Get Tax POA form 20a100 Form

Managing taxes can often feel overwhelming, especially when it comes to navigating the various forms required by the IRS and state tax authorities. One such form, the Tax Power of Attorney (POA) Form 20A100, plays a pivotal role for individuals and businesses seeking to delegate authority for managing their tax matters. This crucial document allows a taxpayer to authorize a trusted individual, such as a family member, accountant, or tax advisor, to handle tax affairs on their behalf. It spans everything from filing returns to communicating directly with tax agencies. Understanding the scope, requirements, and implications of the Tax POA Form 20A100 is essential for anyone looking to ensure their tax-related matters are handled efficiently and in accordance with their wishes. With the right preparation and knowledge, completing and submitting this form can be a smooth and worry-free process.

Tax POA form 20a100 Example

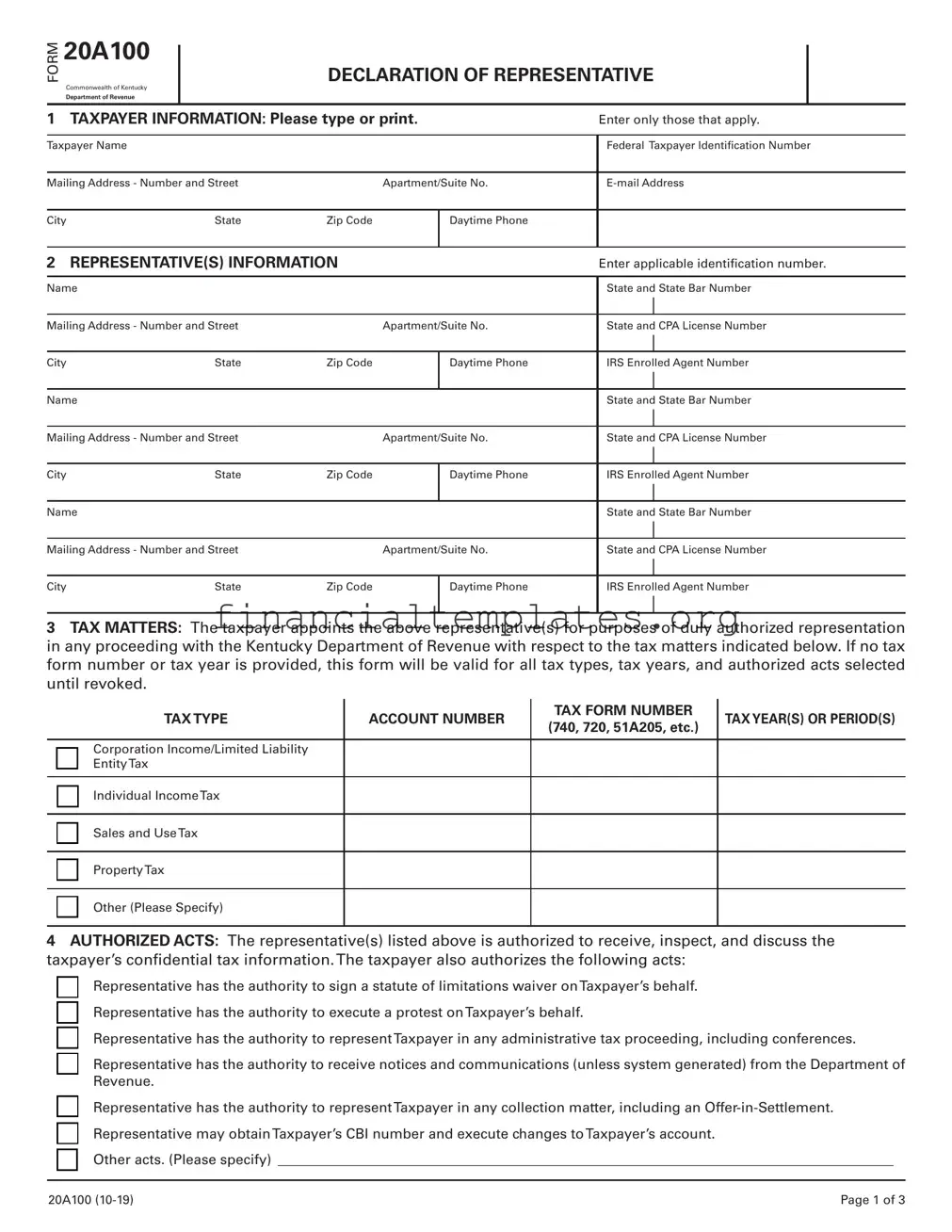

20A100

DECLARATION OF REPRESENTATIVE

Commonwealth of Kentucky

Department of Revenue

1 TAXPAYER INFORMATION: Please type or print. |

|

Enter only those that apply. |

||||

|

|

|

|

|

|

|

Taxpayer Name |

|

|

|

Federal Taxpayer Identifcation Number |

||

|

|

|

|

|

||

Mailing Address - Number and Street |

|

Apartment/Suite No. |

||||

|

|

|

|

|

|

|

City |

State |

Zip Code |

IDaytime Phone |

|

|

|

2 |

REPRESENTATIVE(S) INFORMATION |

|

|

Enter applicable identifcation number. |

||

|

|

|

|

|

|

|

Name |

|

|

|

State and State Bar Number |

||

|

|

|

|

|

|

I |

Mailing Address - Number and Street |

|

Apartment/Suite No. |

State and CPA License Number |

|||

|

|

|

|

|

|

I |

City |

State |

Zip Code |

I |

Daytime Phone |

I |

|

|

IRS Enrolled Agent Number |

|||||

|

|

|

|

|

|

|

Name |

|

|

|

State and State Bar Number |

||

|

|

|

|

|

|

I |

Mailing Address - Number and Street |

|

Apartment/Suite No. |

