Get Tax POA Form

In the complex and often intricate realm of tax law, individuals and entities frequently encounter situations where it becomes necessary to grant someone else the authority to act on their behalf. This is particularly relevant when it comes to dealing with tax matters, where the intricate details and stringent deadlines can overwhelm even the most organized individuals. Entering into this landscape is the Tax Power of Attorney (POA) form, a legal document that plays a pivotal role. By allowing taxpayers to appoint a trusted individual, often a qualified tax professional, to represent them in dealings with tax authorities, the Tax POA form facilitates a smoother interaction with tax agencies. This form covers a range of duties, from filing taxes to addressing disputes and making payment arrangements. Its significance cannot be overstated, as it ensures that taxpayers' rights and interests are effectively represented, especially during times when they cannot personally manage their tax affairs. As such, understanding the nuances of the Tax POA, including its scope, limitations, and the process of its execution, becomes indispensable for anyone navigating the complexities of tax law.

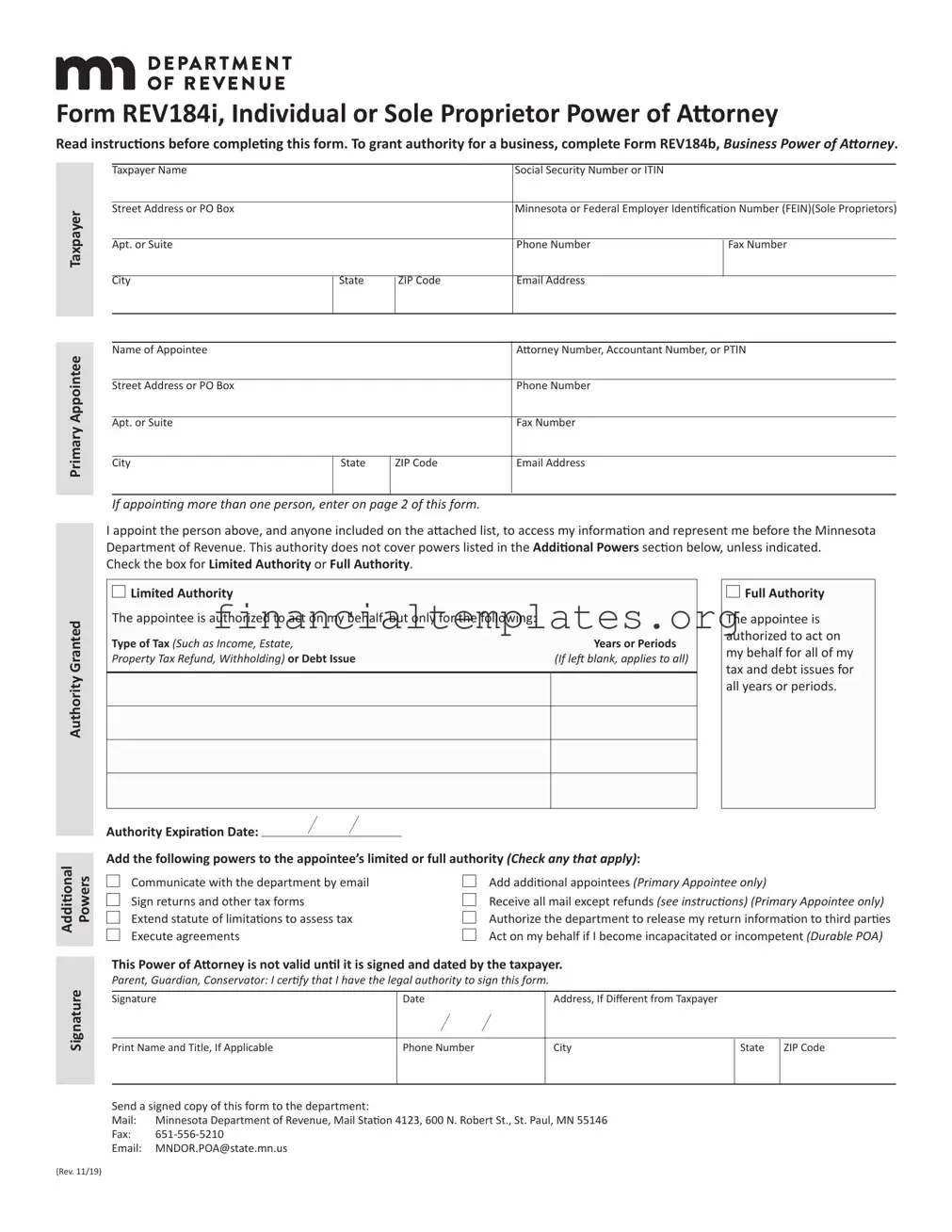

Tax POA Example

mil OFDEPARTMENTREVENUE

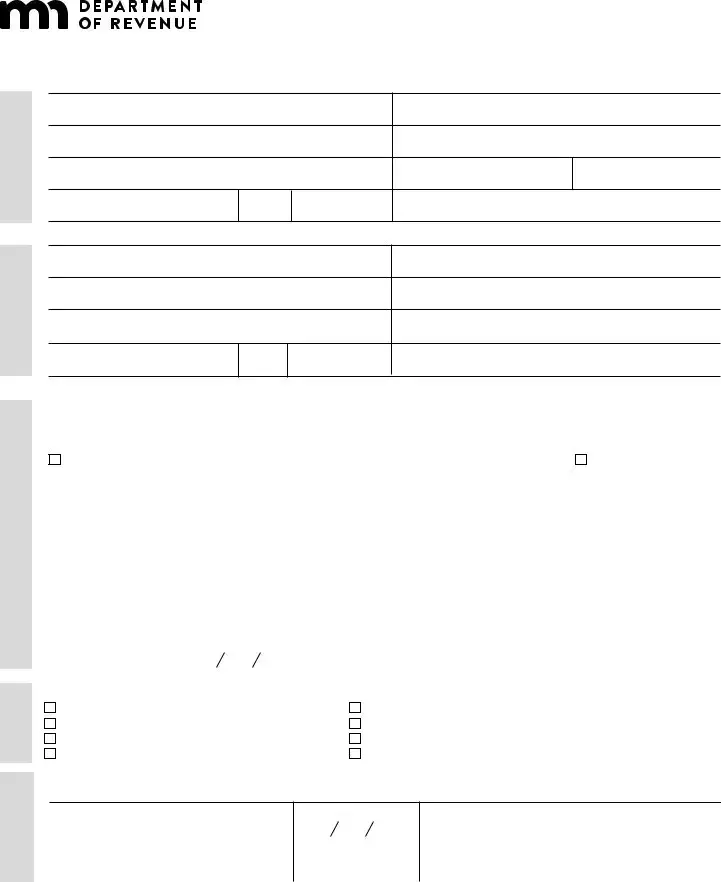

Form REV184b, Business Power of Attorney

Read instructions before completing this form.

To grant authority for an individual or sole proprietor, complete Form REV184i, Individual or Sole Proprietor Power of Attorney.

Business Taxpayer

Primary Appointee

Business Taxpayer Name |

|

|

Minnesota or Federal Employer Identification Number (FEIN) |

|

Street Address or PO Box |

|

|

Phone Number |

Fax Number |

Apt. or Suite |

|

|

|

I |

|

|

Combined Business Returns: Filing entity name (if different) |

||

City |

State |

ZIP Code |

