Get Tax POA 3520-PIT Form

When navigating the complexities of tax obligations, particularly those that involve reporting foreign trusts and receipt of certain foreign gifts, the Tax Power of Attorney (POA) 3520-PIT form emerges as a critical document. It serves as a declaration by individuals to the IRS, detailing the involvement with foreign trusts or the receipt of large gifts from foreign entities. This form is part of a broader effort to ensure transparency in financial dealings that cross international borders, and it helps taxpayers comply with U.S. tax laws by providing a structured way to report these transactions. The importance of this form cannot be overstated, as it aids in avoiding potential penalties by ensuring that all necessary information is reported accurately and on time. By filling out the Tax POA 3520-PIT, taxpayers essentially communicate their financial connections outside the United States, making it easier for tax authorities to understand their financial landscape. This process, while it may seem daunting, is made manageable through the form's detailed sections, each designed to capture specific types of transactions, thereby simplifying the reporting process for both taxpayers and tax professionals.

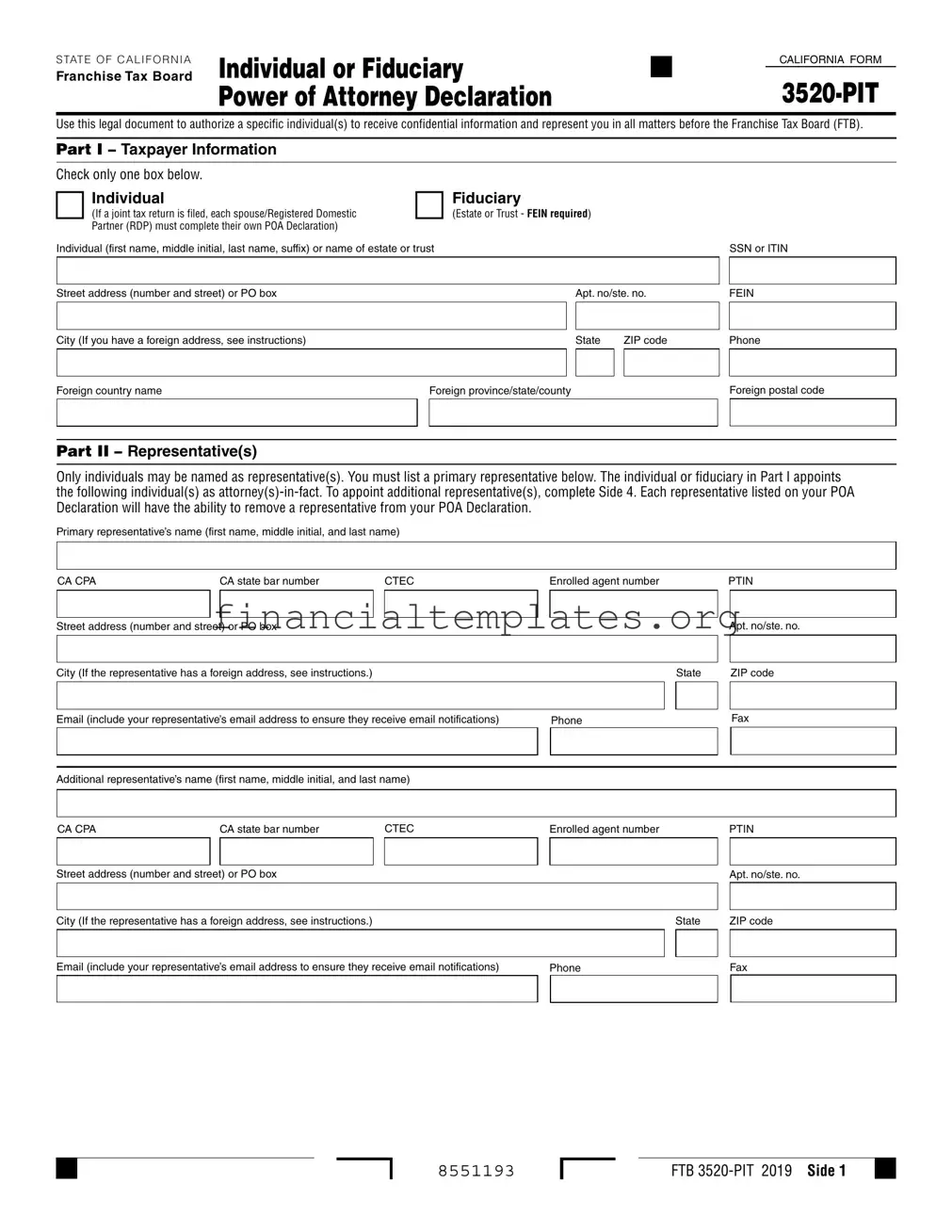

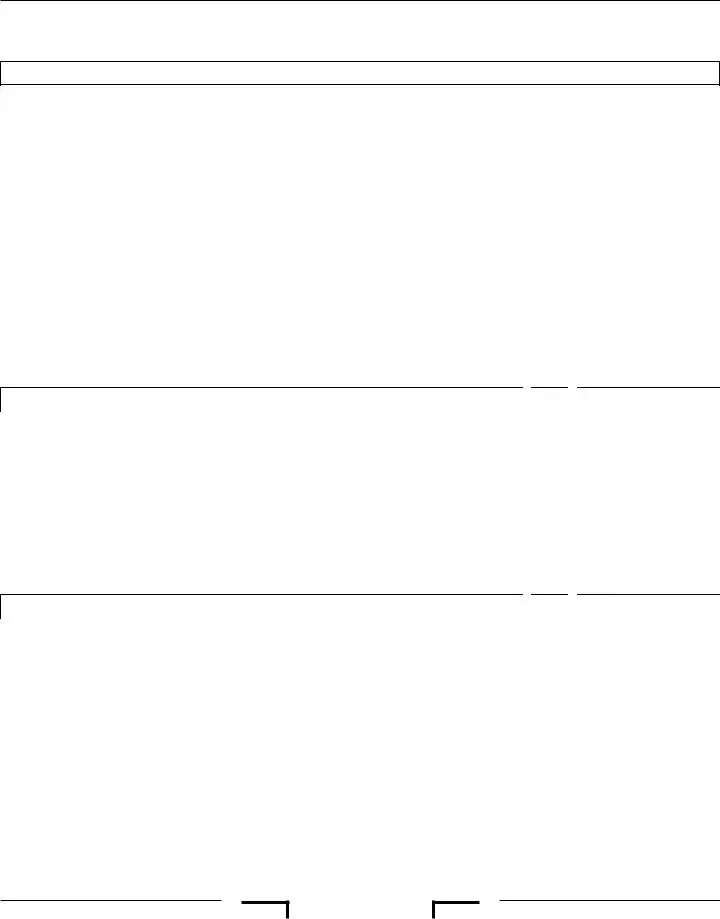

Tax POA 3520-PIT Example

STATE OF CALIFORNIA

Franchise Tax Board

Individual or Fiduciary |

|

|

CALIFORNIA FORM |

|

|

|

|

Power of Attorney Declaration |

|

|

|

|

Use this legal document to authorize a specific individual(s) to receive confidential information and represent you in all matters before the Franchise Tax Board (FTB).

Part I – Taxpayer Information

Check only one box below.

|

Individual |

|

Fiduciary |

|

|

|

|

||||

(If a joint tax return is filed, each spouse/Registered Domestic |

(Estate or Trust - FEIN required) |

|

|

|

|

||||||

|

Partner (RDP) must complete their own POA Declaration) |

|

|

|

|

|

|

|

|

|

|

|

Individual (first name, middle initial, last name, suffix) or name of estate or trust |

|

|

|

|

|

|

SSN or ITIN |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street address (number and street) or PO box |

