Get Tax POA 285-I Form

Individuals and businesses often find themselves in need of granting permission to someone else to handle their tax matters. This is where the Tax POA 285-I form comes into play, serving as a crucial document. It essentially allows a taxpayer to officially designate a representative, such as an accountant or attorney, the authority to act on their behalf with the tax authorities. Understanding the components, importance, and implications of this form is key to ensuring that one's tax matters are handled properly and efficiently. Notably, the process of filling out and submitting the Tax POA 285-I form involves providing detailed information about the taxpayer and the appointed representative, along with specifying the extent of authority being granted. It's a protective measure, ensuring that the rights of the taxpayer are safeguarded while enabling necessary actions to be taken by their appointee without undue delay. With tax laws being complex and ever-evolving, having a trusted representative authorized through this form can alleviate stress and prevent potential legal pitfalls.

Tax POA 285-I Example

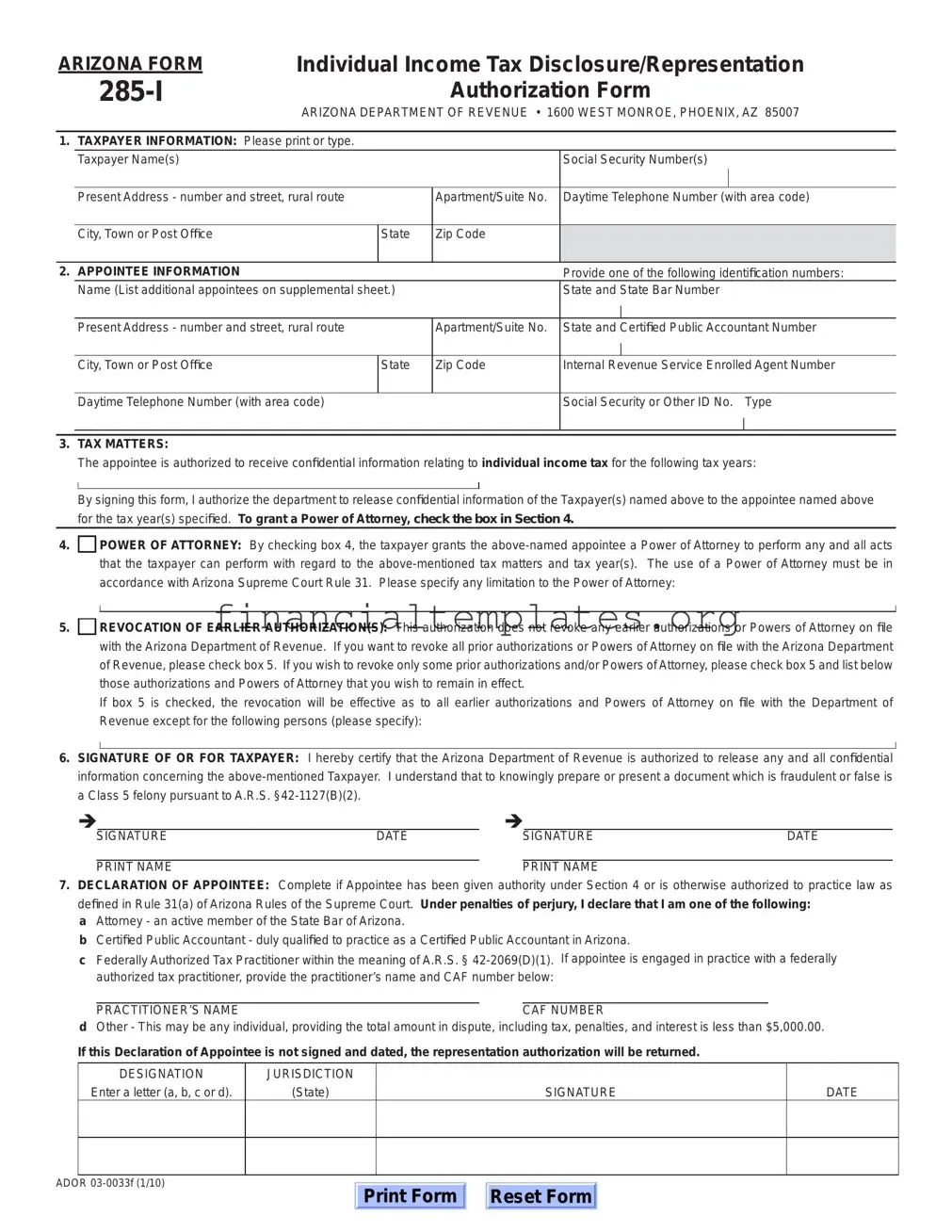

ARIZONA FORM |

Individual Income Tax Disclosure/Representation |

|

|

Authorization Form |

|

|

|

ARIZONA DEPARTMENT OF REVENUE • 1600 WEST MONROE, PHOENIX, AZ 85007 |

|

|

|

1. TAXPAYER INFORMATION: Please print or type. |

||

|

Taxpayer Name(s) |

Social Security Number(s) |

Present Address - number and street, rural route

Apartment/Suite No.

Daytime Telephone Number (with area code)

City, Town or Post Office

State

Zip Code

2. APPOINTEE INFORMATION |

|

|

Provide one of the following identification numbers: |

|

|

Name (List additional appointees on supplemental sheet.) |

|

State and State Bar Number |

|

|

|

|

|

| |

|

Present Address - number and street, rural route |

|

Apartment/Suite No. |

State and Certified Public Accountant Number |

|

|

|

|

| |

|

City, Town or Post Office |

State |

Zip Code |

Internal Revenue Service Enrolled Agent Number |

|

|

|

|

|

|

Daytime Telephone Number (with area code) |

|

|

Social Security or Other ID No. Type |