Filing Entity FEIN or Taxpayer Identification Number |

|

I |

|

I |

|

|

Name of Appointee |

|

|

Attorney Number, Accountant Number, or PTIN |

|

Street Address or PO Box |

|

|

Phone Number |

|

Apt. or Suite |

|

|

Fax Number |

|

City |

State |

ZIP Code |

Email Address |

|

I |

|

I |

|

|

If appointing more than one person, enter on page 2 of this form. |

|

|

||

The person named above, and anyone included on the attached list, is appointed to access the taxpayer’s information and represent it be- fore the Minnesota Department of Revenue. Check the box for Limited Authority or Full Authority. (This authority does not cover powers listed in the Additional Powers section below, unless indicated.)

Authority Granted

□

Limited Authority

Limited Authority

The appointee is authorized to act on behalf of the taxpayer, but only for the following:

Type of Tax (Such as Business Income, |

Tax Form Name or Number |

Years or Periods |

Sales, Withholding) or Debt Issue |

(If applicable) |

(If left blank, applies to all) |

□

Full Authority

Full Authority

The appointee is authorized to act on behalf of the taxpayer for all tax and debt issues for all years or periods.

Authority Expiration Date: |

I |

I |

|

|

Signature Powers

Additional

(Rev. 11/19)

Add the following powers to the appointee’s limited or full authority (check any that apply):

□ |

Communicate with the department by email |

□ |

Add additional appointees (Primary Appointee only) |

□ |

Sign returns and other tax forms |

□ |

Receive all mail except refunds (see instructions) (Primary Appointee only) |

□ |

Extend statute of limitations to assess tax |

□ |

Authorize the department to release return information to third parties |

□ |

Execute agreements |

|

|

This Power of Attorney is not valid until it is signed and dated by someone with legal authority to sign agreements on behalf of the business taxpayer.

