Get Tax POA 774 Form

The Tax Power of Attorney (POA) Form 774 serves as a critical document for individuals who seek to delegate their tax-related tasks and responsibilities to a trusted representative. This form allows taxpayers to authorize an individual, be it a family member, friend, or a professional like an accountant or attorney, to handle their tax affairs. This could range from filing returns to communicating with the tax authority on their behalf. The significance of Form 774 lies not only in its ability to facilitate the delegation of tax duties but also in ensuring that the process is conducted under a structured and legally recognized framework. By using this form, taxpayers can ensure that their tax matters are managed efficiently, without direct involvement in every step of the process, thereby reducing the potential for stress and errors. Additionally, this form plays a pivotal role in safeguarding the taxpayer's interests, by limiting the representative's authority to the specific tasks outlined in the document. In this way, Form 774 offers peace of mind to individuals who, for various reasons, are unable to manage their tax affairs personally, and need to entrust this important aspect of their financial life to another.

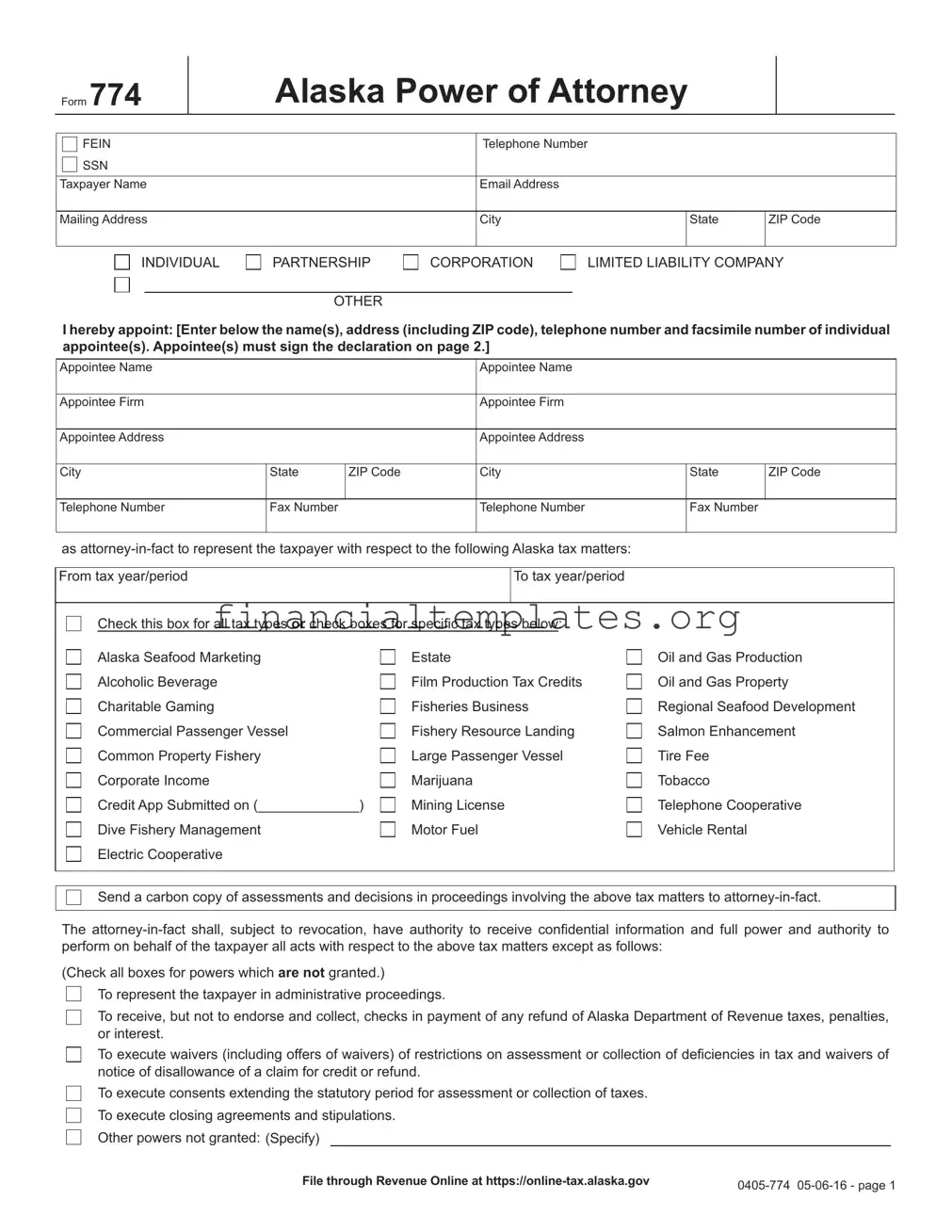

Tax POA 774 Example

Form 774

Alaska Power of Attorney

FEIN |

Telephone Number |

|

|

SSN |

|

|

|

|

|

|

|

Taxpayer Name |

Email Address |

|

|

|

|

|

|

Mailing Address |

City |

State |

ZIP Code |

|

|

|

|

INDIVIDUAL

PARTNERSHIP

OTHER

CORPORATION

LIMITED LIABILITY COMPANY

I hereby appoint: [Enter below the name(s), address (including ZIP code), telephone number and facsimile number of individual appointee(s). Appointee(s) must sign the declaration on page 2.]