|

|

|

|

Apt. no/ste. no. |

|

FEIN |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City (If you have a foreign address, see instructions) |

|

|

|

|

State |

ZIP code |

|

Phone |

||

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign country name |

|

|

Foreign province/state/county |

|

|

|

Foreign postal code |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part II – Representative(s)

Only individuals may be named as representative(s). You must list a primary representative below. The individual or fiduciary in Part I appoints the following individual(s) as

Primary representative’s name (first name, middle initial, and last name)

CA CPA |

CA state bar number |

CTEC |

|

Enrolled agent number |

|

|

PTIN |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street address (number and street) or PO box |

|

|

|

|

|

|

Apt. no/ste. no. |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City (If the representative has a foreign address, see instructions.) |

|

|

|

|

State |

|

ZIP code |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Email (include your representative’s email address to ensure they receive email notifications) |

|

Phone |

|

|

|

Fax |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Additional representative’s name (first name, middle initial, and last name) |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CA CPA |

CA state bar number |

CTEC |

|

Enrolled agent number |

|

|

|

PTIN |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street address (number and street) or PO box |

|

|

|

|

|

|

Apt. no/ste. no. |

|||

|

|

|

|

|

|

|

|

|

|

|

City (If the representative has a foreign address, see instructions.) |

|

|

|

State |

|

ZIP code |

||||

|

|

|

|

|

|

|

|

|

|

|

Email (include your representative’s email address to ensure they receive email notifications) |

|

Phone |

|

|

|

Fax |

||||

|

|

|

|

|

|

|

|

|

|

|

8551203

FTB

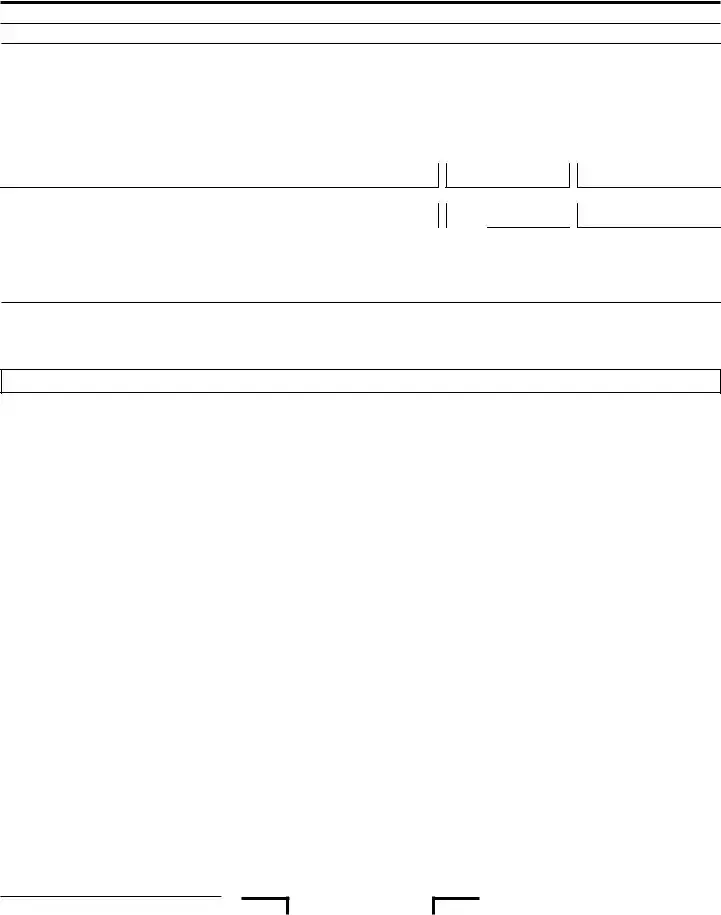

Part III – Authorization for All Years or Specific Years Your POA Declaration Covers

