Get Tax POA 500 Form

Navigating the complexities of tax matters often requires the expertise of a professional, especially when individuals or businesses need to delegate authority to a representative to handle their taxes. This delegation is where the Tax Power of Attorney (POA) 500 form becomes essential. It serves as a legal document that grants a trusted individual or entity the power to manage tax affairs on behalf of the person or entity. This includes filing taxes, communicating with tax agencies, and making decisions about tax payments or disputes. The significance of the Tax POA 500 form lies in its ability to ensure that tax matters are handled efficiently and effectively, even if the taxpayer cannot manage these issues directly. By appointing a representative, who is usually a certified accountant, tax attorney, or other professionals with expertise in tax law, taxpayers can ensure that their tax responsibilities are fulfilled accurately, adhering to the complex regulations and deadlines that govern tax filings and disputes. Furthermore, the form outlines the specific powers granted to the agent, ensuring that taxpayers retain control over the extent of the authority given. This arrangement can relieve taxpayers of the burden of tax management, providing peace of mind with the knowledge that their tax affairs are in capable hands.

Tax POA 500 Example

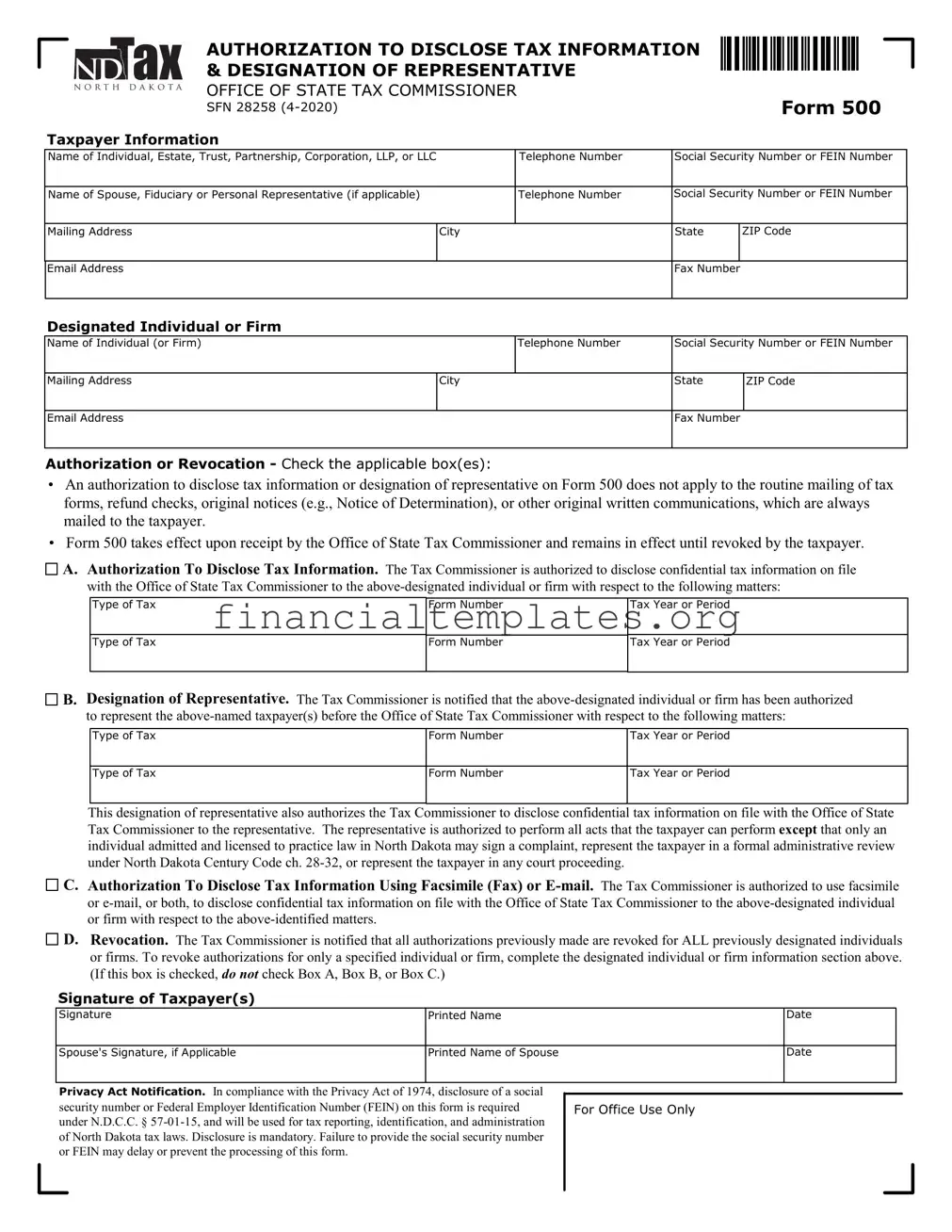

1,~.,ax AUTHORIZATION TO DISCLOSE TAX INFORMATION

&DESIGNATION OF REPRESENTATIVE

NORTH DAKOTA OFFICE OF STATE TAX COMMISSIONER

SFN 28258

Taxpayer Information

Ill

I

I

IIIII

IIIII

I

I

llll

llll

111111111111111

111111111111111

7

7

Form 500

Name of Individual, Estate, Trust, Partnership, Corporation, LLP, or LLC |

Telephone Number |

Social Security Number or FEIN Number |

|||

|

|

|

|

|

|

Name of Spouse, Fiduciary or Personal Representative (if applicable) |

|

Telephone Number |

Social Security Number or FEIN Number |

||

|

|

|

|

|

|

Mailing Address |

City |

|

State |

|

ZIP Code |

|

I |

|

|

I |

|

Email Address |

|

|

Fax Number |

|

|

|

|

|

|

|

|

Designated Individual or Firm |

|

|

|

|

|

Name of Individual (or Firm) |

|

Telephone Number |

Social Security Number or FEIN Number |

||

|

|

I |

|

|

|

Mailing Address |

City |

|

State |

ZIP Code |

|

|

I |

|

|

|

I |

Email Address |

|

|

Fax Number |

|

|

|

|

|

|

|

|

Authorization or Revocation - Check the applicable box(es):

•An authorization to disclose tax information or designation of representative on Form 500 does not apply to the routine mailing of tax forms, refund checks, original notices (e.g., Notice of Determination), or other original written communications, which are always mailed to the taxpayer.

