Get Tax POA DO-10 Form

Navigating the complexities of tax matters can be a daunting task for many individuals. In such situations, authorizing someone else to handle your tax-related issues can offer peace of mind and ensure that everything is managed efficiently. This is where the Tax Power of Attorney (POA) DO-10 form steps in as a critical tool. It is designed to grant a specified individual or entity the authority to represent another person in matters related to taxes. Whether it's for filing returns, communicating with tax authorities, or making necessary decisions, the DO-10 form ensures that your tax matters are in capable hands. The form is straightforward, but its implications are profound, serving as a legal document that officially delegates tax authority. Understanding its major aspects, including when and how to use it, who can be designated, and the scope of powers granted, is essential for anyone looking to navigate their tax affairs with more ease and confidence.

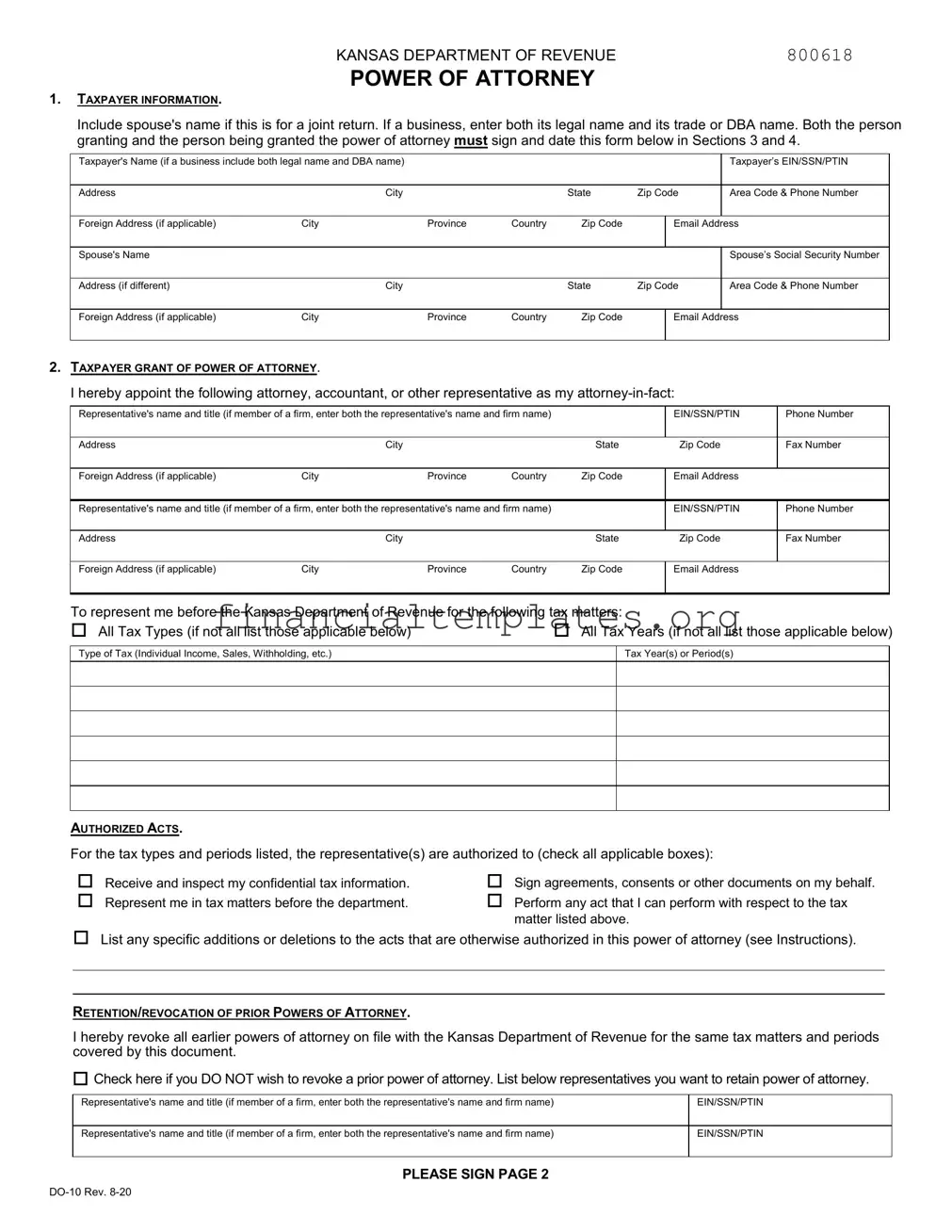

Tax POA DO-10 Example

KANSAS DEPARTMENT OF REVENUE |

800618 |

POWER OF ATTORNEY

1.TAXPAYER INFORMATION.

