Get Tax POA D-2848 Form

Dealing with tax matters can often seem overwhelming, whether you’re managing personal taxes or navigating through the complexities of tax obligations for a business. A powerful tool in this journey is the Tax Power of Attorney, formalized through the D-2848 form. This document serves a critical role by authorizing an individual, typically a tax professional, to represent someone else in tax affairs with the tax authority. This empowerment can cover a range of activities from obtaining confidential tax information to making decisions and taking action in the taxpayer's stead. It’s a form that nuances the trust and authority given to a chosen representative, setting boundaries and specific powers granted. Through this form, taxpayers can ensure their tax matters are handled with the requisite expertise, providing peace of mind while they focus on other important aspects of their life or business. Understanding the scope, application process, and implications of the Tax POA D-2848 is crucial for anyone considering delegating their tax-related responsibilities.

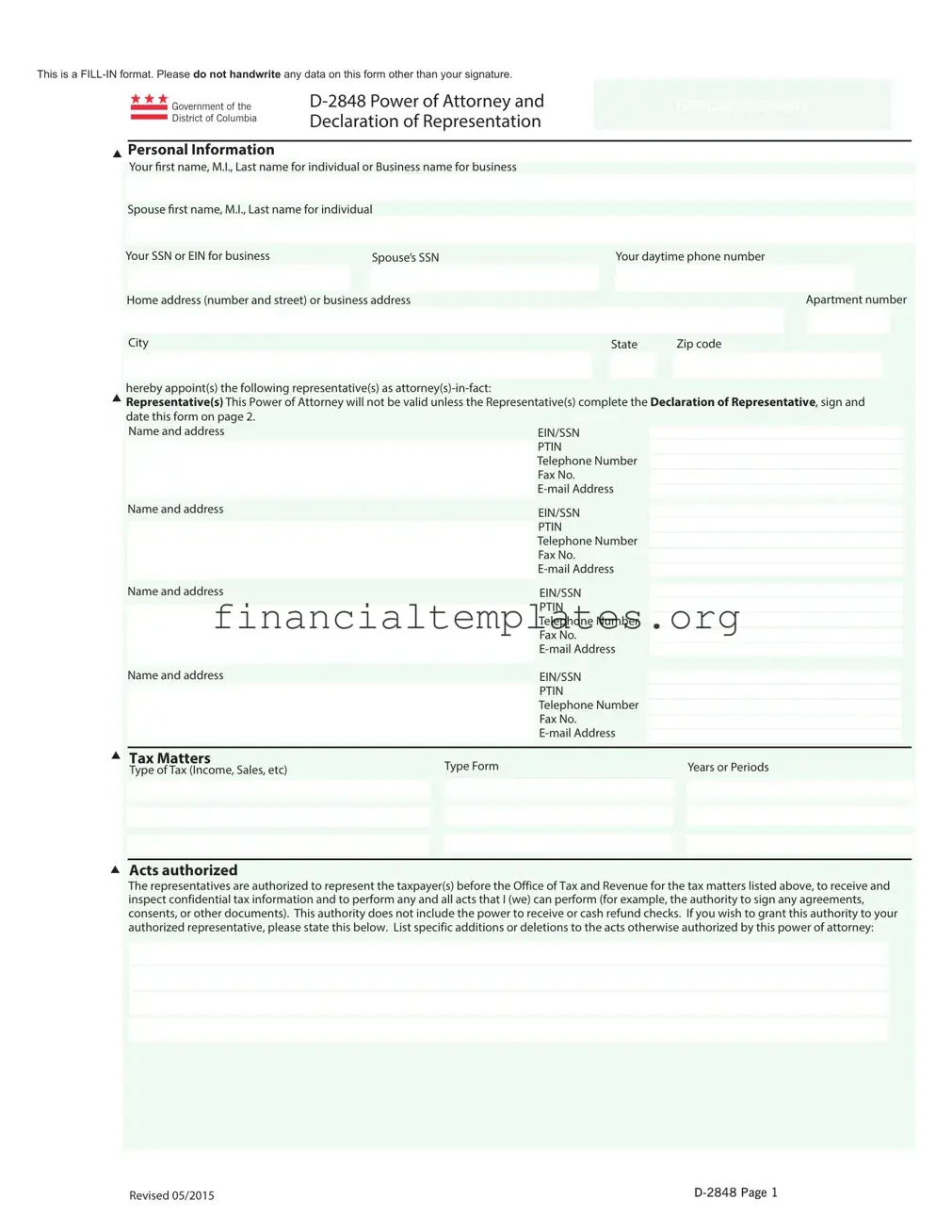

Tax POA D-2848 Example

This is a

- |

Government of the |

OFFICIAL USE ONLY |

|

*** District of Columbia |

Declaration of Representation |

|

|

|

|

||

▲

▲

▲

▲

Personal Information

Your frst name, M.I., Last name for individual or Business name for business

Spouse frst name, M.I., Last name for individual

|

Your SSN or EIN for business |

|

Spouse’s SSN |

|

|

|

Your daytime phone number |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home address (number and street) or business address |

|

|

|

|

|

|

Apartment number |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

State |

|

Zip code |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

hereby appoint(s) the following representative(s) as

Representative(s) This Power of Attorney will not be valid unless the Representative(s) complete the Declaration of Representative, sign and date this form on page 2.

Name and addressEIN/SSN

PTIN Telephone Number

Fax No.

Name and address |

|

|

|

|

|

|

|

|

|||

|

|

EIN/SSN |

|

|

|

|

|

|

|||

|

|

|

|

PTIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Telephone Number |

|

|

|

|

|

|

|

|

|

|

|

Fax No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

Name and address |

|

|

EIN/SSN |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||||

|

|

|

|

PTIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

Telephone Number |

|

|

|

|

|

|

|

|

|

|

|

Fax No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Name and address |

|

|

EIN/SSN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

PTIN |

|

|

|

|

|

|

|

|

|

|

|

Telephone Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

Fax No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax Matters |

Type Form |

|

|

|

|

|

Years or Periods |

|

|

|

|

Type of Tax (Income, Sales, etc) |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acts authorized

