Get Tax POA form 2848-me Form

When individuals or businesses find themselves navigating the complexities of tax matters, understanding and utilizing the right tools can significantly ease the process. Among these essential tools is the Tax Power of Attorney (POA) Form 2848-ME, a crucial document that allows taxpayers to grant authority to a designated representative to act on their behalf in tax matters. This form plays a pivotal role in providing individuals the means to ensure their tax affairs are managed efficiently, especially when direct involvement is not possible or preferred. The scope of authority granted can vary, encompassing tasks from obtaining confidential tax information to representing the taxpayer before tax authorities. The importance of properly completing and submitting this form cannot be overstated, as it ensures that the designated representative can perform necessary actions without legal hindrances, thereby safeguarding the taxpayer's interests. Understanding who can be appointed, the extent of the authority granted, and the specific procedures for its use are key aspects that ensure the form's effectiveness in managing tax-related matters.

Tax POA form 2848-me Example

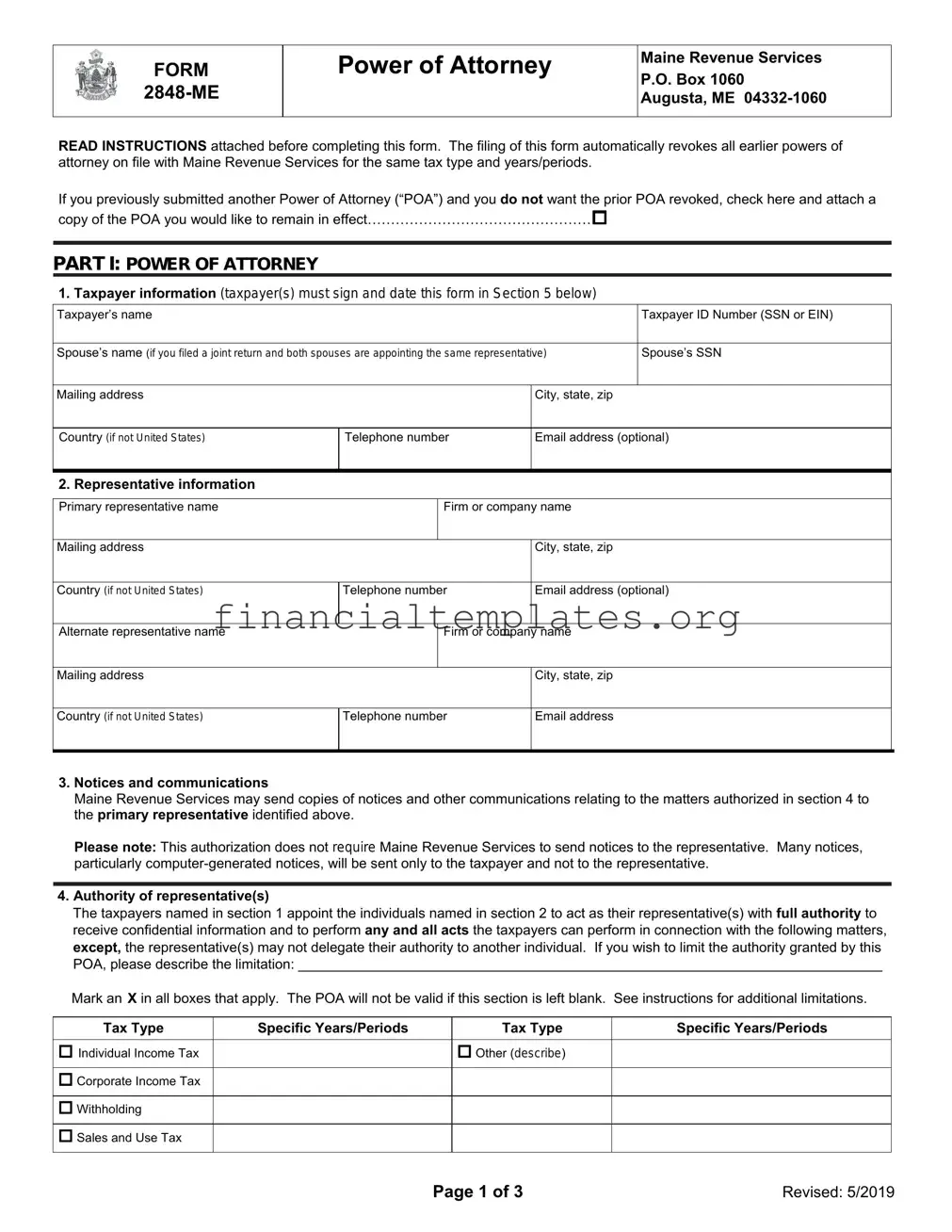

FORM

Power of Attorney

Maine Revenue Services

P.O. Box 1060

Augusta, ME

READ INSTRUCTIONS attached before completing this form. The filing of this form automatically revokes all earlier powers of attorney on file with Maine Revenue Services for the same tax type and years/periods.

If you previously submitted another Power of Attorney (“POA”) and you do not want the prior POA revoked, check here and attach a copy of the POA you would like to remain in effect…………………………………………

PART I: POWER OF ATTORNEY

1.Taxpayer information (taxpayer(s) must sign and date this form in Section 5 below)

Taxpayer’s name |

Taxpayer ID Number (SSN or EIN) |

|

|

Spouse’s name (if you filed a joint return and both spouses are appointing the same representative) |

Spouse’s SSN |

|

|

Mailing address

Country (if not United States) |

Telephone number |

I

2. Representative information

City, state, zip

Email address (optional)

Primary representative name |

Firm or company name |

|

I |

|

City, state, zip |

Mailing address |

|

|

|

|

|

|

Email address (optional) |

Country (if not United States) |

Telephone number |

||

|

I |

|

name |

Alternate representative name |

Firm or company |

|

|

|

I |

|

City, state, zip |

Mailing address |

|

|

|

|

|

|

Email address |

