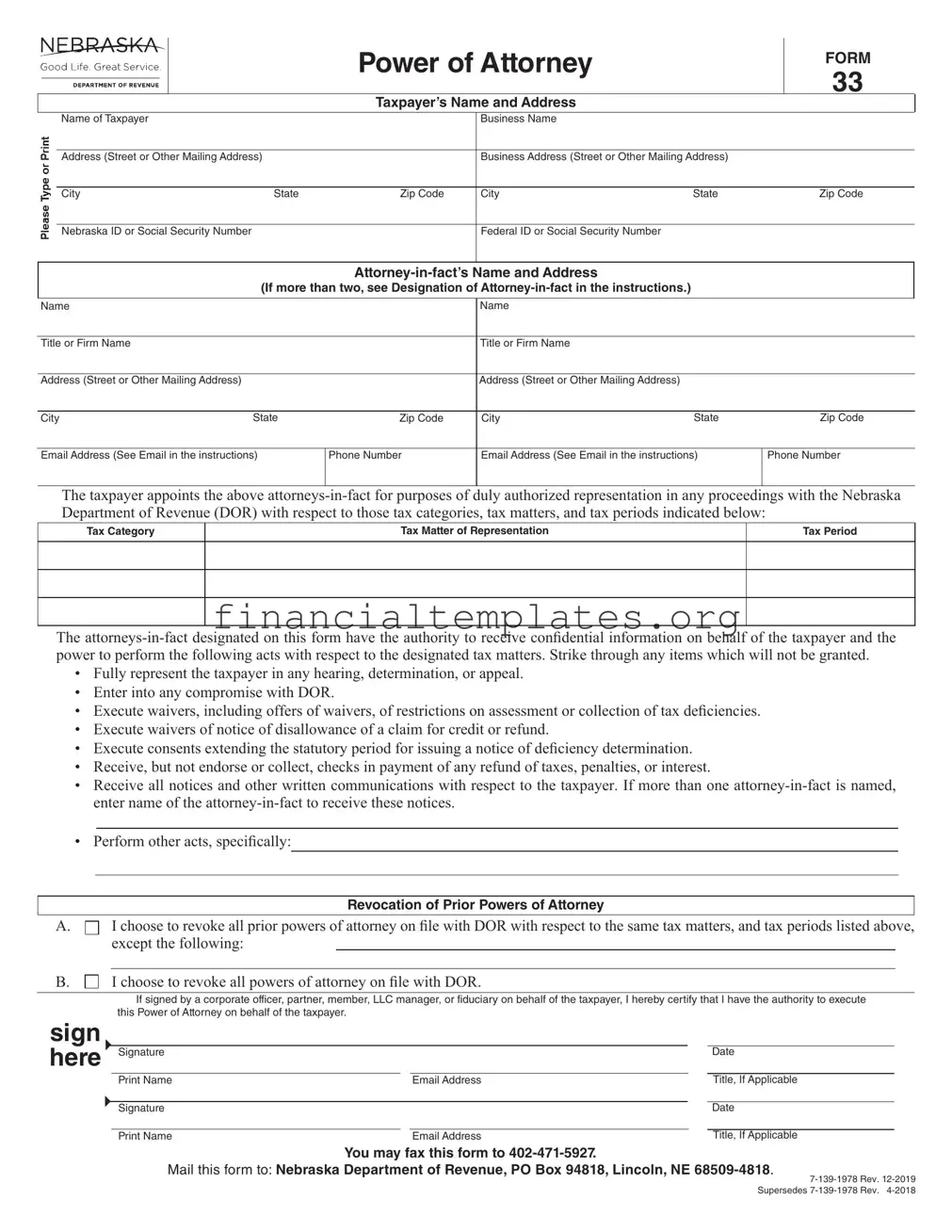

Get Tax POA form 33 Form

When diving into the complexities of dealing with tax matters, understanding the tools at your disposal can lighten the burden significantly. Among these tools, the Tax Power of Attorney (POA) Form 33 stands out as an essential document for individuals seeking to designate someone else to handle their tax affairs. This form not only grants authority to a representative to make decisions and carry out actions on one's behalf concerning their taxes but also delineates the scope of this authority. Whether it's filing returns, dealing with tax notices, or communicating with tax agencies, the Tax POA Form 33 ensures that individuals can have trusted professionals or family members look after their tax-related matters. By clearly setting the boundaries of this permission, the form provides a safe and efficient way to manage one's financial responsibilities without needing to be personally involved in every detail. It is vital for those who find themselves overwhelmed by the tax system or for those who, due to various circumstances, cannot manage their tax affairs on their own. Understanding and properly completing this form becomes imperative to ensure that one's tax matters are handled accurately and responsibly.

