Get Tax POA dr 835 Form

In the realm of tax documentation, one of the essential tools for authorized representation is the Tax Power of Attorney (POA) DR 835 form. This form serves as a legal document, empowering individuals to nominate others to act on their behalf in matters of tax. The significance of the DR 835 form lies in its capacity to grant designated representatives the authority to inquire, negotiate, and resolve tax issues with the tax authorities. Its utility spans across various circumstances, from simple tax filing assists to complex negotiations with tax agencies. Handling tax affairs can often become an intricate task, necessitating the guidance and advocacy of a knowledgeable envoy. The DR 835 form not only facilitates this representation but also ensures that such delegation is systematically recorded and acknowledged by the pertinent tax authorities. In navigating the nuances of tax obligations and interactions with tax agencies, the DR 835 form emerges as a critical document, streamlining the process of tax management and representation for individuals and businesses alike.

Tax POA dr 835 Example

I |

|

|

|

|

|

|

||

|

|

Florida Department of Revenue |

|

|

|

|||

1111111111111111111111111111111111 |

|

|

|

Florida |

R. 10/11 |

|||

|

I iiiiiiiiiiiiiiiiiiiiiiiiiiiiii~I |

|

|

Effective 01/12 |

||||

|

|

|

|

POWER OF ATTORNEY |

|

|

|

TC |

|

|

|

|

and Declaration of Representative |

|

|

|

Administrative Code |

|

|

|

|

L!;;;;;;;;;;;;;l |

|

|

|

Rule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See Instructions for additional information |

