Get Tax POA form 548 Form

The Tax Power of Attorney (POA) Form 548 stands as a critical document for individuals seeking to grant authority to another person or entity to handle their tax matters. This important form enables a designated representative, typically a professional with expertise in tax laws, to communicate with tax agencies, make decisions, and take actions regarding someone's tax affairs. Whether it’s for submitting documents, accessing confidential tax information, or representing the taxpayer in discussions and negotiations with tax authorities, the Form 548 plays a pivotal role in ensuring that individuals have the support they need in managing their taxes. The use of this form is governed by specific regulations and requirements that ensure the process of delegation is both secure and effective, protecting taxpayers’ rights while enabling their representatives to act efficiently on their behalf.

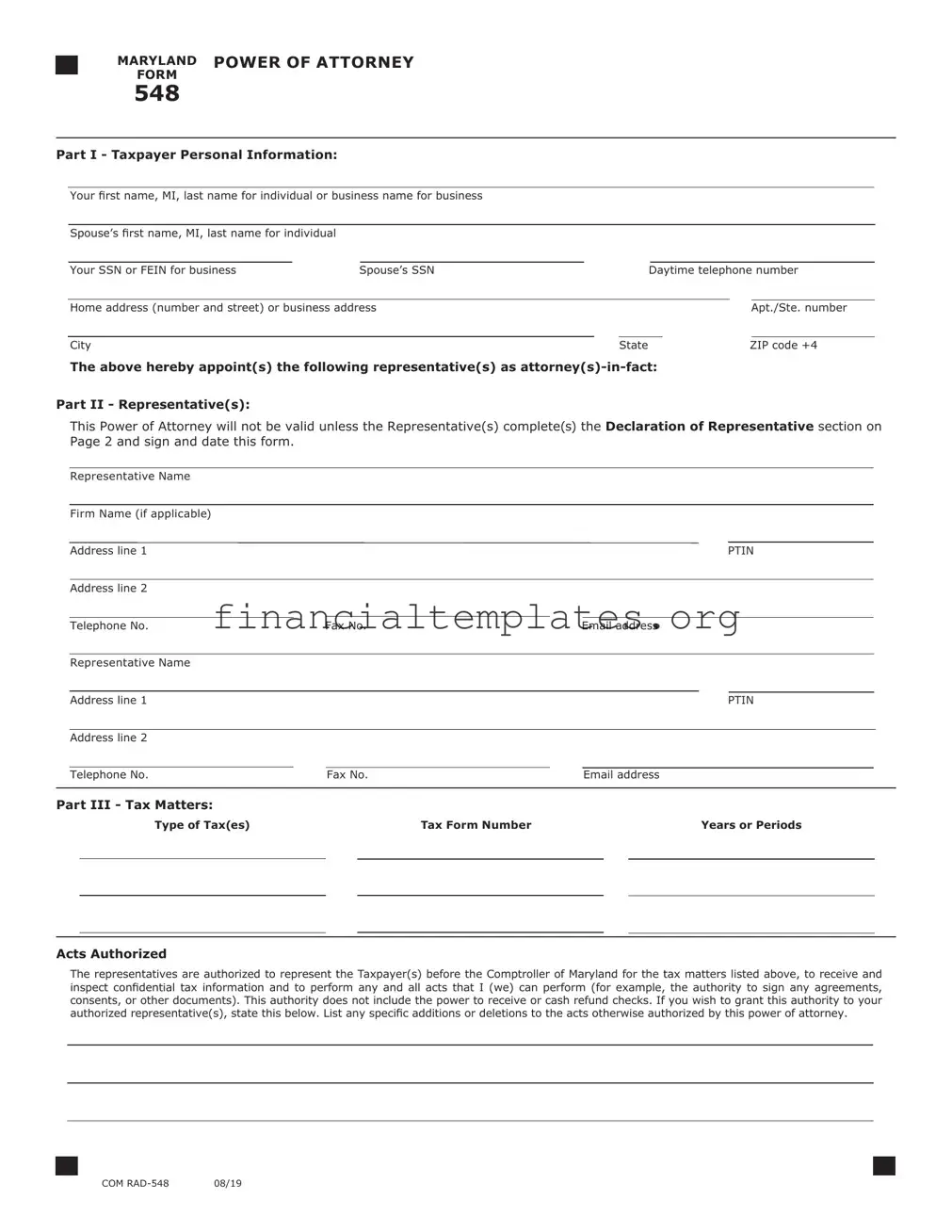

Tax POA form 548 Example

■ |

|

MARYLAND |

POWER OF ATTORNEY |

|

|

|

|

|

|

|||||

|

FORM |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

548 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Part I - Taxpayer Personal Information: |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|||||||

|

Your first name, MI, last name for individual or business name for business |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

||||

|

Spouse’s first name, MI, last name for individual |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|||||||

|

Your SSN or FEIN for business |

Spouse’s SSN |

|

Daytime telephone number |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||||

|

Home address (number and street) or business address |

|

|

|

|

Apt./Ste. number |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

State |

|

|

ZIP code +4 |

|

||

The above hereby appoint(s) the following representative(s) as

Part II - Representative(s):

This Power of Attorney will not be valid unless the Representative(s) complete(s) the Declaration of Representative section on Page 2 and sign and date this form.

Representative Name

|

Firm Name (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address line 1 |

|

|

|

|

|

|

|

|

PTIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address line 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Telephone No. |

Fax No. |

Email address |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Representative Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address line 1 |

|

|

|

|

|

|

|

|

PTIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address line 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone No. |

|

Fax No. |

|

Email address |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

Part III - Tax Matters: |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Type of Tax(es) |

|

|

Tax Form Number |

|

|

|

|

Years or Periods |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acts Authorized

The representatives are authorized to represent the Taxpayer(s) before the Comptroller of Maryland for the tax matters listed above, to receive and inspect confidential tax information and to perform any and all acts that I (we) can perform (for example, the authority to sign any agreements, consents, or other documents). This authority does not include the power to receive or cash refund checks. If you wish to grant this authority to your authorized representative(s), state this below. List any specific additions or deletions to the acts otherwise authorized by this power of attorney.

