Get Tax POA form 21-002-13 Form

Managing taxes can be a complex and time-consuming endeavor, especially when circumstances require delegating these responsibilities to another individual. This is where the Tax Power of Attorney (POA) form 21-002-13 comes into play, offering a legal avenue for taxpayers to authorize someone else to handle their tax matters. The form allows for a broad range of actions to be performed on behalf of the taxpayer, including filing returns, making payments, and receiving confidential information. It's a critical tool for those who, due to various reasons, cannot attend to their tax duties themselves. The significance of this form extends beyond convenience; it establishes a legal framework ensuring that the designated representative acts within the specified boundaries of the power granted. Understanding the scope, limitations, and the process of executing this form is essential for both the taxpayer and the authorized individual, ensuring that tax matters are handled efficiently and securely.

Tax POA form 21-002-13 Example

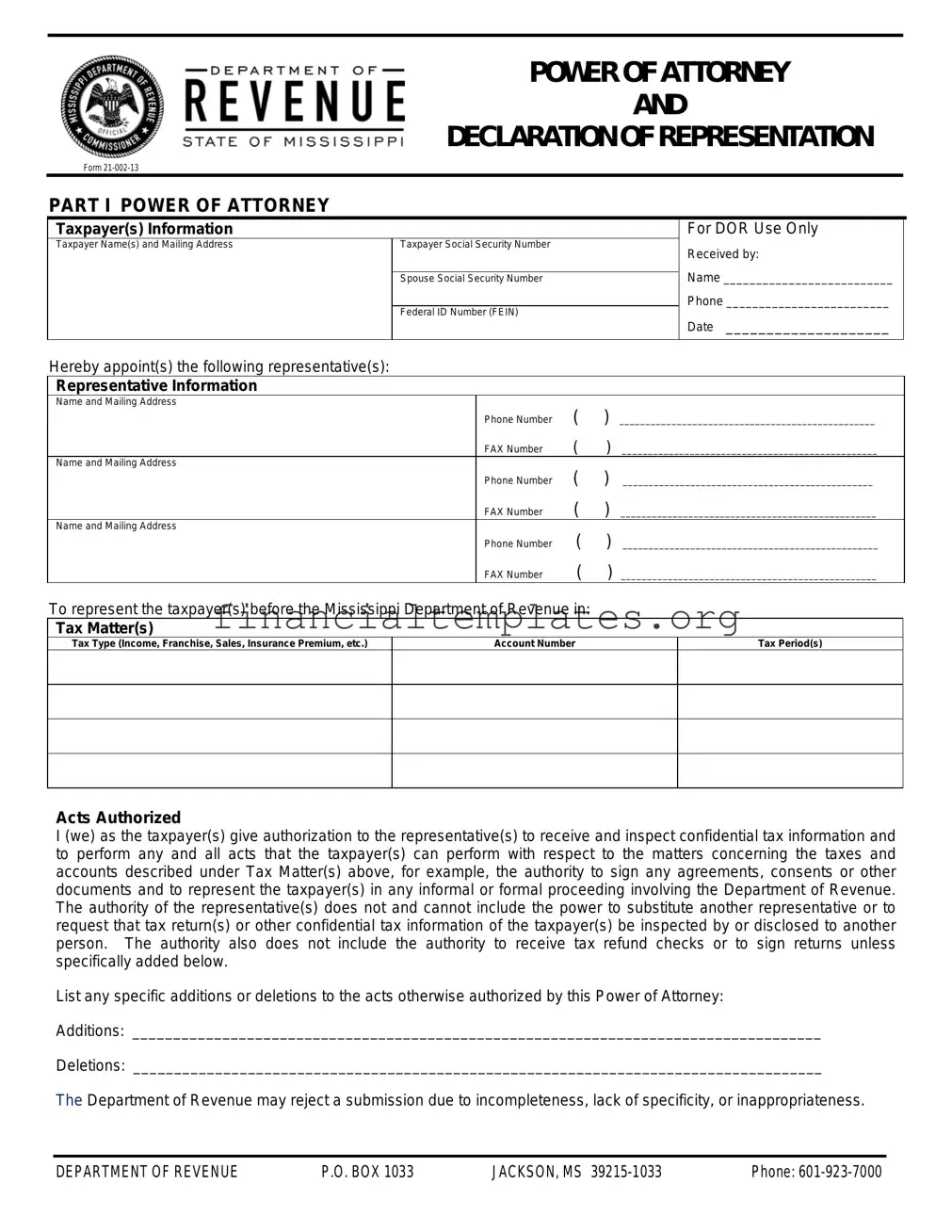

- DEPARTMENT OF - |

POWER OF ATTORNEY |

|

REV EN UE |

AND |

STATE OF M I SS I SSIPPI |

DECLARATION OF REPRESENTATION |

Form

PART I POWER OF ATTORNEY

Taxpayer(s) Information

Taxpayer Name(s) and Mailing Address |

Taxpayer Social Security Number |

|

Spouse Social Security Number |

|

Federal ID Number (FEIN) |

For DOR Use Only

Received by:

Name __________________________

Phone _________________________

Date ____________________

Hereby appoint(s) the following representative(s):

Representative Information

Name and Mailing Address

Phone Number |

( |

) |

_________________________________________________ |

FAX Number |

( |

) |

_________________________________________________ |

Name and Mailing Address |

