney-in-fact, to perform tax-related tasks in their stead. This may encompass a wide range of activities, from filing taxes to representing the principal in tax disputes. Understanding the scope and limitations of the form DP-2848 is crucial, as it not only outlines the agent’s authority but also specifies the conditions under which this power is operational. Importantly, while it provides a mechanism for managing tax affairs through another, it also underscores the importance of carefully selecting whom to grant such authority, recognizing the potential legal and financial implications. The nuances of the form, including its validity, the specific powers it grants, and how to correctly complete and file it, are all critical components for individuals considering its use, making it essential to grasp its major aspects comprehensively.

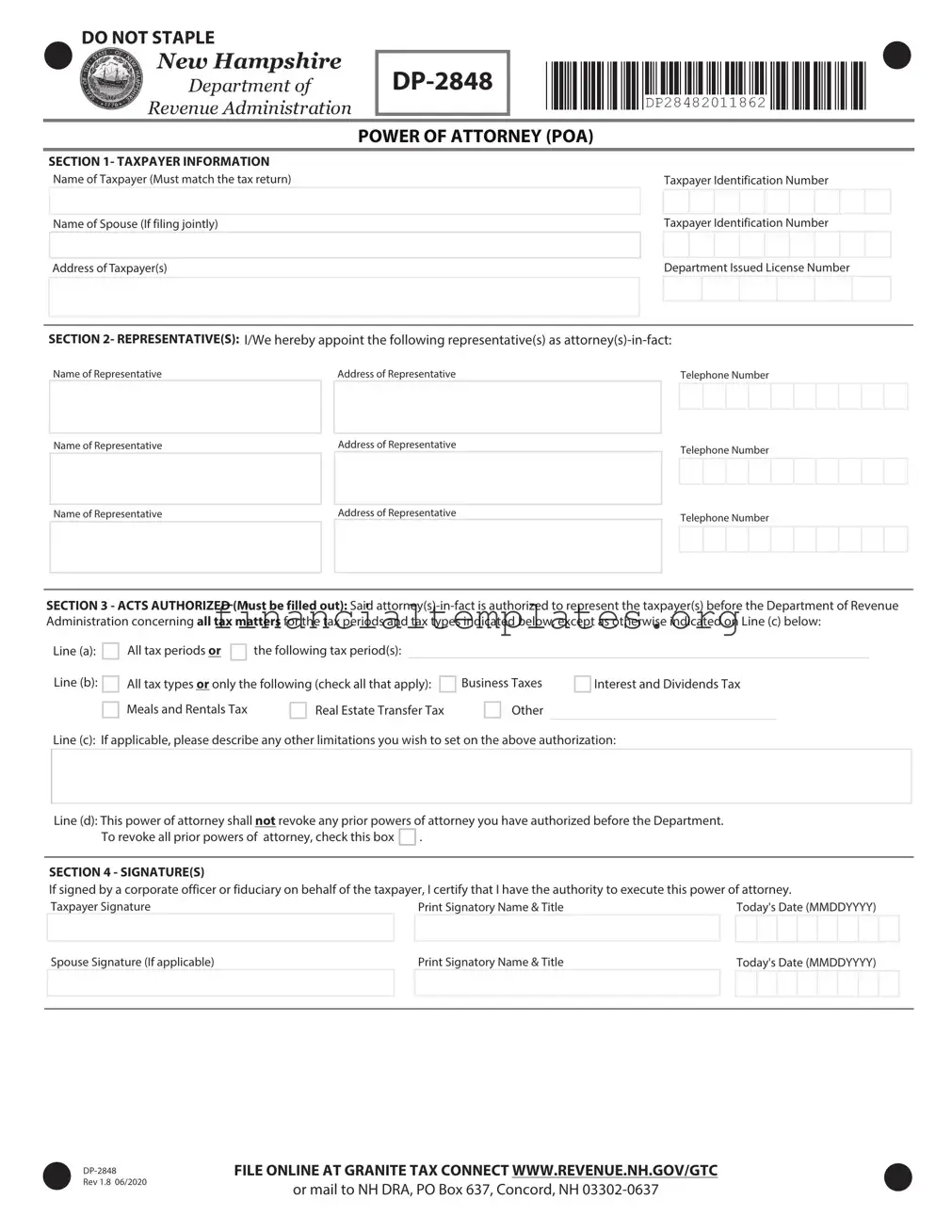

Tax POA form dp-2848 Example

DO NOT STAPLE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

POWER OF ATTORNEY (POA) |

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

SECTION 1- TAXPAYER INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Name of Taxpayer (Mustmatchthe |

