Get Tax POA form acd-31102 Form

Navigating the complexities of tax matters can often be a daunting task for individuals and businesses alike. The need for clear and authoritative representation in dealing with taxes is crucial. This is where the Tax Power of Attorney (POA) Form ACD-31102 steps in, offering a solution for those who seek assistance from professionals. This legal document allows taxpayers to grant a trusted individual or entity the authority to handle tax affairs on their behalf. The breadth of powers conferred can range from filing taxes to representing the taxpayer in discussions with tax authorities. The Tax POA is a critical tool in ensuring that tax matters are handled efficiently and with the required expertise. Employing such a form ensures that even in the taxpayer's absence, their tax obligations are met with diligence and in compliance with the law. Understanding the scope, implications, and proper use of this form is essential for anyone looking to manage their tax responsibilities effectively.

Tax POA form acd-31102 Example

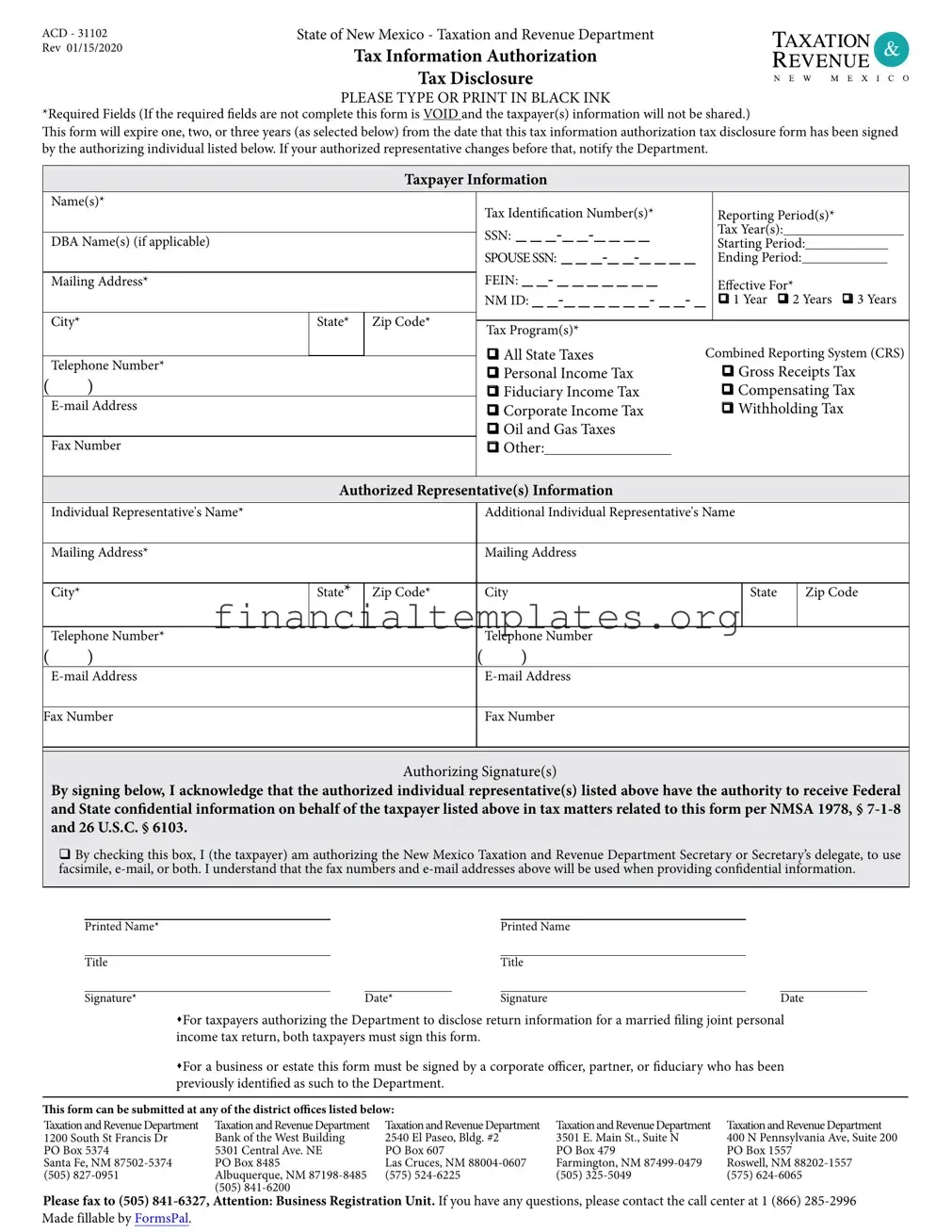

ACD - 31102 |

State of New Mexico - Taxation and Revenue Department |

TAXATION . |

Rev 01/15/2020 |

Tax Information Authorization |

|

|

REVENUE ~ |

|

|

Tax Disclosure |

NE W MEXICO |

PLEASE TYPE OR PRINT IN BLACK INK

*Required Fields (If the required felds are not complete this form is VOID and the taxpayer(s) information will not be shared.)

Tis form will expire one, two, or three years (as selected below) from the date that this tax information authorization tax disclosure form has been signed by the authorizing individual listed below. If your authorized representative changes before that, notify the Department.

Taxpayer Information

|

|

Name(s)* |

|

|

|

Tax Identifcation Number(s)* |

|

Reporting Period(s)* |

|||||||||

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

SSN: - - |

|

Tax Year(s): |

||||||||

|

|

DBA Name(s) (if applicable) |

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

Starting Period: |

|||||||||||

|

|

|

|

|

|

|

SPOUSE SSN: - - |

|

Ending Period: |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

FEIN: - |

|

|

|

|

|

|

|

|||

|

|

Mailing Address* |

|

|

|

|

Efective For* |

||||||||||

|

|

|

|

|

|

|

NM ID: - |

|

q 1 Year |