Country (if not United States) |

Telephone number |

||

|

I |

|

|

3.Notices and communications

Maine Revenue Services may send copies of notices and other communications relating to the matters authorized in section 4 to the primary representative identified above.

Please note: This authorization does not require Maine Revenue Services to send notices to the representative. Many notices, particularly

4.Authority of representative(s)

The taxpayers named in section 1 appoint the individuals named in section 2 to act as their representative(s) with full authority to receive confidential information and to perform any and all acts the taxpayers can perform in connection with the following matters, except, the representative(s) may not delegate their authority to another individual. If you wish to limit the authority granted by this POA, please describe the limitation: ___________________________________________________________________________

Mark an X in all boxes that apply. The POA will not be valid if this section is left blank. See instructions for additional limitations.

Tax Type |

Specific Years/Periods |

Tax Type |

Individual Income Tax |

|

Other (describe) |

Corporate Income Tax

Withholding

Sales and Use Tax

Specific Years/Periods

Page 1 of 3 |

Revised: 5/2019 |

5.Taxpayer signature

I certify, under penalty of perjury, that I am the taxpayer identified in section 1 above, or if signing as a corporate officer, that I am a partner, member, manager, or fiduciary acting on behalf of the taxpayer, that I have the authority to execute this POA.

Signature

Print name (and title, if applicable)

Date

Spouse’s signature (required if listed above)

Print name

Date

PART II: DECLARATION OF REPRESENTATIVE

I certify, under penalty of perjury, that I am:

Primary Alternate

A member in good standing of the bar of the highest court of the following jurisdiction: ______________________

Duly qualified to practice as a certified public accountant in the following jurisdiction: _______________________

|

An enrolled agent under U.S. Department of Treasury Circular 230 |

A bona fide officer of the taxpayer’s organization

A

|

A member of the taxpayer’s immediate family |

A fiduciary of the taxpayer

Other (explain): ______________________________________________________________________________

Signature – Primary Representative

Print name (and title, if applicable)

Date

Signature – Alternate Representative

Print name (and title, if applicable)

Date

FORMS NOT SIGNED, DATED, OR OTHERWISE INCOMPLETE WILL NOT BE ACCEPTED.