■ |

COM |

■ |

■ |

MARYLAND |

POWER OF ATTORNEY |

Page 2 |

FORM |

|

|

|

|

548 |

|

|

Taxpayer’s SSN or FEIN |

|

Taxpayer’s Name |

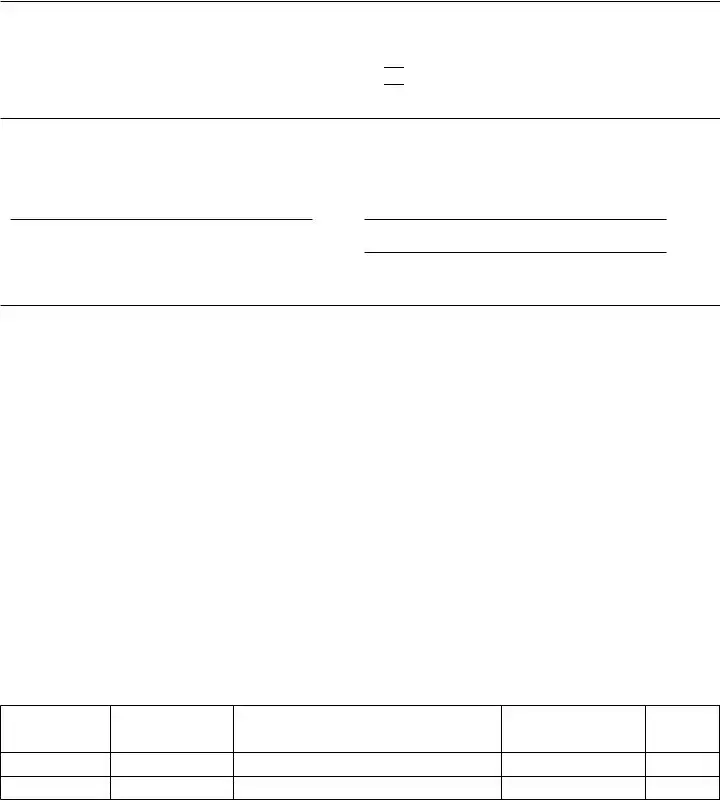

Retention/Revocation of Prior Power(s) of Attorney

By filing this power of attorney form, you automatically revoke all earlier power(s) of attorney on file with the Comptroller of Maryland for the same tax matters and years or periods covered by this document.

If you do not want to revoke a prior power of attorney, check here □

You must attach a copy of any Power of Attorney you want to remain in effect.

Signature of Taxpayer(s)

If a tax matter concerns a joint return, both spouses must sign if joint representation is requested. If signed by a corporate officer, partner, guardian, tax matters partner, executor, receiver, administrator, or trustee on behalf of the Taxpayer, I certify that I have the authority to execute this form on behalf of the Taxpayer. If other than the Taxpayer, print the name here and sign below.

Your signature |

Date |

|

|

Spouse’s signature if filing jointly |

Date |

Title, if business taxpayer or if other than individual taxpayer

Telephone number if other than the Taxpayer

If not signed and dated, this power of attorney will not be processed.

Declaration of Representative Representative(s) must complete this section and sign below.

Under penalties of perjury, I declare that

•I am not currently under suspension or disbarment from practice within the State of Maryland or in any jurisdiction;

•I have verified the identity of the taxpayer described under Taxpayer Personal Information and that the person signing as the authorized taxpayer is the same person described under Taxpayer Personal Information;

•I am aware of regulations governing the practice of attorneys, certified public accountants, public accountants, enrolled agents and others; and the penalties for false or fraudulent statements provided;

•I am authorized to represent in Maryland, the Taxpayer(s) identified for the tax matter(s) specified herein; and I am one of the following:

1.A member in good standing of the bar of the highest court of the jurisdiction shown below.

2.A Certified Public Accountant duly qualified to practice in the jurisdiction shown below.

3.An Enrolled Agent.

Attach

4.A Maryland Registered Individual Tax Preparer.

5.A bona fide officer of the Taxpayer.

6.A

7.A member of the Taxpayer’s immediate family (spouse, parent, child, grandparent, grandchild,

8.A general partner of the Taxpayer (partnership).

9.A fiduciary for the Taxpayer (Estate or trust).

10.Other (attach statement).

Jurisdiction (state)

Signature

Identification Number

(Bar, CPA, EA, Certification or Federal Employer Identification Number)

Date

An incomplete Form 548 will not be processed.

■ |

COM |

■ |

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The Tax Power of Attorney (POA) Form 548 is designed to grant an individual or organization the authority to handle tax matters on behalf of the filer. |

| Authority Granted | This form allows the appointed person or entity to obtain private tax information and make decisions about taxes, including signing tax returns. |

| State-Specific Use | Form 548 is applicable in specific states that have adopted this form for tax representation; each state might have modifications and different requirements. |

| Governing Laws | The use and authority of the Form 548 are governed by the tax laws and regulations of the state in which it is being filed. |

| Duration of Authority | The duration for which the authority remains valid varies by state; it may be limited to a certain number of years or remain effective until revoked. |

| Revocation Process | To revoke the powers granted through Form 548, the filer must typically provide written notice to the taxing authority and, depending on the state, may also need to fill out a revocation form. |

Guide to Writing Tax POA form 548

Once you've decided to grant someone the authority to handle your tax matters, it becomes crucial to fill out the Tax Power of Attorney (POA) Form 548 correctly. This document legally empowers your chosen representative to make decisions and take actions regarding your taxes on your behalf. It's a straightforward process, but attention to detail ensures that your tax matters are handled as you wish, without any unnecessary delays or issues. Here's how to accurately complete the form:

- Start by entering your full name and address in the designated spaces to identify yourself as the taxpayer.

