Get Tax POA form 49357 (POA-1) Form

When dealing with the complexities of tax matters, individuals and businesses often find themselves in need of professional assistance. Whether it's for auditing, tax filing, or addressing disputes with tax authorities, having an advocate who can speak on one’s behalf is invaluable. This is where the Tax Power of Attorney (POA), form 49357 or POA-1, plays a crucial role. Designed to grant a designated representative the authority to discuss and address tax matters with tax agencies, it ensures that taxpayers can be properly represented without needing to be present themselves. The form covers various aspects, including the disclosure of confidential tax information, making decisions about tax payments, and negotiating payment plans. It is essential for taxpayers to understand the significance of this document, as it facilitates a smoother interaction with tax authorities, potentially saving time and reducing stress. The POA-1 form, therefore, stands as a critical tool for those needing to authorize a trusted professional to act on their behalf in tax-related matters.

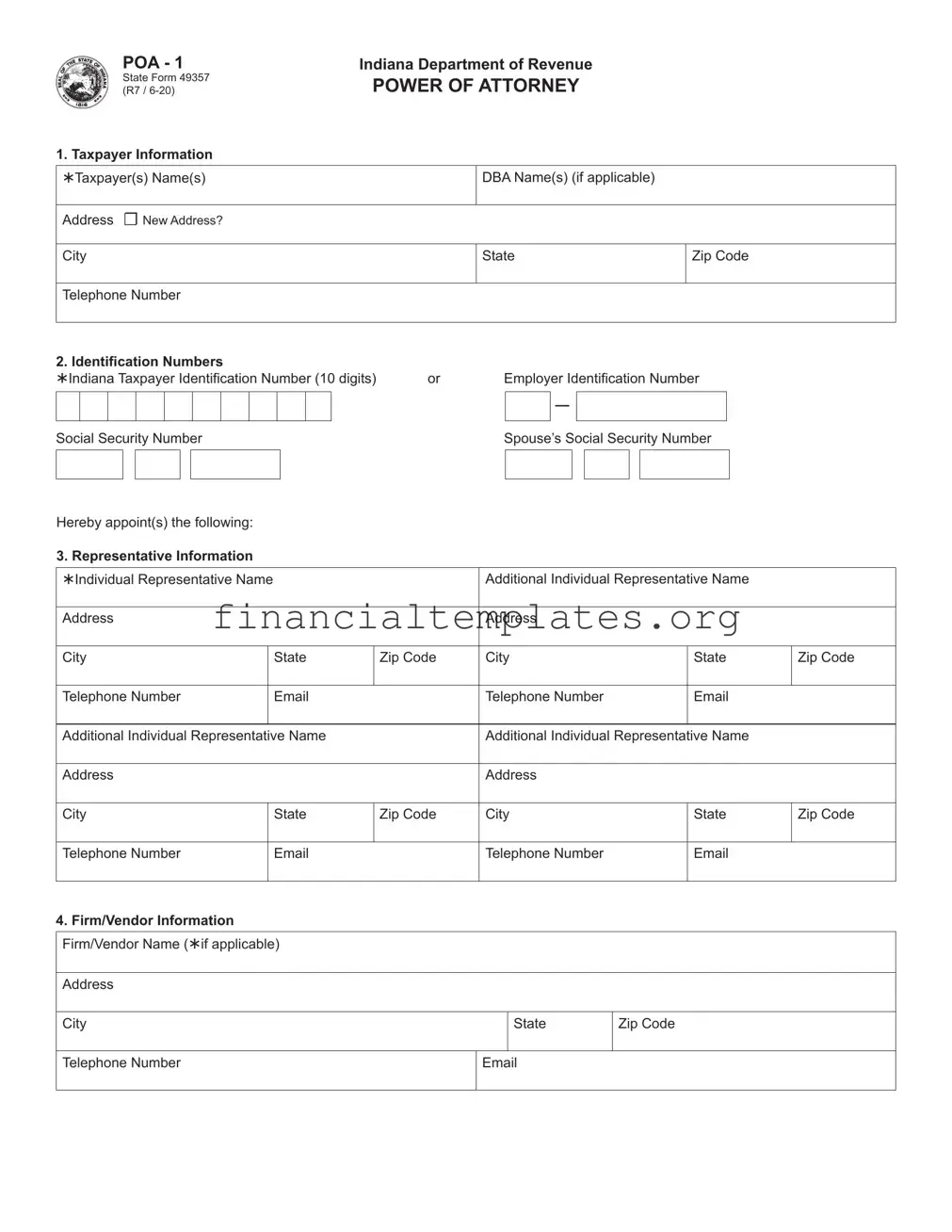

Tax POA form 49357 (POA-1) Example

|

|

|

|

POA - 1 |

|

|

|

|

Indiana Department of Revenue |

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

State Form 49357 |

|

|

|

|

POWER OF ATTORNEY |

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

(R7 / |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

1. Taxpayer Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Taxpayer(s) Name(s) |

|

|

|

|

|

|

|

|

DBA Name(s) (if applicable) |

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

☐ New Address? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

Zip Code |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

|

|

|

|

I |

|

|||

|

Telephone Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

2. Identification Numbers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Indiana Taxpayer Identification Number (10 digits) |

or |

Employer Identification Number |

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

I |

I |

I |

|

|

I |

I |

I |

I |

I |

|

I |

I |

I |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Social Security Number |

|

|

|

|

|

Spouse’s Social Security Number |

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

~l |

|

□ |

~I~ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Hereby appoint(s) the following: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

3. Representative Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Individual Representative Name |

|

|

|

|

|

|

|

|

Additional Individual Representative Name |

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

City |

|

|

|

|

|

|

|

|

|

|

State |

|

Zip Code |

City |

|

State |

Zip Code |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I |

|

Telephone Number |

|

|

|

Telephone Number |

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