You must check either the “Yes” or “No” box below. Your selection authorizes representatives in Part II and on Side 4 to contact FTB about your account, receive and inspect your confidential information, represent you in all FTB matters, and request information we receive from the Internal Revenue Service (IRS) for either question 1 or 2 indicated below.

If you authorize “all years” and “specific years,” the specific years privilege prevails. Enter “NA” (not applicable) or strike through any blank year fields in question 2a through 2d. If you do not check either the “Yes” or “No” box or check both the “Yes” and “No” box, we will process the authorization as a “No.” This may cause your POA Declaration to be invalid, and it may be rejected. If you authorized “all years,” this will include previous, current, and future years up to the expiration date. If you authorized “specific years,” you can designate future years or income periods up to five years from the POA Declaration signature date.

1. |

Authorized All Years |

. . . . . . . . . . . . . . . . . . . . . . . . . . Yes |

No |

|

Or |

. . . . . . . . . . . . . . . . . . . . . . . . . . Yes |

No |

2. |

Authorized Specific Years* |

||

|

Year Begins: |

Year Ends: |

|

|

YYYY |

YYYY |

|

|

2a. |

|

2b. |

* For example, |

2c. |

Single Year: 2020 – 2020 |

|

Multiple Years Range: 2017 – 2020 |

2d. |

|

–

–

–

–

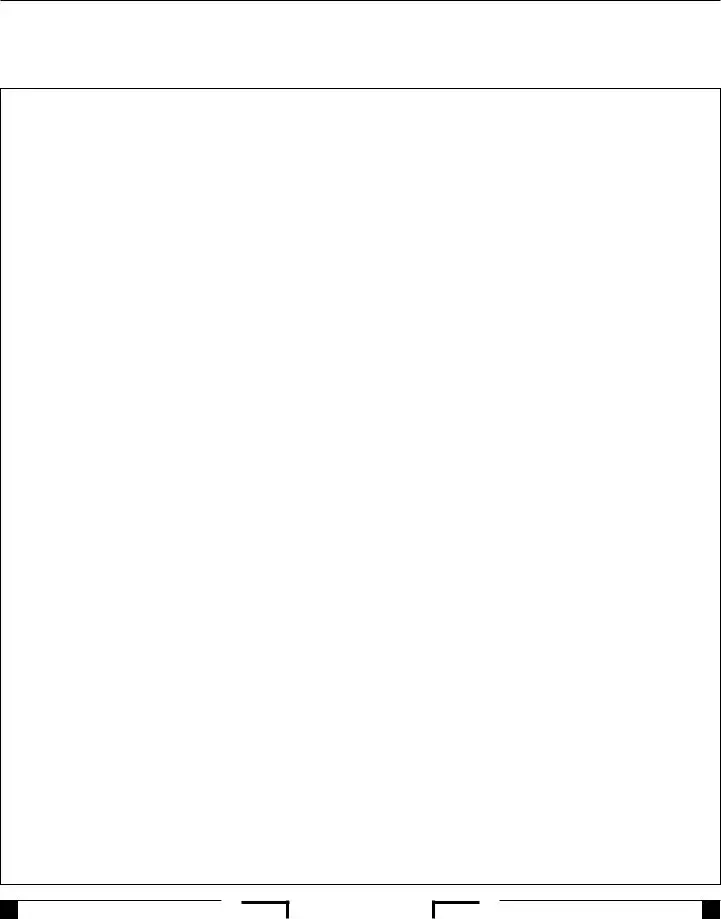

Part IV – Additional Authorizations

Check either the “Yes” or “No” box below for additional authorizations you would like to grant your representative(s) in addition to those described in Part III. If you do not check either the “Yes” or “No” box or check both the “Yes” and “No” box for any additional authorizations below, we will process the authorization as a “No.” For more information, see instructions.

1. |

Add representative(s) |

Yes |

2. |

Authority to sign tax return(s) (only if incapacitated or continuous absence from the U.S.) |

