Get Tax POA 151 Form

Navigating through the complexities of tax matters can often feel like traversing through a dense, unfamiliar forest, especially when it comes to understanding the roles and responsibilities associated with giving someone else the authority to handle these matters on your behalf. In this context, the Tax Power of Attorney (POA) Form 151 emerges as a critical document, designed to ease this process by formally granting another individual or entity the authorization to represent you in tax matters before the tax authorities. This form encapsulates not just the permission but specific details regarding the scope of authority being granted, the time period for which the authorization is effective, and precisely which tax matters and years are covered. Furthermore, while the concept may seem straightforward, the implications of authorizing a POA and the nuances of ensuring that it is correctly executed cannot be overstated, for it directly influences one’s financial and legal standing with respect to tax obligations.

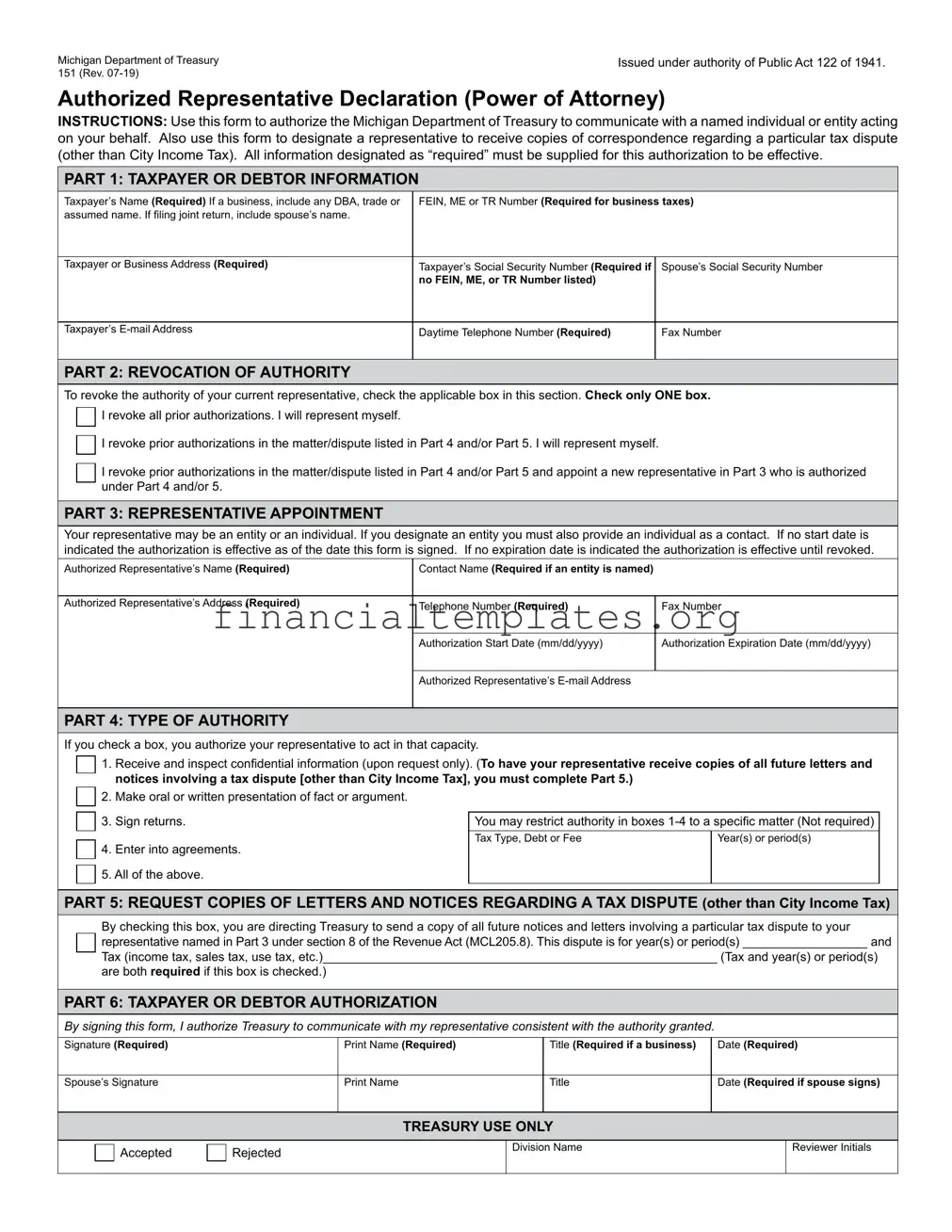

Tax POA 151 Example

Michigan Department of Treasury |

Issued under authority of Public Act 122 of 1941. |

151 (Rev. |

|

Authorized Representative Declaration (Power of Attorney)

INSTRUCTIONS: Use this form to authorize the Michigan Department of Treasury to communicate with a named individual or entity acting on your behalf. Also use this form to designate a representative to receive copies of correspondence regarding a particular tax dispute (other than City Income Tax). All information designated as “required” must be supplied for this authorization to be effective.

PART 1: TAXPAYER OR DEBTOR INFORMATION

Taxpayer’s Name (Required) If a business, include any DBA, trade or |

FEIN, ME or TR Number (Required for business taxes) |

|

assumed name. If filing joint return, include spouse’s name. |

|

|

|

|

|

Taxpayer or Business Address (Required) |

Taxpayer’s Social Security Number (Required if |

Spouse’s Social Security Number |

|

no FEIN, ME, or TR Number listed) |

|

|

|

|

Taxpayer’s |

Daytime Telephone Number (Required) |

Fax Number |

|

|

|

PART 2: REVOCATION OF AUTHORITY

To revoke the authority of your current representative, check the applicable box in this section. Check only ONE box. □

I revoke all prior authorizations. I will represent myself.

I revoke all prior authorizations. I will represent myself.

□