Appointee Name |

|

|

Appointee Name |

|

|

Appointee Firm |

|

|

Appointee Firm |

|

|

Appointee Address |

|

|

Appointee Address |

|

|

City |

State |

ZIP Code |

City |

State |

ZIP Code |

Telephone Number |

Fax Number |

|

Telephone Number |

Fax Number |

|

as

From tax year/period |

|

To tax year/period |

|

|

|

|

|

Check this box for all tax types or check boxes for specific tax types below: |

|

||

Alaska Seafood Marketing |

Estate |

Oil and Gas Production |

|

Alcoholic Beverage |

Film Production Tax Credits |

Oil and Gas Property |

|

Charitable Gaming |

Fisheries Business |

Regional Seafood Development |

|

Commercial Passenger Vessel |

Fishery Resource Landing |

Salmon Enhancement |

|

Common Property Fishery |

Large Passenger Vessel |

Tire Fee |

|

Corporate Income |

Marijuana |

Tobacco |

|

Credit App Submitted on (_____________) |

Mining License |

Telephone Cooperative |

|

Dive Fishery Management |

Motor Fuel |

Vehicle Rental |

|

Electric Cooperative |

|

|

|

|

|

|

|

Send a carbon copy of assessments and decisions in proceedings involving the above tax matters to

The

(Check all boxes for powers which are not granted.)

To represent the taxpayer in administrative proceedings.

To receive, but not to endorse and collect, checks in payment of any refund of Alaska Department of Revenue taxes, penalties, or interest.

To execute waivers (including offers of waivers) of restrictions on assessment or collection of deficiencies in tax and waivers of notice of disallowance of a claim for credit or refund.

To execute consents extending the statutory period for assessment or collection of taxes.

To execute closing agreements and stipulations.

Other powers not granted: (Specify)