Additional Individual Representative Name |

|

|

Additional Individual Representative Name |

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

City |

|

|

|

|

|

|

|

|

|

|

State |

|

Zip Code |

City |

|

State |

Zip Code |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I |

|

Telephone Number |

|

|

|

Telephone Number |

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4.Firm/Vendor Information Firm/Vendor Name (if applicable)

Address

City |

|

State |

Zip Code |

|

|

I |

I |

Telephone Number |

|

||

|

I |

|

|

If firm or vendor, list representative(s) name, telephone number and email.

Representative(s) Name

Telephone Number

5. General Authorization

☐I authorize the listed representative(s), in addition to anything otherwise authorized on this form, to represent me regarding any matters with the Indiana Department of Revenue regardless of tax years or income periods. I understand that this authority will expire 5 years from the date this POA is signed or a written and signed notice is filed revoking this authorization.

6.Tax Type(s) (Not applicable if box is checked in question 5 above)

Type of Tax |

Year(s)/Period(s) |

(Income, Withholding, Sales, etc.) |

☐ Current Year ☐ Specify |

_______________________________________ |

___________________________________ |

_______________________________________ |

___________________________________ |

_______________________________________ |

___________________________________ |

I acknowledge that the designated representative has the authority to receive confidential information and full power to perform on behalf of the taxpayer in tax matters related to this Power of Attorney. This authority does not include the power to receive refund checks.

I acknowledge that actions taken by the designated representative are binding, even if the representative is not an attorney. Proceedings cannot later be declared legally defective because the representative was not an attorney.

If I am a corporate officer, partner, or fiduciary acting on behalf of the taxpayer, I certify that I have authority to execute this Power of Attorney on behalf of the taxpayer.

7. Authorizing Signature |

|

Signature _______________________________________________ |

Date _______________________________ |

Printed Name ____________________________________________ |

Title _______________________________ |

Telephone Number ________________________________________ |

Email ______________________________ |

Required fields - if not complete, this form will be returned to sender.

Instructions for Indiana Form

Casual conversations with a taxpayer’s representative who does not have a Power of Attorney on file are permitted. However, the Indi- ana Department of Revenue will not disclose tax return information or

Pursuant to 45 IAC

1.The taxpayer’s name, DBA name (if applicable), address (Please check the box if this is a new address), and telephone number.