I revoke prior authorizations in the matter/dispute listed in Part 4 and/or Part 5. I will represent myself.

I revoke prior authorizations in the matter/dispute listed in Part 4 and/or Part 5. I will represent myself.

□ I revoke prior authorizations in the matter/dispute listed in Part 4 and/or Part 5 and appoint a new representative in Part 3 who is authorized under Part 4 and/or 5.

PART 3: REPRESENTATIVE APPOINTMENT

Your representative may be an entity or an individual. If you designate an entity you must also provide an individual as a contact. If no start date is indicated the authorization is effective as of the date this form is signed. If no expiration date is indicated the authorization is effective until revoked.

Authorized Representative’s Name (Required) |

Contact Name (Required if an entity is named) |

|

|

|

|

Authorized Representative’s Address (Required) |

Telephone Number (Required) |

Fax Number |

|

|

|

|

Authorization Start Date (mm/dd/yyyy) |

Authorization Expiration Date (mm/dd/yyyy) |

|

|

|

|

Authorized Representative’s |

|

|

|

|

PART 4: TYPE OF AUTHORITY

If you check a box, you authorize your representative to act in that capacity. |

|

|

|||||

|

|

|

1. |

Receive and inspect confidential information (upon request only). (To have your representative receive copies of all future letters and |

|

||

|

□ |

|

|

||||

|

|

|

notices involving a tax dispute [other than City Income Tax], you must complete Part 5.) |

|

|

||

|

□ |

|

2. |

Make oral or written presentation of fact or argument. |

|

|

|

|

|

|

|

|

|

|

|

|

□ |

|

3. |

Sign returns. |

You may restrict authority in boxes |

|

|

|

|

|

|

Tax Type, Debt or Fee |

Year(s) or period(s) |

|

|

|

□ |

|

4. |

Enter into agreements. |

|

|

|

|

|

5. All of the above. |

|

|

|

||

|

□ |

|

I |

I |

I |

||

|

|

|

|

|

|

|

|

PART 5: REQUEST COPIES OF LETTERS AND NOTICES REGARDING A TAX DISPUTE (other than City Income Tax)

By checking this box, you are directing Treasury to send a copy of all future notices and letters involving a particular tax dispute to your

□ representative named in Part 3 under section 8 of the Revenue Act (MCL205.8). This dispute is for year(s) or period(s) __________________ and

Tax (income tax, sales tax, use tax, etc.)_________________________________________________________ (Tax and year(s) or period(s)

are both required if this box is checked.)