q 2 Years q 3 Years |

|||||||

|

|

City* |

|

State* |

Zip Code* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax Program(s)* |

|

|

|

|

|

|

|

|

|||||

|

|

|

I |

|

I |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

q All State Taxes |

Combined Reporting System (CRS) |

|||||||||||

|

|

Telephone Number* |

|

|

|

||||||||||||

|

|

|

|

|

q Personal Income Tax |

|

q Gross Receipts Tax |

||||||||||

( |

) |

|

|

|

|

|

|||||||||||

|

|

|

|

q Fiduciary Income Tax |

|

q Compensating Tax |

|||||||||||

|

|

|

|

|

q Corporate Income Tax |

|

q Withholding Tax |

||||||||||

|

|

|

|

|

|

|

q Oil and Gas Taxes |

|

|

|

|

|

|

|

|

||

|

|

Fax Number |

|

|

|

q Other: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

Authorized Representative(s) Information |

|

|

|

|

|

|

|

|

|||||

|

|

Individual Representative's Name* |

|

|

|

Additional Individual Representative's Name |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Mailing Address* |

|

|

|

Mailing Address |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

City* |

|

State* |

Zip Code* |

|

City |

|

State |

|

|

|

Zip Code |

||||

|

|

|

I |

|

I |

|

|

|

|

|

I |

|

I |

||||

|

|

Telephone Number* |

|

|

|

Telephone Number |

|

|

|

|

|

|

|

|

|||

( |

) |

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Fax Number |

|

|

|

Fax Number |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Authorizing Signature(s)

By signing below, I acknowledge that the authorized individual representative(s) listed above have the authority to receive Federal and State confdential information on behalf of the taxpayer listed above in tax matters related to this form per NMSA 1978, §

qBy checking this box, I (the taxpayer) am authorizing the New Mexico Taxation and Revenue Department Secretary or Secretary’s delegate, to use facsimile,

Printed Name* |

|

Printed Name |

|

Title |

|

Title |

|

Signature* |

Date* |

Signature |

Date |

sFor taxpayers authorizing the Department to disclose return information for a married fling joint personal income tax return, both taxpayers must sign this form.

sFor a business or estate this form must be signed by a corporate ofcer, partner, or fduciary who has been previously identifed as such to the Department.

