Get Tax POA dfa poa Form

Understanding the mechanisms of delegating authority over one's financial affairs, particularly tax-related matters, is crucial for both individuals and businesses. At the forefront of these mechanisms is the Tax Power of Attorney (POA) form, which plays a pivotal role in allowing taxpayers to appoint representatives to handle their tax matters. This document serves as a legal bridge, ensuring that designated individuals or entities can communicate with tax authorities, make decisions, and perform actions on behalf of the grantor concerning their tax obligations. The nuances of how to properly complete and utilize the Tax POA form are significant, as it encompasses various rights and responsibilities. Moreover, recognizing the specific conditions under which it becomes effective, the duration of its validity, and the precise powers granted are fundamental aspects that need thorough consideration. This ensures that the form's execution aligns with the grantor's intentions and complies with state and federal regulations, thereby safeguarding the interests of all parties involved.

Tax POA dfa poa Example

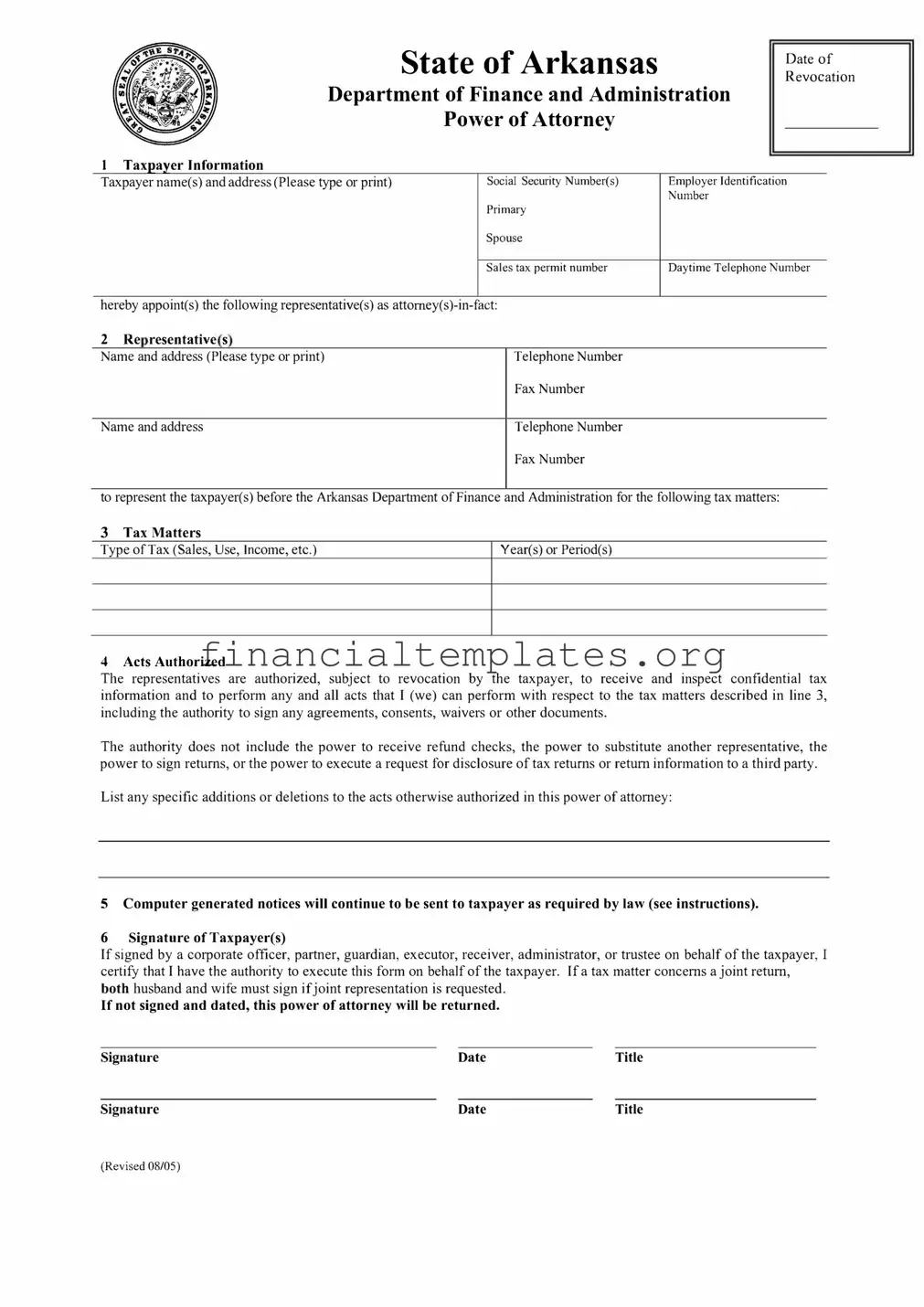

State of Arkansas

Department of Finance and Administration

Power of Attorney

Date of Revocation

1 |

Taxpayer Information |

|

|

||

|

Taxpayer name(s) and address (Please type or print) |

Social Security Number(s) |

Employer Identification |

||

|

|

|

|

Primary |

Number |

|

|

|

|

|

|

|

|

|

|

Spouse |

|

|

|

|

|

|

|

|

|

|

|

Sales tax permit number |

Daytime Telephone Number |

|

|

|

|

||

|

hereby appoint(s) the following representative(s) as |

fact: |

|

||

2 |

Re resentative s |

|

|

||

|

Name and address (Please type or print) |

Telephone Number |

|

||

|

|

|

|

Fax Number |

|

|

|

|

|

||

|

Name and address |

Telephone Number |

|

||

|

|

|

|

Fax Number |

|

to represent the taxpayer(s) before the Arkansas Department ofFinance and Administration for the following tax matters:

3Tax Matters

Type ofTax (Sales, Use, Income, etc.)

Year(s) or Period(s)

4Acts Authorized

The representatives are authorized, subject to revocation by the taxpayer, to receive and inspect confidential tax information and to perform any and all acts that I (we) can perform with respect to the tax matters described in line 3, including the authority to sign any agreements, consents, waivers or other documents.

The authority does not include the power to receive refund checks, the power to substitute another representative, the power to sign returns, or the power to execute a request for disclosure of tax returns or return information to a third party.

List any specific additions or deletions to the acts otherwise authorized in this power of attorney:

5Computer generated notices will continue to be sent to taxpayer as required by law (see instructions).