( |

) |

|

Phone Number |

________________________________________________ |

||

FAX Number |

( |

) |

_________________________________________________ |

Name and Mailing Address |

( |

) |

|

Phone Number |

_________________________________________________ |

||

FAX Number |

( |

) |

_________________________________________________ |

To represent the taxpayer(s) before the Mississippi Department of Revenue in:

Tax Matter(s)

Tax Type (Income, Franchise, Sales, Insurance Premium, etc.)

Account Number

Tax Period(s)

Acts Authorized

I (we) as the taxpayer(s) give authorization to the representative(s) to receive and inspect confidential tax information and to perform any and all acts that the taxpayer(s) can perform with respect to the matters concerning the taxes and accounts described under Tax Matter(s) above, for example, the authority to sign any agreements, consents or other documents and to represent the taxpayer(s) in any informal or formal proceeding involving the Department of Revenue. The authority of the representative(s) does not and cannot include the power to substitute another representative or to request that tax return(s) or other confidential tax information of the taxpayer(s) be inspected by or disclosed to another person. The authority also does not include the authority to receive tax refund checks or to sign returns unless specifically added below.

List any specific additions or deletions to the acts otherwise authorized by this Power of Attorney:

Additions: ____________________________________________________________________________________

Deletions: ____________________________________________________________________________________

The Department of Revenue may reject a submission due to incompleteness, lack of specificity, or inappropriateness.

