Get Tax POA E1285V4 Form

The Tax Power of Attorney (POA) E1285V4 form serves as a critical document for individuals seeking to authorize someone else to handle their tax matters. This form enables a designated person, often referred to as an agent or attorney-in-fact, to represent the principal in dealings with the tax authority. By completing this form, the principal grants the agent the authority to obtain confidential tax information and make decisions regarding tax filings, payments, and disputes. The Tax POA E1285V4 form is especially important for individuals who, due to various reasons such as travel, health issues, or business commitments, cannot manage their tax affairs personally. It ensures that their tax matters are handled efficiently and in accordance with their best interests, relieving them of potential stress and complications with tax authorities. The form must be filled out accurately, detailing the specific powers granted and the duration of the authorization, to ensure that the agent’s actions are legally binding and within the scope of the given authority.

Tax POA E1285V4 Example

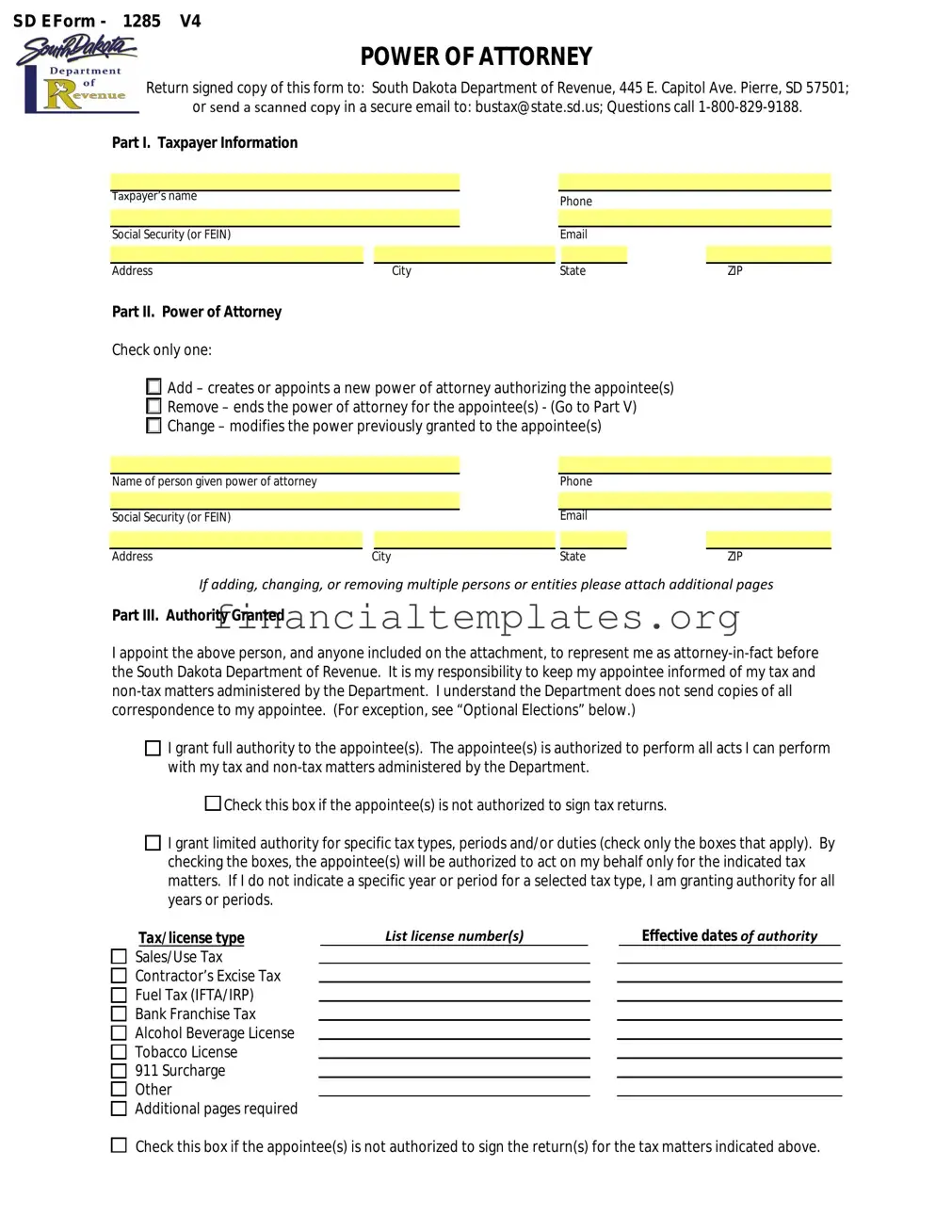

SD EForm - 1285 V4

~

Department of

POWER OF ATTORNEY

Return signed copy of this form to: South Dakota Department of Revenue, 445 E. Capitol Ave. Pierre, SD 57501;

or send a scanned copy in a secure email to: bustax@state.sd.us; Questions call

Part I. Taxpayer Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxpayer’s name |

|

|

|

|

Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security (or FEIN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

