Get Tax POA form 2827 Form

When individuals or businesses face the necessity to navigate through the complexities of tax matters, especially within the intricate framework of state regulations, the empowerment of a representative through a Tax Power of Attorney (POA) becomes paramount. This crucial legal document, encapsulated in Form 2827, serves as a cornerstone for authorizing a designated professional to handle tax-related tasks on one's behalf. This delegation covers a broad spectrum of responsibilities, from obtaining confidential tax information to making pivotal decisions and performing actions that would typically require the direct involvement of the taxpayer. Notably, the utilization of Form 2827 ensures both the legal validity of the representative's actions and the protection of the taxpayer's rights and interests within the bounds of state laws. Understanding the prerequisites, limitations, and specific conditions under which this form operates is essential for both the appointer and the appointee to ensure its correct execution and to avoid any potential legal pitfalls that could arise from its misuse or misunderstanding.

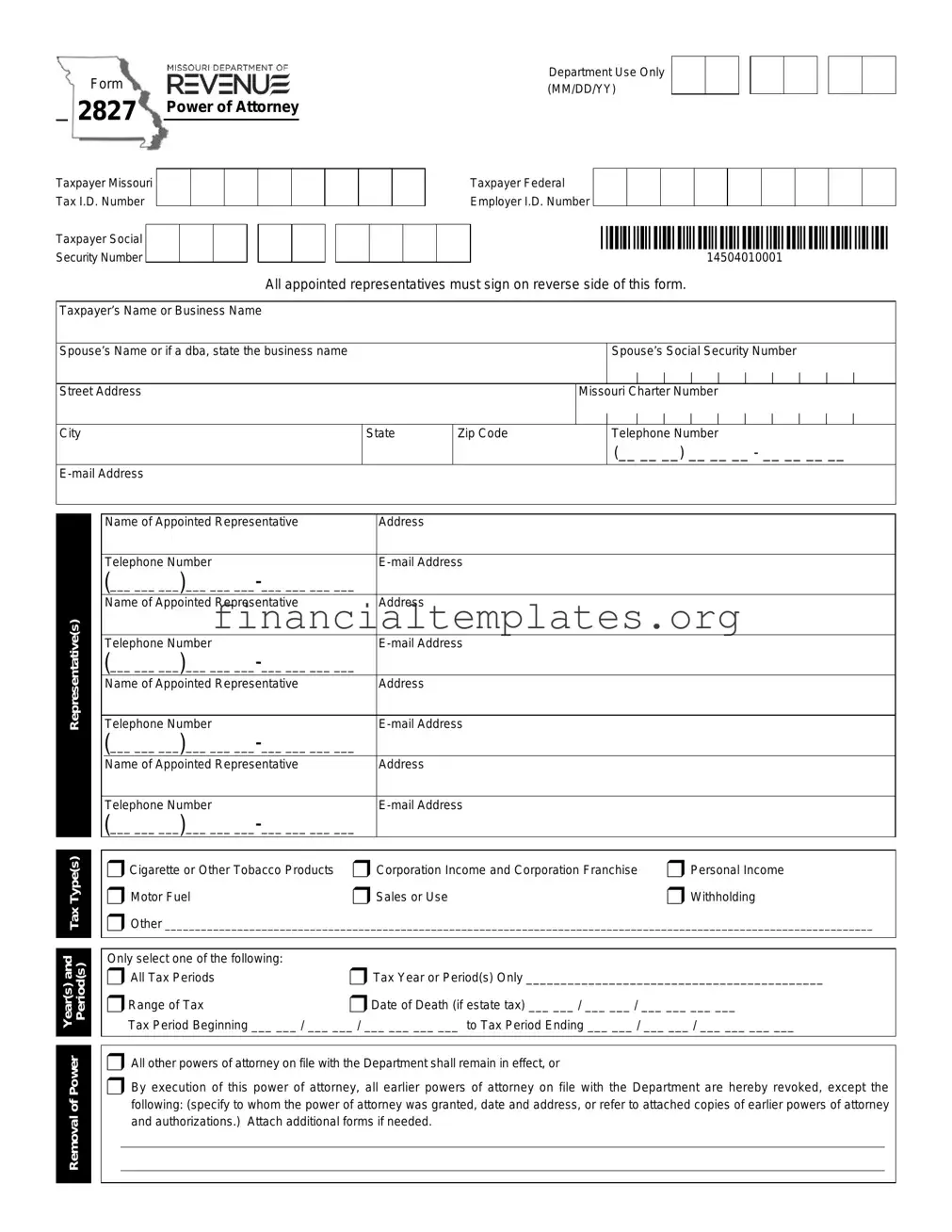

Tax POA form 2827 Example

Form |

|

R:V:NUS |

|

|

|

|

(MM/DD/YY) |

[IJ[IJ[IJ |

||

|

|

|

DEPARTMENT OF |

|

|

|

|

Department Use Only |

|

|

2827 |

|

|

|

|

|

|

|

|

||

|

Power of Attorney |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

Taxpayer Missouri |

I |

I |

I |

I I I |

I |

I |

I |

Taxpayer Federal |

I I I I I I I |

|

Tax I.D. Number |

Employer I.D. Number I I I |

|||||||||

Taxpayer Social |

|

I |

I |

IITJ I |

I |

I |

I |

I |

*14504010001* |

|

Security Number I |

|

|

14504010001 |

|||||||

All appointed representatives must sign on reverse side of this form.

Taxpayer’s Name or Business Name

Spouse’s Name or if a dba, state the business name |

|

|

|

Spouse’s Social Security Number |

|

|

|

|

|

|

I |