DEPARTMENT OF REVENUE |

P.O. BOX 1033 |

JACKSON, MS |

Phone: |

DOR Power of Attorney, Form

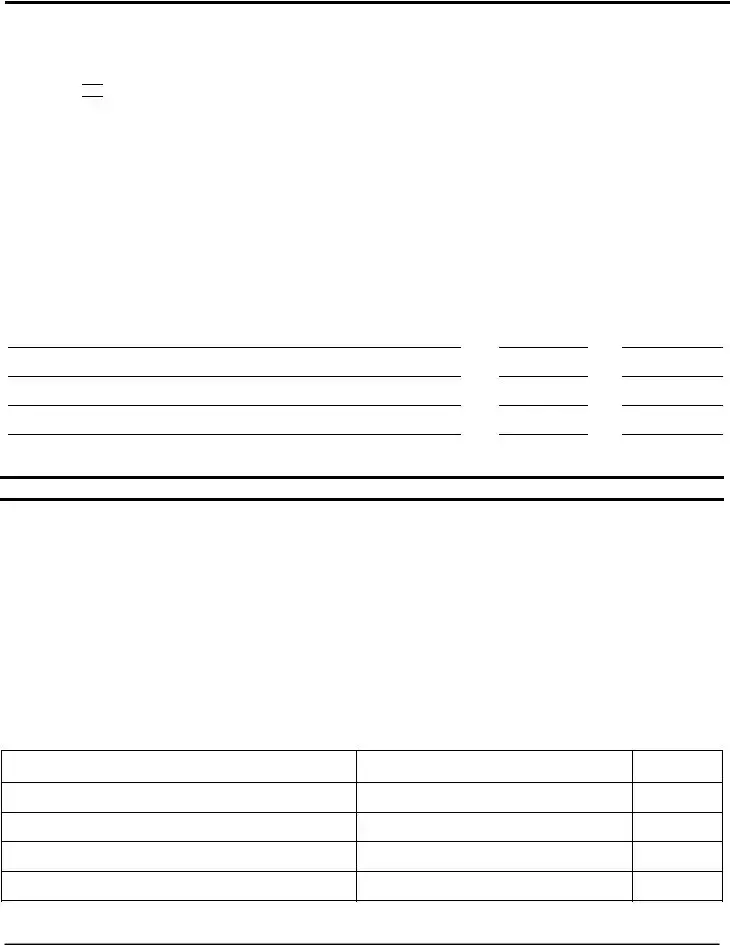

Retention/Revocation of Prior Power(s) of Attorney

The filing of this Power of Attorney automatically revokes all earlier Power(s) of Attorney on file with the Department of Revenue for the same tax matter(s) covered by this document. If you do not want to revoke a prior Power or Attorney,

check here D

and ATTACH A COPY OF THE POWER(S) OF ATTORNEY YOU WANT TO REMAIN IN EFFECT.

and ATTACH A COPY OF THE POWER(S) OF ATTORNEY YOU WANT TO REMAIN IN EFFECT.

Who Must Sign and What Documentation of Authority Must Be Attached

If a tax matter concerns a joint return, both husband and wife must sign if joint representation is requested. A corporation or subsidiary MUST contain the signatures of a principal officer and the secretary or other officer. A guardian, executor, receiver, administrator, conservator or trustee MUST attach the appropriate documentation granting the authority from the court or taxpayer.

Signing is Certification Under Oath Subject to Penalty of Perjury

The person(s) signing this Power of Attorney and Declaration of Representations certifies under oath that all the information contained in this document is true and correct and that he, she or they have the authority to sign this document as the taxpayer(s) or on behalf of the taxpayer(s) and acknowledge that this Power of Attorney and Declaration of Representation is being signed under the penalty of perjury pursuant to Miss. Code Ann. §

IF NOT SIGNED AND DATED, THIS POWER OF ATTORNEY WILL BE RETURNED.

Signature |

Date |

Title (if applicable) |

Print Name |

Phone Number |

FAX Number |

Signature |

Date |

Title (if applicable) |

Print Name |

Phone Number |

FAX Number |

PART II DECLARATION OF REPRESENTATIVE

Under penalties of perjury and Miss. Code Ann.

1)I am authorized to represent the taxpayer(s) identified in Part I for the tax matter(s) specified there: and

2)I am one of the following:

a.Attorney – a member in good standing of the bar of the highest court of the jurisdiction shown below.

b.Certified Public Accountant – duly authorized to practice as a certified public accountant in the jurisdiction shown.

c.Officer – a bona fide officer of the taxpayer’s organization.

d.

e.Family Member – a member of the taxpayer’s immediate family (i.e., spouse, parent, child, brother, or sister).

f.Enrolled Agent – enrolled as an agent under the requirements of the IRS.

g.Other – Provide explanation ________________________________________________________________

IF NOT SIGNED AND DATED, THIS POWER OF ATTORNEY WILL BE RETURNED.