Tax POA form 33 Example

|

b)_EBRASl<A- |

|

|

Power of Attorney |

|

FORM |

||||||

|

Good Life. Great Service. |

|

|

|

||||||||

|

|

|

|

|

|

33 |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DEPARTMENT OF REVENUE |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||

I |

|

|

|

|

Taxpayer’s Name and Address |

|

|

I |

||||

|

|

|

Name of Taxpayer |

|

|

Business Name |

|

|

|

|

||

|

|

C: |

|

|

|

|

|

|

|

|

|

|

~- |

|

|

|

|

|

|

|

|||||

Address (Street or Other Mailing Address) |

|

|

Business Address (Street or Other Mailing Address) |

|

|

|

||||||

0 |

|

|

|

|

|

|

|

|

|

|

||

|

|

Q) |

|

|

|

|

|

|

|

|

|

|

|

~a. |

|

|

|

|

|

|

|

||||

City |

State |

Zip Code |

City |

State |

Zip Code |

|

|

|||||

|

|

..Q) |

|

|

|

|

|

|

|

|

|

|

|

|

Q) |

|

|

|

|

|

|

|

|

|

|

1/1 |

|

|

|

|

|

|

|

|

|

|

||

|

ii: |

Nebraska ID or Social Security Number |

|

|

Federal ID or Social Security Number |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

I

(If more than two, see Designation of

I

Name |

|

|

Name |

|

|

|

|

|

|

|

|

Title or Firm Name |

|

|

Title or Firm Name |

|

|

|

|

|

|

|

|

Address (Street or Other Mailing Address) |

|

|

Address (Street or Other Mailing Address) |

|

|

|

|

|

|

|

|

City |

State |

Zip Code |

City |

State |

Zip Code |

|

|

|

|

||

Email Address (See Email in the instructions) |

Phone Number |

Email Address (See Email in the instructions) |

Phone Number |

||

|

|

I |

|

|

I |

The taxpayer appoints the above

Tax Category

Tax Matter of Representation

Tax Period

The

•Fully represent the taxpayer in any hearing, determination, or appeal.

•Enter into any compromise with DOR.

•Execute waivers, including offers of waivers, of restrictions on assessment or collection of tax deficiencies.

•Execute waivers of notice of disallowance of a claim for credit or refund.

•Execute consents extending the statutory period for issuing a notice of deficiency determination.

•Receive, but not endorse or collect, checks in payment of any refund of taxes, penalties, or interest.

•Receive all notices and other written communications with respect to the taxpayer. If more than one

•Perform other acts, specifically:

|

|

|

|

Revocation of Prior Powers of Attorney |

|

|

|

||||

A. □ |

|

I choose to revoke all prior powers of attorney on file with DOR with respect to the same tax matters, and tax periods listed above, |

|||||||||

|

|

except the following: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

B. □ |

|

I choose to revoke all powers of attorney on file with DOR. |

|

|

|

||||||

|

|

If signed by a corporate officer, partner, member, LLC manager, or fiduciary on behalf of the taxpayer, I hereby certify that I have the authority to execute |

|||||||||

sign |

|

this Power of Attorney on behalf of the taxpayer. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

here |

|

|

|

|

|

|

|

|

|||

|

Signature |

|

|

|

|

|

Date |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Print Name |

|

|

|

Email Address |

Title, If Applicable |

|

|||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|||

|

|

Signature |

|

|

|

|

|

Date |

|

||

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Print Name |

|

|

|

Email Address |

Title, If Applicable |

||||

|

|

|

|

|

|

|

|||||

You may fax this form to

Mail this form to: Nebraska Department of Revenue, PO Box 94818, Lincoln, NE

Supersedes

Instructions

Who Must File. Any taxpayer who wishes to secure representation by another party in matters before the Nebraska Department of Revenue (DOR) with regard to any tax imposed by the tax laws of the State of Nebraska, must fle a Power of Attorney (POA), Form 33, or other appropriate POA. A POA authorizes that party to receive confdential tax information regarding the taxpayer. The Form 33 is provided for the taxpayer’s convenience in designating a POA, but it is not the sole form which may be used. DOR will honor all other properly completed and signed POA authorizations.