| | | | | | |

| |

| |

| |

Street Address |

|

|

Missouri Charter Number |

|

|

|

|

|

|

|

I | |

| | | | | | |

| |

| |

| |

City |

State |

Zip Code |

|

Telephone Number |

|

|

|

|

I |

I |

I(__ __ __) __ __ __ - __ __ __ __ |

|

|||

|

|

|

|

|

|

|

|

Representative(s)

Year(s) and Removal of Power Period(s) Tax Type(s)

Name of Appointed Representative |

Address |

|

|

Telephone Number |

|

(___ ___ ___)___ ___ |

|

Name of Appointed Representative |

Address |

|

|

Telephone Number |

|

(___ ___ ___)___ ___ |

|

Name of Appointed Representative |

Address |

|

|

Telephone Number |

|

(___ ___ ___)___ ___ |

|

Name of Appointed Representative |

Address |

|

|

Telephone Number |

|

(___ ___ ___)___ ___ |

|

rCigarette or Other Tobacco Products r Corporation Income and Corporation Franchise r Personal Income

r Motor Fuel |

r Sales or Use |

r Withholding |

rOther _____________________________________________________________________________________________________________________

Only select one of the following: |

|

r All Tax Periods |

r Tax Year or Period(s) Only ___________________________________________ |

r Range of Tax |

r Date of Death (if estate tax) ___ ___ / ___ ___ / ___ ___ ___ ___ |

Tax Period Beginning ___ ___ / ___ ___ / ___ ___ ___ ___ to Tax Period Ending ___ ___ / ___ ___ / ___ ___ ___ ___

rAll other powers of attorney on file with the Department shall remain in effect, or

rBy execution of this power of attorney, all earlier powers of attorney on file with the Department are hereby revoked, except the following: (specify to whom the power of attorney was granted, date and address, or refer to attached copies of earlier powers of attorney and authorizations.) Attach additional forms if needed.

Signature

Under penalties of perjury, I (we) hereby certify that I (we) am (are) the taxpayer(s) named herein or that I have the authority to execute this power of attorney on behalf of the taxpayer(s).

