Get Tax POA form 3520-BE Form

Navigating the complexities of tax documentation can often feel like trying to decipher an ancient code. Among the myriad of forms the IRS requires, the Tax Power of Attorney (POA) Form 3520-BE stands out as a crucial document for those seeking to grant another individual the authority to handle their tax matters. This form is not just about delegating responsibilities; it's about entrusting someone with significant financial and legal power. It encompasses the authorization to receive confidential tax information and make decisions on one's behalf concerning taxes, making it indispensable in situations where one cannot handle their tax affairs personally. Understanding the in-depth provisions, the scope of authority granted, and the specific situations in which this form is applicable is essential for any taxpayer considering making such an important appointment. Whether dealing with straightforward tax filings or more complex tax issues, the correct completion and submission of Tax POA Form 3520-BE can be a critical step in ensuring your tax matters are handled accurately and efficiently.

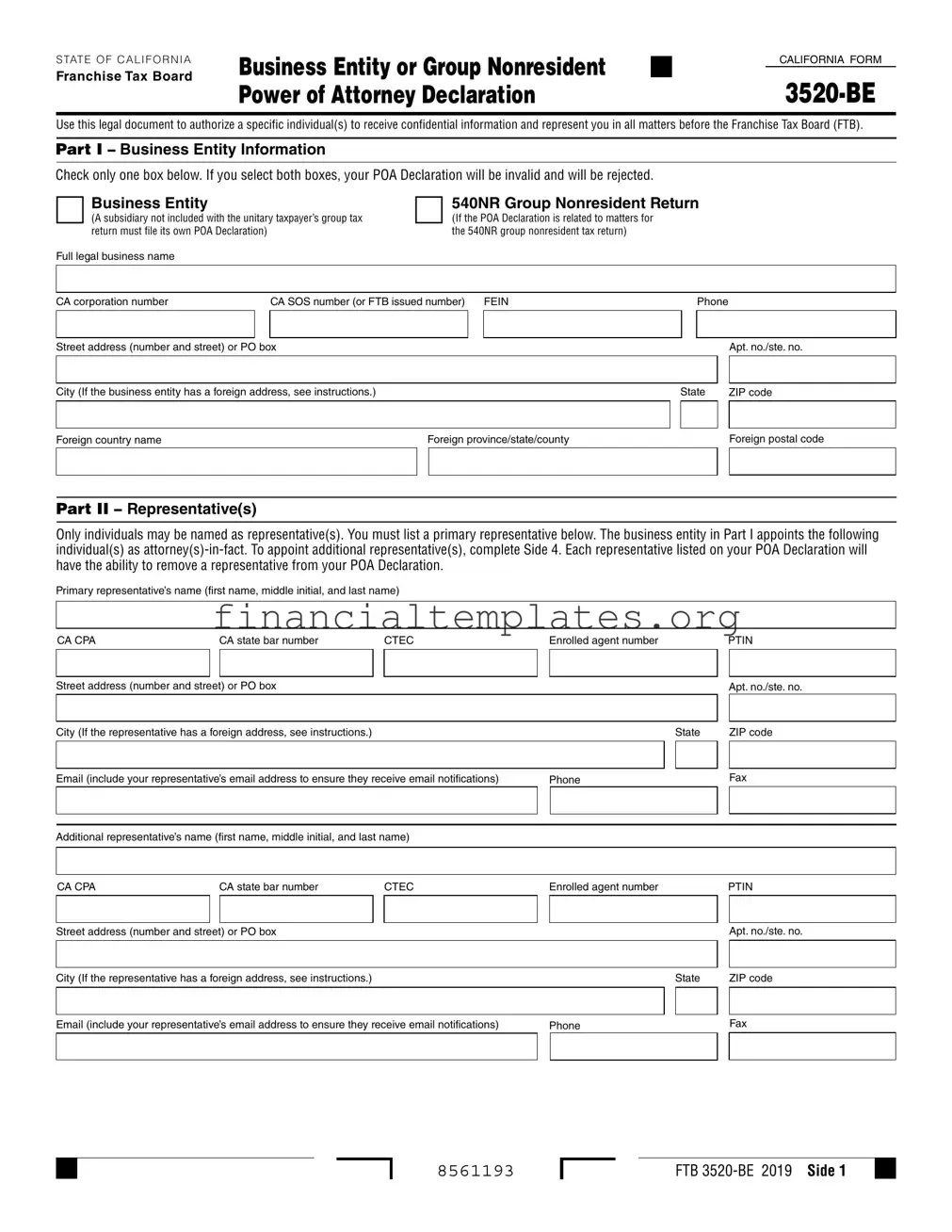

Tax POA form 3520-BE Example

STATE OF CALIFORNIA

Franchise Tax Board

Business Entity or Group Nonresident |

■ |

|

CALIFORNIA FORM |

|

|

|

|

Power of Attorney Declaration |

|

|

|

|

Use this legal document to authorize a specific individual(s) to receive confidential information and represent you in all matters before the Franchise Tax Board (FTB).

Part I – Business Entity Information

Check only one box below. If you select both boxes, your POA Declaration will be invalid and will be rejected.

Business Entity |

|

|

540NR Group Nonresident Return |

|

|||||||

□ (A subsidiary not included with the unitary taxpayer’s group tax |

□ (If the POA Declaration is related to matters for |

|

|

|

|

|

|||||

return must file its own POA Declaration) |

|

|

the 540NR group nonresident tax return) |

|

|

|

|

|

|||

Full legal business name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

