Get Tax POA Authorization to Disclose Tax Information Form

The complexities of managing personal or business tax matters often require individuals to enlist the assistance of professionals, such as accountants or tax attorneys. Navigating the labyrinth of tax regulations and ensuring compliance necessitates access to sensitive information, typically held under strict confidentiality by tax authorities. Here is where the Tax Power of Attorney (POA) Authorization to Disclose Tax Information form becomes pivotal. Simply put, this vital document grants a designated representative the legal capacity to access, discuss, and make decisions regarding an individual's or entity's tax information with the tax authority. It is not merely a formality but a crucial step in facilitating the management of tax affairs, addressing disputes, or engaging in planning strategies with a level of authority and access that would otherwise be unattainable. The form, detailed in its requirements, mandates precise information regarding the identities of the taxpayer and the representative, along with the specific tax periods and types of taxes involved. Its completion is a precondition for any professional to act on behalf of an individual or business effectively and with the necessary insights that only full access to tax information can provide.

Tax POA Authorization to Disclose Tax Information Example

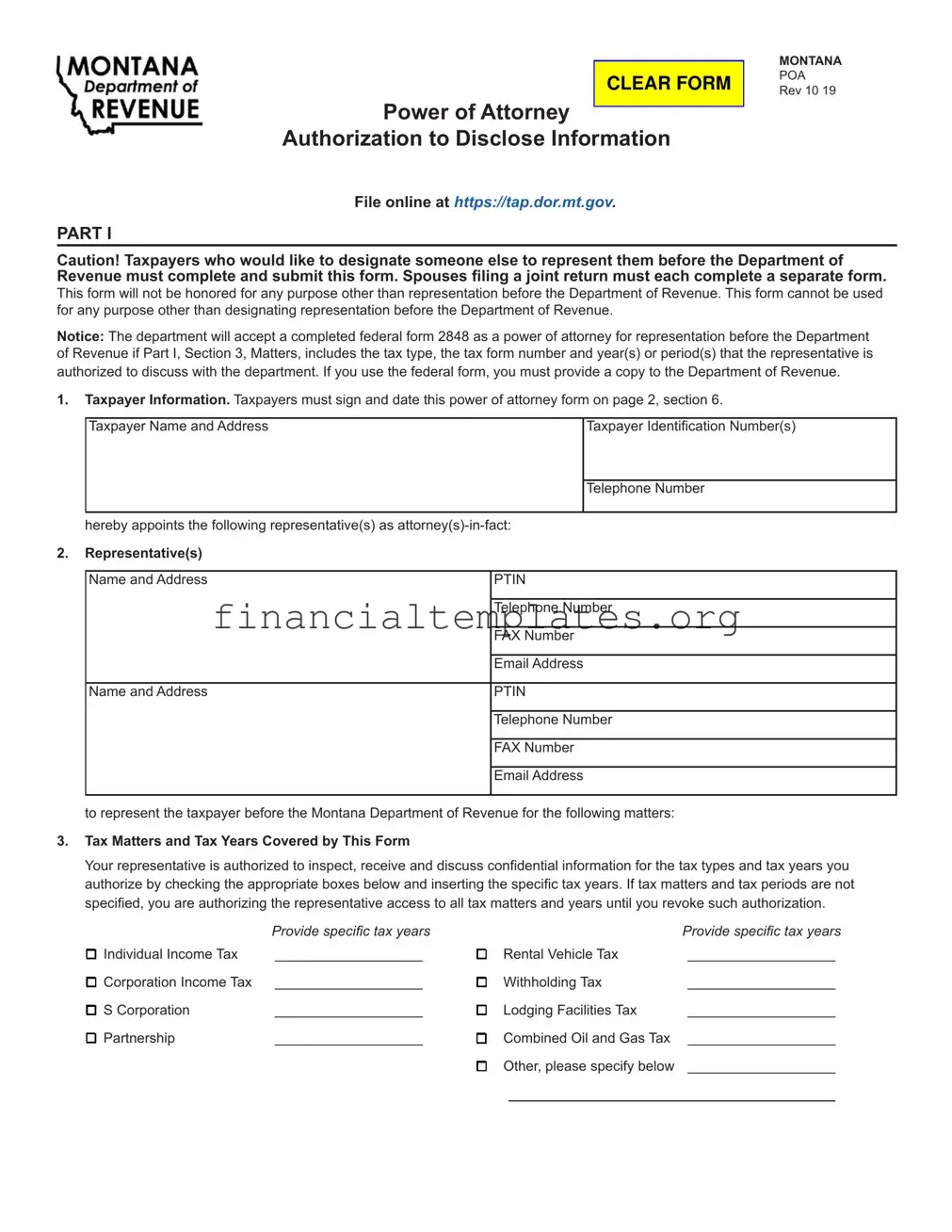

CLEAR FORM

Power of Attorney

Authorization to Disclose Information

File online at https://tap.dor.mt.gov.