•Form 500 takes effect upon receipt by the Office of State Tax Commissioner and remains in effect until revoked by the taxpayer.

□

A. Authorization To Disclose Tax Information. The Tax Commissioner is authorized to disclose confidential tax information on file with the Office of State Tax Commissioner to the

A. Authorization To Disclose Tax Information. The Tax Commissioner is authorized to disclose confidential tax information on file with the Office of State Tax Commissioner to the

Type of Tax

Form Number

Tax Year or Period

Type of Tax

Form Number

Tax Year or Period

□

B. Designation of Representative. The Tax Commissioner is notified that the

B. Designation of Representative. The Tax Commissioner is notified that the

Type of Tax |

Form Number |

Tax Year or Period |

Type of Tax |

Form Number |

Tax Year or Period |

This designation of representative also authorizes the Tax Commissioner to disclose confidential tax information on file with the Office of State Tax Commissioner to the representative. The representative is authorized to perform all acts that the taxpayer can perform except that only an individual admitted and licensed to practice law in North Dakota may sign a complaint, represent the taxpayer in a formal administrative review under North Dakota Century Code ch.

□

C. Authorization To Disclose Tax Information Using Facsimile (Fax) or

C. Authorization To Disclose Tax Information Using Facsimile (Fax) or

□

D. Revocation. The Tax Commissioner is notified that all authorizations previously made are revoked for ALL previously designated individuals or firms. To revoke authorizations for only a specified individual or firm, complete the designated individual or firm information section above. (If this box is checked, do not check Box A, Box B, or Box C.)

D. Revocation. The Tax Commissioner is notified that all authorizations previously made are revoked for ALL previously designated individuals or firms. To revoke authorizations for only a specified individual or firm, complete the designated individual or firm information section above. (If this box is checked, do not check Box A, Box B, or Box C.)

Signature of Taxpayer(s)

Signature |

Printed Name |

Date |

|

|

|

|

|

Spouse's Signature, if Applicable |

Printed Name of Spouse |

Date |

|

|

|

|

Privacy Act Notification. In compliance with the Privacy Act of 1974, disclosure of a social security number or Federal Employer Identification Number (FEIN) on this form is required under N.D.C.C. §

L

For Office Use Only

_J

Form 500 Instructions

SFN 28258

General Instructions

Form 500 may be used by a taxpayer to do one of the following:

Authorize the North Dakota Office of State Tax Commissioner to disclose the taxpayer’s confidential tax information to another individual or firm not otherwise entitled to the information.