tax |

return) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxpayer Identification Number |

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Name of Spouse (If filing jointly) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxpayer Identification Number |

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address of Taxpayer(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Department Issued License Number |

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION 2- REPRESENTATIVE(S): I/We hereby appoint the following representative(s) as

|

Name of Representative |

|

Address of Representative |

Telephone Number |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Representative |

|

Address of Representative |

Telephone Number |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Representative |

|

Address of Representative |

Telephone Number |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION 3 - ACTS AUTHORIZED (Must be filled out): Said

Line (a):

Line (b):

All tax periods or |

|

the following tax period(s): |

All tax types or only the following (check all that apply):

Meals and Rentals Tax |

|

Real Estate Transfer Tax |

Business Taxes

Other

Interest and Dividends Tax

Line (c): If applicable, please describe any other limitations you wish to set on the above authorization:

Line (d): This power of attorney shall not revoke any prior powers of attorney you have authorized before the Department.

To revoke all prior powers of attorney, check this box |

. |

SECTION 4 - SIGNATURE(S)

If signed by a corporate officer or fiduciary on behalf of the taxpayer, I certify that I have the authority to execute this power of attorney.

Taxpayer Signature |

Print Signatory Name & Title |

Today's Date (MMDDYYYY) |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse Signature (If applicable) |

Print Signatory Name & Title |

Today's Date (MMDDYYYY) |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rev 1.8 06/2020

FILE ONLINE AT GRANITE TAX CONNECT WWW.REVENUE.NH.GOV/GTC

or mail to NH DRA, PO Box 637, Concord, NH

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

POWER OF ATTORNEY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

INSTRUCTIONS |

(POA) |

||||||||||||||

|

|

|

|

|

|

|||||||||||

WHEN TO FILE

A Power Of Attorney (POA) is required prior to the Department of Revenue Administration communicating with anyone other than the taxpayer regarding any issue relating to the taxpayer.

WHERE TO FILE

File online at Granite Tax Connect www.revenue.nh.gov/gtc or mail to NH DRA, Taxpayer Services Division, PO Box 637, Concord NH

POA@dra.nh.gov

PLEASE NOTE

All applicable items must be filled in to properly complete Form

SECTION 1 - TAXPAYER INFORMATION

Enter the taxpayer's name (must match the tax return), current mailing address including zip code, and taxpayer identification number (and Department issued license number if applicable). If joint returns are involved and you and your spouse are designating the same representative(s), also enter your spouse's name and taxpayer identification number (and Department issued license number if applicable). If you need to list additional taxpayers, an additional page may be attached with each taxpayer's name and taxpayer identification number.

SECTION 2 - REPRESENTATIVE(S)

Enter the name of the representative(s). This can be an individual(s) or the name of a firm. What you enter in the Name of Representative box determines who the Department will have authority to correspond with as your authorized representative. If you list only an individual(s) name from a firm, then only the individual(s) will have authority to represent you. If you put the firm name in the Name of Representative box then ANYONE with the firm will have the authority to represent you.

Enter the current mailing address including zip code of the representative in the Address of Representative box beside the Name of Representative box. Only the person(s) or firm named in the Name of Representative box has authorization to represent you with the Department. A firm name that is part of an individual's address does not mean that the employees of the firm can represent the taxpayer.

Provide the representative's phone number in the space provided. If more than one name is listed, provide the phone number of the first person listed.

This section allows for three representatives. If you have more than three, please attach an additional sheet and note "see attached" in one of the Name of Representative boxes.