The representatives are authorized to represent the taxpayer(s) before the Office of Tax and Revenue for the tax matters listed above, to receive and inspect confidential tax information and to perform any and all acts that I (we) can perform (for example, the authority to sign any agreements, consents, or other documents). This authority does not include the power to receive or cash refund checks. If you wish to grant this authority to your authorized representative, please state this below. List specific additions or deletions to the acts otherwise authorized by this power of attorney:

Revised 05/2015 |

▲

▲

▲

▲

▲

Taxpayer's SSN or FEIN |

|

Taxpayer's Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retention/revocation of prior power(s) of attorney By filing this power of attorney form, you automatically revoke all earlier power(s) of attorney on file with the Office of Tax Revenue for the same tax matters and years or periods covered by this document.

If you do not want to revoke a prior power of attorney, check here:

You must attach a copy of any Power of Attorney you want to remain in effect.

Signatures

Signature of taxpayer(s) If a tax matter concerns a joint return, both husband and wife must sign if joint representation is requested. If signed by a corporate officer, partner, guardian, tax matters partner, executor, receiver, administrator, or trustee on behalf of the taxpayer, I certify that I have the authority to execute this form on behalf of the taxpayer. If other than the taxpayer, print the name here and sign below.

Your Signature |

|

Date |

|

Title if other than individual |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse's signature if filing jointly |

|

Date |

|

|

|

|

|||

|

|

Telephone number if other than the taxpayer |

|||||||

|

|

|

|

|

|

|

|

|

|

If not signed and dated, this power of attorney will be returned

Declaration of Representative Representative(s) must complete this section and sign below.

Under penalties of perjury, I declare that:

As the authorized representative of the taxpayer(s) identified for the tax matter(s) specified herein; I am one of the following:

a.A member in good standing of the bar of the highest court of the jurisdiction shown below.

b.A Certified Public Accountant duly qualified to practice in the jurisdiction shown below.

c.An Enrolled Agent under the requirements of Treasury Department Circular # 230.

d.A bona fide officer of the taxpayer’s organization.

e.A

f.A member of the taxpayer’s immediate family (i.e., spouse, parent, child, brother, or sister).

g.A general partner of a partnership.

h.Student Attorney or CPA- receives permission to represent taxpayers before the IRS by virtue of his/her status as a law, business, or accounting student working in an Low Income Taxpayer Clinic or Student Tax Clinic Program.

i.Other

Designation- |

|

Licensing jurisdiction (state) |

Bar, license, certification, |

|

|

|

|

|

||

|

Insert above |

|

or other licensing authority |

registration, or enrollment number |

|

Signature |

|

Date |

|

|

|

letter |

|

(if applicable) |

(if applicable) |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If you have any questions regarding the Power of Attorney, contact the Office of Tax and Revenue, Customer Service Administration, 1101 4th Street, SW, Washington, DC 20024; or call (202)

