Get Tax M1 Form

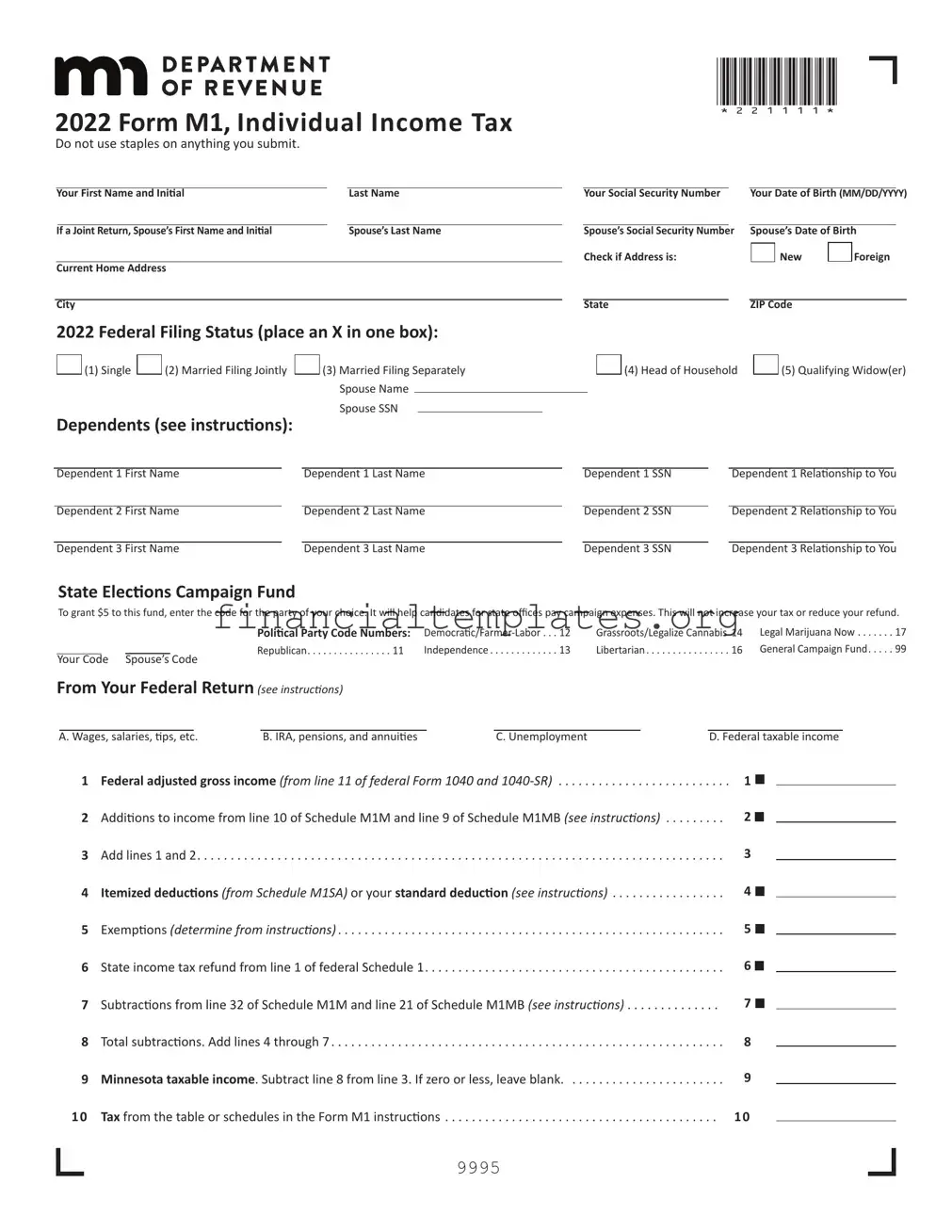

Filing taxes is a responsibility that every individual must manage yearly, and understanding the nuances of specific forms can make this task less daunting. The 2020 Form M1, Individual Income Tax, serves as the primary document for Minnesota residents to report their income taxes. It requires detailed information to ensure accurate tax calculation and compliance with state law. The form captures basic personal data, including names, Social Security numbers, addresses, and filing status — with options ranging from single and married filing jointly to head of household and qualifying widow(er). Additionally, it delves into financial details, such as wages, IRA distributions, unemployment benefits, and federal taxable income. Taxpayers must also report any additions or subtractions to Minnesota income, alongside itemized or standard deductions and exemptions, ensuring their state taxable income is precisely calculated. With sections designated for computing the tax due, claiming nonrefundable and refundable credits, and making adjustments for alternative minimum tax, the Form M1 encapsulates the complexity of tax filing. This form also accommodates contributions to the nongame wildlife fund, showcases the importance of accurate reporting of Minnesota income tax withheld, and discusses estimated tax payments, all affirming its critical role in the state's tax landscape.

Tax M1 Example

2022 Form M1, Individual Income Tax

Do not use staples on anything you submit.

Your First Name and Initial |

Last Name |

If a Joint Return, Spouse’s First Name and Initial |

Spouse’s Last Name |

Current Home Address

City

2022 Federal Filing Status (place an X in one box):

(1) Single

(1) Single

(2) Married Filing Jointly

(2) Married Filing Jointly

(3) Married Filing Separately Spouse Name

(3) Married Filing Separately Spouse Name

*221111*

|

|

|

|

|

|

|

|

|

|

Your Social Security Number |

Your Date of Birth (MM/DD/YYYY) |

||||||

|

|

|

|

|

|

|

|

|

|

Spouse’s Social Security Number |

Spouse’s Date of Birth |

||||||

|

Check if Address is: |

|

|

|

New |

|

Foreign |

|

|

|

|

|

|

|

|

|

|

|

State |

ZIP Code |

|

|

|

|||

|

|

|

|

|

|

|

|

|

(4) Head of Household |

|

(5) Qualifying Widow(er) |

Dependents (see instructions):

Spouse SSN

Dependent 1 First Name |

Dependent 1 Last Name |

Dependent 2 First Name |

Dependent 2 Last Name |

Dependent 3 First Name |

Dependent 3 Last Name |