Name

Signature |

Date (MM/DD/YYYY) |

Taxpayer Telephone Number |

|

__ __ / __ __ / __ __ __ __ |

I(___ ___ ___)___ ___ |

Name |

Title (if applicable) |

|

|

|

|

Signature |

Date (MM/DD/YYYY) |

Taxpayer Telephone Number |

|

__ __ / __ __ / __ __ __ __ |

I(___ ___ ___)___ ___ |

Declaration of Representative(s)

Please consult Missouri Regulation 12 CSR

I declare that I am aware of Regulation 12 CSR

1. |

a member in good standing of the bar; |

5. |

a fiduciary for the taxpayer; |

2. |

a certified public accountant duly qualified to practice; |

6. |

an enrolled agent; |

3. |

an officer of the taxpayer organization; |

7. |

tax preparer, or |

4. |

a |

8. |

other authorized representative or agent |

Note: All appointed representatives must sign below. No digital signatures allowed.

Printed Name of Representative |

Signature of Representative |

Date (MM/DD/YYYY) |

||||||

|

|

|

|

|

|

|

|

___ ___ / ___ ___ / ___ ___ ___ ___ |

Designation (Please select number from list above) |

|

|

Title (if applicable) |

|

||||

r 1 |

r 2 |

r 3 |

r 4 |

r 5 r 6 r 7 |

r 8 |

|

|

|

|

|

|

|

|||||

Printed Name of Representative |

Signature of Representative |

Date (MM/DD/YYYY) |

||||||

|

|

|

|

|

|

|

|

___ ___ / ___ ___ / ___ ___ ___ ___ |

Designation (Please select number from list above) |

|

|

Title (if applicable) |

|

||||

r 1 |

r 2 |

r 3 |

r 4 |

r 5 r 6 r 7 |

r 8 |

|

|

|

|

|

|

|

|||||

Printed Name of Representative |

Signature of Representative |

Date (MM/DD/YYYY) |

||||||

|

|

|

|

|

|

|

|

___ ___ / ___ ___ / ___ ___ ___ ___ |

|

|

|

|

|

||||

Designation (Please select number from list above) |

|

|

Title (if applicable) |

|

||||

r 1 |

r 2 |

r 3 |

r 4 |

r 5 r 6 r 7 |

r 8 |

|

|

|

|

|

|

|

|||||

Printed Name of Representative |

Signature of Representative |

Date (MM/DD/YYYY) |

||||||

|

|

|

|

|

|

|

|

___ ___ / ___ ___ / ___ ___ ___ ___ |

|

|

|

|

|

||||

Designation (Please select number from list above) |

|

|

Title (if applicable) |

|

||||

r 1 |

r 2 |

r 3 |

r 4 |

r 5 r 6 r 7 |

r 8 |

|

|

|

|

|

|

|

|

|

|

|

|

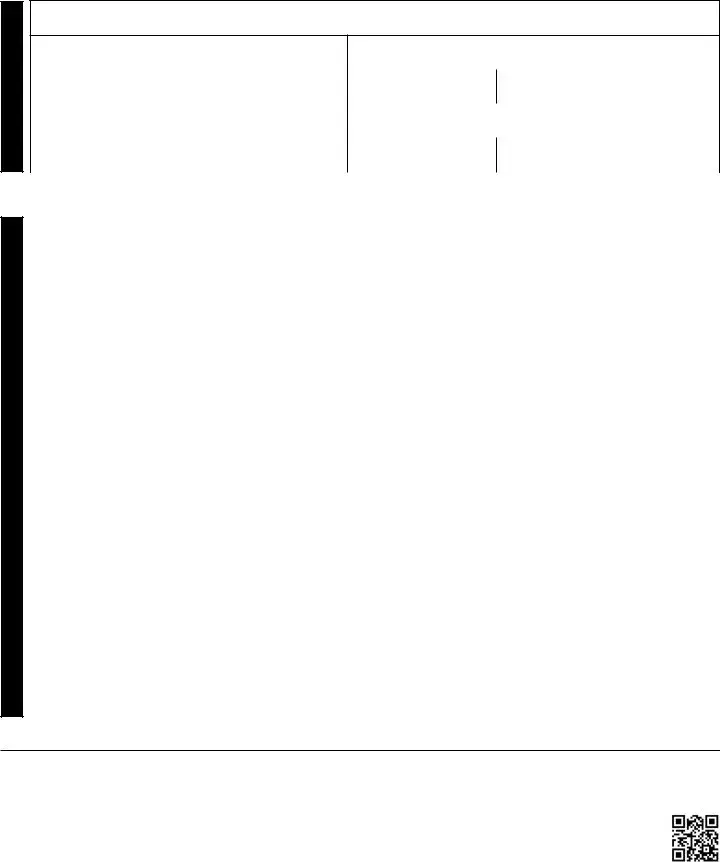

Mail to: |

|

|

Form 2827 (Revised |

|

|

|

|

(Business Tax) |

(Personal Tax) |

(Motor Fuel Tax) |

(Cigarette or Other Tobacco Products Tax) |

Taxation Division |

Taxation Division |

Taxation Division |

Taxation Division |

P.O. Box 357 |

P.O. Box 2200 |

P.O. Box 300 |

P.O. Box 811 |

Jefferson City, MO |

Jefferson City, MO |

Jefferson City, MO |

Jefferson City, MO |

Phone: (573) |

Phone: (573) |

Phone: (573) |

Phone: (573) |

Fax: (573) |

Fax: (573) |

Fax: (573) |

Fax: (573) |

If this is being submitted in response to an audit, please fax to (573)

Visit http://dor.mo.gov/ for additional information.

*14504020001*

14504020001

Document Specifics

| Fact Name | Description |

|---|---|

| Form Number | Tax Power of Attorney (POA) Form 2827 |

| Purpose | Allows an individual to grant authority to another person to handle tax matters on their behalf. |

| Validity | Varies by state, but typically remains in effect until explicitly revoked or the specified end date is reached. |

| Governing Law | Subject to state-specific laws where the tax matters will be handled. |

| Key Components | Includes identifiers for the principal and agent, tax matters and years covered, and signatures from both parties. |