File through Revenue Online at |

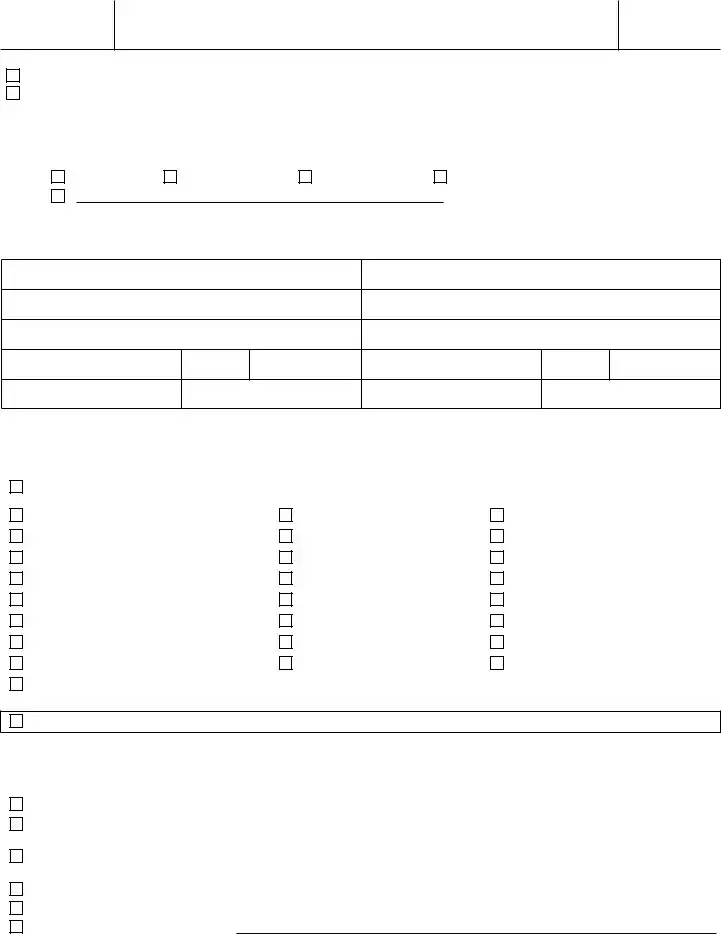

Form 774

Alaska Power of Attorney

This power of attorney revokes all prior powers of attorney filed with respect to the same matters and years or periods covered by this instrument, except the following: (Specify and attach copies of the powers of attorney)

This power of attorney revokes all prior powers of attorney filed with respect to the same matters and years or periods covered by this instrument, except the following: (Specify and attach copies of the powers of attorney)

Signature of Taxpayer – If signed by a corporate officer, partner, or fiduciary on behalf of the taxpayer, I certify that I have the authority to execute this power of attorney on behalf of the taxpayer.

Signature |

Date |

Printed Name |

Printed Title |

DECLARATION OF REPRESENTATIVE

The undersigned representative hereby declares under the penalty of unsworn falsification that he/she is an individual authorized to represent a taxpayer before the Department of Revenue and that he/she is authorized to represent the named taxpayer in this matter.

Signature |

Date |

Signature |

Date |

POWER OF ATTORNEY INFORMATION

USE THIS FORM TO GRANT AUTHORITY TO AN INDIVIDUAL TO REPRESENT YOU BEFORE THE DEPARTMENT AND TO RECEIVE TAX INFORMATION.

An individual who is not the taxpayer must be a recognized representative before the individual may represent a taxpayer before the Department of Revenue. A recognized representative is an individual who is appointed as an

A power of attorney is a document signed by the taxpayer by which another individual is given the authority to appear before the department and act for the taxpayer. An

Generally, the power of attorney encompasses all matters relating to a taxpayer’s rights, privileges, or liabilities under laws and regulations administered by the department. This includes, for example, such things as the preparation and filing of necessary documents, receipt of otherwise confidential tax particulars, correspondence and communication with department personnel, and representation of a taxpayer at audits, conferences, hearing, and other meetings.

Forms filed through Revenue Online are considered original forms and do not need to be mailed in. The original of this form, if not filed through Revenue Online, must be mailed to the department.

Document Specifics

| Fact Number | Description |

|---|---|

| 1 | The Tax POA 774 form is a Power of Attorney (POA) document specifically for tax matters. |

| 2 | This form allows an individual or business entity to designate a representative to handle tax affairs on their behalf. |

| 3 | A key feature of the Tax POA 774 is its ability to grant limited or broad authority to the designated agent. |

| 4 | It is often used to authorize the representative to communicate with tax authorities, obtain confidential tax information, and represent the principal in tax disputes. |

| 5 | The form requires detailed information about the principal, the agent, and the specific tax matters and periods covered. |

| 6 | State-specific versions of the Tax POA form, including form 774, may exist and are governed by state tax law. |

| 7 | Execution of the Tax POA 774 typically requires compliance with state laws, such as signature requirements and possible notarization. |

| 8 | The document's effectiveness is subject to revocation by the principal or expiration as described in the form itself. |

| 9 | Filing the completed form with the relevant tax authority is an essential step for the POA to be recognized and effective. |

| 10 | Using the Tax POA 774 form correctly can ensure that one's tax matters are handled accurately and professionally, potentially relieving much of the stress associated with tax disputes or complications. |

Guide to Writing Tax POA 774

After deciding to authorize someone to represent you in matters concerning taxes, completing the Tax Power of Attorney (POA) Form 774 is a necessary step. This form legally enables your chosen representative to handle tax filings, negotiations, and discussions with the tax authority on your behalf. It's a crucial document that requires accuracy and attention to detail during completion to ensure all authorizations are correctly granted and understood by all parties involved.