I certify that I have the legal authority to sign this form.

Signature |

Date |

Address, If Different from Taxpayer |

|

I |

I |

|

|

Print Name and Title |

Phone Number |

City |

State |

ZIP Code |

|

|

|

|

|

Send a signed copy of this form to the department:

Mail: |

Minnesota Department of Revenue, Mail Station 4123, 600 N. Robert St., St. Paul, MN 55146 |

Fax: |

|

Email: |

MNDOR.POA@state.mn.us |

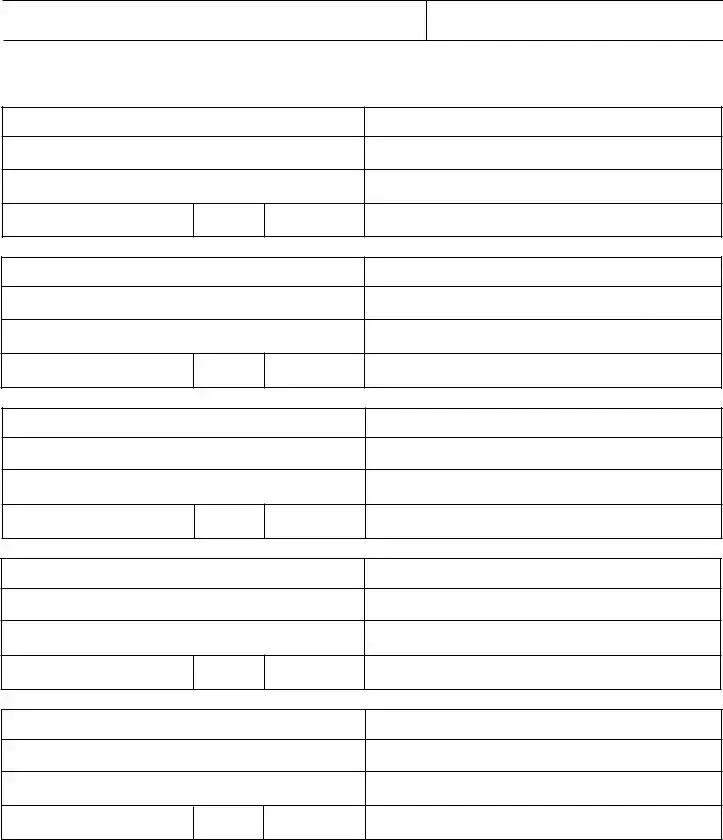

Form REV184b, Page 2 — Additional Appointees

Name of Business Taxpayer

MN ID or FEIN

Include any additional appointees below. Additional appointees only have authority over matters chosen in the Authority Granted and Additional Powers sections on page 1.

Name of Appointee |

|

|

Attorney Number, Accountant Number, or PTIN |

Street Address or PO Box |

|

|

Phone Number |

Apt. or Suite |

|

|

Fax Number |

City |

State |

ZIP Code |

Email Address |

I |

|

I |

|

Name of Appointee |

|

|

Attorney Number, Accountant Number, or PTIN |

Street Address or PO Box |

|

|

Phone Number |

Apt. or Suite |

|

|

Fax Number |

City |

State |

ZIP Code |

Email Address |

I |

|

I |

|

Name of Appointee |

|

|

Attorney Number, Accountant Number, or PTIN |

Street Address or PO Box |

|

|

Phone Number |

Apt. or Suite |

|

|

Fax Number |

City |

State |

ZIP Code |

Email Address |

I |

|

I |

|

Name of Appointee |

|

|

Attorney Number, Accountant Number, or PTIN |

Street Address or PO Box |

|

|

Phone Number |

Apt. or Suite |

|

|

Fax Number |

City |

State |

ZIP Code |

Email Address |

I |

|

I |

|

Name of Appointee |

|

|

Attorney Number, Accountant Number, or PTIN |

Street Address or PO Box |

|

|

Phone Number |

Apt. or Suite |

|

|

Fax Number |

City |

State |

ZIP Code |

Email Address |

I |

|

I |

|

Attach additional copies of this page, as needed.

Form REV184b Instructions

What is a Power of Attorney (POA)?

A power of attorney (POA) is a legal document that grants an attorney, accountant, agent, tax return preparer, or other person authority to access the business taxpayer’s account information and represent the taxpayer before the Minnesota Department of Revenue.