Yes |

3. |

Receive, but not endorse, refund check(s) |

Yes |

4. |

Waive the California statutes of limitations (SOL) |

Yes |

5. |

Execute settlement and closing agreements (only in extenuating circumstances) |

Yes |

6. |

Other acts (describe on Side 5) |

Yes |

No

No

No

No

No

No

Side 2 FTB

8552203

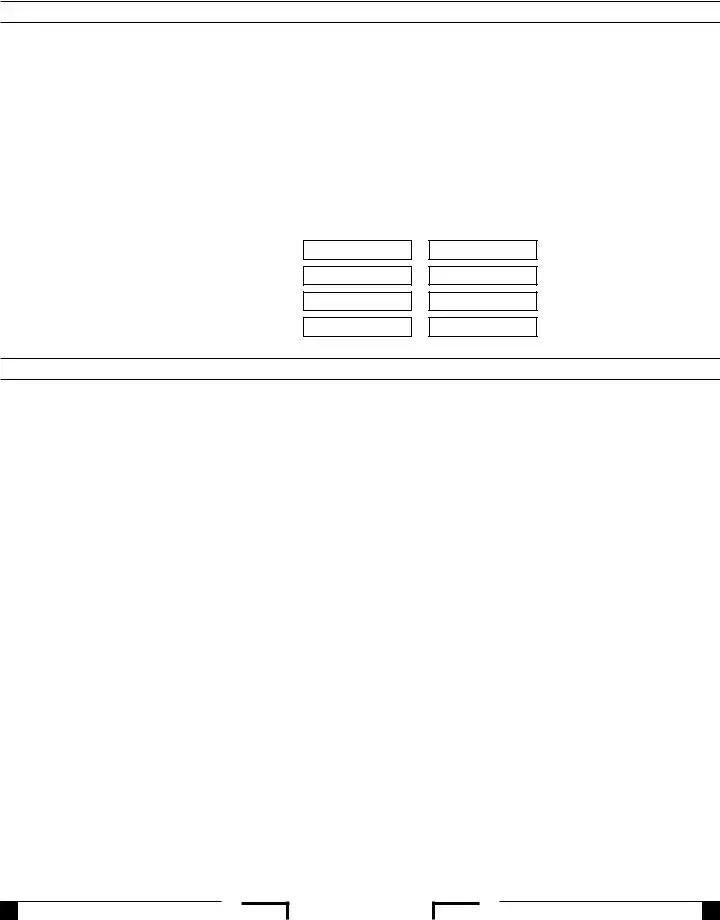

Part V – Request or Retain MyFTB Full Online Account Access for Tax Professional(s)

You must check either the “Yes” or “No” box below. If you check the “Yes” box, you are requesting to authorize or retain full online account access for your tax professional(s), including the ability to view tax returns and take available actions based upon the year(s) designated on this declaration. If you requested full online account access for your tax professional(s) on your POA declaration, a separate notice will be mailed to you with an authorization code and instructions to approve or deny the online account access request. An authorization code will not be sent for tax professional(s) that have existing full online account access.

If you check the “No” box, both the “Yes” and “No” boxes, or do not check any box, we will process the authorization as a “No,” and your tax professional(s) will be granted limited online account access; any existing relationships with full online account access will be changed to limited online account access. Limited online account access includes viewing notices and most correspondence issued by FTB in the last 12 months.

Note: Tax professional(s) with limited or full online account access may have access to notices and correspondence in MyFTB for any tax year(s).

This online account access authorization does not affect their ability to take actions on your behalf or the information your representative can receive by phone, chat, or in person.

If your POA declaration is rejected, this request for online access will not be processed and no updates will be made to online access levels for any existing relationships.

Note: Online access is not available for Fiduciary accounts. |

Yes No |

Authorize MyFTB Full Online Account Access for Tax Professional(s) |

Part VI – Signature Authorizing Power of Attorney Declaration

To learn about your privacy rights, how we may use your information, and the consequences for not providing the requested information, go to ftb.ca.gov/forms and search for 1131. To request this notice by mail, call 800.852.5711.

The authority granted to the representative(s) in this POA Declaration will generally expire six years from the date this form is signed, or on the date that a POA declaration is revoked, whichever occurs first.

I declare under penalty of perjury under the laws of the State of California that I am the taxpayer named in Part I and by my signature below, I authorize the representative(s) listed in Part II to be appointed as my

If signed by a guardian, legal representative, executor, receiver, administrator, or trustee on behalf of the taxpayer, I declare under penalty of perjury under the laws of the State of California that I have the authority to execute this form on behalf of the taxpayer named in Part I and by my signature below, I authorize the representative(s) in Part II to be appointed as the taxpayer’s

FTB will reject this POA Declaration if not signed and dated by an authorized individual.

By signing this POA declaration, I understand that FTB will grant limited online account access to my tax professional representative(s) unless full online account access has been requested in Part V. If you do not want your tax professional representative(s) to have any online access, refer to Part V instructions.

Print Name |

|

Title (required for fiduciary signing for trust or estate) |

|

|

|

|

|

|

Signature |

|

Date |

x

8553203

FTB

The individual or fiduciary in Part I appoints the following additional representative(s) as

Additional representative’s name (first name, middle initial, and last name)

CA CPA |

CA state bar number |

CTEC |

|

Enrolled agent number |

|

|

|

PTIN |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street address (number and street) or PO box |

|

|

|

|

|

|

Apt. no/ste. no. |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City (If the representative has a foreign address, see instructions.) |

|

|

|

State |

|

ZIP code |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Email (include your representative’s email address to ensure they receive email notifications) |

|

Phone |

|

|

|

Fax |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Additional representative’s name (first name, middle initial, and last name) |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CA CPA |

CA state bar number |

CTEC |

|

Enrolled agent number |

|

|

|

PTIN |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address (number and street) or PO box |

|

|

|

|

|

|

Apt. no/ste. no. |

|||

|

|

|

|

|

|

|

|

|

|

|

City (If the representative has a foreign address, see instructions.) |

|

|

|

State |

|

ZIP code |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Email (include your representative’s email address to ensure they receive email notifications) |

|

Phone |

|

|

|

Fax |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Additional representative’s name (first name, middle initial, and last name) |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CA CPA |

