Get Tax POA form a-222 Form

When navigating the complexities of tax matters, individuals and businesses often seek the assistance of professionals to ensure their affairs are in order. At the heart of this process is the Tax Power of Attorney (POA) Form A-222, a crucial document that facilitates this assistance. This form grants a designated person or entity the authority to handle tax-related tasks on behalf of someone else. It covers a broad range of actions, from accessing confidential tax information to making decisions and executing agreements with tax authorities. Understanding the scope, limitations, and proper execution of Form A-222 is essential for anyone looking to establish a tax POA, whether for routine matters or more complex tax planning and resolution. This form not only streamlines the process of managing tax affairs but also ensures that individuals and businesses can confidently delegate these responsibilities while maintaining control over their financial and legal interests.

Tax POA form a-222 Example

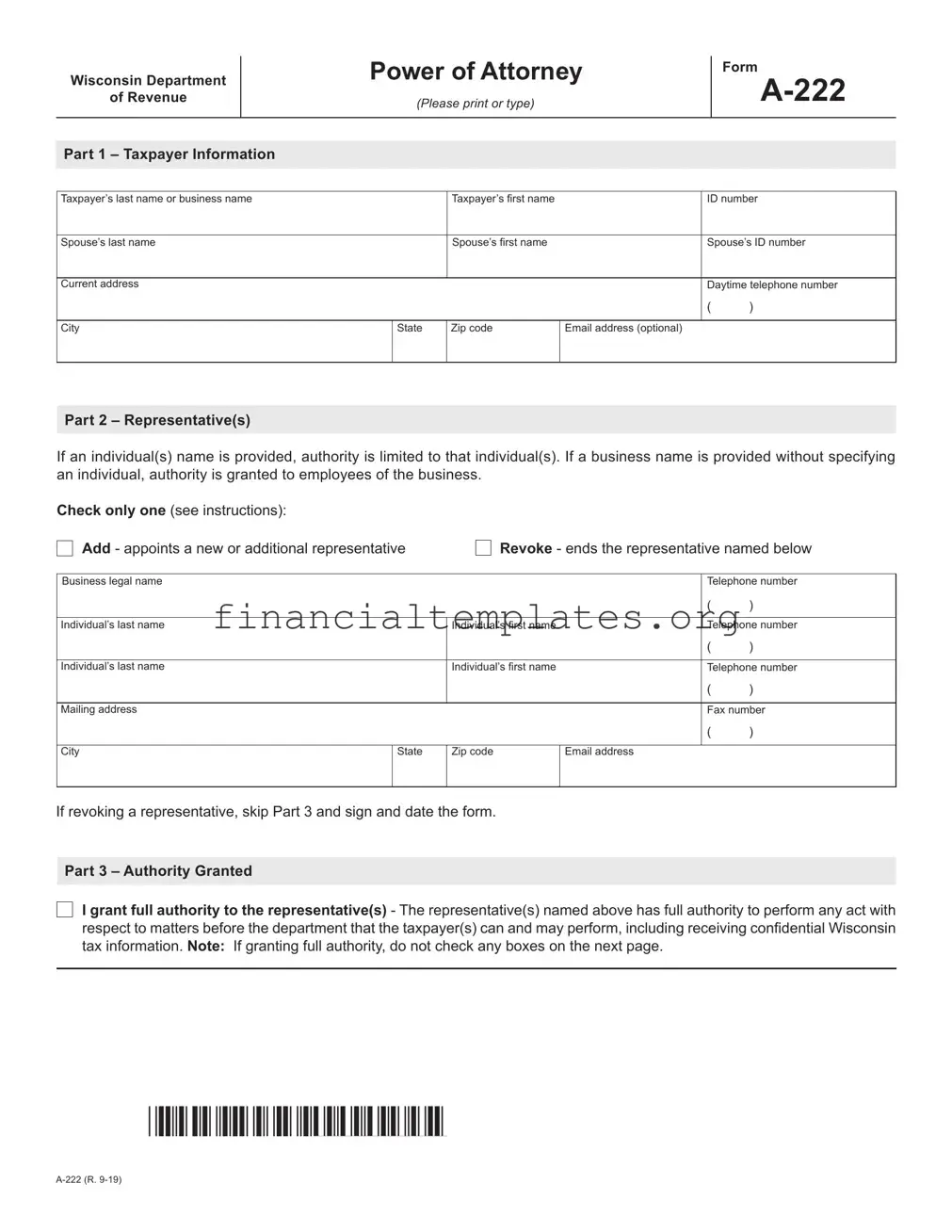

Wisconsin Department

of Revenue

Power of Attorney

(Please print or type)