SECTION 3 - ACTS AUTHORIZED (MUST BE FILLED OUT)

On Line (a), either check the "all" box to indicate that the representative applies to all tax periods, or limit the representation to a particular tax period(s) and provide the date range or period(s). If you enter only a year(s) (e.g. 2018) the representation will include any period (including any Meals and Rooms or Tobacco Tax periods, if authorized on Line (b)) that fall within that year. If you limit the representation to a date range, please be aware that your representative will not be permitted to discuss any other date range with the Department. Note: If you check both the "all" box and provide a date range, the representation will not be limited to the date range, but will apply to all dates and tax periods.

On Line (b), check the boxes for the tax types that apply to your representation. If the representation applies to all taxes, check the "all" box. To limit the representation to one or more taxes, check all the appropriate boxes and for any taxes not shown, check the "other" box and identify the taxes on the line (for example MET or UPT). Note: If you check both the "all" box and the boxes for specific taxes, the representation will not be limited to a specific tax, but will apply to all tax types.

On Line (c), describe any other limitations you wish to place on your representation. For example, if you wish to only authorize your representative to receive information, note this limitation on Line (c). Otherwise, your representative will not only be authorized to receive your confidential information but also full power to perform all acts necessary related to the subject matter of the indicated tax types and periods.

If the box on Line (d) is not checked, the filing of this form will not revoke or otherwise invalidate any prior powers on file with the Department. If you check the box provided on Line (d), you will revoke all prior powers of attorney, unless the representatives are identified again in Section 2 of this form.

If you are a representative that wishes to withdraw representation of a taxpayer, please forward a signed and dated letter with a copy of the POA you are withdrawing to the Department.

Rev 1.8 06/2020

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

POWER OF ATTORNEY

(POA)

INSTRUCTIONS Continued

SECTION 4 - SIGNATURE(S)

The taxpayer is required to sign and date the POA. The completed and signed form

NEED HELP?

Questions not covered here may be answered in our "Frequently Asked Questions" available on our website at www.revenue.nh.gov or by calling Taxpayer Services at (603)

Rev 1.8 06/2020

Document Specifics

| Fact Name | Detail |

|---|---|

| Form Purpose | The DP-2848 form is used to grant a designated individual or entity the authority to make tax-related decisions or perform tax-related actions on behalf of another person or entity. |

| Primary Use | It is primarily utilized to allow representatives to interact with tax authorities, access confidential tax information, and make filings or adjustments to tax documents. |

| Type of Power | This form confers a specific type of power of attorney focused solely on tax matters, limiting the agent’s authority to tax-related activities. |

| Duration of Validity | The duration for which the power of attorney remains valid can vary and should be specified within the form itself; it may continue until explicitly revoked. |

| Revocation Process | To revoke the power granted through DP-2848, the individual who granted the power must typically provide written notice to the tax authority or complete a specific revocation process. |

| Governing Law | This form is governed by the specific state's tax code and legal precedents related to the power of attorney within that jurisdiction. |

| Signature Requirements | Both the individual granting the power and the appointed representative must sign the form, sometimes in the presence of a notary or witnesses, depending on state law. |

| State-Specific Variations | While the concept of a tax power of attorney is recognized in most jurisdictions, the exact requirements, form design, and applicable laws can vary significantly from one state to another. |

Guide to Writing Tax POA form dp-2848

Upon deciding to designate someone to take charge of tax matters on your behalf, completing the Tax Power of Attorney (POA) form, DP-2848, is a vital step. This document legally empowers the individual you choose to represent you in tax affairs, enabling them to gather documents, make decisions, and converse with tax authorities in your stead. Navigating the process can seem daunting, but by following a sequence of steps, you can ensure the form is accurately completed and submitted, paving the way for your representative to act on your behalf without delay.

- Identify the taxpayer: Enter the full legal name of the individual granting permission, alongside their social security number or tax identification number, address, and phone number. This section clarifies who is authorizing the representation.