- Specify your Social Security Number (SSN) or Employer Identification Number (EIN) to ensure your tax records are correctly associated with the POA.

- Fill in the name and contact information of the individual or entity you're granting power to. This person or organization will act on your behalf concerning your tax matters.

- Detail the specific tax forms and periods for which this POA is valid. Being precise here ensures that your representative has authority only over the matters you choose.

- If you wish to revoke any previous powers of attorney, make sure to indicate this by checking the appropriate box on the form. Provide the details of any such documents to avoid confusion.

- Read the provided declarations and consent provisions carefully. By signing the form, you're agreeing to these terms, so it's important you understand them fully.

- Sign and date the form. Your signature legally activates the POA. If you're filling this out on behalf of an entity, make sure your title and authority to sign are clearly indicated.

- Have the designated representative sign the form as well, if required. This acknowledges their acceptance of the responsibility you're entrusting to them.

After completing the form, the next step is to submit it to the appropriate tax authority, often the IRS or a state revenue department, depending on your tax matters. Ensure you keep a copy for your records. Submitting this document is a significant step in managing your taxes through a trusted delegate, enabling you to focus on other aspects of your life or business, knowing your tax affairs are in capable hands.

Understanding Tax POA form 548

-

What is a Tax Power of Attorney (POA) Form 548?

A Tax Power of Attorney (POA), Form 548, is a legal document used to grant someone else the authority to handle your tax matters with the tax authorities. This form allows the designated individual, often referred to as an agent or attorney-in-fact, to perform tasks such as filing taxes, obtaining confidential tax information, and making decisions regarding tax payments on behalf of the person granting the power (the principal).

-

Who should use a Tax POA Form 548?

Anyone who needs someone else to take care of their tax matters because of travel, health issues, business obligations, or lack of expertise in tax matters should consider using a Tax POA Form 548. It's commonly used by individuals, businesses, estates, and trusts.

-

How do I appoint someone as my tax representative?

To appoint someone as your tax representative, you must complete the Tax POA Form 548. This involves providing personal information, specifying the tax matters and periods for which the representative will have authority, and signing the document. Remember, the individual you choose should be someone you trust deeply, as they will have access to sensitive tax-related information.

-

Can I revoke a Tax POA Form 548?

Yes, you can revoke a Tax POA Form 548 at any time. To do this, you should provide written notice to both the tax authority and the individual or entity that was granted the POA. It's also recommended to fill out a new form if appointing a different representative to ensure there is no confusion regarding your current tax representation.

-

Does a Tax POA Form 548 expire?

The Tax POA Form 548 does not automatically expire unless a specific end date is mentioned within the document. If no expiration date is provided, it remains in effect until it is revoked. Nonetheless, it's a good practice to periodically review and potentially update your POA to reflect any changes in your personal or business circumstances.

-

What are the limitations of a Tax POA Form 548?

While a Tax POA Form 548 grants significant authority to the agent, there are limitations to what they can do. For example, unless explicitly stated, the agent may not be able to sign certain tax-related documents on your behalf or make decisions that would alter your estate plan. It's vital to clearly outline the scope of the agent's powers when filling out the form.

-

Do I need a lawyer to complete a Tax POA Form 548?

While you are not required to have a lawyer to complete a Tax POA Form 548, consulting with a legal advisor can be useful, especially to understand the full scope of the authority you're granting and to address any specific concerns you might have. They can also help ensure that the form is filled out correctly and meets all legal requirements.

-

How do I submit my Tax POA Form 548?