Form

Part 1 – Taxpayer Information

Taxpayer’s last name or business name |

|

Taxpayer’s first name |

|

ID number |

||

|

|

|

|

|

|

|

Spouse’s last name |

|

Spouse’s first name |

|

Spouse’s ID number |

||

|

|

|

|

|

|

|

Current address |

|

|

|

Daytime telephone number |

||

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

City |

|

State |

Zip code |

Email address (optional) |

|

|

|

I |

|

|

I |

|

|

Part 2 – Representative(s)

If an individual(s) name is provided, authority is limited to that individual(s). If a business name is provided without specifying an individual, authority is granted to employees of the business.

Check only one (see instructions): |

|

|

|

|

|

□ Add - appoints a new or additional representative |

□ Revoke - ends the representative named below |

||||

Business legal name |

|

|

|

Telephone number |

|

|

|

|

|

( |

) |

|

|

|

|

|

|

Individual’s last name |

|

Individual’s first name |

|

Telephone number |

|

|

|

|

|

( |

) |

|

|

|

|

|

|

Individual’s last name |

|

Individual’s first name |

|

Telephone number |

|

|

|

|

|

( |

) |

|

|

|

|

|

|

Mailing address |

|

|

|

Fax number |

|

|

|

|

|

( |

) |

|

|

|

|

|

|

City |

State |

Zip code |

Email address |

|

|

|

I |

|

I |

|

|

If revoking a representative, skip Part 3 and sign and date the form.

Part 3 – Authority Granted

□

I grant full authority to the representative(s) - The representative(s) named above has full authority to perform any act with respect to matters before the department that the taxpayer(s) can and may perform, including receiving confidential Wisconsin tax information. Note: If granting full authority, do not check any boxes on the next page.

I grant full authority to the representative(s) - The representative(s) named above has full authority to perform any act with respect to matters before the department that the taxpayer(s) can and may perform, including receiving confidential Wisconsin tax information. Note: If granting full authority, do not check any boxes on the next page.