PART 6: TAXPAYER OR DEBTOR AUTHORIZATION

By signing this form, I authorize Treasury to communicate with my representative consistent with the authority granted.

Signature (Required) |

Print Name (Required) |

Title (Required if a business) |

Date (Required) |

Spouse’s Signature |

Print Name |

Title |

Date (Required if spouse signs) |

TREASURY USE ONLY

□ Accepted |

□ Rejected |

Division Name |

Reviewer Initials |

I |

I |

Form 151, Page 2

Purpose

Use the Authorized Representative Declaration (Power of Attorney) (Form 151) to authorize the Michigan Department of Treasury (Treasury) to communicate with a named individual or entity acting on your behalf. This form may also be used to revoke your representative’s authority or to designate a representative to receive letters and notices regarding a particular tax dispute.

Required information. If a box includes the word “Required,” you must provide the information. If a box does not contain the required information, the form is invalid and you will be notified by letter.

Part 2: Revoking the authority of a representative. Complete Part 2 if you want to revoke your representative’s authority in whole or in part or all prior authorizations. After you revoke your representative’s authority, you may represent yourself, or you may appoint a new representative.

Part 3: Appointing an entity as your representative. If you appoint an entity as your representative, then any individual within that entity is authorized to act on your behalf. For example, if you appoint the XYZ Law Firm as your representative, any attorney or paralegal from that firm is authorized to act on your behalf. The “Contact Name” is only to ensure that information sent to the entity is directed to the individual overseeing your representation. The contact name is NOT your sole authorized representative. To appoint an entity, write in the Name and Address box (for example):

XYZ Law Firm 1234 Street

City, State, ZIP Code

Appointing an individual as your representative. If you appoint a specific individual as your representative, then only that individual is authorized to act on your behalf. Treasury will only discuss with or disclose information to that individual. For example, if a specific attorney at the XYZ Law Firm is named as your representative, Treasury will not discuss with or disclose information to any other attorney or paralegal at the same firm. To appoint an individual, write in the Name and Address box (for example):

Lynn Lee XYZ Law Firm 1234 Street

City, State, ZIP Code

Part 4: Type of authority: General or limited. You may grant your representative general or limited authority to act on your behalf. The actions that your representative may take will depend on the boxes that you check in Part 4. Confidential information (box 1) will only be provided upon request; Treasury will not automatically send confidential information to your representative. If you check box 5 in Part 4, you are granting your representative general authority to act on your behalf regarding any tax return and any debt. However, granting your representative general authority does not give the representative the right to receive future copies of letters and notices unless Part 5 is also completed.

Part 5: Requesting copies of letters and notices with respect to a tax dispute.

NOTE: This part does not apply to City Income Tax.

If you complete Part 5, you must identify on the line in Part 5 a single tax matter that is in dispute. The dispute may cover more than one tax period or year. If you have more than one dispute with Treasury and want your representative to receive copies of future notices and letters with respect to those additional disputes, you must fill out a separate form for each dispute. Part 5 does not give a representative authority to act on your behalf. You must give your representative authority to act on your behalf by checking one or more boxes in Part 4 if you want your representative to do more than just receive future notices and letters. Only one representative can be authorized to receive future letters and notices regarding a specific tax dispute under Part 5. Treasury will only send future letters and notices to the person identified on the most recent form. If you appoint an entity as your representative, future letters and notices will be sent to the attention of the first “Contact Name.”

Deceased taxpayer. Do not use this form for a deceased taxpayer. File a Claim for Refund Due a Deceased Taxpayer

MAILING OR FAXING INSTRUCTIONS

Individual taxpayers:

Michigan Department of Treasury

Customer Contact Center

Individual Correspondence Section

P.O. Box 30058

Lansing, Ml 48909

Fax:

When Treasury Collections asks for this form and any attachments:

Michigan Department of Treasury — Coll

P.O. Box 30149

Lansing, Ml 48909

Fax:

When a Treasury field office representative asks for this form, send it as directed by that office.