State and CPA License Number |

|||

|

|

|

|

|

|

I |

City |

State |

Zip Code |

I |

Daytime Phone |

I |

|

|

IRS Enrolled Agent Number |

|||||

|

|

|

|

|

|

|

Name |

|

|

|

State and State Bar Number |

||

|

|

|

|

|

|

I |

Mailing Address - Number and Street |

|

Apartment/Suite No. |

State and CPA License Number |

|||

|

|

|

|

|

|

I |

City |

State |

Zip Code |

I |

Daytime Phone |

I |

|

|

IRS Enrolled Agent Number |

|||||

|

|

|

|

|

|

|

3TAX MATTERS: The taxpayer appoints the above representative(s) for purposes of duly authorized representation in any proceeding with the Kentucky Department of Revenue with respect to the tax matters indicated below. If no tax form number or tax year is provided, this form will be valid for all tax types, tax years, and authorized acts selected until revoked.

TAX TYPE |

ACCOUNT NUMBER |

TAX FORM NUMBER |

TAX YEAR(S) OR PERIOD(S) |

|

(740, 720, 51A205, etc.) |

||||

|

|

|

Corporation Income/Limited Liability

¨EntityTax

¨Individual IncomeTax

¨Sales and UseTax

¨PropertyTax

¨Other (Please Specify)

4AUTHORIZED ACTS: The representative(s) listed above is authorized to receive, inspect, and discuss the taxpayer’s confdential tax information.The taxpayer also authorizes the following acts:

¨Representative has the authority to sign a statute of limitations waiver onTaxpayer’s behalf.

¨Representative has the authority to execute a protest onTaxpayer’s behalf.

¨Representative has the authority to representTaxpayer in any administrative tax proceeding, including conferences.

¨Representative has the authority to receive notices and communications (unless system generated) from the Department of Revenue.

¨Representative has the authority to representTaxpayer in any collection matter, including an

¨Representative may obtainTaxpayer’s CBI number and execute changes toTaxpayer’s account.

¨Other acts. (Please specify) ________________________________________________________________________________________