CA corporation number |

CA SOS number (or FTB issued number) FEIN |

|

|

Phone |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street address (number and street) or PO box |

|

|

|

|

|

|

|

|

Apt. no./ste. no. |

||

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

City (If the business entity has a foreign address, see instructions.) |

|

|

|

|

State |

ZIP code |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign country name |

|

Foreign province/state/county |

|

|

|

|

Foreign postal code |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part II – Representative(s)

Only individuals may be named as representative(s). You must list a primary representative below. The business entity in Part I appoints the following individual(s) as

Primary representative’s name (first name, middle initial, and last name)

CA CPA |

CA state bar number |

CTEC |

Enrolled agent number |

|

|

PTIN |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street address (number and street) or PO box |

|

|

|

|

|

|

Apt. no./ste. no. |

|||

|

|

|

|

|

|

|

|

|

|

|

City (If the representative has a foreign address, see instructions.) |

|

|

|

State |

|

ZIP code |

||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

Email (include your representative’s email address to ensure they receive email notifications) |

Phone |

|

|

|

Fax |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional representative’s name (first name, middle initial, and last name) |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

CA CPA |

CA state bar number |

CTEC |

Enrolled agent number |

|

|

PTIN |

||||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Street address (number and street) or PO box |

|

|

|

|

|

|

Apt. no./ste. no. |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City (If the representative has a foreign address, see instructions.) |

|

|

|

State |

|

ZIP code |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Email (include your representative’s email address to ensure they receive email notifications) |