Page 2 of 3 |

Revised: 5/2019 |

Instructions

General Information

Use Form

Unless you limit the authority (see section 4), your representative will be authorized to perform any and all acts you can perform, including, but not limited to: receiving your confidential information; agreeing to tax adjustments; signing settlement agreements; and making otherwise binding decisions on your behalf with regard to the tax matters covered by the POA.

Limited Power of Attorney Form

If you want your representative to communicate with and receive confidential information from MRS, but you do not want that person to act on your behalf, please fill out Form

Revocation

Filing Form

Example 1:

On 5/1/2017, you authorize Jane Doe to represent you for individual income tax for 2015. On 10/1/2017, you authorize Jim Jones to represent you for individual income tax for 2016. Both POA’s are valid.

Example 2:

On 5/1/2017, you authorize Jane Doe to represent you for individual income tax for 2015. On 10/1/2017, you authorize Jim Jones to represent you for sales and use tax for 2015. Both POA’s will be valid.

Example 3:

On 5/1/2017, you authorize Jane Doe to represent you for individual income tax for 2015. On 10/1/2017, you authorize Jim Jones to represent you for individual income tax for years

If you do not want a prior POA automatically revoked, you must check the box at the top of the form and attach a copy of the prior POA you would like to remain in effect.

Other requests to revoke a POA must be in writing and must be signed by the taxpayer.

Section 2 – Representative information

Form

Section 3 – Notices and communications

MRS may send copies of notices and other communications relating to the tax matters authorized in section 4 only to the primary representative. Many notices, particularly

Section 4 – Authority of representatives

This section allows you to specify which tax matters are covered by the POA and what authority you are granting your representative. By default, your representative will have full authority to receive your confidential information and to perform any and all acts you can perform in connection with the matters described in section 4. However, your authorized representative may not delegate their authority to another individual. If you wish to limit your representative’s authority, please specifically describe the limitation.

For this form to be valid, you must select both the tax type and years/periods covered by the POA. If no tax type is selected, the POA will not be accepted.

You may list current, prior, or future years/periods. You must use specific periods. General references such as “All Years” will not be accepted.

Note: MRS will not accept a POA for future years/period which begin more than three years from the date the POA is received by MRS.

Section 5 – Taxpayer signature

You must sign, print your name, and date the POA for it to be valid. If you filed a joint return and both spouses are appointing the same representative, both spouses must sign. POA forms must be hand- signed.

If you are signing on behalf of the taxpayer, please include your

PART I – Power of Attorney

Section 1 – Taxpayer information

The Taxpayer’s identification number may be a social security number (“SSN”) or employer identification number (“EIN”) depending on the type of taxpayer. Please fill out the taxpayer information section accurately and completely. Note: By providing an email address, you authorize MRS to communicate your confidential information via email to the address provided.

PART II – Declaration of Representatives

Your representative must indicate their relationship to you and sign and date the form. The POA must be signed by the representative to be valid.

Submitting Completed POA Form

Completed POA forms should be mailed to MRS at the address at the top of the form. Completed POA forms may also be faxed or emailed to the MRS division responsible for the tax type covered by the POA. For fax/email contact info for the specific divisions, visit our website at: www.maine.gov/revenue/about/contact.

Page 3 of 3 |

Revised: 5/2019 |

Document Specifics

| Fact Number | Fact Detail |

|---|---|

| 1 | The Tax Power of Attorney Form, Form 2848-ME, is specific to the State of Maine. |

| 2 | It allows a taxpayer to grant authority to another individual, typically a tax professional, to represent them before the Maine Revenue Services. |

| 3 | This form can designate a representative to receive confidential tax information and make decisions regarding the taxpayer's state tax matters. |

| 4 | Form 2848-ME is governed under the laws of the State of Maine and is subject to Maine Revenue Services guidelines. |

| 5 | The representative must be eligible to practice before the Maine Revenue Services, which typically includes attorneys, CPAs, and enrolled agents. |

| 6 | A separate Form 2848-ME must be filed for each tax year or period the taxpayer wants representation. |

| 7 | Completion of the form requires detailed information about the taxpayer, the representative, and the specific tax matters for which authorization is granted. |

| 8 | The form must be signed by the taxpayer, and if filed jointly, the spouse must also sign if they are seeking representation. |

| 9 | Once filed, the Form 2848-ME remains in effect until the taxpayer revokes it, it is automatically revoked by the filing of a new Form 2848-ME, or the specified matters are concluded. |