Use of Information

The information you enter on this form may be private or nonpublic under state law. We use it to allow the appointee to access the taxpay- er’s account and take actions on its behalf. We may share it with other government entities for tax administration if allowed by law. You are not required to provide the information requested; however, we are unable to process the appointment unless the form is complete.

How do I complete this form?

Business Taxpayer

Step 1

Enter the business taxpayer’s name and contact information.

Note: This form does not cover personal tax issues or sole proprietorships. Complete Form REV184i, Individual Power of Attorney.

Step 2

Enter the Federal Employer ID number (FEIN), or Minnesota Tax ID number.

Step 3

For businesses filing combined business returns, enter the name and ID number for the entity responsible for filing returns.

Primary Appointee

Eligibility: The appointee must be eligible to represent the business with the department.

The taxpayer may not appoint:

•A person barred or suspended from practice as an attorney or accountant

•A person barred or suspended from practice before the IRS

•An employee of the department

•A former department employee within one year of leaving the department

For details, go to www.revenue.state.mn.us and enter Preparer Enforcement in the Search box.

Step 4

Enter the appointee’s name and contact information. An appointee is a person selected to represent the taxpayer before the department. The taxpayer may have more than one appointee, but only the primary appointee can be selected to receive mailed correspondence from the department.

For additional appointees, complete page 2 of Form REV184b. Include additional pages, if needed. Note: The taxpayer is responsible for keeping the appointees informed of changes to its account.

Authority Granted

Step 5

Choose whether to grant the appointee full authority or to limit authority to specific issues.

Limited Authority allows the appointee to act on specific tax or debt issues.

•By tax type or issue

•By year or filing period is optional. If no year is provided, authority applies to all periods.

Full Authority allows your appointee to act on your behalf for your tax and debt issues.

Choose an expiration date for the POA if applicable. To have the POA end on a specific date, enter the month, day, and year (enter as MM/ DD/YY). If no date is provided, the POA and additional powers will remain in effect until removed.

Continued

Form REV184b Instructions, cont.

Additional Powers

Step 6

Choose additional powers to give the appointee.

•Communicate by email

Allows the appointee to communicate with the department by email.

Note: Transmit return information at your own risk. Email is not secure. The department is not liable for damages caused by interception of emails.

•Sign returns and other forms

This does not authorize the appointee to endorse or negotiate any checks or other payments issued by the department.

•Add additional appointees

Allows the primary appointee to authorize additional appointees.

Note: The appointee may only grant authority over tax types or issues authorized in the Authority Granted section.

•Execute agreements

Allows the appointee to enter into contracts and other binding agreements on behalf of the taxpayer.

•Authorize disclosure to third parties

Allows the appointee to authorize the department to share return information with people outside the department. Appointees may discuss the taxpayer’s account with people they employ or supervise, even if this box is not checked.

•Receive all mail except refunds

Authorizes the department to mail letters, legal notices, and tax information directly to the primary appointee only. Any refunds or letters relating to refunds will be sent directly to the business.

Note: The business may still receive copies of some mail from the department in certain circumstances.

This power is effective only for the tax types or issues granted to the primary appointee. If the business is only granting authority for spe- cific years or periods, this option is not available. All mail will go directly to the business.

Mail will go to the most recently designated person, replacing designations from a prior POA.

Signature

Step 7

Owners, officers, or authorized agents:

Sign, date, print your name and title, and enter your contact information. This POA is not valid until it is signed and dated by someone with legal authority to sign it

We reserve the right to request additional information as needed to verify identity and authority to sign.

Step 8

Send the form to the department using only one of the following:

•Mail: Minnesota Department of Revenue, Mail Station 4123, 600 N. Robert St., St. Paul, MN 55146

•Fax:

•Email: MNDOR.POA@state.mn.us

How do I revoke an appointee?

To revoke an appointee, the taxpayer or the appointee must send the department a signed and dated statement terminating the appointee’s authority or a completed Form REV184r, Revocation of Power of Attorney.

No POA form is necessary to access a taxpayer’s

Questions?