When and Where to File. The completed Form 33 may be fled any time. This form, or another properly completed and signed POA, must be fled with DOR before any person designated can represent the taxpayer in matters involving disclosure of confdential tax information.

This form, or other appropriate POA, may be faxed or mailed to DOR:

•Fax to

•Mail to the Nebraska Department of Revenue, PO Box 94818, Lincoln, NE

Taxpayer’s Name and Address. If the taxpayer is an individual, a Social Security number must be listed. If a married, fling jointly return was fled, enter both spouses’ Social Security numbers in the spaces provided.

If the taxpayer is a corporation, partnership, or association, enter the name, state and federal ID numbers (if applicable), and the business address. If the Form 33 will be used in a tax matter in the case of a partnership for which the names, addresses, and Social Security numbers or ID numbers have not already been furnished to DOR, these items should be listed on an attached sheet.

If the taxpayer is an estate or trust, enter the name, title, and address of the fduciary, as well as the name and ID number or Social Security number of the taxpayer. If this space is used to list other information, clearly label the change.

Designation of

Email. By entering an email address, the taxpayer acknowledges that DOR may contact the taxpayer by email. The taxpayer accepts any risk to confdentiality associated with this method of communication. DOR will send all confdential information by secure email or the State of Nebraska’s fle share system. If you do not wish to be contacted by email, write “Opt Out” on the line labeled “email address.”

Tax Category, Tax Matter, and Tax Period. Form 33 is designed to clearly express the scope of the authority granted by the taxpayer to any

“Tax Category” requires a list of the type of tax, such as “income” or “sales and use.” “Tax Matter of Representation” requires a brief summary of the subjects for which the attorney-

Authorized Acts. The Form 33 lists several acts which can be performed by the

If the taxpayer wishes to authorize an act which is not listed, a concise and specifc statement about the additional authorization must be made in the space provided, or a separate signed statement may be attached to the Form 33.

Revocation of Prior Powers of Attorney. To revoke any POAs previously fled with DOR, choose Box A or B.

Box A. Checking this box allows the taxpayer the option of revoking all POAs on fle with DOR with the exception of those listed on the lines provided (or on a list attached to the Form 33). Check box A and list the names, addresses, and zip codes of the

Box B. Checking this box revokes all POAs previously fled with DOR. Check Box B, and sign the form.

If no boxes are checked, all prior POAs will remain in force.

Signature. The taxpayer must sign and date the form. If spouses fle a married, fling jointly income tax return, which both have signed, then both spouses must sign the Form 33. If only one spouse in a married couple signs Form 33, then a separate Form 33 must be signed by the other spouse. If there is only one spousal signature or a second POA is not signed, then only the person designated by the POA would be authorized to perform the acts authorized by the POA. The nonsigning spouse who has fled a joint return with his or her spouse may still obtain information about, and may discuss issues regarding, the couple’s joint return. However, a person may not authorize another party, or themselves, to receive confdential tax information regarding separate returns fled by the person’s spouse.

Only certain people may represent a taxpayer in a contested case once a hearing offcer is appointed: (1) the taxpayer;

(2)a Nebraska attorney; or (3) a

If the taxpayer is a partnership, all partners must sign, unless one is duly authorized to act in the name of the partnership. Nebraska has adopted the Uniform Partnership Act of 1998 (Neb. Rev. Stat. §§

If the taxpayer is a corporation or an association, an offcer having authority to bind the entity must sign. The offcer must indicate his or her offcial title on the line provided.

If the taxpayer is a Nebraska limited liability company (LLC), then the Form 33 must be signed by a member of the LLC. The validity of the authorizations made by a foreign LLC will be determined governed by the laws of the state in which the LLC was organized.

