Get Tax POA form Form

When individuals or businesses face the often complex and daunting task of navigating tax matters, the Tax Power of Attorney (POA) form emerges as an indispensable tool, offering both relief and strategic advantage. This legal document, narrowly tailored to accommodate tax-related issues, empowers a trusted representative to act on behalf of someone in their dealings with tax authorities. Beyond the mere filing of documents, the scope of authority granted can extend to negotiating payment plans, obtaining confidential tax information, and representing the grantor in audits or other tax proceedings. Critically, the form delineates the specific tax matters and periods for which such representation is authorized, ensuring a clear boundary is maintained around the representative's powers. Security and peace of mind are further bolstered by the instrument's stringent requirements, including signatures from all parties involved and, in many cases, official approval from the tax agency itself. This tailored authorization not only streamlines interactions with tax authorities but also enables individuals and businesses to harness the expertise of tax professionals, thereby optimizing their financial and legal standing with respect to tax obligations.

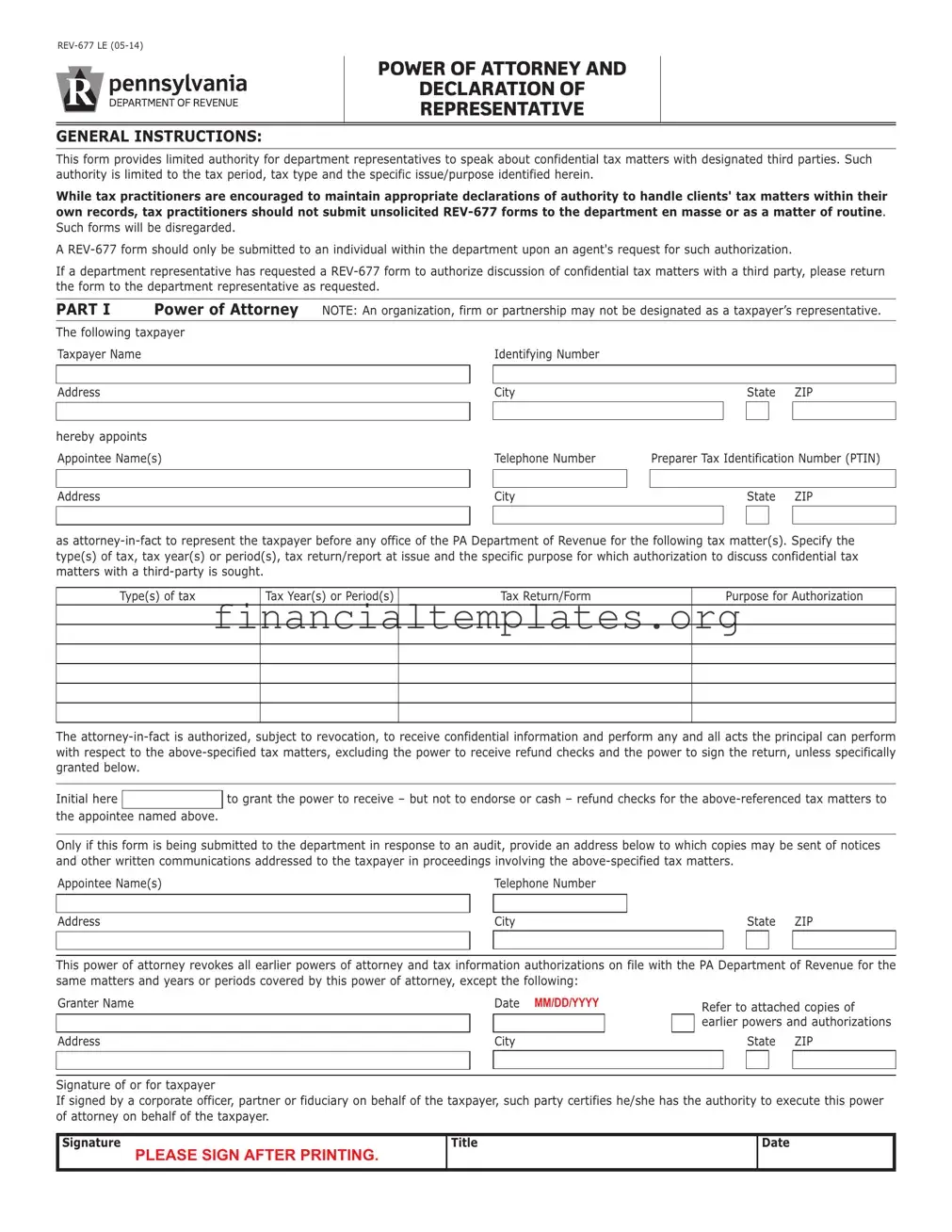

Tax POA form Example

pennsylvania |

POWER OF ATTORNEY AND |

|

DECLARATION OF |

|

|

DEPARTMENT OF REVENUE |

REPRESENTATIVE |

|

|

|

|

|

|

|

GENERAL INSTRUCTIONS:

