Get Tax POA 2848a Form

Dealing with taxes can often feel overwhelming, especially when individuals find themselves in situations where they need someone else to act on their behalf. This is where the Tax Power of Attorney (POA) 2848a form comes into play, serving as a crucial tool for granting authority to a representative to handle tax matters with the Internal Revenue Service (IRS). The form outlines who can be nominated, the specific tax matters and periods covered, and the extent of powers granted to the appointed individual. It is essential for taxpayers who cannot directly deal with the IRS due to various reasons, such as health issues, military service, or extended travel. Accuracy and clarity in completing this form are paramount, as it ensures that the representative can act effectively and in the taxpayer’s best interest, highlighting the importance of understanding each section before submission. Tailored guidance from professionals is often sought to navigate the complexities of this process, emphasizing the form's significance in maintaining compliance and managing tax-related responsibilities efficiently.

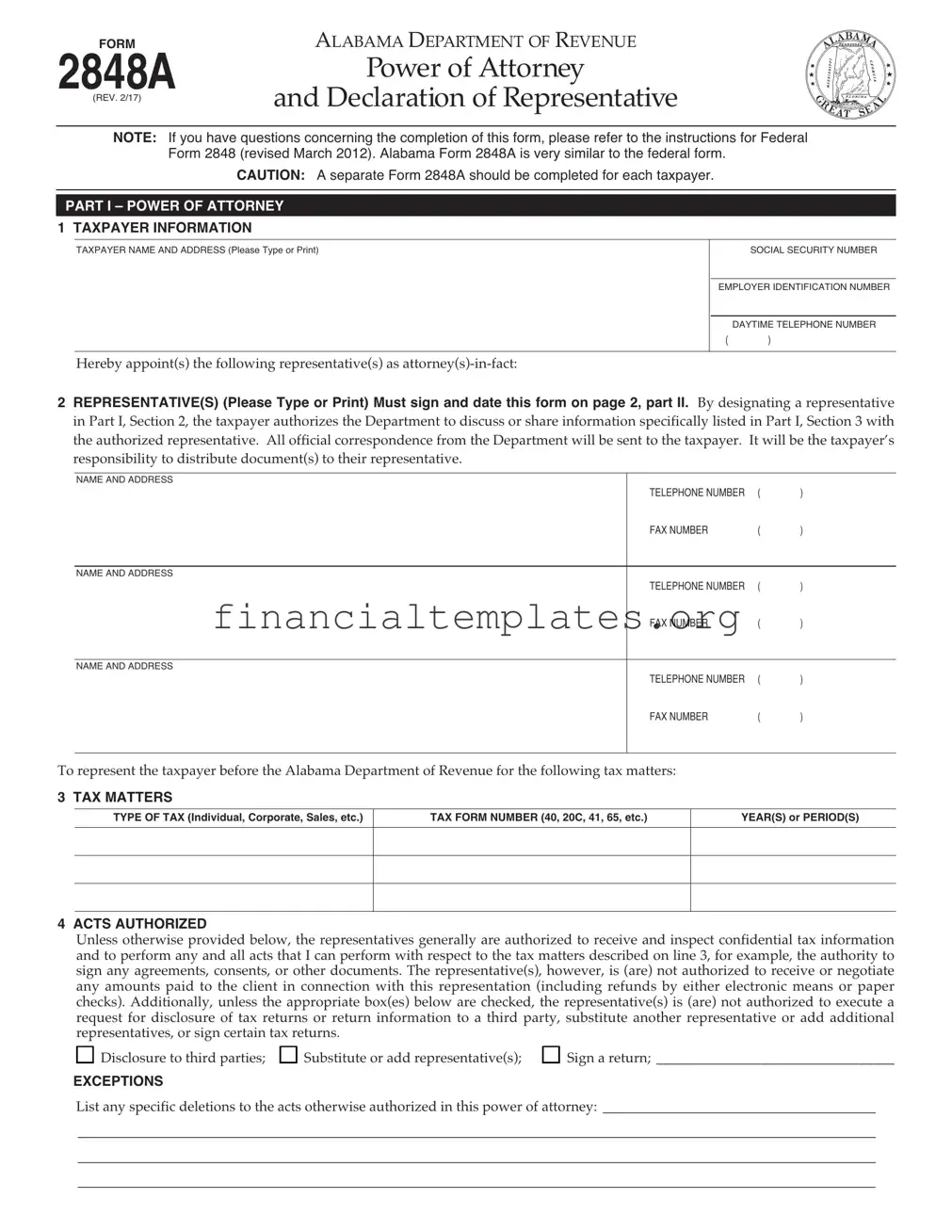

Tax POA 2848a Example

|

FORM |

ALABAMA DEPARTMENT OF REVENUE |

|

|

|

2848A |

Power of Attorney |

|

|

||

and Declaration of Representative |

|

|

|||

|

(REV. 2/17) |

|

|

|

|

|

NOTE: If you have questions concerning the completion of this form, please refer to the instructions for Federal |

||||

|

Form 2848 (revised March 2012). Alabama Form 2848A is very similar to the federal form. |

|

|||

|

|

CAUTION: A separate Form 2848A should be completed for each taxpayer. |

|

|

|

1 TAXPAYER INFORMATION |

|

|

|||

|

TAXPAYER NAME AND ADDRESS (Please Type or Print) |

|

|

SOCIAL SECURITY NUMBER |

|

|

|

|

|

EMPLOYER IDENTIFICATION NUMBER |

|

|

Hereby appoint(s) the following representative(s) as |

|

|

DAYTIME TELEPHONE NUMBER |

|

|

|

( |

) |

||

|

|

|

|

||

|

|

|

|

|

|