Document Specifics

| Fact Name | Description |

|---|---|

| Form Identification | Tax Power of Attorney (POA) Form, commonly referred to as Form 33, is used to grant authority to someone else to handle tax matters on behalf of an individual or entity. |

| Primary Purpose | This form enables the appointee to discuss, obtain private tax information, and make tax-related decisions with the relevant tax authority. |

| Authority Granted | The level of authority granted can vary, ranging from viewing tax records to making payments or entering into agreements with tax authorities on behalf of the grantor. |

| Duration | The power of attorney's duration may be set to a specific term or remain in effect until revoked, depending on the stipulations made when filling out the form. |

| Governing Laws | While a general concept across the United States, each state may have its version of the Tax POA Form 33 with specific laws governing its execution and use. |

| Revocation | The Power of Attorney can be revoked by the grantor at any time, provided the revocation is made in a manner prescribed by the state's law. |

| Signing Requirements | The form typically requires signatures from the grantor and the designated representative, witnessed by a notary public or in accordance with state-specific laws. |

| State-specific Forms | Individuals need to ensure they use the correct state-specific form, as requirements and forms can differ from one state to another. |

Guide to Writing Tax POA form 33

Filling out a Tax Power of Attorney (POA) Form 33 can be a crucial step for individuals who need to grant someone else the authority to handle their tax matters. This could include anything from speaking with the tax authority on their behalf to making decisions regarding their taxes. Embarking on this process ensures that your tax affairs are managed accurately and efficiently, especially if you are unable to do so yourself. Below are the steps needed to accurately complete this form, ensuring that all necessary details are correctly provided and that the form is filled out in accordance with the required standards.

- Begin by locating the most current version of Tax POA Form 33, ensuring it's the one applicable for your state or jurisdiction, as requirements can vary.

- Identify the taxpayer’s personal information section and enter the taxpayer's full name, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), and full address, including zip code.

- Specify the tax matters and years or periods for which the POA is granted. This part requires precise details, such as tax form numbers and the specific years or periods.

- Enter the name(s), address(es), and phone number(s) of the representative(s) being granted POA. If the representative is authorized to receive refund checks, ensure this is clearly marked.

- If there are specific acts that the representative is not authorized to perform, list these clearly in the section provided. This ensures that the powers granted are perfectly understood by all parties.

- Review the acts authorized by the POA to confirm what the appointed representative can do on your behalf concerning your tax matters. This includes the extent of their powers to request and receive confidential tax information.

- Both the taxpayer and the representative must sign and date the form. Ensure that all signatories provide their titles or capacity if they are signing on behalf of an entity.

- Check for any additional requirements that might be specific to your state or the institution requesting the POA. Some jurisdictions require notarization or additional documentation.

Once the form is completely filled out and all necessary signatures are gathered, it is essential to submit the form to the appropriate tax authority or institution that requires it. Timeliness is key, as the processing times can vary, and you'll want the POA to be in effect when needed. Keep a copy of the completed form for your records, ensuring you can reference it or follow up on its status if required. By following these steps, you can navigate the process of granting tax power of attorney confidently, ensuring that your tax matters are in capable hands.

Understanding Tax POA form 33

-

What is the Tax POA Form 33?

The Tax Power of Attorney (POA) Form 33 is a legal document that allows an individual or entity to grant someone else the authority to handle their tax matters. This could include filing taxes, obtaining confidential tax information, and representing them in front of tax authorities.

-

Who can be appointed as a representative on Form 33?

Individuals can choose nearly anyone to be their representative on Form 33, including accountants, attorneys, family members, or friends. However, it’s important to choose someone who is trustworthy and preferably has knowledge of tax matters.

-

How do I fill out the Tax POA Form 33?

Filling out Form 33 involves providing detailed information about the taxpayer and the representative, specifying the tax matters and years for which the POA applies, and ensuring both parties sign and date the form. It’s recommended to review the instructions for the form or consult a professional to avoid mistakes.

-

Is there a filing fee for Tax POA Form 33?

No, there is typically no filing fee required for submitting a Tax POA Form 33 to the designated tax authority. However, costs may be incurred if professional assistance is sought for completing the form.

-

How long does the POA remain in effect?

The duration the POA remains effective can vary. It might be set for a specific time period, or until the completion of the specified tax matters. It’s crucial to clearly state the duration on the form. Without a stated expiration date, the POA might be considered valid indefinitely or until legally revoked.

-

Can the Tax POA Form 33 be revoked?

Yes, the Tax POA can be revoked at any time by the person who granted it. Revocation can be completed by sending a written notice of revocation to the tax authorities or by completing a new Tax POA form that includes a revocation of all prior authorizations.

-

What are the limitations of the Tax POA Form 33?

The powers granted through Form 33 are limited to tax matters. It does not give the representative any authority beyond what is specified in the form, such as making decisions related to the individual's property, medical care, or other financial matters.

-

Do both parties need to be present to submit the form?