This form provides limited authority for department representatives to speak about confidential tax matters with designated third parties. Such authority is limited to the tax period, tax type and the specific issue/purpose identified herein.

While tax practitioners are encouraged to maintain appropriate declarations of authority to handle clients' tax matters within their own records, tax practitioners should not submit unsolicited

A

If a department representative has requested a

PART I |

Power of Attorney |

NOTE: An organization, firm or partnership may not be designated as a taxpayer’s representative. |

||||||||||

The following taxpayer |

|

|

|

|

|

|

|

|

|

|

|

|

Taxpayer Name |

|

|

|

Identifying Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

City |

|

|

|

|

State |

ZIP |

||

|

|

|

|

|

|

|

|

|

□ |

|

|

|

hereby appoints |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Appointee Name(s) |

|

|

Telephone Number |

|

Preparer Tax Identification Number (PTIN) |

|||||||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||

Address |

|

|

|

City |

|

|

|

|

State |

ZIP |

||

|

|

|

|

|

|

|

|

|

□ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

as

Type(s) of tax |

Tax Year(s) or Period(s) |

Tax Return/Form |

Purpose for Authorization |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The

Initial here |

|

to grant the power to receive – but not to endorse or cash – refund checks for the |

the appointee |

named above. |

|

Only if this form is being submitted to the department in response to an audit, provide an address below to which copies may be sent of notices and other written communications addressed to the taxpayer in proceedings involving the

Appointee Name(s) |

|

Telephone Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

State ZIP |

|||

Address |

|

City |

|

|

|

||||

|

|

|

|

|

|

□ |

|

|

|

|

|

|

|

|

|

|

|||

This power of attorney revokes all earlier powers of attorney and tax information authorizations on file with the PA Department of Revenue for the same matters and years or periods covered by this power of attorney, except the following:

Granter Name |

|

Date MM/DD/YYYY |

|

|

|

Refer to attached copies of |

||||||

|

|

|

|

□ |

|

earlier powers and authorizations |

||||||

Address |

|

City |

|

|

|

|

|

State ZIP |

||||

|

|

|

|

|

|

|

|

|

□ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Signature of or for taxpayer

If signed by a corporate officer, partner or fiduciary on behalf of the taxpayer, such party certifies he/she has the authority to execute this power of attorney on behalf of the taxpayer.

Signature

PLEASE SIGN AFTER PRINTING.