City |

|

|

State |

|

ZIP |

Part II. Power of Attorney |

|

|

|

|

|

|

|

Check only one:

Add – creates or appoints a new power of attorney authorizing the appointee(s)

Remove – ends the power of attorney for the appointee(s) - (Go to Part V)

Change – modifies the power previously granted to the appointee(s)

|

|

|

|

|

|

|

|

Name of person given power of attorney |

|

|

|

|

Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security (or FEIN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

City |

|

|

State |

|

ZIP |

If adding, changing, or removing multiple persons or entities please attach additional pages

Part III. Authority Granted

I appoint the above person, and anyone included on the attachment, to represent me as

I grant full authority to the appointee(s). The appointee(s) is authorized to perform all acts I can perform with my tax and

Check this box if the appointee(s) is not authorized to sign tax returns.

I grant limited authority for specific tax types, periods and/or duties (check only the boxes that apply). By checking the boxes, the appointee(s) will be authorized to act on my behalf only for the indicated tax matters. If I do not indicate a specific year or period for a selected tax type, I am granting authority for all years or periods.

Tax/license type |

List license number(s) |

|

|

|

Effective dates of authority |

|

||

Sales/Use Tax |

|

|

|

|

|

|

||

Contractor’s Excise Tax |

|

|

|

|

|

|

|

|

Fuel Tax (IFTA/IRP) |

|

|

|

|

|

|

|

|

Bank Franchise Tax |

|

|

|

|

|

|

|

|

Alcohol Beverage License |

|

|

|

|

|

|

|

|

Tobacco License |

|

|

|

|

|

|

|

|

911Surcharge Other

Additional pages required

Check this box if the appointee(s) is not authorized to sign the return(s) for the tax matters indicated above.

Part IV. Optional Elections.

1. Authorize primary appointee to receive all correspondence, including refunds, from the Department.

I elect to the have South Dakota Department of Revenue send the primary appointee all refunds, legal notices, and correspondence about the tax and nontax debt matters specified in this document. By making this election, I understand that I will no longer receive anything – including refunds and legal notices – from the Department and my primary appointee will receive it on my behalf.

2. Authorize appointee to communicate by email.

I authorize the South Dakota Department of Revenue to communicate by email with my appointee(s). I understand private tax data about me will be sent over the Internet. I accept the risk my data may be accessed by someone other than the intended recipient. I agree the South Dakota Department of Revenue is not liable for any damages I may have as a result of interception.

Part V. Expiration Date and Signature

Expiration Date: ____________________________________________________________

(If no date is provided, this power of attorney and optional elections are valid until removed)

This power of attorney and elections are not valid until this document is signed by the taxpayer before a Notary and received by the Department.

_____________________________________ |

_________________________ |

___________________ |

|

Taxpayer’s signature (corporate officer, partner or fiduciary) |

Print name (and title, if applicable) |

Date |

|

Part VI. Notarization |

|

|

|

State of: |

_______________________ |

|

|

County of: |

_______________________ |

|

|

On this the _____ day of ________________, 20______, before the undersigned, a Notary Public for the State of

_______________________________ personally appeared _______________________________, known to me or

satisfactorily proven to be the person who executed the foregoing instrument, and acknowledged that he executed the same, in capacity as shown, of his own free act and deed.

In witness whereof I hereunto set my hand and official seal this ___ day of ___________, 20____.