20A100 |

Page 1 of 3 |

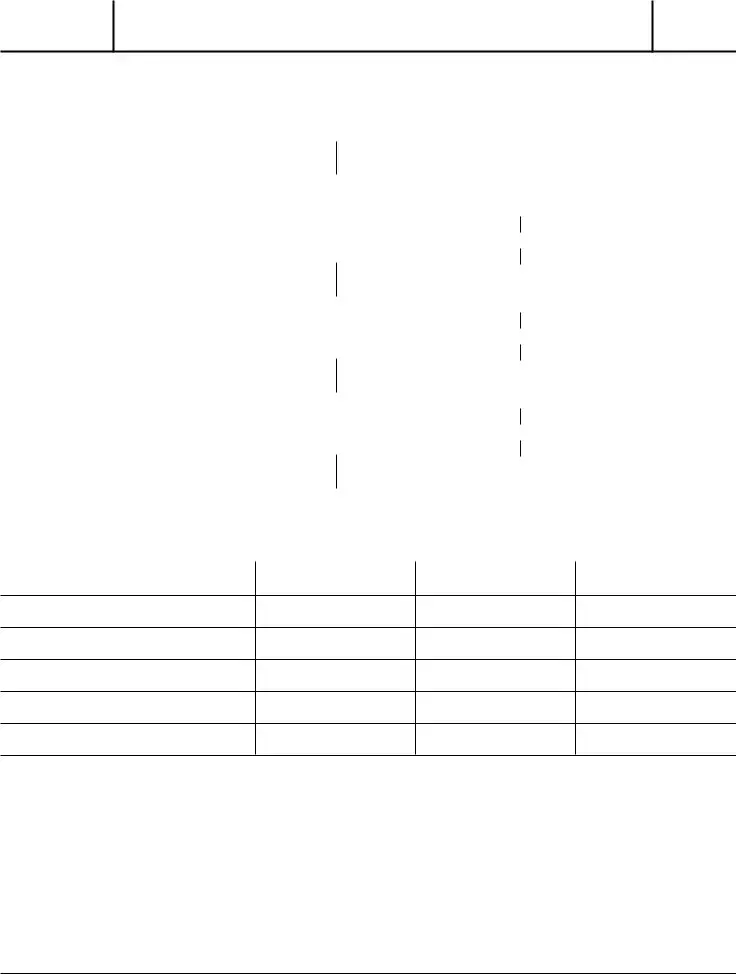

FORM 20A100

DECLARATION OF REPRESENTATIVE

Page 2 of 3

5CONSOLIDATED OR UNITARY COMBINED RETURN FILERS: If the taxpayer fles a consolidated or unitary combined tax return per KRS 141.200(11) and/or KRS 141.201(3)(a), the authorized acts will be extended to the subsidiaries included in the return. If any subsidiaries are to be excluded from the authorized acts, list below.

NAME

FEDERAL IDENTIFICATION

NUMBER

TAX YEARS

6 RETENTION/REVOCATION OF PRIOR POWER(S) OF ATTORNEY OR REPRESENTATIVE AUTHORIZATION(S)

The fling of this authorization form automatically revokes any prior power(s) of attorney or representative authorization(s) on fle with the Department of Revenue for the same matter(s) and year(s) or period(s) covered by this document. If you do not want to revoke any prior power(s) of attorney or representative authorization(s), you must attach a copy of any power(s) of attorney or

representative authorization(s) you wish to remain in effect for the same matter(s) and year(s) or period(s) covered.

7SIGNATURE OFTAXPAYER. If a tax matter concerns a year in which a joint return was fled, each spouse must fle a separate representative authorization even if they are appointing the same representative(s). If signed by a corporate offcer, partner, guardian, tax matters partner, executor, receiver, administrator, or trustee on behalf of the taxpayer, I certify that I have the legal authority to execute this form on behalf of the taxpayer.

NOT VALID UNLESS COMPLETED, SIGNED, AND DATED BY THE TAXPAYER.

Signature |

Date Signed |

|

|

|

|

Print Name |

Title (if applicable) |

|

8 SIGNATURE OF REPRESENTATIVE(S)

Under penalties of perjury, by my signature below I declare that:

•I am not currently suspended or disbarred from practice, or ineligible for practice;

•I am subject to regulations contained in Circular 230 (31 CFR, Subtitle A, Part 10) as amended, governing practice before the Internal Revenue Service;

•I am authorized to represent the taxpayer for the matter(s) specifed; and

NOT VALID UNLESS COMPLETED, SIGNED, AND DATED BY THE REPRESENTATIVE(S).