Tis form can be submitted at any of the district ofces listed below:

Taxation and Revenue Department |

Taxation and Revenue Department |

Taxation and Revenue Department |

Taxation and Revenue Department |

Taxation and Revenue Department |

1200 South St Francis Dr |

Bank of the West Building |

2540 El Paseo, Bldg. #2 |

3501 E. Main St., Suite N |

400 N Pennsylvania Ave, Suite 200 |

PO Box 5374 |

5301 Central Ave. NE |

PO Box 607 |

PO Box 479 |

PO Box 1557 |

Santa Fe, NM |

PO Box 8485 |

Las Cruces, NM |

Farmington, NM |

Roswell, NM |

(505) |

Albuquerque, NM |

(575) |

(505) |

(575) |

|

(505) |

|

|

|

Please fax to (505)

Made fillable by FormsPal.

Document Specifics

| Fact Name | Description |

|---|---|

| Form Designation | ACD-31102 is designated as the Tax Power of Attorney (POA) form. |

| Purpose | The form allows a taxpayer to grant authority to another person, enabling them to handle tax matters on their behalf with the tax authority. |

| Governing Law | This form is governed by the state-specific tax laws and regulations where it is being used. |

| Key Sections | ACD-31102 includes sections for taxpayer information, representative's details, tax matters, and the scope of authority granted. |

Guide to Writing Tax POA form acd-31102

Filling out the Tax Power of Attorney (POA) Form ACD-31102 is a crucial step for those who wish to grant someone else the authority to handle their tax matters in a specific context. This process can seem daunting, but with careful attention to detail, it can be completed successfully. After the form is fully filled out, it needs to be submitted to the appropriate tax authority. This marks the beginning of the individual or entity's representation on your behalf concerning the tax matters stipulated in the form.

- Start by gathering all necessary information, including the taxpayer's full name, identification number (SSN or EIN), and contact information.

- Identify the representative(s) by listing their names, addresses, and phone numbers. If you're appointing more than one representative, make sure to clearly indicate this on the form.

- Specify the tax matters for which you are granting authority. This includes detailing the types of taxes, tax form numbers, and the periods or years involved.

- Define the extent of authority you're granting. This might include actions like receiving confidential tax information, making agreements, or settling disputes.

- Review any default authorizations and restrictions noted in the form to ensure they align with the level of authority you wish to grant.

- If applicable, include any special instructions that limit or further define the representative's authority. Be as specific as possible to avoid ambiguity.

- Ensure both you (the taxpayer) and the representative(s) sign and date the form. The signatures validate the form and authorize the powers granted.

- Finally, submit the completed form to the designated tax authority office. The submission process may vary by location, so it's essential to verify the correct office and any submission requirements.

Once the form has been submitted, the authorized representative will have the legal authority to act on behalf of the taxpayer in accordance with the permissions granted in the document. It's important to monitor any actions taken by the representative and to maintain open communication to ensure your tax matters are handled according to your wishes. Remember, the power of attorney can be revoked at any time, should the need arise.

Understanding Tax POA form acd-31102

-

What is the Tax POA (ACD-31102) form?

The Tax Power of Attorney (POA) form, designated as ACD-31102, is a legal document used in certain states. It grants an individual or entity, referred to as the agent or attorney-in-fact, the authority to handle tax matters on behalf of another person or entity, known as the principal. This responsibility includes making decisions, filing taxes, and communicating with tax authorities.

-

Who should use the ACD-31102 form?

Individuals or entities needing someone to manage their tax affairs due to absence, inexperience, or preference for professional assistance should consider using the ACD-31102 form. It's particularly useful for those who anticipate complex tax matters or have obligations they are unable to fulfill personally.

-

How can one obtain the ACD-31102 form?

The ACD-31102 form can typically be obtained from the official website of the state's department responsible for taxation. It may also be available at local tax offices or through tax professionals who provide services related to tax representation.

-

What information is required to complete the ACD-31102 form?

Completing the ACD-31102 form requires providing detailed information about the principal and the appointed agent. This includes names, addresses, identification numbers (such as Social Security Numbers for individuals or EIN for entities), and the specific tax matters for which the agent is granted authority. A thorough understanding of the extent of power being granted is necessary to ensure accurate completion of the form.

-

Is there a validity period for the ACD-31102 form?