2 REPRESENTATIVE(S) (Please Type or Print) Must sign and date this form on page 2, part II. By designating a representative |

||

in Part I, Section 2, the taxpayer authorizes the Department to discuss or share information specifically listed in Part I, Section 3 with |

||

the authorized representative. All official correspondence from the Department will be sent to the taxpayer. It will be the taxpayer’s |

||

responsibility to distribute document(s) to their representative. |

|

|

NAME AND ADDRESS |

|

|

TELEPHONE NUMBER |

( |

) |

FAX NUMBER |

( |

) |

NAME AND ADDRESS |

|

|

TELEPHONE NUMBER |

( |

) |

FAX NUMBER |

( |

) |

NAME AND ADDRESS |

|

|

TELEPHONE NUMBER |

( |

) |

FAX NUMBER |

( |

) |

To represent the taxpayer before the Alabama Department of Revenue for the following tax matters: |

|

|

3 TAX MATTERS |

TAX FORM NUMBER (40, 20C, 41, 65, etc.) |

YEAR(S) or PERIOD(S) |

TYPE OF TAX (Individual, Corporate, Sales, etc.) |

||

4 ACTS AUTHORIZED |

|

Unless otherwise provided below, the representatives generally are authorized to receive and inspect confidential tax information |

|

and to perform any and all acts that I can perform with respect to the tax matters described on line 3, for example, the authority to |

|

sign any agreements, consents, or other documents. The representative(s), however, is (are) not authorized to receive or negotiate |

|

any amounts paid to the client in connection with this representation (including refunds by either electronic means or paper |

|

checks). Additionally, unless the appropriate box(es) below are checked, the representative(s) is (are) not authorized to execute a |

|

request for disclosure of tax returns or return information to a third party, substitute another representative or add additional |

|

representatives, or sign certain tax returns. |

|

Disclosure to third parties; |

Substitute or add representative(s); Sign a return; __________________________________ |

EXCEPTIONS |

|

List any specific deletions to the acts otherwise authorized in this power of attorney: _______________________________________