Designate another individual or firm to represent or act on behalf of the taxpayer before the Office of State Tax Commissioner, and to authorize the North Dakota Office of State Tax Commissioner to disclose the taxpayer’s confidential tax information to the designated representative or firm.

Form 500 does not apply to the routine mailing of tax forms, refund checks, original notices (e.g., a Notice of Determination), or other original written communications, which are always mailed to the taxpayer.

Unless Box C on Form 500 is checked to authorize the sending of confidential tax information by facsimile (fax) transmission or email, the Office of State Tax Commissioner will send confidential tax information authorized by Form 500 to the designated individual or firm only by letter or telephone.

Changing a previously filed Form 500. To change a Form 500 previously filed with respect to a particular designated individual or firm, complete and file

a new Form 500 for that designated individual or firm. The new Form 500 automatically revokes and replaces the previously filed Form(s) 500.

Revoking a previously filed Form 500. To revoke a previously filed Form 500, see instructions to Box D under “Authorization or Revocation.”

When Form 500 takes effect. Form 500 takes effect upon receipt by the Office of State Tax Commissioner and remains in effect until revoked by the taxpayer.

Specific Instructions

Taxpayer Information

Enter the taxpayer’s name, social security number or federal employer identification number (FEIN), mailing address, and contact information.

For a trust, enter the trust’s name and FEIN, and the name, mailing address, and contact information of the fiduciary.

For an estate, enter the decedent’s name and social security number, and the name, mailing address, and contact information of the decedent’s personal representative or fiduciary.

Designated Individual or Firm

Enter the name, social security number or federal employer identification number (FEIN), mailing address, and contact information for the designated individual or firm. If designating more than one individual or firm, attach a statement listing each one.

Note: Do not complete this section of the form if filing this form to revoke previously filed Forms 500 and the revocation is intended to apply to all previously designated individuals and firms.

Authorization or Revocation

For Box A and Box B, the authorization to disclose or the designation of representative can be limited to a certain tax type (e.g., individual income tax or sales tax), form number, or taxable year or period by entering that information in the spaces provided.

If attaching a statement to identify additional designated individuals or firms, indicate the authority being given to each one by entering “Box A” or “Box B” (and “Box C” if desired) next to each one listed on the statement.

Box A - Check this box to authorize the Office of State Tax Commissioner to disclose confidential tax information to the designated individual or firm.

Box B - Check this box to designate an individual or firm to represent or act on behalf of the taxpayer before the Office of

State Tax Commissioner, and to authorize the Office of State Tax Commissioner to disclose confidential tax information to the designated individual or firm.

Box C - Check this box to authorize the Office of State Tax Commissioner to send confidential tax information to the designated individual or firm by facsimile (fax) transmission or email.

Box D - Check this box to revoke all previously filed Forms 500. To limit the revocation to a specific designated individual or firm, identify that individual or firm by completing the “Designated Individual or Firm” section of the form. Otherwise, leave that section of the form blank to apply the revocation to all previously designated individuals and firms. If checking this box, do not check any of the other boxes (A, B, or C) on the form.

Signature of Taxpayer(s)

Partnership (all types). One of the general partners must sign.

Corporation. An officer having authority to bind the corporation must sign.

Limited liability company. A governor or manager must sign.

Estate, trust, or any other situation where there is a fiduciary relationship. The personal representative, trustee, guardian, conservator, or other fiduciary must sign.

Where to Send Form 500

Form 500 may be submitted to the North Dakota Office of State Tax Commissioner by fax, email, or regular mail.