Include spouse's name if this is for a joint return. If a business, enter both its legal name and its trade or DBA name. Both the person granting and the person being granted the power of attorney must sign and date this form below in Sections 3 and 4.

Taxpayer's Name (if a business include both legal name and DBA name) |

|

|

|

|

|

Taxpayer’s EIN/SSN/PTIN |

|

|

|

|

|

|

|

|

|

Address |

City |

|

|

State |

Zip Code |

Area Code & Phone Number |

|

|

|

|

|

|

|

|

|

Foreign Address (if applicable) |

City |

Province |

Country |

Zip Code |

|

IEmail Address |

|

Spouse's Name |

|

|

|

|

|

|

Spouse’s Social Security Number |

|

|

|

|

|

|

|

|

Address (if different) |

City |

|

|

State |

Zip Code |

Area Code & Phone Number |

|

|

|

|

|

|

|

|

|

Foreign Address (if applicable) |

City |

Province |

Country |

Zip Code |

|

IEmail Address |

|

2.TAXPAYER GRANT OF POWER OF ATTORNEY.

I hereby appoint the following attorney, accountant, or other representative as my

Representative's name and title (if member of a firm, enter both the representative's name and firm name) |

|

EIN/SSN/PTIN |

Phone Number |

|

|||

|

|

|

|

|

|

|

|

Address |

|

City |

|

State |

Zip Code |

Fax Number |

|

|

|

|

|

|

|

|

|

Foreign Address (if applicable) |

City |

Province |

Country |

Zip Code |

Email Address |

|

|

|

|

|

|

|

|||

Representative's name and title (if member of a firm, enter both the representative's name and firm name) |

|

EIN/SSN/PTIN |

Phone Number |

|

|||

|

|

|

|

|

|

|

|

Address |

|

City |

|

State |

Zip Code |

Fax Number |

|

|

|

|

|

|

|

|

|

Foreign Address (if applicable) |

City |

Province |

Country |

Zip Code |

Email Address |

|

|

|

|

|

|

||||

To represent me before the Kansas Department of Revenue for the following tax matters: |

|

|

|

||||

All Tax Types (if not all list those applicable below) |

|

All Tax Years (if not all list those applicable below) |

|||||

Type of Tax (Individual Income, Sales, Withholding, etc.)

Tax Year(s) or Period(s)

AUTHORIZED ACTS.

For the tax types and periods listed, the representative(s) are authorized to (check all applicable boxes):

Receive and inspect my confidential tax information.

Represent me in tax matters before the department.

Sign agreements, consents or other documents on my behalf.

Perform any act that I can perform with respect to the tax matter listed above.

List any specific additions or deletions to the acts that are otherwise authorized in this power of attorney (see Instructions).

RETENTION/REVOCATION OF PRIOR POWERS OF ATTORNEY.

I hereby revoke all earlier powers of attorney on file with the Kansas Department of Revenue for the same tax matters and periods covered by this document.

Check here if you DO NOT wish to revoke a prior power of attorney. List below representatives you want to retain power of attorney.

Representative's name and title (if member of a firm, enter both the representative's name and firm name) |

EIN/SSN/PTIN |

|

|

Representative's name and title (if member of a firm, enter both the representative's name and firm name) |

EIN/SSN/PTIN |

|

|

PLEASE SIGN PAGE 2

3.SIGNATURE OF TAXPAYER(S). If a tax matter concerns a joint return, both husband and wife must sign when joint representation is requested. When a corporate officer, partner, guardian, executor, receiver, administrator, or trustee signs this section on behalf of a taxpayer, the signatory also certifies that the signatory is authorized to execute this form on behalf of the taxpayer.

(Signature) |

(Printed Name) |

(Date) |

(Signature) |

(Printed Name) |

(Date) |

4.SIGNATURE OF REPRESENTATIVE(S).