Designation – Insert |

State Issuing |

State License |

Above letter |

License |

Number |

|

|

|

Signature

Date

DEPARTMENT OF REVENUE |

P.O. BOX 1033 |

JACKSON, MS |

Phone: |

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of the Form | The Tax POA form 21-002-13 is used to grant someone else the authority to handle your tax matters with the tax authority. |

| Who Can Be Appointed | Any individual, such as a family member, friend, or tax professional, who you trust to manage your tax affairs can be appointed. |

| Scope of Authority | This form allows the appointed person to receive confidential tax information and make decisions regarding taxes on your behalf. |

| Validity Period | The period for which the form is valid can be specified within the document, and it can be revoked at any time by the person who granted the authority. |

| Governing Laws | While this form is a general template, specific state laws govern its execution and validity. It's essential to consult state-specific regulations. |

Guide to Writing Tax POA form 21-002-13

Upon deciding to delegate authority for handling your tax matters, it's crucial to complete the form accurately to ensure your representative can act on your behalf effectively. The step-by-step guide below simplifies the process of filling out the Tax POA form 21-002-13. These steps are designed to make the completion process straightforward, removing any potential confusion and ensuring that all necessary information is captured efficiently.

- Begin by entering the full legal name of the taxpayer granting the power of attorney in the designated space at the top of the form.

- Provide the taxpayer’s unique identification numbers, such as the Social Security Number (SSN) for individuals or Employer Identification Number (EIN) for businesses.

- List the taxpayer’s full address, including the street address, city, state, and zip code, to ensure all correspondence reaches the correct address.

- Enter the complete name of the representative being granted the power of attorney. If there are multiple representatives, provide this information for each person.

- Fill in the representative(s) contact information, including their phone number, fax number (if applicable), and email address.

- Specify the tax matters and tax periods for which authorization is given. This section should include the type of tax, the form number, and the year(s) or period(s) applicable.

- Detail any specific additions or restrictions to the representative’s authority. If the form does not provide enough space, attach a separate sheet with the complete information.

- The taxpayer must sign and date the form in the presence of a witness or a notary public to validate the form. Ensure all designated parties complete their part of this section.

- If applicable, the representative(s) should also sign and date the form, acknowledging their acceptance of the designated powers.

- Review the entire form for accuracy and completeness. Double-check that no required fields have been missed and that all provided information is correct.

- Follow the instructions provided on the form for submitting it to the appropriate tax authority. This may involve mailing, faxing, or electronically submitting the form, depending on the options available.

Once submitted, it's a waiting game as the tax authority processes the form. It’s wise to maintain a copy of the completed form and any confirmation receipt or number provided upon submission. This documentation will be crucial for any follow-up or in case any issues arise regarding the appointed representative’s authority to act on the taxpayer’s behalf.

Understanding Tax POA form 21-002-13

-

What is the Tax POA form 21-002-13 used for?

The Tax POA form 21-002-13 is used to grant someone else the authority to handle your tax matters with the tax agency. This could include filing taxes, obtaining information, and making decisions on your behalf concerning your taxes.

-

Who can be appointed as a representative on this form?

Any individual who you trust and who is willing to act on your behalf can be appointed as a representative. This often includes tax professionals, attorneys, family members, or close friends.

-

How long does the authority last?

The duration of the authority granted by the Tax POA form 21-002-13 can be specified in the form itself. If no end date is provided, it generally continues until it is formally revoked or replaced by a new form.

-

Can I revoke the authority given through the Tax POA form 21-002-13?

Yes, you can revoke the authority at any time. This is typically done by notifying the tax agency in writing and providing a copy of the revocation to your former representative.

-

Do I need to notarize the Tax POA form 21-002-13?

Whether notarization is required can vary by jurisdiction. It's important to check the specific requirements of your tax agency to ensure that the form is completed correctly.

-

How do I choose a representative?

When choosing a representative, consider the individual's knowledge of tax law, reliability, and your personal trust in them. Professional qualifications, such as being a certified public accountant or a tax attorney, might also be important depending on your needs.

-

Is there a fee to file the Tax POA form 21-002-13?

Typically, there is no fee to submit the form to the tax agency. However, if you are hiring a professional to act as your representative, they may charge for their services.