Mail the original Power of Attorney to:

Office of Tax and Revenue, Customer Service Administration, PO Box 470, Washington, DC

If this declaration is not signed and dated, this power of attorney will be returned

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The D-2848 form allows individuals to grant authority to a representative to act on their behalf for state tax matters. |

| Usage | It is specifically used within certain states that have adopted this form for tax representation purposes. |

| Governing Law | Each state that uses the Tax POA D-2848 form has its own governing laws regarding power of attorney for tax matters. |

| Validity | The form's validity may vary by state, including specific requirements for duration, revocation, and witness or notarization needs. |

| Key Components | The form typically includes identification of the taxpayer, identification of the representative, the tax matters and periods covered, and the specific powers granted. |

| State Specific Forms | While the D-2848 form is a template, it is important to use the version provided by the specific state's taxing authority, as there can be state-specific requirements and modifications. |

Guide to Writing Tax POA D-2848

Once you decide to authorize someone to handle your tax matters, you'll need to fill out a Tax Power of Attorney (POA) form, specifically the D-2848 form if it applies to your state. This form allows your representative to receive confidential information and make decisions about your taxes on your behalf. Completing this form accurately is essential to ensure that the process goes smoothly. Follow these steps to fill out the D-2848 form correctly.

- Start by entering your full name and address in the designated spaces at the top of the form.

- Provide your taxpayer identification number, such as your Social Security Number (SSN) or Employer Identification Number (EIN), in the space provided.

- Fill in the name and contact information of the representative you are authorizing. If you are authorizing more than one person, use a separate line for each representative.

- Specify the tax matters for which this authorization applies, including type of tax, tax form number, and the year(s) or period(s) involved. Be as specific as possible.

- If there are any specific acts you do or do not want the representative to perform, list these in the section provided. This might include actions like receiving refunds, signing agreements, or accessing previous tax returns.

- Indicate the acts your representative is not authorized to perform under any circumstances. This step is crucial for maintaining certain controls over your tax matters.

- Read the declaration of representative section carefully, ensuring your appointed representative meets the qualifications described.

- Sign and date the form in the presence of a witness or notary if required by your state's law. Your representative must also sign and date the form.

- Review the form for accuracy and completeness before submitting it to the appropriate tax authority.

After completing and submitting the D-2848 form, the tax authority will process your request. This enables your authorized representative to start handling your tax matters according to the permissions you've granted. It's essential to keep a copy of the completed form for your records and to remember that you can revoke the authorization at any time if your situation or preferences change.

Understanding Tax POA D-2848

-

What is the Tax POA D-2848 form?

The Tax Power of Attorney (POA) D-2848 form is a document that allows an individual, referred to as the principal, to designate someone else, known as the agent or attorney-in-fact, to handle their tax matters before the tax authority. This could include filing taxes, obtaining confidential tax information, and making decisions about tax payments and agreements.

-

Who can act as an agent on the Tax POA D-2848 form?

An agent can be almost anyone the principal trusts to handle their tax matters, such as a certified public accountant (CPA), attorney, or sometimes, a family member. However, it's crucial that the person chosen is trustworthy and has some knowledge or experience in dealing with tax issues.

-

How do I complete the Tax POA D-2848 form?

Completing the Tax POA D-2848 form requires detailed information about the principal and the agent. This includes their full names, addresses, and taxpayer identification numbers. The form also asks for specifics about which tax matters and years the agent has authority over. Both the principal and the agent must sign the form, signifying their agreement to the terms.

-

Is there a submission deadline for the Tax POA D-2848 form?

No specific submission deadline exists for the Tax POA D-2848 form. However, it should be submitted before the agent needs to act on the principal's behalf. Timing is important to ensure the agent has authority when needed, especially if dealing with time-sensitive tax matters.

-

How long does the Tax POA D-2848 authorization last?

The duration of the Tax POA D-2848 authorization can vary. It generally remains in effect until the expiration date specified in the form, if any. Without a specified expiration date, it may continue indefinitely until it is revoked. It's also important to note that certain events, such as the death of the principal, automatically terminate the power of attorney.

-

Can the Tax POA D-2848 be revoked?