|

|

|

Dependent 1 Relationship to You |

|

|

Dependent 1 SSN |

|||

|

|

|

Dependent 2 Relationship to You |

|

|

Dependent 2 SSN |

|||

|

|

|

|

|

|

Dependent 3 SSN |

Dependent 3 Relationship to You |

||

State Elections Campaign Fund

To grant $5 to this fund, enter the code for the party of your choice. It will help candidates for state offices pay campaign expenses. This will not increase your tax or reduce your refund.

|

|

|

|

|

|

|

Political Party Code Numbers: |

Grassroots/Legalize Cannabis 14 |

|

Legal Marijuana Now |

17 |

|||||||||||

|

|

|

|

|

|

|

Republican |

11 |

Independence . |

. . . . . . . . . . . . 13 |

Libertarian |

. . . . 16 |

|

General Campaign Fund |

99 |

|||||||

Your Code Spouse’s Code |

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

From Your Federal Return (see instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. Wages, salaries, tips, etc. |

B. IRA, pensions, and annuities |

|

|

C. Unemployment |

|

|

D. Federal taxable income |

|

|

||||||||||||

1 |

Federal adjusted gross income (from line 11 of federal Form 1040 and |

|

|

|

1 |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||

. . . . . . . |

. . . . . . . . . |

. . . . . |

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||

2 |

Additions to income from line 10 of Schedule M1M and line 9 of Schedule M1MB (see instructions) |

|

2 |

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|||||||||||||||||

3 |

Add lines 1 and 2 |

. . . . . . . . . . . . . . . . . . . . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

3 |

|

|

|

|

|

|

||||||||||

4 |

Itemized deductions (from Schedule M1SA) or your standard deduction (see instructions) |

|

4 |

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|||||||||||||||||

5 |

Exemptions (determine from instructions) |

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|||||||

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

|

|

|

|

|

||||||||||||||

6 |

State income tax refund from line 1 of federal Schedule 1 |

|

|

|

|

|

|

6 |

|

|

|

|

|

|

||||||||

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

|

|

|

|

|

|||||||||||||||

7 |

Subtractions from line 32 of Schedule M1M and line 21 of Schedule M1MB (see instructions) |

|

7 |

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|||||||||||||||||

8 |

Total subtractions. Add lines 4 through 7 |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