|

|

|

|

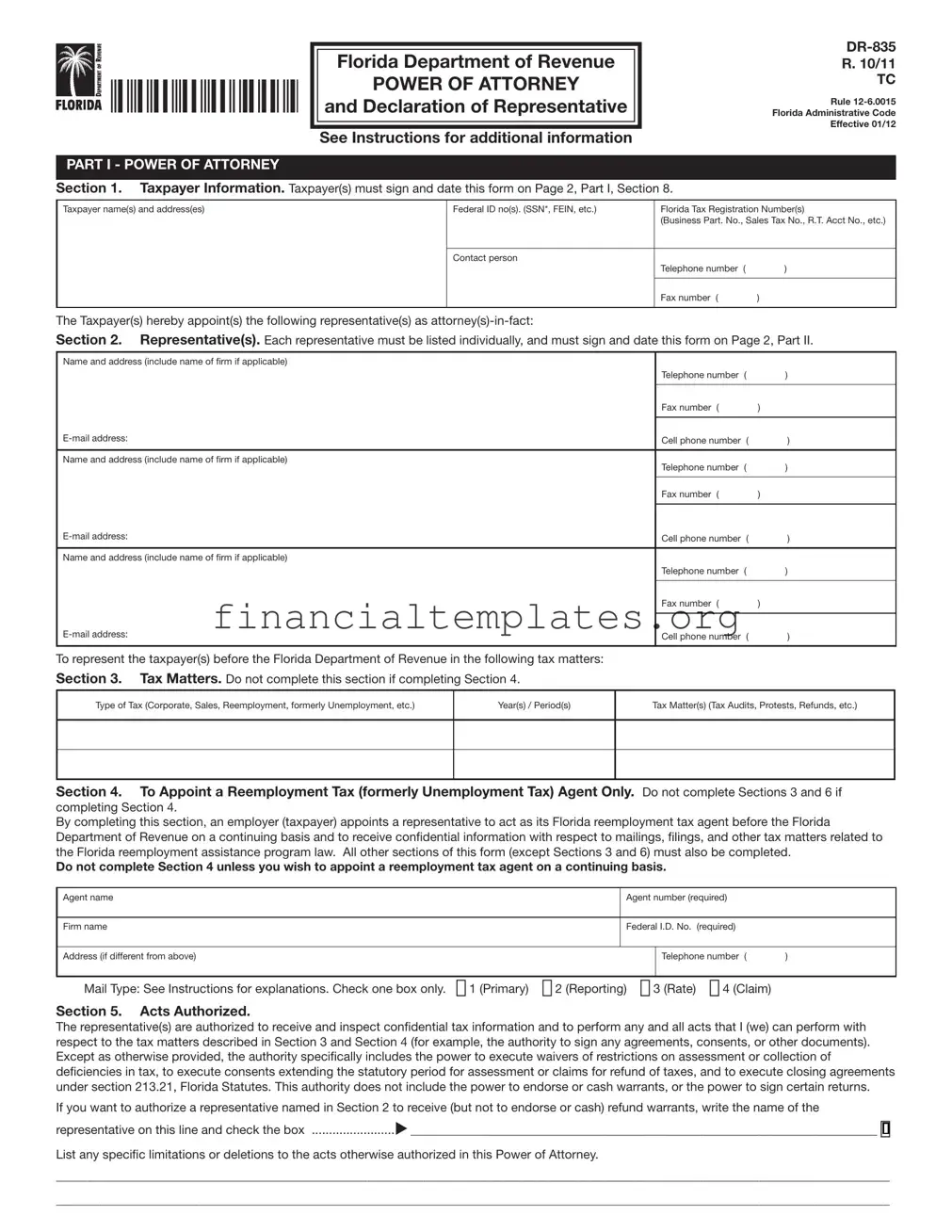

PART I - POWER OF ATTORNEY

Section 1. Taxpayer Information. Taxpayer(s) must sign and date this form on Page 2, Part I, Section 8.

Taxpayer name(s) and address(es) |

Federal ID no(s). (SSN*, FEIN, etc.) |

Florida Tax Registration Number(s) |

|

|

|

(Business Part. No., Sales Tax No., R.T. Acct No., etc.) |

|

|

|

|

|

|

Contact person |

Telephone number ( |

) |

|

|

||

|

|

|

|

|

|

Fax number ( |

) |

|

|

|

|

The Taxpayer(s) hereby appoint(s) the following representative(s) as

Section 2. Representative(s). Each representative must be listed individually, and must sign and date this form on Page 2, Part II.

Name and address (include name of frm if applicable) |

|

|

|

|

Telephone number |

( |

) |

|

|

|

|

|

Fax number ( |

|

) |

|

|

|

|

Cell phone number |

( |

) |

|

|

|

|

|

Name and address (include name of frm if applicable) |

Telephone number |

( |

) |

|

|||

|

|

|

|

|

Fax number ( |

|

) |

|

|

|

|

Cell phone number |

( |

) |

|

|

|

|

|

Name and address (include name of frm if applicable) |

|

|

|

|

Telephone number |

( |

) |

|

|

|

|

|

Fax number ( |

|

) |

|

|

|

|

Cell phone number |

( |

) |

|

|

|

|

|

To represent the taxpayer(s) before the Florida Department of Revenue in the following tax matters:

Section 3. Tax Matters. Do not complete this section if completing Section 4.

Type of Tax (Corporate, Sales, Reemployment, formerly Unemployment, etc.)

Year(s) / Period(s)

Tax Matter(s) (Tax Audits, Protests, Refunds, etc.)

Section 4. To Appoint a Reemployment Tax (formerly Unemployment Tax) Agent Only. Do not complete Sections 3 and 6 if completing Section 4.

By completing this section, an employer (taxpayer) appoints a representative to act as its Florida reemployment tax agent before the Florida Department of Revenue on a continuing basis and to receive confdential information with respect to mailings, flings, and other tax matters related to the Florida reemployment assistance program law. All other sections of this form (except Sections 3 and 6) must also be completed.

Do not complete Section 4 unless you wish to appoint a reemployment tax agent on a continuing basis.

Agent name |

Agent number (required) |

|

|

|

|

|

|

Firm name |

Federal I.D. No. (required) |

|

|

|

|

|

|

Address (if different from above) |

|

Telephone number ( |

) |

|

|

|

|

Mail Type: See Instructions for explanations. Check one box only. ❑ 1 (Primary) ❑ 2 (Reporting) ❑ 3 (Rate) ❑ 4 (Claim)

Section 5. Acts Authorized.

The representative(s) are authorized to receive and inspect confdential tax information and to perform any and all acts that I (we) can perform with respect to the tax matters described in Section 3 and Section 4 (for example, the authority to sign any agreements, consents, or other documents). Except as otherwise provided, the authority specifcally includes the power to execute waivers of restrictions on assessment or collection of defciencies in tax, to execute consents extending the statutory period for assessment or claims for refund of taxes, and to execute closing agreements under section 213.21, Florida Statutes. This authority does not include the power to endorse or cash warrants, or the power to sign certain returns.

If you want to authorize a representative named in Section 2 to receive (but not to endorse or cash) refund warrants, write the name of the

representative on this line and check the box |

u___________________________________________________________________________ ❑ |

List any specifc limitations or deletions to the acts otherwise authorized in this Power of Attorney.

______________________________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________________________

I |

|

|

|

|

111111111111111111111111111111111111111 |

R. 10/11 |

|

|

|||

|

Page 2 |

||

|

|

|

Florida Tax Registration Number: |

Taxpayer Name(s): |

Federal Identifcation Number: |

||

•Taxpayer(s) must complete Page 1 of this Power of Attorney or it will not be processed.

Section 6. Notices and Communication. Do not complete Section 6 if completing Section 4.