CA state bar number |

CTEC |

|

Enrolled agent number |

|

|

|

PTIN |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street address (number and street) or PO box |

|

|

|

|

|

|

Apt. no/ste. no. |

|||

|

|

|

|

|

|

|

|

|

|

|

City (If the representative has a foreign address, see instructions.) |

|

|

|

State |

|

ZIP code |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Email (include your representative’s email address to ensure they receive email notifications) |

|

Phone |

|

|

|

Fax |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Additional representative’s name (first name, middle initial, and last name) |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CA CPA |

CA state bar number |

CTEC |

|

Enrolled agent number |

|

|

|

PTIN |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street address (number and street) or PO box |

|

|

|

|

|

|

Apt. no/ste. no. |

|||

|

|

|

|

|

|

|

|

|

|

|

City (If the representative has a foreign address, see instructions.) |

|

|

|

State |

|

ZIP code |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Email (include your representative’s email address to ensure they receive email notifications) |

|

Phone |

|

|

|

Fax |

||||

|

|

|

|

|

|

|

|

|

|

|

Side 4 FTB

8554203

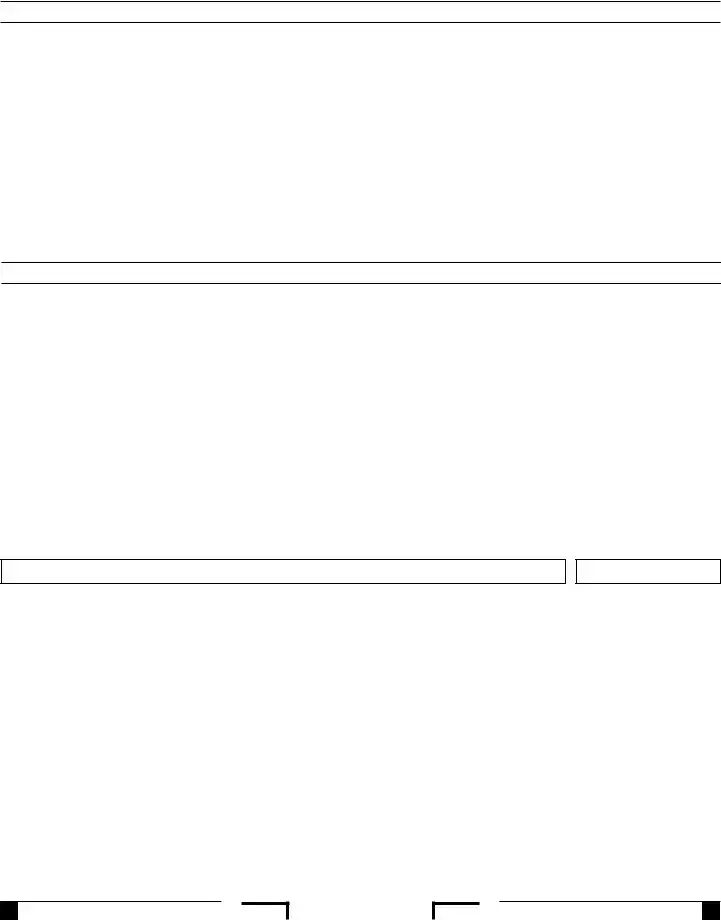

Other Acts Authorization(s)

Submit this side if you selected “Yes” to the Other Acts Authorization box from Part IV. If you did not select “Yes” or selected both “Yes” and “No” within Part IV, we will disregard this side without the listed authorizations being granted. Describe the specific other acts you authorize your representative(s) named in Part II and on Side 4 to perform before FTB. Authorizations listed in Part III and Part IV prevail over conflicting authorizations listed in this section. Do not return this side if blank.

8555203

FTB

Document Specifics

| Fact Number | Fact Name | Description |

|---|---|---|

| 1 | Form Type | Tax Power of Attorney (POA) 3520-PIT |

| 2 | Purpose | Authorizes an individual to represent the taxpayer before the tax authority. |

| 3 | Applicability | Used for personal income tax matters. |

| 4 | Governing Law | The form is governed by state tax laws and regulations. |

| 5 | Validity | Remains in effect until explicitly revoked by the taxpayer. |

| 6 | Filing Requirement | Must be filed with the relevant state tax authority. |

| 7 | Who Can Act as POA | Generally, a licensed attorney, certified public accountant, or other individual authorized by state law. |

| 8 | Limits of Authority | The scope of authority can be specifically defined within the form. |

| 9 | Revocation | The taxpayer can revoke the POA at any time by notifying the tax authority in writing. |

Guide to Writing Tax POA 3520-PIT

When seeking to grant someone authority to handle your tax matters, the Tax POA 3520-PIT form becomes necessary to fill out. This process can seem daunting at first, but with a clear step-by-step guide, you can complete it effectively and accurately. This document allows individuals to authorize another person to receive confidential information and make decisions regarding their taxes. To ensure that the document serves its intended purpose without any hitches, it's important to pay attention to detail and fill it out correctly.

- Begin by entering the full name of the taxpayer granting the power of attorney in the designated section of the form.

- Provide the taxpayer’s identification number, usually a Social Security Number (SSN) or Employer Identification Number (EIN), in the space provided.

- Fill in the taxpayer’s complete address, including street, city, state, and zip code.

- List the tax matters the representative is authorized to handle, including the type of tax, the form number, and years or periods.

