Get Tax POA form 01-137 Form

Many individuals and businesses find themselves in need of professional assistance when dealing with tax matters. This is where the Tax Power of Attorney (POA) Form 01-137 comes into play. It serves as a vital tool, empowering a representative to handle tax affairs on behalf of someone else. This could mean anything from filing taxes to communicating with tax authorities. The form is specifically designed to simplify the process of granting this authority, ensuring that tax issues can be managed efficiently and effectively. It outlines the specific powers being granted, the duration of these powers, and any conditions or limitations. Understanding the form's features, how to properly complete it, and its legal implications is crucial for anyone considering its use. This process not only helps in maintaining compliance with tax laws but also provides peace of mind during what can often be a stressful time.

Tax POA form 01-137 Example

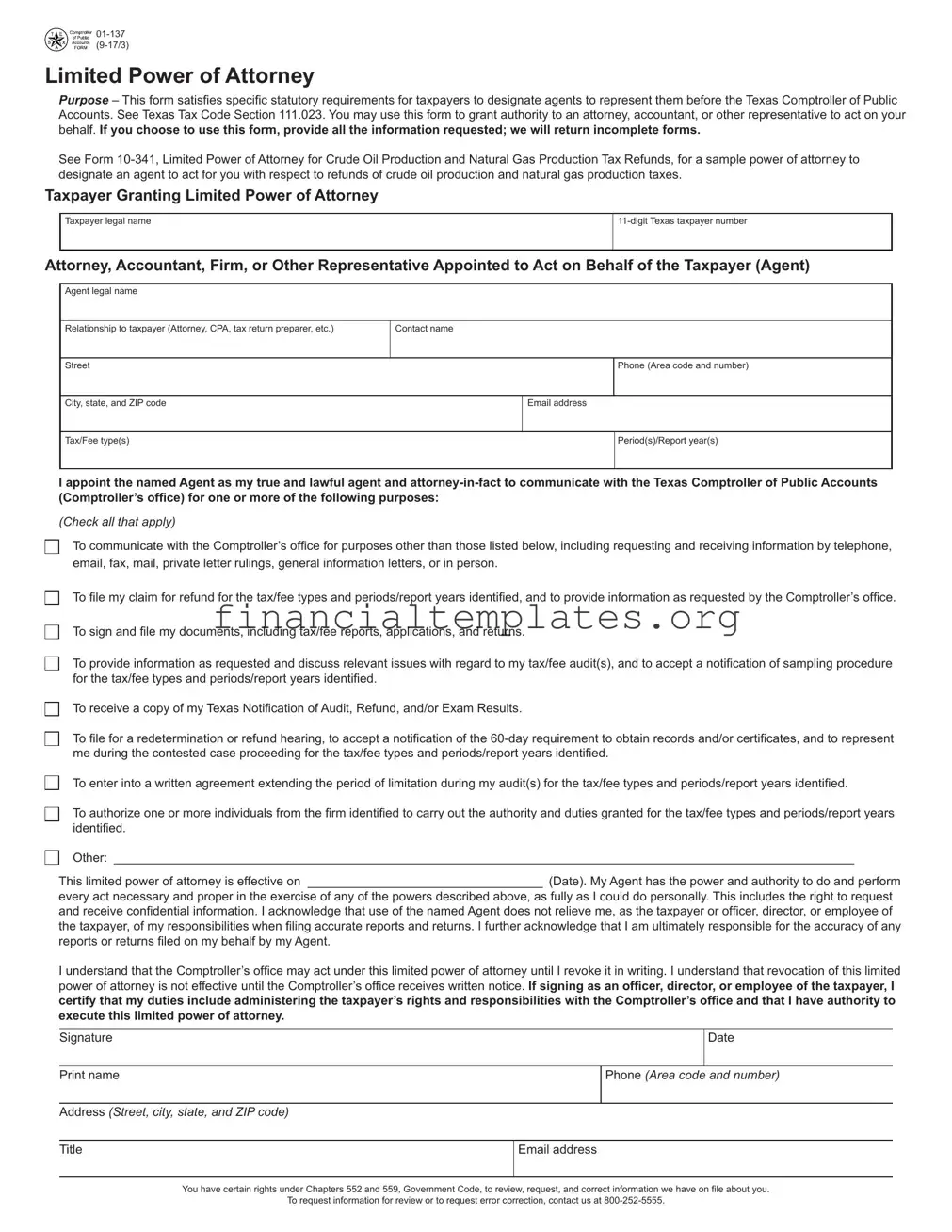

Limited Power of Attorney

Purpose – This form satisfies specific statutory requirements for taxpayers to designate agents to represent them before the Texas Comptroller of Public Accounts. See Texas Tax Code Section 111.023. You may use this form to grant authority to an attorney, accountant, or other representative to act on your behalf. If you choose to use this form, provide all the information requested; we will return incomplete forms.

See Form

Taxpayer Granting Limited Power of Attorney

Taxpayer legal name

Attorney, Accountant, Firm, or Other Representative Appointed to Act on Behalf of the Taxpayer (Agent)

Agent legal name

Relationship to taxpayer (Attorney, CPA, tax return preparer, etc.) |

Contact name |

|

|

I |

|

Street |

lPhone (Area code and number) |

|

City, state, and ZIP code |

Email address |

|

|

I |

|

Tax/Fee type(s) |

|

Period(s)/Report year(s) |

|

|

I |

I appoint the named Agent as my true and lawful agent and

(Check all that apply)

□

□

□

To communicate with the Comptroller’s office for purposes other than those listed below, including requesting and receiving information by telephone, email, fax, mail, private letter rulings, general information letters, or in person.

To file my claim for refund for the tax/fee types and periods/report years identified, and to provide information as requested by the Comptroller’s office.

To sign and file my documents, including tax/fee reports, applications, and returns.

□ |

To provide information as requested and discuss relevant issues with regard to my tax/fee audit(s), and to accept a notification of sampling procedure |

|

for the tax/fee types and periods/report years identified. |

□ To receive a copy of my Texas Notification of Audit, Refund, and/or Exam Results. |

|

□ |

To file for a redetermination or refund hearing, to accept a notification of the |

|