6Signature ofTaxpayer(s)

If signed by a corporate officer, partner, guardian, executor, receiver, administrator, or trustee on behalf of the taxpayer, I certify that I have the authority to execute this form on behalf of the taxpayer. Ifa tax matter concerns a joint return, both husband and wife must sign ifjoint representation is requested.

If not signed and dated, this power of attorney will be returned.

Signature |

Date |

Title |

Signature |

Date |

Title |

(Revised 08/05)

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Tax POA | This form grants someone else the authority to handle tax matters on your behalf. |

| Also Known As | The Tax Power of Attorney (POA) is often called a Tax POA form. |

| Applicable Forms | Each state may have its own specific Tax POA form, e.g., Form 2848 for federal issues. |

| Governing Law | State-specific laws govern the creation and use of Tax POA forms alongside federal regulations for federal matters. |

| Key Uses | It is used for filing taxes, obtaining confidential tax information, and representing you in tax matters before tax authorities. |

Guide to Writing Tax POA dfa poa

When dealing with tax matters, it's often necessary to authorize someone else to handle these affairs on your behalf. This is where a Tax Power of Attorney (POA) form comes into play, allowing you to appoint a trusted individual or organization to make decisions and take actions with the tax authorities in your stead. The process of filling out this form is straightforward, but each step needs to be completed carefully to ensure the document is valid and effective. Here’s how you can fill out a Tax POA form.

- Identify the parties: Start by providing the full legal names and contact information of the person granting the power (the principal) and the person or organization being granted the power (the agent).

- Specify the powers granted: Detail the specific tasks and decisions the agent is authorized to perform on behalf of the principal. This could include filing taxes, making payments, or receiving confidential tax information.

- Define the term: Clearly state the duration for which the POA will be in effect. This could be a set period, until a certain event occurs, or indefinitely until it is revoked.

- Address limitations: If there are any specific actions that the agent is not allowed to perform, list these restrictions clearly on the form.

- Legal requirements: Ensure the form meets any state-specific legal requirements, which may include notarization or witnessing. Check with your state’s tax authority or a legal professional to verify these requirements.

- Sign and date the form: The principal must sign and date the form. Depending on your state’s laws, the agent may also need to sign the form to acknowledge their acceptance of the responsibilities being granted to them.