Signature |

Date Signed |

|

|

|

|

Printed Name |

PTIN (if applicable) |

|

|

|

|

Signature |

Date Signed |

|

|

|

|

Printed Name |

PTIN (if applicable) |

|

|

|

|

Signature |

Date Signed |

|

Printed Name |

PTIN (if applicable) |

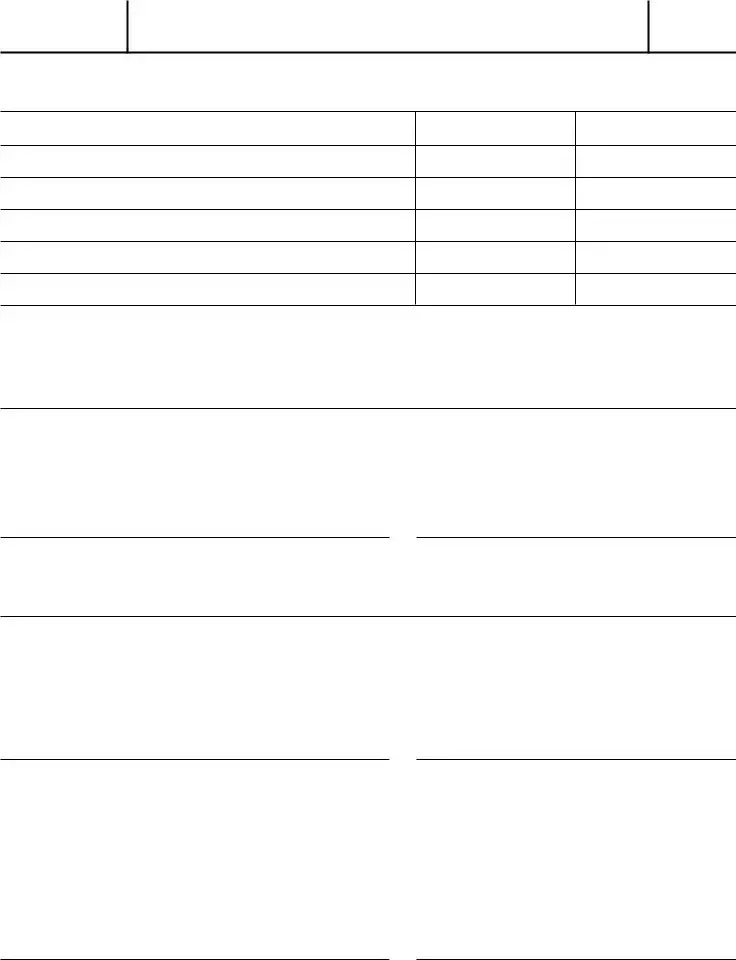

FORM 20A100

Instructions for Form 20A100

Page 3 of 3

Purpose of Form 20A100

Use the Declaration of Representative (Form 20A100) to authorize the individual(s) to represent you before the Kentucky Department of Revenue. You may grant the individual(s) authorization to act on your behalf with regard to any tax administered by the Kentucky Department of Revenue. Form 20A100 is provided for the taxpayer’s convenience. One form may be submitted to designate all tax types the Department is authorized to communicate with the authorized representative(s). You may revoke this form at any time.

1Taxpayer

Name and

Daytime

Federal Taxpayer Identifcation

2Representative Information

Enter up to three individuals authorized to represent you and act on your behalf before the Department about the tax matters and authorized acts specifed on this form. Provide the name, address, and telephone number of the authorized representative(s). If the authorized representative is an attorney, certifed public accountant (CPA), or enrolled agent, provide the appropriate identifcation number.

3Tax Matters

Select the tax types the authorized representative(s) may act on your behalf with the Department. Provide the account number for all tax types selected. If authorization is being granted for specifc forms and tax periods, list the tax forms and tax periods. If tax forms and tax periods are left blank, this form will be valid for all tax types, tax periods, and authorized acts selected until revoked.

4Authorized Acts

This form allows the authorized representative(s) to communicate and receive confdential tax information. You may also select other acts the authorized representative(s) may perform on your behalf. If an act is not listed, select “Other” and specify.

Note: This form does not allow the authorized representative to sign tax returns or settlement agreements on your behalf.

5Consolidated or Unitary Combined Return Filers

If a consolidated or unitary combined tax return has been fled, list any subsidiary(ies) to be excluded from this authorization. The Department will not discuss or provide confdential tax information to the authorized representative(s) for any subsidiary listed. If no subsidiaries are listed, this form will extend to all corporations in a consolidated or unitary combined tax return.

6Retention/Revocation

Filing this form will automatically revoke any prior power of attorney or authorization letter submitted to the Department for the tax matters included on this form. If you do not want to revoke a prior power of attorney or authorization letter, a copy MUST be attached to this form to remain in effect.

7Signature of Taxpayer

This form must be signed and dated by the taxpayer to be valid. If the taxpayer is a business entity, it must be signed by an individual with the authority to delegate a representative on behalf of the taxpayer. If not signed and dated, the Department will not communicate with or provide confdential tax information to the authorized representative(s) included on this form.