- Enter the name(s) and address(es) of the representative(s) being granted this authority. If more than one, specify the acts each can perform on your behalf.

- Specify any limitations on the power of attorney, if applicable. This could include restricting the years, types of decisions, or actions the representative can take.

- For each representative, provide their telephone number, fax number, and email address.

- Check the box if a copy of a notice or communication sent to the taxpayer should also be sent to the representative.

- Sign and date the form in the designated area. If the taxpayer is a business entity, make sure the person signing the form has the authority to grant a power of attorney on behalf of the business.

- If a third party prepared the form, they must fill in their name, address, and phone number at the bottom of the form.

Once the Tax POA 3520-PIT form is fully completed, review it to ensure all information is accurate and matches the taxpayer’s records. Following completion, the next step involves submitting the form to the appropriate tax authority or department as indicated by state or local guidelines. Retain a copy of the form for your records and wait for any further instructions or confirmation from the tax authority.

Understanding Tax POA 3520-PIT

-

What is a Tax Power of Attorney (POA) 3520-PIT form?

A Tax Power of Attorney, specifically the 3520-PIT form, is a legal document that allows an individual (the principal) to designate another person (the agent) to handle their tax matters with the tax authority. This document is particularly useful when you need someone else to discuss, sign-off, or make decisions regarding your taxes on your behalf.

-

Who can be appointed as an agent on a 3520-PIT form?

Individuals can appoint almost anyone as their agent. Typically, people choose a trusted family member, friend, or a professional like a certified public accountant (CPA), an attorney, or a tax preparer. It’s essential that the person appointed is trustworthy and has a good understanding of tax laws and practices.

-

How does one fill out the 3520-PIT form?

Filling out the 3520-PIT form usually involves specifying your information as the taxpayer, the details of the agent you're appointing, and the specific tax matters and years for which the agent is being given authority. Instructions for filling out the form can typically be found on the website of the issuing tax authority or obtained from a tax professional.

-

Is the 3520-PIT form valid indefinitely?

No, the 3520-PIT form typically has an expiration date, which the principal can set according to their preference. It might also automatically expire if not specified otherwise according to state laws or upon completion of the specified tax matters. Always check current regulations, as this can vary.

-

Can the authority granted on a 3520-PIT form be revoked?

Yes, the principal can revoke the authority granted on a 3520-PIT form at any time. This is usually done by issuing a written notice of revocation to both the agent and the tax authority. It’s advised to clearly state the effective date of the revocation and to make sure it is communicated effectively to all involved parties.

-

What powers can I grant with the 3520-PIT form?

The 3520-PIT form can be used to grant a wide range of powers related to tax matters. These can include but are not limited to, the power to receive confidential tax information, the power to represent you in tax audits, and the power to make payments or arrangements on your behalf. The specific powers granted should be clearly outlined in the form.

-

Do I need a lawyer to prepare the 3520-PIT form?

While it’s not a legal requirement to have a lawyer prepare the 3520-PIT form, consulting with one or a tax professional can be very beneficial. This is especially true if your tax matters are complex or if you want to ensure that the powers you are granting are clearly defined and understood by all parties.

-

Can the 3520-PIT form cover state taxes?

Yes, the 3520-PIT form can cover state tax matters in addition to federal taxes, depending on the wording of the document and the laws of the state. It is important to specify which taxes and tax matters the agent is authorized to handle on your behalf.

-

What happens if the agent abuses their power?

If an agent abuses their power, they can be held legally responsible for their actions. The principal might have grounds to sue the agent for any harm caused. Additionally, legal actions can be taken against the agent for fraud, misrepresentation, or theft. It’s critical to choose an agent carefully and to monitor their actions.

-

Are there any alternatives to the 3520-PIT form?

Yes, there are alternatives depending on what needs to be accomplished. For example, a more limited form of authorization or specific tax forms for certain transactions may suffice for some tasks. In some cases, a comprehensive durable power of attorney document might be more appropriate. Consulting with a professional can help determine the best approach for your situation.

Common mistakes

Filling out the Tax Power of Attorney (POA) Form 3520-PIT is a significant step for individuals seeking assistance with their tax matters. However, errors made during this process can delay or complicate the intended representation. Below is an expanded list of common mistakes to avoid:

Not verifying the form’s version – The Internal Revenue Service (IRS) updates forms periodically. Using an outdated form can lead to the submission being rejected.

Incorrect identification information – Providing incorrect or incomplete taxpayer identification numbers (TINs), such as Social Security Numbers (SSNs) or Employer Identification Numbers (EINs), can lead to processing delays.

Omitting representative information – Every detail about the appointed representative, including their full name, address, and phone number, must be filled in accurately. Errors here can prevent the representative from being recognized by the IRS.

Lack of specificity in granted powers – The form allows taxpayers to specify the tax matters for which they are granting authority. Being too vague or too broad can lead to misunderstandings or limitations on the representative’s ability to act.

Forgetting to specify tax forms – If certain tax forms are relevant to the representation, they should be explicitly mentioned. Omission can restrict the representative’s access to necessary information.

Skipping the duration of power – Failing to indicate the time frame for which the POA is valid can lead to its immediate invalidation or unintended indefinite validity.

Ignoring the need for witnesses or a notary – Depending on the state’s requirements, a tax POA form may need to be witnessed or notarized. Overlooking this requirement can render the document legally ineffective.

Submitting without a signature – A missing signature from the taxpayer can lead to the immediate rejection of the form, as it is considered incomplete and invalid without this crucial element.