- Copy and distribute: Make copies of the signed form. Provide one to the agent, keep one for your records, and submit a copy to your state’s tax authority if required.

After completing these steps, the Tax POA will be in effect, empowering the agent to act on the principal's behalf for tax-related matters. It's important to store the original document in a safe place and inform a trusted individual of its location. Should circumstances change, you have the option to revoke the POA at any time, as long as you complete the necessary revocation process and notify any relevant parties, including the tax authority and the appointed agent.

Understanding Tax POA dfa poa

-

What is a Tax POA (Power of Attorney)?

A Tax Power of Attorney (POA) form allows an individual (the principal) to appoint someone else (the agent), often a professional like an accountant or attorney, to handle tax matters with the tax authority. This includes filing taxes, obtaining information, and making decisions on behalf of the individual.

-

Why would someone need a Tax POA?

Individuals might need a Tax POA if they are unable to manage their tax affairs themselves due to various reasons such as being out of the country, health issues, or lacking specific knowledge about tax matters. It allows their appointed agent to manage these affairs efficiently and in their best interest.

-

How can one appoint a Tax POA?

To appoint a Tax POA, the individual must complete the Tax POA form, providing details of the agent and the specific tax matters the agent is authorized to handle. It’s crucial to sign and date the form. Depending on the jurisdiction, it might also require a witness or notarization.

-

Who can be appointed as an agent under a Tax POA?

An individual can appoint almost anyone as their agent under a Tax POA, including family members, friends, or professionals such as accountants or lawyers. It's important to choose someone who is trustworthy and has the necessary knowledge or skills to handle tax matters competently.

-

Are there any limitations to what an agent can do with a Tax POA?

Yes, there are limitations. The powers of the agent are defined by the terms of the POA form itself. Generally, an agent can file taxes, retrieve tax information, and make decisions regarding tax payments. However, the principal can restrict these powers by specifying limitations in the POA document.

-

What happens if the Tax POA is no longer needed or the individual wants to revoke it?

If a Tax POA is no longer needed or the individual wishes to revoke it, they must inform the tax authority and the appointed agent in writing. The revocation process may require filling out a specific form or providing a written statement. It’s important to ensure that all parties are aware of the revocation to prevent any unauthorized actions.

Common mistakes

Filling out a Tax Power of Attorney (POA) form is a critical process that demands attention to detail. People often make mistakes during this process due to oversight or misunderstanding. Recognizing and avoiding these common errors can streamline the process and ensure the document’s accuracy and effectiveness.

Not checking the form for completeness. Every section of the form is important and skipping parts can lead to misunderstandings or incomplete authority granted to the agent.

Failing to specify the powers granted. Without clear instructions, an agent may not be able to act effectively on the individual's behalf, potentially leading to financial or legal problems.

Using incorrect or outdated forms. Tax laws and regulations change, and using an outdated form can invalidate the POA or cause delays.

Not naming an alternate agent. Life is unpredictable. If the primary agent is unable to serve, having an alternate ensures representation without the need for a new POA.

Misunderstanding the scope of authority granted. This can either result in giving too much control or not enough, making it difficult to manage tax matters efficiently.

Forgetting to sign and date the form. A POA without the required signatures is legally ineffective.

Not keeping a copy for personal records. Should any disputes or misunderstandings arise, having a personal copy of the POA can provide crucial evidence of the agreed-upon terms.

By paying careful attention to these areas, individuals can avoid common pitfalls and ensure that their Tax POA accurately reflects their intentions and complies with applicable laws and regulations.

Documents used along the form

When individuals or businesses navigate the complexities of tax matters, they often utilize a Tax Power of Attorney (POA) form. This document authorizes a specific person, such as an accountant or attorney, to handle tax affairs on someone else's behalf. Given the serious nature of tax-related work, a few other forms and documents typically accompany the Tax POA to ensure thorough and effective representation. Below is a brief overview of these additional documents.

- IRS Form 2848, Power of Attorney and Declaration of Representative: This form is specifically designed by the IRS to grant an individual the authority to represent another before the IRS. It details the specific tax matters and years for which representation is authorized. It's often used alongside the Tax POA for more comprehensive coverage.

- Engagement Letter: An Engagement Letter outlines the scope of services, responsibilities, and terms of engagement between a tax professional and their client. It sets clear expectations for both parties, detailing what services will be provided, the duration of the engagement, and how the tax professional will be compensated.