Illlllll llll 111111111111111 111111111111111 IIIII IIII IIII

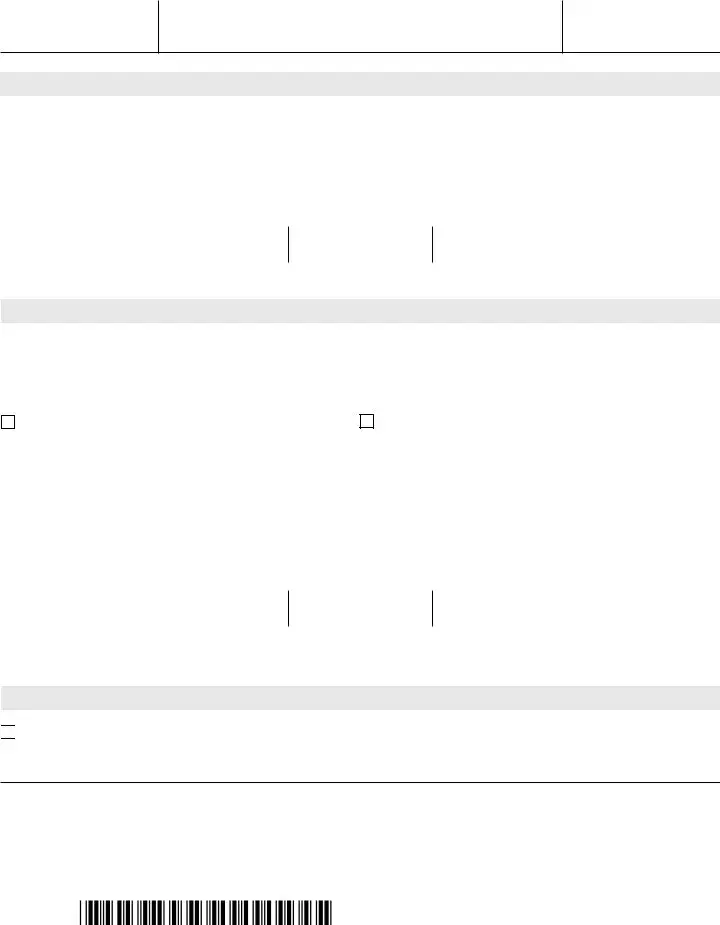

Form

Taxpayer Name

Page 2 of 2

ID Number

Part 3 – Authority Granted (continued)

□

I grant limited authority to the representative(s) - (check only items below for which you are granting authority.) The representative(s) named above has authority to perform any act, with respect to the items checked below, that the taxpayer(s) can and may perform, including the authority to receive confidential Wisconsin tax information.

I grant limited authority to the representative(s) - (check only items below for which you are granting authority.) The representative(s) named above has authority to perform any act, with respect to the items checked below, that the taxpayer(s) can and may perform, including the authority to receive confidential Wisconsin tax information.

Limited Authority |

Period(s) (optional) |

Limited Authority |

Period(s) (optional) |

□

Income or Franchise Taxes □

Income or Franchise Taxes □

Sales and Use Taxes

Sales and Use Taxes

□

Excise Taxes

Excise Taxes

□

Property Taxes

Property Taxes

□

Employer Withholding Taxes

Employer Withholding Taxes

□

□

Nontax Debt

Nontax Debt

□

Other (describe below)

Other (describe below)

Part 4 – Signature of Taxpayer(s)

I understand that the execution of this Power of Attorney does not relieve me of personal responsibility for correctly and timely reporting and paying taxes, or from the penalties, fees, or interest for failure to do so, all as provided for under Wisconsin tax law. I understand a photocopy, faxed copy, and/or electronic copy of this form has the same authority as the signed original.

If signed by a corporate officer, general partner, managing member, or fiduciary on behalf of the taxpayer, I certify that I have the authority to execute this Power of Attorney on behalf of the taxpayer.

Signature |

Title |

Date |

Signature |

Title |

Date |

Note: All notices that are automatically generated by the department’s computer system will be sent only to the taxpayer. If the representative needs copies of these notices, the representative must request a copy each time a notice is issued if it cannot be accessed in My Tax Account as an approved third party.

Illlllll llll 111111111111111 111111111111111 IIIII IIII IIII

Made fillable by FormsPal.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form A-222 | This form is used to allow a taxpayer to grant authority to an individual, typically a tax professional, to communicate with the state’s tax department on their behalf. |

| Key Components | The form typically requires the taxpayer’s information, the representative’s information, the extent of the authority being granted, and the specific tax matters and periods covered. |

| Governing Law | While the form is designed for state-specific use, the governing laws would be those of the individual state’s tax codes and regulations under which the form is filed. |

| Renewal and Revocation | A Tax POA like Form A-222 often comes with provisions for its duration, detailing when it expires and how it can be revoked by the taxpayer, providing a mechanism to withdraw the granted powers. |

Guide to Writing Tax POA form a-222

When it comes to managing taxes, sometimes you need a professional to take the reins. That's where a Tax Power of Attorney (POA) form, like Form A-222, comes into play. It allows you to name someone else to handle your tax matters with the tax authority. Whether you're dealing with complex tax issues, or you just don't have the time, filling out Form A-222 correctly is the first step to ensuring your tax affairs are handled properly. Here's how you can fill out the form efficiently and accurately.

- Identify the taxpayer: Start by providing the full name of the person or entity granting the power of attorney. This might be you or someone you're legally authorized to represent.

- Include identification information: Add the taxpayer's identification number, such as a Social Security Number (SSN) or Employer Identification Number (EIN), along with their current address and contact information.