To fill out the Tax POA 774 form, follow these steps:

- Begin by entering the full legal name of the individual or entity granting the power of attorney in the designated section.

- Fill in the social security number (SSN) or taxpayer identification number (TIN) of the individual granting the authority, as applicable.

- Provide the full legal name of the representative being granted the power of attorney. If more than one representative is being designated, include all names, ensuring that each has the authority to act independently unless specified otherwise.

- List the representative(s)'s address(es), including city, state, and zip code, where official communications should be sent.

- Enter the phone number and, if available, the fax number of the representative(s) to facilitate direct communication.

- Detail the specific tax matters for which this power of attorney is granted. This includes the type of tax, the federal tax form numbers, and the year(s) or period(s) involved.

- If there are any specific acts you do not wish to authorize, such as signing a tax return, identify these limitations in the specified section of the form.

- Should the representation rights be replacing or revoking a previously filed power of attorney, indicate this by providing details of the prior authorization in the designated area.

- The form must be signed and dated by the individual or entity granting the power of attorney. If a non-individual entity is granting the authorization, the title of the signing individual must be included.

- Finally, the representative(s) must also sign and date the form, agreeing to the representation responsibilities outlined.

Once the Tax POA 774 form is completed and signed by all parties, it should be reviewed for accuracy and completeness. Afterward, the form is ready to be submitted to the appropriate tax authority as directed, either via mail or electronically, according to the instructions provided by the local or state tax department. This submission officially activates the representative's authority to manage the tax matters specified, marking an important step in ensuring your tax affairs are managed as desired.

Understanding Tax POA 774

-

What is the Tax POA 774 form?

The Tax POA 774 form, commonly known as a Tax Power of Attorney, is a legal document that allows an individual to grant another person the authority to make tax-related decisions and handle tax matters on their behalf. This form is typically used to authorize a tax professional, such as an accountant or attorney, to communicate with tax agencies, obtain confidential tax information, and perform actions like filing taxes on behalf of the individual.

-

Who can be designated as a representative on the Tax POA 774 form?

On the Tax POA 774 form, the individual granting the power (the principal) can designate almost any trusted individual as their representative. This representative is often a professional with expertise in tax matters, like a certified public accountant (CPA), tax attorney, or enrolled agent. It is essential to choose someone who is not only trustworthy but also has the necessary knowledge and experience to handle complex tax issues effectively.

-

How does one fill out and submit the Tax POA 774 form?

Filling out the Tax POA 774 form requires careful attention to detail to ensure accurate representation of the powers being granted. The form must include the principal's personal information, the representative's details, and the specific tax matters and periods for which authority is granted. Once completed, the form's submission process varies; it might need to be mailed or submitted electronically, depending on the specific requirements of the local or state tax authority. It is advisable to check with the relevant tax agency for their submission guidelines.

-

What are the limitations of the Tax POA 774 form?

While the Tax POA 774 form grants significant authority to the designated representative, it does have limitations. For instance:

- The representative cannot change the principal's will.

- They cannot take actions that the principal has not specifically authorized within the document.

- The power granted is limited to tax matters, meaning the representative cannot handle other financial or legal affairs unless authorized separately.

-

Can the Tax POA 774 form be revoked?

Yes, the principal can revoke the Tax POA 774 form at any time, provided they are mentally competent. To revoke the power of attorney, the principal must generally notify the representative and the relevant tax agency in writing. A new Tax POA 774 form may also need to be submitted to formally appoint a new representative or to notify the tax agency that the principal no longer wishes to have a representative.

-

Is the Tax POA 774 form recognized in all states?