8Signature of the Authorized Representative(s)

This form must be signed and dated by the authorized representative(s) to be valid. If not signed and dated, the Department will not communicate with or provide confdential tax information to the authorized representative(s) included on this form.

Mail this form to the following address:

Kentucky Department of Revenue

P. O. Box 181, Station 56

Frankfort, Kentucky

Document Specifics

| Fact Number | Detail |

|---|---|

| 1 | The Tax POA form 20A100 is a legal document. |

| 2 | It is used to grant authority to another person to handle tax matters. |

| 3 | This form is specific to certain state tax matters. |

| 4 | The person granting authority is referred to as the principal. |

| 5 | The authorized person is called the agent or attorney-in-fact. |

| 6 | It allows the agent to receive confidential tax information. |

| 7 | The agent can also represent the principal in tax affairs. |

| 8 | The form's validity and powers are subject to the governing state laws. |

| 9 | Completion and submission requirements may vary by state. |

| 10 | Revocation of the form must be done in writing by the principal. |

Guide to Writing Tax POA form 20a100

When stepping into the realm of managing or assisting with someone's tax matters, the Tax Power of Attorney (POA) form 20a100 is a pivotal document. This form grants the authority to an individual or entity to act on another's behalf in matters related to taxes. Completing this form accurately is crucial for ensuring that the designated party can effectively handle tax affairs without any unnecessary hiccups. The following steps are designed to guide through the process of filling out the form, ensuring clarity and precision at each turn.

- Gather all necessary information before starting. This includes the taxpayer's full name, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), and contact information, as well as the same information for the representative(s).

- Enter the taxpayer's name and identification number at the top of the form. Be sure to use the name that appears on the tax returns.

- Fill in the representative's section with the name(s), mailing address(es), and telephone number(s) of the individual(s) being granted POA. If there are multiple representatives, indicate whether they can act independently by checking the appropriate box.

- Specify the tax matters for which authority is being granted. This includes detailing the type(s) of tax, the federal tax form number(s), the year(s) or period(s), and any specific matters, if applicable.

- Indicate the acts authorized for the representative. This section outlines what the representative is permitted to do on the taxpayer's behalf, such as receiving confidential tax information or signing agreements.

- State any specific additions or restrictions to the representative's authority. If there are certain actions the taxpayer does not want the representative to perform, they should be listed in this section.

- Review the form for accuracy and completeness. Double-check every section to ensure that all the required information is provided and correct.

- Sign and date the form. The taxpayer must sign and date the form, verifying that the information is accurate and that they are authorizing the representative(s) named in the document.

- Have the representative(s) sign the form, if required. Depending on the jurisdiction, representatives may also need to sign the form to acknowledge their acceptance of the POA.

- Submit the form to the appropriate tax authority. The submission instructions vary by state and jurisdiction, so it is essential to follow the specific guidelines provided for the form 20a100.

After completing and submitting the Tax POA form 20a100, it's important to keep a copy for your records. The designated representative(s) can now officially undertake tax-related tasks on behalf of the taxpayer. It's crucial for the taxpayer and the representative(s) to communicate effectively and ensure all actions taken are in the taxpayer's best interest. From this point, managing tax matters should proceed more smoothly with the proper authorizations in place.

Understanding Tax POA form 20a100

-

What is the Tax POA form 20a100?

The Tax Power of Attorney (POA) form 20a100 is a document that allows individuals to designate someone else, often a tax professional, to make tax-related decisions and handle tax matters on their behalf with the tax authority. This form grants specified powers relating to tax filings, negotiations, and decisions.

-

Who can be designated as a representative on the form 20a100?

Individuals can designate a certified tax professional, such as a Certified Public Accountant (CPA), a tax attorney, or an enrolled agent, as their representative on the form 20a100. The designated representative should have the knowledge and expertise to handle tax matters competently.

-

When should I use the Tax POA form 20a100?

The Tax POA form 20a100 should be used when you want to authorize someone else to handle your tax affairs. This is especially useful in situations where you are unable to manage your taxes due to health issues, absence, or lack of expertise in tax matters.

-

How do I fill out the Tax POA form 20a100?

When filling out the Tax POA form 20a100, you must include your personal information, the details of the designated representative, and specify the tax matters and tax periods for which the power is granted. It is crucial to read and follow the instructions carefully to ensure that the form is completed correctly.