Fax or email

Income & Withholding Taxes—

Fax701.328.1942

Email individualtax@nd.gov

Business Registration—

Fax701.328.0332

Email taxregistration@nd.gov

General (other tax or purpose)—

Fax701.328.3700

Emailtaxinfo@nd.gov

Regular mail

Office of State Tax Commissioner

600 E. Boulevard Ave., Dept. 127

Bismarck, ND

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Tax Power of Attorney (POA) Form 500 allows individuals to grant authority to another person to handle their tax matters. |

| Scope of Authority | This form can grant broad or specific powers to the agent, including the ability to file taxes, obtain information, and represent the individual before tax authorities. |

| Limitations | The POA does not allow the agent to receive refund checks, unless specifically stated. |

| Duration | The duration of the powers granted can be specified in the form; otherwise, it will be in effect until explicitly revoked. |

| Revocation | The individual can revoke the POA at any time by providing written notice to the tax authority and the agent. |

| State-Specific Forms | Most states have their own version of a Tax POA form, with requirements and provisions varying by jurisdiction. |

| Governing Law | State laws govern the execution, use, and validity of Tax POA forms, and individuals must comply with the specific legal requirements of their state. |

Guide to Writing Tax POA 500

After deciding to delegate authority for tax matters, the Tax Power of Attorney (POA) Form 500 becomes a vital document. This form allows individuals to grant others the power to speak, act, and make decisions on their behalf with tax authorities. Completing this form accurately ensures that all tax-related representations are handled without delay. Here are the step-by-step instructions to fill out the Tax POA Form 500 correctly.

- Start by providing the name and address of the taxpayer. Include full legal names to avoid any confusion with tax authorities.

- Next, input the taxpayer’s identification number, such as a Social Security Number (SSN) or Employer Identification Number (EIN), ensuring accuracy to facilitate proper record matching.

- Specify the tax matters by listing the type of tax, tax form numbers, and the years or periods covered. Being specific here helps in limiting the scope of the power granted.

- Enter the name(s) and address(es) of the representative(s) being given this power. If appointing multiple representatives, decide if they can act independently by marking the appropriate option.

- If the form grants specific powers not commonly included, such as the power to receive refund checks, detail these in the provided section. Clearly stating these powers ensures the representatives can act as intended.

- For the document to be valid, the taxpayer must sign and date the form. If the taxpayer is incapacitated or unable to sign, a legal guardian or power of attorney may sign on their behalf, providing the appropriate legal documentation.

- Lastly, the representative(s) must also sign and date the form to acknowledge their acceptance of the responsibilities being delegated to them. This ensures both parties are aware of and agree to the terms set.

Once completed, the Tax POA Form 500 should be reviewed for accuracy and completeness. Submitting an accurate and fully completed form is crucial for the smooth handling of one’s tax matters by the appointed representative. Depending on jurisdiction, this form may need to be submitted to a specific tax department or kept by the representative to be presented upon request.

Understanding Tax POA 500

-

What is the Tax POA 500 form?

The Tax Power of Attorney (POA) 500 form is a legal document that allows an individual (the principal) to delegate their authority to someone else (the agent or attorney-in-fact) to manage their tax matters. This can include filing taxes, obtaining confidential tax information, and representing them before tax authorities. The extent of the powers granted can vary depending on the specific provisions outlined in the form.

-

Who can serve as an agent on a Tax POA 500?

Generally, any individual can be designated as an agent, as long as they are competent and willing to act on behalf of the principal. Most often, principals choose professionals such as accountants, attorneys, or family members whom they trust to handle their tax affairs.

-

How do you execute a Tax POA 500 form?

To execute a Tax POA 500 form, the principal must complete and sign the form, clearly stating the powers being granted to the agent. The agent must also sign the form, accepting the duties and responsibilities bestowed upon them. In some jurisdictions, notarization and/or witnesses may be required for the form to be legally valid.

-

Can a Tax POA 500 form be revoked?

Yes, a principal can revoke a Tax POA 500 at any time, provided they are mentally competent. To do so, the principal should provide written notice of the revocation to the agent and any institutions or agencies that were informed of the power of attorney. Executing a new POA can also automatically revoke a previous one, depending on the language in the new POA and state law.

-

Is the Tax POA 500 form different from other POA forms?

Yes, the Tax POA 500 is specifically designed for tax-related matters and does not grant authority for other types of decisions, such as healthcare or financial decisions unrelated to taxes. Other forms of POA are necessary to cover non-tax-related matters.

-

Do you need a lawyer to create a Tax POA 500 form?

While it's not legally required to have a lawyer create a Tax POA 500, consulting with one can be beneficial to ensure the form is completed accurately and tailored to the principal's specific needs. A lawyer can also advise on the implications of granting certain powers and help navigate any legal requirements specific to the principal's jurisdiction.