Guide to Writing Tax POA form 2827

After deciding to grant someone else the authority to handle your tax matters, the next step involves filling out the Tax Power of Attorney (POA) Form 2827. This form enables you to appoint an individual or organization as your representative in matters with the tax department. Proper completion and submission of this form are critical to ensure that your appointed representative can legally act on your behalf. Here's a guide to help you through the process of filling it out accurately.

- Start by entering your full name and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) in the designated fields to identify yourself as the taxpayer.

- Fill in your current address, including the city, state, and ZIP code, to ensure correspondence related to the POA can be sent to the correct location.

- Specify the name of the individual or organization you are appointing as your representative. If you are appointing an organization, make sure to include the name of an individual within the organization who will act on its behalf.

- Provide the representative’s contact information, including their telephone number, fax number (if applicable), and email address, to facilitate communication between the tax department and your representative.

- Detail the specific tax matters and periods for which the representative will have authority. This includes indicating the type of tax, the form number, and the year(s) or period(s) involved. Be as specific as possible to avoid any confusion regarding the scope of the representative’s authority.

- Check the appropriate box if the representative is expected to receive refund checks, sign returns, or receive confidential information regarding your tax matters. This section vests specific permissions in your representative, so consider each option carefully.

- Review the form to ensure that all the information provided is accurate and complete. Misinformation or incomplete forms can lead to delays or the rejection of your POA request.

- Sign and date the form in the designated area. Your signature formally authorizes the representative to act on your behalf in the specified tax matters.

- If applicable, make sure your appointed representative also signs and dates the form. Their signature acknowledges their acceptance of the responsibilities bestowed upon them.

- Lastly, submit the completed form to the relevant tax department or authority as instructed. The submission process may vary by state or locality, so it’s important to follow the specific guidelines provided for in your jurisdiction.

Once the Tax POA Form 2827 is submitted, the appointed representative will have the authority to act on your behalf in the specified tax matters. Keep a copy of the completed form for your records and be sure to monitor the representative’s actions to ensure they align with your expectations and legal requirements.

Understanding Tax POA form 2827

-

What is the Tax POA Form 2827?

The Tax Power of Attorney (POA) Form 2827 is a legally binding document that allows an individual or business to grant another person or entity the authority to handle their tax matters. This form is used to designate someone else, often a tax professional, to communicate with the tax department, make decisions, and undertake actions on their behalf regarding their taxes.