•Notices and other written communications will be sent to the first representative listed in Part I, Section 2, unless the taxpayer selects one of the options below. Receipt by either the representative or the taxpayer will be considered receipt by both.

a. |

If you want notices and communications sent to both you and your representative, check this box |

u |

❑ |

b. |

If you want notices or communications sent to you and not your representative, check this box |

u |

❑ |

Certain

Section 7. Retention / Nonrevocation of Prior Power(s) of Attorney.

The fling of this Power of Attorney will not revoke earlier Power(s) of Attorney on fle with the Florida Department of Revenue, even for the same tax matters and years or periods covered by this document. If you want to revoke a prior Power of

Attorney, check this box |

u ❑ |

You must attach a copy of any Power of Attorney you wish to revoke.

Section 8. Signature of Taxpayer(s).

If a tax matter concerns a joint return, both husband and wife must sign if joint representation is requested. If signed by a corporate offcer, partner, member/managing member, guardian, tax matters partner/person, executor, receiver, administrator, trustee, or fduciary on behalf of the taxpayer, I declare under penalties of perjury that I have the authority to execute this form on behalf of the taxpayer.

Under penalties of perjury, I (we) declare that I (we) have read the foregoing document, and the facts stated in it are true.

If this Power of Attorney is not signed and dated, it will be returned.

_______________________________________________________________________________________ |

________________________________________ |

_________________________________________ |

Signature |

Date |

Title (if applicable) |

_______________________________________________________________________________________ |

|

|

Print name |

|

|

_______________________________________________________________________________________ |

________________________________________ |

_________________________________________ |

Signature |

Date |

Title (if applicable) |

_______________________________________________________________________________________ |

|

|

Print name |

|

|

PART II - DECLARATION OF REPRESENTATIVE

Under penalties of perjury, I declare that:

•I am familiar with the mandatory standards of conduct governing representation before the Department of Revenue, including Rules

•I am familiar with the law and facts related to this matter and am qualified to represent the taxpayer(s) in this matter.

•I am authorized to represent the taxpayer(s) identified in Part I for the tax matter(s) specified therein, and to receive and inspect confidential taxpayer information.

•I am one of the following:

a.Attorney - a member in good standing of the bar of the highest court of the jurisdiction shown below.

b.Certifed Public Accountant - duly qualifed to practice as a certifed public accountant in the jurisdiction shown below.

c.Enrolled Agent – enrolled as an agent pursuant to the requirements of Treasury Department Circular Number 230.

d.Former Department of Revenue Employee. As a representative, I cannot accept representation in a matter upon which I had direct involvement while I was a public employee.

e.Reemployment Tax Agent authorized in Section 4 of this form.

f.Other Qualifed Representative

•I have read the foregoing Declaration of Representative and the facts stated in it are true.

If this Declaration of Representative is not signed and dated, it will not be processed.

Designation – Insert |

Jurisdiction (State) and |

Signature |

Letter from Above (a |

Enrollment Card No. (if any) |

|

|

|

|

Date

Made fillable by FormsPal.

POWER OF ATTORNEY INSTRUCTIONS

R.10/11 Page 3

Purpose of this form

A Power of Attorney (Form

to an attorney, certifed public accountant, enrolled agent, former Department employee, reemployment tax agent, or any other qualifed individual. A Power of Attorney is a legal document authorizing someone other than yourself to act as your representative.

You may use this form for any matters affecting any tax administered by the Department of Revenue. This includes both the audit and collection processes. A Power of Attorney will remain in effect until you revoke it. If you provide more than one Power of Attorney with respect to a tax and tax period, the Department employee handling your case will address notices and correspondence relative to that issue to the frst person listed on the latest Power of Attorney.

A Power of Attorney Form is generally not required, if the representative is, or is accompanied by: a trustee, a receiver, an administrator, an executor of an estate, a corporate offcer, or an authorized employee of the taxpayer.

Photocopies and fax copies of Form

How to Complete Form

PART I POWER OF ATTORNEY

Section 1 – Taxpayer Information

•For individuals and sole proprietorships: Enter your name, address, social security number, and telephone number(s) in the spaces provided. Enter your federal employer identifcation number (FEIN), if you have one. If a joint return is involved, and you and your spouse are designating the same

•For a corporation, limited liability company, or partnership: Enter the name, business address, FEIN, a contact person familiar with this matter, and telephone number(s).

•For a trust: Enter the name, title, address, and telephone number(s) of the fduciary, and name and FEIN of the trust.

•For an estate: Enter the name, title, address, and telephone number(s) of the decedent’s personal representative, and the name and identifcation number of the estate. The identifcation number for an estate includes both the FEIN if the estate has one and the decedent’s social security number.

•For any other entity: Enter the name, business address, FEIN, and telephone number(s), as well as the name of a contact person familiar with this matter.

