Get Tax POA 150-800-005 Form

Navigating the complexities of the tax world requires a clear understanding of the tools and documents available to taxpayers. Among these tools, the Tax POA 150-800-005 form plays a pivotal role. Serving as a power of attorney for tax matters, this form allows individuals to designate another person, often a tax professional, to handle their tax affairs. This delegation can include the authority to receive confidential information and make decisions about various tax issues. It is especially useful in situations where the taxpayer cannot manage their tax matters due to various reasons such as being out of the country or facing health issues. Understanding the scope, limitations, and the correct way to execute this form correctly is paramount for effective tax management and compliance. With the power vested by this form, the designated representative can effectively communicate with tax authorities, providing clarity and simplification of the taxpayer's obligations and rights under the tax laws.

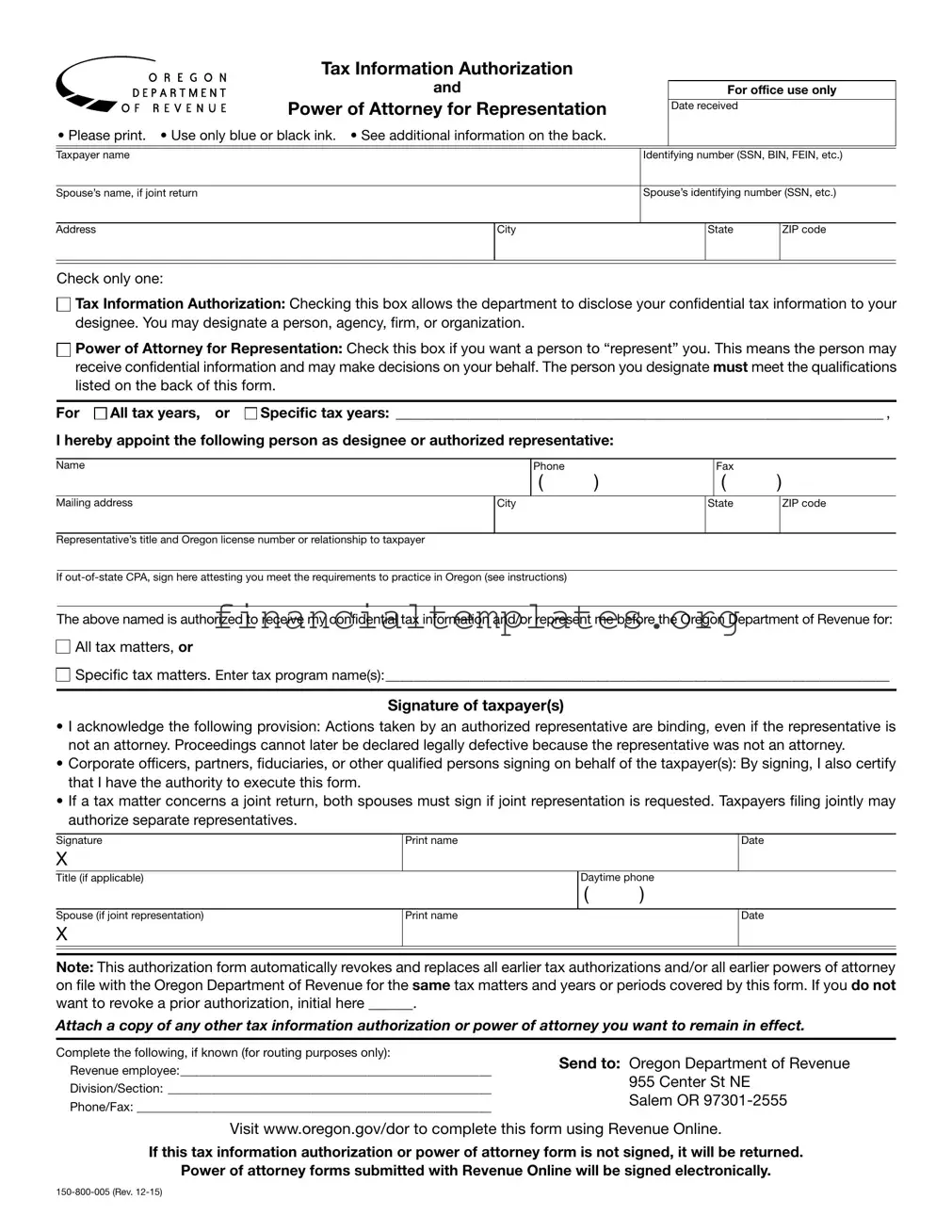

Tax POA 150-800-005 Example

~AEGON |

Tax Information Authorization |

|

|

|

|

||

|

|

|

|

|

|

||

~~ |

DE~ARTMENT |

and |

|

|

For office use only |

||

~~ 0 F R EV E N U E |

Power of Attorney for Representation |

|

|

|

|

||

|

|

|

|

|

Date received |

|

|

• Please print. • Use only blue or black ink. • See additional information on the back. |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxpayer name |

|

|

|

Identifying number (SSN, BIN, FEIN, etc.) |

|||

|

|

|

|

|

|

||

Spouse’s name, if joint return |

|

|

Spouse’s identifying number (SSN, etc.) |

||||

|

|

|

|

|

|

|

|

Address |

|

|

City |

|

|

State |

ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check only one:

□

Tax Information Authorization: Checking this box allows the department to disclose your confidential tax information to your designee. You may designate a person, agency, firm, or organization.

Tax Information Authorization: Checking this box allows the department to disclose your confidential tax information to your designee. You may designate a person, agency, firm, or organization.

□

Power of Attorney for Representation: Check this box if you want a person to “represent” you. This means the person may receive confidential information and may make decisions on your behalf. The person you designate must meet the qualifications listed on the back of this form.

Power of Attorney for Representation: Check this box if you want a person to “represent” you. This means the person may receive confidential information and may make decisions on your behalf. The person you designate must meet the qualifications listed on the back of this form.

For □

All tax years, or □

All tax years, or □

Specific tax years: __________________________________________________________________ ,