- Name the representative(s): Write down the name(s) of the individual(s) who will be acting as the taxpayer's representative. This can be a certified public accountant, attorney, or anyone the taxpayer trusts to handle their tax matters.

- Specify the representative's credentials: Provide details like the representative's address, telephone number, and fax number (if available). If the representative has a Preparer Tax Identification Number (PTIN), include it here.

- List the tax matters to be handled: Clearly outline the types of tax matters the representative is authorized to handle (e.g., income tax, employment tax, etc.), including the tax form number(s) where applicable, and specify the years or periods covered.

- Define the extent of authority: Detail any specific powers being granted to the representative, including whether they can receive confidential tax information, sign documents on behalf of the taxpayer, or make decisions regarding payment plans.

- Retention/Revocation of prior POAs: Indicate whether any previously filed power of attorney documents should be retained or revoked with the submission of Form A-222.

- Taxpayer’s signature: The form must be signed and dated by the taxpayer, or in the case of an entity, by an individual with the authority to bind the entity. If the form is for a joint filing, both parties must sign and date.

- Declaration of representative: The appointed representative(s) must also sign and date the form, affirming their agreement to act within the limits of the power granted and acknowledge their responsibility to comply with tax laws.

Once you've completed these steps, review the form to ensure all information is accurate and no required details are missing. Proper completion and submission of Form A-222 authorize your representative to start handling your tax affairs with the confidence that they have the necessary legal permission. Remember, this form doesn't relieve you of your tax obligations; it simply allows someone else to assist you in fulfilling them.

Understanding Tax POA form a-222

-

What is the Tax POA Form A-222?

The Tax Power of Attorney (POA) Form A-222 is a legal document that grants an individual or entity the authority to represent someone else in matters related to their taxes. This form enables the designated representative, often a professional tax preparer, accountant, or attorney, to discuss the taxpayer’s account with tax authorities, make decisions, and perform actions like filing taxes on their behalf. It’s critical in situations where the taxpayer cannot manage their tax affairs due to various reasons.

-

Who can be appointed as a representative on Form A-222?

Any individual or organization that the taxpayer trusts can be appointed as a representative on Form A-222. Typically, tax professionals such as certified public accountants (CPAs), attorneys, and enrolled agents who are authorized to practice before the IRS or state tax authorities are chosen. It’s important to appoint someone who is not only trustworthy but also knowledgeable about tax laws and practices.

-

How can one obtain Tax POA Form A-222?

Tax POA Form A-222 can be obtained from the website of the state’s Department of Revenue or the IRS, depending on which tax authority the representation is required for. Alternatively, one can also contact these agencies directly to request a copy of the form. In many cases, tax professionals already have access to these forms and can provide them to their clients.

-

Is there a filing fee for the Tax POA Form A-222?

Typically, there is no filing fee for submitting Tax POA Form A-222 to the tax authority. However, there might be costs associated with obtaining the services of a professional to act as a representative, or if legal advice is sought in completing the form. Always check with the specific tax authority or a professional advisor to be certain of any costs involved.

-

How is the Tax POA Form A-222 submitted?

The submission process for Tax POA Form A-222 varies by tax authority. In many cases, it can be submitted electronically through the tax authority's website, by mail, or in person at a local office. Detailed submission instructions are usually provided with the form or can be found on the respective authority’s website. Ensure all sections are completed accurately to avoid delays.

-

Can the authority granted by the Tax POA Form A-222 be revoked?

Yes, the authority granted by the Tax POA Form A-222 can be revoked at any time by the taxpayer. To revoke the power, the taxpayer typically needs to submit a written notice to the tax authority, specifying the revocation of the POA. Some tax authorities may also require the completion of a specific revocation form. It’s advisable to consult with a professional to ensure the revocation is processed correctly.

-

Does the Tax POA Form A-222 expire?

Whether the Tax POA Form A-222 expires depends on the directives specified within the document itself and the laws of the state or the guidelines of the IRS. Many forms allow the taxpayer to set a specific expiration date. If no expiration date is specified, the form remains effective until it is revoked. Checking the current laws or guidelines governing the POA Form A-222 is important for understanding its validity period.