-

What if my representative makes a mistake on my taxes?

You are still ultimately responsible for the information submitted on your taxes, even if it is prepared by your representative. Therefore, it is crucial to choose someone you trust and to review any filings carefully.

-

Can I have more than one representative?

Yes, the form allows for the appointment of more than one representative. Each representative's authority can be limited to specific tax matters or periods as desired.

-

Where do I submit the completed Tax POA form 21-002-13?

The completed form should be submitted to the tax agency handling your taxes. The address or electronic submission guidelines are usually provided in the form instructions or on the agency's website.

Common mistakes

Filling out the Tax POA (Power of Attorney) form, specifically form 21-002-13, is a critical task that grants someone else the authority to handle tax matters on your behalf. However, mistakes can easily occur during this process, leading to delays, misunderstandings, or in some cases, legal complications. Here are nine common mistakes to be aware of:

Not specifying the scope of authority. Failing to clearly outline the specific tax years and types of taxes for which the agent has power can lead to confusion and limit their ability to act effectively on your behalf.

Overlooking the importance of choosing the right agent. The person granted this power will have access to sensitive financial information and make decisions in your stead. Therefore, ensuring they are trustworthy and competent is crucial.

Omitting the signature and date. The form is invalid without the principal's (the person granting the power) signature and the date it was signed, yet, surprisingly, this step is often overlooked.

Not updating the form when situations change. Life changes, such as a divorce or the death of the named agent, require an updated POA to reflect the current circumstances.

Ignoring the need to specify any limitations. Without clear boundaries, an agent may assume more power than intended, making it important to clarify these limitations within the document.

Inaccurate or incomplete information about the principal or the agent. Every detail needs to be correct to ensure the document’s validity and functionality.

Not using the most current form. Tax laws and forms can change, so using an outdated version might mean your document is not compliant with current regulations.

Failing to properly revoke previous POAs. If you have old POAs that are no longer relevant, these should be explicitly revoked to avoid confusion or conflicting authorities.

Forgetting to keep a copy for personal records. Once the form is filled out and submitted, retaining a copy is vital for maintaining personal records and resolving any future disputes.

Avoiding these mistakes not only ensures the Power of Attorney form meets legal standards but also secures the proper handling of one’s tax matters. Careful attention to detail and thoroughness are key when completing any such important legal document.

Documents used along the form

When dealing with tax matters, especially when using a Tax Power of Attorney (POA) form like form 21-002-13, it's crucial to understand the other forms and documents that may be necessary to complete your tax-related tasks effectively. These documents work in conjunction with the Tax POA to ensure comprehensive management of an individual's tax affairs.

- Form W-9, Request for Taxpayer Identification Number and Certification: This form is often necessary for verifying one’s tax ID number, such as a Social Security Number, for banking or employment purposes. It’s crucial when the agent dealing with the tax matters needs to confirm the taxpayer’s identification.

- Form 2848, Power of Attorney and Declaration of Representative: This IRS form allows individuals to authorize an attorney, accountant, or another person to represent them before the IRS. It is more detailed than a standard Tax POA and specifies the tax matters and years for which representation is granted.

- Form 8821, Tax Information Authorization: This form authorizes individuals or organizations to request and inspect confidential tax information. It is useful for agents who need to access tax records but do not need the authority to represent the taxpayer.

- Form 4506-T, Request for Transcript of Tax Return: Individuals use this form to request a transcript of their tax return which is often needed for loan applications or to verify income. It can be used by an authorized agent under a Tax POA to obtain necessary records.

- Form 1040, U.S. Individual Income Tax Return: The backbone of individual tax filing, this form is essential for reporting annual income, claiming deductions, and determining the amount of tax owed or refund due. It is often the focus of actions taken by an agent under a Tax POA.

- Form SS-4, Application for Employer Identification Number (EIN): Necessary for businesses, this form is used to apply for an EIN, a nine-digit tax identification number assigned by the IRS. It may be required if the agent under a Tax POA needs to handle business-related tax affairs.