For all others:

Michigan Department of Treasury

Customer Contact Center

Registration Section

P.O. Box 30778

Lansing, Ml 48909

Document Specifics

| # | Fact | Detail |

|---|---|---|

| 1 | Form Name | Tax Power of Attorney (Form 151) |

| 2 | Purpose | Used to grant authorization to an individual to represent another person in matters related to state tax. |

| 3 | Type of Form | State-Specific |

| 4 | Governing Law | Varies by state; the form is subject to the tax laws of the respective state. |

| 5 | Who Can File | Individuals or businesses seeking to delegate their tax responsibilities to a third party. |

| 6 | Who Can Be Appointed | Typically, a qualified individual such as a certified public accountant, attorney, or enrolled agent who has a tax preparation background. |

| 7 | Scope of Authorization | The form allows for specification of powers, including but not limited to discussing tax matters, obtaining confidential information, and representing the person in tax matters before the state tax authority. |

| 8 | Validity Period | Varies by state, but typically remains in effect until explicitly revoked or a specified expiration date has passed. |

| 9 | How to Revoke | The granter can revoke the authorization at any time through written notice to the state tax authority. |

| 10 | Signing Requirements | Both the individual granting the power and the appointed representative must sign the form, sometimes in the presence of a witness or notary, depending on state requirements. |

Guide to Writing Tax POA 151

After deciding to grant someone else the power to handle your tax matters, the next step involves accurately completing the Tax POA 151 form. This document officially gives the person you choose the authority to discuss and manage your taxes with the tax agency. Ensuring that each part of the form is filled out correctly is crucial for its approval. Follow these steps carefully to fill out the form accurately.

- Begin by entering the taxpayer's full name and Taxpayer Identification Number (TIN) in the designated spaces. The TIN could be a Social Security Number (SSN) or an Employer Identification Number (EIN).

- Fill in the taxpayer's address, including the street name, city, state, and ZIP code. Ensure this information is current and matches the address on file with the tax agency.

- Specify the tax forms involved, such as the 1040, 1120, or other tax return forms, along with the years or periods for which the POA is granted. Make sure to list each year or period clearly.

- Enter the full name and address of the individual or entity being granted the POA. If an individual, include their telephone number and any designation, like CPA or attorney, that may be relevant.

- Clarify the specific acts you are authorizing, such as discussing your tax returns, receiving confidential information, or representing you in tax matters. Be as specific as possible to ensure that the scope of the POA is clearly understood.

- Check any boxes that apply to the retention or revocation of prior POAs. If you are revoking a previous POA, provide the name of the individual or organization whose authority is being revoked.

- Review the form with the appointed individual or organization to ensure that all provided information is accurate and they understand their responsibilities.

- Both the taxpayer and the individual or entity being granted the POA must sign and date the form. Ensure that the date reflects when the POA is being executed.

Once the form is completed and signed, it should be sent to the designated tax agency's address provided in the form's instructions. Hold onto a copy for your records. The processing time may vary, so it's advisable to submit it well before any deadlines related to your tax matters. Following these steps will help streamline the process, ensuring your tax matters are managed as intended.

Understanding Tax POA 151

-

What is the Tax POA 151 form?

The Tax POA 151 form, commonly known as the Power of Attorney (POA) form, is a document that allows an individual or business to grant authority to another person or entity to handle their tax matters. This includes the ability to access confidential tax information and make decisions regarding tax payments, filings, and disputes on their behalf.

-

Who can act as an agent on a Tax POA 151 form?

Any individual, such as a family member or friend, or a professional, like a lawyer, certified public accountant, or enrolled agent who meets the state or federal requirements, can be designated as an agent on a Tax POA 151 form. The person appointed must be willing and legally able to act on behalf of the principal (the person granting the power).

-

How do I complete the Tax POA 151 form?