-

Who can be appointed as a Tax POA?

Almost anyone can be appointed as a Tax POA, including accountants, attorneys, family members, or trusted friends. The person appointed, known as the agent or representative, must be willing and able to handle the tax responsibilities assigned to them. It’s crucial to choose someone who is trustworthy and understands tax matters to ensure your taxes are handled properly.

-

How do you fill out Form 2827?

Filling out Form 2827 involves providing detailed information about the taxpayer and the appointed representative. This includes names, addresses, and taxpayer identification numbers. The form will also require specifying the tax matters and periods for which the agent has authority. It's important to read the instructions carefully and to fill out the form accurately to ensure the POA is granted correctly. For specific entries and sections, seeking guidance from a professional can help avoid mistakes.

-

Is the Tax POA Form 2827 permanent?

No, the Tax POA Form 2827 is not permanent. It can be revoked by the taxpayer at any time should they choose to do so. This can be done by submitting a written revocation to the tax authority or by completing a new form that overrides the previous one. It's also important to note that this POA authorization typically has an expiration date, so attention to the validity period is necessary to ensure continuous representation if required.

Common mistakes

When dealing with the Tax Power of Attorney (POA) Form 2827, many individuals find themselves navigating through somewhat complex territory. This document grants someone else the authority to handle your tax matters, so it's crucial to fill it out correctly. Unfortunately, mistakes can happen. To help you avoid common pitfalls, here's a list of five frequent errors made during this process:

Not specifying the tax matters: One of the most common mistakes is not being specific about the tax issues the appointed person can handle. It's important to detail which taxes, years, and types of information your representative can access and manage.

Choosing the wrong representative: It's vital to choose someone who is trustworthy and capable of handling your tax affairs with competence. Remember, this person will have access to sensitive information and the authority to make decisions on your behalf.

Forgetting to sign and date the form: An unsigned or undated form is invalid. It's a simple step but crucial. Make sure you don't overlook this detail before submission.

Not updating the form when necessary: Life changes, such as marriage, divorce, or changing your representative, require an update to your POA form. Failing to keep this form current can lead to confusion or unauthorized access to your tax information.

Ignoring state-specific requirements: While the POA Form 2827 is a federal document, some states have their own rules and forms for tax representation. Make sure you comply with state requirements to avoid any legal issues.

By steering clear of these common errors, you can ensure that your tax matters are handled smoothly and by the right person. Remember, the details matter when it comes to legal and financial forms. Taking the time to fill out your Tax POA Form correctly is an investment in your peace of mind.

Documents used along the form

When managing tax matters, particularly with the use of the Tax Power of Attorney (POA) Form 2827, it's important to understand that this form does not stand alone. To ensure comprehensive handling of one's tax affairs, several other documents are commonly employed alongside the Tax POA. These documents serve various purposes, from confirming identity to providing detailed instructions or reports. Below we outline some of these essential forms and documents, highlighting their significance in the tax preparation and filing process.

- Form 1040: The U.S. Individual Income Tax Return is the foundational document for personal tax filing. It is where all income, deductions, and credits are reported, and it serves as the primary tax form for most individuals.

- Form W-2: This Wage and Tax Statement is issued by employers to report an employee's annual earnings and taxes withheld. This essential document is necessary for preparing accurate tax returns.

- Form 1099: Various versions of Form 1099 report different types of income other than wages, such as freelance income, interest, dividends, and distributions from a retirement plan.

- Form 4868: Application for Automatic Extension of Time To File U.S. Individual Income Tax Return provides taxpayers extra time to file their Form 1040, thereby preventing potential penalties for late filing.

- Schedule A (Form 1040): This form is used to itemize deductions, allowing taxpayers who choose not to take the standard deduction to itemize deductible expenses such as medical, dental, charitable contributions, and mortgage interest.

- Schedule C (Form 1040): Profit or Loss from Business is utilized by sole proprietors to report business income and expenses, hence determining the net profit or loss from business activities.