- Select the representative(s): Provide the name(s), address(es), phone number(s), and CAF numbers of the individual(s) being granted this authority. If appointing multiple representatives, indicate whether each can act independently by marking the appropriate box.

- Define the tax matters: Specify the nature of the tax issues you're authorizing representation for, including types of tax, tax form numbers, and the years or periods involved. This precision ensures your representative can only access and decide on matters you've explicitly outlined.

- Specify the powers being granted: Check the boxes next to the powers you're granting your representative. This might include the ability to receive and inspect confidential tax information, to sign agreements or consents involving tax payments or abatements, and more. Being clear about the extent of the powers granted is crucial for both your protection and clarity in representation.

- Add any special instructions (if necessary): If there are specific limitations or extensions to the powers listed, detail them in the provided section. This could range from restricting access to certain documents, to specifying actions that the representative is not authorized to take.

- Sign and date the form: The taxpayer must sign and date the form to validate the POA. If a non-individual entity is the taxpayer, an authorized individual must sign, denoting their capacity next to their signature.

- Representative’s acceptance: The chosen representative must also sign and date the form, acknowledging their acceptance of the responsibilities this authority entails. If multiple representatives are named, each must sign.

- Keep a copy: After completing the form, ensure you retain a copy for your records. Additionally, provide the original signed form to your representative, who may need to furnish it when interacting with tax authorities on your behalf.

With these steps fulfilled, your representative is equipped to handle your specified tax matters with the authority and information needed to act diligently and accurately. Remember, this delegation of authority does not relieve the taxpayer of their tax obligations, but it facilitates a smoother management of tax affairs through a trusted individual or entity.

Understanding Tax POA form dp-2848

-

What is a Tax Power of Attorney (POA) Form DP-2848?

A Tax Power of Attorney, specifically Form DP-2848, is a legal document that allows you to appoint someone else to handle your tax matters with the tax authority. This person, known as your agent or attorney-in-fact, can perform tasks such as filing your taxes, obtaining tax information, and representing you in tax matters under the authority you've given them.

-

Who should use the Tax POA Form DP-2848?

Individuals or businesses that need to designate another person to manage their tax-related responsibilities should use this form. It's especially useful if you are unable to handle your tax affairs due to absence, illness, or lack of expertise.

-

How do I complete the Tax POA Form DP-2848?

To complete the form, you'll need to provide your personal information (or your business information if it's for a business), the details of the appointed agent, and the specific tax matters and years or periods you're granting authority for. You must also sign and date the form, usually in the presence of a notary public or witnesses, depending on state requirements.

-

Can I appoint more than one person on my Tax POA?

Yes, you can appoint more than one person as your agent. However, you need to specify whether they can act independently or must make decisions together. It's important to consider how this decision might affect the handling of your tax matters.

-

Is the Tax POA Form DP-2848 valid indefinitely?

No, the validity of the Tax POA depends on the terms stated in the form. You can specify an expiration date or event that will end the POA. If no duration is specified, it generally remains in effect until you revoke it.

-

How can I revoke a Tax POA Form DP-2848?

To revoke the form, you must send a written notice to the tax authority and to the appointed agent. The notice should clearly state your intention to revoke the power of attorney and include information that identifies the original POA, such as the date of execution or the agent's name.

-

What if my agent cannot perform their duties?

If your agent is unable to fulfill their responsibilities, you should appoint a new agent by completing a new Tax POA Form DP-2848. Remember to revoke the previous POA if necessary.

-

Do I need a lawyer to complete a Tax POA Form DP-2848?

While it's not required to have a lawyer, consulting with one can be beneficial, especially for complex tax situations or if you have specific legal concerns. A lawyer can ensure that the form accurately reflects your wishes and complies with state laws.

-

Where do I file the completed Tax POA Form DP-2848?

The completed form should be filed with the tax authority that handles your tax matters. This could be your state's Department of Revenue or a similar entity. Check the specific filing requirements and address with the relevant tax authority.

-

What are the common mistakes to avoid when filling out the Tax POA Form DP-2848?

- Not providing all required information or providing incorrect information.