Title

Date

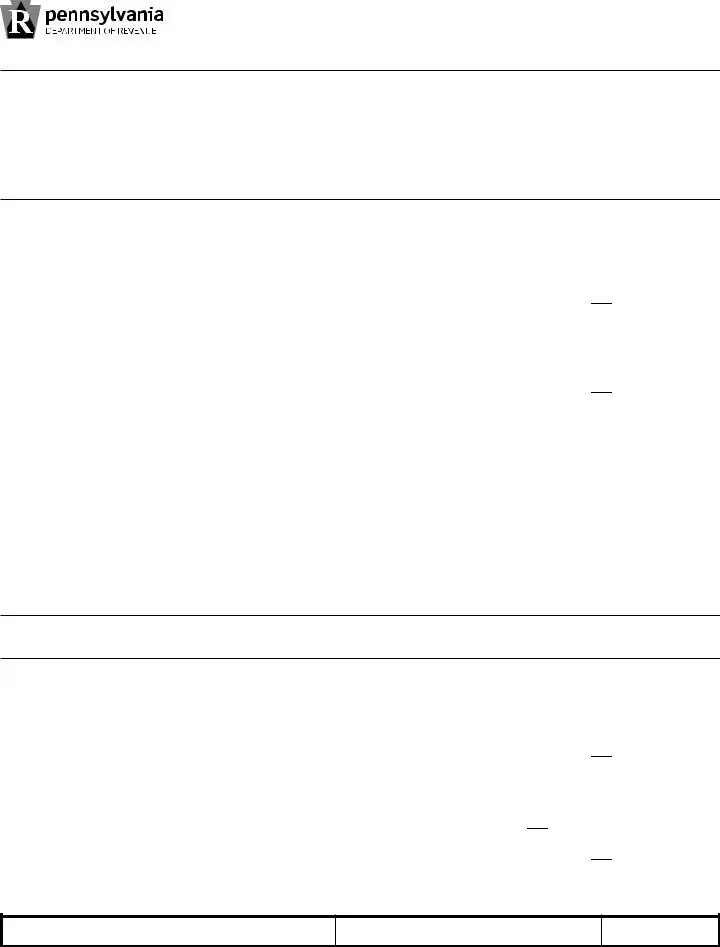

If the power of attorney is granted to a person other than an attorney, certified public accountant or enrolled agent, the taxpayer's signature must be witnessed or notarized below.

The person signing as or for the taxpayer (check and complete one):

□

is known to and signed in the presence of the two disinterested witnesses whose signatures appear here:

is known to and signed in the presence of the two disinterested witnesses whose signatures appear here:

PLEASE SIGN AFTER PRINTING.

(Signature of Witness) |

(Date) |

PLEASE SIGN AFTER PRINTING.

(Signature of Witness) |

(Date) |

□

appeared this day before a notary public and acknowledged this power of attorney as a voluntary act and deed.

appeared this day before a notary public and acknowledged this power of attorney as a voluntary act and deed.

Witness |

PLEASE SIGN AFTER PRINTING. |

|

NOTARIAL SEAL |

|

|

|

|

||

|

(Signature of Notary) |

|

(Date) |

|

PART II Declaration of Representative

I declare that I am one of the following:

1a member in good standing of the bar of the highest court of the jurisdiction indicated below;

2duly qualified to practice as a certified public accountant in the jurisdiction indicated below;

3a bona fide officer of the taxpayer organization;

4a

5a member of the taxpayer’s immediate family (spouse, parent, child, brother or sister);

6a fiduciary for the taxpayer; and/or

7 Other (specify) |

|

|

|

|

; |

and that I am authorized to represent the taxpayer identified in Part I for the tax matters specified therein. |

|

|

|||

|

|

|

|

|

|

DESIGNATION |

JURISDICTION |

|

|

|

|

(INSERT APPROPRIATE NUMBER |

(STATE, ETC.) |

SIGNATURE |

DATE |

||

FROM ABOVE LIST) |

|

|

|

|

|

|

|

|

PLEASE SIGN AFTER PRINTING. |

|

|

|

|

|

|

|

|

|

|

|

PLEASE SIGN AFTER PRINTING. |

|

|

|

|

|

|

|

|

|

|

|

PLEASE SIGN AFTER PRINTING. |

|

|

|

|

|

|

|

|

|

|

|

PLEASE SIGN AFTER PRINTING. |

|

|

|

|

|

|

|

|

|

|

|

PLEASE SIGN AFTER PRINTING. |

|

|

|

|

|

|

|

|

|

|

|

PLEASE SIGN AFTER PRINTING. |

|

|

|

|

|

|

|

|

|

|

|

PLEASE SIGN AFTER PRINTING. |

|

|

|

|

|

|

|

|

|

|

|

PLEASE SIGN AFTER PRINTING. |

|

|

|

|

|

|

|

|

|

|

|

PLEASE SIGN AFTER PRINTING. |

|

|

|

|

|

|

|

|

|

|

|

PLEASE SIGN AFTER PRINTING. |

|

|

|

|

|

|

|

|

|

|

|

PLEASE SIGN AFTER PRINTING. |

|

|

|

|

|

|

|

|

Document Specifics

| Fact Number | Description |

|---|---|

| 1 | The Tax Power of Attorney (POA) form allows an individual to grant authority to another person to handle their tax matters. |

| 2 | This form is commonly used to authorize a tax professional to communicate with the IRS or state tax agencies on one's behalf. |

| 3 | Each state has its own version of the Tax POA form, which conforms to its specific laws and requirements. |

| 4 | The form typically requires the taxpayer's personal information, the representative's details, and the specific tax matters and years for authorization. |

| 5 | Signing the form does not relieve the taxpayer of any tax obligations; it merely allows the representative to obtain information and make decisions on their behalf. |

| 6 | The authority granted can be revoked by the taxpayer at any time, typically by sending a revocation notice to the relevant tax authority. |

| 7 | For IRS matters, Form 2848 is used, while state-specific forms might have different numbers or titles depending on the jurisdiction. |