Phone |

|

|

|

Fax |

|||||

|

|

|

|

|

|

|

|

|

|

|

■

8561193

FTB |

■ |

■

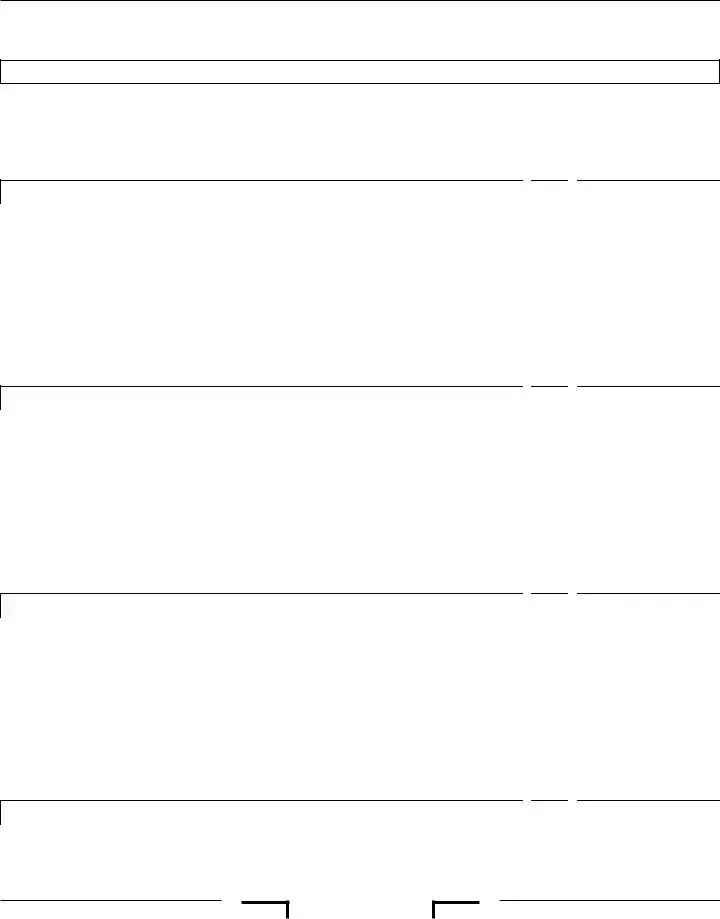

Part III – Authorization for All Years or Specific Income Periods Your POA Declaration Covers

You must check either the “Yes” or “No” box below. Your selection authorizes representatives in Part II and on Side 4 to contact FTB about your account, receive and inspect your confidential information, represent you in all FTB matters, and request information we receive from the Internal Revenue Service (IRS) for either question 1 or 2 indicated below.

If you authorize “all years” and “specific income periods,” the specific income periods privilege prevails. Enter “NA” (not applicable) or strike through any blank year fields in question 2a through 2d. If you do not check either the “Yes” or “No” box or check both the “Yes” and “No” box, we will process the authorization as a “No.” This may cause your POA Declaration to be invalid, and it may be rejected. If you authorized all years, this will include previous, current, and future years up to the expiration date. If you authorized “specific income periods,” you can designate future years or income periods up to fve years from the POA Declaration signature date.

1. |

Authorized All Years |

. . . . . . . . . . . . . . . . . . . . . . . . . . . □Yes |

□No |

|

Or |

. . . . . . . . . . . . . . . . . . . . . . . . . . . □Yes |

□No |

2. |

Authorized Specifc Income Periods* |

||

|

Year Begins: |

Year Ends: |

|

|

(mm/dd/yyyy) |

(mm/dd/yyyy) |

|

|

|

2a. |

|

|

2b. |

* For example, |

|

2c. |

Single Year: |

||

Year Range: |

2d. |

|

Multiple Years: |

–

–

–

–

Part IV – Additional Authorizations

Check either the “Yes” or “No” box below for additional authorizations you would like to grant your representative(s) in addition to those described in Part III. If you do not check either the “Yes” or “No” box or check both the “Yes” and “No” box for any additional authorizations below, we will process the authorization as a “No.” For more information, see instructions.

1. |

Add representative(s) |

□Yes |

□No |

2. |

Receive, but not endorse, refund check(s) |

□Yes |

□No |

3. |

Waive the California statutes of limitations (SOL) |

□Yes |

□No |

4. |

Execute settlement and closing agreements |

□Yes |

□No |

5. |

Other acts (describe on Side 5) |

□Yes |

□No |

Side 2 FTB

J

8562193

7

■

Part V – Request or Retain MyFTB Full Online Account Access for Tax Professional(s)

You must check either the “Yes” or “No” box below. If you check the “Yes” box, you are requesting to authorize or retain full online account access for your tax professional(s), including the ability to view tax returns and take available actions based upon the year(s) designated on this declaration. If you requested full online account access for your tax professional(s) on your POA declaration, a separate notice will be mailed to you with an authorization code and instructions to approve or deny the online account access request. An authorization code will not be sent for tax professional(s) that have existing full online account access.

If you check the “No” box, both the “Yes” and “No” boxes, or do not check any box, we will process the authorization as a “No”, and your tax professional(s) will be granted limited online account access; any existing relationships with full online account access will be changed to limited online account access. Limited online account access includes viewing notices and most correspondence issued by FTB in the last 12 months.

This online account access authorization does not affect their ability to take actions on your behalf or the information your representative can receive by phone, chat, or in person.

If your POA declaration is rejected, this request for online access will not be processed and no updates will be made to online access levels for any existing relationships.

Note: Online access is not available for 540NR Group Nonresident Return accounts.