- Forgetting to specify the tax matters and periods the POA covers.

- Failing to sign and date the form or not following the proper witnessing or notarization requirements, if applicable.

- Not notifying your agent or the tax authority when revoking the POA.

Common mistakes

Filling out the Tax Power of Attorney (POA) Form, officially known as DP-2848, is an essential procedure for authorizing someone to represent you in tax matters before the tax authorities. However, errors can occur during this process, leading to delays or problems with tax representation. Here are eight common mistakes people make when completing this form:

Not checking the current version of the form. Tax forms are updated regularly, and using an outdated version can invalidate the document.

Failing to complete all required sections. Every part of the form has a specific purpose, and missing information can lead to administrative issues.

Incorrectly identifying the representative. The person you authorize, known as your representative, must be accurately identified with their full name and contact information.

Misunderstanding the extent of authorization. It's crucial to specify the exact tax matters and years for which the representative is authorized, to avoid any scope-related confusion.

Omitting the taxpayer's information. As the taxpayer, providing your complete details, including your social security number or tax identification number, is vital for the form's validity.

Not specifying the duration of the POA. If the form does not indicate when the power of attorney starts and ends, it may not be considered valid.

Forgetting to sign and date the form. An unsigned form is not legally binding. Both the taxpayer and the representative must sign the form.

Not retaining a copy. Once submitted, having a copy of the form is important for personal records and future reference.

By avoiding these common errors, you can ensure that your Tax Power of Attorney Form DP-2848 is accurately completed and accepted by tax authorities, granting your representative the authority to act on your behalf without unnecessary complications.

Documents used along the form

When managing one's tax affairs, particularly in situations requiring a Tax Power of Attorney (POA) Form DP-2848, it's essential to understand the companion forms and documents often involved in the process. The Tax POA enables an individual to grant another person the authority to handle their tax matters, which often necessitates the use of additional forms to ensure comprehensive management and accuracy. Below is a list of other forms and documents commonly utilized alongside the Tax POA Form DP-2848, each serving a unique but complementary function in the broader scope of tax administration and personal financial management.

- Form 1040: The U.S. Individual Income Tax Return is the standard federal income tax form many people use to report their income, claim tax deductions and credits, and calculate the amount of their tax refund or tax bill for the year.

- Form W-9: Request for Taxpayer Identification Number and Certification, used to provide the correct taxpayer identification number to entities that are required to file information returns with the IRS to report interest, dividends, and certain other income paid.

- Form 2848: Power of Attorney and Declaration of Representative, which allows taxpayers to authorize an individual to represent them before the IRS, covering a more comprehensive range of tax matters beyond the state-specific DP-2848.

- Form 8821: Tax Information Authorization, permits individuals or organizations to appoint someone else to inspect and/or receive confidential tax information for the types specified in the form.

- Form 4506-T: Request for Transcript of Tax Return, often used to request a transcript of a tax return or other tax records. It can be essential for mortgage applications, student or small business loan applications, and for those with a tax arrangement with the IRS.

- Form 4868: Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, provides taxpayers with an extension on the deadline for filing their income tax returns.

- Schedule D: Capital Gains and Losses, a part of Form 1040, used to report the sale or exchange of capital assets not reported on another form or schedule.

- Form 1099: Various versions of this form are used to report income from self-employment earnings, interest and dividends, government payments, and more. It is crucial for individuals who are managing their taxes and those under their representation.

Understanding and properly utilizing these forms in conjunction with the Tax POA Form DP-2848 can significantly streamline the tax handling process. Each document has its role, from reporting income and authorizing representatives, to requesting information and filing for extensions. Knowledge of these forms ensures that one's tax affairs are handled efficiently and in compliance with federal and state regulations, safeguarding one's financial health. It's always advisable to consult with a tax professional to ensure that the correct forms are used and accurately processed.

Similar forms

The Tax Power of Attorney (POA) form, known in some jurisdictions as DP-2848, allows an individual to designate another person to handle their tax matters. This form is similar to the General Power of Attorney form, which empowers an agent to make a wide range of decisions on behalf of the principal. Both forms establish a legal relationship where one individual can act in the interest of another, but the General Power of Attorney covers a broader scope beyond just tax-related matters.