Website: www.revenue.state.mn.us

Email: MNDOR.POA@state.mn.us

Phone:

Document Specifics

| Fact | Description |

|---|---|

| Definition | A Tax Power of Attorney (POA) form is a legal document that allows an individual to designate another person to manage their tax affairs. |

| Purpose | The main purpose of the form is to grant authority to a representative, often a certified tax professional, to communicate with the tax authority, make decisions, and perform actions on the individual’s behalf. |

| Key Components | Typically includes the taxpayer’s information, the representative’s details, the scope of authority granted, and the duration of the power. |

| Authority Granted | Can cover a wide range of authorities, from discussing tax matters with the IRS to making decisions about tax payments, depending on the document’s specifics. |

| Duration | Most forms specify a period during which the POA remains effective, which can be until a specified date or until the completion of certain tax matters. |

| State-Specific Forms | While the IRS provides a federal form (Form 2848), many states have their own specific forms and guidelines that must be followed. |

| Governing Laws | State-specific forms are governed by the tax laws and regulations of the individual state in which they are filed. |

| Revocation | The individual granting authority can typically revoke the POA at any time, usually by notifying all relevant parties in writing. |

| Federal vs. State | Even with an IRS Form 2848 filed, separate state forms might be necessary for handling state tax matters. |

| Important Considerations | Choosing a representative with the appropriate knowledge and experience is crucial, as they will have significant control over the individual’s tax matters. |

Guide to Writing Tax POA

Filling out a Tax Power of Attorney (POA) form correctly ensures that individuals can grant another person or entity the authority to handle their tax affairs. This process might sound daunting, but by following a series of straightforward steps, one can complete the task efficiently and accurately. After the form is filled and submitted, the designated representative will have the legal right to receive and provide confidential tax information, make decisions, and act on the behalf of the person granting this power, within the constraints of the form's stipulations.

- Begin by gathering all necessary information, including the full legal names, addresses, and Social Security numbers (or Tax ID numbers) for both the individual granting authority and the designated representative.

- Identify the type of tax matters for which authority is being granted, including the specific forms and tax periods covered.

- If the form allows for the designation of multiple representatives, decide if each will have full authority or if specific roles and limitations will be applied to each.

- Read through the form to understand any limitations or additional powers that can be granted, such as the ability to sign tax returns, obtain tax information, or represent the grantor in tax audits.

- Fill in the taxpayer's information section thoroughly, ensuring accuracy in the details to prevent any delays or issues with the form's acceptance.

- Complete the representative(s) section, including all requested details such as name, telephone number, fax number, address, and CAF number if applicable. For entities or firms, include the full legal name and address.

- Clearly indicate the tax matters authorized by checking the appropriate boxes or filling in the specific forms and tax periods. Be meticulous to ensure the representative is granted exactly the intended authority.

- If applicable, specify any additions to or deletions from the acts authorized on the form. This may include restricting certain rights or explicitly granting additional ones.

- Review the form to ensure all necessary sections are completed and that there are no inaccuracies or omissions that could invalidate the POA.

- Sign and date the form in the designated area. If the form is being filed for an entity, ensure the person signing has the authority to grant POA on behalf of that entity.

- If specified by the form or applicable laws, have the representative sign and date the form as well, acknowledging their acceptance of the responsibilities granted by the POA.

- Follow the submission instructions provided with the form, which may include mailing or faxing it to the appropriate tax authority's office.

Once the form is submitted, it is processed by the tax authority, and the representative is granted the powers stipulated in the form. It is important for both parties to maintain copies of the completed form for their records. Additionally, the individual granting authority should monitor the actions taken by their representative to ensure they remain within the agreed-upon scope of authority. Remember, the Tax POA can be revoked at any time should the need arise.

Understanding Tax POA

When navigating the complexities of tax matters, individuals and businesses may find themselves in need of granting someone else the authority to act on their behalf. This is where a Tax Power of Attorney (POA) form becomes relevant. Below are answers to some frequently asked questions pertaining to the Tax POA form.

- What is a Tax Power of Attorney (POA) form?

- Who can be designated as an agent on a Tax POA form?

- How does one obtain and complete a Tax POA form?

- Is a Tax POA form different from other types of Power of Attorney documents?

A Tax Power of Attorney form is a legal document that grants one individual (the agent) the authority to handle tax matters on behalf of another (the principal). This can include filing taxes, obtaining confidential tax information, and making binding decisions regarding tax payments and agreements with tax authorities. The form's specifics, including its valid duration and the agent's extent of power, vary based on state law and the preferences of the individual granting the authority.

Any competent adult can be designated as an agent, but individuals often choose a trusted professional, such as a certified public accountant (CPA), a tax attorney, or an enrolled agent, due to the complex nature of tax law and the need for specialized knowledge in dealing with the Internal Revenue Service (IRS) and state tax entities. It is crucial that the chosen agent is someone the principal trusts implicitly, as they will have access to sensitive financial information and the ability to make significant decisions regarding the principal's taxes.