PART I

MONTANA POA Rev 10 19

Caution! Taxpayers who would like to designate someone else to represent them before the Department of Revenue must complete and submit this form. Spouses filing a joint return must each complete a separate form.

This form will not be honored for any purpose other than representation before the Department of Revenue. This form cannot be used for any purpose other than designating representation before the Department of Revenue.

Notice: The department will accept a completed federal form 2848 as a power of attorney for representation before the Department of Revenue if Part I, Section 3, Matters, includes the tax type, the tax form number and year(s) or period(s) that the representative is authorized to discuss with the department. If you use the federal form, you must provide a copy to the Department of Revenue.

1.Taxpayer Information. Taxpayers must sign and date this power of attorney form on page 2, section 6.

Taxpayer Name and Address

Taxpayer Identification Number(s)

Telephone Number

hereby appoints the following representative(s) as

2.Representative(s) Name and Address

Name and Address

PTIN

Telephone Number

FAX Number

Email Address

PTIN

Telephone Number

FAX Number

Email Address

to represent the taxpayer before the Montana Department of Revenue for the following matters:

3.Tax Matters and Tax Years Covered by This Form

Your representative is authorized to inspect, receive and discuss confidential information for the tax types and tax years you authorize by checking the appropriate boxes below and inserting the specific tax years. If tax matters and tax periods are not specified, you are authorizing the representative access to all tax matters and years until you revoke such authorization.

|

Provide specific tax years |

|

|

Provide specific tax years |

q Individual Income Tax |

___________________ |

q |

Rental Vehicle Tax |

___________________ |

q Corporation Income Tax |

___________________ |

q |

Withholding Tax |

___________________ |

q S Corporation |

___________________ |

q |

Lodging Facilities Tax |

___________________ |

q Partnership |

___________________ |

q Combined Oil and Gas Tax |

___________________ |

|

|

|

q Other, please specify below |

___________________ |

|

__________________________________________

4.Acts Authorized by This Form

Check the box that best describes what authorization you are delegating to your representative.

q Representation. Department employees can provide confidential information to the representative and discuss the information. q Information sharing. Department employees can provide confidential information to the representative, but cannot discuss

the information.

q

5.Revocation of Prior Power(s) of Attorney

q Check this box if you want all prior POAs revoked.

If you are a representative and want to withdraw an existing POA, write WITHDRAW across the top of the existing form. See instructions on page 3.

6.Signature of taxpayer. If a tax matter concerns a year in which a joint return was filed, the spouses each file a separate power of attorney even if the same representative(s) is(are) appointed. If signed by a corporate officer, partner, guardian, tax matters partner, executor, receiver, administrator, fiduciary or trustee on behalf of the taxpayer, I certify that I have the authority to execute this form

on behalf of the taxpayer.

If not signed and dated, this power of attorney will not be in effect and the taxpayer will be notified.

_______________________________________ |

____________________ |

__________________________________ |

Signature |

Date |

Title (if applicable) |

_______________________________________ |

|

__________________________________ |

Print Name |

|

Print Taxpayer Name from Line 1 (if other |

|

|

than individual) |

PART II. Declaration of Representative

I declare that:

I am authorized to represent the taxpayer identified in Part I for the matter(s) specified there; and

I am one of the following:

a.Attorney - licensed to practice law in the jurisdiction shown below.

b.Certified Public Accountant - duly qualified to practice as a certified public accountant in the jurisdiction shown below.

c.Enrolled Agent or Licensed Public Accountant, etc.

d.Officer - a bona fide officer of the taxpayer’s organization.

e.Full time employee - a full time employee of the taxpayer.

f.Family member - a member of the taxpayer’s immediate family (for example, spouse, parent, child, grandparent,

g.Other

Representative Signature. See instructions on page 4.