Both parties do not need to be physically present together to submit the form. However, it must be signed by both the taxpayer and the representative. Once completed and signed, it can be submitted according to the instructions provided by the specific tax authority.

-

Where can I find Tax POA Form 33?

Tax POA Form 33 can typically be found on the website of the state's Department of Revenue or the equivalent tax authority. It can also be obtained by contacting the tax authority directly. Ensure to use the most current form to avoid processing delays.

Common mistakes

When dealing with the Tax Power of Attorney (POA) Form 33, individuals often encounter complexities that can lead to errors. These mistakes may not only delay the processing of the form but can also have significant implications on one's tax matters. By understanding and avoiding these common errors, filers can ensure their tax matters are managed efficiently and accurately.

- Incorrect or Incomplete Information: One of the most frequent errors is providing information that is either incorrect or incomplete. This includes misspelling names, using outdated addresses, or failing to include all necessary identification numbers. Such inaccuracies can lead to the rejection of the form or complications in the representation.

- Double-check all entries for accuracy before submission.

- Ensure that all required fields are completed.

- Not Specifying the Tax Matters Correctly: Tax POA Form 33 requires specific details about the tax matters for which the representative is being granted authority. A common mistake is not clearly defining the scope of this authority, including the types of taxes, tax periods, and specific tax issues.

- Clearly outline the tax matters and periods for which the POA is granted.

- Consult with a professional if unsure about how to specify this information.

- Failing to Sign and Date the Form: The validity of Tax POA Form 33 is contingent upon it being properly signed and dated by the taxpayer. Overlooking these requirements can render the form invalid.

- Ensure that the taxpayer signs and dates the form in the designated areas.

- Verify that the date reflects when the taxpayer actually signs the form.

- Not Updating the POA Form When Changes Occur: Tax situations can evolve, necessitating updates to the Power of Attorney. Not updating the POA to reflect changes such as a new representative or altered tax matters is a mistake that can lead to misrepresentation or lack of representation.

- Regularly review the POA for any needed updates or changes.

- Submit a new form promptly to account for any alterations in representation or tax matters.

By addressing these common mistakes, filers can facilitate a smoother process in handling their tax affairs through the Tax POA Form 33, ensuring that their representation is accurate and effective. It's always advisable to seek guidance from tax professionals or legal advisors when completing this form to avoid these pitfalls.

Documents used along the form

When managing tax matters, whether for an individual or a business, filing a Tax Power of Attorney (POA) Form 33 is often just one step in a series of necessary actions. This form allows a designated individual, often a tax professional, to handle tax filings and communications with tax authorities on behalf of someone else. However, to fully address tax issues or ensure comprehensive financial management, several other documents might be required. Here's a rundown of forms and documents that are commonly used in conjunction with the Tax POA Form 33.

- Form 1040: The U.S. Individual Income Tax Return is the standard form used by citizens and residents in the USA to file their annual income tax return. It's essential for reporting an individual's financial income and calculating their tax liability.

- W-2 Form: This is the Wage and Tax Statement employers provide to their employees and the IRS, detailing the employee’s annual wages and the amount of taxes withheld from their paycheck.

- 1099 Forms: These forms are used to report various types of income other than salaries, wages, and tips (e.g., independent contractor income, interest, dividends). It's crucial for taxpayers who have multiple sources of income.

- Form 4868: Application for Automatic Extension of Time To File U.S. Individual Income Tax Return allows taxpayers who need more time to file their tax return a way to request an extension.

- Form 8822: Change of Address is used to notify the IRS of a change in address. Keeping your address current ensures that you receive all IRS correspondence promptly.

- Schedule C: Profit or Loss from Business (Sole Proprietorship) is necessary for self-employed individuals or freelancers. It details the income and expenses related to their business, affecting the tax calculation.

- Schedule D: Capital Gains and Losses document is used to report the sale or exchange of capital assets not reported on another form or schedule.

- Form 941: Employer's Quarterly Federal Tax Return is used by employers to report income taxes, social security tax, or Medicare tax withheld from employees' paychecks, and to pay the employer's portion of social security or Medicare tax.

- Form 9465: Installment Agreement Request can be filed by taxpayers who cannot pay their tax debt in full and wish to make monthly installment payments to the IRS.

- State-Specific Tax Forms: Depending on the state, taxpayers may also need to file state-specific tax returns or forms, which vary by state and may include income, sales, and property taxes.