•Identifcation Number: The Department may have assigned you a Florida tax registration number such as a sales tax number, a reemployment tax account number, or a business partner number. These numbers further assist the Department in identifying your particular tax matter, and you should enter them in the appropriate box. If you do not provide this information, the Department may not be able to process the Power of Attorney.

Section 2 – Representative(s)

Enter the individual name, frm name (if applicable), address, telephone number(s), and fax number of each individual appointed as

Section 3 – Tax Matters

Enter the type(s) of tax this Power of Attorney authorization applies to and the years or periods for which the Power of Attorney is granted. The word “All” is not specifc enough. If your tax situation does not ft into a tax type or period (for example, a specifc administrative appeal, audit, or collection matter), describe it in the blank space provided for “Tax Matters.” The Power of Attorney can be limited to specifc reporting period(s) that can be stated in year(s), quarter(s), month(s), etc., or can be granted for an indefnite period. You must indicate the tax types, periods, and/or matters for which you are authorizing representation by your

Examples: |

|

|

Sales and Use Tax |

First and second quarter 2008 |

|

Corporate Income Tax |

|

7/1/07 – 6/30/08 |

Communications Services Tax |

|

2006 thru 2008 |

Insurance Premium Tax |

|

1/1/06 – 12/31/08 |

Technical Assistance Advisement Request |

dated 8/6/08 |

|

Claim for Refund |

|

3/7/07 |

Section 4 – To Appoint a Reemployment Tax Agent Complete this section only if you wish to appoint an agent for reemployment taxes on a continuing basis. You should not complete Section 3 or Section 6, but you must complete the remaining sections of Form

Enter the agent’s name. It must be the same name as found in Section 2. Enter the frm name and address. You do not need to complete the address line if you reported that information in Section 2.

1.Enter the agent number. The agent number is a

2.Enter the federal employer identifcation number. The FEIN is a

3.Select the mail type.

Primary Mail. If you select primary mail, the agent will receive all documents from the Department of Revenue related to this reemployment tax account, and will be authorized to receive confdential information and discuss matters related to the tax and wage report, beneft information, claims, and the employer’s rate.

Reporting Mail. If you select reporting mail, the agent will receive the Employer’s Quarterly Report (Form

Rate Mail. If you select rate mail, the agent will receive tax rate notices and correspondence related to the rate and will be authorized to receive confdential information and discuss the employer’s rate notices and rate with the Department.

Claims Mail. If you select claims mail, the agent will receive the notice of benefts paid, and will be authorized to receive confdential information and discuss matters related to benefts.

Note: Duplicate copies of certain

Note: If you wish to appoint a representative to act on your behalf in a specifc and

Section 5 – Acts Authorized

Your signature on the back of the Power of Attorney authorizes the individual(s) you designate (your representative or

Section 6 – Mailing of Notices and Communications

If you do not check a box, the Department will send notices and other written communications to the frst representative listed in Section 2, unless you select another option. If you wish to have no documents sent to your representative, or documents sent to both you and your representative, you should check the appropriate box in Section 6. Check the second box if you wish to have notices and other written communications sent to you and not to your representative. In certain instances, the Department can only send documents to the taxpayer. Therefore, the taxpayer has the responsibility of keeping the representative informed of tax matters.

Note: Taxpayers completing Section 4 (To Appoint a Reemployment Tax Agent Only) should not complete Section 6. See Section 4 of these instructions for information regarding notices and communications sent to a reemployment tax agent.

Section 7 – Retention/Nonrevocation of Prior Power(s) of Attorney The most recent Power of Attorney will take precedence over, but will not revoke, prior Powers of Attorney. If you wish to revoke a prior Power of Attorney, you must check the box on the form and attach a copy of the old Power of Attorney.

Section 8 – Signature of Taxpayer(s)

The Power of Attorney is not valid until signed and dated by the taxpayer. The individual signing the Power of Attorney is representing, under penalties of perjury, that he or she is the taxpayer or authorized to execute the Power of Attorney on behalf of the taxpayer.

•For a corporation, trust, estate, or any other entity: A corporate offcer or person having authority to bind the entity must sign.

•For partnerships: All partners must sign unless one partner is authorized to act in the name of the partnership.

•For a sole proprietorship: The owner of the sole proprietorship must sign.

•For a joint return: Both husband and wife must sign if the representative represents both. If the representative only represents one spouse, then only that spouse should sign.

PART II – DECLARATION OF REPRESENTATIVE

Any party who appears before the Department of Revenue has the right, at his or her own expense, to be represented by counsel or by a qualifed representative. The representative(s) you name must declare, under penalties of perjury, that he or she is qualifed to represent you in this matter and will comply with the mandatory standards of conduct

R. 10/11

Page 4

governing representation before the Department of Revenue. The representative(s) must also declare, under penalties of perjury, that he or she has been authorized to represent the taxpayer(s) in this matter and authorized by the taxpayer(s) to receive confdential taxpayer information.