Designation -

Insert Letter from

Above

Relationship to Taxpayer (see instructions for Part II)

Signature

Date

Filing this Form

►File Online on TransAction Portal at https://tap.dor.mt.gov.

►Fax to: (406)

Or, if you are already working with a department employee, fax your completed form to the number provided by that person.

►Mail the completed form to: Montana Department of Revenue 340 N. Last Chance Gulch

PO Box 5805

Helena, MT

2

Instructions for Power of Attorney

Authorization to Disclose Tax Information

Part I

Section 1. Taxpayer Information

Individual. Enter your name, personal address, social

security number (SSN), telephone number, individual taxpayer identification number (ITIN) and/or federal employee identification number (FEIN) if applicable. Do not use your representative’s address or post office box for your own. If you file a tax return that includes

a sole proprietorship business (federal Schedule C) and the matters for which you are authorizing the listed representative(s) to represent you include your individual and business tax matters, including employment tax liabilities, enter both your SSN (or ITIN) and your business

FEIN as your taxpayer identification numbers. If the tax

matter concerns a joint return, a separate power of attorney form is required for each spouse.

C Corporation, S corporations, partnership, limited

liability company or association. Enter the name, business address, federal employer identification number

(FEIN), and telephone number. If this form is being prepared for C corporations filing a combined tax return, a list of subsidiaries is not required. This power of attorney

applies to all members of the combined tax return.

Trust. Enter the name, title, address of the trustee, the name and FEIN of the trust and telephone number.

Estate. Enter the name of the decedent as well as the name, title and address of the decedent’s personal

representative. Enter the estate’s FEIN for the taxpayer identification number or, if the estate does not have an

FEIN, the decedent’s SSN (or ITIN).

Section 2. Authorization of Representative

Enter your representative’s full legal name. Use the identical full name on all submissions and correspondence.

Enter the representative’s telephone number, address or post office box and

If a trust, estate, guardianship or conservatorship wants an

individual other than the personal representative, trustee or other fiduciary to handle tax matters before the Department

of Revenue, the personal representative, trustee or other

fiduciary must complete this form and designate the

other individual with the power of attorney. Otherwise, the personal representative, trustee or other fiduciary has the requisite authority to handle tax matters before the

Department of Revenue and need not complete this form.

Section 3. Tax Matters and Tax Years Covered by the Form

Indicate, by checking the appropriate boxes, what tax types you are authorizing your representative to inspect, receive and discuss with the Department of Revenue.

You may list any tax years or periods that have already ended as of the date you sign the form.

If the matter relates to estate tax, enter the date of the

decedent’s death instead of a tax year.

If the tax matter and tax periods aren’t specified, you are authorizing the representative access to all tax matters and years until you revoke their authorization.

Section 4. Acts Authorized by This Form

If you are providing authorization to another individual, check one of the three boxes depending on what authorization you are providing to your representative. A disclosure authorized by this form may take place by telephone, letter, facsimile, email or a personal visit.

Note: If you check the “yes” box on the individual tax return next to the question “Do you want to allow another person

(third party designee) to discuss this return with us?” you

authorize Department of Revenue employees to discuss the tax return with the third party designee. They cannot

discuss any other issues, such as outstanding tax liabilities, without a completed power of attorney form.

Section 5. Revocation of Prior Power(s) of Attorney

Taxpayer Revocation. Check the box if you want all prior POAs revoked.

Revocation Withdraw by Representative. If you are a representative and want to revoke an existing POA, write REVOKE across the top of the form and submit the form as indicated on page 4.

Section 6. Signature

Individual. You must sign and date the form. If you file a joint return, your spouse must execute his or her own Montana power of attorney to designate a representative.

Corporation or association. An officer having authority to bind the corporation must sign.

Partnership. All partners must sign unless one partner is authorized to act in the name of the partnership. A partner is authorized to act in the name of the partnership if, under Montana law, the partner has authority to bind the partnership. If there is any doubt whether a partner has the authority to bind the partnership, it is best that all partners sign the form.