Submission procedures vary by state and may also depend on the specific tax agency (federal, state, local) with which you're dealing. Generally, you can submit your completed Tax POA Form 548 via mail, fax, or, in some cases, online. Check with the relevant tax authority to confirm their submission requirements.

-

Is there a difference between a Tax POA and other types of Power of Attorney?

Yes, a Tax Power of Attorney is specifically designed for tax matters and does not cover other types of decisions, such as medical or general financial decisions. Other types of POAs, such as General Power of Attorney or Healthcare Power of Attorney, are used to grant broader or entirely different types of authority. It's important to choose the right type of POA for your needs.

-

Can a Tax POA Form 548 be used for both federal and state tax matters?

Typically, a Tax POA Form 548 is used for state tax matters. For federal tax matters, the Internal Revenue Service (IRS) requires its own form, Form 2848, Power of Attorney and Declaration of Representative. However, procedures and requirements can vary, so it's essential to check with both the state and federal tax authorities to ensure you're using the correct form and following the appropriate process for your situation.

Common mistakes

Not Checking the Form's Version: Tax forms are updated regularly. Using an outdated version can mean missing out on important changes or instructions.

Incorrect Information: Simple errors like misspelling names or transposing numbers can invalidate the entire form. Accuracy is key.

Leaving Sections Blank: Every section of Form 548 needs attention. Skipping parts can lead to processing delays or questions about the filer's intentions.

Failing to Specify Powers Granted: You must be clear about what the appointee can and cannot do. Vague language leads to confusion and legal gray areas.

Overlooking the Duration: If you don't specify how long the POA is effective, there may be disputes about its validity later on.

Misunderstanding Revocation Procedures: Knowing how to properly revoke the POA when it's no longer needed or if you wish to appoint someone else is crucial.

Not Having It Witnessed or Notarized: Depending on your state's requirements, skipping this step can render the form null and void.

Forgetting to Keep a Copy: Always keep a copy for your records. If questions arise in the future, having your own documentation can be invaluable.

These common mistakes highlight the importance of thoroughness and accuracy when dealing with tax documents. By taking the time to review and correctly complete the Tax POA Form 548, filers can help ensure their tax matters are in good hands.

Documents used along the form

When dealing with tax matters, it's common to need more than just the Tax Power of Attorney (POA) Form 548. This form grants someone else the authority to handle your tax affairs, which can be crucial during times when you're unable to manage them yourself. However, to ensure a comprehensive approach to handling tax issues, several other forms and documents are often used alongside the Tax POA. Let's look at some of these essential documents.

- Form 1040: The U.S. Individual Income Tax Return form is the standard federal income tax form used to report an individual's gross income.

- Form 2848: This is the IRS Power of Attorney and Declaration of Representative form. It's more detailed than the Tax POA Form 548 and is required for someone to represent you before the IRS.

- Form 8821: Tax Information Authorization form allows appointees to review and receive confidential tax information but not to represent you to the IRS.

- Form 8857: Request for Innocent Spouse Relief form is necessary when seeking relief from joint tax liabilities due to actions taken by a spouse or former spouse.

- Schedule C: Profit or Loss from Business is used by sole proprietors to report the income and expenses of their business.

- Form W-2: Wage and Tax Statement is a federal document employers complete to report employee income and withholdings to the IRS.

- Form 1099: Various forms under the 1099 designation report different types of income other than wages, such as independent contractor income, dividend income, or interest income.

- Form 8962: Premium Tax Credit form is used to calculate the amount of premium tax credit you're eligible for if you purchased health insurance through the Marketplace.

Together with the Tax POA Form 548, these documents form a comprehensive toolkit for managing a wide range of tax-related activities. Whether you're handling your tax affairs or supporting someone else in managing theirs, understanding these forms can provide a clearer path through the complexities of tax law. It's important to remember, though, that tax matters can often become quite complicated. When in doubt, seeking advice from a tax professional can help ensure that you're making informed decisions and taking the right steps according to your specific circumstances.