Guide to Writing Tax POA form 2848-me

When it comes to dealing with taxes, having the right documentation in place is crucial. One such document is the Tax Power of Attorney (POA) form, known in some states as form 2848-me. This form allows you to grant another person the authority to handle your tax matters on your behalf. It's particularly useful in situations where you're unable to manage these issues yourself. The process of filling out this form is straightforward but requires attention to detail to ensure that all the necessary information is correctly provided. Follow the steps below to accurately complete the form.

- Start by downloading the latest version of form 2848-me from your state's tax authority website or obtaining a paper copy from a local office.

- Enter your full name and address in the designated spaces at the top of the form.

- Fill in your taxpayer identification number (TIN), such as your Social Security Number (SSN) or Employer Identification Number (EIN), in the appropriate field.

- Next, specify the name and address of the individual you are granting power of attorney to. This person will act on your behalf in tax matters.

- Provide the representative's telephone number and fax number, if available, to ensure they can be easily contacted by the tax authority.

- Clearly list the tax matters for which you are granting authority, including the types of tax, the federal tax forms related to your situation, and the years or periods involved.

- If you wish to specify any limitations to the authority granted to your representative, clearly describe these restrictions in the space provided.

- Sign and date the form in the indicated areas. If you're filing jointly, your spouse must also sign and date the form if they are granting power of attorney as well.

- Finally, your representative must complete the declaration at the bottom of the form, including their information and signature, to accept the responsibility you are assigning to them.

Once you have filled out the form, review it to ensure all the information is accurate and complete. Then, submit it to the appropriate state tax authority office either via mail or, if available, through electronic submission on the state's tax authority website. After the form is processed, your designated representative will have the authority to handle your tax matters as specified. Remember, granting someone power of attorney over your taxes is a significant decision. Choose a person you trust and consider consulting with a tax professional or attorney if you have any questions or concerns about the process.

Understanding Tax POA form 2848-me

-

What is the purpose of the Tax Power of Attorney (POA) Form 2848-ME?

The Tax POA Form 2848-ME is designed to give someone else the legal authority to discuss and handle your tax matters with the tax department. This person, known as your agent or attorney-in-fact, can act on your behalf to make decisions, receive confidential information, and perform actions like filing returns.

-

Who can be designated as an agent on Form 2848-ME?

Generally, anyone you trust can be designated as your agent. This includes family members, friends, or tax professionals such as certified public accountants (CPAs), attorneys, or enrolled agents who have the knowledge and experience in handling tax matters.

-

How do I complete the Tax POA Form 2848-ME?

Completing the form typically involves providing your name, tax identification number (such as your SSN), and the specific tax matters and years you want the agent to handle. You must also include the name and contact details of the agent you're appointing. It's important to sign and date the form to validate it. If you're appointing a professional, they may need to sign the form as well.

-

Is there a fee to file Form 2848-ME?

Filing Form 2848-ME with the tax department does not usually require a fee. However, if you are hiring a professional to act as your agent, they may charge for their services.

-

What is the duration of the authority granted under Form 2848-ME?

The duration can vary. It might be limited to a specific tax year or cover a range of years. The form allows you to specify the exact duration. Unless you explicitly limit the time frame, the authority will continue until you revoke it.

-

Can I revoke the authorization I've given through Form 2848-ME?

Yes, you can revoke the authorization at any time. This is typically done by submitting a written statement to the tax department stating that you are revoking the power of attorney and by providing a copy of the original form. It's also recommended to notify your agent about the revocation.

-

Do I lose control over my tax matters if I assign someone as my agent?

No, you do not lose control. You can still act on your own behalf in all tax matters. The agent is simply authorized to act alongside you or on your behalf, according to the permissions you've granted them on Form 2848-ME.