Comparable to the Tax POA is the Durable Power of Attorney. The main difference lies in the durability aspect; a Durable Power of Attorney remains in effect if the principal becomes incapacitated. While both forms delegate authority to another individual, the Durable Power of Attorney ensures that this delegation continues even under circumstances where the principal cannot make decisions themselves.

The Medical Power of Attorney is another document similar in nature to the Tax POA, as it grants an agent the ability to make decisions on behalf of the principal. However, the decisions are limited to medical and health care issues, unlike the Tax POA, which is focused on tax matters. The similarity lies in the principle of represented decision-making, albeit in different domains.

The Limited Power of Attorney is closely related to the Tax POA, with its defining feature being the limitation to specific tasks or a limited time period. Like the Tax POA, which might restrict the agent’s powers to certain tax years or types of taxes, a Limited Power of Attorney precisely defines its scope, but it can apply to various areas beyond taxes, such as real estate transactions.

Similar in function to the Tax POA is the Financial Power of Attorney, specifically focusing on financial matters. This document empowers an agent to handle the financial affairs of the principal, such as banking, investment decisions, and other monetary matters. While the Tax POA is a subset of financial powers, focusing primarily on tax filings and issues, the Financial Power of Attorney encompasses a broader range of financial responsibilities.

The Advance Healthcare Directive, or Living Will, shares a fundamental similarity with the Tax POA in that it allows individuals to make decisions in advance—in this case, about their healthcare and treatment preferences in the event they are unable to communicate those decisions themselves. Both documents are proactive, allowing individuals to dictate how certain matters should be handled if they're not in a position to make those decisions at a needed time.

Another related document is the Agent or Attorney-in-Fact Designation, which is a general term for any document that appoints an individual to act on behalf of another. The Tax POA is a specific type of this broader category, designating someone to manage tax matters specifically. Both involve a trust relationship, where one party relies on another to represent their interests.

The Guardianship Appointment is somewhat related to the Tax POA, with a broader and more profound application. It involves the court-ordered appointment of a guardian to handle the personal and financial affairs of a minor or an incapacitated adult. While the Tax POA voluntarily assigns someone to handle tax issues, guardianship encompasses a wider range of responsibilities and is typically ordered by a court.

Very much akin to the Tax POA is the IRS Form 2848, Power of Attorney and Declaration of Representative. This federal form specifically grants individuals the authority to represent taxpayers before the IRS, allowing them to perform actions such as presenting documents, communicating with the IRS, and making agreements. The similarity lies in the focus on tax-related matters, though the IRS Form 2848 is applicable at the federal level.

Filing a Business Representation or Corporate Power of Attorney shares similarities with the individual Tax POA. This document authorizes an agent to act on behalf of a business entity in financial transactions, including tax filings. While the individual Tax POA focuses on personal tax matters, the Business Representation extends these legal powers to the realm of business operations, highlighting the scale and context in which the POA can operate.

Dos and Don'ts

When tackling the task of filling out the Tax Power of Attorney (POA) form, DP-2848, it's crucial to approach it with attention and care. To guide you through this process, here are five things you should do, as well as five things you should avoid, to ensure the form is completed accurately and effectively.

Do:

- Read the instructions carefully before you begin. Understanding the requirements can save you time and prevent mistakes.

- Ensure all information is accurate and complete, including full names, addresses, and taxpayer identification numbers.

- Specify the tax matters and years or periods you are authorizing, to avoid any confusion or errors with the tax authority.

- Keep a copy of the completed form for your records, as it may be necessary for future reference.

- Submit the form to the appropriate tax authority in a timely manner, to avoid any delays in the authorization of your POA.

Don't:

- Forget to sign and date the form. An unsigned form is invalid and will not be processed.

- Overlook the need for a witness or notary signature if required, as some jurisdictions may require this for the form to be considered valid.