Specific tax years: __________________________________________________________________ ,

I hereby appoint the following person as designee or authorized representative:

Name |

|

Phone |

|

|

Fax |

|

|

|

|

( |

) |

|

( |

) |

|

|

|

|

|

|

|

|

|

Mailing address |

City |

|

State |

|

ZIP code |

||

|

|

|

|

|

|

|

|

Representative’s title and Oregon license number or relationship to taxpayer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If |

|

|

|

|

|

||

The above named is authorized to receive my confidential tax information and/or represent me before the Oregon Department of Revenue for:

□

All tax matters, or

All tax matters, or

□

Specific tax matters. Enter tax program name(s):________________________________________________________________________

Specific tax matters. Enter tax program name(s):________________________________________________________________________

Signature of taxpayer(s)

•I acknowledge the following provision: Actions taken by an authorized representative are binding, even if the representative is not an attorney. Proceedings cannot later be declared legally defective because the representative was not an attorney.

•Corporate officers, partners, fiduciaries, or other qualified persons signing on behalf of the taxpayer(s): By signing, I also certify that I have the authority to execute this form.

•If a tax matter concerns a joint return, both spouses must sign if joint representation is requested. Taxpayers filing jointly may authorize separate representatives.

Signature |

Print name |

|

Date |

|

X |

|

|

|

|

Title (if applicable) |

|

Daytime phone |

||

|

|

( |

) |

|

|

|

|

|

|

Spouse (if joint representation) |

Print name |

|

Date |

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: This authorization form automatically revokes and replaces all earlier tax authorizations and/or all earlier powers of attorney on file with the Oregon Department of Revenue for the same tax matters and years or periods covered by this form. If you do not want to revoke a prior authorization, initial here ______.

Attach a copy of any other tax information authorization or power of attorney you want to remain in effect.

Complete the following, if known (for routing purposes only):

Revenue employee:__________________________________________________

Division/Section: ____________________________________________________

Phone/Fax: _________________________________________________________

Send to: Oregon Department of Revenue 955 Center St NE

Salem OR

Visit www.oregon.gov/dor to complete this form using Revenue Online.

If this tax information authorization or power of attorney form is not signed, it will be returned.

Power of attorney forms submitted with Revenue Online will be signed electronically.