__________________________

Notary Public

__________________________

My commission expires on:

Document Specifics

| Fact | Detail |

|---|---|

| Form Name | Tax POA E1285V4 |

| Purpose | This form is used to grant someone else the authority to handle tax matters on your behalf. |

| Who Can File | Individuals or entities looking to authorize another person or entity to act on their behalf for tax purposes. |

| Where to File | The specific office or website where this form should be submitted varies by state and sometimes by local jurisdiction. |

| Required Information | The form typically requires personal information about the grantor and grantee, tax identification numbers, and the specific tax matters and years for which authorization is granted. |

| Governing Laws | For state-specific forms, governance will depend on the individual state's laws regarding tax representation and power of attorney. |

| Expiration | The duration of the granted authority may be specified within the form, otherwise, state laws may dictate the validity period. |

| Revocation | The individual or entity granting the power may revoke it at any time, following the process outlined by state regulations or specified in the form itself. |

Guide to Writing Tax POA E1285V4

Filling out the Tax Power of Attorney Form, designated as E1285V4, is a critical step for taxpayers seeking to authorize an individual, often a tax professional, to handle their tax matters. This document grants the appointed person the authority to communicate with the tax authority on the taxpayer's behalf, request and examine confidential tax information, and perform other tax-related activities as allowed under the form's provisions. Understanding the correct way to complete this form is crucial in ensuring that tax matters are handled efficiently and effectively.

- Start by providing the full legal name of the taxpayer or taxpayers if the form is being completed for jointly filed taxes. Ensure that the name matches the one registered with the tax authority to avoid any processing delays.

- Enter the taxpayer identification number next. For individuals, this would be their Social Security Number (SSN), and for businesses, their Employer Identification Number (EIN).

- Specify the tax form number that the power of attorney will apply to. If the power covers more than one form, list all relevant form numbers clearly to avoid confusion.

- Indicate the year(s) or period(s) for which the power of attorney is being granted. Be precise to prevent any misunderstanding about the duration of the authorization.

- Fill in the name and contact information of the representative to whom you are granting power of attorney. This information should include their full legal name, address, phone number, and, if applicable, their designation or title and the organization they represent.

- If the representative has a Preparer Tax Identification Number (PTIN) or any other relevant identification number, ensure to include this in the designated section.

- Clearly specify the powers being granted to the representative. This may include the authority to receive confidential tax information, represent the taxpayer in tax matters, and sign agreements or consents regarding tax issues.

- If there are any specific acts that the taxpayer wishes to prohibit or restrict, they should be listed clearly in the section provided. This ensures that the representative’s powers are precisely defined according to the taxpayer's wishes.

- The taxpayer(s) must sign and date the form. If the form is for a joint matter, both parties must sign. A witness or notary public may also be required, depending on the state’s regulations.

- Review the entire form for accuracy and completeness before submitting it to the designated tax authority. Errors or omissions may cause delays or rejection of the form.

Once the Tax POA E1285V4 form is fully completed and reviewed for accuracy, it should be submitted according to the tax authority’s instructions. This could involve mailing it to a specific address or submitting it electronically, depending on the options available. It's important to keep a copy for your records and to follow up with the tax authority to ensure the form has been processed and the powers granted are in effect. Promptly addressing tax matters with the proper authorization in place facilitates a smoother interaction with tax officials and helps ensure compliance with tax laws.

Understanding Tax POA E1285V4

-

What is the purpose of the Tax POA E1285V4 form?

The Tax POA (Power of Attorney) E1285V4 form is designed to allow individuals to grant someone else the authority to handle their tax matters. This includes the power to obtain and provide confidential information, make decisions, and represent them in front of tax authorities. The form is typically used when an individual is unable, for various reasons, to manage their tax affairs personally.

-

Who can be appointed as an agent through this form?

Any individual, such as a family member, friend, or professional (like a lawyer, certified public accountant, or enrolled agent) who the taxpayer trusts, can be appointed as an agent. However, the appointed agent must be willing to act on the taxpayer’s behalf and, in the case of professionals, must typically be authorized to practice before the tax authority concerned.

-

What are the main sections of the Tax POA E1285V4 form?

The form typically contains sections for the identification of the taxpayer, identification of the appointed agent(s), the specific tax matters and years for which the power of attorney is granted, and any special instructions. It also includes a declaration that the appointed agent accepts the appointment, along with signatures from both the taxpayer and the agent.

-

How do I revoke a previously granted Tax POA E1285V4?

To revoke a previously granted power of attorney, the taxpayer must provide written notice to the tax authority indicating the desire to revoke the authorization. This notice should include the taxpayer's identification information and details about the power of attorney to be revoked. In some jurisdictions, a new power of attorney form may also automatically revoke any prior authorizations.