-

How long does a Tax POA 500 last?

The duration of a Tax POA 500 can vary. It may be set to expire on a specific date or upon the completion of certain tasks. Unless the form specifies a time frame, it remains effective until revoked or upon the death of the principal. Some states may have laws affecting the duration of a POA, so it's important to be aware of local regulations.

-

What should you consider before creating a Tax POA 500?

Before creating a Tax POA 500, consider the scope of powers you wish to grant, the tasks you need handled, and the qualifications of the agent you're appointing. Ensure the agent is trustworthy and capable of managing your tax affairs competently. It’s also wise to review the form periodically to ensure it still reflects your wishes, especially after major life changes.

-

Can the same agent be granted different types of POA?

Yes, the same agent can be granted different types of powers of attorney, including for healthcare or financial decisions beyond tax matters. However, separate forms must be completed for each type of POA, as a Tax POA 500 only covers tax-related authorizations.

-

Where to file the Tax POA 500 form?

Once completed and signed, the Tax POA 500 form should be filed with the relevant tax authority that will be dealing with the agent. This could be the Internal Revenue Service (IRS), a state tax agency, or both, depending on the tax matters being handled. Always keep a copy for your records and provide one to your agent as well.

Common mistakes

When filling out the Tax Power of Attorney (POA) 500 form, many individuals encounter errors that can lead to delays or issues with their tax representation. Understanding these common mistakes can help filers avoid them and ensure their paperwork is processed smoothly.

- Failing to Provide Complete Information: Many forms are returned because they are not fully completed. All required sections must be filled out accurately to ensure the form is valid.

- Incorrect Taxpayer Identification Number (TIN): Entering an incorrect TIN, such as a Social Security Number (SSN) or Employer Identification Number (EIN), is a common mistake that can lead to processing delays.

- Not Specifying Tax Matters Correctly: It is crucial to clearly specify the tax matters, including the type of tax, tax form number, and the years or periods involved. A lack of specificity can render the POA invalid for the intended purpose.

- Signing and Dating Errors: The form must be signed and dated by the taxpayer or a duly authorized representative. If signatures and dates are missing or incorrect, the form may not be accepted.

- Forgetting to List All Necessary Representatives: If multiple representatives are being authorized, each must be listed on the form with their specific authorization. Failing to do so may limit who can act on behalf of the taxpayer.

- Ignoring the Need for Witness or Notary Signatures: Depending on the state or the specific requirements of the tax authority, a witness or notary public may need to sign the form. Overlooking this requirement can invalidate the POA.

By paying close attention to these details and ensuring all information is complete and accurate, individuals can effectively navigate the process of granting someone authority to handle their tax matters.

Documents used along the form

When handling one's tax affairs, a Tax Power of Attorney (POA) Form 500 is a critical tool, allowing an individual to grant another person the authority to manage their tax matters. This significant document does not stand alone in the legal landscape; several other forms and documents may be required to ensure thorough and accurate handling of one's financial responsibilities and legal situations. These documents facilitate comprehensive tax management, compliance with regulations, and the protection of the individual's rights and interests.

- Form 1040: The U.S. Individual Income Tax Return is the foundational document for personal tax filing, detailing income, deductions, and credits to calculate taxes owed or refunds due.

- W-2 Form: Provided by employers, this form reports an employee's annual wages and the amount of taxes withheld from their paycheck, crucial for accurate tax return filings.

- 1099 Forms: These forms report various types of income other than wages, salaries, and tips. Different versions apply to specific income types such as independent contractor earnings, interest, dividends, and government payments.

- Schedule C: This form is used by sole proprietors to report profits or losses from their business, detailing expenses and income related to their enterprise.

- 4868 Form: The Application for Automatic Extension of Time To File U.S. Individual Income Tax Return provides individuals extra time to file their taxes, without extending the deadline for any tax owed.

- 8822 Form: This Change of Address form informs the IRS when an individual moves, ensuring that tax documents and refunds are sent to the correct location.

- 8332 Form: The Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent allows for the transfer of a child's exemption to the noncustodial parent, impacting tax credits and deductions.

- W-9 Form: Request for Taxpayer Identification Number and Certification is used in transactions that require the disclosure of a taxpayer's identification number, such as when working as an independent contractor.