Limited Liability Company (LLC). If the LLC is member- managed, all members must sign, unless one member is authorized to act in the name of the LLC. If the LLC is

Estate, trust or other fiduciary. As discussed in Section 2, if a trust, estate, guardianship or conservatorship wants an

individual other than the personal representative, trustee or other fiduciary to handle tax matters before the Department

of Revenue, the personal representative, trustee or other

fiduciary must complete this form and designate the other individual with the power of attorney. Thus, the personal representative of an estate must sign. The trustee of a trust must sign. If a guardian or conservator has been appointed

3

for a taxpayer, the guardian or conservator must sign. In all cases, the fiduciary must include the representative capacity in which the fiduciary is signing, such as “John Doe, guardian of Jane Roe.”

Part II. Declaration of Representative

The representative(s) you name may sign and date the Declaration of Representative. Enter the applicable designation (items

a.Attorney – Enter the

b.Certified Public Accountant – Enter the

c.Enrolled Agent, Licensed Public Accountant, etc.

d.Officer – Enter the title of the officer (for example,

President, Vice President, Secretary, etc.).

e.

f.Family Member – Enter the relationship to the taxpayer (for example, spouse, parent, child, brother, sister, etc.).

g.Other – Identify the type of representative and enter a brief description of the representative’s relationship to the taxpayer.

Filing this Form

File Online on TransAction Portal at https://tap.dor.mt.gov.

Fax the completed form to (406)

Mail the completed form to:

Montana Department of Revenue

340 N. Last Chance Gulch

PO Box 5805

Helena, MT

Questions? Please call us at (406)

File online at https://tap.dor.mt.gov.

4

Document Specifics

| Fact | Description |

|---|---|

| Definition | The Tax POA (Power of Attorney) Authorization to Disclose Tax Information form allows designated individuals or entities to receive and review confidential tax information from the IRS or state tax agencies. |

| Usage | It is used when taxpayers want to authorize a third party, such as accountants or attorneys, to access their tax records for assistance with tax-related matters. |

| Limitations | The form does not allow the designated party to represent the taxpayer in tax court or to execute refund checks but solely to review tax documents and information. |

| Valid Period | The authorization typically holds its validity until a specified date set by the taxpayer or until it is revoked by the issuing taxpayer. |

| Governing Laws | While the IRS provides a federal form for such purposes (Form 8821, Tax Information Authorization), each state may have its own specific forms and governing laws regarding the disclosure of tax information. |

Guide to Writing Tax POA Authorization to Disclose Tax Information

Once you've decided that you need someone else to assist with your taxes by obtaining tax information on your behalf, you will need to complete the Tax Power of Attorney (POA) Authorization to Disclose Tax Information form. This form is a written authorization allowing a designated individual or organization, known as your representative, to receive and inspect confidential tax information. The following steps will guide you through the process of filling out this form accurately.

- Start by entering your full name and Social Security Number (SSN) or your Employer Identification Number (EIN) if the authorization is for a business.

- Provide your current mailing address, including the city, state, and ZIP code.

- Fill in the name and contact information of the individual or organization you are authorizing as your representative. This includes their full name, telephone number, and address.

- If your representative has a Preparer Tax Identification Number (PTIN) or Centralized Authorization File (CAF) number, enter it in the space provided.

- Specify the types of tax information your representative is allowed to access. This includes the form number (e.g., 1040, 940), the type of tax (e.g., income, employment), and the year(s) or period(s) involved.

- Define the specific tax matters and years or periods for which this authorization applies. Be as precise as possible to ensure correct handling of your tax information.

- Sign and date the form in the designated area at the bottom. If you are authorizing on behalf of a business, the signature of an officer or individual with the authority to bind the business is required.

- If the form grants authority for a use not related to tax administration, you must check the corresponding box to indicate this specific use.

- Make sure to provide any additional information or special instructions in the space provided on the form.

After completing the form, review it thoroughly to ensure all information is accurate and complete. Incorrect or incomplete forms may delay the process. Once satisfied, submit the form to the indicated address or according to the instructions provided by the tax authority or your tax professional. Following submission, keep a copy of the completed form for your records. The designated representative will then have the authority to access and discuss your tax information as specified in the authorization. Remember, the authorization can be revoked at any time, but the revocation must be done in writing.

Understanding Tax POA Authorization to Disclose Tax Information

-

What is the Tax POA Authorization to Disclose Tax Information form?