-

Is there a filing fee for the Tax POA form 20a100?

Typically, there is no filing fee for submitting a Tax Power of Attorney form to a tax authority. However, it is advisable to consult with the specific tax authority or a tax professional to confirm any associated costs.

-

How long is the Tax POA form 20a100 valid?

The period of validity for the Tax POA form 20a100 can vary based on the specifications within the form and applicable state laws. Some forms allow the principal to set a specific expiration date; others remain in effect until revoked. Be sure to state your preferred validity period clearly on the form.

-

Can the Tax POA form 20a100 be revoked?

Yes, the Tax POA form 20a100 can be revoked at any time by the individual who granted the power. Revocation typically requires a written notice to the tax authority and may also require informing the representative in a prescribed manner.

-

What happens if the designated representative misuses their power?

If a designated representative misuses their power, it can result in financial loss or legal complications. It is essential to choose a representative you trust and to revoke the POA immediately if misuse is suspected. Legal actions can also be taken against the representative for any wrongdoing.

-

Do I still need to file taxes if I have a representative on form 20a100?

Yes, having a representative on form 20a100 does not exempt you from your tax obligations. The representative can assist with the preparation and filing of taxes, but the legal responsibility for accurate and timely filing remains with the individual.

-

Where can I find more information on the Tax POA form 20a100?

For more information on the Tax Power of Attorney form 20a100, it is recommended to visit the official website of your tax authority or contact a certified tax professional. They can provide guidance specific to your situation and help you navigate the responsibilities and benefits of assigning a power of attorney for your tax matters.

Common mistakes

Filling out tax forms can sometimes feel like navigating through a maze. Among these forms, the Tax Power of Attorney (POA), form 20a100, stands out as particularly important. It grants someone else the authority to handle your tax matters, which can be critical in situations where you might not be able to manage them yourself. However, it’s easy to stumble on some common pitfalls during this process. Here’s a look at five mistakes people often make on the Tax POA form 20a100.

Not checking the correct boxes: With multiple options to specify the extent of powers being granted, it's crucial to carefully select the correct authority you wish to assign. Overlooking or mischecking boxes can lead to unintentional restrictions or too broad powers granted to the agent.

Failing to provide detailed information about the authorized individual: The form requires specific details about the person being granted POA, including full name, address, and telephone number. Omitting this information or providing incomplete details can invalidate the form.

Mistakes in specifying the tax matters and periods covered: The form allows the principal to grant authority for specific tax types and periods. A common mistake is not being clear or specific enough about the tax matters and time frames, which can cause confusion and limit the agent's ability to act effectively.

Skipping the signature and date: Like most legal documents, the Tax POA requires signatures from both the principal and the agent. Forgetting these signatures or failing to date the form accurately can render the document invalid. This oversight is surprisingly common and easily avoidable.

Not updating the form when circumstances change: Life changes such as marriage, divorce, moving to a different state, or changes in tax laws can affect the relevance and accuracy of the POA. Failing to update the POA to reflect these changes can lead to complications and confusion during tax matters handling.

Avoiding these five mistakes will help ensure that your Tax POA form 20a100 accurately reflects your intentions and stands up to legal scrutiny. When in doubt, seeking advice from a tax professional or attorney can help clarify matters and ensure the form is filled out correctly.

Documents used along the form

When managing taxes, particularly in more complex or business-related matters, the Tax Power of Attorney (POA) Form 20A100 is often just one piece of the puzzle. Several other forms and documents typically complement this form to ensure thorough handling of tax affairs. These additional forms play critical roles in facilitating communication with tax authorities, organizing financial information, and ensuring compliance with tax laws.

- Form 1040: This is the U.S. Individual Income Tax Return form. It's the standard form used by individuals to file their annual income tax returns. It provides the IRS with information about the filer's income, tax deductions, and credits.

- Form W-9: Request for Taxpayer Identification Number and Certification. This form is used to provide the correct taxpayer identification number (TIN) to the person who is required to file an information return with the IRS. It's often used in business transactions and for independent contractors.

- Form 8821: Tax Information Authorization. This allows a third party to review and receive confidential tax information but not to represent you before the IRS. It's often used alongside the Tax POA when someone needs access to your tax records for financial planning or compliance reviews.