By paying close attention to these details, taxpayers can ensure their Tax POA Form 3520-PIT is filled out correctly, facilitating a smoother process in granting someone the ability to represent them in tax matters.

Documents used along the form

When dealing with the Tax Power of Attorney (POA) Form 3520-PIT, it's important to have a clear understanding of not only this form but also other related documents that are often required. These additional forms ensure that all facets of one's tax affairs are properly handled and documented. Whether you're authorizing someone to handle your taxes due to travel, health issues, or simply for convenience, knowing which forms might accompany your Tax POA can simplify the process. Below is a list of documents that are frequently used alongside Form 3520-PIT, each with a brief description for a better understanding of its purpose.

- Form 1040: The U.S. Individual Income Tax Return is the standard form most taxpayers use to report their annual income to the IRS. It's crucial for calculating tax liability or refund.

- Form W-2: Wage and Tax Statement, issued by employers, reports an employee's annual wages and the amount of taxes withheld from their paycheck. It's vital for completing the 1040 form.

- Form 1099: Various types of 1099 forms report income other than wages, such as freelance earnings, interest, and dividends. They're necessary for accurate income reporting.

- Form 4868: Application for Automatic Extension of Time To File U.S. Individual Income Tax Return allows taxpayers extra time to file their 1040 form without penalty for late filing.

- Schedule C: Profit or Loss from Business is used by self-employed individuals to report business income and expenses. It attaches to the 1040 form.

- Form 8822: Change of Address notifies the IRS of a change in address. Keeping the IRS informed ensures you receive all tax-related correspondence.

- Form 2848: Power of Attorney and Declaration of Representative allows taxpayers to appoint an individual to represent them before the IRS, handling matters more complex than those covered by Form 3520-PIT.

- State Tax Return Forms: Depending on one’s residency, state tax return forms may be required in addition to federal forms. Requirements vary by state.

Understanding and gathering the correct forms can be overwhelming, but it's a necessary part of managing one's taxes effectively. Each of these documents plays a specific role in ensuring that your tax reporting is accurate and comprehensive. Whether you're handling taxes on your own or appointing someone else through a Tax POA, familiarizing yourself with these forms can lead to a smoother tax handling process. Always remember, when in doubt, consulting with a tax professional can provide clarity and guidance tailored to your individual situation.

Similar forms

The Tax Power of Attorney (POA) 3520-PIT form shares similarities with the IRS Form 2848, "Power of Attorney and Declaration of Representative." Both documents grant a designated individual the authority to represent the taxpayer before the IRS, allowing them to make inquiries, obtain confidential tax information, and perform specific acts like signing agreements. However, Form 2848 is more comprehensive in its application, covering federal tax matters beyond the state-specific matters addressed in the 3520-PIT form.

Another document akin to the Tax POA 3520-PIT is Form 8821, "Tax Information Authorization." This form also authorizes individuals to receive and inspect confidential tax information on behalf of someone else. However, unlike the 3520-PIT, Form 8821 does not allow the appointed person to represent the taxpayer in tax matters or perform any acts; it solely allows them to review the information.

The Durable Power of Attorney (DPOA) is similarly related to the Tax POA 3520-PIT but has a broader scope. DPOAs grant agents the power to handle a wide range of legal and financial matters for the principal, not just tax issues. This can include managing property, financial accounts, and even making life decisions, contrasting the specific tax representation focus of the 3520-PIT.

Form SS-4, "Application for Employer Identification Number (EIN)," is connected to the Tax POA 3520-PIT in the sense that both can involve third-party authorization. On Form SS-4, an entity applies for an EIN, and a third party can be authorized to receive the EIN and answer questions on behalf of the applicant, similar to how a Tax POA allows for representation in tax matters.

Form 4506-T, "Request for Transcript of Tax Return," is yet another document that, like the Tax POA 3520-PIT, involves authorization to obtain tax-related information. Both forms can authorize representatives to access tax transcripts, albeit Form 4506-T is specifically tailored for the purpose of requesting transcripts rather than broader tax representation.

The Health Insurance Portability and Accountability Act (HIPAA) Release Form, though not tax-related, parallels the Tax POA 3520-PIT in the concept of authorization. It allows designated individuals to access another's private health information, similar to how the Tax POA enables access to confidential tax information and representation.

The "Limited Power of Attorney," akin to the Tax POA 3520-PIT, grants an agent the authority to perform specific acts on behalf of the principal. However, while the Tax POA is narrowly focused on tax representation and actions, a Limited Power of Attorney can cover a wide range of specific, non-tax-related tasks.

The IRS Form 706, "United States Estate (and Generation-Skipping Transfer) Tax Return," connects to the Tax POA 3520-PIT because executors or legal representatives may need POA to manage tax filings and responsibilities for an estate, underscoring the role of representatives in handling complex tax matters following someone's death.

Form 709, "United States Gift (and Generation-Skipping Transfer) Tax Return," is related to the Tax POA 3520-PIT in context. Similar to estate tax filings, gift tax filings might require a POA for individuals to manage the filing on behalf of another, emphasizing the need for representation in intricate tax situations.

Lastly, the IRS Form 56, "Notice Concerning Fiduciary Relationship," has ties to the Tax POA 3520-PIT form as both address representation roles in tax matters. Form 56 is used to notify the IRS of a fiduciary relationship, requiring the fiduciary to file and act on behalf of another in tax matters, showcasing the legal framework for representation similar to what is established through a Tax POA.