Additional information

This form is used for two purposes:

•Tax information disclosure authorization. You authorize the department to disclose your confidential tax infor- mation to another person. This person will not receive original notices we send to you.

•Power of attorney for representation. You authorize another person to represent you and act on your behalf. The person must meet the qualifications below. Unless you specify differently, this person will have full power to do all things you might do, with as much binding effect, including, but not limited to: providing information; pre- paring, signing, executing, filing, and inspecting returns and reports; and executing statute of limitation extensions and closing agreements.

This form is effective on the date signed. Authorization termi- nates when the department receives written revocation notice or a new form is executed (unless the space provided on the front is initialed indicating that prior forms are still valid).

Unless the appointed representative has a fiduciary relation- ship to the taxpayer (such as personal representative, trustee, guardian, conservator), original Notices of Deficiency or Assessment will be mailed to the taxpayer as required by law. A copy will be provided to the appointed representative when requested.

For corporations, “taxpayer” as used on this form, must be the corporation that is subject to Oregon tax. List fiscal years by year end date.

Qualifications to represent taxpayer(s) before Department of Revenue

Under Oregon Revised Statute (ORS) 305.230 and Oregon Administrative Rule (OAR)

1.For all tax programs:

a.An adult immediate family member (spouse, parent, child, or sibling).

b.An attorney qualified to practice law in Oregon.

c.A certified public accountant (CPA) or public accoun- tant (PA) qualified to practice public accountancy in Oregon, and their employees.

d.An IRS enrolled agent (EA) qualified to prepare tax returns in Oregon.

e.A designated employee of the taxpayer.

f.An officer or

g.A

h.An individual outside the United States if representa- tion takes place outside the United States.

2.For income tax issues:

a.All those listed in (1); plus

b.A licensed tax consultant (LTC) or licensed tax pre- parer (LTP) licensed by the Oregon State Board of Tax Practitioners.

3.For ad valorem property tax issues:

a.All those listed in (1); plus

b.An Oregon licensed real estate broker or a principal real estate broker; or

c.An Oregon certified, licensed, or registered appraiser; or

d.An authorized agent for designated utilities and com- panies assessed by the department under ORS 308.505 through 308.665 and ORS 308.805 through 308.820.

4.For forestland and timber tax issues:

a.All those listed in (1), (2), and (3)(b) and (c); plus

b.A consulting forester.

An individual who prepares and either signs your tax return or who is not required to sign your tax return (by the instruc- tions or by rule), may represent you during an audit of that return. That individual may not represent you for any other purpose unless they meet one of the qualifications listed above.

Generally, declarations for representation in cases appealed beyond the Department of Revenue must be in writing to the Tax Court Magistrate. A person recognized by a Tax Court Magistrate will be recognized as your representative by the department.

Tax matters partners and S corporation shareholders. See OARs

Attorneys may contact the Oregon State Bar for information on practicing in Oregon. If your

CPAs may practice in Oregon if they meet the following substantial equivalency requirements of ORS 673.010:

1.Licensed in another state;

2.Have an accredited baccalaureate degree with at least 150 semester hours of college education;

3.Passed the Uniform CPA exam; and

4.Have a minimum of one year experience.

Have questions? Need help?

General tax information |

www.oregon.gov/dor |

|

Salem |

(503) |

|

1 (800) |

||

Asistencia en español: |

|

|

En Salem o fuera de Oregon |

(503) |

|

Gratis de prefijo de Oregon |

1 (800) |

|

TTY (hearing or speech impaired; machine only): |

|

|

Salem area or outside Oregon |

(503) |

|

1 (800) |

||

Americans with Disabilities Act (ADA): Call one of the help numbers above for information in alternative formats.