The Tax POA 774 form is designed to comply with the laws of the jurisdiction in which it is used, but it is crucial to verify whether the form is recognized and accepted by the state or local tax agency where the principal resides or is required to file taxes. Tax laws and regulations vary widely across different states, and some may have their own specific forms and requirements for granting someone the power of attorney for tax matters. Always check with the local tax authority or consult a tax professional to ensure compliance with state-specific guidelines.

Common mistakes

Filling out the Tax Power of Attorney (POA) Form 774 is a critical step for individuals who need to delegate authority for their tax matters. This document, however, can be a bit tricky to complete without making errors. Understanding and avoiding common mistakes can streamline the process, ensuring that your tax matters are handled efficiently and correctly.

-

Not verifying the current form version. Tax laws and forms are subject to updates, which means using an outdated version of Form 774 could lead to rejection. Always check for the most current version before starting.

-

Skipping sections. Each section of Form 774 is designed for specific information. Leaving sections blank can lead to misinterpretation or even rejection of the form. Ensure all relevant sections are carefully completed.

-

Failing to specify the type of tax matters. The form allows you to designate authority for particular tax periods and types. Not being specific about which tax matters the POA covers can create confusion and limit the agent's ability to act effectively.

-

Omitting the agent's qualifications. Your appointed agent should have the necessary qualifications such as being a certified tax preparer or a licensed attorney. Not listing their qualifications can raise questions about their legitimacy to act on your behalf.

-

Misunderstanding the scope of the POA. It's crucial to understand what your agent can and cannot do under the POA. Overestimating or underestimating this scope can lead to unexpected outcomes.

-

Not using a witness or a notary, when required. Some jurisdictions may require your Tax POA Form 774 to be either witnessed or notarized, or both. Failing to comply with this requirement can invalidate the entire document.

To ensure your forms are accurately completed and accepted, consider the following practical tips:

- Before filling out the form, gather all necessary documentation regarding your tax matters.

- Consult with a professional if you are unsure about any sections of the form or its requirements.

- Review your completed form for any errors or omissions before submission.

- Keep a copy of the filled-out form for your records, and ensure your agent also has a copy.

By paying attention to these details, you can avoid common pitfalls and ensure that your Tax Power of Attorney Form 774 effectively communicates your needs and authorizes your agent correctly.

Documents used along the form

When dealing with tax matters, using the Tax Power of Attorney (POA) Form 774 can be essential for those seeking to authorize someone else to handle their tax affairs. Besides the Tax POA 774 form, individuals often find themselves in need of a variety of other forms and documents that play crucial roles in the broader context of financial and legal planning. The documents listed below are commonly utilized in conjunction with the Tax POA 774 to ensure comprehensive management and compliance in tax-related matters.

- Form 1040: The U.S. Individual Income Tax Return is the foundational document that most taxpayers use to file their annual income tax returns. It details an individual's income, calculates the taxes owed or the refund due, and facilitates adjustments to income and credits.

- Form 2848: The Power of Attorney and Declaration of Representative form allows taxpayers to grant authorization to a designated individual, such as an accountant or attorney, to represent them before the IRS. This form is more comprehensive than the Tax POA 774 and is necessary for representation in tax matters beyond simple document submission or payment arrangement.

- Form 8821: Tax Information Authorization permits a third party to receive and inspect confidential tax information from the IRS but does not allow them to represent the taxpayer before the IRS or sign documents on their behalf. This is often used alongside the Tax POA for visibility without delegation of representation powers.

- Form W-9: Request for Taxpayer Identification Number and Certification is used to provide third parties with the taxpayer's correct Taxpayer Identification Number (TIN), to help manage tax information reporting in the context of interest, dividends, and other income types. It's crucial for ensuring that entities have the correct information for tax withholding and reporting purposes.

- Form 433-F: Collection Information Statement is used by the IRS to collect financial information from individuals who owe taxes and wish to discuss payment plans or settlements. When working under a Tax POA 774, the representative may need to submit this form to arrange or renegotiate payment terms on behalf of the taxpayer.

- Schedule C (Form 1040): Profit or Loss from Business (Sole Proprietorship) is a supplementary form used to report income or loss from a business operated as a sole proprietor. This form is necessary for individuals who manage their business and need to outline their business income and expenses as part of their personal tax return.