me during the contested case proceeding for the tax/fee types and periods/report years identified. |

□ To enter into a written agreement extending the period of limitation during my audit(s) for the tax/fee types and periods/report years identified. |

|

□ |

To authorize one or more individuals from the firm identified to carry out the authority and duties granted for the tax/fee types and periods/report years |

|

identified. |

□

Other: ___________________________________________________________________________________________________________

Other: ___________________________________________________________________________________________________________

This limited power of attorney is effective on __________________________________ (Date). My Agent has the power and authority to do and perform

every act necessary and proper in the exercise of any of the powers described above, as fully as I could do personally. This includes the right to request and receive confidential information. I acknowledge that use of the named Agent does not relieve me, as the taxpayer or officer, director, or employee of the taxpayer, of my responsibilities when filing accurate reports and returns. I further acknowledge that I am ultimately responsible for the accuracy of any reports or returns filed on my behalf by my Agent.

I understand that the Comptroller’s office may act under this limited power of attorney until I revoke it in writing. I understand that revocation of this limited power of attorney is not effective until the Comptroller’s office receives written notice. If signing as an officer, director, or employee of the taxpayer, I certify that my duties include administering the taxpayer’s rights and responsibilities with the Comptroller’s office and that I have authority to execute this limited power of attorney.

Signature

Date

Print name

Phone (Area code and number)

Address (Street, city, state, and ZIP code)

Title

Email address

You have certain rights under Chapters 552 and 559, Government Code, to review, request, and correct information we have on file about you.

To request information for review or to request error correction, contact us at

Document Specifics

| Fact Number | Description |

|---|---|

| 1 | The Tax Power of Attorney Form 01-137 is a document that grants authority to an individual or entity to act on behalf of another in tax matters relating to the state of Texas. |

| 2 | This form is specifically designed for use within the State of Texas and falls under the jurisdiction and governance of Texas state laws. |

| 3 | The individual granting the authority is known as the principal, while the recipient of the authority is referred to as the agent or attorney-in-fact. |

| 4 | Form 01-137 enables the agent to perform tasks such as filing taxes, obtaining confidential tax information, and representing the principal in tax matters before the Texas Comptroller of Public Accounts. |