Employing these documents in conjunction with the Tax POA Form 2827 can streamline the tax preparation process, ensuring all relevant income, deductions, and credits are accounted for correctly. Proper preparation can result in a more accurate tax return and potentially more favorable tax outcomes. Moreover, understanding the role of each document empowers taxpayers, enabling them to navigate the tax filing process with greater confidence and efficiency.

Similar forms

The Tax Power of Attorney (POA) Form 2827 is a document that allows an individual to grant another person the authority to make tax-related decisions and handle tax matters on their behalf. A similar document is the General Power of Attorney. This document grants broad powers to an agent to act on an individual's behalf in various matters, not just tax issues. It can include the authority to manage financial, legal, and property matters, making it more comprehensive than the Tax POA.

Another document similar to the Tax POA Form 2827 is the Durable Power of Attorney. The key distinction between a Durable Power of Attorney and a Tax POA is that the former remains effective even if the principal becomes incapacitated. While the Tax POA is specifically for tax matters, a Durable Power of Attorney covers a wide range of decisions and can include tax matters among its provisions.

The Health Care Power of Attorney shares similarities with the Tax POA in that it designates someone else to make specific types of decisions on behalf of the individual. However, as the name suggests, it focuses on medical and health care decisions instead of tax or financial matters. It comes into effect under circumstances defined by the individual, such as incapacity to make health care decisions.

A Limited Power of Attorney is also akin to the Tax POA Form 2827 but with a more narrowly defined scope. This document allows an individual to grant another person the authority to act in specific situations or for specific tasks, such as selling a car or managing a single financial transaction, in contrast to the broader authority granted for handling all tax matters with a Tax POA.

The Financial Power of Attorney, much like the Tax POA, allows an individual to name someone else to handle their financial affairs. It can be more encompassing, including but not limited to tax matters, such as managing bank accounts, investments, and other financial decisions. The key similarity is the focus on financial decision-making, though the scope may be broader with a Financial Power of Attorney.

Last but not least, the IRS Form 2848, Power of Attorney and Declaration of Representative, is a document specifically designed by the Internal Revenue Service for tax purposes, akin to the Tax POA Form 2827. It allows taxpayers to appoint an individual, usually a tax professional, to represent them before the IRS. The form grants this individual the authority to obtain and disclose tax information, negotiate and agree to payment or settlement terms, and make other tax-related decisions. This form is very similar in purpose to the Tax POA but is specific to dealings with the IRS.

Dos and Don'ts

Filling out the Tax Power of Attorney (POA) Form 2827 accurately is crucial for ensuring that your tax matters are handled as you wish. Here are key dos and don'ts to keep in mind:

Do:

- Ensure you have the most current version of Form 2827. Tax laws and forms can change, impacting the validity of your POA.

- Read the instructions carefully before filling out the form to avoid common mistakes.

- Provide accurate information for all required fields, including full legal names and taxpayer identification numbers.

- Specify the tax matters and years or periods you want the POA to cover. Being clear about the extent of authority you're granting is essential.

- Choose a representative who is qualified and whom you trust. This individual will be acting on your behalf in tax matters.

- Sign and date the form. Without your signature, the form will not be valid.

- Keep a copy for your records. Having your own record can help in future disputes or questions.

- Notify your representative that you've filed a POA and share a copy with them.

- Consider state-specific requirements. Some states may have additional procedures or forms.

- Revoke the POA if your situation changes and it's no longer needed or you wish to appoint a different representative, by submitting a written revocation to the tax authority.

Don't:

- Leave any sections blank. If a section doesn't apply, indicate "N/A" (not applicable).

- Use the form to grant broader powers than you're comfortable with. Only include the tax years and types of tax for which you need representation.

- Choose a representative without considering their expertise and reliability. Your tax matters are important, and you should trust who represents you.

- Forget to update the form when your circumstances change, such as a change in your representative or tax matters.

- Sign without reviewing the entire form. Ensuring all information is correct and complete is crucial.

- Ignore the need for a witness or notary if your state requires one. Some states may have specific witnessing or notarization requirements for a POA to be valid.