-

Where can I find Form 2848-ME and additional guidance on how to complete it?

Form 2848-ME can usually be obtained from the website of your state's tax department or its physical offices. Many tax departments also offer instructions or guidance documents that provide detailed information on how to complete and submit the form properly.

Common mistakes

Filing important documents with the IRS is a task that demands careful attention to detail, especially when it involves the Power of Attorney (POA) form, also known as Form 2848. A POA form is a powerful document that grants an individual or organization the authority to act on your behalf in matters related to taxes. Given its significance, it's crucial to avoid common errors that can lead to delays or complications. Below is a list of mistakes frequently made by individuals when completing the Tax POA Form 2848.

-

Not specifying the tax form number: Many forget to list the specific tax forms they are granting their representative authority over. This detail is crucial for the IRS to understand the scope of the permission granted.

-

Misidentifying the tax period: It's easy to overlook the importance of accurately indicating the tax periods involved. The IRS needs these details to accurately assess the authority being granted.

-

Choosing the wrong type of representative: The form allows you to designate different types of representatives, such as attorneys, CPAs, or family members. Mistakenly choosing the wrong type can inadvertently limit the actions your representative can perform.

-

Incomplete representative information: All required details of the representative, including their name, address, and phone number, must be fully provided. Any missing information can render the POA invalid.

-

Failing to sign or date the form: A common oversight is forgetting to sign and date the form. Without the taxpayer's signature and the date, the POA is not considered valid.

-

Not including the declaration of representative: The representative must sign and declare that they are authorized to represent you, according to the IRS regulations. Omitting this declaration can lead to rejection of the form.

-

Submitting outdated forms: The IRS periodically updates its forms. Using an outdated version of Form 2848 could mean automatic rejection.

-

Not checking for state-specific requirements: While Form 2848 is a federal document, some states have their own POA requirements. Neglecting to check for these can complicate state tax matters.

Each of these errors can significantly impact the processing and acceptance of a Tax POA Form 2848. It's advised to review the form thoroughly before submission, paying close attention to detail and ensuring all necessary information is accurately provided. When in doubt, consulting with a tax professional can help navigate the complexities of tax representation and ensure the POA is correctly filled out and submitted.

Documents used along the form

When it comes to managing tax matters, particularly for someone else, completing a Tax Power of Attorney (POA) Form 2848-ME is a critical step. This form allows an individual to grant authority to another person (the agent) to handle their tax affairs, making it essential in many scenarios, especially complex tax situations or when the principal cannot manage their tax responsibilities personally. However, this form is often just one piece of a larger puzzle. Several other forms and documents are commonly used alongside the Tax POA Form 2848-ME to ensure comprehensive handling of an individual's tax matters.

- Form 1040: This is the U.S. Individual Income Tax Return form. It's a critical document for most people because it's used to report an individual's annual income, calculate taxes owed to the federal government, or determine the refund due. When an agent is acting on behalf of someone else, having access to and understanding this form is paramount.

- Form W-2: The Wage and Tax Statement is issued by employers to report an employee's annual wages and the taxes withheld from their paycheck. This document is indispensable for completing Form 1040 accurately, and an agent might need it to fulfill their duties under the Tax POA.

- Form 1099: There are various forms in the 1099 series, each used to report different types of income other than wages, such as freelance earnings (1099-NEC), interest (1099-INT), dividends (1099-DIV), and miscellaneous income (1099-MISC). These documents are crucial for a comprehensive understanding of an individual's income, which is necessary for accurate tax filing.

- Schedule A (Form 1040): This form is used to itemize deductions that a taxpayer is claiming. For someone acting under a Tax POA, knowing and applying these deductions correctly can significantly affect the principal's tax liabilities and potential refund.

- Form 8821, Tax Information Authorization: While not granting the comprehensive authority of a POA, this form allows an individual to authorize someone else to access and view their tax information. This can be particularly useful in situations where the agent needs to gather historical tax information or documents without needing full POA privileges.