- Schedule C: Profit or Loss from Business (Sole Proprietorship). Used by sole proprietors to report their business income and expenses. It's crucial for accurately calculating the tax owed on business profits.

- Form 4506-T: Request for Transcript of Tax Return. This form allows individuals and businesses to request a transcript of their tax returns. This can be necessary for loan applications, legal matters, or after filing the Tax POA to ensure that the represented party's tax information is accurate and up to date.

- Form 2848: Power of Attorney and Declaration of Representative. This authorizes an individual, such as an accountant or attorney, to represent you before the IRS. This form provides broader representation rights than Form 20A100 and is essential in cases involving audits, appeals, or collections.

Together, these forms and documents create a comprehensive framework for managing and delegating tax-related responsibilities. Whether for individual or business purposes, their use in conjunction with the Tax POA Form 20A100 ensures that one's tax matters are handled accurately, compliantly, and efficiently.

Similar forms

The Tax Power of Attorney (POA) form, known in some jurisdictions as form 20a100, serves as a legal document authorizing someone else to manage your tax matters. A similar document is the General Power of Attorney form. This document extends broader authorization, allowing the appointed person to handle a wide range of affairs beyond taxes, including financial and legal decisions. Both documents involve appointing an agent to act on one's behalf, but the General Power of Attorney covers a more extensive array of responsibilities.

Another document related to the Tax POA is the Healthcare Power of Attorney. While it diverges in focus—concentrating on healthcare decisions rather than financial matters—it similarly involves appointing an individual to make important decisions on someone else's behalf. The fundamental similarity is the trust placed in another person to make critical choices in scenarios where the principal cannot do so themselves.

The Durable Power of Attorney (DPOA) is closely related to the Tax POA. The key distinction is its durability; it remains in effect even if the principal becomes mentally incapacitated. While a Tax POA is specifically for tax-related issues, a DPOA can encompass tax matters among other things, depending on how it is written, making it a versatile tool in estate planning and beyond.

The Limited Power of Attorney is another related document, offering a more narrowed authorization compared to the Tax POA. It grants the agent power to act in specific situations or for particular tasks, which can include, but is not limited to, tax matters. This precision in scope provides a tailored approach to delegating authority.

The IRS Form 2848, Power of Attorney and Declaration of Representative, is a federal document specifically designed for tax purposes, much like the Tax POA form. It authorizes individuals, such as accountants or attorneys, to represent others before the IRS, handling their tax affairs. Both serve the purpose of enabling representation in tax matters, although the IRS form is recognized at a federal level.

A Revocation of Power of Attorney is a document that, as its name suggests, revokes the powers granted in any Power of Attorney form, including a Tax POA. This document is crucial for situations where the individual no longer needs or trusts the appointed agent to handle their affairs. It showcases the fluidity and control individuals have over their authorized representations.

The Business Power of Attorney is a vital document for entrepreneurs and business owners, permitting agents to make business-related decisions. Similar to a Tax POA, which allows handling of tax matters, this document empowers an agent to oversee various business affairs. The principal difference lies in the focus on business operations rather than personal tax issues.

The Declaration of Financial Hardship is a form used to demonstrate an individual's financial difficulties, often to request tax relief or installment plans from tax authorities. While not a Power of Attorney, it shares the context of tax matters, enabling individuals to manage and negotiate their tax liabilities based on their financial situation. It reflects the breadth of documents that assist in navigating tax responsibilities.

Lastly, the Estate Tax Planning form is intricately linked to tax affairs, focusing on the strategic planning to minimize estate taxes upon an individual's death. Though primarily used for estate planning rather than immediate tax representation, it ties into the broader theme of managing one's financial legacy, including tax implications. Like the Tax POA, it plays a pivotal role in a well-rounded tax and estate strategy.

Dos and Don'ts

Filling out Form 20A100, the Tax Power of Attorney (POA), is a critical step in managing one’s tax affairs, allowing a designated representative to act on one’s behalf with tax authorities. To navigate this process effectively, it is crucial to understand the best practices and common pitfalls. Here’s a guide on what you should and shouldn’t do when completing this form.

Do's:Ensure all information is accurate and complete. From personal identification details to the type of tax and tax periods covered, correctness is key to avoiding processing delays or denials.

Clearly identify the designated representative. Provide their full name, address, and contact information to ensure clear communication channels with the tax authorities.

Specify the extent of authority granted. Detail the powers you are transferring, such as the right to receive confidential tax information or make decisions on your behalf.