The representative(s) you name must sign and date this declaration and enter the designation (i.e., items

a.Attorney – Enter the

b.Certifed Public Accountant – Enter the

c.Enrolled Agent – Enter the enrollment card number issued by the Internal Revenue Service.

d.Former Department of Revenue Employee – Former employees may not accept representation in matters in which they were directly involved, and in certain cases, on any matter for a period of two years following termination of employment. If a former Department of Revenue employee is also an attorney or CPA, then the additional designation, jurisdiction, and enrollment card should also be entered.

e.Reemployment Tax Agent – A person(s) appointed under Section 4 of the Power of Attorney to handle reemployment tax matters on a continuing basis. A separate Power of Attorney form must be completed in order for a reemployment tax agent to handle a specifc and

f.Other Qualifed Representative – An individual may represent a taxpayer before the Department of Revenue if training and experience qualifes that person to handle a specifc matter.

Rule

(a)Engage in conduct involving dishonesty, fraud, deceit, or misrepresentation.

(b)Engage in conduct that is prejudicial to the administration of justice.

(c)Handle a matter that the representative knows or should know that he or she is not competent to handle.

(d)Handle a legal or factual matter without adequate preparation.

*Social security numbers (SSNs) are used by the Florida Department of Revenue as unique identifers for the administration of Florida’s taxes. SSNs obtained for tax administration purposes are confidential under sections 213.053 and 119.071, Florida Statutes, and not subject to disclosure as public records. Collection of your SSN is authorized under state and federal law. Visit our Internet site at www.foridarevenue.com and select “Privacy Notice” for more information regarding the state and federal law governing the collection, use, or release of SSNs, including authorized exceptions.

Where to Mail Form

If Form

If Form

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Tax POA DR 835 form is used to grant authorization to another individual or entity to represent the taxpayer before the tax authority and make decisions regarding tax matters. |

| State Specificity | This form is specific to the state of Florida and is governed by the laws and regulations of the Florida Department of Revenue. |

| Authorization Scope | The form allows for a wide range of authorizations, including, but not limited to, obtaining confidential tax information and making agreements or compromises. |

| Validity Period | The period of validity can be defined by the taxpayer but has legal limitations on the maximum duration under state law. |

| Revocation | Authorization granted through the DR 835 form can be revoked by the taxpayer at any time, subject to the procedures outlined by Florida's tax authority. |

| Who Can Serve as an Agent | Typically, a qualified individual such as a tax attorney, certified public accountant, or other individuals authorized under Florida law can serve as an agent. |

| Requirements for Validity | The form must be completed in accordance with the guidelines set by the Florida Department of Revenue, including all necessary taxpayer and agent information and signatures. |

| Filing the Form | The completed form must be submitted to the designated office or electronically, depending on the methods approved by the Florida Department of Revenue. |

Guide to Writing Tax POA dr 835

After deciding to authorize someone else to handle your tax matters, the next step is filling out the Tax Power of Attorney (POA) form, specifically the DR 835. By completing this form, you are granting permission for an individual, typically a tax professional, to communicate with tax authorities on your behalf. It's important for this process to be done carefully to ensure your tax matters are handled accurately and confidentially.

Here's a step-by-step guide to help you fill out the form successfully:

- Start by filling in your full name and address in the designated spaces. Make sure to use the address where you receive your tax correspondence.

- Enter your telephone number and email address. This contact information is crucial in case the tax authority needs to reach out to you directly.

- Provide your Taxpayer Identification Number (TIN), which could be your Social Security Number (SSN) or Employer Identification Number (EIN).

- Next, detail the name and address of the individual or firm you are authorizing. This is the person or entity that will have the power to deal with your tax matters.

- Include the representative’s telephone number, fax number, and email address. These contact details are necessary for seamless communication between the tax authority and your representative.

- Clearly specify the tax matters and years or periods for which the authorization is granted. This helps in defining the scope of the POA, ensuring your representative only deals with the matters you’ve designated.

- If there are specific forms or tax types you want your representative to have access to, list these in the appropriate section of the form. Being specific here helps prevent any unauthorized access to your tax information.

- Important: Check the box if the representative is to receive copies of notices and communications from the tax authority. This is vital for ensuring they are well-informed about your tax matters.

- Read the declaration carefully. It outlines what you are authorizing, including any limitations to the POA.

- Sign and date the form at the bottom. Your signature officially grants the authorization to your appointed representative.

- If applicable, have your appointed representative also sign and date the form. Their signature acknowledges their acceptance of the designated responsibilities.