2.The Indiana taxpayer’s identification

3.The name, address, and telephone number of your individual representative(s). Only individuals can be named as representatives. If you want to add one individual representative, enter one in the spaces provided. If you want to add more representatives, enter them in the spaces provided.

4.If your representative works for a consulting firm or vendor, enter the company’s name, address, telephone number, and email address. Enter the individual representative name(s) employed by the firm or vendor you have designated. If you want to add more than four individual representatives for a firm or vendor, you can provide the names of those representatives in a separate list, to be attached to this Power of Attorney form.

If you wish for your firm to be represented generally by a company such as a payroll processor, enter the company’s name,

address, telephone number, and email address. If the company is not listed, you must provide the names of one or more individual |

|

representatives. |

|

|

|

5.Check this box if you want to authorize your representative to represent you regarding all tax matters, regardless of the tax year or income period involved.

6.The Power of Attorney form can contain the specific type of tax, or the option ALL. By choosing the option ALL, you will be allowed access to ALL tax types appropriate to the taxpayer. The tax years must be specific.

7.The taxpayer’s signature or the signature of an individual authorized to execute the Power of Attorney on the taxpayer’s behalf.

NOTE: Include as an enclosure any restrictions or limitations the taxpayer has placed on the representative while acting as the tax- payer’s representative.

After the taxpayer executes a Power of Attorney, the department will communicate primarily with the taxpayer’s representative.

The department accepts faxed copies of original Power of Attorney forms. If a copy is provided, the person forwarding the copy certifies, under penalties for perjury, that the copy is a true, accurate, and complete copy of the original document.

Do not send

The department will not accept a Power of Attorney form that has been altered unless it has the initials of the taxpayer (or an individual authorized to execute the Power of Attorney on the taxpayer’s behalf) beside the alteration(s).

This Power of Attorney is effective for 5 years from the date the form is signed. After the expiration of 5 years, a new Power of Attorney form must be completed if the taxpayer wishes to permit the department to communicate with the taxpayer’s representative.

This Power of Attorney can be revoked prior to expiration only by written and signed notice. A subsequent Power of Attorney alone will NOT revoke a prior Power of Attorney.

Required fields – if not complete, this form will be returned to sender.

Submit the form using these methods:

•Fax: (317)

•Mail: Indiana Department of Revenue PO Box 7230

Indianapolis, IN

Document Specifics

| Fact Number | Detail |

|---|---|

| 1 | The Tax POA form 49357 (POA-1) is used to grant authority to an individual to act on someone else's behalf in tax matters. |

| 2 | It allows the appointed person to receive confidential tax information and make decisions about the taxpayer's account. |

| 3 | The form requires detailed information about the taxpayer and the representative, including names, addresses, and identification numbers. |

| 4 | Specific tax matters and years for which the authorization is granted must be clearly listed on the form. |

| 5 | Both the taxpayer and the authorized representative must sign and date the form for it to be valid. |

| 6 | The form's validity can vary by state, as governing laws and requirements for tax POA differ across jurisdictions. |

| 7 | Filing instructions, including where to send the completed form, are often specific to the state’s tax department or agency. |

Guide to Writing Tax POA form 49357 (POA-1)

Filling out a Tax Power of Attorney (POA), specifically form 49357 (POA-1), is a critical action that allows someone else to represent you or act on your behalf for tax matters. This paperwork can be a lifeline in complex tax situations, allowing experts to navigate the tax landscape for you. The process requires precision and attention to detail, ensuring that every section is completed accurately to avoid any potential legal hiccups. Below are step-by-step instructions designed to guide you through this process smoothly.

Steps to Fill Out Tax POA Form 49357 (POA-1)

- Begin by identifying the taxpayer. This includes providing full legal names, Social Security Numbers (SSNs), or Employer Identification Numbers (EINs). If the POA is for an individual, their SSN is required. For businesses, the EIN will be necessary.

- Specify the appointment of attorney(s)-in-fact. Here, you will detail the name(s), address(es), and phone number(s) of the individual(s) you are authorizing to represent you. If more than one representative is appointed, specify whether each can act independently.