The process varies by jurisdiction, but generally, the IRS and state tax authorities provide their own versions of the Tax POA form, which can be downloaded from their respective websites. Completing the form typically involves specifying the type of tax matters and years or periods for which the agent is authorized to act, along with providing detailed information about the principal and the agent. Both the principal and the agent must sign the document, and in some cases, a witness or notarization may be required for the form to be valid.

Yes, the Tax POA is specifically for tax-related matters and generally does not grant the agent any authority beyond what is stipulated in the document concerning those matters. This is in contrast to more general POA documents, which can convey broader powers such as buying or selling property, making healthcare decisions, or managing financial accounts. Furthermore, tax authorities typically require a specific POA form to deal with tax matters, meaning a general POA may not be recognized for these purposes.

Common mistakes

When handling your taxes, particularly in circumstances where you need someone else to take the reins on your behalf, a Tax Power of Attorney (POA) form becomes crucial. However, filling out this document can be trickier than many realize. Here are ten common blunders people tend to make, leading to issues down the line:

- Not specifying the type of tax matters correctly. The form needs exact details such as the type of tax, tax form number, and the years or periods covered.

- Choosing the wrong representative. It's vital to appoint someone who is not only trustworthy but also has adequate knowledge of tax laws relevant to your situation.

- Forgetting to check the representative’s qualifications. Certain states have specific requirements about who can act as a POA.

- Omitting necessary information about the representative, such as their full name, address, and phone number.

- Not defining the scope of authority granted to the POA. Without clear instructions, your representative may not be able to perform the necessary actions.

- Failing to sign and date the form. An unsigned form is like an unsealed letter – it won't reach its intended legal effect.

- Overlooking the need for a witness or notary, depending on state requirements. This step is crucial for the form's legal standing.

- Not reviewing the form for accuracy and completeness. A single mistake can render the document ineffective or lead to misunderstandings.

- Ignoring the expiration date of the POA. If the form expires, it will no longer be valid, and you'll need to execute a new one.

- Failing to notify the IRS or state tax authority by not submitting the form properly. Simply filling out the form is not enough; it must be sent to the right place.

By steering clear of these pitfalls, you can ensure that your Tax Power of Attorney form is correctly completed and, most importantly, valid. Remember, the goal is to facilitate tax matters, not complicate them. Paying attention to these details can save you significant time and stress.

Documents used along the form

When dealing with tax matters, particularly in the preparation, submission, or dispute of tax returns, several documents often accompany the Tax Power of Attorney (POA) form. The Tax POA form is crucial as it grants an individual or a professional, such as an accountant or attorney, the authority to handle tax affairs on someone else's behalf. Beyond the Tax POA, other forms and documents play vital roles in ensuring the comprehensive management and resolution of tax-related tasks and issues. These documents vary based on the specific needs and circumstances of the taxpayer but often include the following:

- IRS Form 1040: This is the standard Federal Income Tax Return form used by individuals in the United States. It's essential for reporting an individual’s annual income, calculating taxes owed or refundable, and summarizing tax credits and deductions.

- W-2 Form: Issued by employers, the W-2 form reports an employee's annual wages and the amount of taxes withheld from their paycheck. It is crucial for individuals to accurately complete their 1040 form.

- 1099 Forms: These forms are used to report various types of income other than wages, salaries, and tips (like independent contractor income, dividends, and interest). They are essential for individuals who have multiple income sources.

- Schedule C: Utilized by sole proprietors and single-member LLCs, Schedule C is attached to Form 1040 to report profits or losses from a business. It details income, expenses, and potential deductions for a business.

- Form 4868: Known as the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, this form allows individuals extra time to file their tax returns, typically six months, without penalty for late filing.

- Form 8821: Tax Information Authorization grants another individual or entity the permission to review and receive confidential tax information for a specified period. Though it does not allow them to represent you to the IRS, it is useful for financial planning and consultations.

Together, the Tax POA and these accompanying forms and documents enable individuals to thoroughly manage their tax affairs, ensuring compliance and maximizing potential benefits. Each form has a specific purpose, from reporting income to authorizing representation, and is critical for accurate and efficient tax management. Navigating the complexities of tax preparation and planning often necessitates utilizing these documents to their fullest extent.

Similar forms

The Tax Power of Attorney (POA) form is one of many documents designed to grant certain powers from one person to another. A General Power of Attorney form bears resemblance in that it also allows an individual to grant a broad range of legal authorities to an agent. This can include handling financial matters, making healthcare decisions, and more. The difference lies in the breadth of authority granted; whereas, the Tax POA is specific to tax matters.