| 5 | It is a legally binding document once properly executed, requiring signatures from both the principal and the agent. |

| 6 | Execution of the form does not relieve the principal of their tax obligations; the principal remains responsible for taxes, penalties, and interest due. |

| 7 | To be valid, the form must clearly identify the powers granted to the agent, including specific tax matters and years covered. |

| 8 | Revocation of the power of attorney (POA) must be done in writing by the principal if they wish to cancel the authorization before its expiration. |

| 9 | The form generally does not have an expiration date unless one is specifically stated; therefore, it remains in effect until revoked or the specified expiration date occurs. |

| 10 | For accurate completion and submission, the form and its instructions are available on the Texas Comptroller’s website, ensuring compliance with the current tax laws and requirements. |

Guide to Writing Tax POA form 01-137

Filling out a Tax Power of Attorney (POA) form, specifically form 01-137, is a critical step for individuals or businesses seeking to grant authority to another person to handle their tax matters. This authority can encompass a range of activities, including filing taxes, receiving confidential tax information, and representing the individual or entity before tax authorities. To ensure accuracy and completeness, it's essential to pay close attention to the details while completing this form. Following the specified instructions can streamline the process and ensure that the designated representative can carry out their duties without unnecessary delays or legal complications.

- Start by carefully reading the entire form to understand the type of information required. This preliminary step is crucial for gathering all necessary documents and details before filling out the form.

- Enter the taxpayer's information, including the full legal name, taxpayer identification number (TIN), and address. This information should be accurate and match the records with the tax authority to prevent any discrepancies.

- Specify the type of tax and tax form number related to the authorization. It's essential to detail the specific taxes and forms to clarify the scope of authority granted to the representative.

- List the tax periods for which the POA is granted. You must indicate the specific years or periods during which the representative has the authority to act on the taxpayer's behalf. This can include past, present, and future periods, as needed.

- Designate the representative(s) by including their name(s), address(es), and telephone number(s). If appointing more than one representative, clearly state the extent of each representative's authority, if it differs.

- Sign and date the form. The taxpayer (or a duly authorized individual on behalf of the taxpayer) must sign and date the form. Ensure that the signature matches the one on file with the tax authority to validate the POA.

- If applicable, the representative(s) should also sign the form, acknowledging their acceptance of the POA. Their signature is a formal acknowledgement of their responsibility and authority to act on behalf of the taxpayer.

Once the form is fully completed and signed, it should be submitted according to the instructions provided by the issuing authority or tax agency. This often involves mailing the form to a specific address or submitting it through an online portal, if available. After submission, it's advisable to follow up to confirm that the form has been processed and that the POA is in effect, facilitating the representative's ability to perform the authorised tasks without delay.

Understanding Tax POA form 01-137

-

What is a Tax POA Form 01-137?

The Tax Power of Attorney (POA) Form 01-137 is a document that allows an individual or business to grant authority to another person or entity (the agent) to handle their tax matters. This can include filing taxes, obtaining confidential information, and making decisions about tax payments on behalf of the grantor.

-

Who can be appointed as an agent on the Tax POA Form 01-137?

Individuals can appoint anyone they trust as their agent. Common choices include accountants, attorneys, family members, or business partners. However, it is crucial to choose someone knowledgeable about tax matters and trustworthy, as they will have wide-ranging powers to act on the grantor's behalf.

-

How does one fill out the Tax POA Form 01-137?

Filling out the Tax POA Form 01-137 involves providing detailed information about the grantor and the appointed agent, including names, addresses, and identification numbers. The form also requires specifying the types of tax matters and years or periods for which the agent will have authority. Signatures from both the grantor and the agent, witnessed by a notary public, are usually required to validate the form.

-

Is the Tax POA Form 01-137 applicable in all states?

No, the Tax POA Form 01-137 may not be applicable in all states. Tax laws and forms can differ significantly from one state to another. It's important to check with your state's tax authority or a legal professional to ensure you are using the correct form and following the appropriate rules for your state.

-

How can I revoke the Tax POA Form 01-137?