Each of these forms and documents serves a unique purpose in the context of tax preparation, filing, and resolution. They are integral to ensuring that individuals can adequately manage their tax affairs, either independently or through a designated representative. Proper completion and submission of these forms, in conjunction with the Tax POA 774, allow for a more streamlined and effective handling of tax-related matters.

Similar forms

The Tax Power of Attorney (POA) 774 form bears resemblance to the General Power of Attorney document in that both authorize an individual or entity to act on behalf of another in matters specified within the document. However, while the General Power of Attorney can cover a broad range of activities, including financial, legal, and personal affairs, the Tax POA 774 is specifically tailored towards tax-related matters. This specialization allows for a trusted individual or entity, typically a tax professional, to handle tax filings, disputes, and negotiations with tax authorities on behalf of the grantor.

Similarly, the Tax POA 774 form shares commonalities with the Healthcare Power of Attorney. Both documents designate an agent to act on the principal's behalf under specified circumstances. The critical difference lies in their domain of authority; the Healthcare Power of Attorney focuses on medical decisions when the principal is incapacitated, whereas the Tax POA 774 is concerned with tax matters. Despite this difference, both forms underscore the importance of appointing trusted representatives in critical areas of one's life.

The Durable Power of Attorney is another document akin to the Tax POA 774 form. It grants an agent authority to manage a wide range of affairs, including financial matters, that remain in effect even if the principal becomes incapacitated. The 'durable' aspect signifies that the powers granted persist beyond the principal's loss of capacity to make decisions. While the Durable Power of Attorney encompasses much broader authority, including but not limited to tax matters, the Tax POA 774 focuses explicitly on tax representation and actions.

The Limited Power of Attorney document also shares similarities with the Tax POA 774 form. The Limited Power of Attorney grants an agent powers to perform specific acts or duties for a limited time, unlike the potentially broad and enduring powers in a General or Durable Power of Attorney. The Tax POA 774 can be considered a form of Limited Power of Attorney with a strict focus on tax-related powers. Both documents allow the principal to tailor the authority given to the agent, ensuring that it is appropriate for their precise needs.

Lastly, the IRS Form 2848, Power of Attorney and Declaration of Representative, is directly comparable to the Tax POA 774 form, as both are used to authorize an individual, such as an accountant or attorney, to represent the principal in tax matters. However, IRS Form 2848 is specific to the Internal Revenue Service in the United States, allowing designated agents to perform a variety of tax-related tasks including obtaining confidential tax information. While the scope may vary by jurisdiction, both forms serve the essential function of appointing a representative in dealings with tax authorities.

Dos and Don'ts

Preparing the Tax Power of Attorney (POA) Form 774 requires attention to detail and an understanding of both your rights and obligations. The guidance provided here aims to assist in accurately completing the form, ensuring your intentions are clearly communicated and legally sound. Below are key dos and don'ts to consider:

Do:Ensure you have the correct form, Tax POA 774, for your specific needs and jurisdiction, as requirements may vary by state.

Clearly print or type information to prevent any misunderstandings or processing delays caused by illegible handwriting.

Provide complete information for all required fields, including full legal names, addresses, and tax identification numbers, to ensure the POA is valid and effective.

Specify the exact tax matters and years or periods for which the POA is granted, avoiding any ambiguity about the scope of authority being given.

Include any special instructions or restrictions you wish to apply to the agent’s powers, to maintain greater control over the handling of your tax matters.

Have all parties, including the principal and the agent(s), sign and date the form as required, to validate the POA.

Keep a copy of the completed form for your records, ensuring you have proof of the granted authority and can reference it if questions arise.

File the form with the appropriate tax authority, following their guidelines for submission, which may vary by location.

Regularly review and update the POA as necessary, especially if your personal situation or tax matters change.

Consider consulting with a tax professional or attorney to ensure the POA meets your needs and complies with current laws and regulations.

Rush through filling out the form without thoroughly understanding each section, as mistakes can lead to unintended legal and financial consequences.

Overlook the importance of specifying a termination date, which can prevent an outdated POA from remaining in effect indefinitely.

Fail to notify your agent about the responsibilities and limitations of their role, which can lead to confusion or misuse of authority.