Similarly, the Healthcare Power of Attorney form is designed to allow an individual to designate another person to make healthcare decisions on their behalf if they become unable to do so themselves. Both documents function under the principle of assigning decision-making power to an agent, though the Tax POA is limited to dealing with tax authorities, and the Healthcare POA focuses on medical decisions.

The Durable Power of Attorney is another related document, enduring even if the principal becomes mentally incapacitated. This permanence is what distinguishes it from a Tax POA, which may not necessarily contain such durable provisions unless specifically indicated. Both, however, are preemptive measures to ensure representation in critical areas of a person's life.

Limited Power of Attorney documents share a common feature with Tax POA forms in that they restrict the agent's authority to a specific area or task. While a Limited POA might be used for a single real estate transaction, a Tax POA is narrowly confined to tax-related activities. The specificity of authority is a key similarity here.

The Estate Planning Will, though not a form of POA, is connected through its function of designating individuals to manage or inherit a person's assets after death. The Tax POA also involves managing assets, albeit in a very different context, by handling tax matters during the principal's lifetime.

The Financial Power of Attorney, much like the Tax POA, grants someone else the authority to manage financial affairs. However, its scope is much broader, possibly covering banking, investment, and other financial decisions, beyond just tax matters. They both entrust financial decision-making to another, albeit with varying degrees of scope.

The Guardianship Form is another document that permits an individual to appoint someone to make decisions on their behalf, similar to a POA. It is often used for the purpose of designating a guardian for minor children or adults unable to make their own decisions. Unlike the Tax POA, which is tax-specific, guardianship covers a wider range of personal and financial decisions.

A Business Power of Attorney allows a business owner to designate another individual to make decisions related to the business, including financial transactions and operations. This document shares the concept of delegating authority seen in the Tax POA, but is applied within the context of managing a business rather than personal tax affairs.

The Advance Directive, or Living Will, allows individuals to outline their wishes regarding medical treatment in the event they become unable to communicate their decisions. Though primarily focused on health care, like the Tax POA, it represents another facet of forward-thinking legal planning, ensuring an individual's wishes are known and can be acted upon by someone they trust.

Lastly, the Springing Power of Attorney activates only under certain conditions, such as the principal’s incapacitation. This feature differentiates it from the Tax POA, which is typically effective upon execution. Both, however, emphasize contingency planning, with one focusing on general affairs triggered by specific events, and the other concentrating on tax matters.

These documents, while diverse in their applications and specifics, all share the underlying principle of entrusting an agent with decision-making power or authority in one's stead. Whether focused on healthcare, finances, tax matters, or personal care, they collectively represent tools for planning ahead, designating responsibility, and ensuring that one’s affairs are managed according to their wishes.

Dos and Don'ts

When filling out the Tax Power of Attorney (POA) Form, certain guidelines should be followed to ensure the process is completed correctly and efficiently. Below are the dos and don'ts that should be taken into consideration.

Things You Should Do:

- Review the entire form before filling it out to understand each section and what information is needed.

- Use black ink or type when filling out the form to make sure all information is legible and can be read easily by the tax authorities.

- Provide accurate and complete information for both the taxpayer and the representative, including full names, addresses, and identification numbers, to avoid any processing delays.

- Clearly specify the tax matters and years/periods the POA covers to ensure the representative has the correct authority.

- Sign and date the form in the designated sections. Without your signature, the POA will not be considered valid.

- Keep a copy of the completed POA form for your records.

- Check for any state-specific requirements if your POA form is being used for state tax matters, as different states may have varying requirements.

Things You Shouldn't Do:

- Do not leave any sections blank that are applicable to your situation. Incomplete forms may result in rejection or processing delays.

- Do not use correction fluid or tape on the form. If you make a mistake, it is better to start over with a new form to maintain the form's neatness and legibility.

- Do not forget to specify the types of tax and years for which the representative is granted authority. Vague or incorrect information can limit the representative's effectiveness.

- Do not neglect to confirm the representative’s willingness to act on your behalf before appointing them on the form.

- Do not sign the form without reviewing and ensuring that all the information is correct and complete.

- Do not ignore the necessity of a witness or notarization, if required by your state or the Internal Revenue Service (IRS).

- Do not send the original POA to the tax agency without keeping a copy for your personal records.