- Submit the form without making a copy for your personal records.

- Assume the POA is immediately effective without confirmation from the tax authority. There may be a processing period.

- Underestimate the importance of clearly specifying the powers you are granting. Ambiguities can lead to misunderstandings or misuse of authority.

- Use the POA form to handle non-tax matters. This form is specifically designed for tax representation purposes.

Misconceptions

Understanding the nuances of tax forms is crucial, yet, the Tax Power of Attorney (POA) Form 2827 is often surrounded by misconceptions. This form is vital for granting someone authority to handle tax matters on another's behalf. However, misconceptions can lead to misuse or hesitance to use the form rightfully. Below are four common misconceptions clarified to ensure accurate understanding and usage.

- Misconception 1: The form grants complete power over all financial matters. It's a common belief that the Tax POA Form 2827 gives the appointed individual full control over all of the grantor's financial affairs. However, this form specifically grants authority only in matters related to taxes. This limitation is crucial for filers to understand to ensure they're only giving access to the areas intended.

- Misconception 2: Only family members can be appointed. Many believe that the Tax POA can only be assigned to family members. In truth, any individual or qualified entity, such as an attorney or CPA, can be granted this power. This flexibility allows taxpayers to choose someone based on trust and qualifications, not just familial ties.

- Misconception 3: The form is permanent until the grantor's death. This is not the case. The duration of the power granted can be set for a specific timeframe or task and can be revoked at any time by the grantor. This flexibility ensures that the grantor retains control over their tax affairs and can make adjustments as their situation or preferences change.

- Misconception 4: It automatically includes state tax matters. Another misunderstanding is that the Tax POA Form 2827 covers both federal and state tax matters. It's essential to know that this form applies to the specific tax matters indicated and often only to federal taxes. Separate forms or stipulations might be needed for state tax matters, varying by state.

Clarifying these misconceptions helps in appreciating the Tax Power of Attorney Form 2827's role and limitations. Armed with the correct information, individuals can make informed decisions regarding their tax affairs and the appointment of representatives. Not only does this ensure proper handling of their taxes, but it also protects their financial interests.

Key takeaways

Filling out and using the Tax Power of Attorney (POA) Form 2827 is a critical step for individuals seeking to authorize someone else to handle their tax matters with the tax authority. This document enables the designated agent, such as an accountant or attorney, to act on behalf of the taxpayer, empowering them to perform a variety of tax-related tasks. Understanding the key components and implications of this form ensures that taxpayers can effectively manage their tax responsibilities through their chosen representatives.

Complete the form accurately: Ensuring that all sections of Form 2827 are filled out correctly is paramount. Every piece of information, from the taxpayer's identification numbers to the specific tax forms and periods covered, needs to be accurately recorded. Mistakes or omissions can lead to processing delays or the rejection of the POA form.

Specify the powers granted: Taxpayers have the flexibility to dictate the extent of the authority granted to their agent. This can range from the ability to access confidential tax information to making payments or disputing tax decisions on their behalf. Clearly outlining these powers prevents any confusion regarding the agent's scope of authority.

Understand the form's duration: The effective period of Form 2827 should be noted, as it indicates how long the agent will have the powers granted. If the taxpayer desires to extend this period, they will need to execute a new POA form once the current one expires.

Keep a signed copy: After submitting Form 2827 to the relevant tax authority, it's important for both the taxpayer and the authorized agent to retain signed copies for their records. Having this documentation readily available is crucial for reference in any future disputes or questions about the agent's authority or actions taken on the taxpayer's behalf.

Popular PDF Documents

How to Report a Workplace Injury - Employers are required to complete this form promptly after being notified of an employee's work-related injury or illness, detailing the incident and any subsequent medical treatment.

Affidavit of Heirship for a House - Ultimately, an Affidavit of Heirship serves to affirm the orderly and lawful transition of a deceased person’s assets to their rightful successors, safeguarding the interests of all involved.

Mtc Form - It is imperative for entities to be in good standing, with no tax delinquencies and up-to-date CRS registration, to qualify for the issuance of this certificate.