- Detail the tax matters the form covers. This encompasses tax types, tax form numbers, and the years or periods for which the power of attorney is granted. Be as specific as possible to avoid any ambiguity regarding your representative's authority.

- Clarify the specific powers granted to your representative. This section provides checkboxes for actions your representative is authorized to perform on your behalf, including receiving confidential tax information, representing you in tax matters, and signing agreements or waivers. Tick the appropriate boxes that apply.

- Include any restrictions or additional information that may limit the power of your representative. This is crucial if you wish to tailor the scope of authority granted to your representative expressly.

- Sign and date the form. Your signature is required to validate the form, along with the date of signing. If the POA is for a corporate entity, the signature of an authorized corporate officer is necessary, along with their title.

- Have the designated representative(s) sign the form. This acknowledges their acceptance of the designated responsibilities. Their signature(s) also need to be dated.

Once completed, the form should be reviewed for accuracy and completeness. Any errors or omissions can lead to delays or the rejection of the form, so thoroughness is key. After the review, the form should be submitted following the instructions provided by the issuing authority. This might involve mailing or electronically submitting the form to a specific office or department that handles tax matters for your jurisdiction. Prompt submission after completion ensures that your representative can begin acting on your behalf without unnecessary delays.

Understanding Tax POA form 49357 (POA-1)

-

What is the purpose of the Tax POA form 49357 (POA-1)?

The Tax POA form 49357, also known as POA-1, serves the primary purpose of granting a designated person or organization the authority to represent and make decisions on behalf of another individual regarding tax matters. This form is particularly useful when individuals need someone else to handle their tax affairs due to various reasons such as complexity, time constraints, or the need for specialized knowledge. By completing this form, the person named will be empowered to speak with tax authorities, access confidential tax information, and perform actions like filing taxes on behalf of the principal.

-

Who can be designated as a representative on the Tax POA form 49357 (POA-1)?

Generally, the individual chosen as a representative on the Tax POA form 49357 (POA-1) can be a trusted family member, friend, or professional such as an accountant, attorney, or tax advisor. This individual should be someone the principal trusts fully with their personal tax information and believes to possess the necessary knowledge and skills to manage their tax responsibilities effectively. It's important for the principal to ensure that the appointed representative is willing and able to take on this role before completing the form.

-

How does one complete and submit the Tax POA form 49357 (POA-1)?

Completing and submitting the Tax POA form 49357 (POA-1) involves several steps. First, the form must be accurately filled out with required details such as the principal's personal information, the representative's information, and the specific tax matters and years for which the representation is authorized. Both the principal and the designated representative need to sign the form, indicating their agreement to the terms of representation. After completion, the form should be submitted to the appropriate tax authority, following the guidelines provided by said authority. Submission methods vary by jurisdiction and may include mail, fax, or electronic submission through official tax authority websites.

-

Are there any restrictions or limitations to the authority granted through the Tax POA form 49357 (POA-1)?

Yes, there are certain restrictions and limitations to the authority granted through the Tax POA form 49357 (POA-1). While the representative is given significant powers to act on the principal's behalf concerning tax matters, their authority is generally limited to those actions and periods expressly mentioned in the form. Additionally, representatives cannot delegate this authority to others, nor can they use their position to benefit personally at the expense of the principal. The form may also set boundaries on the types of tax matters the representative can handle, such as specific tax years or types of taxes. It's crucial for both parties to clearly understand these limitations to ensure the power of attorney serves its intended purpose without causing unintended issues.

Common mistakes

Filling out the Tax Power of Attorney (POA) Form 49357, commonly known as POA-1, is a critical step for individuals seeking to authorize representation for their tax matters. However, mistakes can happen, potentially leading to delays or complications in one's tax affairs. Below are five common errors encountered:

- Not specifying the tax matters and years covered. Often, individuals may fill out the form without clearly identifying the specific tax issues and the tax years for which the authorization is granted. This omission can limit the representative's ability to act effectively.

- Failure to include all necessary personal information. The form requires detailed personal information, including social security numbers and full legal names. Skipping or inaccurately providing this data can invalidate the document.