Guide to Writing Tax POA form

Once an individual decides to grant someone else the authority to act on their behalf for tax purposes, the Tax Power of Attorney (POA) form is the official document to complete. This document empowers the designated person or entity to make decisions and handle matters relating to the principal's taxes. It is crucial to approach this form with attention to detail to ensure that all the information is accurate and reflects the principal's wishes. The following steps guide you through the process of successfully completing the Tax POA form.

- Begin by identifying the principal, the person who is granting authority. Include their full legal name, social security number (SSN), or taxpayer identification number (TIN), and full address.

- List the representative(s) being granted this power. This section should include their name(s), address(es), and contact information. If the representative is a firm, include the firm’s name and the name of the individual authorized to act on behalf of the firm.

- Determine the tax matters for which this power is granted, such as specific tax forms, types of taxes, periods, and, if applicable, specific transactions. It's essential to be as detailed as possible to avoid any ambiguity.

- Specify the tax form number(s) for which the representative will have the authority to receive and inspect confidential tax information.

- Outline the acts authorized by this Power of Attorney, like the ability to receive and inspect confidential tax information, to sign agreements, consents, or other documents, and to represent the principal before tax authorities.

- If there are any acts not authorized or any special conditions, those should be carefully outlined in the designated section of the form.

- In the event that a prior Tax POA is in effect and the principal wishes for it to remain in effect alongside the new one, details regarding the prior POA must be provided. If the new POA is intended to replace any previous arrangements, this should be clearly stated.

- Both the principal and the representative(s) must sign and date the form. The principal's signature grants the legal authority, and the representative’s signature acknowledges this authority.

After filling out the Tax POA form, it's essential to follow the submission guidelines provided by the issuing authority, typically the state's Department of Revenue or the IRS, depending on the jurisdiction. This may involve mailing the form to a specific address or submitting it online, if available. Once submitted, the form is usually processed within a few weeks, after which the representative will have the authority to act on behalf of the principal concerning the specified tax matters.

Understanding Tax POA form

-

What is a Tax Power of Attorney (POA) Form?

A Tax Power of Attorney (POA) Form is a legal document that allows you to designate another person, known as an agent or attorney-in-fact, to handle your tax matters with the tax authority. This includes, but is not limited to, signing documents, obtaining confidential information, and making decisions regarding your taxes. It is commonly used when individuals need someone else to manage their tax matters due to absence, illness, or lack of expertise.

-

Who can be designated as an agent on a Tax POA Form?

Anyone you trust can be designated as your agent on a Tax POA Form. This could be a family member, friend, accountant, or tax attorney. It's crucial to choose someone who is not only trustworthy but also has the necessary knowledge or expertise to handle your tax matters effectively.

-

How do I complete a Tax POA Form?

Completing a Tax POA Form typically involves filling out specific information, such as your name, social security number, and the details of the appointed agent. You'll also need to specify the tax matters and years you are giving the agent authority over. Most tax authorities provide specific forms and instructions on how to complete them. It's essential to follow these instructions precisely to ensure the form is valid.

-

Is a Tax POA Form different from a General POA Form?

Yes, a Tax POA Form is different from a General POA Form. A Tax POA is specifically designed for tax matters and only grants authority in dealings with tax authorities. In contrast, a General POA can cover a broad range of legal and financial matters beyond taxes, depending on how it's structured.

-

Do I need to file a Tax POA Form with my state’s tax authority?

Yes, in most cases, you will need to file your Tax POA Form with your state’s tax authority for it to be effective. The process for filing can vary by state, so it's important to check with your local tax authority or consult a tax professional to understand the specific requirements.

-

Can I revoke a Tax POA Form?

Yes, you can revoke a Tax POA Form at any time. To do so, you must generally provide written notice of the revocation to both the agent and the tax authority with whom the POA was filed. Some states may also have specific forms or procedures for revoking a POA, so it's a good idea to consult with a professional or the local tax authority.

-

What happens if my agent misuses the authority given under a Tax POA Form?