Sign and date the form. An unsigned or undated form is invalid. If you’re filing jointly, both parties must sign.

Keep a copy for your records. After submitting the form to the tax authority, retaining a copy helps you manage your tax affairs more effectively and serves as evidence of the POA’s existence.

Do not leave fields blank. If a section does not apply to your situation, mark it as “N/A” instead of leaving it empty to avoid the appearance of an incomplete form.

Avoid using outdated or incorrect forms. Tax laws and forms are subject to change. Always verify that you are using the most current version of Form 20A100.

Do not forget to specify a termination date. Without one, the POA might remain in effect longer than you intend, potentially leading to issues down the line.

Refrain from appointing a representative without proper credentials. Ensure your designee is qualified and, if necessary, licensed to act on your behalf in tax matters.

Do not neglect to notify the tax authority of any changes. If the POA is revoked or your representative’s information changes, inform the authorities promptly to prevent unauthorized actions.

Executing Form 20A100 with attention to these do's and don'ts ensures that your tax matters are handled according to your wishes, safeguarding your financial interests and ensuring compliance with tax regulations.

Misconceptions

When it comes to understanding tax forms, it's easy to get tripped up by misinformation or misconceptions, especially with forms like the Tax Power of Attorney (POA), commonly referred to as form 20a100. Let's clear up some of the confusion with a straightforward look at common misunderstandings:

- It's too complicated for non-professionals to fill out: Many people believe that you need a tax professional or an accountant to accurately complete form 20a100. However, with the right information and a careful read-through, many individuals are capable of filling it out on their own. It's more about understanding the specifics of your tax situation than navigating complex tax jargon.

- Form 20a100 gives unlimited power over your finances: This misconception can cause unnecessary worry. In reality, the scope of authority granted by form 20a100 can be customized. The form allows you to specify exactly which tax years and types of taxes your representative can deal with on your behalf. It's about giving someone you trust the ability to handle specific tax issues, not an all-access pass to your entire financial life.

- Once submitted, it can't be revoked: Some are under the impression that once you've given someone power of attorney through form 20a100, the decision is final. This isn't the case. You have the ability to revoke it at any time should your circumstances or your relationship with your representative change.

- Any tax professional can be your POA: While it's true that many tax professionals can serve as your power of attorney, it's important to choose someone who is authorized to practice in front of the IRS and who understands your financial situation well. This choice matters, as the IRS has specific requirements about who can fulfil this role.

- It's only for individuals with complex tax issues: This form isn't just for those navigating complicated tax landscapes. Sometimes, it's simply about convenience or needing someone to act on your behalf because you're unable to do so yourself. Whether you're out of the country during tax season or you want someone with more expertise to handle a straightforward issue, form 20a100 can be a practical tool for many taxpayers.

Key takeaways

The Tax Power of Attorney (POA) Form 20a100 is an important document for individuals who want to authorize someone else to handle their tax matters. Here are key takeaways for filling out and using this form:

- Understand the Purpose: The form allows you to appoint an individual or organization to represent you before the tax authority. This can include making decisions and acting on your behalf in regards to your taxes.

- Choose the Right Representative: It's crucial to select someone who is knowledgeable and trustworthy, as they will have access to sensitive personal and financial information and the authority to make decisions regarding your taxes.

- Be Specific About the Power Granted: The form allows you to specify the extent of power you are granting, including which tax matters and periods are covered. Make sure these details are clearly mentioned to avoid any confusion later.

- Complete All Required Sections: Ensure that all parts of the form are filled out completely and accurately. Missing information can delay the process or result in the rejection of the form.

- Sign and Date the Form: Your signature and the date are required to validate the form. Depending on your jurisdiction, you may also need a witness or notarization.

- Keep a Copy for Your Records: After submitting the form to the necessary tax authority, keep a copy for yourself. This will help you keep track of who has been authorized to represent you and what powers they have.

- Revoke When Necessary: If you no longer want the representative to have power over your tax matters, you must fill out a revocation form to cancel the Power of Attorney. It's important to officially revoke the power to ensure your privacy and security.

Popular PDF Documents

Arizona Tpt - It includes a chart to assist businesses in identifying the proper tax rate and allowable deduction codes for their activities.

Lgl-001 - The form acts as a bridge of trust between the taxpayer and their representative, solidifying a professional relationship centered on financial stewardship and integrity.