Common mistakes

Filling out tax forms can often be a daunting task. Among these, the Tax Power of Attorney (POA) Form, often designated as A-222, is a critical document that allows an individual to grant another person the authority to handle their tax matters. However, significant mistakes can occur during the completion of this form, which can lead to delays or issues with tax filings and representations. Here are four common errors made when filling out the Tax POA Form A-222:

Not specifying the type of tax matters: Many people forget to clearly define the types of tax issues and years they are granting authority for. This form allows you to grant someone else the ability to represent you in front of tax authorities, but this representation needs clear boundaries. Specifying which taxes (income, property, etc.) and for which years or periods the POA applies is crucial. Without this specificity, the document can become too vague to be useful or too broad, giving more power than intended.

Incomplete identification information: Another common error is not providing complete identification information for both the taxpayer and the representative. This includes full legal names, addresses, and taxpayer identification numbers (such as Social Security numbers). Missing or inaccurate information can lead to the form being rejected or delays in processing, as the tax authorities cannot properly identify the parties involved.

Overlooking the need for signatures: The Tax POA Form A-222 requires signatures from both the taxpayer granting the authority and the representative accepting it. People often overlook this crucial step, particularly when rushing or filing electronically. Without the necessary signatures, the document is not legally binding and cannot be enforced, rendering it essentially useless.

Failing to specify limitations: While some individuals may desire to grant broad powers to their representatives, others might want to limit the scope of authority. Not clearly defining these limitations is a common oversight. For example, you may want to restrict your representative's power to only certain tax years or specific tax-related actions. Clearly outlining these restrictions can prevent unwanted overreach and ensure your tax matters are handled according to your wishes.

By being aware of and avoiding these mistakes, you can ensure that your Tax POA Form A-222 is filled out accurately and effectively. This will enable your appointed representative to act on your behalf without unnecessary delays or legal hurdles.

Documents used along the form

When navigating the complexities of tax matters, particularly those involving the Tax Power of Attorney (POA) Form A-222, it becomes essential to familiarize oneself with a variety of other forms and documents. These auxiliary materials not only complement the Tax POA but also ensure a comprehensive approach towards tax representation and reporting. Below, we explore some of these vital forms and documents, shedding light on their purposes and importance.

- Form 1040: The U.S. Individual Income Tax Return is the cornerstone document for personal tax filing. It reports an individual's annual income, deductions, and credits to the IRS.

- Form W-2: The Wage and Tax Statement, issued by employers, summarizes an employee's annual earnings and taxes withheld. This form is indispensable for completing Form 1040.

- Form 1099: Various 1099 forms report income other than wages, such as freelance income (1099-NEC), interest and dividends (1099-INT and 1099-DIV), and other types of payments.

- Form 8867: The Paid Preparer's Due Diligence Checklist is crucial for tax professionals preparing claims for the Earned Income Tax Credit, Child Tax Credit, and other credits, ensuring compliance with due diligence requirements.

- Schedule C: Profit or Loss from Business (Sole Proprietorship) reports income and expenses from a business operated as a sole proprietor, contributing to the taxpayer's overall tax liability.

- Form 4868: Application for Automatic Extension of Time To File U.S. Individual Income Tax Return helps taxpayers request additional time to file their Form 1040, minimizing penalties for late filing.

- Form 8821: Tax Information Authorization permits individuals or businesses to authorize someone else to access and inspect their tax records, not to represent them before the IRS.

- Form 2848: Power of Attorney and Declaration of Representative enables a taxpayer to grant a qualified individual the authority to represent them before the IRS, handling matters more complex than what Form A-222 covers.

- Form 4506-T: Request for Transcript of Tax Return allows taxpayers or their authorized representatives to request a transcript of previously filed tax returns, useful for verification purposes and resolving discrepancies.

Understanding and gathering the appropriate documentation are fundamental steps toward effective tax management and representation. Each form serves a specific role in the broader tax preparation and filing process, ensuring accuracy, compliance, and timely communication with the IRS. Whether dealing with personal or business taxes, these documents form the bedrock of a structured and responsible approach to tax affairs.