(Signature) |

(Printed Name) |

(Date) |

(Signature) |

(Printed Name) |

(Date) |

INSTRUCTIONS FOR POWER OF ATTORNEY AUTHORIZATION

A power of attorney is a legal document authorizing someone to act as your representative. You, the taxpayer, must complete, sign, and return this form if you wish to grant a power of attorney (POA) to an attorney, accountant, agent, tax return preparer, family member, or anyone else to act on your behalf with the Kansas Department of Revenue (KDOR). You may use this form for any matter affecting any tax administered by the department, including audit and collection matters. This POA will remain in effect until the expiration date, if included under Section 2, or until you revoke it, whichever is earlier. KDOR will accept copies of this form, including fax copies.

SECTION 1. TAXPAYER INFORMATION.

Individuals. In the block provided, enter your name, SSN, address, telephone number, and email address in the spaces provided. If this POA is for a joint return and your spouse is designating the same representative or representatives, enter your spouse’s name, address (if different from your own), Social Security number, and your spouse’s email address.

Businesses. Enter both the legal name and the DBA or trade name, if different. For example, if the business is an individual proprietorship, enter the proprietor's name and the name under which business is transacted. (e.g., Joe Smith dba Joe's Diner). Also enter the EIN (federal employer identification number), telephone number, business address, and email address.

Estates. Enter the name, title, address, and email address of the decedent’s executor/personal representative in the taxpayer section. Use the spouse’s section to enter the decedent’s name, date of death, and SSN.

SECTION 2. TAXPAYER GRANT OF POWER OF ATTORNEY.

Representative's name. Complete all the requested information for each representative. If the representative is a member of a firm, enter the firm’s name too. If you are designating more than two representatives, please complete another form and attach it to this form. Mark the second form “additional representatives.”

Type of tax. If you wish the power of attorney to apply to all periods and all tax types administered by KDOR, please check the box(es) for "All tax types" and "All tax periods". If for a specific tax type and/or tax year enter the type of tax and the tax years or reporting periods for each tax type. If the matter relates to estate, inheritance, or succession tax, please enter the date of the decedent’s death.

Authorized acts. Check all boxes that apply. Use the additional lines to limit, clarify, or otherwise define the acts authorized by this POA. For example, if you wish to limit the POA to a specific time period or to establish an expiration date, enter that information and the dates (month, day, and year) on these lines.

Retention/revocation of prior powers of attorney. Unless otherwise specified, this POA replaces and revokes all previous POAs on file with the department. If there is an existing POA that you do NOT want to revoke, check the box in this section and enter the representative’s name and EIN/SSN/PTIN in the space provided.

If you wish to revoke an existing POA without naming a new representative, attach a copy of the previously executed POA. On the copy of the previously executed POA, write “REVOKE” across the top of the form, and initial and date it again under your signature or signatures already in Section 3.

SECTION 3. SIGNATURE OF TAXPAYER(S).

You must sign and date the POA. If a joint return is being filed and both husband and wife intend to authorize the same person to represent them, both spouses must sign the POA unless one spouse has authorized the other in writing to sign for both. You must attach a copy of your spouse's written authorization to this POA.

SECTION 4. SIGNATURE OF REPRESENTATIVE(S).

Each representative that you name must sign and date this form.

TAXPAYER ASSISTANCE

If you have questions about this form, please visit or call our office.

Taxpayer Assistance Center

Scott State Office Building

120 SE 10th St.

PO Box 3506

Topeka, KS

Phone:

The Department of Revenue office hours are 8 a.m. to 4:45 p.m., Monday through Friday.

Additional copies of this form are available from our website at: ksrevenue.org

2

Document Specifics

| Fact Number | Description |

|---|---|

| 1 | The Tax POA DO-10 form is a legal document that allows an individual to grant authority to another person to handle their tax matters. |

| 2 | This form is typically used to authorize a tax professional to represent an individual before the taxing authority. |

| 3 | The POA stands for "Power of Attorney," a legal concept granting one person the power to act on another person’s behalf. |

| 4 | It's crucial to accurately complete the DO-10 form to ensure the designated representative has the appropriate level of authority. |

| 5 | The scope of authority granted can be customized, including limitations on the years and types of tax matters. |

| 6 | Before acting on behalf of the individual, the appointed representative must present this form to the relevant tax authority. |

| 7 | Both the individual granting the power and the designated representative must sign the DO-10 form. |

| 8 | Filing requirements and validity periods of the DO-10 form may vary based on the jurisdiction and specific tax matters involved. |

| 9 | Revoking the DO-10 form typically requires a written notice to both the tax authority and the appointed representative. |

| 10 | State-specific versions of the tax POA form, including the DO-10, may have differing requirements, governed by the relevant state laws. |