__________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________

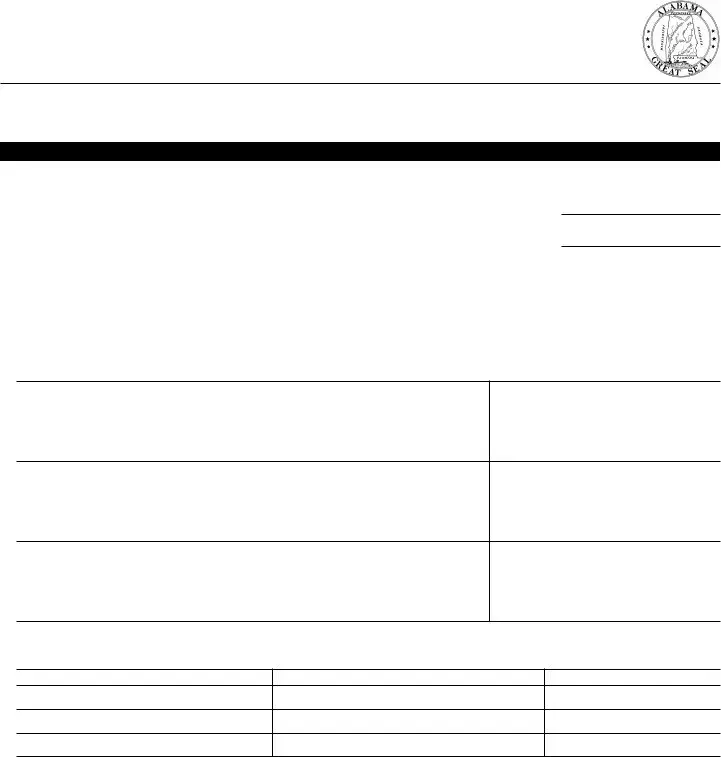

FORM 2848A (REV. 2/17) |

PAGE 2 |

5 RETENTION / REVOCATION OF PRIOR POWER(S) OF ATTORNEY |

|

The filing of this power of attorney automatically revokes all earlier power(s) of attorney on file with the Alabama |

|

Department of Revenue for the same tax matters and years or periods covered by this document. If you do not want |

|

to revoke a prior power of attorney, check here |

6 SIGNATURE OF TAXPAYEou MuStR AttAch A copY oF ANY power oF AttorNeY You wANt to reMAIN IN eFFect.

If a tax matter concerns a year in which a joint return was filed, the husband and wife must each file a separate power of attorney even if the same representative(s) is (are) being appointed. If signed by a corporate officer, partner, guardian, tax matters partner, executor, receiver, administrator, or trustee on behalf of the taxpayer, I certify that I have the authority to execute this form on behalf of the taxpayer.

If this power of attorney is not signed and dated, it will be returned to the taxpayer.

SIGNATURE |

DATE |

TITLE (If Applicable) |

|

|

|

PRINT NAME |

|

|

Under penalties of perjury, I declare that:

• I am not currently under suspension or disbarment from practice before the Internal Revenue Service;

• I am aware of regulations contained in Treasury Department Circular No. 230 (31 CFR, Part 10), as amended, concerning the practice of attorneys, certified public accountants, enrolled agents, enrolled actuaries, and others;

• I am authorized to represent the taxpayer identified in Part I for the tax matter(s) specified there; and

• I am one of the following:

Attorney – a member in good standing of the bar of the highest court of the jurisdiction shown below.

a. Certified Public Accountant – duly qualified to practice as a certified public accountant in the jurisdiction shown below. b. Enrolled Agent – enrolled as an agent under the requirements of Treasury Department Circular No. 230.

c. Officer – a bona fide officer of the taxpayer’s organization. d.

e. Family Member – a member of the taxpayer’s immediate family (i.e., spouse, parent, child, brother, or sister).

f. Enrolled Actuary – enrolled as an actuary by the Joint Board for the Enrollment of Actuaries under 29 U.S.C. 1242 (the g. authority to practice before the Service is limited by section 10.3(d)(1) of Treasury Department Circular No. 230).

Unenrolled Return Preparer – an unenrolled return preparer under section 10.7(c)(1)(viii) of Treasury Department Circular h. No. 230.