Navigating through tax documentation can be complex and overwhelming, especially considering the multitude of forms and their specific deadlines. Many taxpayers find it immensely beneficial to work with a tax professional when dealing with specialized forms like the Tax POA Form 33 and the additional documents described. Remaining informed and prepared with the correct forms ensures compliance and optimizes financial health.

Similar forms

The Financial Power of Attorney (FPOA) form stands as a document closely akin to the Tax Power of Attorney (POA) Form 33, sharing its core function of designating someone else with the authority to make vital decisions. While the Tax POA specifically entrusts an individual with the power to handle tax matters on someone else’s behalf, the FPOA extends this authority across a broader spectrum of financial affairs. This range may encompass the management of bank accounts, investments, and other financial decisions beyond the realm of taxes, demonstrating a wider application while maintaining a focus on financial stewardship.

The Health Care Power of Attorney form parallels the Tax POA Form 33 in its essence of designation, albeit in a completely different domain. This document empowers an individual, chosen by the person who fills out the form, to make health care decisions on their behalf in the event they are incapable of doing so themselves. Although it operates in the health care sphere, the foundational principle of entrusting decision-making authority to another resonates with the purpose of the Tax POA, emphasizing preparation and forethought in personal affairs management.

The Durable Power of Attorney form bears resemblance to the Tax POA Form 33 through its provision for lasting authority. Both documents allow an individual to appoint someone to handle specific affairs; however, the Durable Power of Attorney is distinctive because its power extends beyond the granter’s incapacitation. This enduring nature parallels the Tax POA’s aim to ensure representation in tax matters, reflecting a shared goal of sustained oversight and control over personal affairs, regardless of the grantor's physical or mental state.

Advance Health Care Directive, much like the Tax POA Form 33, is another instrument of preparatory intent, albeit focused on health care decisions and wishes regarding medical treatment. It amalgamates the authority of a Health Care Power of Attorney with a Living Will, detailing treatment preferences alongside the appointment of an agent. This dual function mirrors the Tax POA’s objective of allocating both responsibility and specific instruction, showcasing a similar blend of delegation and directive in a critical aspect of personal planning.

The Limited Power of Attorney document, sharing a conceptual foundation with the Tax POA Form 33, distinguishes itself by its temporary and specific nature. This document confers a narrowly defined authority to act on another’s behalf, typically for a singular transaction or a specified period. The Tax POA also allows for granular delegation, particularly to address tax-related matters, underlining a common theme of targeted, temporary empowerment within a defined scope.

The Revocation of Power of Attorney form serves as the counterpart to the initiation represented by the Tax POA Form 33, emphasizing the control individuals maintain over granted powers. This document is employed to officially cancel or nullify previously granted powers of attorney, reflecting an inherent aspect of such arrangements—the ability to revoke authority. While it functions as a termination rather than a grant of power, it underscores the flexibility and revocable nature of legal authorities like those conveyed by the Tax POA.

The Estate Planning Will, or simply a Will, parallels the Tax POA Form 33 in its foresight and directive capabilities, though it primarily concerns posthumous affairs. It enables individuals to delineate the distribution of their assets and the guardianship of minors upon their death. The similarity lies in the preparative intent and the designation of responsibilities, albeit the Tax POA operates during the individual's life, underscoring a shared emphasis on personal agency and the careful allocation of duties.

Finally, the Business Power of Attorney document is akin to the Tax POA Form 33, with its focus shifted to the commercial realm. It authorizes an individual to make business-related decisions, manage operations, and undertake transactions on behalf of the business owner. Like the Tax POA, which entrusts an agent with tax-related decisions, the Business Power of Attorney empowers representation in a specialized field, showcasing parallel structures of delegated authority tailored to distinct contexts.

Dos and Don'ts

Filing out the Tax Power of Attorney (POA) Form 33 is a critical step in allowing someone else to handle your tax matters. This form grants authority to an individual or entity of your choice to act on your behalf in dealings with tax authorities. Taking the right steps in completing this form ensures your tax matters are managed as you intend, while mistakes can lead to potential legal issues or misunderstandings. Below are key dos and don'ts to consider.

Things You Should Do

Ensure all information is accurate: Double-check the taxpayer's information, the representative's details, and any specific tax matters or periods covered by the POA to avoid delays or rejections.

Select an appropriate representative: Choose someone who is not only trustworthy but also has adequate knowledge of tax law and experience dealing with the IRS or state tax authorities.