- Form W-9, Request for Taxpayer Identification Number and Certification: Often collected by the tax professional from the client, this form is used to request the taxpayer's identification number (TIN). It ensures that all tax documents and filings are accurately reported under the correct taxpayer ID.

- Conflict of Interest Waiver: In cases where the tax professional represents multiple clients with potentially opposing interests, a Conflict of Interest Waiver may be needed. This document ensures that all parties are aware of the potential conflict and agree to the representation despite the circumstances.

These documents, when used with the Tax POA, create a comprehensive framework that allows for effective and authorized tax representation. Ensuring these forms are correctly completed and in place is crucial for anyone aiming to navigate their tax matters smoothly and efficiently, safeguarding their interests and compliance with tax laws.

Similar forms

The Tax Power of Attorney (POA) DFA POA form allows a person to grant another individual the authority to handle their tax matters. This form is similar to a General Power of Attorney, where one can designate someone to make a wide range of decisions and take actions on their behalf, not limited to financial transactions. The primary distinction lies in the scope of authority, with a General POA covering more than just tax issues.

Comparable to the Tax POA is the Durable Power of Attorney. While both empower an agent to act on behalf of the principal, the Durable POA remains in effect even if the principal becomes incapacitated. This feature is critically important in planning for potential future health challenges, highlighting the role of foresight in legal preparations.

Another document akin to the Tax POA is the Medical Power of Attorney. This type grants an agent the authority to make healthcare decisions on the principal’s behalf when they cannot make decisions for themselves. The major difference involves the nature of the decisions: the Tax POA is financial, while the Medical POA concerns health matters.

The Limited Power of Attorney shares similarities with the Tax POA in that it grants specific, restricted powers to an agent. However, a Limited POA could be drafted for various purposes beyond tax matters, such as selling a property or managing certain business activities. It's flexible, focusing on particular tasks or transactions.

The Financial Power of Attorney, much like the Tax POA, allows an individual to authorize an agent to handle their financial affairs. This includes, but is not limited to, managing bank accounts, paying bills, and making investment decisions. The Tax POA can be viewed as a subset of the broader financial powers granted under a complete Financial POA.

Springing Power of Attorney is conceptually related to the Tax POA but with a key difference: it comes into effect only under circumstances specified in the document, such as the principal’s incapacitation. This mechanism provides additional control over when the agent’s power becomes active, contrasting with the typically immediate effect of a Tax POA.

Revocable Living Trust documents share a central idea with the Tax POA, in the sense that they allow an individual (the grantor) to designate another person (the trustee) to manage their assets. While a trust is more comprehensive and involves ownership transfer to the trust itself, it achieves a similar goal of assigning responsibility for asset management.

The Advance Healthcare Directive, though primarily focused on healthcare decisions, resembles the Tax POA through its feature of appointing someone to act on the principal’s behalf. This document comes into play for medical decisions when the individual cannot express their wishes, illustrating the broad applicability of the POA concept across different areas of personal affairs.

Last but not least, the Guardianship or Conservatorship arrangement echoes the Tax POA's intentions by assigning another individual the authority to make decisions for someone else, often covering personal, healthcare, and financial decisions. This legal mechanism is used when individuals cannot make safe or sound decisions concerning their life and resources, requiring court involvement to ensure their protection.

Dos and Don'ts

When it comes to filling out the Tax Power of Attorney (POA) form, accurately completing the document is essential for ensuring that your chosen representative can effectively handle your tax matters. To assist with this process, here’s a comprehensive list of dos and don'ts:

- Do thoroughly review the form instructions before starting. This initial step prevents common mistakes and ensures you understand all requirements.

- Do provide complete information about yourself and your representative. This includes full names, addresses, and contact information to avoid any processing delays.

- Do specify the tax forms and years you are granting your representative permission to access. Being clear and precise about the scope of authority will streamline the handling of your tax matters.

- Do sign and date the form. An unsigned form is considered invalid and will not be processed, delaying any actions your representative needs to take on your behalf.

- Don't leave any sections blank. Incomplete forms can lead to misunderstandings or require resubmission, potentially delaying important tax-related actions.

- Don't use outdated forms. Tax regulations and forms can change, so ensure you’re using the most current version of the POA form to prevent any processing issues.

- Don't forget to notify your representative once you’ve submitted the form. They should be aware that they’ve been granted this authority and understand the extent of their responsibilities.