- Form 8962, Premium Tax Credit: This form is used to reconcile or claim the premium tax credit, which helps eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplace. It can be relevant for agents managing healthcare-related tax benefits under a Tax POA.

Understanding and using these forms in conjunction with a Tax Power of Attorney can streamline the process of managing one's tax affairs through a designated agent. Each document serves a specific purpose, from granting various levels of authority to requesting tax records, thereby ensuring thorough and authorized handling of sensitive tax-related matters.

Similar forms

The Tax Power of Attorney (POA) form, such as the form 21-002-13, enables an individual to grant authority to another person or entity to handle their tax matters. This is notably comparable to a General Power of Attorney document, which also allows someone to appoint a representative to manage a broad array of financial and legal affairs on their behalf. The primary similarity lies in the fundamental concept of delegating authority to another party. However, the distinction arises in the scope, as the Tax POA is specifically tailored for tax-related issues, while the General Power of Attorney encompasses a wider range of authorities.

Similarly, a Healthcare Power of Attorney shares the principle of designation of authority found in the Tax POA. Through a Healthcare Power of Attorney, an individual appoints someone to make healthcare decisions on their behalf, should they become incapacitated. The essence of both documents is to entrust a representative with decision-making powers, albeit in distinctly different contexts; one focuses on tax matters, and the other on health care decisions.

Another related document is the Durable Power of Attorney. This type grants enduring powers to a designated agent to manage the principal’s affairs, and it remains effective even if the principal becomes mentally incapacitated. The parallel with the Tax POA lies in the provision of delegated authority, yet the Durable Power of Attorney differs as it continues to apply through the principal's incapacity, highlighting the importance of specifying powers and conditions in such legal documents.

The Limited Power of Attorney document also bears resemblance to the Tax POA by allowing the principal to confer specific authority to an agent for limited purposes. The main similarity is their specificity. However, unlike the Tax POA, which is exclusively focused on tax matters, a Limited Power of Attorney can be customized for various distinct tasks, ranging from selling a particular asset to managing certain types of transactions.

A Financial Power of Attorney is similarly aligned with the Tax POA in that it permits someone to act on the principal’s behalf in financial affairs. Both documents serve to delegate financial responsibilities, yet the Tax POA is specially designed for tax obligations, showcasing that while both forms involve financial decision-making, the scope and intentions behind the delegation can vary.

The Advanced Health Care Directive, also known as a living will, parallels the Tax POA in its forward-looking approach to planning. This document specifies an individual’s wishes regarding medical treatment in future situations where they might be unable to communicate their decisions. Both documents share the anticipation of future scenarios where direct personal management is not feasible, aiming to ensure the individual's preferences and affairs are handled according to their wishes.

Lastly, the Estate Planning Power of Attorney is akin to the Tax POA in its focus on the management of one’s affairs, specifically in the sphere of estate and asset management. It enables someone to manage the estate planning process on behalf of the principal. While the Tax POA primarily deals with tax-related matters, both documents underscore the importance of having trusted representatives manage critical aspects of one’s financial life.

Dos and Don'ts

Filling out the Tax Power of Attorney (POA) Form 21-002-13 is an important step for individuals wishing to grant others the authority to act on their behalf for tax matters. Below are essential dos and don'ts to help guide you through this process:

- Do carefully read the entire form before you start filling it out. Understanding all sections in advance can help prevent mistakes.

- Do ensure that the person you are appointing as your agent is trustworthy and understands their responsibilities. This individual will have significant access to your personal tax information and the authority to make decisions on your behalf.

- Do use black ink when filling out the form, as it is less likely to smudge and is easier to read, which helps in avoiding processing delays.

- Do include all required information such as your full name, tax identification number, and the specific tax matters and years for which the POA is granted.

- Do sign and date the form. An unsigned form is invalid and will be returned, causing delays.

- Don't leave any sections incomplete. If a section does not apply, make sure to write “N/A” (not applicable) rather than leaving it blank.