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The Tax POA 150-800-005 form is designed to grant a designated individual or entity the authority to handle tax matters on behalf of someone else. |

| Usage | This form is used to authorize a representative to receive confidential tax information and to perform any acts that the taxpayer can perform, such as signing agreements, consents, or other documents related to tax matters. |

| Governing Law | The form is governed by the state laws where it is being used. This means its applicability and specific requirements may vary from one state to another. |

| Validity | The period of validity for the POA can be specified within the document itself. If not specified, the validity period will be determined based on the governing state laws. |

| Revocation | The authority granted by the form can be revoked at any time by the person who granted it, usually requiring a written notice of revocation. |

| Who Can File | Individuals, corporations, partnerships, and other entities may use this form to designate a representative for tax purposes. |

| Where to File | The completed form should be submitted to the relevant state tax department or authority that handles tax matters in the state where it is being used. |

| Special Considerations | When completing the form, it is important to choose a representative who is knowledgeable in tax matters and whom the taxpayer trusts, as they will have significant authority over the taxpayer's financial information. |

Guide to Writing Tax POA 150-800-005

Filling out the Tax POA (Power of Attorney) 150-800-005 form is a crucial step in allowing a designated individual or entity to handle tax matters on your behalf. This process requires careful attention to detail to ensure that all the information is accurate and complete. By following the steps below, individuals can navigate the form more efficiently and effectively, streamlining the empowerment of their chosen representative in tax affairs.

- Gather all necessary information before starting, including the taxpayer's full name, social security number or tax identification number, and the representative's name, address, and contact details.

- Enter the taxpayer's information in the designated section at the top of the form, including name, address, phone number, and identification numbers required.

- In the section labeled "Representative’s information", fill in the full name, firm or organization (if applicable), address, telephone number, and fax number of the person or entity being granted the power of attorney.

- Specify the tax matters the representative is authorized to handle. This could include specific tax types, forms, periods, and tax years. Be as precise as possible.

- Indicate the acts authorized for the representative, such as the right to receive and inspect confidential tax information or to represent you in tax matters before the tax department.

- If there are any acts not authorized, these should be spelled out clearly in the designated section to avoid any confusion or misunderstanding.

- Review the form thoroughly to ensure that all sections are completed accurately. If any revisions are necessary, make them clearly and legibly.

- The taxpayer must sign and date the form. If filing jointly, both taxpayers must sign. This officially grants the representative the specified powers.

- For additional verification, the representative also needs to sign and date the form, acknowledging their acceptance of the responsibilities and limitations outlined.

- Finally, once completed, submit the form as directed. This might involve mailing it to a specific address or, in some cases, submitting it electronically, depending on the guidelines provided by the tax department.

After submission, the taxpayer should keep a copy of the form for their records. They might also want to follow up with the tax department or their representative to ensure the form has been processed and accepted. Taking these steps helps ensure that the taxpayer's tax matters are managed effectively and according to their wishes.

Understanding Tax POA 150-800-005

-

What is the purpose of the Tax POA 150-800-005 form?

The Tax POA 150-800-005 form is designed to grant a designated individual or entity the authority to handle tax matters on behalf of another person or entity with the tax authority. This includes the ability to request and receive confidential tax information and make decisions regarding filings, payments, and disputes.

-

Who can be appointed as an agent through this form?

An agent appointed through the Tax POA 150-800-005 form can be any individual, such as a family member or friend, or an entity, such as a law firm or an accounting firm, that the taxpayer trusts to manage their tax affairs. It's crucial that the taxpayer selects someone who is knowledgeable about tax matters and whom they trust implicitly.

-

How can one obtain the Tax POA 150-800-005 form?

The Tax POA 150-800-005 form is typically available through the official website of the tax authority overseeing the jurisdiction in question. It may also be obtained in person at a local tax office or by contacting the tax authority directly through their customer service channels to request a mailed copy.

-

Are there any special instructions for completing the form?

When completing the Tax POA 150-800-005 form, it is important to fill out all sections accurately and completely. The form will require personal details about the taxpayer and the appointed agent, including identification numbers and contact information. Clear instructions on the specific tax matters the agent is authorized to handle must be provided. It may also require notarization, depending on the jurisdiction's requirements. Always check with the tax authority or consult a professional for guidance.

-

What happens after the form is submitted?

After the Tax POA 150-800-005 form is submitted, it is reviewed by the tax authority. If accepted, the agent will have the authority to act on the taxpayer’s behalf for the tax matters specified in the form. The taxpayer will receive a confirmation notice, and it's advisable to keep a copy of the form and any correspondence for their records. Note that the taxpayer retains the right to revoke the power of attorney at any time, should their circumstances or preferences change.