Once you've filled out the form, review it to ensure all the information provided is accurate and complete. Then, submit it to the appropriate tax authority as directed. Remember, by granting someone power of attorney, you are not relinquishing your own rights to access or manage your tax affairs. You can revoke the authorization any time if your situation or preferences change.

Understanding Tax POA dr 835

What is a Tax Power of Attorney (POA) DR 835 form?

The Tax Power of Attorney (POA) DR 835 form is a legal document that allows an individual (the principal) to grant another person (the agent or attorney-in-fact) the authority to handle their tax matters with the state’s tax department. This could include filing taxes, obtaining confidential tax information, and making decisions on behalf of the principal.

Who can act as an agent on a DR 835 form?

On a DR 835 form, an agent can be anyone the principal trusts to manage their tax affairs. This often includes certified public accountants (CPAs), tax attorneys, enrolled agents, or sometimes a trusted family member. The principal should choose someone who is knowledgeable about tax law and whom they trust implicitly.

How do you fill out a DR 835 form?

Filling out a DR 835 form involves providing detailed information about the principal and the agent, including their full names, addresses, and contact information. It also requires specifying the tax matters and years for which the agent is given authority. The form must be signed and dated by the principal, and in some cases, it may also need to be signed by the agent.

Does the DR 835 form need to be notarized?

The requirements for notarization can vary. In some jurisdictions, the DR 835 form does not need to be notarized. However, to ensure the form’s acceptance by the tax authority and to verify the identity of the signing parties, it is often recommended to have the form notarized.

When should you use a DR 835 form?

You should use a DR 835 form when you need someone else to handle your tax matters with the state tax authority. This could be due to lack of expertise, absence during the tax filing period, or any other reason that prevents you from managing your taxes directly.

Is there a fee to file a DR 835 form?

Typically, there is no fee charged by the state tax authority to file a DR 835 form. However, if you require the services of a professional, such as a CPA or tax attorney, to act as your agent or to assist in filling out the form, they may charge a fee for their services.

How long does the authority granted by a DR 835 form last?

The duration of the authority granted by a DR 835 form can vary. The form usually includes a section where the principal can specify an expiration date. If no expiration date is provided, the authority could continue indefinitely, or until it is revoked by the principal.

Can the principal revoke the authority granted in a DR 835 form?

Yes, the principal can revoke the authority granted in a DR 835 form at any time. Revoking the authority typically requires providing written notice to the tax authority and the agent, effectively canceling the agent's power to act on the principal's behalf.

Where can you find a DR 835 form?

A DR 835 form can usually be found on the official website of the state tax authority. It may also be available through tax professionals or by directly contacting the tax authority to request a copy.

Common mistakes

Filling out the Tax Power of Attorney (POA) DR 835 form comes with its set of challenges. It is crucial to get it right to ensure your tax matters are handled as you intend. However, people often stumble over some common pitfalls during the process. Here are four mistakes to watch out for:

-

Not providing complete information about the representative. It's important to fill out every field related to your representative's details accurately. This includes their full name, address, and telephone number. Leaving out any of this information can lead to delays or the form being returned for corrections.

-

Failure to specify the tax matters and years correctly. The DR 835 form requires you to indicate the tax types and the years or periods your representative will have authority over. Being vague or incorrect when detailing these specifics can limit your representative's ability to act on your behalf effectively.

-

Forgetting to sign and date the form. It might seem obvious, but it's a surprisingly common oversight. Your signature and the date confirm that you are granting POA willingly and acknowledge the form's contents. Without this, the document is not valid.

-

Overlooking the need for a witness or notary. Depending on your state’s requirements, a witness or notary public may need to sign the form to validate it. Not adhering to this step can render the whole effort null and void, hence it’s crucial to understand and follow the guidelines specific to your situation.

By maneuvering around these common errors with care and attention, you can ensure that your Tax POA DR 835 form is properly filled out and accepted on the first try. Proper completion of this form is pivotal for effective representation in tax matters, so take the time to review each section carefully.

Documents used along the form

When navigating the complexities of tax matters, particularly those requiring a Tax Power of Attorney (POA) through form DR 835, individuals often find themselves managing multiple documents to ensure a comprehensive approach to their tax responsibilities. The Tax POA DR 835 form empowers a designated representative to handle tax affairs on behalf of another person, but it is just a piece of the puzzle. Several other documents commonly complement the Tax POA to provide a full scope of authority and clarity in tax matters.

- IRS Form 2848, Power of Attorney and Declaration of Representative: This document gives an individual or entity the authority to represent the taxpayer before the IRS, allowing them to receive and inspect confidential tax information. It is particularly useful in situations requiring representation at a federal level, complementing the state-specific DR 835 form.