- Appointing a representative not authorized to practice before the IRS. Not every professional is eligible to act as your representative on tax matters. If the designated individual does not hold the appropriate credentials or authorization, the POA will not be recognized.

- Omitting required signatures and dates. Both the taxpayer and the authorized representative must sign and date the form. Missing signatures or failing to date the document correctly are common errors that can lead to the rejection of the POA.

- Not updating the POA when circumstances change. Life changes, such as a change in marital status or a new address, can necessitate an update to the POA. Neglecting to refresh this crucial document can result in miscommunication or misrepresentation.

Understanding and avoiding these common pitfalls when completing the Tax Power of Attorney Form 49357 (POA-1) can streamline tax handling processes and ensure that the appointed representative can act effectively on one's behalf.

Documents used along the form

When handling your taxes, especially if you're navigating complex transactions or dealing with various tax authorities, it becomes crucial to ensure you have all the necessary documents prepared and organized. One important document in this realm is the Tax Power of Attorney (POA) Form 49357 (POA-1), which allows you to designate someone to act on your behalf for tax purposes. Along with the Tax POA, there are several other forms and documents often used to ensure comprehensive handling of one’s tax matters. These documents not only support the POA but also provide additional layers of instruction, declaration, and verification that might be needed in various scenarios.

- IRS Form 2848, Power of Attorney and Declaration of Representative - This form is used alongside or in place of state-specific forms like POA-1 to grant someone the authority to represent you before the IRS, making it essential for federal tax matters.

- IRS Form 8821, Tax Information Authorization - This document allows appointed individuals to access and review your tax information but does not permit them to act as your representative.

- Form W-9, Request for Taxpayer Identification Number and Certification - Often needed in conjunction with the Tax POA, this form is used to provide your tax ID or Social Security number to entities that pay you income.

- Form 4506-T, Request for Transcript of Tax Return - This form enables individuals or their designated representatives to request a transcript of previously filed tax returns, crucial for verifying past income and tax filings.

- State-specific Tax Compliance Certificates - Many states require these certificates for businesses to prove they are in compliance with state tax laws, often necessary when applying for state contracts or licenses.

- Financial Power of Attorney - Though broader than a Tax POA, this document allows the designated individual to handle a wide range of financial transactions, which may include tax matters, on behalf of the principal.

- IRS Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return - For estates that may be subject to estate taxes, this form is used along with POA-1 when the designated representative is handling estate matters that involve federal tax filings.

- IRS Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return - This form is used for reporting any transfers of property or gifts that might be subject to gift tax, an area where a POA might be required for representation during the process.

Understanding and organizing these documents in line with the Tax POA can be imperative for efficient tax management and compliance. Each form serves a unique purpose, from granting representatives the authority to act, to ensuring accurate reporting and compliance with tax laws. It's essential for individuals and businesses alike to familiarize themselves with these forms to ensure that all tax-related matters are handled smoothly and in accordance with the law. By doing so, one can avoid common pitfalls that arise from mismanagement or oversight of tax responsibilities.

Similar forms

The Durable Power of Attorney (POA) is a document similar to the Tax POA form 49357 (POA-1) in that it allows an individual, known as the principal, to designate someone else, called the agent or attorney-in-fact, to make decisions on their behalf. While the Tax POA focuses specifically on tax matters, a Durable POA can cover a broader range of responsibilities, including financial and legal decisions, and remains in effect even if the principal becomes incapacitated.

The Healthcare Power of Attorney shares similarities with the Tax POA form in that it grants an agent the authority to make decisions on behalf of the principal. However, this type of POA specifically addresses medical and healthcare decisions rather than tax-related matters. It becomes effective when the principal is unable to make their own healthcare decisions, highlighting a similar principle of delegation found in the Tax POA.

A General Power of Attorney (GPOA) is another document resembling the Tax POA form, providing an agent with broad powers to act on the principal's behalf. These powers can include handling financial matters, entering contracts, and managing real estate, amongst other responsibilities. Unlike the Tax POA, which is limited to tax affairs, a GPOA encompasses a wide range of activities but usually ceases to be effective if the principal becomes incapacitated.