- Don't hesitate to seek assistance if you’re unsure about any part of the form. Whether it’s discussing with a tax professional or contacting the issuing authority, getting help can prevent errors and ensure the form is filled out correctly.

Misconceptions

When it comes to authorizing someone else to handle your tax matters, the Tax Power of Attorney (POA) form is a critical tool. However, there are several misconceptions about this document that can lead to misunderstandings and incorrect usage. Below are eight common misconceptions about the Tax POA form:

- All Tax POA forms are the same: This is not true. The specific form and requirements can vary by state, and it's important to use the appropriate form for your jurisdiction to ensure that it is legally valid.

- Completing a Tax POA form gives the agent unlimited power: The reality is that the scope of authority granted to the agent can be specifically tailored within the form. You can limit what the agent can and cannot do regarding your tax matters.

- Any type of attorney can be designated in a Tax POA: While it's true that you can appoint anyone you trust as your agent, not everyone will have the necessary knowledge or experience to handle complex tax issues effectively. Choosing someone with expertise in tax matters is often recommended.

- Once signed, a Tax POA is permanent: In fact, a Tax POA can be revoked at any time by the principal (the person who granted the POA), provided the revocation process follows the legal requirements of the jurisdiction.

- Verbal agreements can substitute for a Tax POA: Verbal agreements are not sufficient. For a Tax POA to be legally binding, it must be documented in the proper form and executed according to state laws, which usually requires a written document.

- A Tax POA allows the agent to file taxes on behalf of the principal automatically: While a Tax POA does allow an agent to take certain actions regarding the principal's taxes, whether the agent can file taxes on behalf of the principal depends on the specific authorities granted within the POA document.

- Creating a Tax POA is a complex and time-consuming process: Although it's important to be thoughtful when granting someone else authority over your tax matters, creating a Tax POA generally involves completing a standardized form and possibly notarization, depending on the state's requirements. It’s a straightforward process.

- A Tax POA form needs to be filed with the IRS: This is not necessarily true. The requirement to file the POA with the IRS applies only when the agent will act on the principal's behalf in matters before the IRS. Otherwise, having the document on hand when dealing with tax authorities is typically sufficient.

Key takeaways

When dealing with the Tax Power of Attorney (POA) form, often referred to as the DFA POA form, individuals grant another person the authority to handle their tax matters. Understanding how to properly fill out and use this form is crucial for ensuring that your tax affairs are managed accurately and in accordance with your wishes. Below are eight key takeaways:

- Identification of Parties: Clearly identifying the principal (the person granting the power) and the agent (the person receiving the power) is essential. This includes full legal names, addresses, and taxpayer identification numbers.

- Specify Tax Matters: The form requires you to specify which tax matters and years the POA covers. Being precise about the scope of authority granted helps prevent any unintended permissions.

- Duration of Authority: It is crucial to state when the POA will come into effect and its expiry date, if any. Without this information, the validity of the POA could be in question.

- Revocation Process: Understanding how to revoke the POA when it is no longer needed or if you wish to appoint a different representative is critical. This typically requires a written notice.

- Signatures: Both the principal and the agent must sign the form. In some cases, witnesses or notarization may be required to validate the signatures.

- State-Specific Requirements: Tax POA requirements can vary significantly from one state to another. It’s essential to ensure that the form meets the specific requirements of the state in which it will be used.

- Filing with the Relevant Tax Authority: Completing the form is just the first step; it must also be filed with the appropriate tax authority. In some cases, you may need to provide additional documentation.

- Keep Records: Always keep a copy of the signed POA form for your records. It’s also wise to keep detailed records of any tax matters handled by the agent under the authority of the POA.

By adhering to these guidelines, individuals can ensure that their tax matters are handled effectively and in accordance with their preferences. Remember, the Tax POA form is a powerful legal document; it should be completed thoughtfully and reviewed periodically.

Popular PDF Documents

1099sa - This form plays a key role in the management and oversight of tax-advantaged medical savings accounts, ensuring that they are used appropriately.

Irs Form 1040 Sr Instructions 2023 Printable - Recognize the additional reporting requirements for individuals who have earned interest or dividends in foreign bank accounts.

How to Cancel Carefirst Insurance - Make sure to sign the termination form and provide the date to formally request the discontinuation of your CareFirst insurance plan.