Completing the Tax POA 151 form typically involves providing detailed information about the principal and the agent, including their names, addresses, and identification numbers. The specific tax matters and periods the agent is authorized to handle must also be clearly defined. It is important to read the instructions provided with the form carefully to ensure all required sections are completed accurately.

-

Does the Tax POA 151 need to be signed?

Yes, the Tax POA 151 form must be signed and dated by the principal. Depending on the state's requirements, the agent may also need to sign the form. Some states require the signatures to be notarized or witnessed to validate the document.

-

How long does the authority granted by the Tax POA 151 last?

The duration of the authority granted by the Tax POA 151 form can vary. It may be set for a specific period or until the principal revokes it. Some forms also automatically expire on a certain date or upon the completion of the specified tax matters. It is crucial to specify the duration clearly on the form.

-

Can the authority granted by a Tax POA 151 be revoked?

Yes, the principal can revoke the authority granted under a Tax POA 151 at any time. This is done by notifying the agent and any relevant tax authorities in writing. A new POA form may also need to be filed if a different agent is being appointed.

-

Do I need to file the Tax POA 151 with the tax authorities?

Yes, the completed and signed Tax POA 151 form usually needs to be filed with the relevant tax authorities. This ensures they recognize the agent's authority to act on the principal's behalf. Check with the specific tax authority to confirm the filing requirements and process.

-

Where can I find the Tax POA 151 form?

The Tax POA 151 form can typically be obtained from the website of the respective tax authority. It is also available at local tax offices. Ensure that you are using the most current version of the form to comply with the latest requirements and regulations.

Common mistakes

Filling out the Tax Power of Attorney (POA) Form 151 requires attention to detail and a clear understanding of its implications. Common mistakes can lead to delays or complications in handling one’s tax matters. Recognizing these errors is the first step toward ensuring that your tax affairs are managed efficiently and correctly.

-

Not checking the current version of the form: Tax laws and forms can be updated frequently. Using an outdated form may result in the submission being rejected or unnecessary delays. It's crucial to verify that the most current version of the Tax POA 151 form is being used.

-

Incorrect or incomplete information: Every section of the form must be filled out with accurate information. Common errors include misspelled names, incorrect Tax Identification Numbers (TINs), or incomplete addresses. These mistakes can significantly hinder the process, as the tax authority may be unable to match the form with the correct taxpayer records.

-

Failure to specify the powers granted: The Tax POA 151 form allows taxpayers to grant specific powers to their representatives. Failing to clearly specify or mistakenly granting broader powers than intended can lead to unwanted consequences. It is vital to carefully review and select the applicable powers to ensure that the representative can act as intended.

-

Not signing or dating the form: A common oversight is forgetting to sign or date the form before submission. The form is not valid without the taxpayer's signature and the date. This lack of validation can lead to the assumption that the form was never fully completed or submitted with the intent to authorize representation.

By avoiding these mistakes, individuals can streamline the process of granting a representative the authority to handle their tax matters. It is always recommended to review the form thoroughly and consult with a professional if there are any uncertainties regarding the Tax POA 151 form.

Documents used along the form

When dealing with tax matters, especially when authorizing a representative through a Tax Power of Attorney (POA) Form 151, various other forms and documents often come into play to ensure comprehensive handling of an individual's or entity's tax affairs. These documents, each serving its unique purpose, range from requests for specific tax return information to broader authorizations for representation. Understanding these documents can provide clarity and facilitate smoother interactions with tax authorities.

- Form 2848, Power of Attorney and Declaration of Representative: This form is used to authorize an individual, such as a certified public accountant, attorney, or enrolled agent, to represent a taxpayer before the IRS. It details the specific tax matters and periods for which authorization is granted.

- Form 8821, Tax Information Authorization: Unlike the POA, this form authorizes individuals to review and receive confidential tax information but does not allow them to represent the taxpayer before the IRS. It's often used by tax preparers and financial institutions to obtain necessary tax information from the IRS.

- Form 4506, Request for Copy of Tax Return: Taxpayers use this document to request copies of previously filed tax returns and attachments. These can be vital for legal, financial, or personal reasons.