Yes, the ACD-31102 form typically has a validity period that can be defined by the principal at the time of completion. Without a specified expiration date, its duration may depend on state laws or until the purpose for which it was issued is fulfilled or revoked by the principal.

-

Can the ACD-31102 form be revoked?

A principal can revoke the ACD-31102 form at any time. Revocation requires a written notice expressing the principal's intention to withdraw the powers granted to the agent. This notice should be sent to the agent and any relevant tax authorities to whom the POA was presented. It may also be prudent to complete a new form if another agent is being designated.

-

Are there any special considerations when choosing an agent for the ACD-31102 form?

Choosing an agent for the ACD-31102 form demands careful consideration. The selected agent should be trustworthy, knowledgeable about tax laws, and capable of handling the specified tax matters diligently. Often, people choose certified professionals like accountants or tax attorneys for their expertise. Additionally, it's essential to discuss the responsibilities with the chosen agent before appointing them to ensure they are willing and able to act on your behalf.

Common mistakes

When filling out the Tax Power of Attorney (POA) Form, also known as form ACD-31102, individuals often overlook important details or make errors. These mistakes can lead to delays or complications in allowing a designated individual to make tax-related decisions on your behalf. Here is an expanded list of common mistakes to be aware of:

-

Not checking for the most recent form version: Tax laws and forms change. Make sure you're using the latest version of the form ACD-31102 to ensure compliance with current regulations.

-

Incorrect or incomplete taxpayer information: Every field related to the taxpayer's identity, including their social security number or tax identification number, must be accurately filled. Minor mistakes can lead to major issues.

-

Failing to specify the powers granted: The form allows for different levels of authorization. You need to be clear about which matters the representative can handle, such as specific tax years or types of taxes.

-

Neglecting to list the representative(s) correctly: Full details including the representative’s name, address, and phone number are crucial. Also, the form allows for more than one representative, but their scope of authority must be clearly defined.

-

Missing signatures and dates: The form must be signed and dated by the taxpayer. An unsigned or undated form is invalid.

-

Omitting the declaration of representative’s section: This section is often overlooked but is essential for validating the representative’s qualifications and authority to act on behalf of the taxpayer.

-

Not specifying the duration: If you wish to limit the duration of the POA, the specific start and end dates must be provided. Without this, the POA might be considered valid indefinitely, or not valid at all if an end date is mandatory.

-

Ignoring the need for a witness or notarization: Depending on state laws, a POA form may need to be witnessed or notarized. Failing to meet these requirements can lead to the form being considered invalid.

-

Using the form for non-tax matters: The ACD-31102 form is specifically for tax representation. Using it for other purposes will not grant the representative the desired authority.

In summary, paying close attention to the details when completing the Tax POA form can prevent unnecessary setbacks. Whether it's ensuring that all sections are correctly filled, or understanding the specific requirements such as notarization, a little diligence goes a long way.

Documents used along the form

When handling tax matters, it's often necessary to go beyond just a single form. The Tax Power of Attorney form, often referred to as form ACD-31102, is a critical tool for allowing someone else to handle your tax affairs. However, to ensure thoroughness and compliance, several other forms and documents are commonly used alongside it. Understanding each one can streamline the process and provide clarity on what each document accomplishes.

- IRS Form 2848 - Power of Attorney and Declaration of Representative: This document is used to authorize an individual, typically a tax advisor or an attorney, to represent a taxpayer before the IRS, allowing them to make decisions and receive confidential tax information.

- Form W-9 - Request for Taxpayer Identification Number and Certification: This form is used by individuals and entities to provide their Taxpayer Identification Number (TIN) to the entity that will be paying them income, ensuring accurate tax reporting.

- Form 8821 - Tax Information Authorization: This allows appointed individuals or organizations to access and review a person’s tax information but not to act on their behalf, which is less comprehensive than the powers granted under Form 2848 or the Tax POA form ACD-31102.

- IRS Form 4506-T - Request for Transcript of Tax Return: This form is used to request a transcript of a tax return or other tax records. It is often used in conjunction with a Tax POA when the representative needs to see previous tax filings to provide advice or prepare current tax filings.