|

|

|

|

| |

|

|

|

|

|

3.TAX MATTERS:

The appointee is authorized to receive confidential information relating to individual income tax for the following tax years:

By signing this form, I authorize the department to release confidential information of the Taxpayer(s) named above to the appointee named above for the tax year(s) specified. To grant a Power of Attorney, check the box in Section 4.

4.

POWER OF ATTORNEY: By checking box 4, the taxpayer grants the

5.

REVOCATION OF EARLIER AUTHORIZATION(S): This authorization does not revoke any earlier authorizations or Powers of Attorney on file with the Arizona Department of Revenue. If you want to revoke all prior authorizations or Powers of Attorney on file with the Arizona Department of Revenue, please check box 5. If you wish to revoke only some prior authorizations and/or Powers of Attorney, please check box 5 and list below those authorizations and Powers of Attorney that you wish to remain in effect.

If box 5 is checked, the revocation will be effective as to all earlier authorizations and Powers of Attorney on file with the Department of Revenue except for the following persons (please specify):

6.SIGNATURE OF OR FOR TAXPAYER: I hereby certify that the Arizona Department of Revenue is authorized to release any and all confidential information concerning the

Î |

|

|

Î |

|

|

||

|

|

SIGNATURE |

DATE |

|

|

SIGNATURE |

DATE |

|

|

|

|

|

|

||

|

PRINT NAME |

|

PRINT NAME |

|

|||

7.DECLARATION OF APPOINTEE: Complete if Appointee has been given authority under Section 4 or is otherwise authorized to practice law as defined in Rule 31(a) of Arizona Rules of the Supreme Court. Under penalties of perjury, I declare that I am one of the following:

a Attorney - an active member of the State Bar of Arizona.

b Certified Public Accountant - duly qualified to practice as a Certified Public Accountant in Arizona.

c Federally Authorized Tax Practitioner within the meaning of A.R.S. §

PRACTITIONER’S NAME |

CAF NUMBER |

dOther - This may be any individual, providing the total amount in dispute, including tax, penalties, and interest is less than $5,000.00.