-

Are there any limitations to the authority granted by this form?

Yes, the authority granted by the Tax POA E1285V4 form can be limited both in scope and duration, based on what is specified in the form itself. Taxpayers have the flexibility to specify exactly which tax matters and years the agent is authorized to handle. Additionally, special instructions can further restrict or define the powers granted.

-

Where do I file the completed Tax POA E1285V4 form?

The completed form should be submitted to the tax authority overseeing the taxpayer’s affairs. The specific office or location for filing can vary depending on the jurisdiction and the type of tax matters involved. It is essential to refer to the instructions provided by the local tax authority or consult a tax professional to ensure the form is filed correctly.

Common mistakes

Filling out the Tax Power of Attorney (POA) form E1285V4 can often be confusing. While trying to navigate through the form, individuals commonly make mistakes. Recognizing and avoiding these errors can make the process smoother and ensure that their tax matters are handled correctly.

-

Not verifying the version of the form: Always ensure you are using the most current version of form E1285V4, as tax regulations and forms can update frequently.

-

Incorrect information: Entering incorrect personal details, such as misspelled names or wrong social security numbers, can lead to unnecessary delays or the rejection of the form.

-

Omitting relevant years or periods: Failing to specify all tax periods that the POA covers can limit the representative's ability to act effectively on your behalf.

-

Not delineating the representative’s powers: It’s crucial to clearly outline the scope of authority you’re granting to your representative, including any limitations you wish to impose.

-

Choosing an unsuitable representative: The importance of carefully selecting a representative who is both trustworthy and equipped with the necessary knowledge to handle your tax matters cannot be overstated.

-

Forgetting to sign and date the form: An unsigned or undated form is invalid. Double-check that both the taxpayer and the representative have signed and dated the form.

-

Not keeping a copy: Failing to retain a copy of the completed form for your records can pose problems if there’s a dispute or if verification is needed in the future.

-

Ignoring state requirements: Be aware that some states have specific requirements for a Tax POA. It’s wise to check state guidelines to ensure compliance.

Avoiding these mistakes requires a detailed review and understanding of the form E1285V4's instructions and sometimes, seeking advice from a professional. Taking these steps can protect your interests and ensure that your tax matters are managed accurately and efficiently.

Documents used along the form

When dealing with tax matters, specifically when using the Tax Power of Attorney (POA) E1285V4 form, several additional documents might be necessary to ensure everything is handled accurately and thoroughly. These documents play vital roles in clarifying details, providing necessary information, and ensuring that the individual or entity granted the POA can perform their duties effectively.

- IRS Form 2848: This document is the official Power of Attorney and Declaration of Representative form used by the IRS. It allows individuals to grant a specific person the authority to represent them before the IRS, enabling actions like receiving confidential tax information and negotiating with the IRS on their behalf.

- Form 8821, Tax Information Authorization: Unlike Form 2848, Form 8821 authorizes individuals or organizations to request and inspect confidential tax information, but it does not allow them to represent the taxpayer before the IRS.

- Form W-9, Request for Taxpayer Identification Number and Certification: This form is often required to accompany tax-related documents to provide the taxpayer's identification number. It helps in verifying the taxpayer's identity and facilitating tax filings.

- Form 4506-T, Request for Transcript of Tax Return: Individuals or entities granted POA might need access to previous tax returns. This form allows them to request and obtain a transcript of a tax return, which can be crucial for various financial and legal processes.

- Annual Filing Season Program Record of Completion: For those representing taxpayers under the POA E1285V4, showing completion of the IRS’s Annual Filing Season Program might be necessary. It demonstrates that the representative has current knowledge of tax laws and filing procedures.

- State-Specific Tax Power of Attorney Forms: Depending on the taxpayer's state of residence, specific state tax POA forms may also be required to grant similar authorizations at the state level, adhering to state tax laws and regulations.

Together, these documents create a comprehensive toolkit for managing tax matters efficiently and effectively. While the Tax POA E1285V4 form is a critical component, the additional documents ensure that representatives can perform their duties with the necessary information and authority. Understanding each document’s purpose and requirements can significantly streamline the tax handling process.

Similar forms

The Tax Power of Attorney Form, similar to Form 2848 at the federal level, allows an individual to grant authority to another person to handle their tax matters. This form includes specifying details about which types of tax matters and for which years the representative can act. Its structure and purpose closely resemble the federal version, making it a vital tool for those needing representation before the IRS or state tax agencies.