Together, these forms and documents play pivotal roles in the tax filing process, each contributing specific information that is essential for accuracy and compliance. For someone acting as an agent under a Tax POA, being familiar with these documents is just as important as the POA itself. Having a thorough understanding and access to these documents can significantly streamline the process, ensuring that tax matters are handled efficiently and in the best interest of the principal.

Similar forms

The Tax Power of Attorney (POA) Form, specifically Form 2848-ME, is notably similar to the General Power of Attorney document. Both serve the purpose of granting someone else the authority to make decisions on behalf of the grantor. While the Tax POA focuses narrowly on tax matters, allowing the designee to represent the grantor before the tax authority, make filings, and obtain confidential tax information, the General Power of Attorney has a broader scope. It might encompass financial, real estate, and personal affairs decision-making powers, not limited to tax matters.

Another document resembling the Tax POA Form 2848-ME is the Healthcare Power of Attorney. This document enables an individual to appoint someone to make healthcare decisions on their behalf if they become unable to do so. Although the Healthcare POA and Tax POA serve significantly different functions—one addressing health care decisions and the other tax matters—they share the underlying principle of authorizing a trusted person to act in the grantor's stead under specific circumstances.

The Limited Power of Attorney document also bears similarities to the Tax POA Form 2848-ME. The Limited Power of Attorney allows an individual to grant limited powers to an agent for specific tasks, time frames, or events, which can range from selling a particular property to representing the principal in a specific transaction. Like the Tax POA, which grants specific authority to handle tax matters, the scope of authority in a Limited Power of Attorney is clearly delineated and restricts the agent's power to the outlined activities.

Lastly, the Durable Power of Attorney (DPOA) shares common features with the Tax POA Form 2848-ME. The Durable Power of Attorney remains in effect even if the grantor becomes mentally incapacitated, ensuring continuous management of the grantor’s affairs. While a DPOA can be broad or specific in the powers it grants, like the ability to handle financial and legal decisions, the Tax POA is a type of specific DPOA that focuses solely on tax-related issues. Both documents are designed to operate under certain conditions, but the Tax POA is uniquely tailored for tax representation and actions.

Dos and Don'ts

When it comes to filling out the Tax Power of Attorney (POA) Form 2848-ME, accuracy and attention to detail are paramount. This document grants an individual or organization the authority to handle tax matters on your behalf, making it crucial to complete it correctly. Below is a list of dos and don’ts to guide you through the process:

Do:

- Read instructions carefully: Before filling out the form, ensure you fully understand all the requirements and instructions to avoid any mistakes.

- Provide accurate information: Double-check all entries for accuracy, especially your name, address, Social Security Number (SSN), or Employer Identification Number (EIN), and your representative’s details.

- Specify the tax matters: Clearly identify the tax forms and years or periods for which the POA is granted. This clarity will prevent any misunderstandings regarding the extent of the authority given.

- Use the current form version: Always use the most recent version of Form 2848-ME to ensure compliance with current tax laws and requirements.

- Sign and date the form: The form is not valid without your signature and the date. Verify that both you and your representative sign and date the form accordingly.

Don't:

- Overlook the representative’s credentials: Ensure that the individual or firm you are appointing as your representative is eligible and adequately qualified to act on your behalf in tax matters.

- Leave sections blank: If a section does not apply, mark it as “N/A” instead of leaving it blank. This approach indicates that you did not accidentally skip the section.

- Use white-out or correction tape: Mistakes should be cleanly crossed out, and correct information should be entered nearby. Modifications made with correction fluid or tape can raise questions about the form's integrity.

- Forget to specify limits on your representative’s authority: If you wish to place any restrictions on your representative’s authority, clearly outline these on the form to avoid giving them unfettered access to your tax matters.

- Fail to update the POA: Should your situation or your representative change, make sure to update your POA accordingly. A current form is necessary to reflect accurately who has the authority to act on your behalf.

Misconceptions

Understanding the Tax Power of Attorney (POA) Form 2848-ME requires clarity, especially because misconceptions can complicate an otherwise straightforward process. Here are some common misunderstandings and their explanations:

The belief that all tax issues can be handled with this form is widespread. However, Form 2848-ME is specific to the state of Maine and is designed for addressing state tax matters. It does not cover federal tax issues or tax matters in other states.