Common mistakes

When preparing to grant someone the authority to handle their tax matters, people often utilize form 150-800-005, commonly known as the Tax Power of Attorney (POA). This document is crucial for ensuring that your tax affairs are managed correctly and according to your wishes. Unfortunately, errors can occur during the completion of this form, leading to delays or complications. To navigate this process more smoothly, it's important to be aware of common mistakes:

Failing to provide complete information about the representative. It's essential to include all required details of the person you are appointing, such as their full name, address, and telephone number. This information ensures that the tax authorities can easily contact your representative when necessary.

Neglecting to specify the types of tax matters and years or periods. The Tax POA form requires you to list the specific tax types and periods for which you are granting authority. Without this detail, the document may not grant the expected powers, potentially hindering your representative's ability to act on your behalf.

Incorrectly signing or dating the document. For the Tax POA to be valid, it must be properly signed and dated by the taxpayer. An incorrect date or a missing signature can invalidate the whole document, leading to significant administrative delays.

Not revoking prior Tax POAs. If you have previously submitted a Tax POA and are now submitting a new one, it's crucial to revoke the earlier version unless you intend for the previous representatives to retain their authority. This oversight can cause confusion as to who legally holds the power to make decisions on your behalf.

To ensure the effectiveness of your Tax Power of Attorney and avoid the common mistakes outlined above, thorough reading and attention to detail are paramount. Take your time when filling out the form, double-check the information provided, and, if necessary, seek professional guidance. This approach will help streamline your tax matters and ensure that your financial interests are appropriately managed.

Documents used along the form

When dealing with tax matters, particularly in appointing a representative via the Tax Power of Attorney (POA) 150-800-005 form, individuals often need to gather and complete several other related documents. These documents facilitate a smoother process and ensure that all necessary permissions and information are clearly communicated. Whether for individual or business tax matters, understanding the functions and requirements of these additional forms can significantly streamline your dealings with tax authorities.

- Form 1040: Known as the U.S. Individual Income Tax Return, it's the standard form used by individuals to file their annual income tax returns with the IRS. This document is crucial for reporting an individual's financial income, calculating taxes owed, or determining the amount of a tax refund.

- W-9 Form: Request for Taxpayer Identification Number and Certification, is commonly used in situations where a business needs to report income paid to a contractor. It’s essential for verifying an individual's or a company’s tax identification number (TIN).

- Schedule K-1: This form is used by partnerships and S corporations to report each partner's or shareholder's share of earnings, losses, deductions, and credits. It's vital for individuals who need to report their share of business income on their personal tax returns.

- Form 8821: Tax Information Authorization grants permission to individuals or entities to request and inspect confidential tax information. It is similar to a POA but does not allow representation before the IRS.

- Form 2848: Power of Attorney and Declaration of Representative, allows individuals to authorize a qualified person, like an accountant or attorney, to represent them before the IRS. This form spans beyond tax information disclosure, enabling the representative to perform acts like signing agreements.

- Form 4868: Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, is used to request an additional six months to file Form 1040. It's crucial for taxpayers who need more time to gather their documents.

- Form 4506-T: Request for Transcript of Tax Return, enables individuals and businesses to request a transcript of their tax returns. This is often necessary for mortgage applications, student loans, or other financial matters.

- Form 8962: Premium Tax Credit, is used to calculate the amount of premium tax credit (PTC) you're eligible for if you purchased health insurance through the Marketplace. It's essential for ensuring that taxpayers receive the correct amount of credit.

In conclusion, navigating through tax responsibilities and ensuring compliance involves more than just the Tax POA 150-800-005 form. The above-listed forms each play a crucial role in different aspects of tax filing and administration, from authorizing representatives to requesting extensions or reporting income. Understanding and correctly utilizing these forms can lead to a more organized and less stressful tax experience.

Similar forms

The Tax Power of Attorney (POA) Form 150-800-005 is a document that grants an individual the authority to handle tax matters on behalf of another person. A similar document is the General Power of Attorney. This document grants broader authority, allowing the agent to conduct a wide range of actions on behalf of the principal, such as handling financial and business transactions, in addition to tax matters. The key similarity lies in the delegation of authority from one individual to another.