Yes, the principal can revoke the Tax POA D-2848 at any time. This is typically done by notifying the agent and the tax authority in writing. The revocation document should include the principal's intention to revoke the power of attorney and information about the original Tax POA D-2848 form to avoid confusion.

-

Where can I find the Tax POA D-2848 form?

The Tax POA D-2848 form is usually available on the website of the state tax authority or the Internal Revenue Service (IRS), depending on whether your tax matters are state or federal. Additionally, tax professionals and legal advisors often have access to these forms and can provide guidance on how to complete and submit them properly.

Common mistakes

Filling out the Tax Power of Attorney (POA) D-2848 form can often be complex and confusing. Understanding the common pitfalls can help avoid unnecessary delays or errors in processing. Here are four mistakes many people make:

- Not providing complete information.

Many filers forget to include essential details, like full names, addresses, and Social Security numbers for both the taxpayer and the representative. This information is crucial for the form to be processed correctly.

- Choosing the wrong representative.

It's important to select someone who is legally eligible to represent you in front of the tax authority. Picking a friend or a family member who lacks the required credentials, such as being an attorney, certified public accountant (CPA), or enrolled agent, can lead to the rejection of the form.

- Failure to specify tax matters correctly.

On the form, you need to clearly indicate which tax years and types of taxes your representative can handle. Being vague or using incorrect terms can limit your representative's ability to act on your behalf effectively.

- Forgetting to sign and date.

A surprisingly common mistake is neglecting to sign and date the form at the bottom. Without this, the document is not legally binding, and the tax authority will not recognize it.

Avoiding these mistakes will streamline the process of granting someone else the authority to handle your tax matters, ensuring that your financial and legal interests are properly represented and protected.

Documents used along the form

When an individual or entity grants someone the power to handle their tax matters, a Tax Power of Attorney (POA) Form D-2848 is often employed. This critical document allows a designated representative, usually a tax professional, to act on behalf of the grantor with the tax authority. However, the authorization form D-2848 does not stand alone in the realm of tax documentation. Several other forms and documents typically accompany or follow the Tax POA D-2848, each with its unique purpose and significance.

- Form 8821, Tax Information Authorization - This form does not grant the same level of authority as the Tax POA D-2848. Instead, it allows an appointee to access or receive confidential tax information from the IRS for the taxpayer, but it doesn't permit them to represent the taxpayer before the IRS.

- Form 1040, U.S. Individual Income Tax Return - Often, the individual granting the POA is doing so in the context of needing assistance with their annual tax return. The Form 1040 is the standard federal income tax form used to report an individual's gross income.

- Form 2848-A, Authorization for Release of Tax Information - Similar to form 8821 but more restricted in scope, this document permits the release of specific tax information by the IRS to a third party designated by the taxpayer.

- Form 4506, Request for Copy of Tax Return - This form is essential for obtaining past tax returns, which may be necessary for the representative to understand the taxpayer's financial and tax history comprehensively.

- Form 433-A, Collection Information Statement for Wage Earners and Self-Employed Individuals - In situations where the taxpayer is dealing with outstanding liabilities, this form provides the IRS with detailed information about the taxpayer’s financial situation to establish a payment plan or settlement.

- Form 941, Employer’s Quarterly Federal Tax Return - For taxpayers who are business owners, this form is used to report payroll taxes and is often relevant in discussions with the IRS regarding the business’s tax obligations.

Beyond these forms, each case may require additional documentation, dependent on the specific circumstances and needs of the taxpayer. The synergy between the Tax POA D-2848 and accompanying documentation creates a comprehensive framework, ensuring that the taxpayer's representative can effectively manage and advocate on their behalf. Recognizing the purpose and necessity of each document allows for a smoother navigation through tax proceedings and enhances the representative’s ability to serve the taxpayer’s best interests.

Similar forms

The Tax Power of Attorney (POA) Form D-2848 is closely related to the General Power of Attorney form. Both documents grant an individual the authority to make decisions on another's behalf. While the Tax POA D-2848 specifically focuses on tax matters, authorizing someone to handle tax-related issues with the tax authority, the General Power of Attorney provides broader powers across various aspects of an individual’s life, including financial and legal matters.

Similarly, the Financial Power of Attorney form shares characteristics with the Tax POA D-2848 as it allows someone to manage another person's financial affairs. However, the Tax POA is narrowly tailored to tax issues, whereas a Financial Power of Attorney encompasses a wider range of financial actions, such as managing bank accounts and investments.