Guide to Writing Tax POA DO-10

Filling out a Tax Power of Attorney (POA) form is a crucial step for anyone who needs to authorize another individual to handle their tax matters. This could be necessary for a variety of reasons, from travel constraints to complexities in handling tax-related issues. The DO-10 form, specifically, is designed to grant this authorization, allowing the appointed person to communicate with tax authorities, make decisions, and take actions regarding the taxpayer's obligations and rights. The process of completing this form can be straightforward, as long as one follows the proper steps and ensures that all the required information is accurately provided. Here's how to fill out the DO-10 form:

- Gather Necessary Information: Before starting the form, ensure you have all the required information, including the full names, addresses, and Taxpayer Identification Numbers (TINs) for both the taxpayer and the appointed representative.

- Identify the Tax Matters: Specify the types of tax and years or periods for which the power of attorney is granted. Be as specific as possible to avoid any ambiguity.

- Complete the Taxpayer Information Section: Fill in the taxpayer’s name, TIN, and address. If the taxpayer is a business, include the entity type and principal place of business.

- Fill in the Representative’s Details: Provide the full name, address, telephone number, and any other contact information required for the appointed representative. If there are multiple representatives, ensure to include details for each.

- Assign the Powers: Clearly indicate the specific tax-related decisions and actions the representative is authorized to carry out on behalf of the taxpayer. This might include, but not limited to, the power to receive confidential tax information, sign agreements, or make payments.

- Check the Retention/Revocation of Prior POAs: If the taxpayer has any previous power of attorneys that need to be retained or revoked, this should be indicated appropriately on the form.

- Sign and Date the Form: For the POA to be valid, it must be signed and dated by the taxpayer. If the taxpayer is a business, an authorized individual must sign on behalf of the business.

- Witnessing or Notarization (if required): Some jurisdictions may require the POA form to be either witnessed or notarized. Check the local regulations and, if needed, have the form witnessed or notarized accordingly.

- Submit the Completed Form: Once the form is completed and all necessary signatures have been obtained, submit it to the relevant tax authority as directed on the form or in the accompanying instructions. Be sure to keep a copy for your records.

After submitting the DO-10 form, it is important to wait for an acknowledgment from the tax authority, which can take a few weeks. This acknowledgment confirms the appointment of your representative and their authority to act on your behalf. During this time, it may be beneficial to stay in close contact with your appointed representative to ensure they have everything they need to effectively handle your tax matters. Remember, granting someone the power of attorney over your taxes is a significant move that should be done with careful consideration and trust in the representative's capabilities and integrity.

Understanding Tax POA DO-10

What is a Tax POA DO-10 form?

The Tax Power of Attorney (POA) DO-10 form is a legal document that grants an individual or organization the authority to represent another person in matters related to taxes before the tax authorities. This form allows the designated representative to obtain confidential tax information and make decisions regarding tax filings, payments, and disputes on behalf of the grantor.

Who needs to file a Tax POA DO-10 form?

Any taxpayer who wishes to authorize another person or entity to handle their tax matters with the tax authority should file a Tax POA DO-10 form. This can be particularly useful for individuals who are unable to manage their tax affairs due to absence, illness, or lack of expertise in tax matters.

How can one obtain a Tax POA DO-10 form?

The Tax POA DO-10 form can typically be obtained from the local or state tax authority's website. Alternatively, it may also be available at their office. Ensure to use the most current version of the form to avoid any processing delays.

Is the Tax POA DO-10 form applicable to both state and federal tax matters?

No, the Tax POA DO-10 form is usually specific to state tax matters. For federal tax matters, taxpayers will need to use a different form, such as the IRS Form 2848, Power of Attorney and Declaration of Representative.

What information is required to complete the Tax POA DO-10 form?

Completing the Tax POA DO-10 form typically requires the taxpayer's full name, tax identification number (such as SSN or EIN), and the tax matters and years for which representation is being granted. The designated representative's name, address, and contact information, as well as their qualifications, must also be specified.

Can one appoint multiple representatives on a Tax POA DO-10 form?

Yes, it is possible to appoint multiple representatives on a Tax POA DO-10 form. However, it is important to specify the extent of the authority each representative has, and whether they are to act independently or jointly in their representation.