Registered Tax Return Preparer – registered as a tax return preparer under the requirements of section 10.4 of Circular 230.

i. Your authority to practice before the Internal Revenue Service is limited. You must have been eligible to sign the return under examination and have signed the return. See Notice

StudentunenrolledAttorneyand returnor CPApreparers– receivesin permissionthe in tructitopracticens. before the IRS by virtue of his/her status as a law, business, or j. accounting student working in LITC or STCP under section 10.7(d) of Circular 230. See instructions for Part II for additional

information and requirements.

Enrolled Retirement Plan Agent – enrolled as a retirement plan agent under the requirements of Circular 230 (the authority to k. practice before the Internal Revenue Service is limited by section 10.3(e)).

If this declaration of representative is not signed and dated, the power of attorney will be returned.

Note: For designations

DESIGNATION – INSERT

ABOVE LETTER

JURISDICTION (State) or

ENROLLMENT CARD NO.

SIGNATURE

DATE

Made fillable by FormsPal.

Document Specifics

| Fact Number | Description |

|---|---|

| 1 | The IRS Form 2848, Power of Attorney and Declaration of Representative, allows a taxpayer to authorize an individual to represent them before the IRS. |

| 2 | This form is used to grant a specified person or persons authority to receive and inspect confidential tax information and to perform acts on behalf of the taxpayer, such as signing agreements or consents. |

| 3 | Form 2848 requires detailed information about the taxpayer, the representative(s), and the specific tax matters and years or periods for which the power is granted. |

| 4 | The appointed representative must be an individual authorized to practice before the IRS, including attorneys, certified public accountants, enrolled agents, and others specified in the form’s instructions. |

| 5 | A separate Form 2848 must be completed for each taxpayer, meaning that joint filers must each file a form to grant power of attorney to the same or different representatives. |

| 6 | Submitting Form 2848 does not relieve the taxpayer of any tax obligations or prevent the IRS from contacting the taxpayer directly. |

| 7 | The power of attorney granted by Form 2848 is typically valid until the expiration date specified by the taxpayer on the form, if any, or until revoked by the taxpayer or the representative. |

| 8 | State-specific tax matters require separate state forms and are governed by state law, as the IRS Form 2848 only applies to federal tax matters. |

| 9 | Filing Form 2848 electronically through the IRS e-services is an option available to taxpayers and representatives, providing a faster alternative to mailing a paper form. |

Guide to Writing Tax POA 2848a

After completing the Tax Power of Attorney (POA) Form 2848a, individuals grant a trusted representative the authority to handle specific tax matters on their behalf. This step is essential for those who need assistance with their tax responsibilities, including dealing with the IRS more effectively. The form must be filled out correctly to ensure that the designated representative has the necessary permissions to act on the individual's behalf. The following steps provide a guide for completing this form accurately.

- Begin by entering the taxpayer's full name and mailing address, including the city, state, and ZIP code.

- Provide the taxpayer's identification number(s), such as their Social Security Number (SSN) or Employer Identification Number (EIN).

- Enter the name and address of the representative being granted the power of attorney. This includes their phone number and fax number, if available.

- Specify the tax form number(s) related to the matter(s) for which you are granting authority. These could include income tax returns, employment tax reports, etc.

- Indicate the specific tax periods or years that the power of attorney will cover. Be precise, as the representative will only have authority for these specified periods.

- If applicable, describe the particular tax matters and type of IRS notice (if any) that the representative is authorized to handle. This information helps clarify the scope of the representative’s authority.

- The taxpayer must sign and date the form. If the taxpayer is a business or entity, an authorized individual must sign on behalf of the organization.

Note: After the form is filled out, it should be submitted following the instructions provided by the IRS. This usually involves mailing or faxing the form to the IRS office designated for the taxpayer's state. The IRS reviews the form and, once approved, the representative will have the authority to act on the taxpayer’s behalf for the specified tax matters. Keep a copy of the completed form for your records.