Similar forms

The Tax POA Form A-222 is similar to the IRS Form 2848, "Power of Attorney and Declaration of Representative." Both forms are used to authorize an individual to represent the signer before the IRS or state tax authorities. They allow the representative to receive confidential tax information and to act on behalf of the signer in tax matters. However, Form 2848 is specifically for use with the IRS, while Form A-222 may be used with state-level tax entities.

Similar to the Health Care Power of Attorney, the Tax POA form provides a designated individual with the authority to make decisions on another's behalf. While the Health Care POA focuses on medical decisions, the Tax POA centers on tax matters, showcasing the adaptability of POA documents to various fields for representing interests and making decisions.

The Tax POA Form A-222 shares similarities with the General Power of Attorney form. Both empower an agent to act on behalf of the principal, though the General Power of Attorney typically covers a broader range of activities. The Tax POA is more specific, limiting the agent's powers to tax-related issues.

Comparable to the Durable Power of Attorney, the Tax POA allows individuals to appoint someone to handle their affairs. The Durable Power of Attorney remains effective even if the principal becomes incapacitated, which may or may not be the case with the Tax POA, depending on how it is structured. Each serves to safeguard the principal's interests in various scenarios.

Similar to the Limited Power of Attorney, the Tax POA focuses on a specific aspect of the principal's affairs – in this case, tax matters. Unlike broader POA forms that grant wide-ranging powers, both of these documents limit the agent's authority to designated areas or tasks.

Like the Advance Directive, the Tax POA form takes effect under specific conditions and is a proactive measure for managing one's affairs. However, while Advance Directives concern healthcare decisions and end-of-life care, the Tax POA pertains to financial and tax-related decisions.

The Business Power of Attorney is another document related to the Tax POA Form A-222, as it allows a business owner to appoint someone to handle business-related matters, potentially including tax issues. The Tax POA can be seen as a specialized form of Business POA that deals strictly with tax-related concerns.

Similarly, the Guardianship document appoints an individual to make decisions on behalf of another, often a minor or someone unable to make decisions for themselves. While Guardianship covers a broad range of decisions, including health and financial matters, the Tax POA is narrowly focused on tax issues.

The Estate Power of Attorney bears resemblance to the Tax POA Form A-222 as it authorizes someone to manage the principal's estate, which can include dealing with tax matters among other responsibilities. It is another example of how POA forms can be tailored to suit specific needs within the scope of estate management.

Lastly, the Financial Power of Attorney and the Tax POA Form A-222 are alike in that they both grant someone authority to handle financial aspects of the principal's life. While the Financial Power of Attorney covers a wide range of financial dealings, the Tax POA is specifically aimed at addressing tax-related tasks and responsibilities.

Dos and Don'ts

Filling out a Tax Power of Attorney (POA) form, such as the a-222 form, is a crucial step that grants another person the authority to handle your tax matters. It's vital to approach this task with attention to detail to ensure your tax affairs are managed correctly and to avoid any legal complications. Below are lists of things you should and shouldn't do when completing this form.

Things You Should Do:

Read the instructions carefully before starting. Each form has specific requirements and instructions that can help you fill it out correctly.

Verify the credentials of the person you are granting power to. Ensure they are qualified and have a good reputation for managing tax matters.

Be specific about the tax matters and years you are giving them authority over. This prevents any confusion and limits their power to only what you're comfortable with.

Sign and date the form in the presence of a witness or notary if required. This step is vital for the document's legality and enforceability.

Keep a copy of the completed form for your records. It's important to have proof of the authorization you've granted and to refer back to it if questions arise.

Things You Shouldn't Do:

Do not leave any sections blank. If a section does not apply, write 'N/A' (for 'Not Applicable') to confirm it was not overlooked.

Avoid using unclear language or abbreviations that could be misinterpreted. Clarity is key in legal documents.

Don't forget to update the form if your situation changes. For example, if the person you've granted power is no longer able or willing to serve in that role.

Never grant more power than necessary. Limit the scope of authority to only what is needed for them to assist you.