If this Declaration of Appointee is not signed and dated, the representation authorization will be returned.

DESIGNATION

Enter a letter (a, b, c or d).

JURISDICTION

(State)

SIGNATURE

DATE

ADOR

Print Form

Reset Form

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Tax POA 285-I form is used to grant power of attorney for tax matters to an individual or organization. |

| Entity Involved | This form is typically utilized by taxpayers to authorize someone else to handle their tax affairs. |

| Scope of Authority | The document specifies the extent of authority given to the agent, including which tax matters and years are covered. |

| Validity | The form remains valid until the expiration date specified, or it is revoked by the taxpayer. |

| Revocation Procedure | To revoke the power of attorney, the taxpayer must provide written notice to the relevant tax authority. |

| Governing Law | The form is governed by the tax laws and regulations of the state in which it is filed. |

| Signature Requirements | Both the taxpayer and the authorized individual or organization must sign the document for it to be valid. |

Guide to Writing Tax POA 285-I

After deciding to grant someone the power to handle your tax matters, completing the Tax Power of Attorney (POA) form 285-I is the next step. It's an important document that allows your chosen representative to communicate with the tax authority on your behalf. Fill out this form with attention to detail to ensure all information is accurate and clear. Here's how to navigate the process.

- Start by entering the date on the top right corner of the form.

- Provide the full name and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) of the person granting the power (you).

- Enter the full name(s) and address(es) of the individual(s) or entity you're appointing as your representative(s). If you're assigning more than one representative, include information for each.

- Specify the tax matters you want the representative(s) to handle. This includes the type of tax, tax form number, and the year(s) or period(s). Be as specific as possible to avoid any confusion.

- State the specific powers you're granting your representative. This includes actions like receiving and inspecting confidential tax information and performing acts like signing agreements. If there are any powers you do not wish to grant, clearly mention them here.

- If you desire, limit the duration of the power of attorney by specifying an expiration date. If no date is provided, the POA will remain in effect until it's revoked.

- Review the acts your representative cannot perform under this POA, as stated in the instructions provided with the form. This will help ensure that both parties understand the limitations of the document.

- Sign and date the form at the bottom. Your signature officially authorizes the representative to act on your behalf for the tax matters specified.

- If applicable, have your representative(s) sign the form to acknowledge their acceptance of the responsibilities being assigned to them.

Once the form is fully completed and signed, keep a copy for your records and provide your representative with a copy. The next step will involve your representative presenting this document to the tax authority when required, ensuring a smooth process in handling your tax matters.

Understanding Tax POA 285-I

-

What is the Tax POA 285-I form used for?

The Tax POA 285-I form, also known as the Power of Attorney (POA) form, is used to authorize an individual or organization to represent you or handle your tax matters before the tax authority. This form grants a designated agent the power to receive confidential information and to perform actions like submitting documents, making agreements, or negotiating on your behalf regarding your tax issues.

-

Who can be designated as an agent on the Tax POA 285-I form?

Anyone you trust can be designated as your agent, including family members, close friends, or professionals like accountants or attorneys. It's important to choose someone who is knowledgeable about tax matters or has a background in finance or law, especially if your tax situation is complex. Ensuring that the person you choose is willing and able to take on these responsibilities is crucial.

-

How do you fill out the Tax POA 285-I form?

Filling out the Tax POA 285-I form requires careful attention to detail. Typically, you will need to provide your personal information, including your name, Social Security number, and contact details. You must also include the same information for the agent you are appointing. Details about the specific tax matters and years you are authorizing them to handle on your behalf must be clearly outlined. Don't forget to sign and date the form; in some cases, a witness or notary may also need to sign it.

-

What are the limitations of the Tax POA 285-I form?

The Tax POA 285-I form does not grant unlimited power. It only applies to tax matters and within the scope specified in the form. This means your agent can only make decisions or receive information about your taxes as explicitly outlined in the form. It's also important to note that this form can be revoked at any time. You have the power to end the authorization if you no longer need the agent's services or if you wish to appoint someone else.