- Form 8821, Tax Information Authorization: Form 8821 authorizes any individual, corporation, firm, organization, or partnership to inspect and receive confidential information in any office of the IRS for the type of tax and the years or periods you list on the form. Unlike Form 2848, it does not allow the designated party to represent the taxpayer before the IRS or sign documents.

- IRS Form 4506-T, Request for Transcript of Tax Return: Often used alongside the Tax POA, this form allows individuals to request a transcript of their tax returns or other tax-related documents. This can be particularly helpful for the representative to understand the taxpayer's past filings and make informed decisions.

- IRS Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns: This form is relevant for businesses operating under a power of attorney arrangement. It allows the business to request an extension for filing its tax returns, offering additional time for the designated representative to gather necessary information and ensure accurate filings.

- State-Specific Tax Forms: Depending on the state, there might be additional or alternative state-specific tax forms to the DR 835 that need to be completed to fully address state tax matters. These forms are necessary to grant powers of attorney or request information specific to a state's tax regulations.

Together, these documents form a toolkit that, alongside the Tax POA DR 835, equips individuals and businesses to manage their tax affairs with greater efficiency and efficacy. Each document serves a specific purpose, from authorizing representatives to deal with the IRS, to granting access to essential tax records, and ensuring compliance with both federal and state tax laws. This collective approach ensures a well-rounded strategy in handling tax matters, ensuring nothing is overlooked.

Similar forms

The Tax Power of Attorney (POA) DR 835 form is closely related to other documents that authorize someone to act on another's behalf, especially in financial and legal matters. One such document is the General Power of Attorney form. This document grants broad powers to an agent to handle a wide range of actions and decisions for the principal, covering legal, financial, and personal matters. Unlike the Tax POA, which is specifically tailored for tax purposes, the General Power of Attorney encompasses a wider spectrum of the principal's affairs.

Another similar document is the Durable Power of Attorney. The key characteristic that distinguishes it from the Tax POA DR 835 form is its durability. It remains in effect even if the principal becomes mentally incapacitated. While the Tax POA focuses on tax-related matters, the Durable Power of Attorney covers a broad area of decisions and remains effective under circumstances that would otherwise revoke a standard Power of Attorney.

The Limited Power of Attorney is also akin to the Tax POA but with a more narrowed focus. It authorizes the agent to perform specific acts for a limited time, such as selling a property or managing certain financial transactions. The Tax POA DR 835 is essentially a type of Limited Power of Attorney, specifically designed for handling the principal's tax matters with the designated tax authority.

The Medical Power of Attorney is another variant, granting an agent the authority to make healthcare decisions on behalf of the principal if they are unable to do so. Although serving a completely different domain, the essence of representing someone and making crucial decisions is a common thread it shares with the Tax POA DR 835.

The Financial Power of Attorney, similar to the Tax POA, focuses specifically on the principal's financial affairs. However, it covers a broader range of financial matters beyond just tax issues, such as managing bank accounts, investing, and buying or selling real estate, thereby offering a comprehensive financial management tool.

An Advanced Directive, or Living Will, is another related document that specifies a person’s healthcare preferences in the event they become incapable of making decisions themselves. While it doesn’t appoint an agent like the Tax POA DR 835, it shares the concept of making preemptive decisions to guide future actions on one’s behalf.

The Estate Plan documents, including wills and trusts, have a conceptual similarity with the Tax POA DR 835 as they involve making arrangements on behalf of the principal for future scenarios. These documents specifically deal with the distribution of an individual's estate after their death, but like the Tax POA, they involve delegating responsibilities and outlining specific instructions to be carried out by another individual or entity.

Last but not least, a Business Power of Attorney allows a business owner to appoint someone to handle their business affairs. This can include financial decisions, contractual agreements, or any other business-related matter. Similar to the Tax POA DR 835, this document enables a trusted individual to act in the best interest of the principal concerning specific, often complex, matters.

Dos and Don'ts

Understanding the importance of accurately filling out the Tax POA DR 835 form is essential for ensuring your tax matters are handled properly. Here are some crucial dos and don'ts to consider:

Do:Read the instructions thoroughly before you begin. Each section of the form has its specifications and requirements, so understanding them fully is crucial for accurate completion.

Use black ink or type your responses. This ensures that your information is legible and can be processed efficiently by the tax authorities.

Provide complete information for the taxpayer and the representative. This includes full names, addresses, and contact details. Incomplete information can lead to delays or complications.

Specify the tax matters and years or periods clearly. Make sure to list precisely which types of taxes and for what years or periods the representative has the authority to handle.

Sign and date the form. The form is not valid unless it is signed by the taxpayer (or the taxpayer’s authorized representative). Ensure that the date of signing is also included.

Do not leave any sections blank that are applicable to your situation. If a section does not apply, it is better to put ‘N/A’ than to leave it empty, which could be interpreted as an oversight.