If an agent misuses their authority under a Tax POA Form, you may have legal recourse against them. This could include suing them for any damage they have caused. It's essential to carefully choose your agent and clearly define their powers within the POA to reduce the risk of misuse.

-

Does a Tax POA Form expire?

Whether a Tax POA Form expires or not can depend on the terms specified within the document and the laws of your state. Some POAs are drafted to remain in effect until explicitly revoked, while others may have a set expiration date. Always specify the duration of the POA when completing the form to avoid any confusion.

Common mistakes

Filling out a Tax Power of Attorney (POA) form is a crucial task that grants someone else the authority to handle your tax matters. However, some common mistakes can lead to problems with the IRS or delays in managing your tax issues. Here are six mistakes that individuals often make when completing their Tax POA forms:

-

Not checking the form version: The IRS updates forms regularly, including the Tax POA form. Using an outdated version can lead to the IRS not accepting the form.

-

Skipping parts of the form: It’s important to complete every applicable section of the form. Missing information can result in the IRS rejecting the POA or in delays.

-

Incorrect Taxpayer Information: Entering incorrect taxpayer information, such as the wrong Social Security Number (SSN) or name spelling, can lead to processing delays or the IRS not being able to match the POA with the taxpayer's records.

-

Failing to specify the tax matters: The form requires you to specify which tax matters and years the representative is authorized to handle. The omission of these details can limit the representative’s ability to act effectively.

-

Not naming a substitute or successor representative: Life is unpredictable. If the primary representative is unable to serve for any reason and no substitute or successor is named, there could be significant delays in tax matters.

-

Forgetting to sign and date the form: The IRS will not process a POA form without the taxpayer's signature and the date. This mistake can cause unnecessary delays.

In addition, here are some tips to ensure that the process of filling out the Tax POA form goes smoothly:

-

Always check the IRS website for the most current version of the Tax POA form.

-

Review the form in its entirety before submitting it to ensure that all necessary sections have been completed accurately.

-

Consider consulting with a tax professional or attorney when filling out the form, especially if the tax matters are complex.

Documents used along the form

When handling tax matters, a Power of Attorney (POA) form is a critical document that allows an individual to grant another person the authority to act on their behalf. Apart from the Tax POA, there are several other important forms and documents that are often employed to ensure comprehensive management of one's tax and financial affairs. These forms serve various purposes, from reporting income to designating beneficiaries for certain accounts. Understanding each document's role can significantly streamline the process of managing financial and tax matters.

- Form 1040: The U.S. Individual Income Tax Return is the standard form used by individuals to file their annual income tax returns with the IRS. It collects information about the filer's income, deductions, and credits to determine the amount of tax owed or refund due.

- W-2 Form: This form is issued by employers to report an employee's annual wages and the amount of taxes withheld from their paycheck. It is vital for individuals preparing their tax returns.

- 1099 Form: Independent contractors, freelancers, and others who earn income outside of traditional employment use this form to report earnings. There are several versions, indicating different types of income such as interest, dividends, and non-employee compensation.

- Schedule C: Utilized by sole proprietors or single-member LLCs to report profits or losses from a business. This form breaks down the costs and expenses involved in running the business.

- Schedule D: This form is used to report capital gains or losses from the sale of assets, including stocks, bonds, and real estate, which are necessary for accurately reporting to the IRS.

- Form 4868: An Application for Automatic Extension of Time to File U.S. Individual Income Tax Return allows individuals more time to file their taxes, typically extending the deadline by six months.

- Form 8822: Change of Address form is used to notify the IRS of a change in address. Keeping the IRS informed ensures that tax documentation and refunds are sent to the correct location.

- Form 8832: This Entity Classification Election form is used by LLCs to choose how they are classified for federal tax purposes, such as a corporation, partnership, or disregarded entity.

- Beneficiary Designations: Though not a form directly related to tax filing, beneficiary designation forms for IRAs, 401(k)s, and other retirement accounts are crucial for estate planning and ensuring that assets are distributed according to the account holder's wishes.

In addition to the Tax POA, these documents encompass a wide range of activities surrounding an individual's financial and tax life. Some documents, like the Form 1040 or W-2, are essential for annual tax filing, while others, such as beneficiary designations, play a crucial role in long-term planning. By familiarizing themselves with these forms, individuals can take proactive steps towards managing their finances more effectively and making informed decisions about their economic future.