How long is the Tax POA DO-10 form valid?

The validity of the Tax POA DO-10 form can vary depending on the terms specified within the document or the laws of the specific jurisdiction It's crucial to review state guidelines or consult with a tax professional to understand the duration of the form’s validity in your specific circumstance.

Can the Tax POA DO-10 authorization be revoked?

Yes, the authorization granted by a Tax POA DO-10 form can be revoked at any time by the taxpayer. To revoke the authorization, the taxpayer should provide written notice to the tax authority and, if necessary, file a revocation form or statement.

Are there any fees associated with filing a Tax POA DO-10 form?

Generally, there are no fees associated with filing a Tax POA DO-10 form with the state tax authority. However, if you are using the services of a professional, such as a lawyer or accountant, to fill out or file the form on your behalf, they may charge for their services.

Common mistakes

Filling out a Tax Power of Attorney (POA) Form DO-10 is a critical step in allowing someone else to handle your tax matters. Unfortunately, many people make mistakes during this process, which can lead to delays and complications. Here are nine common errors:

Not checking the correct boxes for the tax matters and years you need assistance with. The form requires you to specify which matters and years the agent will have authority over.

Forgetting to sign and date the form. A signature and date are essential for the form to be valid.

Failing to provide complete information for the agent. This includes their full name, address, and contact information.

Skipping the agent’s declaration section. The agent must acknowledge their acceptance of the duties.

Using an outdated form. Always make sure you are filling out the most current version of the Tax POA DO-10 form.

Omitting the taxpayer’s social security number or taxpayer identification number. This information is crucial for identifying the taxpayer’s records.

Neglecting to specify any restrictions or special conditions you wish to apply to the agent’s authority.

Choosing an agent who is not qualified or does not meet the state's requirements to act on your behalf.

Not keeping a copy of the completed form for your records. It is always a good idea to have your own copy in case questions arise later.

Avoiding these common mistakes can help ensure that your Tax POA DO-10 form is filled out correctly and processed without delay. Taking the time to review and double-check your form can save you from unnecessary headaches in the future.

Documents used along the form

Dealing with taxes involves more than just filling out a single form. When individuals or businesses use the Tax Power of Attorney (POA) DO-10 form, it's often just one piece of the puzzle. This document grants someone else the authority to handle tax matters on your behalf, but it's typically accompanied by other forms and documents to ensure a comprehensive approach to tax management. Here's a brief overview of other commonly used forms and documents in conjunction with the Tax POA DO-10 form.

- Form 1040: The U.S. Individual Income Tax Return is a crucial form for individuals to report their annual income, claim deductions, and calculate federal tax owed or refund due.

- Form W-2: Wage and Tax Statement provided by employers to employees, this form details the employee's annual wages and the amount of taxes withheld from their paycheck.

- Form 1099: Various types of 1099 forms report income from sources other than wages, such as independent contractor income, interest, dividends, and government payments.

- Form 4868: Application for Automatic Extension of Time To File U.S. Individual Income Tax Return can give individuals more time to file their Form 1040, though not to pay any taxes owed.

- Form 8822: Change of Address form notifies the IRS of a change in address to ensure all correspondence reaches the taxpayer.

- Schedule C (Form 1040): Profit or Loss from Business is used by sole proprietors to report income or loss from a business they operated or a profession they practiced as a sole proprietor.

- Form W-9: Request for Taxpayer Identification Number and Certification is used by individuals and entities to provide their taxpayer identification number to entities that will pay them income during the tax year.

- Form 2848: Power of Attorney and Declaration of Representative is similar to the DO-10 but is used for granting authority to a tax professional to represent you before the IRS.

- Form 4506-T: Request for Transcript of Tax Return allows taxpayers to request a transcript of previous tax returns, which can be necessary for loan applications or to settle discrepancies.

Navigating the complexities of tax laws and requirements can be daunting. These forms and documents, when used alongside the Tax POA DO-10 form, play a vital role in ensuring that all aspects of tax reporting and payment are handled correctly. Whether managing personal taxes or handling business-related tax affairs, having a comprehensive understanding of these documents and their purposes can help streamline the process and avoid potential legal pitfalls.