Do not forget to revoke previous POAs if intended. If this form is meant to replace any previously granted powers of attorney, you must indicate this clearly to avoid any confusion.

By following these guidelines, you can avoid common mistakes and ensure that your Tax POA DR 835 form is filled out correctly and effectively. Remember, accuracy and clarity are key when dealing with legal documents and tax matters.

Misconceptions

Understanding the correct use and capabilities of the Tax Power of Attorney, DR 835 form, is essential for anyone dealing with tax matters, either personally or for someone else. Misconceptions about this form can lead to confusion, misuse, or missed opportunities for those it's designed to assist. Here are ten common misconceptions explained:

- The DR 835 form is only for businesses. This form is not solely for businesses; it applies to individuals as well. Anyone needing to grant another person the authority to handle their tax matters can use it.

- It grants unlimited power. The Tax POA, DR 835 form, does not grant unlimited power to the agent. It specifically relates to tax matters and its scope is defined by the granter, who can limit the authority given.

- Any tax professional can be an agent. While many tax professionals can serve as agents, they must be eligible to practice before the IRS or the respective state tax authority. It’s important to verify their eligibility.

- It's valid in all states. The DR 835 form applies to a specific jurisdiction. If taxes are filed in multiple states, separate forms might be needed for each state, according to their laws and requirements.

- Signing over a POA is permanent. The granter of the power can revoke it at any time. The form is not inherently permanent and will also usually have an expiration date specified by the issuer.

- The form covers personal and business taxes together. The DR 835 must specify what tax matters and years are covered. If someone needs authority over both personal and business taxes, this must be explicitly detailed.

- Completion of the form is complicated. While accuracy is crucial, completing the Tax POA, DR 835, isn't inherently complicated. Clear instructions are provided, and professional help is available if needed.

- Filing electronically is not an option. Electronic filing of the DR 835 form is available and encouraged in many jurisdictions, providing a quicker and more secure method of submission.

- It allows the agent to sign tax returns. Not all POAs include the authority to sign tax returns on behalf of the granter. This power must be specifically granted within the scope of the form.

- Only one agent can be named. It's possible to name more than one agent on the DR 835 form. However, the granter should specify whether these agents can act independently or if they must make decisions jointly.

Correct understanding and use of the Tax POA, DR 835 form, ensure that taxpayers can effectively manage their tax affairs through a trusted representative, without misconceptions leading to unintended consequences.

Key takeaways

The Tax Power of Attorney (POA) DR 835 form is a critical document that allows a designated individual, often referred to as an agent or attorney-in-fact, to make decisions and act on behalf of another person (the principal) in matters related to state taxation. Understanding how to correctly fill out and use this form is essential for ensuring that tax matters are handled efficiently and legally. Below are key takeaways to aid in this process.

- The POA form must be fully completed with accurate information to be considered valid. This includes the full legal names, addresses, and identification numbers of the principal and the agent.

- Specific tax matters and the years or periods for which the agent is granted authority must be clearly defined in the document. Ambiguity in granting authority can lead to complications and delays.

- Multiple agents can be appointed, but the form should clarify whether each agent can act independently or if all must make decisions together.

- For the POA to be recognized by tax authorities, it must be signed and dated by the principal. An agent's signature is not mandatory unless the form specifies otherwise.

- An effective date can be specified on the form. If not, the POA is considered effective immediately upon signing.

- Limitations or specific powers can be granted to the agent through the POA form. It's important to detail these restrictions clearly to avoid misunderstandings.

- Revocation of a prior POA must be done in writing. Simply completing a new POA form does not automatically revoke a previous one unless it is explicitly stated.

- Digital signatures may be accepted depending on the state’s regulations. It's important to verify whether digital completion and signatures are permitted.

- The completed POA form should be filed with the appropriate state tax authority, often the department of revenue, for the state in which it is to be used.

- Keeping a copy of the filed POA form is crucial for both the principal and the agent. This ensures that both parties have a record of the granted authority and its terms.

Proper completion and filing of the Tax POA DR 835 form are foundational to managing tax affairs through an appointed agent efficiently. It fosters a clear understanding between the principal, the agent, and the tax authorities regarding the extent and limitations of the granted powers. Adhering to these key takeaways will aid in navigating the complexities of tax representation.

Popular PDF Documents

Wisconsin Income Tax Forms - Urges careful consideration of all financial assets and liabilities, as these figures critically impact the evaluation of installment agreement requests.

Irs Power of Attorney - Enables seamless transfer of responsibility for tax matters to someone with the necessary expertise and qualifications.

8879-f - Required for e-filing, Form 8879-EO provides a clear procedure for officers to authorize and review the organization's tax returns.