-

How can you revoke the Tax POA 285-I form?

To revoke the Tax POA 285-I form, you must provide written notice to the tax authority indicating that you wish to withdraw the power of attorney you've previously granted. Including specific details about the original POA, such as the date it was executed and the name of the agent, can help the tax authority process your request more efficiently. Additionally, it's wise to inform the agent that their authorization has been revoked to avoid any confusion or accidental continuation of their representation.

Common mistakes

Filling out the Tax Power of Attorney Form (POA 285-I) is a critical step in allowing someone else to handle your tax matters. However, people often make mistakes that can lead to delays or complications. Awareness and careful attention to detail can prevent these issues.

-

Not specifying the scope of authority. Individuals sometimes forget to clearly define the extent of powers they are granting to their representative. This can cause confusion or limit the representative's ability to act effectively on their behalf.

-

Choosing the wrong representative. It is crucial to choose a representative who is not only trustworthy but also has the requisite knowledge of tax matters. Selecting someone without the necessary expertise can lead to errors or oversight in handling your tax affairs.

-

Failure to include all required information. Every section of the POA 285-I form is important. Missing details, such as identification numbers or relevant tax years, can render the document invalid or incomplete.

-

Not updating the form. Tax laws and personal circumstances change. A POA 285-I form might need updates to remain effective and relevant. Neglecting to review and revise the document can result in a power of attorney that does not reflect your current needs or the latest legal requirements.

Avoiding these common mistakes requires careful reading, thoughtful selection of a representative, and paying close attention to detail when completing the Tax POA 285-I form. Taking these steps ensures that your tax matters will be handled according to your wishes and in compliance with legal standards.

Documents used along the form

When handling tax matters, particularly those that involve representation before tax authorities, it's essential to gather and prepare not just the Tax Power of Attorney (POA) Form 285-I but also several other critical documents. These forms work in concert to ensure the taxpayer's interests are thoroughly represented, and their tax matters are handled efficiently and in compliance with the law.

- Form 433-A (OIC) - Collection Information Statement for Wage Earners and Self-Employed Individuals: This document is vital for individuals who wish to settle their tax debt for less than the full amount owed. It provides the IRS with detailed information about the taxpayer's financial situation, helping the agency decide on the feasibility of an offer in compromise.

- Form 433-B (OIC) - Collection Information Statement for Businesses: Similar to its counterpart for individuals, this form is used by businesses that seek to settle their tax liabilities. It provides a comprehensive overview of the business's financial status, assets, liabilities, and income, helping the IRS assess the viability of an offer in compromise from a business entity.

- Form 8821 - Tax Information Authorization: This form does not grant the same level of representation as a Power of Attorney, but it allows a designated third party to receive and inspect confidential tax information. This can be beneficial for individuals or businesses that need a tax professional to review their records without being authorized to act on their behalf.

- Form 2848 - Power of Attorney and Declaration of Representative: While it may seem redundant to the Tax POA 285-I, this form is actually a broader document that authorizes an individual, such as a tax attorney or certified public accountant, to represent taxpayers before the IRS. It includes the ability to receive confidential information, negotiate settlements, and make decisions regarding appeals or collections.

Together, these documents comprise a comprehensive toolkit for addressing complex tax issues, from disputes and negotiations to settlements and compliance. Each plays a pivotal role in ensuring that individuals and businesses navigate their tax challenges with the best possible outcomes. Preparing these forms with accuracy and thoroughness is crucial for anyone seeking to resolve tax matters effectively.

Similar forms

The Tax POA 285-I form establishes a relationship where an individual or entity (the principal) grants another individual or entity (the agent) the power to act on their behalf, particularly for tax-related matters. A General Power of Attorney (POA) operates on a similar principle. In a General POA, an agent is given broad powers by the principal to handle various affairs, including but not limited to financial and business transactions, not just limited to tax matters. The main similarity lies in the delegation of decision-making power from the principal to the agent.