Misconceptions

When it comes to navigating tax matters, many individuals find the concept of a Tax Power of Attorney (POA) form complex and are often misled by common misconceptions. Understanding what a Tax POA form entails is crucial for accurate and effective tax management. Here are nine misconceptions about the Tax POA form clarified to help provide a clearer understanding:

- Only for the wealthy: A common misconception is that Tax POA forms are only necessary for individuals with significant wealth. In reality, anyone can utilize a Tax POA, regardless of their financial status, to allow another person to handle their tax matters.

- Grants full control over personal finances: Some individuals believe appointing a Tax POA gives the agent complete control over their personal finances. However, a Tax POA specifically limits the agent's authority to tax-related issues.

- Difficult to revoke: There's a fear that once a Tax POA form is signed, it's challenging to revoke. The truth is, the principal can revoke the authority granted to the agent at any time as long as they are mentally competent.

- Automatic expiration: Many think that Tax POA forms automatically expire at the end of the tax year. While some POAs have expiration dates, others remain in effect until explicitly revoked by the principal.

- Only for filing taxes: Another common myth is that Tax POAs are only useful for filing annual tax returns. In actuality, these forms can authorize agents to perform a variety of tax-related tasks, including responding to IRS notices and obtaining confidential tax information.

- One size fits all: People often believe that there is a universal Tax POA form that is accepted in every state. The requirements for a Tax POA can vary significantly from one state to another, and it's essential to use a form that complies with your state's laws.

- Not necessary if you have a general POA: Some think that a general Power of Attorney form also covers tax matters, making a separate Tax POA unnecessary. However, most general POA forms do not grant authority for specific tax-related activities, which is why a Tax POA is often needed.

- Complex to create: The process of creating a Tax POA is believed to be difficult and time-consuming. Though accuracy is essential, many states provide standardized forms that are straightforward to complete.

- Requires a lawyer to complete: There's a misconception that you must have a lawyer to create a Tax POA form. While legal advice can be helpful in complex situations, most individuals can complete the form without direct legal assistance by following their state's guidelines.

Dispelling these misconceptions is the first step toward making more informed decisions about managing your tax affairs through a Tax Power of Attorney. Remember, understanding the specifics of any legal document before signing is fundamental to ensuring it meets your needs and complies with state laws.

Key takeaways

Filing and utilizing a Tax Power of Attorney (POA) form is a critical procedure that grants someone else the authority to handle your tax matters. Understandably, this can be a complex process filled with nuances. Whether you're a taxpayer plotting your course through tax season or a professional assisting clients, clarity on these key points can ensure that the POA form is correctly filled out and used. Below are nine essential takeaways that can guide you through this process:

Understanding the form's purpose is crucial. A Tax POA allows you to designate an individual, often a tax professional, to communicate with the tax authorities on your behalf. This includes obtaining confidential tax information and making decisions about your taxes.

Know the specific form for your state or jurisdiction. The IRS has a standard form (Form 2848) for federal tax matters, but many states require a different form. Ensure you have the correct one for the relevant tax authority.

Clearly identify the parties involved. The taxpayer's full name, social security number, and address must be accurately filled out, and so should the representative’s information, including their name, phone number, and address.

Detail the tax matters and periods. Specify the types of taxes, the tax form numbers, and the years or periods for which the POA is granted. This will prevent any confusion or ambiguity regarding the scope of authority.

Choose your representative wisely. Your representative should be someone you trust, preferably a certified tax professional such as a CPA, attorney, or enrolled agent who has experience dealing with tax authorities.

Understand the limits of the authority you’re granting. You can stipulate what your representative can and cannot do on your behalf. This can include negotiating with the IRS, signing agreements, or making payment arrangements.

Sign and date the form. An unsigned form is like an unfilled sail; it won't go anywhere. Make sure both you and your designated representative sign and date the form to validate it.

Keep a copy for your records. After the form is filled out and submitted, ensure you keep a copy. This document is important for your records and may be necessary for future reference.

Revocation process. Be aware that if you wish to revoke the POA, specific steps need to be followed, usually involving submitting a written notice of revocation to the same tax authority where the original POA was filed.

Remember, the power to manage your taxes effectively begins with understanding and correctly utilizing the Tax Power of Attorney form. Taking these steps not only protects you but also empowers the individual you’ve entrusted with this responsibility.

Popular PDF Documents

Pslf Employment Certification Form - Unpaid loans may impact future benefits from the SSS, highlighting the importance of timely repayment.

IRS Notice 703 - It includes a worksheet for taxpayers to calculate the taxable portion of their retirement income.