Understanding Tax POA 2848a

-

What is the Tax POA 2848a form?

The Tax Power of Attorney (POA) Form 2848a is a document that authorizes an individual (typically a tax professional, such as an accountant or lawyer) to represent another person before the Internal Revenue Service (IRS). Through this form, the representative is granted specific powers to handle tax matters on behalf of the taxpayer. It's important for managing tax issues efficiently, especially for those who might not have the expertise or time to deal with the IRS directly.

-

How do I complete and submit the Tax POA 2848a form?

To complete the Tax POA 2848a form, you must provide detailed information about the taxpayer and the appointed representative, including their names, addresses, and taxpayer identification numbers. The form also requires you to specify the tax forms, years, and types of IRS matters the representative is authorized to handle. After filling out the form, it must be signed by the taxpayer and the authorized representative. The completed form can then be mailed or faxed to the IRS, according to the instructions provided with the form.

-

Who can be designated as a representative on the Tax POA 2848a form?

A variety of individuals can be designated as representatives on the Tax POA 2848a form, including attorneys, certified public accountants (CPAs), enrolled agents, family members, or others who qualify under IRS regulations. The key requirement is that the individual must have the knowledge, experience, and credentials, if applicable, to deal with tax matters effectively on behalf of the taxpayer.

-

What powers does the representative have with a Tax POA 2848a?

Using the Tax POA 2848a form grants the representative a range of powers to act on the taxpayer's behalf. These powers can include communicating with the IRS, obtaining and providing confidential tax information, negotiating and agreeing to tax settlements or payment plans, and representing the taxpayer in IRS proceedings. However, the specific powers granted depend on what is specified in the form, and certain powers must be expressly granted, such as signing tax returns.

-

Is the Tax POA 2848a form different from other power of attorney documents?

Yes, the Tax POA 2848a is specifically designed for tax purposes and is only recognized by the IRS. It is different from a general power of attorney or other types of legal POA documents, which may grant broader powers unrelated to tax matters. The Tax POA 2848a is focused solely on tax issues and allows the representative to perform only those tasks designated in the form related to dealing with the IRS.

-

Can the Tax POA 2848a form be revoked?

Yes, the taxpayer can revoke the Tax POA 2848a at any time. To do so, the taxpayer must provide written notice to the IRS, either by mailing a statement of revocation or by submitting a new POA form that states it revokes all prior authorizations. It’s important to ensure the IRS is notified to prevent the former representative from continuing to act on the taxpayer's behalf.

-

Does the Tax POA 2848a expire?

The Tax POA 2848a does not have a set expiration date and remains in effect until it is revoked by the taxpayer. However, taxpayers have the option to specify an expiration date on the form if they wish the authorization to end at a specific time. Regardless, it's advisable to review and update the POA periodically to ensure it reflects the taxpayer's current needs and circumstances.

Common mistakes

Navigating the complexities of tax forms can test anyone's patience and attentiveness. Among these, the Tax Power of Attorney Form 2848A is crucial yet prone to errors by filers. Understanding common mistakes can safeguard against potential delays or complications in managing tax affairs. Presented below are the frequent missteps individuals make on this form.

Not providing complete information for the taxpayer: It's essential to fill in all required fields with accurate information, including full name, address, and Taxpayer Identification Numbers (TINs). Skipping details leads to processing delays.

Misidentifying the representative: The form requires the designation of an individual authorized to represent the taxpayer. Often, filers incorrectly list the representative or fail to provide necessary credentials such as address, phone number, and Preparer Tax Identification Number (PTIN).

Incorrect use of form sections: Each part of Form 2848A serves a specific purpose. A common error is misunderstanding which sections to complete for granting authority, revoking previous authorizations, or specifying acts authorized. This misunderstanding can invalidate the form.

Omitting specific tax forms and periods: The form requires detailed listing of tax types, forms, and years or periods for which the power of attorney is granted. A general authorization without specifics can lead to refusal.