Similar forms

The Durable Power of Attorney (POA) for healthcare decisions is akin to the Tax Power of Attorney form in its function of granting authority to a designated individual. Both documents allow individuals to appoint representatives to make crucial decisions on their behalf—tax-related decisions in the case of the Tax POA, and healthcare decisions for the Durable POA for healthcare. This setup ensures that the principal's wishes are honored in specific arenas of their life, whether financial or healthcare-related, in times when they cannot make these decisions themselves.

Similarly, the General Power of Attorney (POA) document shares common ground with the Tax POA form. This document likewise vests a chosen agent with the power to act on the principal's behalf. However, the scope of the General POA is broader, encompassing a wide range of legal and financial decisions beyond just tax matters. The Tax POA is a more specialized form, focusing solely on tax matters, but both are essential legal tools for estate planning and managing one’s affairs through representation.

The Living Will is another document that parallels the Tax POA form in terms of allowing individuals to express their wishes in advance, albeit focusing on end-of-life care rather than tax issues. While the Tax POA appoints an agent to handle tax affairs, the Living Will speaks to healthcare professionals about the types of life-sustaining treatments an individual does or does not wish to receive. Both documents serve to ensure that an individual’s preferences are respected and legally recognized in critical moments.

The Revocable Living Trust is related to the Tax POA form as it concerns the efficient management and protection of the individual's assets. With a Revocable Living Trust, an individual can outline how their assets should be managed during their lifetime and after their death. Like the Tax POA, which designates an agent for tax purposes, a trust involves appointing a trustee to manage and distribute the trust's assets in accordance with the grantor's wishes, ensuring financial affairs are in order.

The Financial Power of Attorney document closely resembles the Tax POA form by allowing an individual to designate someone to manage their financial affairs. Though the Tax POA is explicitly for tax matters, both documents empower a representative to act in the principal’s financial best interest, be it managing bank accounts, investing, or handling tax issues. This ensures continuity in financial management when the principal is unable to do so.

The HIPAA Release Form is conceptually similar to the Tax POA in that it grants permission for a designated party to access specific, confidential information. For the Tax POA, this information relates to the individual’s taxes, while the HIPAA Release Form pertains to personal health information. Both forms are crucial for ensuring that pertinent information is accessible to trusted individuals, thus facilitating informed decision-making on the principal's behalf.

The Appointment of Guardian Form shares similarities with the Tax POA by enabling individuals to select someone who will make decisions for them, in this case, if they become unable to care for themselves or their property. While the Tax POA focuses on tax matters, the Appointment of Guardian covers a broader spectrum of personal and financial decisions, ensuring the principal’s well-being and affairs are managed according to their wishes.

The Bank Account Authorization Letter, like the Tax POA, allows individuals to grant others the authority to manage specific assets—this time, bank accounts. Both documents streamline the process of managing financial assets, be it accessing bank accounts or handling tax-related matters, by authorizing representatives to act on the individual’s behalf, ensuring financial operations can proceed without delays or legal hurdles.

Finally, the Advance Healthcare Directive can be likened to the Tax POA as both enable individuals to dictate how decisions should be made when they cannot make them independently. While the Tax POA deals with tax affairs, the Advance Healthcare Directive outlines preferences for medical treatment and health-related decisions. Each document plays a critical role in preemptive planning, safeguarding an individual's choices across different aspects of life.

Dos and Don'ts

When filling out the Tax Power of Attorney (POA) Form 548, there are specific do's and don'ts to keep in mind. These guidelines help ensure that the form is completed accurately and effectively, granting the right level of authority to the designated individual. Below are lists of things you should and shouldn't do.

Do's:

Read the instructions carefully before filling out the form. Understanding every section is crucial to providing accurate information.

Ensure that you provide the complete and correct names and identification numbers for both the taxpayer and the representative. Accuracy is essential for the power of attorney to be valid.