This form grants permission to an individual or entity, such as an accountant or tax preparer, to access your tax information. It's a legal document that specifies who can view or discuss your tax records with the tax authorities.

-

Who should use this form?

Individuals who need a professional to assist with tax matters, handle tax disputes, or gather tax information on their behalf should use this form. It's also beneficial for those managing the affairs of someone else, such as in fiduciary or guardianship roles.

-

How is this form different from a general Power of Attorney?

Unlike a general Power of Attorney (POA) that covers a wide range of legal and financial matters, the Tax POA Authorization specifically limits the scope to tax information disclosure. It does not grant authority for any other transactions or legal actions.

-

What information is required to complete the form?

To complete the form, you will need the taxpayer's identification number (such as SSN or EIN), the taxpayer's name, the name and identification of the authorized individual or entity, and the specific tax forms or periods the authorization covers.

-

Can I revoke this authorization?

Yes, you can revoke the authorization at any time. To do so, you must notify the tax authority in writing, specifying the original authorization's details and your intent to revoke it.

-

Is there a validity period for this form?

Many Tax POA forms have an expiration date, typically set by the taxpayer at the time of completion. If no duration is specified, the authorization continues until it is formally revoked.

-

How do I submit the form?

Submission procedures vary by tax authority. Generally, you can submit the form either electronically through the authority's website or by mailing a completed paper copy to the designated address. Always check the specific instructions provided by your tax authority.

-

What should I do if my authorized representative changes?

If the individual or entity authorized to access your tax information changes, you need to complete a new Tax POA Authorization form. The new form will replace the previous authorization once processed by the tax authority.

Common mistakes

When attempting to navigate the complexities of taxation, individuals often find themselves tasked with the authorization of disclosure of tax information. This process, crucial as it is, is prone to errors that can significantly impede one's objective. Here are nine common mistakes people make when filling out the Tax Power of Attorney (POA) Authorization to Disclose Tax Information form:

Failing to provide complete information about the taxpayer. This includes the taxpayer's Full Name, Social Security Number (SSN), or Individual Taxpayer Identification Number (ITIN), and their address. Leaving any of these blank can invalidate the form.

Incorrectly identifying the representative. The person or organization authorized to receive the tax information must be clearly and accurately described, with their name, address, phone number, and CAF number if applicable.

Omitting the specific tax form numbers. Without specifying which tax forms the representative is authorized to access, the process can be stalled.

Forgetting to state the tax periods. Each year or period for which the authorization is valid must be clearly listed. An incomplete listing can lead to partial disclosure.

Not stipulating the specific tax matters. This oversight can result in the representative being under-informed, limiting their ability to effectively manage the taxpayer’s affairs.

Misunderstanding the scope of authorization. Individuals sometimes assume the form grants broader authority than it actually does, leading to confusion about what the representative can and cannot do.

Signature issues. A common error is the taxpayer forgetting to sign and date the form, which is essential for its validity. Similarly, failing to have the representative’s signature when required will render the form ineffective.

Ignoring the need for a witness or notary. Depending on jurisdiction, the form may need to be witnessed or notarized to be recognized as valid.

Relying on outdated information. Laws and regulations undergo changes, and using an outdated form or following old guidelines can result in the rejection of the Tax POA.

Mitigating these errors requires attention to detail and an understanding of the specific requirements of the Tax POA Authorization form. By adhering closely to the instructions and reviewing the form thoroughly before submission, taxpayers can ensure that their representatives are properly empowered to act on their behalf.

Documents used along the form

Tax-related matters often entail a complex and detailed process that requires various forms and documents. The Tax Power of Attorney (POA) Authorization to Disclose Tax Information form is one such important document that allows an individual to grant another person the authority to access their tax information. Alongside this crucial form, there are other important documents that are frequently used to ensure tax matters are handled comprehensively and efficiently. Each of these forms serves a specific purpose and aids in the broader context of managing tax responsibilities and legal considerations.

- Form 1040: U.S. Individual Income Tax Return form that individuals use to file their annual income tax returns with the Internal Revenue Service (IRS).

- Form W-2: Wage and Tax Statement provided by employers to employees and the IRS, detailing the employee's annual wages and taxes withheld.

- Form W-9: Request for Taxpayer Identification Number and Certification used by individuals to provide their tax identification number to entities that pay them income.