Similar forms

The Tax Power of Attorney (POA) DO-10 form, empowering an individual to handle another's tax matters, parallels the General Power of Attorney. The latter delegates broad legal powers from one person to another. Similar to the Tax POA, it allows an agent to make decisions on the principal's behalf, but its scope extends beyond tax-related affairs, covering legal, financial, and personal matters.

Comparable to the Tax POA DO-10 form, the Durable Power of Attorney (DPOA) also entrusts significant authority to an agent. The key similarity lies in their enduring nature; a DPOA remains effective even if the principal becomes incapacitated, emphasizing its seriousness. While the Tax POA focuses on tax matters, the durability of a DPOA applies to a broader range of decisions, including healthcare and financial decisions.

Similarly, the Healthcare Power of Attorney delegates decision-making authority, but with a specific focus on medical decisions. Like the Tax POA DO-10 form, it grants an agent the power to act on behalf of the principal. However, its scope is limited to health care decisions, illustrating the varied applicability of POAs based on the principal's needs and intentions.

The Limited Power of Attorney (LPOA) shares a core similarity with the Tax POA DO-10 form in its designation of an agent for specific tasks. However, unlike the generally broad tax-related powers granted by the Tax POA, an LPOA defines narrowly tailored powers and duties, often for a single transaction or limited purpose, showcasing the flexibility of POA documents to fit precise needs.

The Representation Authorization Form, frequently used in tax dealings, closely resembles the Tax POA DO-10. Both forms authorize individuals to represent others before tax authorities. The primary difference lies in their specific uses; while the Tax POA is broad, covering various tax matters, a Representation Authorization might be used for a specific tax issue or year.

The Financial Power of Attorney parallels the Tax POA DO-10 form in its empowerment of an agent to handle financial matters. Both documents enable a trusted individual to act in the principal's best interest regarding financial affairs. The Tax POA is a subset, specifically directed at tax obligations, while a Financial Power of Attorney covers a broader range of financial decisions.

Springing Power of Attorney shares a conceptual similarity with the Tax POA DO-10 form, in that it designates an agent to act on the principal's behalf. The key difference lies in its activation condition; it "springs" into effect upon the occurrence of a specific event, typically the principal's incapacity. This contrasts with the Tax POA's immediate effectiveness, demonstrating how POA documents can be tailored to individual preferences and circumstances.

The Advanced Healthcare Directive, though primarily healthcare-focused, bears a resemblance to the Tax POA DO-10 form in its preparatory nature. It allows individuals to specify their healthcare preferences in advance, including appointing an agent to make decisions if they are unable. This is similar to how a Tax POA preemptively designates someone to manage tax matters, underscoring the importance of planning ahead across different life aspects.

Finally, the Estate Power of Attorney is similar to the Tax POA DO-10 form as it enables an agent to manage the principal's estate. The scope can include financial transactions, property management, and, notably, tax filings and payments. The primary difference lies in the Estate Power of Attorney's broader estate management focus, compared to the Tax POA's specific tax-related scope.

While each of these documents shares the foundational principle of appointing an agent to act on another's behalf, their applications range from broad legal authority to specific medical or financial decisions. Understanding their distinct purposes is crucial for individuals aiming to make informed decisions regarding their representation in different aspects of life.

Dos and Don'ts

When dealing with the Tax Power of Attorney (POA) DO-10 form, it's paramount to pay attention to details. This form allows you to grant authority to an individual, usually a tax professional, to handle your tax matters on your behalf. The process, while straightforward, requires adherence to specific rules to avoid complications. Here are some essential dos and don'ts to consider:

- Do ensure that all information provided on the form is accurate and up-to-date. This includes personal information, tax identification numbers, and details about the representative you are appointing.

- Do double-check the form for any errors or omissions before submitting it. Even small mistakes can lead to delays or complications in the authorization process.

- Do specify the exact tax matters and years for which the representative is being given authority. This clarification helps prevent any unauthorized access to your tax information.

- Do sign and date the form in the designated areas. A missing signature can render the document invalid.

- Do retain a copy of the completed form for your records. It's important to have proof of the authorization you've granted.

- Don't overlook the validity period of your POA. Be aware of when the document will expire and whether you need to renew it.

- Don't use the form to grant authority for matters not related to taxes. The POA DO-10 form is specifically intended for tax-related issues.

- Don't forget to revoke the authorization if it's no longer needed or if you wish to appoint a different representative. This requires submitting a revocation form to the IRS.