Similar forms

A General Power of Attorney (POA) form bears similarity to the Tax POA, as both authorize someone, known as the agent or attorney-in-fact, to act on behalf of another person, the principal. However, while the Tax POA specifically grants the agent authority to handle tax matters with the IRS on the principal's behalf, a General POA is broader, allowing the agent to make financial, legal, and sometimes personal decisions.

The Durable Power of Attorney for Health Care is another document related to the Tax POA. It designates an agent to make healthcare decisions for the principal if they become incapacitated. Although it pertains to health decisions instead of tax matters, it parallels the Tax POA in how it empowers an agent to act in the principal’s stead under specific circumstances.

The Limited Power of Attorney is akin to the Tax POA, sharing the feature of granting an agent powers to act in the principal's place. The significant difference lies in the scope; the Limited Power of Attorney is tailored for specific tasks or timeframes, whereas the Tax POA focuses solely on tax-related responsibilities.

The Advance Healthcare Directive, while primarily healthcare-focused, shares a conceptual similarity with the Tax POA. It lays out instructions for medical care if the individual cannot make decisions themselves, analogous to how the Tax POA specifies how tax matters should be handled by an agent on the principal’s behalf.

A Financial Power of Attorney parallels the Tax POA in that it authorizes an agent to manage the financial affairs of the principal. However, it encompasses a broader range of financial activities beyond tax matters, including banking transactions, real estate management, and investment decisions.

The Revocation of Power of Attorney form serves as the counterpart to any POA form, including the Tax POA. It is a document through which the principal can cancel or revoke the powers granted to an agent, highlighting the control the principal retains over the powers assigned to another.

A Living Will, distinct in its focus on end-of-life decisions rather than delegating decision-making authority, shares a similarity with the Tax POA through its function of recording specific wishes of an individual, to be executed when they themselves cannot express or enforce these wishes.

The Executor of Will is a document appointing a person to manage the estate of someone who has passed away. Like the Tax POA, it grants an individual the authority to perform certain acts on behalf of another, although it is used posthumously to administer the wishes contained in a will.

The Business Power of Attorney allows a business owner to designate someone else to make decisions regarding their business. This bears a resemblance to the Tax POA as it delegates decision-making power, but it is specifically tailored to the operations and decisions within a business context.

The Real Estate Power of Attorney is a document specific to real estate transactions, where an individual grants another person the authority to act on their behalf in matters related to property. It parallels the Tax POA by granting authority for a particular area of the principal’s affairs, emphasizing the importance and specificity of the powers granted.

Dos and Don'ts

When dealing with the Tax Power of Attorney (POA) form, it's crucial to proceed with care to ensure all information is accurate and legally binding. Below is a comprehensive guide to what you should and shouldn't do when filling out this form.

Do:

- Read the form instructions carefully to understand each section and its requirements.

- Verify the form version to ensure it's the most current one accepted by the tax authority.

- Use black ink or type the information to maintain clarity and legibility.

- Include your full legal name and identification numbers (such as your Social Security Number) as required, to avoid any processing delays.

- Clearly specify the tax matters and years or periods covered by the POA to grant authority specifically as intended.

- Ensure the agent’s (or representative’s) information is complete and accurate, including their name, mailing address, and telephone number.

- Check that all parties required to sign the form have done so in the designated spots.

- Keep a copy of the completed and signed form for your records.

- Submit the form to the appropriate tax authority office, as directed in the form instructions.

- Consider consulting a tax professional or attorney if you have any questions or concerns about granting tax power of attorney to someone.

Don't:

- Leave any required fields blank. If a section does not apply, note it as "N/A" (not applicable).

- Use correction fluid or tape; if you make a mistake, start over with a new form to prevent processing errors.

- Sign or date the form without reviewing all information to ensure its accuracy and completeness.

- Forget to specify any limitations or special instructions that you want to apply to the agent’s authority.

- Assume the form grants the same powers in every state; tax laws and POA requirements can vary significantly.

- Rely solely on the POA for tax advice; the agent’s role is to represent you, not to provide legal or financial advice.

- Overlook the need to update the form if there are any significant changes in your situation or wishes.

- Ignore the expiration date if your state tax POA form has one; ensure it covers the necessary time frame.

- Forget to revoke the POA formally if you no longer wish the agent to act on your behalf.