To revoke the Tax POA, the grantor must complete a revocation form or provide a written statement expressing their desire to revoke the authority granted to their agent. This document must be signed, dated, and, in some cases, notarized. It should then be sent to the same authorities where the original POA was filed. Informing the agent about the revocation in writing is also recommended to clear any ongoing tax matters.

-

Does filing a Tax POA Form 01-137 with the tax authority allow my agent to receive my refund?

While the Tax POA Form 01-137 grants an agent the authority to handle tax matters on behalf of the grantor, it does not automatically entitle the agent to receive tax refunds. Specific powers, such as the ability to receive checks or make deposits, must be explicitly mentioned in the POA document. If receiving refunds is intended, this authority needs to be clearly stated in the form.

Common mistakes

Filling out tax-related forms can often be a daunting task, especially when it comes to something as critical as a Power of Attorney (POA) for tax matters. The Tax POA Form 01-137 is essential in authorizing someone to handle your tax affairs. However, errors can occur during this process. Awareness of these mistakes can lead to a smoother, more accurate process for all parties involved. Below are some common pitfalls:

-

Not checking the form's version - Tax laws and forms evolve, so it's imperative to use the most current version of Form 01-137 to ensure compliance with existing regulations.

-

Incorrect taxpayer information - Providing inaccurate taxpayer information, such as a wrong social security number or misspelled name, can lead to significant delays and misunderstandings.

-

Misunderstanding the authority granted - Often, individuals do not fully comprehend the extent of the authority they are granting. It's vital to understand which rights are being given to the representative, such as the right to receive confidential tax information or to make decisions on one’s behalf.

-

Failing to specify the tax matters and periods - The form requires detailed information about the specific tax matters and periods for which the POA is granted. A common mistake is not being specific enough, or omitting this information altogether.

-

Omitting representative's qualifications - The form asks for the representative’s qualifications. Sometimes, individuals forget to include this information, which can question the legitimacy of the representative’s authority.

-

Incorrect or incomplete representative information - Just as with the taxpayer's details, providing incorrect or incomplete information about the representative can delay the process. Ensure all contact information is accurate and current.

-

Not specifying the form's validity period - If a specific timeframe for the POA’s validity is intended, not mentioning this period can lead to the POA remaining in effect indefinitely or not as long as needed.

-

Forgetting to sign and date the form - Perhaps the most common and yet critical mistake is not signing or dating the form. Without the taxpayer’s signature, the POA Form 01-137 is not valid.

To avoid these common errors, individuals should approach the form with diligence and attention to detail. Seeking the assistance of a tax professional can also help ensure that the form is completed correctly and according to current laws and regulations.

Documents used along the form

When handling tax matters, especially with the Tax Power of Attorney (POA) Form 01-137, it's common to encounter various other forms and documents that are typically used alongside it. These documents aid in ensuring that all aspects of one’s tax affairs are appropriately addressed, providing clear authorization and directives for tax representation. Below is an overview of some forms and documents often used in conjunction with the Tax POA Form 01-137, designed to streamline and support the tax handling process.

- IRS Form 2848, Power of Attorney and Declaration of Representative: This form is used to authorize an eligible individual to represent the taxpayer before the Internal Revenue Service (IRS), specifying the tax matters and periods for which they have authority.

- IRS Form 8821, Tax Information Authorization: Allows designated parties to receive and inspect confidential tax information from the IRS for the types specified by the taxpayer, without granting authority to represent the taxpayer.

- W-9, Request for Taxpayer Identification Number and Certification: Used to provide the correct taxpayer identification number (TIN) to entities that are required to file information returns with the IRS on the taxpayer’s behalf.

- Form 4506-T, Request for Transcript of Tax Return: Permits individuals or their authorized representatives to request tax return transcripts, tax account information, W-2 information, and certain other tax records.

- Form 1040, U.S. Individual Income Tax Return: The standard IRS form that individuals use to file their annual income tax returns, which might be necessary for representatives to review or amend in conjunction with a Tax POA.

- Form SS-4, Application for Employer Identification Number (EIN): Used by entities to apply for an EIN, necessary for tax reporting purposes. This form may be required if the POA involves business tax matters.

- State-specific Tax Declaration Forms: Depending on the jurisdiction, additional state-specific tax forms may be necessary to grant similar authorization at the state level, mirroring the federal Tax POA form’s purpose.