Failing to specify the extent of authority: Properly detailing the powers granted, including whether the representative can sign returns, is crucial but often overlooked. This ambiguity can hinder the representative’s ability to act effectively.

Not addressing line 5 issues effectively: Line 5 seeks consent for disclosure to third parties. Many filers misunderstand its intent, inadvertently restricting or unnecessarily broadening access to their information.

Overlooking the need for original signatures: Electronic signatures are not accepted. This oversight can render the form invalid. Each party must sign the document in ink.

Unclear revocation of prior authorizations: If intending to revoke previous powers of attorney without listing them individually on the form, clarity is often missing. This confusion may accidentally maintain unwanted authorizations.

Incorrect filing: Either filing with the wrong IRS office or not filing at all are common mistakes. Knowing where and how to file the form is fundamental for it to be recognized and processed.

Keeping an eye on these pitfalls can greatly enhance the filing process. Every detail matters in ensuring that your Tax Power of Attorney Form 2848A is filled out correctly, effectively granting the necessary authority to your chosen representative.

Documents used along the form

When dealing with tax matters, it's quite common to encounter the need for several forms and documents alongside the Tax Power of Attorney (POA) Form 2848a. Each of these documents plays a crucial role in ensuring that tax affairs are managed comprehensively and in compliance with the law. Below is a list of forms and documents often used in conjunction with Form 2848a to provide a clearer picture of the prerequisites and companions in tax-related proceedings.

- Form 1040: The U.S. Individual Income Tax Return is essential for filing annual income tax returns. It provides the IRS with the details of your income, deductions, and credits to determine your tax liability or refund.

- Form W-2: Wage and Tax Statement, issued by employers to employees, details the annual wages and the amount of taxes withheld from paychecks. It is indispensable for completing tax returns.

- Form W-9: Request for Taxpayer Identification Number and Certification, used to provide your correct Taxpayer Identification Number (TIN) to the entity managing your finances, ensuring proper reporting to the IRS.

- Form 1099: These forms report various types of income other than wages, salaries, and tips. For instance, Form 1099-MISC covers income from rentals or services provided as an independent contractor.

- Schedule C (Form 1040): Profit or Loss From Business (Sole Proprietorship). This schedules details the income and expenses of a sole proprietorship and calculates the net profit or loss for the tax year.

- Form 8863: Education Credits (American Opportunity and Lifetime Learning Credits). This form allows taxpayers to calculate and claim educational credits, which can reduce tax liability.

- Form 4506-T: Request for Transcript of Tax Return. This document is used to request a transcript of your tax return or other tax records. It is often required by lenders or other organizations needing proof of tax return filings.

- Form 8822: Change of Address. If you move, this form notifies the IRS of your new address to ensure you receive any refunds or correspondence without delay.

Together with the Tax POA Form 2848a, these documents form a comprehensive toolkit for handling various tax responsibilities efficiently. Whether managing personal income tax, business earnings, or ensuring accurate reporting of income and deductions, these forms facilitate compliance with tax laws and support effective financial management.

Similar forms

The Form 2848, Power of Attorney and Declaration of Representative, is a critical document for those needing to authorize an individual, typically a tax professional, to represent them before the IRS. This form's importance is mirrored in other legal documents that similarly empower another party to act on one’s behalf. One such document is the General Power of Attorney, which grants broad powers to an agent to act in all financial affairs. Unlike the specific authority outlined in Form 2848 for tax matters, the General Power of Attorney encompasses a wider range of financial decisions.

Similarly, the Healthcare Power of Attorney is a document that parallels the intent behind Form 2848, but in the realm of medical decisions. It authorizes someone to make healthcare decisions on another person's behalf when they are unable to do so. Although distinct in its application to healthcare, it exemplifies the same foundational principle of representation found in the Tax POA 2848a.

The Durable Power of Attorney stands close to Form 2848, with a key difference being its durability clause. This means it remains in effect even if the grantor becomes mentally incapacitated. It can be contrasted with Form 2848 in that it covers a broader scope beyond just tax matters but shares the similarity of appointing someone to act on another’s behalf.