- Form 1040 - U.S. Individual Income Tax Return: The main form used by individuals to file their annual income tax returns with the IRS. Representatives may need to prepare or amend this form on behalf of the taxpayer.

- Form 433-A - Collection Information Statement for Wage Earners and Self-Employed Individuals: This form is required when setting up a payment plan or compromise with the IRS and provides detailed information on a taxpayer's financial situation.

- Form 656 - Offer in Compromise: This form allows taxpayers to settle their tax debt for less than the full amount owed. It is often used in conjunction with financial statement forms like Form 433-A.

- Form 7004 - Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns: This form is used by businesses to request additional time to file their tax returns.

These documents, used together, offer a comprehensive framework for managing tax affairs. Whether you're setting up a power of attorney, challenging an IRS decision, or simply needs to organize tax records, recognizing and understanding these forms can make navigation through tax-related matters much more manageable. Each serves a unique purpose, contributing to a smoother, more efficient handling of one’s tax responsibilities.

Similar forms

The Tax Power of Attorney (POA) Form, such as the ACD-31102, shares similarities with the IRS Form 2848, Power of Attorney and Declaration of Representative. Both forms authorize an individual, such as a certified public accountant, attorney, or other authorized person, to represent the taxpayer before the taxing authority. They allow the representative to receive confidential tax information and take actions like negotiating a payment plan on behalf of the taxpayer. The primary difference is the jurisdiction; while the ACD-31102 is state-specific, the Form 2848 applies to federal tax matters with the IRS.

Another document resembling the Tax POA is the General Power of Attorney form. This form grants broad powers to an agent to act on the principal's behalf in various matters, including financial, legal, and personal affairs. However, the similarity lies in the delegation of authority to another individual. The General Power of Attorney is more encompassing, while the Tax POA is specifically tailored for tax-related matters, limiting the agent’s powers to the tax realm.

The Durable Power of Attorney for Finances is also akin to the Tax POA. It authorizes someone to handle financial affairs on the principal's behalf, which can include dealing with tax matters. However, its scope is broader, covering all financial decisions, not just taxes. Unlike the Tax POA, which becomes invalid if the principal becomes incapacitated, a "durable" poa remains in effect, showing a critical distinction in terms of when each document applies and under what circumstances.

The Health Care Power of Attorney bears resemblance in its foundational concept—appointing someone to act on your behalf. In this case, the appointed agent makes health care decisions if you're unable to do so. Although it covers a completely different aspect of one's life, the idea of entrusting decision-making power to another individual links it to the Tax POA. The main difference is in the areas of authority: one is focused on health care decisions, while the other deals with tax matters.

Lastly, the Limited Power of Attorney (LPOA) is closely related to the Tax POA. The LPOA allows the principal to grant specific powers to an agent for a limited purpose or time frame. This can include tax-related issues but is not restricted to them. Similar to the Tax POA, it provides a way to delegate responsibility to another individual. However, the LPOA can be more narrowly defined and tailored to specific tasks beyond tax representation, highlighting its versatility in application but shared purpose in delegating authority.

Dos and Don'ts

When completing the Tax Power of Attorney (POA) form, often referred to as form ACD-31102, it's important to proceed carefully to ensure the document accurately reflects your intentions and complies with legal requirements. Below is a list of recommended dos and don'ts to consider:

Do:Read the instructions carefully before filling out the form. Understanding each section can help you provide accurate and complete information.

Use black ink or type the information to ensure legibility. This makes the document easier to read and reduces the chance of errors.

Include all the required personal information, such as your full legal name, the name of the designated agent(s), and their contact details.

Specify the tax matters and years or periods clearly. This ensures the POA is only applied within the bounds you intend.

Sign and date the form in the designated areas. Your signature is necessary to validate the POA.

Leave any sections incomplete. An incomplete form may be rejected or cause delays.

Use correction fluid or tape. Errors should be corrected by completing a new form to avoid questions of tampering or validity.

Forget to revoke previous POAs if applicable. If this new POA is meant to replace an older one, ensure the previous POA is properly revoked to prevent confusion or conflicting authorities.