Authorize MyFTB Full Online Account Access for Tax Professional(s) |

□Yes □No |

Part VI – Signature Authorizing Power of Attorney Declaration

To learn about your privacy rights, how we may use your information, and the consequences for not providing the requested information, go to ftb.ca.gov/forms and search for 1131. To request this notice by mail, call 800.852.5711.

The authority granted to the representative(s) in this POA Declaration will generally expire six years from the date this form is signed, or on the date that a POA declaration is revoked, whichever occurs first.

I declare under penalty of perjury under the laws of the State of California that I am a corporate officer, general partner, authorized managing member, or tax matter partner on behalf of the business entity in Part I, and that I have the authority to sign this form on behalf of the business entity.

I understand that submitting this POA Declaration will not revoke any previously submitted POA Declarations with overlapping privileges.

FTB will reject this POA Declaration if not signed and dated by an authorized individual.

By signing this POA declaration, I understand that FTB will grant limited online account access to my tax professional representative(s) unless full online account access has been requested in Part V. If you do not want your tax professional representative(s) to have any online access, refer to Part V instructions.

Print Name |

|

Title (required for business entities) |

|

|

|

|

|

|

Signature |

|

Date |

x

J

8563193

7

FTB

■

The business entity in Part I appoints the following additional representative(s) as

Additional representative’s name (first name, middle initial, and last name)

CA CPA |

|

CA state bar number |

|

CTEC |

|

Enrolled agent number |

|

PTIN |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street address (number and street) or PO box |

|

|

|

|

|

|

|

|

|

|

Apt. no./ste. no. |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City (If the representative has a foreign address, see instructions.) |

|

|

|

|

|

State |

|

ZIP code |

|

|

||||||

._________________, |

|

|

|

D |

|

|

|

._____ |

____, |

|

||||||

|

|

|

|

|

||||||||||||

Email (include your representative’s email address to ensure they receive email notifications) |

|

Phone |

Fax |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional representative’s name (first name, middle initial, and last name) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CA CPA |

|

CA state bar number |

|

CTEC |

|

Enrolled agent number |

|

PTIN |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street address (number and street) or PO box |

|

|

|

|

|

|

|

|

|

|

Apt. no./ste. no. |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City (If the representative has a foreign address, see instructions.) |

|

|

|

|

|

State |

|

ZIP code |

|

|

||||||

._________________, |

|

|

|

D |

|

|

|

._____ |

____, |

|

||||||

|

|

|

|

|

||||||||||||

Email (include your representative’s email address to ensure they receive email notifications) |

|

Phone |

|

|

Fax |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional representative’s name (first name, middle initial, and last name) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CA CPA |

|

CA state bar number |

|

CTEC |

|

Enrolled agent number |

PTIN |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street address (number and street) or PO box |

|

|

|

|

|

|

|

|

|

|

Apt. no./ste. no. |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City (If the representative has a foreign address, see instructions.) |

|

|

|

|

|

State |

|

ZIP code |

|

|

||||||

._________________, |

|

|

|

D |

|

|

|

._____ |

____, |

|

||||||

|

|

|

|

|

||||||||||||

Email (include your representative’s email address to ensure they receive email notifications) |

|

Phone |

|

Fax |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional representative’s name (first name, middle initial, and last name) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CA CPA |

|

CA state bar number |

|

CTEC |

|

Enrolled agent number |

PTIN |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street address (number and street) or PO box |

|

|

|

|

|

|

|

|

|

|

Apt. no./ste. no. |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City (If the representative has a foreign address, see instructions.) |

|

|

|

|

|

State |

|

ZIP code |

|

|

||||||

._________________, |

|

|

|

D |

|

|

|

._____ |

____, |

|

||||||

|

|

|

|

|

||||||||||||

Email (include your representative’s email address to ensure they receive email notifications) |

|

Phone |

|

Fax |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

■ Side 4 FTB

8564193

■

■

Other Acts Authorization(s)

Submit this page if you selected Yes to the Other Acts Authorization box from Part IV. If you did not select “Yes,” or selected both “Yes” and “No” within Part IV, we will disregard this page without the listed authorizations being granted. Describe the specific other acts you authorize your representative(s) named in Part II (and on Side 4) to perform before FTB. Authorizations listed in Part III and Part IV prevail over conflicting authorizations listed in this section. Do not return this page if blank.