Comparable as well, the Durable Power of Attorney for Health Care notably diverges in its focus on health decisions rather than financial or tax-related ones. Like the Tax POA 285-I, it enables an individual to designate another person to make decisions on their behalf. However, its specificity towards health care decisions under circumstances where the principal is unable to make those decisions themselves is what sets it apart, highlighting the versatility in the scope of powers that can be assigned through such documents.

The Limited Power of Attorney form closely resembles the Tax POA 285-I by allowing the principal to grant specific powers to an agent. This document, however, is customizable to various tasks beyond tax matters, such as selling property or managing certain financial affairs. The critical similarity is the limitation of powers to designated areas or tasks, providing a focused scope of authorization compared to broader POA forms.

Another related document is the Springing Power of Attorney. This form becomes effective under specific conditions set by the principal, such as illness or disability. While it can cover a range of matters, including taxes, its distinguishing feature is its "springing" mechanism, which holds the agent's authority in abeyance until a triggering event occurs. This contrasts with the Tax POA 285-I's immediate effect upon execution.

For businesses, the Corporate Power of Attorney is remarkably akin to the Tax POA 285-I, as it allows a business entity to appoint an individual or another business to act on its behalf in matters that could include tax affairs. The principal-agent relationship is essential in both documents, facilitating the delegation of authority to handle specific transactions or operational functions, underscoring the adaptability of power of attorney forms to various contexts.

The Real Estate Power of Attorney offers a more targeted version of authorization, specifically for real estate transactions. Similar to the Tax POA 285-I, it grants an agent the power to act on the principal’s behalf but narrows its focus to buying, selling, managing, or refinancing real estate properties. The parallel lies in how both documents provide a legal framework for representation in specific types of transactions.

Lastly, the Advanced Healthcare Directive, or Living Will, parallels the Tax POA 285-I in its purpose to prepare for future scenarios where the principal cannot make decisions themselves. While the Advanced Healthcare Directive focuses on medical treatment and end-of-life care rather than tax matters, both documents showcase the foresight in delegating decision-making authority to ensure the principal’s wishes are followed in critical situations.

In summary, while each of these documents serves a unique purpose or addresses different areas of one’s personal or business affairs, they all share the fundamental concept of assigning authority to another. The Tax POA 285-I form, similar to these documents, plays a crucial role in planning and managing specific aspects of one’s life, financial or otherwise.

Dos and Don'ts

Filling out the Tax Power of Attorney (POA) 285-I form is an essential process for taxpayers seeking to grant someone else the authority to handle their tax matters. However, it’s important to approach this task with care to ensure that the authority is granted accurately and effectively. Below are some crucial dos and don’ts to consider when filling out this form:

Do:

- Read the instructions carefully before you begin to fill out the form. Understanding every section is crucial to avoid mistakes.

- Clearly identify the person or organization being granted the POA by full name and address. Accuracy here is crucial for legal and contact purposes.

- Specify the tax matters and periods you are granting authority for. Being specific about what the appointed person can and cannot do is important for your financial safety.

- Include your taxpayer identification number (TIN), such as your Social Security Number (SSN) or Employer Identification Number (EIN), to ensure your tax records are accurately associated with the POA.

- Sign and date the form. Your signature is necessary to validate the form and the authority it grants.

Don’t:

- Leave any fields blank. Incomplete forms may be rejected, or worse, they could lead to unauthorized actions if details are assumed or misinterpreted.

- Sign without reviewing the entire form. Ensure that all information is correct and that you agree with every authorization you are granting.

- Forget to revoke previous POAs if necessary. If you’re replacing an old POA, you should explicitly revoke the former ones if they are no longer valid or needed.

- Rely on outdated forms. Tax forms are updated regularly, and using the most current version is essential to comply with current laws and regulations.

- Dismiss the importance of keeping a copy. After you’ve completed the form, keep a copy for your records and future reference.