Ignore the need to formally revoke the POA if you wish to terminate the agent’s authority before the specified end date, as simply destroying the document may not be legally sufficient.

Forget to consider state-specific requirements and forms, as using the wrong form or omitting necessary information can invalidate the POA.

Assume one POA form covers all tax-related matters; certain transactions may require additional or separate forms.

Give more authority than necessary, as it's safer to limit the agent’s powers to only those tasks you are unable or unwilling to perform yourself.

Hesitate to ask for professional help if you have questions or concerns about the POA process or its implications for your tax situation.

Underestimate the importance of choosing a trustworthy and competent agent, as this person will have significant power over your financial matters.

Assume the process is complete after the form is filled out; follow through with all required steps for filing and notification to ensure the POA is recognized and effective.

Misconceptions

Understanding the Tax Power of Attorney (POA) Form 774 can be confusing due to widespread misconceptions. Clarity on these misconceptions is crucial for handling tax matters efficiently and effectively. Below are seven common misunderstandings about the Tax POA 774 form and the truths behind them.

- Only for individuals: Many believe that the Tax POA 774 form is exclusively for individual taxpayers. However, it is applicable to both individuals and businesses needing to grant authority to a representative for tax matters.

- Unlimited power: A common misconception is that filling out this form gives the representative unlimited power over all tax affairs. The truth is, the scope of authority can be specifically limited within the form according to the granter's wishes.

- Requires a lawyer to complete: Some think that a lawyer must complete the Tax POA 774 form. Although legal advice can be helpful, taxpayers can fill out and submit the form themselves or with the help of their chosen representative.

- Valid indefinitely: Another misconception is that once the Tax POA 774 form is submitted, it's valid indefinitely. The form's validity can be limited by a specified expiration date chosen by the taxpayer.

- Only for resolving tax disputes: Many assume that the form is to be used solely for resolving disputes with tax authorities. In reality, it enables the representative to perform a wide range of tasks, including filing returns, making payments, and receiving confidential information.

- Instant authorization: Some believe that the representative's authority takes effect immediately upon signing the form. The truth is, the form must be processed and approved by the applicable tax authority before the representative's authority is recognized.

- Irrevocable: A common misunderstanding is that the authority granted through the Tax POA 774 form cannot be revoked. Taxpayers have the right to revoke the power of attorney at any time provided they follow the proper procedure to do so.

Key takeaways

Filling out the Tax Power of Attorney (POA) Form 774 is a critical step that allows individuals to grant another person the authority to handle their tax matters. This process, while straightforward, requires attention to detail to ensure that all information is accurate and legally binding. Here are five key takeaways to consider when dealing with this form:

- Complete identification information accurately: It's crucial that the names, addresses, and identification numbers of both the taxpayer and the appointed representative are filled out completely and without errors. This ensures there are no delays in processing the form due to identification mismatches.

- Specify the tax matters and years involved: The form allows taxpayers to delineate exactly which tax matters and years the representative has authority over. Being specific in this section prevents any unnecessary confusion and limits the scope of the representative's power to the intended areas.

- Understand the extent of authority granted: The person filling out the form should be aware of the extent of authority they are granting to their representative. This includes understanding which rights they are allowing their representative to exercise on their behalf, such as receiving confidential tax information or making decisions regarding tax matters.

- Obtaining the proper signatures: For the Power of Attorney to be considered valid, it must be signed and dated by the taxpayer and, in some cases, their appointed representative. Ensure these signatures are obtained and clearly legible to avoid any questions of authenticity.

- Keep a copy for your records: Once the form is completed and submitted, it's advisable for both the taxpayer and the appointed representative to keep a copy for their records. This documentation can be crucial in resolving any future disputes or misunderstandings regarding the authority granted.

By keeping these key points in mind, individuals can navigate the process of filling out and using the Tax POA 774 form more effectively, ensuring their tax matters are handled in accordance with their wishes.

Popular PDF Documents

Rev 1706 - This form is crucial for companies ceasing operations, ensuring compliance with state tax laws by ending tax liabilities.

Pa Sales Tax Exemption Number Lookup - Learn about the significance of listing the highest paid individuals and their benefits for transparency in the tax exemption process.