Dos and Don'ts

Filling out the Tax Power of Attorney (POA) Form 3520-PIT requires careful attention to detail and clarity. For those navigating this important document, the following guidelines may help ensure that the process is completed correctly and efficiently. Here are several dos and don'ts to consider:

- Do thoroughly read the instructions for Form 3520-PIT before beginning. Understanding every section and requirement can prevent mistakes and save time.

- Do ensure that all personal information is accurate and matches the details on your government-issued identification. This includes full names, addresses, and taxpayer identification numbers.

- Do clearly state the specific tax matters and years for which the POA is granted. Being explicit about the scope of authority will help avoid any confusion later on.

- Do check that both the taxpayer and the representative sign the form in the designated areas. An unsigned form can lead to unnecessary delays.

- Do keep a copy of the completed form for your records. Having this documentation readily available can be helpful in future communications with the tax agency.

- Don't leave any sections incomplete unless specifically instructed. An incomplete form can be rejected or returned, causing delays.

- Don't use pencil or erasable ink to fill out the form. To ensure permanence and legibility, always use black or blue ink.

- Don't attempt to grant more powers than the form allows. The POA Form 3520-PIT has specific limitations that must be respected.

- Don't forget to update or revoke the form as necessary. Life changes may require updates to the representatives listed or the powers granted.

By following these recommendations, individuals can navigate the complexities of granting a tax power of attorney with confidence, ensuring that their financial matters are managed in accordance with their wishes.

Misconceptions

Understanding the Tax Power of Attorney (POA), specifically form 3520-PIT, can sometimes be confusing. Here are six common misconceptions about this form explained in simple terms:

Only for the wealthy: Many believe that form 3520-PIT is solely for individuals with significant wealth or complex tax situations. However, this form can be beneficial for anyone needing to grant another person the authority to handle their tax matters, regardless of wealth.

It grants complete control: Another misconception is that by signing a Tax POA form, you are giving away control over all your financial decisions. In reality, the scope of authority is limited to tax affairs, and the powers granted can be specifically tailored.

Permanent and irrevocable: Some people think that once a Tax POA is signed, it cannot be changed or revoked. This is not true. The taxpayer can revoke the power of attorney at any time or replace it with a new one as needed.

Complex and expensive to set up: There's a common belief that setting up a Tax POA is a complex and costly process, requiring extensive legal help. While professional advice can be beneficial, especially in complicated cases, the form itself is straightforward and can be completed without significant expense.

Only necessary for tax evasion: A misconception exists that the only reason someone would need a Tax POA is if they were trying to evade taxes. This is entirely false. The form is a legal way to ensure one's taxes are handled efficiently, especially if the individual is unable to do so themselves due to various reasons like travel, illness, or lack of knowledge.

It covers tax payments: Some people mistakenly believe that by authorizing someone with a Tax POA, that person is responsible for paying the taxes owed. The form does not transfer the liability of paying taxes. It merely allows someone else to act on your behalf in matters related to tax filings and discussions with the tax authority.

Key takeaways

When navigating the intricacies of tax representation, the Tax Power of Attorney (POA) 3520-PIT form is a critical document for authorizing a designated individual, such as a tax attorney or accountant, to handle tax matters on another's behalf in certain jurisdictions. Understanding the key aspects of this form is essential for both the taxpayer and the representative to ensure accurate and compliant tax dealings. Here are five key takeaways regarding the completion and usage of the Tax POA 3520-PIT form:

- Understanding the Purpose: The primary role of the Tax POA 3520-PIT form is to grant legal authority to a specified individual or entity, allowing them to discuss with tax authorities, request and receive confidential tax information, and perform certain acts like signing documents on behalf of the taxpayer. Recognizing the scope of this authorization is fundamental to its proper use.

- Clear Identification of Parties: It is crucial to accurately identify both the taxpayer and the representative within the form. This includes full legal names, contact information, and identifying numbers (such as Social Security or taxpayer identification numbers). Mistakes in this section can lead to the rejection of the form or unintentional disclosure of confidential information.

- Detailed Powers Granted: The form requires a clear delineation of the representative's powers. This can range from general tax matters to specific tax years or types of taxes. Specifying the extent of authorization helps in preventing misunderstandings and ensures that the representative has the necessary authority to act effectively.

- Validity and Revocation: Understanding the form’s duration and how to revoke it is as essential as its setup. The document typically remains in effect until a specified expiration date or until the taxpayer revokes it. Knowing how to correctly terminate the POA’s authority avoids unauthorized actions and maintains the taxpayer's control over their tax matters.

- State-Specific Requirements: While the Tax POA 3520-PIT form is widely used, it's important to note that tax laws and POA forms can vary by jurisdiction. Some states or localities may have unique forms or additional requirements. Taxpayers should verify the specific needs of their jurisdiction to ensure full compliance and effectiveness of their POA.

Properly completing and using the Tax POA 3520-PIT form is a critical step in managing one’s tax affairs through a representative. By adhering to these key takeaways, taxpayers and their designated representatives can navigate tax matters more smoothly and with greater confidence.

Popular PDF Documents

How to Avoid California Health Insurance Penalty - Form 8965 is a critical document for those utilizing health coverage exemptions, detailed with sections for both household and individual exemptions.

8655 Form - Filling out and submitting the IRS 8655 is a straightforward process that enhances operational efficiency for businesses.