The Limited or Special Power of Attorney is closely related to the Tax POA form, as it authorizes an agent to perform specific acts or make decisions in certain situations on behalf of the principal, similar to how the Tax POA allows for representation in tax matters. However, this document is more narrowly focused and can be tailored to any number of specific tasks beyond taxes, such as selling property or managing a particular account.

An Advance Healthcare Directive, also known as a Living Will, shares a core similarity with the Tax POA by allowing individuals to outline their wishes and instructions for future situations. This document specifically pertains to medical treatments and end-of-life care instead of tax issues. It indicates the types of medical interventions a person wishes to accept or refuse, should they become unable to communicate their decisions due to illness or incapacity.

The Executorship is a role designated in a person’s will, distinct yet related to the function served by the Tax POA. An executor is responsible for managing the deceased's estate according to the wishes expressed in their will, which may include handling tax matters. The similarity lies in the executor’s authority to make legal decisions on behalf of someone else, although in this case, it is posthumously rather than on behalf of a living individual.

A Guardianship or Conservatorship arrangement bears resemblance to the Tax POA in that it involves one person being legally appointed to make decisions for another. These decisions can relate to the caretaking of the individual (guardianship) or their estate (conservatorship), contrasting with the Tax POA’s focus on tax issues. Nevertheless, both arrangements are designed to help manage the affairs of individuals who are unable to do so themselves.

The Business Power of Attorney is akin to the Tax POA form, specifically allowing an agent to handle business-related decisions and operations, including financial transactions, contracts, and asset management on behalf of the principal. This parallels the Tax POA’s purpose of managing tax matters, underscoring the theme of delegated authority within a specified domain.

A Trust is an arrangement where a trustee holds and manages assets on behalf of a beneficiary, which relates to the Tax POA’s concept of someone acting on another's behalf. While trusts are typically used for estate planning and can last for an extended period, a Tax POA is often more temporarily focused, specifically addressing tax responsibilities as opposed to the broader asset management and distribution roles of a trust.

Finally, a Financial Statement Power of Attorney, similar to the Tax POA form, empowers an agent to handle the principal's financial matters, including but not limited to tax filing and representation before tax authorities. It’s specifically designed to deal with financial institutions and transactions, showcasing a focused delegation of authority like the Tax POA but with a broader application in financial areas beyond taxation.

Dos and Don'ts

When filling out the Tax Power of Attorney (POA) form 49357 (POA-1), there are several important do's and don'ts to keep in mind to ensure the process is completed correctly and effectively. These guidelines will help in avoiding common mistakes and ensure that the form is filled out in a way that best represents the interests of the person granting the power of attorney.

Do's:

- Ensure all information is complete and accurate, including full names, addresses, and taxpayer identification numbers.

- Specify the tax matters and years or periods covered by the POA.

- Use the most current form version to avoid processing delays.

- Have the form signed and dated by the taxpayer(s) granting the POA.

- If appointing more than one representative, indicate whether they can act independently of each other.

- Keep a copy of the completed and signed POA form for your records.

- Revoke any previous POAs that this new POA is intended to replace, if applicable.

- Mail or otherwise deliver the original POA form to the appropriate tax authority.

- Inform your representative(s) if the tax authority rejects the POA, and understand why it was rejected.

Don'ts:

- Don’t leave any required fields incomplete, as this may lead to rejection of the form.

- Don’t use outdated forms, as they may not be accepted by the tax authority.

- Don’t forget to specify the extent of the powers granted, including which tax matters and years are covered.

- Don’t neglect to date and sign the form, as without these, the form is not valid.

- Don’t appoint a representative you do not fully trust, as they will be making important decisions on your behalf.

- Don’t fail to notify the representative of their appointment.

- Don’t ignore the need to revoke previous POAs if this new POA is meant to replace them.

- Don’t submit the form without keeping a copy for your personal records.

- Don’t hesitate to seek professional advice if you have questions or concerns about filling out the POA form.