The Healthcare Power of Attorney is another document related to the Tax POA D-2848, but it diverges in its purpose. It grants an agent the authority to make healthcare decisions on behalf of the grantor, highlighting the distinction in scope compared to the Tax POA, which is strictly limited to tax matters.

A Durable Power of Attorney, much like the Tax POA D-2848, authorizes someone to act on your behalf. The key difference is in its durability; it remains in effect even if the principal becomes incapacitated. This contrasts with the Tax POA, which does not necessarily include such provisions.

The Limited Power of Attorney is quite similar to the Tax POA D-2848 in its specificity. While the Tax POA is focused on tax issues, a Limited Power of Attorney could be designated for any specific area or task, such as real estate transactions, indicating a similarity in the tailored scope of authority granted.

The Child Care Power of Attorney is a specialized form that allows a parent or guardian to grant another individual the authority to make decisions regarding their child's welfare. This contrasts with the Tax POA D-2848’s focus on tax issues, showing how Power of Attorney forms can vary greatly in their application, from child care to financial matters.

The Revocation of Power of Attorney document is directly related to the Tax POA D-2848 as it serves to cancel or invalidate a previously granted power of attorney, including a Tax POA. It is essential for reversing the authority given in situations where it is no longer needed or the relationship has changed.

The Real Estate Power of Attorney provides specific authority to handle real estate transactions on behalf of the principal. This specialization makes it akin to the Tax POA D-2848, as both focus on particular areas rather than offering broad, general powers.

The Vehicle Power of Attorney allows someone to make decisions and take actions regarding the principal's vehicle, such as title transfers and registrations. Like the Tax POA D-2848, it is designed for a specific purpose, emphasizing the variety of Power of Attorney forms tailored to different needs and circumstances.

The Springing Power of Attorney is designed to become effective only under certain conditions, typically when the principal becomes incapacitated. This conditional aspect sets it apart from the Tax POA D-2848, which does not have such a triggering mechanism, demonstrating the flexibility and diverse functionality of Power of Attorney documents.

Dos and Don'ts

Filling out the Tax Power of Attorney (POA) D-2848 form is a critical step in authorizing an individual to represent you in matters related to your state taxes. To ensure the process is completed effectively and accurately, here's a comprehensive list of do's and don'ts:

- Do thoroughly read the instructions accompanying the form to understand the specifics of how to properly fill it out and submit it.

- Do ensure that all provided information is accurate and complete. This includes your personal information, the representative's details, and the tax matters and years you are authorizing.

- Do clearly specify the tax matters for which you are granting authority. This includes identifying the types of taxes, the periods, and the specific actions your representative is authorized to perform on your behalf.

- Do sign and date the form in the designated area to validate it. The omission of a signature may result in the form being considered invalid.

- Do keep a copy of the completed form for your records. This can be helpful for future reference or in the event that any disputes or questions arise regarding the representation.

- Do choose a representative (such as a qualified tax professional, accountant, or attorney) who is authorized to practice before the state taxing authority and whom you trust to handle your tax affairs responsibly and ethically.

- Do revoke any previous Power of Attorney documents that conflict with the new POA D-2848 form, if necessary, to prevent any confusion or overlap in representation.

- Don't leave any sections blank unless the form specifically instructs you to do so. Incomplete forms may be rejected or cause delays.

- Don't use the form to authorize representation for matters not related to state taxes. The D-2848 form is specifically designated for tax-related representations only.

- Don't forget to notify your representative that you have officially authorized them via the form. Effective communication is essential for ensuring that your representative can begin acting on your behalf without any delays.

- Don't neglect to review the powers you are granting. It's crucial to understand the extent of the authority you are giving to your representative and ensure it aligns with your needs and expectations.

- Don't authorize a representative without considering their qualifications and experience. Your financial wellbeing is important, and the individual you choose should be capable of managing your tax matters competently.

- Don't hesitate to seek assistance if you encounter difficulties in filling out the form. Professional guidance can help prevent mistakes and ensure that the process is completed correctly.

- Don't underestimate the importance of timely submission. Be mindful of any deadlines that may apply to ensure your representation is in place when required.