Specify the powers granted: Clearly outline the authority you are granting to your representative, including any limitations or specific tasks you wish them to perform.

Sign and date the form: The POA Form 33 is not valid unless it is properly signed and dated by the taxpayer. If filing jointly, both parties must sign.

Keep a copy for your records: Once the form is filled out and submitted, make sure to keep a copy for your own records in case any disputes or questions arise in the future.

Things You Shouldn't Do

Do not leave sections blank: Incomplete forms will likely be rejected or returned, causing delays. If a section does not apply, indicate this appropriately with terms such as "N/A" (not applicable).

Do not use outdated forms: Tax laws and forms change. Always use the most current version of POA Form 33 to ensure compliance with current regulations.

Do not choose a representative poorly: Avoid selecting someone solely because they are a friend or family member. Their ability to manage tax affairs effectively is paramount.

Do not forget to notify your representative: Ensure that the person or entity you are appointing is willing and able to take on the responsibility before you submit the form.

Do not fail to review and update: Circumstances change, and so might your choice of representative or the scope of their authority. Regularly review and, if necessary, update your POA to reflect current needs.

Misconceptions

When it comes to managing taxes, the Tax Power of Attorney (POA) Form 33 is a crucial document that allows individuals to grant others the authority to act on their behalf with tax matters. However, there are several misconceptions surrounding this form that can lead to confusion. Understanding these misconceptions is essential for anyone considering the use of a Tax POA.

-

It grants unlimited power: A common misconception is that the Tax POA Form 33 gives the representative unrestricted power over all financial decisions. In reality, this form specifically limits the authority to tax-related matters only. The scope can be further defined within the document itself.

-

One form fits all states: Another mistake is assuming that Tax POA Form 33 is universally accepted across all states. Tax laws vary by state, and while many states have similar forms or may accept Form 33, others require their specific form to be used.

-

It's effective indefinitely: Some people believe that once you file a Tax POA Form 33, it remains effective until it is formally revoked. However, many states set an expiration date for these forms, typically ranging from one to several years after the document is executed.

-

Only for individuals: The misconception that the Tax POA Form 33 is only for individual use is quite common. Businesses can also use this form to authorize representatives to handle their tax matters. This flexibility supports both individuals and entities in managing their tax-related responsibilities.

-

No need for a witness or notarization: A prevalent but incorrect belief is that Tax POA forms do not need to be witnessed or notarized. Depending on state requirements, having a witness or notarization might be necessary for the form to be valid.

-

Revoking requires legal action: Many assume that revoking a Tax POA Form 33 involves complex legal steps. In reality, revoking the form can be as simple as submitting a written notice to the tax authority and informing the previously designated representative.

Dispelling these myths is crucial for those looking to accurately understand and effectively utilize the Tax POA Form 33. By recognizing these misconceptions, individuals and businesses can ensure they are adequately prepared to designate someone to manage their tax matters correctly and legally.

Key takeaways

Filling out and using the Tax Power of Attorney (POA) Form 33 is a crucial step in ensuring someone has the legal authority to handle tax matters on someone else’s behalf. Here are six key takeaways to remember:

- Understand the form’s purpose: Tax POA Form 33 grants an individual or an entity the power to represent another person in tax affairs before the tax authority. This could include filing taxes, obtaining confidential tax information, and making decisions about tax payments on someone else's behalf.

- Know who can be appointed: It’s important to carefully consider who is appointed as the agent. This person or entity should be trustworthy, and preferably have expertise in tax matters, such as a certified public accountant, attorney, or a family member with significant insight into the principal's financial affairs.

- Fill out the form accurately: Ensure all sections of the form are completed with accurate information. Mistakes or omissions can lead to delays or the rejection of the form by the tax authority.

- Be clear about the granted powers: The form allows the principal to specify the extent of powers granted to the agent. It's important to be clear and explicit about what the agent is and is not allowed to do.

- Remember the duration: Tax POA Form 33 remains effective until the expiration date specified in the form, if any. Otherwise, it may remain in effect indefinitely or until it is revoked. Keep in mind that some states require the renewal of a POA after a certain period.

- Don’t forget to sign and witness the form: For the form to be valid, it must be signed by the principal and, depending on the state’s laws, may also need to be witnessed or notarized. This is a crucial step to ensure the form’s legality.

By paying close attention to these key points, the process of filing and using Tax POA Form 33 can be smooth and effective, providing peace of mind that tax matters are being handled properly and legally.