- Form 1099-MISC: Used to report various types of income other than wages, salaries, and tips to the IRS. This includes freelance or contractor income.

- Form 4868: Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, allowing taxpayers extra time to file their Form 1040.

- Form 8822: Change of Address form for notifying the IRS of a change in address to ensure the taxpayer receives any IRS correspondence.

- Schedule C: Profit or Loss from Business form used by sole proprietors to report the income and expenses of their business when filing their tax return.

- Form 4506-T: Request for Transcript of Tax Return, which allows taxpayers to request prior-year tax returns and information.

- Form 8962: Premium Tax Credit form used to reconcile or claim the premium tax credit for individuals who have marketplace health insurance.

- Form SS-4: Application for Employer Identification Number, which businesses use to apply for an employer identification number (EIN) from the IRS.

These documents collectively support the Tax POA Authorization to Disclose Tax Information form in managing an individual's or business's tax-related matters. They ensure individuals and entities can report income accurately, comply with tax laws, and facilitate smooth communication with tax authorities. Understanding the purpose and requirements of each form can significantly streamline the tax filing and management process.

Similar forms

The General Power of Attorney (POA) form parallels the Tax Power of Attorney (Tax POA) Authorization to Disclose Tax Information form in several respects. It grants an agent broad authorization to handle the principal’s affairs. While the General POA may encompass a wider range of activities, including financial, legal, and personal matters, the Tax POA specifically focuses on tax-related issues. The similarity lies in the concept of delegation of authority from the principal to the agent.

Similarly, the Healthcare Power of Attorney is another variant that, like the Tax POA, allows for the delegation of certain decision-making powers. Instead of handling tax matters, a Healthcare POA empowers an agent to make healthcare-related decisions on the principal's behalf, should they become unable to do so. Both documents operate on the principle of assigning authority to an individual for specific matters under specific circumstances.

The HIPAA Authorization Form shares a connection with the Tax POA in its focus on privacy and disclosure. This form permits the sharing of an individual's health information with designated parties, aligning with the Tax POA’s purpose of authorizing the disclosure of tax information. In both instances, confidentiality is a key concern, with the forms limiting information access to authorized parties.

The Financial Information Release Authorization Form is closely related to the Tax POA as it involves the disclosure of sensitive financial information. While this form usually addresses a broader spectrum of financial data beyond taxes, it shares the objective of allowing individuals to control who can access their personal information. The main similarity is in safeguarding the principal's financial privacy through delegated consent.

The Durable Power of Attorney for Finance mirrors the Tax POA by focusing on financial matters, but it extends beyond tax information to include a wide range of financial decisions and actions. The durability aspect means the POA remains effective even if the principal becomes incapacitated. Both documents entrust an agent with significant financial responsibilities, emphasizing trust and authority in financial affairs.

The Limited Power of Attorney form is closely aligned with the Tax POA by permitting a principal to grant an agent specific powers for a limited time or purpose. While the Tax POA authorizes disclosure of tax information, a Limited POA might be used for selling a car, managing real estate, or handling other specific transactions. The commonality lies in their narrow focus and temporary nature, differentiating them from more broad-ranging authorizations.

Dos and Don'ts

When preparing the Tax POA (Power of Attorney) Authorization to Disclose Tax Information, it is important to approach the task with careful attention to detail and accuracy. To assist with this process, here is a list of dos and don'ts that should be followed:

- Do review the form thoroughly before beginning to ensure you understand all the requirements.

- Do provide complete and accurate information for all fields required on the form to avoid delays or issues with processing.

- Do use black ink or type your responses if possible to ensure that the information is legible and can be processed efficiently.

- Do make sure that the taxpayer's identification number, usually a Social Security Number or Employer Identification Number, is correctly entered.

- Do verify the tax years or periods for which authorization is being granted to ensure correct processing of requests and queries.

- Do sign and date the form in the designated sections to validate the authorization. An unsigned form may not be processed.

- Do keep a copy of the completed form for your records and future reference.

- Do not use correction fluid or tape on the form. If a mistake is made, a new form should be completed to ensure clarity.

- Do not forget to specify the precise type of tax information and years you are authorizing disclosure for to prevent unauthorized access to information.

- Do not hesitate to seek professional advice if there are questions or uncertainties about filling out the form to ensure that it is completed correctly.