Misconceptions

The Tax Power of Attorney (POA), Form D-2848, is an important document that allows an individual or entity to grant another person the authority to handle tax matters on their behalf with the tax authority. However, there are several misconceptions surrounding this form that can lead to confusion. Here are ten such misconceptions explained:

Only for the Elderly or Infirm: Some people mistakenly believe that the Tax POA Form D-2848 is only necessary for the elderly or those with a serious illness. In reality, anyone who needs assistance with tax matters, for any reason, can benefit from assigning a POA.

Grants Complete Control: Another common misconception is that by signing a Tax POA, you are giving up complete control over your finances and tax decisions. The truth is, the form allows you to specify exactly which powers your representative will have.

Irrevocable: Many assume that once a Tax POA is executed, it cannot be revoked. However, the person who granted the POA can revoke it at any time as long as they are mentally competent.

One Size Fits All: There's a belief that a single POA form applies universally. In fact, requirements and forms can vary by state, and the D-2848 is specific to certain tax-related matters.

Legal Expertise Required: Filing a Tax POA is assumed to necessitate legal help. While consulting with a professional can be beneficial, individuals can complete and submit Form D-2848 without legal assistance, as long as they follow the guidelines.

Only Relatives Can Act as Agents: A common belief is that only family members can be designated as your agent on a POA. Actually, you can choose anyone you trust, be it a friend, accountant, or lawyer.

Automatically Includes All Tax Years: It's mistakenly thought that a Tax POA covers all tax years or periods. The truth is, the form requires you to specify the years or transactions for which the agent will have authority.

Limited to Tax Payments: Some believe that the powers of a Tax POA are limited to making tax payments on behalf of the grantor. In fact, the agent can perform a wide range of tax-related tasks, depending on the permissions granted.

Confers the Same Powers as a General POA: There's a misconception that a Tax POA and a general POA are interchangeable. A Tax POA is specific to tax matters, while a general POA can cover a broad spectrum of financial and legal affairs.

Signature by Witness or Notary Always Required: While some types of POA forms require a witness or notarization, the requirement for a Tax POA Form D-2848 varies by jurisdiction and case. It's essential to check the specific requirements in your area.

Understanding these misconceptions can help individuals and entities approach Tax POA Form D-2848 with clarity, ensuring that they make informed decisions that best suit their needs.

Key takeaways

Filling out and using the Tax Power of Attorney (POA) D-2848 form is an important process that allows individuals to grant others the authority to handle their tax matters. Understanding the correct way to complete and use this document can ensure the process goes smoothly and effectively. Here are nine key takeaways that might be helpful.

- Identification Is Crucial: When completing the form, it's essential that all identifying information for both the taxpayer and the representative is filled out accurately. This includes full names, addresses, and Social Security numbers or Employer Identification Numbers. Mistakes in this area can lead to delays or non-recognition of the form.

- Specify Tax Matters: The form requires you to detail the specific tax forms and periods for which the POA is granted. Being precise ensures that the representative has the authority only over the matters you choose.

- Limited Duration: Remember that the POA has a limited duration. It typically remains in effect until the expiration date you specify, unless revoked earlier. Consider the time frame that you will need the representation for when completing the form.

- Selection of Representative(s): You can choose one or more representatives on the D-2848 form. If you decide to appoint more than one, you must indicate whether each can act independently or if all must make decisions together.

- Signature Requirement: For the POA to be valid, it must be signed and dated by the taxpayer. If filing jointly, both spouses must sign the form if both wish to grant POA to the same person for joint tax matters.

- Revocation Process: If you wish to revoke a previously granted POA, you must do so in writing. Simply completing a new D-2848 form does not automatically revoke prior authorizations.

- Filing with the Tax Authority: Once completed and signed, the D-2848 form must be filed with the appropriate tax authority. This could be the Internal Revenue Service (IRS) or a specific state's tax board, depending on the jurisdiction of the tax matters.

- Keep Records: It’s advisable to keep a copy of the signed POA form for your records. Additionally, ensure your representative also has a copy, so they can prove their authority when dealing with tax matters on your behalf.

- Professional Help: Given the complexities associated with tax laws and the POA, consider seeking professional help to fill out the form. A tax professional or lawyer can provide valuable guidance, ensuring that the form accurately reflects your intentions and complies with current laws and regulations.

Popular PDF Documents

Kentucky Composite Return - Form 20a100 is also vital for those who are incapacitated and need someone else to handle their financial affairs.

Tax Form 4506-t - This IRS-issued document facilitates the retrieval of past tax information, vital for auditing or legal purposes, ensuring transparency and compliance.