Navigating tax matters with a Power of Attorney requires careful consideration and the correct accompanying documentation to ensure compliance and proper representation. These forms and documents play critical roles in providing comprehensive authorization, allowing representatives to perform their duties effectively and efficiently. Whether for individual or business tax affairs, understanding and utilizing these documents in conjunction with the Tax POA Form 01-137 can significantly streamline tax-related processes.

Similar forms

The Tax Power of Attorney (POA) Form 01-137, allows a person to grant authority to another individual or entity to handle their tax matters. This form is quite similar to the General Power of Attorney document. The General Power of Attorney enables an individual, known as the principal, to grant broad powers to a designated agent. These powers can include managing financial transactions, making health care decisions, and handling other personal matters. Both documents operate under the principle of allowing someone else to act in your stead, though the Tax POA is more specific to tax-related issues.

Another document resembling the Tax POA Form 01-137 is the Healthcare Power of Attorney. This form specifically allows an individual to appoint someone else to make healthcare decisions on their behalf should they become unable to do so. While the healthcare POA focuses on health-related matters and the Tax POA concentrates on tax issues, both documents share the fundamental purpose of appointing another party to act on the principal’s behalf under specific circumstances.

The Limited Power of Attorney (LPOA) document also bears similarity to the Tax POA Form 01-137. The LPOA allows a person to grant limited powers to an agent, which can be for specific tasks, and usually for a limited time. For example, an LPOA might authorize someone to sell a car or manage certain financial transactions. Like the Tax POA, which provides authority specifically related to the handling of tax matters, an LPOA grants narrowly defined powers and often pertains to specific events or tasks.

Furthermore, the Durable Power of Attorney shares characteristics with the Tax POA Form 01-137. This type of POA remains in effect even if the principal becomes incapacitated, unlike other forms that may terminate under such conditions. While the Tax POA is focused on tax matters, and the Durable POA can encompass a wide range of authorities including healthcare and financial decisions, the continuity of authority despite the principal’s incapacity is a notable similarity between these two types of documents.

Each of these documents, while tailored toward different scenarios, serves the purpose of authorizing an agent to act on behalf of the principal. Whether for general, healthcare, limited, or durable needs, the premise aligns closely with that of the Tax POA Form 01-137, illustrating the foundational legal principle of delegated authority. Understanding the specific functions and limitations of each can help individuals make informed decisions about managing their affairs.

Dos and Don'ts

Filling out the Tax Power of Attorney (POA) form 01-137 requires precision and understanding of its implications. This legal document grants another individual or entity the authority to handle tax matters on your behalf, making it paramount to approach this task with care. Below are guidelines on what you should and shouldn't do to ensure the process is completed accurately and securely.

What You Should Do:

- Read the Instructions Carefully: Before filling out the form, take the time to thoroughly read and understand the instructions provided. This will help you avoid common mistakes and ensure that you fill out the form correctly.

- Provide Accurate Information: Ensure all the information you provide is accurate and up-to-date. This includes your name, address, tax identification number, and the details of the representative you are appointing.

- Specify the Tax Matters: Clearly indicate the specific tax matters and years for which you are granting authority. This will limit your representative's power to only those items you specify.

- Sign and Date the Form: Your signature is required to validate the form. Make sure to sign and date the document in the presence of a witness if required by your state law.

- Keep a Copy: After submitting the form to the relevant tax authority, keep a copy for your records. This will help you keep track of who has authority to act on your behalf and for which tax matters.

What You Shouldn't Do:

- Do Not Leave Blank Spaces: Avoid leaving any section of the form blank. If a section does not apply, write "N/A" (Not Applicable) to indicate this. Leaving spaces blank can lead to delays and misunderstandings.

- Do Not Rush: Take your time to fill out the form correctly. Rushing through the process increases the risk of making errors, which could invalidate the document.

- Do Not Use Pencil: Fill out the form in ink to ensure that your entries are permanent and tamper-proof. Using pencil makes the document appear unprofessional and may raise questions about its authenticity.

- Do Not Forget to Notify Your Representative: Make sure that the person or entity you are appointing is aware of and agrees to their designation as your representative. This includes discussing the responsibilities and limitations of their authority.