Misconceptions

Tackling tax issues often leads to the complex world of forms and legal documents. Among these, the Power of Attorney (POA) Form 285-I is a critical tool for individuals needing someone to represent them in tax matters. However, myths and misconceptions can muddy the waters, making it challenging for people to understand its value and purpose correctly. Let's clear up some of these misunderstandings.

- It grants unlimited power. A common misunderstanding is that once you sign a Tax POA 285-I, you're giving another person carte blanche over all your financial decisions. This isn't the case. The authority granted through Form 285-I is limited to tax matters, meaning the representative can act on your behalf when dealing with taxes but doesn't have unlimited access to or control over all your financial affairs.

- Only family members can be assigned. While it's typical for taxpayers to appoint family members as their POA, there’s no rule stating that only relatives can take up this role. Qualified professionals such as accountants, attorneys, and tax preparers often serve as Representatives, bringing their expertise to the table, which might be something a family member can't offer in these complex situations.

- The document is irrevocable. Some people hesitate to use Form 285-I, fearing that once it's signed, it cannot be undone. However, this perception is incorrect. The taxpayer can revoke it at any time. This flexibility ensures that if circumstances or relationships change, the taxpayer retains control and can appoint a new representative or handle their tax matters independently.

- It's only for those in legal trouble. The notion that the Tax POA 285-I is only for those who have crossed swords with the law or are in deep tax-related trouble is misleading. In reality, this document is a proactive measure that people use for a variety of reasons, such as convenience, health issues preventing them from managing their tax matters, or simply the desire to have an expert handle tax affairs. It's about forward-thinking and practicality, rather than an admission of legal woes.

Understanding the truth behind these misconceptions can demystify the Tax POA 285-I, emphasizing its role as an empowering tool rather than something to be feared or misunderstood. With this clarity, individuals can make informed decisions about their tax representation, ensuring their rights and finances are handled with the care and expertise they deserve.

Key takeaways

Understanding the Tax Power of Attorney form, or form 285-I, is essential for anyone wishing to authorize another individual to handle their tax matters. This document grants a specified person or entity the legal authority to represent or act on another's behalf in matters related to state taxes. Here are key takeaways to ensure you fill out and use the form correctly:

- Accurate Information is Critical: Ensure that all information provided on the Tax POA 285-I form is accurate and up-to-date. This includes the personal information of the taxpayer and the designated representative(s), such as names, addresses, and taxpayer identification numbers. Any errors or discrepancies can lead to delays or the rejection of the form.

- Specify the Tax Matters and Periods: The form requires you to delineate the specific tax matters and periods for which the representative will have authority. Be concise and clear about the scope of authorization, including the types of taxes, tax years, or specific transactions covered. This precision prevents any ambiguity regarding the representative's powers.

- Understanding the Representative's Powers: By signing the form, you are granting significant authority to the representative in matters concerning state taxes. This includes the power to receive and inspect confidential tax information and to act on your behalf in transactions with the tax authority. It's important to trust the individual or organization you are appointing fully.

- Sign and Date Accurately: For the Tax POA 285-I form to be valid, it must be signed and dated by the taxpayer or a legally authorized individual in the case of an entity. If a taxpayer cannot sign due to illness, absence, or other reasons, a duly authorized agent may sign on their behalf, provided documentation supporting this authority is attached.

Completing and utilizing the Tax POA 285-I form is a responsibility that should not be taken lightly. Careful consideration and understanding of the form's requirements can help ensure that your tax matters are handled efficiently and securely by the representative of your choice.

Popular PDF Documents

3rd Party Designee - It acts as a safeguard mechanism, ensuring that all transmitted documents are accounted for and correctly processed upon reaching their destination.

Tax Forms 2023 - Structured format for taxpayers to calculate and report their city of Springfield income and taxes.

Tuscaloosa Sales Tax - Instructions stress the non-acceptance of duplicate or replicated forms to ensure the integrity of the tax filing process.