- Form 4506-T, Request for Transcript of Tax Return: This form allows taxpayers to request a transcript of their tax return rather than a full copy. Transcripts are often sufficient for mortgage and student loan applications.

- Form 1040, U.S. Individual Income Tax Return: This is the standard IRS form that individuals use to file their annual income tax returns. It's central to most tax operations and often accompanies POA forms when authorizing representation for matters related to specific tax years.

- Form 433-A, Collection Information Statement for Wage Earners and Self-Employed Individuals: This form is used to gather financial information from individuals to determine the appropriate payment plan for back taxes owed to the IRS.

- Form 433-B, Collection Information Statement for Businesses: Similar to Form 433-A, this version is tailored for businesses, collecting financial details to assist in determining how a business can settle its tax debts.

In summary, while the Tax POA Form 151 is critical for authorizing a representative in tax matters, it's often just one component of a broader set of documents required for thorough and effective tax management. Whether it’s for authorizing professionals, requesting tax return copies, or disclosing financial information, each form plays a vital role in navigating the complexities of tax obligations and representation.

Similar forms

The Tax POA 151 form closely resembles the Durable Power of Attorney for Finances and Property. This document also allows an individual to appoint someone they trust to manage their financial affairs. However, the Durable Power of Attorney for Finances and Property is broader in scope than the Tax POA 151, encompassing more than just tax matters. It includes the authority to handle bank transactions, real estate matters, and other financial decisions.

Similarly, the Healthcare Power of Attorney form shares commonalities with the Tax POA 151 form. This type of Power of Attorney allows an individual to appoint another person to make healthcare decisions on their behalf in the event they become unable to do so. While it focuses on healthcare decisions instead of tax matters, both documents function to empower a trusted individual to act on the principal's behalf under specific circumstances.

The General Power of Attorney form is another document akin to the Tax POA 151 form. It grants an appointed agent broad powers to handle affairs on behalf of the principal. These affairs can range from financial to personal or business matters, unlike the Tax POA 151, which is specialized for tax-related issues. The General Power of Attorney typically remains in effect until it is revoked or until the principal becomes incapacitated, absent a durability provision.

Finally, the Limited Power of Attorney is directly comparable to the Tax POA 151 form, in that it also grants an agent the authority to act in the principal's stead for a specific task or for a limited time. What differentiates the two is the nature of the authority granted. The Limited Power of Attorney could apply to a wide range of activities, not just tax matters, depending on the principal's needs, such as selling a particular piece of property or managing a specific account. However, both forms are utilized to delegate authority for distinct, clearly defined tasks.

Dos and Don'ts

When filling out the Tax Power of Attorney (POA) Form 151, there are important dos and don'ts to keep in mind. Properly completing this form grants someone else the authority to handle your tax matters, making accuracy and clarity crucial. Below are four essential tips each for what you should and shouldn't do during this process.

What You Should Do:

- Double-check the details: Ensure all information, especially identification numbers and contact details, is correct and up to date.

- Clearly specify the powers granted: Be explicit about what your representative can and cannot do on your behalf.

- Sign and date the form: Your signature and the date are required to validate the form.

- Keep a copy for your records: After submitting the form, retain a copy for future reference or in case of disputes.

What You Shouldn't Do:

- Leave sections incomplete: An incomplete form can lead to processing delays or outright rejection.

- Forget to specify the duration: Failing to indicate how long the POA is in effect could lead to confusion or legal complications down the line.

- Use vague language: Ambiguities in granting authority could result in misinterpretations of your intentions.

- Ignore the requirement for witness or notarization: Depending on your jurisdiction, a witness or notarization may be necessary for the form to be considered valid.

Misconceptions

The Tax Power of Attorney (POA) Form 151 plays a crucial role in managing tax matters in the United States. However, there are several misconceptions surrounding this document that can lead to confusion. It's important to clarify these misunderstandings to ensure individuals and businesses make informed decisions when handling their taxes.