- Don't hesitate to seek professional assistance if you have doubts or questions about how to properly fill out the form. Mistakes can have significant consequences, and professional advice can help ensure everything is in order.

Approaching the task of filling out and submitting the Tax POA DO-10 form with care and attention to detail will help streamline the process, ensuring that your tax matters are handled efficiently and by the right person.

Misconceptions

The Tax Power of Attorney (POA) DO-10 form is an important document in managing tax affairs, authorizing representatives to act on behalf of individuals in matters with the tax authority. However, misunderstandings about its utility and implications are common. Addressing these misconceptions is crucial for a clear grasp of the document's significance and limitations.

The POA DO-10 grants unlimited power over personal finances. Contrary to what some believe, the scope of the POA DO-10 is specifically limited to tax matters. This means that the appointed representative can perform actions such as filing taxes or discussing tax issues with authorities on behalf of the individual. However, they are not authorized to manage other financial matters like banking transactions or property sales unless explicitly stated in a separate power of attorney document.

Once signed, the POA DO-10 cannot be revoked. Another common mistake is the assumption that once this form is filed, the individual loses the ability to retract the powers granted. In reality, the person who has issued the power of attorney can revoke it at any time, provided they follow the required legal procedures to do so. This ensures flexibility and control over their tax representation.

Any type of representative can be appointed. While it may seem as though an individual can appoint anyone to act on their behalf, in practice, the tax authority often requires that the representative has a certain level of professional qualification, such as being a certified public accountant or a licensed attorney. This requirement helps safeguard the process’s integrity by ensuring that the appointed representatives are knowledgeable about tax laws and practices.

The POA DO-10 covers all tax-related matters by default. It is a misconception that this form grants a blanket authority across all tax matters. The individual can specify the extent of powers granted, including limitations on the types of tax matters the representative can handle and the duration of the power of attorney. This specificity helps tailor the scope of authority to the individual's needs.

Filing a POA DO-10 means you no longer need to deal with your taxes. Some individuals mistakenly believe that once they have appointed a tax representative, they are completely relieved of all tax-related responsibilities. However, the principal remains ultimately responsible for ensuring that their taxes are filed correctly and on time. The representative acts on behalf of the individual but does not absolve them of their tax liabilities or compliance obligations.

The form is the same in every state. Given the federal nature of tax legislation, there's a misconception that tax forms like the POA DO-10 are uniform across the United States. On the contrary, tax laws can vary significantly from one state to another, leading to variations in the form’s format and requirements. It's essential for individuals to ensure they are using the correct state-specific form to avoid any legal complications.

Key takeaways

The Tax Power of Attorney (POA) Form DO-10 is a crucial document for individuals seeking to grant others the authority to handle their tax matters. Here are six key takeaways about how to properly fill out and use this form:

Understanding the Purpose: The Tax POA DO-10 allows a taxpayer to appoint a representative, such as an accountant or attorney, to act on their behalf in tax matters with the tax authority. This includes filing taxes, receiving confidential information, and making decisions regarding tax payments and disputes.

Completing the Form Accurately: It's important to fill out the form with precise details, including the taxpayer's full name, social security number, and the specific tax matters and years for which the POA is granted. Mistakes or omissions can lead to delays or the rejection of the form.

Selecting the Right Representative: Choose a representative wisely, as this individual or organization will have significant control over your tax affairs. Ensure the representative has the necessary qualifications and experience, and is someone you trust.

Determining the Scope: Clearly define the scope of authority being granted to your representative. This can range from broad authority to handle all tax matters to limited authority for specific issues or tax years.

Signing Requirements: Both the taxpayer and the designated representative must sign the form. In some cases, a witness or notarization may be required for the signatures to be valid. Check the specific requirements for your jurisdiction.

Retaining Copies: After submitting the form to the appropriate tax authority, keep copies for your records. The representative should also retain a copy. This ensures both parties have proof of the authorized representation and can refer to the document if questions arise.

Using the Tax POA DO-10 form correctly is essential for a smooth delegation of tax-related responsibilities. Always stay informed about any changes to the form or related legal requirements to ensure compliance and protect your financial interests.

Popular PDF Documents

IRS 8379 - For those caught off-guard by their joint tax refund being used to pay the other spouse’s solo debts, Form 8379 offers a path to reclaim their share.

IRS 4506 - This form assists in the modification of loan terms, providing lenders with verified income information to reassess borrower capacity.