Taking the time to carefully complete the Tax POA Authorization to Disclose Tax Information form will help ensure that the process moves forward smoothly and efficiently. Remember, when in doubt, seeking clarification can prevent unnecessary errors and protect sensitive tax information.

Misconceptions

Many misconceptions surround the Tax Power of Attorney (POA) Authorization to Disclose Tax Information form. Understanding these misconceptions can help individuals navigate their tax matters more accurately and efficiently.

- Only Attorneys Can Be Designated: A common misconception is that only a practicing attorney can be appointed with this form. In reality, any individual, such as a trusted family member or a professional tax preparer, can be designated to receive tax information, provided they are deemed responsible and knowledgeable enough to handle such information.

- It Grants Complete Control Over Financial Matters: Another misunderstanding is that the Tax POA grants the designee full authority over the principal's financial assets and decisions. This form specifically limits the designee’s power to receiving tax information and does not allow them to manage finances or make decisions on behalf of the taxpayer.

- The Form Is Irrevocable: Some believe once the Tax POA form is filed, it cannot be revoked. However, the taxpayer retains the right to revoke the authorization at any time, should they decide to change their designee or handle their tax matters personally.

- All Tax Forms Are Covered Automatically: A prevailing myth is that executing a Tax POA covers all tax forms and years by default. In practice, the specific tax forms and periods must be clearly indicated on the form, otherwise, the authorization may not be valid for all intended purposes.

- It Allows the Designee to File Returns: There is a misunderstanding that this authorization permits the designee to file tax returns on behalf of the taxpayer. The primary role of the designee under this form is to receive and inspect tax information, not to act as a filer unless specifically authorized through another type of POA form.

- It’s Only for Individuals with Complex Taxes: Many people think that the Tax POA is only necessary for those with complicated tax situations. However, it can benefit anyone wishing to have a trusted person receive their tax information for easier management, advice, or even for routine checks.

Key takeaways

The Tax Power of Attorney (POA) Authorization to Disclose Tax Information form is an important document that allows individuals to grant others the authority to access and discuss their tax information with taxing agencies. Understanding how to fill out and use this form is essential for both the individual granting the power and the one receiving it. Here are ten key takeaways about this process:

- Identification is crucial: The form requires detailed information about the individual granting authority (the principal) and the person or entity being granted the authority (the agent). Ensure all names, addresses, and identifying numbers (such as Social Security numbers) are accurate.

- Specify the tax information: The form allows the principal to specify which types of tax records and for which years the agent can access. Be clear and precise to avoid any confusion or unauthorized access.

- Understand the authority granted: Filling out the form gives the agent the power to access tax records, but depending on the specifics of the form, it may also allow them to make decisions or take actions concerning the principal's tax matters. Understand the extent of the authority being granted.

- Limited vs. General Powers: The principal can choose to grant either limited or general authority. Limited authority might restrict the agent's power to specific tax matters or years, while general authority might cover a broad range of actions.

- Signing and witnessing: The form must be signed by the principal and, in some cases, may need to be witnessed or notarized depending on state laws. Check the requirements in your jurisdiction to ensure the form is legally binding.

- Duration: The form should specify when the authorization begins and ends. If no expiration date is mentioned, it may be subject to state laws that dictate the duration of such authorizations.

- Revocation: The principal can revoke the authorization at any time. To do so, they must typically provide written notice to the taxing authority and the agent. Be aware of the process for revocation.

- Multiple Agents: The form can authorize more than one agent. If appointing multiple agents, the principal must decide whether they can act independently or must make decisions jointly.

- State-Specific Forms: Some states may require a specific form or have additional requirements. Always use the form prescribed for your state and adhere to its guidelines.

- Record Keeping: Both the principal and the agent should keep copies of the completed form. This documentation will prove the authority granted and can help resolve any disputes or misunderstandings in the future.

Handling tax matters can be complex, and the Authorization to Disclose Tax Information form is an important tool in managing these affairs. Whether you are the individual granting authority or the one receiving it, understanding the key aspects of this form ensures that tax information is accessed and used appropriately and in compliance with the law.

Popular PDF Documents

Wv State Tax Forms - Familiarizing yourself with this form and its requirements can lead to a smoother tax experience.

Itr - Special sections are included for reporting income subject to final tax and exempt income receipts.