J

8565193

7

FTB

Document Specifics

| Fact Name | Description |

|---|---|

| Form Title | Tax Power of Attorney Form 3520-BE |

| Primary Use | Used to grant authority to another person to handle tax matters on behalf of the filer. |

| Issuing Authority | Typically issued by state tax departments or the IRS, depending on jurisdiction. |

| Governing Law | Varies by state; it is subject to state law where filed, or federal law if used for IRS matters. |

| Eligibility | Any taxpayer wishing to have representation for tax purposes. |

| Validity Period | Depends on the specifications outlined in the form, or until revoked. |

| Revocation | Can be revoked by the taxpayer at any time with a written notice. |

| Signing Requirements | Must be signed by the taxpayer and, in some jurisdictions, notarized. |

| Where to File | Depends on the tax authority; can be state department of revenue or IRS. |

| Additional Notes | Specific authorization details vary; it's important to accurately complete all required sections for valid representation. |

Guide to Writing Tax POA form 3520-BE

Once the decision to delegate someone the authority to handle tax matters on someone's behalf has been made, the next essential step is ensuring the Tax Power of Attorney (POA) Form 3520-BE is correctly filled out. This legally binding document is critical in granting the precise powers needed to the designated individual, ensuring they can act in the best interest of the person they're representing. The following steps will guide through the process of completing the form accurately, reducing the likelihood of errors and ensuring the process moves forward smoothly.

- Start by clearly printing the full legal name of the individual or entity granting the power of attorney in the designated space at the top of the form.

- Enter the taxpayer identification number (SSN, ITIN, or EIN) of the grantor next to their name.

- Provide the full legal name of the appointed representative(s) in the specified section. If more than one representative is being named, make sure to include the information for each.

- Just beside the name(s) of the representative(s), fill in their contact information, including their address, phone number, and fax number (if applicable).

- In the section designated for the tax matters, specify the type(s) of tax, the federal tax form number, and the year(s) or period(s) for which the POA is granted. Be as specific as possible to avoid any confusion or misinterpretation of authority.

- If there are any specific acts authorized or conditions attached to this power of attorney, make sure to detail these in the space provided. This might include limitations or expansions on the representative's power.

- Review the section that outlines the acts the representative is authorized to perform on behalf of the individual, ensuring understanding and agreement with each listed item. If there are any exceptions, these should be clearly noted in the designated area.

- Both the individual granting the power and the representative(s) must sign and date the form in the designated areas at the bottom. Ensure the date is correct, as this will be the effective date of the power of attorney.

- Finally, make sure to keep a copy of the completed form for personal records and provide the original to the designated representative. The representative will need the original form to demonstrate their authority when acting on behalf of the grantor.

Filling out the Tax POA Form 3520-BE with care and precision is pivotal in ensuring that tax matters are handled efficiently and accurately by the appointed representative. Once the form has been completed and signed, it becomes a vital document in the administration of one’s tax affairs. The designated representative can now legally undertake the responsibilities bestowed upon them in respect to the powers detailed in the form, laying the groundwork for a well-managed financial foundation.

Understanding Tax POA form 3520-BE

-

What is the Tax Power of Attorney (POA) Form 3520-BE?

The Tax Power of Attorney (POA) Form 3520-BE is a document that allows an individual or business to grant another person or entity the authority to handle their tax matters. This form is typically used to authorize a tax professional, such as an accountant or attorney, to represent the taxpayer before the tax authorities. The authorization can include discussing the taxpayer’s account, receiving confidential information, and performing certain actions on behalf of the taxpayer.

-

Who should use Form 3520-BE?

This form is suitable for anyone who needs to authorize a third party to manage their tax matters. It could be individuals who prefer professional assistance in dealing with complicated tax situations or businesses that require an expert to handle their tax filings and communications with tax authorities. It's particularly beneficial for those who have limited time, lack the necessary expertise to manage their taxes, or will be unavailable during key tax periods.

-

How does one complete Form 3520-BE?