- Don't appoint an agent who has a history of tax non-compliance. The IRS or your state's taxation authority may reject the POA form if they have concerns about the agent's ability to comply with tax laws.

- Don't use correction fluid or tape; instead, if you make a mistake, start over with a new form. Amendments made with correction fluid or tape can lead to questions about the authenticity of the form.

- Don't forget to keep a copy of the completed form for your records. Having your own copy is important for reference and in case any disputes arise regarding the POA.

Misconceptions

When dealing with the Tax Power of Attorney (POA) Form 21-002-13, individuals often come across misconceptions. Understanding these can streamline the process and help in accurately completing the form.

It's only for businesses: A common misunderstanding is that Form 21-002-13 is exclusively for corporate or business use. In truth, this form is utilized by individuals, such as taxpayers wishing to grant another party the authority to handle their tax matters.

Any tax professional can be assigned: While it might seem that any tax advisor can be designated as your representative, the fact is only those holding specific credentials, like CPAs or attorneys, are authorized to act on your behalf under this form.

It grants unlimited financial authority: Some assume this form provides the representative with broad financial powers beyond tax matters. However, it strictly limits authority to tax issues, and does not extend to other financial transactions or decisions.

It's valid indefinitely: Another misconception is that once completed, the form remains effective indefinitely. The form actually has an expiration date or becomes invalid once specific conditions, as mentioned in the form, are met.

It's complicated to revoke: Many believe that revoking the POA is a complex process. Revocation is quite straightforward and can be done by the taxpayer by notifying the relevant tax authorities and providing a written revocation.

Filing electronically is not allowed: There is a false belief that Form 21-002-13 cannot be submitted electronically. The truth is, both electronic and paper filings are acceptable, depending on the specific procedures of the tax authority.

A physical signature is always required: In today’s digital age, this form does not always need a hand-written signature. Depending on the jurisdiction and the specific requirements of the tax authority, electronic signatures are often considered valid.

Understanding these misconceptions helps in avoiding common pitfalls and ensures that the process of assigning a tax POA is completed effectively and accurately.

Key takeaways

Filling out the Tax Power of Attorney (POA) form, designated as form 21-002-13, is a significant step in granting someone the authority to handle your tax matters. Understanding the nuances of this process ensures that it is conducted smoothly and effectively. Here are six key takeaways to consider when you are preparing to use this form:

- Know the designated parties: The form requires clearly identifying two main parties: the principal, who is the individual granting authority, and the agent or attorney-in-fact, who will receive the authority to act on the principal's behalf concerning tax matters.

- Be specific about granted powers: The form allows the principal to specify the extent of powers being granted to the agent. These can range from filing taxes to representing the principal in tax disputes. Being specific helps in avoiding misunderstandings and ensures that the agent knows the extent of their responsibilities.

- Understand the duration: It's crucial to note that the POA form has a duration clause. This means the principal must state when the agent's power begins and when it will end. If no termination date is specified, the powers remain in effect until revoked or modified.

- Notarization may be required: Depending on the jurisdiction, submitting a notarized form may be necessary to validate the POA. It's important to check the specific requirements of your state or locality to ensure the form is legally binding.

- Keep records: Once completed, it's advisable for both the principal and the agent to keep copies of the POA form. Having records readily available can help address any questions or issues that may arise with tax authorities.

- Revocation process: If the principal decides to revoke the powers granted, it must be done formally through a written notice. Understanding the process for revocation ensures that the principal can efficiently withdraw powers if the situation necessitates.

By adhering to these guidelines, individuals can ensure they are properly prepared to fill out and use the Tax POA form 21-002-13, enabling them to confidently delegate their tax-related tasks.

Popular PDF Documents

Efile Tax Return - Allows you to designate a trusted individual or professional to access your tax information when necessary.

What Is a Transfer Tax - It elucidates the process for adjusting estimated taxes and how these funds are applied post-transaction closure.

IRS 1040-NR - Filing the 1040-NR is a requirement for nonresidents with U.S. income exceeding certain thresholds, as mandated by tax laws.