Specify the tax matters and years or periods for which the authorization is granted. Being clear about the scope will prevent any misunderstandings.

Sign and date the form. A Power of Attorney form without the taxpayer’s signature is not valid.

If necessary, get the form notarized, depending on the state requirements where the form is being submitted. Some states may require notarization for the form to be considered valid.

Don'ts:

Do not leave any sections blank. If a section does not apply, write “N/A” (not applicable) to indicate that you have read and acknowledged the section.

Avoid using nicknames or abbreviations for names. Always use the full legal name to prevent any confusion or issues with identification.

Do not provide outdated or expired identification numbers for either the taxpayer or the representative. This could invalidate the document.

Refrain from guessing on dates or tax matters if you are unsure. It's important to verify all information before submission to ensure its accuracy.

Do not forget to keep a copy of the signed form for your records. Keeping a record is important for future reference or if any disputes arise.

Misconceptions

The Tax Power of Attorney (POA) Form 548 is an important document that allows someone to act on another's behalf in matters related to taxes. However, there are some common misconceptions about this form that need clearing up:

It grants unlimited power: Many believe that by signing a Tax POA Form 548, they are giving the appointed individual complete control over all their financial affairs. This is not true. The form specifically limits the agent's power to tax matters only. The scope of authority can be further restricted within the document itself.

It's permanent: Another misconception is that once the Tax POA Form 548 is signed, it is irrevocable. In reality, the person who granted the power (the principal) can revoke it at any time. The form can also specify an expiration date, making it automatically invalid after that period.

Any POA form will work for tax matters: A common mistake is assuming that any power of attorney document will suffice for tax purposes. However, the IRS requires the specific use of Form 548 or a form that meets certain requirements to be recognized for tax purposes. General POA documents may not be accepted.

Only a lawyer can complete it: While legal advice might be helpful in complex situations, it is not necessary to have a lawyer to complete the Tax POA Form 548. Individuals can fill out the form themselves, ensuring they provide all the necessary information and follow the instructions provided by the IRS.

Key takeaways

Filling out and using the Tax Power of Attorney (POA) Form 548 requires understanding and attention to detail to ensure it accurately reflects your wishes and legal requirements. Here’s what you need to know:

- What it is: Tax POA Form 548 allows taxpayers to grant authority to an individual, often a tax professional, to represent them before the tax authority.

- Choose wisely: The representative(s) you designate will have significant control over your tax matters, so select someone trustworthy and competent.

- Fill out completely: Ensure all sections of the form are filled out correctly to prevent any delays or misunderstandings.

- Specify the extent: You can determine the extent of the authority granted, from handling all tax affairs to just specific issues or periods.

- Signing requirements: Both the taxpayer and the representative must sign the form, adhering to the requirements to make it legally binding.

- Durability: Consider whether the power should remain in effect indefinitely, until revoked, or only for a specified duration.

- Revocation process: Understand the process for revoking the POA if you change your mind or wish to appoint someone else.

- State considerations: Tax laws and POA requirements can vary by state, so ensure the form meets your state’s specific requirements.

- Keep records: Retain a copy of the completed form for your records and ensure your representative also has a copy.

- Know the limits: While the Form 548 grants authority in tax matters, it does not permit the representative to make legal decisions outside of this scope.

Properly completing and using the Tax POA Form 548 is a critical step in managing your tax affairs efficiently and effectively. By following these key takeaways, you can navigate the process with confidence.

Popular PDF Documents

W7 Tax Form - For those involved in a partnership that invests in the U.S., the IRS W-7 form is essential for obtaining an ITIN to comply with tax obligations.

IRS Schedule SE 1040 - Assists in the reconciliation of estimated tax payments made during the year with actual tax liabilities.

Florida Sales Tax by County - Identify any other taxable amounts not subject to surtax as required on the form.