Completing Form 3520-BE involves filling out specific sections that detail the taxpayer's information, the representative’s information, and the extent of authority granted. This includes the taxpayer’s name, identification number, and contact information, as well as similar details for the appointed representative. The form also requires a clear enumeration of the tax matters and years for which the authority is granted. It’s important to read the instructions carefully to ensure all necessary sections are completed correctly.

-

Is Form 3520-BE valid indefinitely?

No, Form 3520-BE is not valid indefinitely. The validity period must be specified in the form, and it cannot exceed the duration allowed under the applicable laws and regulations. The taxpayer has the flexibility to set the duration of the power of attorney, whether for a specific period or tied to the completion of certain actions, like resolving a tax dispute. It's crucial to consider the time frame for your tax matters when specifying the validity period.

-

Can the authorization granted by Form 3520-BE be revoked?

Yes, the authorization granted by Form 3520-BE can be revoked at any time by the taxpayer. This is typically done by notifying the tax authorities in writing that the power of attorney authorization is withdrawn and, optionally, by submitting a new power of attorney form to appoint a different representative, if desired. It’s important to ensure that the revocation is communicated clearly to both the tax authorities and the previously authorized representative to prevent further actions on your behalf.

Common mistakes

Filling out the Tax Power of Attorney (POA) Form 3520-BE can be a critical step for individuals who need to grant someone else the authority to handle their tax matters. However, mistakes can easily be made in this process, potentially leading to complications or delays. Here are eight common errors to avoid:

-

Not using the correct form: People often mistakenly use an outdated version of Form 3520-BE or a different form entirely. Always verify you're using the latest version provided by the IRS.

-

Incomplete information: Failing to fill out all the required sections or providing partial information can render the form invalid. Ensure every applicable part is thoroughly completed.

-

Misidentifying the parties: The form requires the identification of the principal (the person granting the power) and the agent (the person receiving the power). Confusion or errors in identifying these parties can lead to rejection of the form.

-

Incorrect Tax Matters: Specifying the wrong tax matters or tax periods can limit the agent's ability to act effectively on behalf of the principal. Be clear and precise about which taxes and years are covered.

-

Signature issues: Every POA form must be signed and dated by the principal. Omission of the signature or signing in the wrong place can invalidate the form.

-

Failing to specify limits on powers: If you wish to restrict the agent's power in any way, these limitations must be clearly outlined in the form. Neglecting to do so can give the agent more authority than intended.

-

Not including necessary attachments: Sometimes additional documentation is required to validate the POA. Failing to attach these documents can lead to processing delays or outright denial.

-

Lack of witness or notary acknowledgment: Depending on your state's requirements, the form may need to be witnessed or notarized. Ignoring these legal formalities can lead to the form's non-recognition.

Avoiding these mistakes can streamline the process, ensuring that your tax matters are handled efficiently and correctly. It's always a good idea to review the form carefully and consult with a tax professional if you have any uncertainties or questions.

Documents used along the form

When compiling documents related to the Tax Power of Attorney (POA), Form 3520-BE, it's important to understand that this form is just a part of the broader documentation necessary for tax reporting and representation. The Tax POA allows an individual or an entity to grant another person the authority to handle their tax matters. Alongside this form, several other documents are frequently required to ensure comprehensive tax management and compliance. Here's a rundown of some key documents often used in conjunction with Form 3520-BE.

- Form 1040: This is the standard Internal Revenue Service (IRS) form that individuals use to file their annual income tax returns. It is a fundamental component of personal tax documentation.

- W-2 Form: Issued by employers, this form reports an employee's annual wages and the amount of taxes withheld from their paycheck. It's essential for accurately reporting income on tax returns.

- 1099 Forms: These forms are used to report various types of income other than wages, salaries, and tips. Different 1099s cover things like freelance income, interest, dividends, and distributions from retirement accounts.

- Schedule C: For individuals who are self-employed or own a business, Schedule C is used to report profits or losses from that business activity on their tax return.

- Form 2848: The IRS Power of Attorney and Declaration of Representative form is used to formally authorize an individual, such as an accountant or attorney, to represent you before the IRS.

- Form 8821: Tax Information Authorization form allows designated parties to request and receive your tax information but does not allow them to represent you before the IRS.

- Form 4868: Application for Automatic Extension of Time To File U.S. Individual Income Tax Return provides taxpayers with an extension on the deadline to file their income tax return, though not to pay any owed taxes.