Only for Tax Evasion: Some people mistakenly believe that the Tax POA Form 151 is primarily for those trying to evade taxes. In reality, it's a legal instrument that authorizes a representative to handle tax matters on someone's behalf, ensuring proper compliance and potentially resolving issues more efficiently.

Complicated to Execute: Another common misconception is that completing and submitting a Tax POA Form 151 is a complex and time-consuming process. Although it requires specific information and signatures, the process is straightforward. Clear instructions are available to guide individuals through each step.

Permanent and Irrevocable: Many believe once a Tax POA is executed, it's permanent and cannot be revoked. This is not true. The person who granted the power can revoke it at any time, providing they are mentally competent to do so. This flexibility ensures that the grantor always has control over their financial and tax-related decisions.

Grants Unlimited Power: There is a misconception that a Tax POA Form 151 gives the representative unlimited power over all aspects of the grantor's financial matters. However, this form specifically limits the representative’s power to tax-related issues. The scope of authority can be further limited based on the preferences of the person granting the power.

Only for Businesses: Some people incorrectly assume that Tax POA Form 151 is designed exclusively for business use. While businesses frequently use it, individuals can also utilize this form to authorize a representative to manage their personal tax matters, especially in complex situations or when dealing with the Internal Revenue Service.

Legal Expertise Required to Serve as a Representative: There’s a belief that a representative must be a lawyer or have formal legal training. In truth, while the representative should be knowledgeable about tax laws, they do not need to be a lawyer. Tax professionals, accountants, or family members who meet the IRS's requirements can also serve as representatives.

Immediate Effect: Another misunderstanding is that the Tax POA Form 151 takes effect immediately upon signing. The truth is, the form typically comes into effect once it has been processed and accepted by the relevant tax authority, which may take some time. Therefore, it’s essential to submit the form well before the representative needs to act.

Understanding the accurate scope and function of the Tax Power of Attorney Form 151 is essential for effectively managing tax affairs. By clearing up these misconceptions, individuals and businesses can ensure that they are leveraging this tool appropriately and according to their needs.

Key takeaways

Delving into the realm of tax paperwork can seem daunting, especially when it comes to empowering someone else to handle your affairs. The Tax Power of Attorney (POA) 151 form plays a crucial role in this process. Here are seven key takeaways that can help illuminate this path and ensure a smoother experience.

- Understanding the Form's Purpose: The Tax POA 151 form is specifically designed to grant another individual or entity the authority to discuss and make decisions regarding your taxes with the tax authority. This includes the power to obtain confidential tax information and make decisions about payments, agreements, and disputes.

- Choosing the Right Representative: Not everyone can serve as your POA. The selected individual should be trustworthy, and ideally, have expertise in tax matters. This is often a certified public accountant, a tax attorney, or someone with significant tax preparation experience.

- Details Matter: When filling out the form, precision is key. Every detail from the taxpayer's identification numbers to the representative’s qualifications needs to be meticulously entered. Errors can invalidate the form or delay its processing.

- Scope of Authority: The form allows you to specify the extent of the powers granted. Whether it's for a specific tax year or a range of years, or for particular types of taxes, clarity here ensures that the representative’s authority is precisely as intended.

- Duration and Expiration: Power of attorney agreements don’t last forever. The Tax POA 151 form will require you to define the duration of the agreement. If you don't specify an expiration date, the form may default to a state-specified period.

- Revocation Process: If circumstances change and you need to revoke the POA, the process typically involves submitting a written notice to the tax authority. Ensuring clarity on this process beforehand can save time and prevent misunderstandings.

- Keep Records: After submitting the form, keep a copy for your records. This document is essential for your personal financial records and may be required for future legal or tax-related queries.

By keeping these takeaways in mind, you can navigate the process of filling out and using the Tax POA 151 form with confidence. Empowering someone with this responsibility is a significant decision, and doing it correctly helps safeguard your financial well-being.

Popular PDF Documents

Irs Form 2159 - Encourages punctuality in tax payments, potentially avoiding penalties associated with late or incorrect submissions.

Irs 10k Lutzdecrypt - The IRS 8300 form is a document required for reporting cash payments over $10,000 received in a trade or business transaction.