Many think that once the form is filed, the designated representative has unlimited power over their taxes. In reality, the scope of authority is determined by the specifics stated on the form, including particular tax matters and years covered.

There's a misconception that the form requires an attorney to act as a representative. Actually, while an attorney can serve in this capacity, the taxpayer can also appoint CPAs, enrolled agents, or other individuals authorized to represent taxpayers before the tax authorities in Maine.

Some users mistakenly believe the form grants the representative the right to receive refund checks. The form authorizes the representative to access information and make decisions, but it does not permit them to receive refunds directly unless specifically authorized through other documentation.

There's often confusion that completing the form is a complex and lengthy process. While attention to detail is required, the form itself is straightforward. Accurate completion involves specifying the tax forms, years, and types of tax matters you are authorizing your representative to handle.

A common myth is that the Tax POA Form 2848-ME will stay in effect indefinitely. The truth is, the form remains effective until the expiration date specified by the taxpayer, or until it's revoked, whichever comes first.

Some taxpayers assume they can authorize representation for future tax years with Form 2848-ME. The form can cover past and current tax years, but it doesn't extend to tax years or periods that have not yet ended.

There's a false notion that filing the form with the Maine Revenue Services automatically informs the IRS. The state of Maine and the IRS operate independently, so separate forms must be submitted for state and federal tax matters.

Lastly, there's an assumption that the form can only be submitted by mail. While mailing is an option, Maine Revenue Services may also offer other methods for submission, such as fax or electronically, depending on their current processes and policies.

Clearing up these misconceptions can help ensure that taxpayers utilize the Tax POA Form 2848-ME effectively and according to their actual needs and intentions.

Key takeaways

Filling out the Tax Power of Attorney (POA) form 2848-ME is a crucial step for individuals who want to grant someone else the authority to handle their tax matters before the Maine Revenue Services. Whether it's due to complexity, convenience, or necessity, understanding how to properly complete and use this form is essential. Here are nine key takeaways to keep in mind:

- Identify the parties: Clearly distinguish between the taxpayer granting power and the representative. Include full names, addresses, and identification numbers to prevent any confusion.

- Specific powers: The form allows you to specify the exact tax matters and years or periods for which the representative will have authority. Be precise to ensure your representative can act as needed without overstepping their bounds.

- Multiple representatives: You can name more than one representative on the form. If you do, decide whether they must act together or if each can act independently.

- Document requirements: Both the taxpayer and the representative(s) must sign the form. Additionally, representatives need to provide their Preparer Tax Identification Number (PTIN) or other relevant identification, certifying their eligibility to act in this capacity.

- Limited vs. general authority: Consider whether the representative’s powers should be broad or limited to specific tasks, such as responding to notices or representing you in a tax audit.

- Duration: The authority granted through the form 2848-ME can be limited to a specific period. Ensure that the expiry date aligns with your needs, keeping in mind some tasks may take longer than anticipated.

- Cancellation: You can revoke the power of attorney at any time by providing written notice to the Maine Revenue Services. It’s wise to understand the process for cancellation should your circumstances change.

- Completeness is key: Incomplete forms can delay processing. Double-check all information for accuracy and completeness before submission. Pay special attention to dates and descriptions of tax matters.

- Professional assistance: Consider seeking advice from a tax professional when filling out the form. Their expertise can help ensure the POA meets your needs and is completed correctly.

Using the Tax POA form 2848-ME properly not only allows for smoother dealings with tax matters but also ensures your tax responsibilities are managed according to your wishes. Always update your POA as necessary to reflect any changes in your situation or in your relationship with your representative.

Popular PDF Documents

3rd Party Designee - It is a legal mechanism for granting authority to a representative to negotiate and make decisions about your taxes.

IRS 13614-C - It is a crucial step in preparing for a tax appointment, serving to make the process smoother and helping to ensure all necessary information is covered.

Pag - For immediate financial solutions, detailing your loan purpose, such as livelihood or minor home improvements, is crucial in the MPL form.