- Form 4506-T: Request for Transcript of Tax Return form enables individuals and authorized third parties to request tax return transcripts, tax account information, and other IRS records.

Gathering these documents in a timely and organized manner can significantly streamline the process of delegating tax-related responsibilities through the Tax POA (Form 3520-BE) and ensure thorough preparation for tax reporting and advisory sessions. Preparing these documents, alongside the Tax POA, can help individuals and their representatives maintain accuracy and compliance with tax laws, supporting smoother interactions with the IRS and other financial institutions.

Similar forms

The Form 2848, Power of Attorney and Declaration of Representative, shares similarities with the Tax POA form 3520-BE, as both serve to authorize another individual or entity to represent the taxpayer before the IRS. This form is pivotal for taxpayers seeking to delegate authority specifically for tax matters, allowing representatives to receive confidential tax information and negotiate with the IRS on their behalf. Just like the 3520-BE, Form 2848 requires detailed information about the taxpayer, the representative, and the extent of the authorization.

Form 8821, Tax Information Authorization, is another document that parallels the features of the Tax POA form 3520-BE. While Form 8821 does not grant authority to act as a taxpayer’s representative or to negotiate tax payments, it does authorize the designated party to inspect and receive confidential tax information for the period specified on the document. This form is particularly useful for individuals who need someone else to access their tax information without making any decisions on their behalf.

The Form SS-4, Application for Employer Identification Number (EIN), while primarily used for obtaining an EIN, can be likened to the Tax POA form 3520-BE in the context of third-party designees. On the SS-4, the applicant can designate a third party to receive the EIN and answer questions on behalf of the entity applying for it. This designated party has temporary authority, akin to the specific tax matters authorization granted through the Tax POA.

Similar in purpose to the 3520-BE, Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return, includes a section for appointing a third party to act on behalf of the estate in tax matters. This parallel exists in the realm of estate taxation, where the need for representatives to handle complex tax issues after an individual's death is crucial. By designating a third party, the executor ensures that the estate's tax responsibilities are managed correctly, reflecting the essence of delegating authority found in the 3520-BE.

Lastly, the Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return, also bears similarity to the Tax POA form 3520-BE through its provision for third-party involvement. Specific sections within Form 709 allow for designation of another to receive information and correspond with the IRS about the return. While the primary purpose is to report gifts exceeding the annual exclusion, the ability to involve a third party for tax matters connects directly to the representative authorization characteristic of the 3520-BE.

Dos and Don'ts

When completing the Tax Power of Attorney (POA) Form 3520-BE, it's crucial to follow specific guidelines to ensure the process is completed accurately and effectively. Here is a list of ten do's and don'ts to consider:

- Do thoroughly read the instructions before you start filling out the form to ensure you understand every section and requirement.

- Do use black ink or type your responses to ensure that all information is legible and can be clearly read by tax authorities.

- Do verify the correctness of your taxpayer identification number (TIN), including Social Security Numbers (SSN) or Employer Identification Numbers (EIN), to avoid processing delays or rejections.

- Do specify the tax form numbers and years for which you are granting power of attorney to ensure there is no ambiguity about the scope of authorization.

- Do ensure that both the taxpayer and the appointed representative sign and date the form to validate its execution and effectiveness.

- Don't leave any sections blank; if a section does not apply, indicate with "N/A" (not applicable) to demonstrate that you have reviewed each part of the form.

- Don't use correction fluid or make alterations on the form; if you make a mistake, start over with a new form to maintain the document’s clarity and integrity.

- Don't forget to include the representative’s contact information, such as their phone number and address, to ensure they can be reached by the tax authorities if needed.

- Don't ignore the requirement to specify any limits to the representative’s authority; clearly outline what they can and cannot do on your behalf.

- Don't hesitate to seek assistance from a professional if you have questions or concerns about completing the form correctly to avoid potential legal issues.

Misconceptions

Understanding the Tax Power of Attorney (POA) Form 3520-BE is crucial for individuals wishing to ensure their tax matters are handled correctly. However, misconceptions about this form can lead to confusion and errors. Addressing these misconceptions is key to empowering individuals to make informed decisions. Below are 10 common misconceptions about the Tax POA Form 3520-BE and explanations to clarify them.