- Estate Tax Forms: These include various documents such as the 706 form, used to report the estate tax due for deceased individuals, critical for executors handling estates of significant value.

- Form 2848: Power of Attorney and Declaration of Representative allows taxpayers to grant authority to a qualified individual to represent them before the IRS, offering broader representation than the Tax POA 500.

Using the Tax Power of Attorney 500 form in conjunction with these documents ensures a holistic approach to managing tax duties, navigating legal requirements, and safeguarding one's financial interests. It's important for individuals to understand the role each document plays in their financial and tax planning to maintain compliance and optimize their financial strategy. Proper utilization of these forms can significantly lessen the complexity of tax management and provide peace of mind through organized and legally sound financial affairs.

Similar forms

The Tax Power of Attorney (POA) Form, often designated as Form 500, enables an individual to grant authority to another person, referred to as an agent or attorney-in-fact, to handle tax-related matters on their behalf with the tax authorities. A similar document is the General Power of Attorney, which provides a much broader authorization, allowing the named agent to make decisions and take actions on the principal's behalf in a wide range of matters, not limited to taxes but also including financial and legal affairs.

Comparable to the Tax POA is the Healthcare Power of Attorney. This authorization allows an agent to make healthcare decisions for the principal should they become incapacitated. Though it serves a different purpose, focusing on healthcare instead of tax matters, it similarly requires the principal to trust someone to act in their best interests when they cannot do so themselves.

The Durable Power of Attorney aligns closely with the Tax POA in its function of authorizing another individual to act on one’s behalf. Its notable distinction lies in its enduring nature, remaining in effect even if the principal becomes mentally incapacitated, unlike a traditional POA which typically ceases upon the principal's incapacity. This feature makes it invaluable for long-term planning across financial, legal, and personal affairs, beyond just tax matters.

Limited Power of Attorney shares a concept with the Tax POA, focusing on granting authorization to an agent for specific tasks or situations, rather than providing broad authority. It can be tailored to various needs, including but not limited to, selling a property, managing certain financial transactions, or handling specific legal issues, offering a precise and controlled approach to delegating authority.

The Financial Power of Attorney, like the Tax POA, permits an agent to handle financial affairs on behalf of the principal. This can encompass a range of activities from managing investments, paying bills, to handling tax filings and dealings with the IRS. The scope can be as broad or as narrow as the principal decides, making it adaptable to different financial management needs.

An Advanced Healthcare Directive, or Living Will, while primarily focused on healthcare decisions rather than financial matters, shares a kinship with the Tax POA in its foundational purpose of anticipating circumstances where the principal is unable to act on their own behalf. It lays out specific instructions for medical treatment preferences, thereby guiding healthcare providers and loved ones in critical decision-making processes.

The Representative Payee Program form, used by Social Security, allows for the designation of an individual or organization to manage benefit payments for someone deemed unable to do so on their own. This parallels the Tax POA’s objective of authorizing another party to act in one’s stead for financial matters, specifically tailored to the administration and management of federal benefits.

Lastly, the Estate Power of Attorney is akin to the Tax POA but is specifically designed to handle affairs after the principal's death, providing the executor or administrator of an estate the authority to manage and settle the deceased's financial and legal matters. While its activation is contingent upon death, contrasting with the Tax POA’s operational period during the principal’s lifetime, both documents function to entrust important responsibilities to another individual.

Dos and Don'ts

When attempting to complete the Tax POA (Power of Attorney) 500 form, individuals must proceed with both caution and precision. This document authorizes another person to handle tax matters on one's behalf, hence the need for a clear understanding and strict adherence to guidelines. Below are several do's and don'ts to assist in the process:

- Do ensure that all relevant sections of the form are filled out completely. Missing information can delay processing or lead to misunderstandings.

- Do verify the credentials and trustworthiness of the individual you are granting power of attorney to. This person will have access to sensitive information and make decisions on your behalf.

- Do include specific details about the tax matters for which you are granting authority, such as types of taxes, tax periods, and transactions.

- Do use a current form version to comply with potential updates in tax laws and regulations.

- Do keep a copy of the completed form for your records, ensuring you have proof of the authorization granted.

- Don't leave the choice of your representative to chance. Select someone who has experience with tax matters similar to yours.

- Don't forget to sign and date the form. An unsigned form is invalid and will be disregarded by tax authorities.