Misconceptions

Many people hold misconceptions about the Tax Power of Attorney (POA) form, specifically the ACD-31102 form. Addressing these misunderstandings is key to ensuring individuals are well-informed about the implications and use of this document.

Only for the wealthy: A common misconception is that the Tax POA form ACD-31102 is only necessary for wealthy individuals. In reality, this form can be beneficial to anyone, regardless of their financial standing, by allowing them to designate a representative to handle tax matters on their behalf.

Limits on representation: People often think that a Tax POA limits the representative to only handling tax returns. However, the representative can also deal with issues like audits, tax disputes, and requests for information from the tax authority, depending on the permissions granted in the form.

Fixed duration: There's a misconception that the Tax POA lasts indefinitely. The truth is the form’s duration can be specified by the principal (the person granting the power), including setting an expiry date or event that ends the representative’s authority.

Immediate loss of control: Some believe that by signing a Tax POA, they immediately lose control over their tax matters. The fact is, the principal can stipulate the extent of the representative’s powers, retaining control over which decisions can be made on their behalf.

Legal expertise required: It’s often mistakenly thought that only a lawyer or tax professional can serve as a representative. Actually, while expertise in tax matters is beneficial, the principal can choose anyone they trust to act as their representative.

Complex process: Many people are intimidated by the process, thinking it’s too complex. Completing the Tax POA form ACD-31102 is straightforward, requiring basic information about the principal, the representative, and the scope of authority granted.

Expensive: There's a false belief that creating a Tax POA is expensive. While hiring a professional to help fill out the form might incur a fee, the process of obtaining and submitting the form itself does not usually require a significant expense.

Correcting these misconceptions ensures individuals understand the importance and utility of the Tax POA form ACD-31102, enabling them to make informed decisions about managing their tax matters effectively.

Key takeaways

Navigating through the process of handling taxes can seem daunting, especially when circumstances require you to delegate authority to another party to manage them on your behalf. The Tax Power of Attorney (POA) Form ACD-31102 serves as a vital tool for such scenarios. Understanding the correct way to fill out and use this form can significantly ease the process for both the individual granting authority and the recipient. Below are eight key takeaways to guide you:

- Know the Purpose: The Tax POA Form ACD-31102 is specifically designed to grant another individual or entity the power to handle tax matters on your behalf with the tax authority. This can include filing taxes, obtaining information, and making decisions.

- Complete Information is Key: Ensuring that all sections of the form are filled out with accurate and complete information is crucial. This includes personal identification details, the extent of the powers granted, and the time period for which the POA is valid.

- Be Specific: Clearly specify the tax matters and years for which the POA is being granted. Vagueness can lead to unnecessary complications and delays in the handling of your tax affairs.

- Choosing the Right Agent: The agent or attorney-in-fact you choose should be someone you trust completely with your personal tax information and decisions. This can be a professional, such as an accountant or lawyer, or a personal acquaintance who has the requisite knowledge and integrity.

- Notarization May Be Required: Depending on your jurisdiction, you might need to have the Tax POA form notarized to ensure its validity. Check the specific requirements of your state or the taxing authority.

- Dual Representation: If you're appointing more than one agent, decide whether they must act together on all matters or if they can act independently of each other. This must be clearly stated in the form.

- Understand the Expiration: Some POA forms come with an expiration date, while others remain valid until explicitly revoked. Ensure you know how long your POA will last and under what conditions it can be terminated.

- Revocation Process: If you wish to revoke the POA, understand the process for doing so. This usually involves notifying the tax authority and all parties involved in writing, specifying that the POA is no longer valid.

Properly executed, the Tax Power of Attorney can be an empowering document, allowing you to manage your tax affairs effectively even when you are unable to do so yourself. Whether for convenience or necessity, knowing how to correctly fill out and use the Form ACD-31102 is essential for maintaining control over your financial and legal matters.

Popular PDF Documents

Do I Have to File a 1099 - The IRS provides guidelines on their website on how to correctly fill out and submit Form 8809.

Acquisition or Abandonment of Secured Property - It's used when there has been no foreclosure sale yet, but the borrower loses possession of the collateral property.

Affidavit of Heirship California - Helps legal professionals accurately assess and distribute the assets of an estate.