The Healthcare Power of Attorney is another document that shares similarities with the Tax POA 150-800-005, albeit in a different context. It allows an individual to make healthcare decisions on another's behalf, emphasizing the principal-agent relationship found in the Tax POA. However, rather than focusing on financial or tax-related matters, its scope is limited to decisions regarding medical treatments and health care services.

The Financial Power of Attorney closely aligns with the Tax POA 150-800-005 by specifically authorizing someone to handle financial matters for someone else. This can include tax issues as well as other financial decisions, such as managing investments or bank accounts. Both documents serve to legally empower an agent to act in the principal's best financial interests.

The Durable Power of Attorney shares a foundational similarity with the Tax POA 150-800-005 in terms of allowing an individual to appoint another to make decisions on their behalf. However, it differs in that it remains in effect even if the principal becomes incapacitated, ensuring continuous authority over matters that could include tax affairs, financial management, or personal care, depending on the document’s specifications.

The Limited Power of Attorney is akin to the Tax POA 150-800-005 but with a more restricted scope. It grants the agent authority to perform specific tasks or transactions, which could include tax-related activities, but its scope is clearly defined and limited to particular events or tasks, contrasting with the broader authority potentially encompassed in a Tax POA.

The IRS Power of Attorney (Form 2848) is directly comparable to the Tax POA 150-800-005, as both deal explicitly with tax matters. Form 2848 is used to authorize an individual, often a tax professional, to represent the taxpayer before the IRS, covering tax issues similar to those addressed by the Tax POA 150-800-005, but with a focus on federal tax matters specifically.

The Representation Authorization (Form 8821) resembles the Tax POA 150-800-005 in that it allows taxpayers to authorize someone to receive and inspect confidential tax information. Although it doesn’t grant the authority to represent the taxpayer before the IRS or to sign documents, it facilitates the handling of tax matters by permitting access to necessary information.

Last, the Estate Planning Power of Attorney bears resemblance to the Tax POA 150-800-005 as it can include provisions for managing the principal's tax affairs as part of broader estate planning objectives. This may involve decisions related to the transfer of assets, handling estate taxes, and other financial tasks associated with estate management, highlighting the document's role in future planning.

Dos and Don'ts

Filling out the Tax Power of Attorney (POA) form 150-800-005 is a critical task that enables someone else to handle your tax matters on your behalf. It's important to approach this document with care to ensure your tax issues are managed correctly and efficiently. Here are several dos and don'ts to consider when completing this form:

- Do read the entire form before beginning to fill it out. Understanding all the requirements can help avoid mistakes and save time.

- Do ensure that all information is accurate and current. This includes your personal details, the representative's details, and any specific tax matters or years you want the POA to cover.

- Do use black ink or type your responses if possible. This helps in making the document legible and photocopy-friendly.

- Do specify any particular tax years or matters you want the representative to handle. Being explicit about the scope of authority will help prevent any confusion.

- Do sign and date the form. Without your signature, the document is not valid.

- Don't leave any fields blank. If a section does not apply, mark it as "N/A" (not applicable) to indicate you did not overlook it.

- Don't use abbreviations or nicknames. Always use full names and tax ID numbers to prevent any issues with identification.

- Don't forget to notify your tax representative if you decide to revoke the POA. Communication is key to ensure that all parties are updated regarding any changes in representation.

By following these guidelines carefully, you can fill out the Tax POA form 150-800-005 properly, ensuring that your tax matters are in good hands. Always consider consulting with a tax professional if you have questions or concerns about completing this form or about your tax situation in general.

Misconceptions

When dealing with the Tax Power of Attorney (POA) Form 150-800-005, several misunderstandings can occur. Here, we’ll clear up some common misconceptions to help ensure that individuals and professionals can navigate this process with a more informed perspective.

It’s only for businesses: One common misconception is that the Tax POA 150-800-005 form is exclusively for business use. In reality, this form is pertinent for both individuals and businesses seeking to grant authority to someone else to handle their tax matters.

Any POA form will work: Another misunderstanding is assuming that any Power of Attorney document will suffice for tax purposes. The Tax POA 150-800-005 is specifically designed for tax-related matters, and using a generic POA form may not be acceptable for the intended tax-related tasks.