- Don't neglect to specify the expiration date for the power of attorney if you wish for the authorization to have a time limit.

- Don't hesitate to consult a professional if you have questions or concerns. Errors can be costly and result in legal complications.

Misconceptions

The Tax POA (Power of Attorney) 500 form is a critical document for individuals seeking to grant someone else the authority to handle their tax matters. However, several misconceptions surround its use and implications. Understanding these can help taxpayers make more informed decisions regarding their tax affairs.

It grants unlimited power: Many people believe that signing a Tax POA 500 form gives the agent carte blanche over all their financial affairs. However, the truth is that its powers are strictly limited to tax-related matters. The scope of authority is clearly outlined in the document itself, ensuring the agent cannot make decisions beyond what is specified.

It's irrevocable: Another common misconception is that once the Tax POA 500 form is signed, it cannot be revoked. In reality, the taxpayer retains the right to revoke the powers granted at any time, as long as they are mentally competent to do so. This flexibility ensures that taxpayers can reassess their choice of agent as circumstances evolve.

Any POA form will work for tax matters: Some individuals mistakenly believe that a generic POA form is sufficient for handling tax matters. However, tax matters require the specific use of a Tax POA 500 form, which is designed to comply with tax laws and regulations. Using the wrong form can lead to significant delays and complications.

The agent can be anyone: While it is true that taxpayers have wide discretion in choosing their agent, not everyone is qualified to act in this capacity. The selected agent should be someone who is knowledgeable about tax law and capable of responsibly managing the taxpayer's affairs. This often means choosing a professional like a certified public accountant or tax attorney, rather than a family member without these qualifications.

It's only for the elderly or incapacitated: Some assume that the Tax POA 500 form is only necessary for those who are elderly or unable to handle their affairs due to incapacity. However, anyone can benefit from having a Tax POA, especially individuals who travel frequently, face complicated tax issues, or simply wish to ensure their tax matters are handled by a professional.

Filing it with the IRS automatically implements it: Once signed, some people think the form is automatically in effect. In reality, the Tax POA 500 form must be filed with the appropriate tax authorities, and in some cases, additional steps may be necessary to activate its powers. This process ensures that the authorities are aware of the agent's authority and can act accordingly.

It covers tax matters in all states: Lastly, there is a misconception that a Tax POA 500 form, once executed, is effective for handling tax matters in any state. The truth is that tax laws vary by state, and some states require their own specific forms. Taxpayers should verify the requirements of each state where they need representation to ensure compliance.

Clearing up these misconceptions allows taxpayers to better understand the importance and specific use of the Tax POA 500 form, ensuring they can effectively manage their tax-related affairs through trusted agents.

Key takeaways

When it comes to handling tax matters, the Tax Power of Attorney (POA) Form 500 allows you to designate someone else, typically a tax professional, to make decisions and take actions on your behalf with the tax authorities. Here are key takeaways you should know about filling out and using this form:

- Complete all required sections: Ensure every necessary field is filled out to avoid any delays or rejections. This includes your personal information, the designated individual’s details, and the specific tax matters you are authorizing them to handle.

- Specify the tax matters clearly: You must be clear about what tax years and types of taxes your representative can access and discuss. Ambiguity can lead to complications or limitations in the representative’s ability to assist you.

- Choose your representative wisely: The person you designate will have access to sensitive information and the authority to make decisions on your behalf. Make sure they are knowledgeable, trustworthy, and experienced in dealing with tax matters.

- Understand the validity period: Be aware of how long the POA will remain in effect. If you want the POA to have an expiration date, make sure to specify this on the form. Otherwise, it might remain in effect until you revoke it.

- Keep a record for your files: Once the POA Form 500 is filled out and submitted, ensure you keep a copy for your records. It’s also a good idea to inform your authorized representative that they should retain a copy in case they need to verify their authority.

Correctly filling out and understanding the use of the Tax POA Form 500 can significantly smooth the process of allowing someone else to manage your tax matters. It's a practical step for anyone who needs professional assistance with their taxes and wants to ensure everything is handled accurately and efficiently.

Popular PDF Documents

Form It-303 - Emphasizes the importance of reporting bad debt and recoveries, impacting total taxable sales.

Sss Form Loan - Facilitating a smooth loan application experience, it designs sections for both member-borrower and employer certifications.