Don't neglect to review the entire form once filled out. A quick review can catch mistakes or omissions that could become issues later.

Misconceptions

Discussing Tax Power of Attorney (POA) forms, especially the form A-222, can lead to various misconceptions. Understanding these forms correctly is crucial for handling tax matters efficiently. Here, we will tackle some common misunderstandings:

- It's too complicated for non-professionals: Many believe that the Tax POA form A-222 is overly complex and can only be completed by a tax professional. While professional assistance is beneficial, especially in complicated tax situations, the form itself is designed to be accessible. With clear instructions, most individuals can fill it out with some due diligence.

- It grants unlimited power: A common misconception is that once signed, the Tax POA form A-222 gives the appointed person unlimited control over all tax matters. However, the scope of authority can be specifically tailored within the form, allowing the granter to restrict access only to designated areas.

- It's only for businesses: Some people think that Tax POA forms like A-222 are solely for business owners or corporations. In reality, anyone, including individuals managing personal tax issues, can use it to authorize a representative for tax purposes.

- It's optional and not that important: Underestimating the importance of the Tax POA form A-222 is another common mistake. This document is critical when you need someone else to handle your tax matters, ensuring they have the legitimate authority to act on your behalf with the tax authorities.

- It's irrevocable: There's a misconception that once you've signed a Tax POA, revoking it is next to impossible. This isn't true. The individual who granted the power can revoke it at any time, provided they complete the necessary steps to inform the relevant tax authorities.

- It lasts forever: People often mistakenly believe that the Tax POA form A-222 has no expiration date. The truth is, the form allows you to set a specific duration for the powers granted, after which they automatically expire. Moreover, some states have default expiration laws if no time frame is specified.

- Any POA form will work for tax matters: A specific misunderstanding is that all POA forms are interchangeable for dealing with tax issues. However, the Tax POA form A-222 is designed to address tax-specific concerns and is the appropriate form to use when granting someone authority over your tax matters with state tax agencies.

Clearing up these misconceptions about the Tax POA form A-222 is vital for empowering individuals to take charge of their tax representation confidently. Remember, when in doubt, seeking guidance from a tax professional can be invaluable.

Key takeaways

Understanding and accurately completing the Tax Power of Attorney (POA) Form A-222 is crucial for empowering a designated individual to handle your tax matters with the tax authority. Here are five key takeaways to ensure that you complete and use the form effectively:

- Know the purpose: The Tax POA Form A-222 allows taxpayers to grant authority to an individual, such as a certified public accountant (CPA), attorney, or other designated agent, to receive confidential tax information and perform actions on their behalf concerning their tax matters.

- Complete all required sections: To avoid delays or rejections, ensure every required field on Form A-222 is completed accurately. This includes personal identification details, the specific tax matters and periods you are granting the agent authority over, and any limitations to the authority you are granting.

- Choose your representative carefully: Designating someone as your representative is an important decision. The person you choose will have access to your sensitive tax information and the ability to make decisions regarding your taxes. Ensure that the individual or firm you select is trustworthy, competent, and has the appropriate knowledge to handle your tax affairs efficiently.

- Understand the duration and revocation process: The Tax POA remains in effect until the expiration date you specify, if any, or until you revoke it. Should you wish to change your representative or no longer require their services, you must complete a revocation process to terminate their authority officially.

- Keep a record and share responsibly: Once the form is completed and signed, retain a copy for your records and provide the original to your designated representative. Be mindful of the sensitive nature of the information and share it securely to protect your personal data.

Properly filled and utilized, the Tax POA Form A-222 is a powerful tool in managing your tax affairs through a trusted representative. Remembering these key points will help ensure the process is smooth and your interests are well-protected.

Popular PDF Documents

Client Organizer for Taxes - By detailing investment-related expenses, the form helps clients identify often-missed tax reduction opportunities.

Metlife Dog Insurance - A requirement for both the pet owner and veterinarian to sign the form, ensuring accurate and verified information for accident, illness, or routine care coverage claims.

IRS 1095-B - If you receive a 1095-B, you don't have to send it with your tax return but should keep it with your tax records.