Another comparable document is the Limited Power of Attorney, which, akin to Form 2848, grants specific powers to an agent. However, it is differentiated by its temporary nature or its restriction to a particular transaction. Its similarity lies in its purpose of authorizing someone to act in a specific capacity, illustrating the tailored delegation of authority much like the Tax POA 2848a.

The Trust Agreement document echoes the principle of acting on another's behalf found in Form 2848. However, it specifically relates to managing and overseeing assets placed in a trust. While this document establishes a trustee’s legal authority to manage trust assets, it resonates with the aspect of representation and delegated authority found in the Tax POA 2848a.

Similarly, the Bank Power of Attorney is a focused document that authorizes an agent to conduct banking transactions on someone’s behalf. While narrower in scope and specific to banking activities, it embodies the same fundamental concept of delegating authority to another, matching the core intention behind Form 2848.

The Advance Directive is another legal document that parallels the intent behind the Tax POA 2848a through its function of appointing a healthcare representative. Although specific to healthcare decisions and end-of-life care, it shares a common theme with Form 2848: the act of designating another person to make critical decisions on one’s behalf.

The Executorship Assignment is a document that dovetails with the intent behind Form 2848 by authorizing someone to administer the estate of a deceased person. While its scope is centered on estate administration post-death, it shares the pivotal idea of representation and delegated authority found in the Tax POA 2848a.

Last but not least, the Business Power of Attorney is a document that allows a business owner to designate an agent to make decisions and act on the business’s behalf. Similar to Form 2848’s tax representation focus, this document centers on business matters, yet both serve the critical function of entrusting an individual with significant decision-making powers.

Dos and Don'ts

Filling out the Tax Power of Attorney (POA) Form 2848a allows you to grant authority to an individual, often a professional such as an accountant or attorney, to handle tax matters on your behalf. Navigating through this form can be straightforward if you keep in mind a few critical do's and don'ts:

Do:Ensure all information is complete and accurate. Including your full name, address, Taxpayer Identification Number (TIN), and the tax form numbers related to the matters you are seeking assistance with.

Specify the tax periods and types of taxes clearly. Make sure these details align with the matters for which you are granting authority.

Choose your representative carefully. Only select individuals who are eligible to practice before the IRS, such as attorneys, certified public accountants, or enrolled agents.

Sign and date the form. Your signature is mandatory to validate the authorization.

Keep a copy of the completed form for your records. It's important to have a record of the authorization you've given.

Notify your representative if there's a change in your tax situation or if you wish to revoke the POA. Communication is key to ensuring that your tax matters are handled appropriately.

Use the most current version of the form. The IRS occasionally updates forms, and using the most up-to-date version ensures compliance with the latest regulations and requirements.

Leave any sections of the form blank. Incomplete forms may be rejected or may delay processing.

Forget to specify any limitations to the representative's authority if necessary. If there are specific matters you do not wish your representative to handle, be sure to indicate so on the form.

Overlook the need for a witness or notary, if required. Depending on your location or specific circumstances, you may need to have your signature witnessed or notarized.

Fail to inform your representative of their appointment. They need to know that they have been authorized to act on your behalf and understand the extent of their responsibilities.

Assume the POA grants unlimited time for representation. Be aware of the form’s expiration provisions and renew as necessary.

Authorize more representatives than needed. While you can name more than one representative on Form 2848a, doing so without a clear need may complicate matters.

Disregard the importance of reviewing the form for errors before submitting. One small mistake can invalidate your form or delay its processing.

Misconceptions

Misunderstandings surrounding the Tax Power of Attorney (POA) Form 2848a can lead to confusion and incorrect filing, which might affect individuals' tax handling and representation. Here are ten common misconceptions:

It grants unlimited power: Many believe signing a Tax POA 2848a gives the agent unlimited control over their financial and tax affairs. In reality, the form specifies the exact tax matters and years for which they are authorized.