- Do Not Ignore State Requirements: Be aware of any specific requirements or additional forms your state may require for a tax POA to be considered valid. Ignoring these can result in an invalid POA.

Misconceptions

When discussing the Tax Power of Attorney Form 01-137, commonly used in Texas, several misconceptions often arise. Understanding the correct information helps in accurately navigating the process of granting someone the authority to handle your tax matters. Below are some common misconceptions and their clarifications.

It grants unlimited authority: A common misconception is that Form 01-137 grants unlimited authority over all financial matters. In reality, this form specifically limits the agent’s power to tax matters with the Texas Comptroller’s Office, such as filing taxes and obtaining confidential tax information.

It's valid indefinitely: People often think once signed, the Tax POA remains effective indefinitely. However, the form has a specified duration and can expire. The principal (the person granting the power) or the government agency may also choose to terminate it earlier.

Any tax professional can be appointed: While it's true that you can appoint most adults as your agent, selecting a professional with knowledge of Texas tax laws is critical for effective representation in tax matters directly related to what the form governs.

A legal degree is required to act as an agent: There's a belief that only a lawyer can be appointed as an agent through this form. However, accountants and other tax professionals familiar with Texas tax law can also serve effectively.

Signing away your rights: Some think that by signing a Tax POA, they are relinquishing their right to deal with their taxes directly. This is incorrect. The taxpayer retains the right to manage their taxes and can revoke the POA at any time.

Immediate effect upon signing: There's a notion that the POA takes immediate effect upon signing. While generally true, processing times mean there might be a delay before the representative can act on your behalf.

Only for individuals: It is often misunderstood that Form 01-137 is only for individual taxpayers. Businesses can also use this form to authorize someone to handle their tax matters with the state.

It covers federal tax matters: A significant misunderstanding is that this form also applies to federal tax issues. Form 01-137 is specifically for authorizing representation with the Texas Comptroller’s Office, not the IRS or other federal tax matters.

Witnesses or notarization are required: Many believe the form requires witnessing or notarization to be valid. While it's always a good idea to follow best practices for legal documents, the state of Texas does not require these steps for Tax POA Form 01-137 to be considered valid.

Dispelling these misconceptions can make the process of granting or acting under a Tax Power of Attorney more straightforward and effective, ensuring that tax matters are handled appropriately and according to state laws.

Key takeaways

Filing out and using the Tax Power of Attorney (POA) form 01-137 can empower someone to handle your tax matters, but it's crucial to navigate the process with care. Here are key takeaways to guide you through it:

- Understand what the form does. The Tax POA form 01-137 allows you to grant another person the authority to make decisions and take actions with the tax department on your behalf. This could include filing taxes, obtaining confidential tax information, and representing you in tax matters.

- Choose your representative wisely. This person will have significant access to your personal and financial information and the power to make decisions about your taxes. Make sure it's someone you trust completely, such as a family member, a close friend, or a professional like a certified public accountant or a tax attorney.

- Fill out the form accurately. Provide all necessary details such as your full name, tax identification number (such as your Social Security number), and specify the tax matters and years for which the authorization is granted. Errors in this information can delay or invalidate the process.

- Be specific about the powers you are granting. The Tax POA form lets you define the extent of the authority you are giving your representative. You can limit their power to specific tasks, tax types, or periods, or you can grant broad authority.

- Keep records and monitor actions. Even though someone else is managing your tax affairs, it's vital to stay informed and involved. Request updates, review decisions, and ensure all actions taken on your behalf are in your best interest.

- Know how to revoke the POA if necessary. Your circumstances or your relationship with your representative may change. The Tax POA form 01-137 typically includes instructions on how to revoke the power of attorney. It’s important to understand this process in case you need to withdraw the authorization.

Approaching the Tax POA with care and due diligence ensures that your tax matters are handled effectively while safeguarding your rights and interests.

Popular PDF Documents

433 B Oic - Taxpayers use Form 433-A to prove financial hardship and negotiate terms such as reduced settlements or installment plans.

Form 843 Irs - This form serves as a formal petition to the IRS for the abatement of charges that the taxpayer deems inaccurate or unfair.