- Use incorrect or outdated forms, as this can lead to processing delays or the need to resubmit the form.

- Leave any sections blank that apply to your situation. Incomplete information can result in processing delays.

- Assume the tax authority has received and processed your form without confirmation. Always follow up to ensure it has been received and accepted.

Misconceptions

When dealing with the Tax Power of Attorney (POA) form, specifically the DP-2848 form, many individuals hold misconceptions about its use, requirements, and implications. Clearing up these misunderstandings is crucial to ensure that taxpayers can effectively utilize this form, enabling them to grant the right individuals the authority to handle their tax matters properly.

It is only for businesses: A common misconception is that the DP-2848 form is solely for business use. In reality, this form can be used by both individuals and businesses to authorize a representative, such as an accountant or attorney, to handle their tax affairs with the tax authority.

Granting complete control: Another misunderstanding is believing that by signing the DP-2848 form, one is giving the designated representative complete control over all financial decisions. The truth is, the authority granted can be as limited or as broad as the taxpayer wishes, often restricted to dealing with specific tax matters outlined in the form.

Any representative qualifies: Some taxpayers think that they can appoint anyone as their representative on the DP-2848 form. However, representatives must generally meet specific qualifications and sometimes need to be recognized professionals, such as licensed attorneys, certified public accountants, or individuals enrolled to practice before the taxing authority.

A permanent decision: The idea that once a DP-2848 form is signed, it cannot be revoked or changed, is incorrect. Taxpayers can revoke the POA at any time if their circumstances change or they wish to appoint a new representative, simply by submitting a new form or following the procedure established by the relevant tax authority.

No expiration date: People often assume the DP-2848 form has no expiration date. While it's true that the form can remain in effect for a long duration, specifying an expiration date is possible and often recommended to ensure that the power of attorney reflects the taxpayer's current wishes.

It equates to a legal Power of Attorney: A significant misconception is conflating the tax-specific DP-2848 form with a general Power of Attorney (POA). The DP-2848 form is limited to tax matters, whereas a general POA can encompass broad legal authority over a person's financial and personal affairs.

Understanding the specifics and correcting these misconceptions about the Tax POA form DP-2848 are critical steps towards empowering taxpayers to manage their affairs more effectively and ensuring that their rights are adequately protected.

Key takeaways

When managing tax matters, understanding the process and requirements for filling out and utilizing the Tax Power of Attorney (POA) form, specifically the DP-2848 form, is crucial. This form serves as a legal document that allows an individual to grant another person the authority to handle their tax affairs. Below are key takeaways to consider when dealing with the DP-2848 form:

- Accurate Information is Crucial: The DP-2848 form requires detailed information about both the taxpayer and the representative. This includes full names, addresses, and identification numbers (such as Social Security numbers or Employer Identification Numbers). Ensuring that all the provided information is accurate and up-to-date is essential for the form's validity.

- Define the Scope Clearly: The form allows the taxpayer to specify the extent of the authority granted to the representative. This can range from discussing tax returns with the tax authority to making decisions about tax payments or refunds. Clearly outlining the scope of the representative’s powers can prevent misunderstandings and unauthorized actions.

- Valid Signatures are Required: For the DP-2848 form to be legally binding, it must be signed and dated by the taxpayer. If the taxpayer is representing a business, appropriate documentation must be provided to prove the signatory has the authority to grant power of attorney on behalf of the business.

- Keep the Original and Provide Copies: After completing and signing the form, it is advisable to keep the original document in a safe place and provide copies to the representative and the relevant tax authority. This ensures that all parties have access to the document and are aware of the representative’s authority.

By paying close attention to these key aspects, taxpayers and their representatives can effectively manage the responsibilities and authorities granted through the DP-2848 form, facilitating smoother interactions with tax authorities and ensuring compliance with legal requirements.

Popular PDF Documents

California Sales Tax Certificate - The certificate's acceptance as a resale certification by several states reflects a unified effort to simplify the tax exemption process for businesses.

Profits or Loss From Business - Necessary for those who have received a 1099-NEC form for nonemployee compensation.