Misconceptions

When it comes to authorizing someone to handle your tax matters through a Tax Power of Attorney (POA), Form 49357 (POA-1) is crucial. However, there are several misunderstandings about this form that need clarification:

Only a Lawyer Can Be Your Representative: It's a common misconception that only lawyers can be appointed as a representative on Tax POA form 49357 (POA-1). In reality, any individual, including certified public accountants, family members, or friends whom the taxpayer trusts, can be designated, provided they’re willing to act on your behalf and have a clear understanding of their responsibilities.

The Form Grants Unlimited Power: Some people mistakenly believe that by filling out the Tax POA form 49357 (POA-1), they are giving their representative the ability to make all decisions on their behalf. The truth is, the form allows you to specify the tax matters and years or periods for which the representative has authority, thus limiting their power to your specific instructions.

Once Filed, It Cannot Be Revoked: Another misunderstanding is that once the POA-1 form is filed, the decision is irreversible. However, taxpayers can revoke the power of attorney at any time, should their circumstances or trust in the representative change. This revocation must be done in writing and according to the guidelines provided by the tax authority.

Filling and Filing Is Complicated: The process is often thought to be tedious and complicated. While it is important to provide accurate and detailed information, the instructions are designed to be straightforward. Assistance from a tax professional can also simplify the process, ensuring all the necessary details are correctly filled out.

The Form Covers All Tax-Related Matters: People sometimes assume that the POA-1 form applies to all tax-related issues. In reality, the form specifically states which taxes and periods the representative can address. If you need to grant authority for matters not covered on the form, additional documentation may be necessary.

It’s Only for Handling Audits or Investigations: Finally, there’s a misconception that this form is only necessary if you're facing an audit or investigation. However, the POA-1 can be useful in many situations, such as authorizing someone to file your taxes, communicate with tax authorities on your behalf, or access confidential tax information.

By understanding the actual scope and limitations of Tax POA form 49357 (POA-1), taxpayers can more effectively manage their tax affairs and ensure they are confidently delegating the appropriate responsibilities.

Key takeaways

Filing a Tax Power of Attorney (POA) form, specifically form 49357 (POA-1), is a crucial step for anyone seeking to grant another individual the authority to manage their tax matters. This procedure, while straightforward, involves several key points that individuals should keep in mind to ensure the process is completed accurately and effectively. Below are eight important takeaways regarding filling out and using the Tax POA form 49357 (POA-1).

- Understand the purpose: The Tax POA form enables you to designate someone else, typically a tax professional, to speak with the tax authority, obtain confidential information, and perform actions like filing a return on your behalf.

- Identify the agent: Accurately identify the person or firm you're granting authority to. This includes providing their full name, address, and contact information. Mistakes here can lead to unnecessary complications or delays.

- Specify the powers granted: The form requires you to specify the extent of powers you are granting, including which tax matters and periods the agent has authority over. Be as precise as possible to avoid any ambiguities.

- Consider durability: Think about whether the POA should remain in effect even if you become incapacitated. This is crucial for ensuring continuous management of your tax affairs under unforeseen circumstances.

- Dual representation: If you're appointing more than one agent, decide whether they must act together (jointly) or if each can act independently (severally). This affects how decisions are made and actions are carried out.

- Sign and date: The form must be signed and dated by you (the principal). Depending on your jurisdiction, witness signatures or a notary public may also be required to validate the form.

- Notify the agent: Once completed, provide the agent with a copy of the POA. They will need this document when representing you before tax authorities.

- Keep it up to date: Life changes, such as moving to a different state or changing agents, may necessitate updating the POA. Regularly review and, if necessary, update the POA to reflect your current wishes and circumstances.

By keeping these key points in mind, individuals can ensure they fill out and utilize the Tax POA form 49357 (POA-1) correctly, thus making the management of their tax matters more efficient and secure. Remember, when in doubt, consulting with a tax professional can provide clarity and guidance through this process.

Popular PDF Documents

4361 Form - The form serves as a permanent waiver of benefits, illustrating its significance in financial planning for religious personnel.

Arkansas Tax Forms - It details where to list other income sources, such as farm income or depreciation differences.

IRS Schedule SE 1040 - Allows entrepreneurs to work out their self-employment tax which includes both the employer and employee portion.