It's permanent: There's a misconception that once executed, the form remains effective indefinitely. However, it can be revoked at any time by the individual who granted the power.

Anybody can be appointed: While it is true that individuals can choose who they wish to represent them, the IRS requires that the appointed agent must be an eligible individual, such as an attorney, certified public accountant, or enrolled agent.

It's only for individuals: Some think the Tax POA 2848a is solely for individual use. Businesses, trusts, and estates can also use it to authorize representation.

Filling it out is complicated: People often assume that completing the form is complex. With clear instructions provided by the IRS, along with the option to seek professional help, it can be filled out correctly.

Signature must be physical: There is a belief that a physical signature is mandatory. The IRS accepts electronic signatures, making the process more accessible.

It covers state tax matters: A common mistake is thinking the federal Tax POA 2848a also applies to state taxes. Most states have their own POA forms for state tax matters.

It's the only form needed for tax representation: Sometimes it's assumed this is the only document required. Depending on the situation, other forms, like the IRS Form 8821 (Tax Information Authorization), might also be necessary.

It allows agents to sign tax returns: People often misunderstand that this form permits the agent to sign income tax returns. Unless specifically authorized in the document, agents cannot sign income tax returns on behalf of the taxpayer.

It can be filed electronically by individuals: While electronic filing is accepted, it typically must be done through a tax professional authorized to use the IRS e-services Taxpayer Authorization File (TAF).

Addressing these misconceptions is crucial for accurate and effective use of the Tax POA 2848a, ensuring proper representation and compliance with IRS regulations.

Key takeaways

When it comes to managing your taxes, especially if you're in a situation where you need someone else to handle them on your behalf, understanding the Tax Power of Attorney (POA) Form 2848a is crucial. This document plays a significant role in authorizing someone else, often a tax professional, to act on your behalf in matters related to the Internal Revenue Service (IRS). The importance of filling out and using this form correctly cannot be overstated. Below are key takeaways to ensure that you are well-informed about the process.

- Know the Purpose: The primary function of Form 2848a is to grant authority to a specified individual, commonly referred to as an agent or attorney-in-fact, to represent you in front of the IRS. This includes discussing your tax matters, signing agreements, or receiving confidential tax information.

- Choose the Right Agent: Selecting an agent is a decision that should be made carefully. Ensure that the individual or firm you choose is qualified, trustworthy, and has the necessary expertise in tax matters. Typically, agents are certified public accountants (CPAs), attorneys, or enrolled agents who have been granted the privilege to practice before the IRS.

- Complete Form Accurately: Precision in filling out Form 2848a is crucial. Mistakes or incomplete information can lead to the IRS rejecting the form. Ensure all sections are filled correctly, including your personal information, the specific tax matters and periods you are granting authority for, and the identification of your selected agent.

- Understand the Scope of Authority: Be clear about the extent of power you are granting to your agent. The form allows you to specify which tax issues and periods the agent can address. Limitations can be placed if you wish to restrict the agent's authority to certain aspects of your tax affairs.

- Keep a Record: After the form is completed and submitted to the IRS, keep a copy for your records. Having a copy can be helpful if there are any disputes or misunderstandings about the authorization granted to your agent.

- Know the Expiry: The authorization provided through Form 2848a does not last indefinitely. Be aware of the expiration date and be prepared to renew the authorization if your agent will need to continue representing you beyond that period.

Properly utilizing the Tax POA 2848a form is pivotal for ensuring that your tax matters are handled efficiently and accurately by your chosen representative. By keeping these key takeaways in mind, you can navigate the process with confidence and peace of mind.

Popular PDF Documents

Form 5060 - The form facilitates a streamlined process for claiming hotel tax exemptions for official business stays in Missouri.

IRS 4137 - This form underscores the broader legal principle that all income, irrespective of source, is subject to tax.

Ptax 300 - The PTAX-300 form is a document utilized by entities in Illinois seeking a property tax exemption for non-homestead properties.