- Misconception 1: The form gives the agent full control over all personal and financial matters.

Contrary to this belief, Form 3520-BE specifically limits the agent's power to tax matters only, allowing them to act on your behalf with the IRS.

- Misconception 2: It’s valid in all legal matters outside of taxes.

This form is solely for tax-related purposes and does not grant authority in other legal affairs.

- Misconception 3: The form is permanent and cannot be revoked.

Actually, the taxpayer can revoke it at any time provided they follow the IRS procedures for revocation.

- Misconception 4: Filing the form automatically triggers an IRS audit.

Filing Form 3520-BE does not increase the chances of an audit. It's a procedural document, not an audit trigger.

- Misconception 5: It only allows one agent to be named.

You can name multiple agents, allowing flexibility and ensuring that your tax matters can be handled if one agent is unavailable.

- Misconception 6: Any agent named must be a certified public accountant or tax attorney.

While it's advisable to choose someone with tax knowledge, the IRS does not require agents to be certified professionals.

- Misconception 7: The form covers tax liabilities for previous years.

Form 3520-BE only applies to the tax year or years specifically designated on the form; it does not retroactively apply to unresolved tax liabilities from past years.

- Misconception 8: Once submitted, the form cannot be modified.

The taxpayer can submit a new Form 3520-BE to make changes or to update agent information.

- Misconception 9: The form allows the agent to sign tax returns on behalf of the taxpayer.

The form does not grant the agent the power to sign income tax returns; it allows them to receive and provide information to the IRS only.

- Misconception 10: You don’t need a tax POA if you file taxes online.

Even if you file taxes online, having a Tax POA can be essential for addressing IRS notices or for representation in audits, which can occur regardless of how taxes are filed.

Correcting these misconceptions ensures that individuals are better informed about the powers and limitations of the Tax POA Form 3520-BE. This knowledge can aid in effective tax planning and representation, minimizing misunderstandings and potential legal issues.

Key takeaways

Understanding how to complete and utilize the Tax Power of Attorney (POA) form 3520-BE is crucial for effectively managing tax matters on behalf of someone else. Here are key takeaways to help guide individuals through this process:

Know the purpose: The Tax POA form 3520-BE is designed to grant authority to a designated person or entity to handle tax affairs and make decisions with the tax authorities on someone's behalf. This can include filing taxes, obtaining confidential tax information, and making payments.

Identify the agent carefully: An agent, also known as a representative, should be someone you trust implicitly. This could be a family member, a trusted friend, or a professional like an accountant or attorney.

Clearly specify the powers granted: The form allows the granter to specify the extent of powers given to the agent. This can range from broad authority across all tax matters to more specific tasks. Clearly outlining these parameters helps in avoiding any confusion or misinterpretation.

Understand the duration: The form requires specifying the duration for which the power remains in effect. This can be for a limited period or until revoked. Knowing how long the authority lasts is important for both parties.

Complete the form accurately: Filling out the form with accurate and complete information is crucial. Any errors or omissions can delay the process or invalidate the form, potentially complicating tax matters.

Sign and date: For the POA to be valid, it must be signed and dated by the person granting the power. Depending on state laws, witness signatures or notarization may also be required.

Keep a copy: Once completed and submitted, it’s wise to keep a copy of the form for your records. This will be useful for reference and in case any disputes arise.

Notify financial institutions: If relevant, financial institutions should be informed about the power of attorney. This helps in facilitating any necessary financial transactions related to tax payments or refunds.

Revocation process: Understanding how to revoke the form is as important as filling it out. If the situation changes and you wish to withdraw the powers granted, knowing the correct process to do so ensures a smooth transition.

By keeping these key takeaways in mind, individuals can navigate the nuances of granting tax-related powers of attorney with confidence and precision.

Popular PDF Documents

Idr Application - This form also includes a section for borrowers who currently aren't required to make payments but are anticipating a future requirement for IBR plan enrollment.

Irs Power of Attorney - Through the RD-1061 form, ensure that your tax filings reflect your financial situation accurately and beneficially, under the guidance of a seasoned representative.

IRS 990-PF - This form is essential for understanding a foundation's commitment to its charitable mission.