The form grants unlimited power: Some believe that completing this form gives the agent complete control over all financial affairs. In truth, the scope of authority granted is limited to tax matters and can be further restricted by the person filling out the form.

It’s permanent: The belief that once signed, the Tax POA 150-800-005 is irrevocable, is incorrect. The individual who grants the power (the principal) can rescind it at any time, as long as they are mentally competent.

Requires a lawyer to complete: While having a legal professional’s assistance can be beneficial, especially for complex situations, it is not a requirement for completing or filing the Tax POA 150-800-005 form.

Signing the form eliminates the principal’s authority: Some people incorrectly assume that once they appoint a tax representative, they can no longer make decisions or act on their own behalf in tax matters. The principal retains the right to act on their own behalf, in addition to the representative’s authority.

Only for those owing taxes: There’s a false notion that the Tax POA form is only necessary for individuals or entities with tax debts. In truth, this form can be crucial for a variety of tax-related issues, not just those involving debts.

Immediate family members don’t require a POA: A common mistake is thinking that immediate family members can automatically handle tax matters without formal authorization. Legally, they need the authority granted by the Tax POA 150-800-005 form, just like anyone else would.

The form grants access to all past and future tax years: People often believe that the Tax POA automatically applies to all past and future tax years. However, the form requires specific tax years or periods to be listed, limiting the agent’s authority to those specified times.

Electronic signatures are not allowed: The misconception that the form must be signed in ink and cannot be submitted with an electronic signature is outdated. Current guidelines often accommodate electronic signatures, recognizing their validity and legal standing, though this can vary by jurisdiction.

Understanding the specific uses, limitations, and requirements of the Tax POA 150-800-005 form can significantly smooth out the process of authorizing someone to handle your tax matters. It’s important to clear up these misconceptions to avoid potential mishaps or misunderstandings. Whenever in doubt, seeking guidance from a tax professional or attorney can help ensure that you’re taking the right steps according to your needs.

Key takeaways

The Tax Power of Attorney (POA) Form 150-800-005 is a crucial document for anyone needing to grant authority to another individual to handle their tax matters. Understanding the key aspects of filling out and using this form ensures that the process is completed accurately and effectively. Here are nine essential takeaways to guide you through this process:

Ensure all information is complete and accurate. Before submitting the Tax POA Form 150-800-005, double-check all entered information to avoid delays or issues with the authorization.

Identify the representative correctly. Clearly state the name, address, and contact information of the individual or firm being granted the power of attorney to ensure there are no misunderstandings regarding who has authorization.

Specify the tax matters and years covered. Detail the specific tax forms, types, and tax years the representative is allowed to access and discuss on your behalf to prevent any unauthorized access to additional information.

Understand the powers being granted. Be aware that the representative will have the authority to receive and inspect confidential tax information and to perform acts like signing agreements. Knowing the extent of their powers is essential.

Multiple representatives can be named. If choosing to appoint more than one representative, specify whether each can act independently regarding the tax matters.

Sign and date the form. The form is not valid without the signature of the taxpayer or a duly authorized individual in case of an entity. The date of the signature is also required for the document to be considered valid.

A copy of the form is sufficient. Once signed, a photocopy or fax of the original Tax POA Form 150-800-005 is acceptable for submission and use, making the process more convenient.

Revocation process. If the need arises to revoke the power of attorney, it must be done in writing. The taxpayer should submit a statement of revocation to the tax department to ensure the previous POA is no longer in effect.

Keep a copy for your records. After completing and submitting the form, retain a copy for personal records. This will help in case any disputes or questions arise regarding the authorization.

Correctly using the Tax POA Form 150-800-005 plays a pivotal role in managing tax matters efficiently. Individuals are encouraged to seek guidance if they have any questions or concerns during this process.

Popular PDF Documents

How to Get Direct Deposit - Enhance your paycheck processing with First Midwest Bank by using this form to authorize direct deposit into your checking or savings account.

IRS Schedule 1 1040 or 1040-SR - For taxpayers with investment properties generating income or loss, this form allows you to report those amounts for tax purposes.

Ptax 203 - This supplemental form demands specificity about the property's condition and sale circumstances, preventing oversights in the official record.