Comparable to the Tax POA is the General Power of Attorney Form. This document grants broader powers to an agent, covering a wide range of affairs beyond just tax matters. It includes financial and legal decision-making powers, but, unlike the Tax POA, it's not limited to tax issues. This similarity lies in the fundamental concept of granting authority to another individual, although the General POA has a wider scope.

The Durable Power of Attorney Form shares the feature of assigning decision-making powers to another person. However, its distinction comes with its durability – it remains in effect even if the person who has granted the powers becomes incapacitated. This feature is crucial for long-term planning, contrasting with the Tax POA’s focus on specific tax-related tasks.

The Medical Power of Attorney Form is another document related in principle to the Tax POA, as it gives someone else authority to make healthcare decisions on the grantor's behalf. Though its domain is healthcare, not taxes, the core idea of assigning decision-making power to another remains consistent across both documents. This highlights how POA forms can cater to various aspects of a person’s life, from health to financial matters.

The Limited Power of Attorney Form parallels the Tax POA by also granting specific powers to an agent, but its applications span beyond just tax matters. This document can be customized to include various tasks, such as selling a car on the grantor's behalf, contrasting with the Tax POA’s exclusive focus on tax affairs. The similarity lies in the concept of granting authority for specified actions.

Another similar document is the Revocation of Power of Attorney Form, which is used to cancel a previously granted power of attorney. It serves as a critical control mechanism, allowing individuals to withdraw powers if situations change or if they're dissatisfied with the agent's actions. This document connects with the Tax POA by setting the groundwork for its potential revocation, underscoring the principle of changeable permissions in POA relationships.

The Advanced Healthcare Directive, sometimes known as a living will, is akin to the Tax POA by providing instructions or preferences for future actions, albeit in the realm of healthcare. It differs by focusing on healthcare decisions in anticipation of incapacity, rather than on financial or tax matters. The connection lies in the forward-looking nature of both documents, planning for circumstances when the individual may not be able to make decisions.

The Financial Information Release Form, similar in function to the Tax POA, specifically authorizes the release of an individual’s financial information to another party. This could include tax records, among other financial documents. While it focuses on the release of information rather than granting authority for actions, it underscores the theme of designated representation and privacy waiver found in the Tax POA.

The Estate Planning Power of Attorney, often part of a comprehensive estate plan, grants an agent authority to manage the principal’s estate matters. It can include tax issues related to the estate, making it relevant to the interests covered by the Tax POA. The estate planning aspect provides a focused application on managing and disposing of assets, resonating with the tax management objectives of the Tax POA.

Lastly, the Business Power of Attorney form empowers an agent to make business-related decisions and actions on behalf of the principal. This can encompass tax matters for the business, aligning it with the Tax POA's scope. The business orientation of this document highlights the multifaceted uses of POAs in professional contexts, extending the principle of delegated authority into the corporate realm.

Dos and Don'ts

When dealing with the Tax Power of Attorney (POA) E1285V4 form, it’s crucial to follow certain dos and don'ts to ensure the process is completed accurately and effectively. Here are five key points to consider:

Do's:

Double-check all information for accuracy before submitting the form. Ensure all names, addresses, and social security numbers match the information on file with the IRS.

Clearly specify the tax matters and years or periods you are authorizing, to avoid any confusion.

Use a blue or black ink pen if filling out the form by hand, to ensure legibility.

Keep a copy of the completed form for your records, as it’s important to have a reference of the authority you’ve granted.

Ensure that both the taxpayer and the representative sign and date the form to validate it.

Don'ts:

Don’t leave any required fields blank. Incomplete forms may be rejected or delayed.

Avoid guessing on any information. If you’re unsure, verify the information before submitting the form.

Don’t use correction fluid or tape. Mistakes should be cleanly crossed out with a single line and initialed, then correct information should be provided next to them or above.

Don’t forget to specify if there are any restrictions to the representative’s authority. If left blank, it may be assumed they have full authority over the specified tax matters.

Do not submit the form without reviewing it with the designated representative, ensuring both parties understand the extent of the authorization being granted.

Misconceptions

When dealing with the Tax Power of Attorney (POA) Form E1285V4, many individuals hold onto misconceptions that can affect their understanding and the steps they take in completing or using the form. Correcting these misconceptions is important to ensure the process goes smoothly and with confidence.