- Submit the form without ensuring all information is present and correct, which could delay processing or invalidate the document.

Misconceptions

When it comes to the Tax Power of Attorney (POA) form, misconceptions can easily arise, leading individuals to make uninformed decisions. Understanding the truth behind these common misunderstandings is crucial for anyone considering granting someone else authority over their tax matters.

- Misconception 1: The Tax POA only allows the agent to sign tax returns. Truth: The scope of the Tax POA encompasses much more, including representing the taxpayer before the IRS, making decisions about tax payments, and obtaining confidential tax information.

- Misconception 2: Once appointed, the agent has unlimited power over all financial matters. Truth: The powers of the agent are limited to tax matters specified in the Tax POA form. It doesn't grant authority over the principal's other financial or legal issues.

- Misconception 3: A Tax POA is irrevocable. Truth: The taxpayer can revoke a Tax POA at any time, as long as they provide notice to the IRS and any agents named in the POA form.

- Misconception 4: The form is too complex for individuals to fill out without professional help. Truth: While tax laws can be complicated, the Tax POA form is designed to be straightforward. Individuals can complete it without professional assistance, although consulting a tax professional or attorney may be helpful in certain situations.

- Misconception 5: Only family members can be named as agents. Truth: Any individual or qualified professional, such as an accountant or attorney, can be designated as an agent on a Tax POA, not just family members.

- Misconception 6: A Tax POA covers tax matters in all states. Truth: A Tax POA typically applies to federal tax matters. Separate state-specific forms may be needed to grant authority for state tax matters.

- Misconception 7: Submitting a Tax POA automatically triggers a tax audit. Truth: There is no evidence to suggest that filing a Tax POA form increases the likelihood of an audit. The form simply designates who has the authority to represent the taxpayer's interests before the IRS.

- Misconception 8: The Tax POA grants the agent access to the principal's bank accounts. Truth: The authority granted by a Tax POA is limited to tax matters and does not include access to the taxpayer's personal bank accounts or financial assets unrelated to taxes.

- Misconception 9: A general POA covers tax matters, making a separate Tax POA unnecessary. Truth: A general POA and a Tax POA serve different purposes. A general POA may not grant the specific authority needed for tax matters, making it necessary to execute a separate Tax POA for those purposes.

Dispelling these misconceptions ensures that individuals can make informed decisions about managing their tax affairs through a Power of Attorney. It's important to carefully consider who is appointed as the agent and to understand the extent of the authority being granted.

Key takeaways

When it comes to navigating taxes, understanding the power of attorney (POA) form can be crucial. This document allows someone else, often a tax professional, to make decisions and take actions regarding your taxes on your behalf. Here are some key takeaways about filling out and using the Tax POA form to ensure that you are well-prepared and informed:

- Identify the right form: Different states may have specific forms for tax purposes. Make sure you're using the correct one for your needs and that it's the most current version.

- Know the parties involved: The "principal" is the person granting authority to someone else, the "agent" or "attorney-in-fact," to handle their tax matters.

- Be specific about granted powers: Clearly outline what the agent can and cannot do with your taxes. This can range from filing taxes to representing you in audits.

- Include the necessary details: Full names, addresses, and identification numbers (like Social Security Numbers for individuals or EIN for businesses) are crucial for both the principal and the agent.

- Understand the timeframe: The POA form typically specifies when the agent's power begins and ends. Make sure this timeframe suits your needs.

- State requirements vary: Some states may require witnesses or notarization for the POA form to be valid. Check the requirements in your state.

- Keep records: Once completed, both the principal and the agent should keep copies of the POA form for their records.

- Revocation is possible: The principal has the right to revoke the power of attorney at any time, provided they follow the necessary legal steps to do so.

Handling tax matters can sometimes feel overwhelming, but equipping yourself with the right tools and knowledge, like understanding how to properly fill out and use a Tax POA form, can significantly ease the process. Remember, this document is a powerful one, designed to ensure that your tax affairs are managed according to your wishes, especially when you're unable to do so yourself.

Popular PDF Documents

IRS 6744 - Updated annually, this material includes a series of tests for certifying volunteer tax preparers in various levels of tax law complexity.

Fasfa Parent Plus Loan - Importance of providing complete and accurate information on the Parent PLUS Loan request form.

Kra Waiver Application Letter - Applicants must provide comprehensive personal and business details, including the nature of their business and reasons for removing tax obligations.