Here are ten common misconceptions about the Tax POA E1285V4 form explained:

- It’s only for the elderly. Many think this form is only for senior citizens, but in reality, anyone can use it. The Tax POA is useful for anyone who needs another person to manage their tax matters, regardless of their age.

- It grants complete control over all financial matters. The Tax POA specifically grants authority related to tax matters, not the entirety of a person’s financial affairs. It’s focused on allowing someone else to handle taxes, not to manage all financial decisions.

- It’s too complicated to fill out. While legal documents can seem daunting, the Tax POA is designed to be straightforward. With clear instructions and specific sections to be filled out, individuals can complete it without needing extensive legal knowledge.

- Lawyers are needed to create one. While legal advice is beneficial, especially in complex situations, anyone can fill out the Tax POA form by themselves or with minimal help. Guidance from tax professionals or utilizing available resources can suffice.

- You lose your rights after signing it. Signing a Tax POA doesn’t mean you lose your rights. It simply authorizes someone else to act on your behalf for tax matters. You retain the right to make decisions and revoke the POA at any time.

- It’s effective immediately and forever. The Tax POA can be set to take effect immediately, or start and end on specified dates. This flexibility ensures that it serves its purpose exactly as needed by the individual who signs it.

- All Tax POAs are the same. The structure and requirements for a Tax POA can vary by state. It’s crucial to use the correct form specific to your state and situation to ensure it’s valid and effective.

- It automatically includes business taxes. If you need a representative for your business taxes, this should be specifically included in the form. Not all Tax POAs automatically cover both personal and business tax matters.

- Filing it with the IRS is necessary for it to be valid. While it's important for the IRS to have a copy if the representative will deal with them directly, the form’s validity comes from properly completing and signing it, not from filing it with the IRS.

- It’s only for when you’re unable to manage your own taxes. Some individuals choose to assign a Tax POA as a convenience, not just out of necessity. It can be a strategic move to ensure taxes are handled by someone with more expertise or time to dedicate to the process.

Understanding the true scope and function of the Tax POA E1285V4 form helps individuals make informed decisions about managing their tax affairs. Clearing up these misconceptions ensures that when someone decides to use a Tax POA, they do so with a comprehensive understanding of its implications.

Key takeaways

Understanding the Tax Power of Attorney (POA) E1285V4 form is crucial for those wishing to authorize someone else to handle their tax matters. Below are key takeaways to ensure its proper completion and utilization:

- Complete Information Is Crucial: Ensure every section of the form is filled out with accurate information. Missing details can lead to processing delays or the form’s rejection.

- Designating a Representative: The form allows you to appoint an individual, such as a tax accountant or attorney, to act on your behalf in matters concerning the taxing authority.

- Specific Powers Granted: Clearly specify the tax matters and years or periods for which the representative has authority. Being explicit helps in avoiding any ambiguity.

- Multiple Representatives: You have the option to appoint more than one representative, but you must specify if they can act independently or must act together.

- Duration of Authority: Indicate the exact period your representative will have power. Without specifying an end date, the POA might remain in effect indefinitely or until legally revoked.

- Revoking Authority: To cancel a previously granted POA, a formal revocation notice must be submitted to the taxing authority, or a new POA form should clearly state the intention to revoke all prior authorizations.

- Witnesses or Notarization: Some jurisdictions may require the POA form to be either witnessed or notarized. Check local laws to ensure compliance.

- Submitting the Form: Understand the correct submission method for your jurisdiction. Some require mail-in submissions, while others may accept electronic filing.

- Keep Records: Always keep a copy of the submitted POA form for your records. Documentation is essential for any future disputes or clarifications.

- Consultation with Professionals: Considering the complexities associated with tax matters, consulting with a tax professional or attorney before appointing a representative is advisable.

By following these guidelines, individuals can more effectively manage their tax matters through a representative, ensuring that their tax responsibilities are handled accurately and efficiently.

Popular PDF Documents

New York Sales Tax Due Dates - Web filing the ST-100 form is a convenient option for many businesses, streamlining the tax reporting process.

Purple Heart Furniture Pick Up - Your officially documented contribution of goods to the Purple Heart Foundation, a significant gesture towards helping veterans and preserving our environment.

Form 4684 Instructions 2022 - It outlines the process to determine the loss value from unexpected events, guiding through deductible calculations.