8 |

|

|

|

|

|

|

|||||||||||

9 |

Minnesota taxable income. Subtract line 8 from line 3. If zero or less, leave blank |

9 |

|

|

|

|

|

|

||||||||||||||

10 |

Tax from the table or schedules in the Form M1 instructions |

. . . . . . . . . . . . . . . . . |

. 10 |

|

|

|

|

|

|

|||||||||||||

9995

|

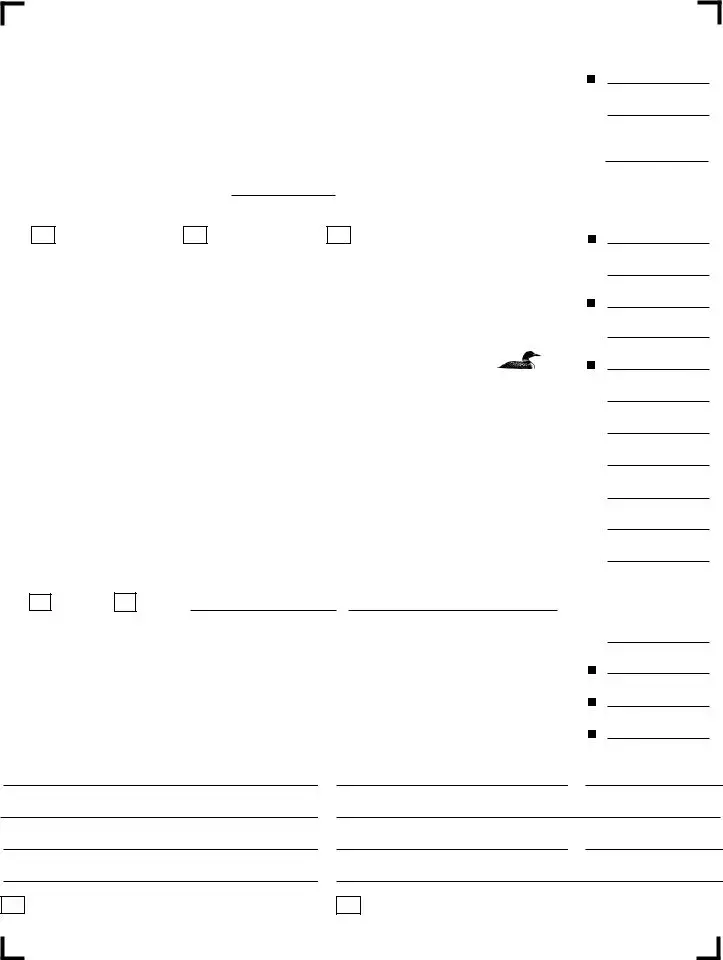

2022 M1, page 2 |

|

|

|

*221121* |

11 |

Alternative minimum tax (enclose Schedule M1MT) |

.11 |

12 |

Add lines 10 and 11 |

.12 |

13

line 13, from line 28 on line 13a, and from line 29 on line 13b (enclose Schedule M1NR) . . . . . . . . . . . . . . . . . . 13

13a |

|

|

|

13b |

|

|

|

|

|

14Other taxes, such as recapture amounts and the tax on

(a) Schedule M1HOME |

(b) Schedule M1529 |

(c) Schedule M1LS |

14 |

15 |

Tax before credits. Add lines 13 and 14 |

15 |

16 |

Amount from line 19 of Schedule M1C, Nonrefundable Credits (enclose Schedule M1C) |

16 |

17 |

Subtract line 16 from line 15 (if result is zero or less, leave blank) |

17 |

18 |

Nongame Wildlife Fund contribution (see instructions) |

|

|

This will reduce your refund or increase the amount you owe |

18 |

19 |

Add lines 17 and 18 |

19 |

20Minnesota income tax withheld. Complete and enclose Schedule M1W to report

Minnesota withholding from Forms

21 Minnesota estimated tax and extension payments made for 2022 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

22 Amount from line 12 of Schedule M1REF, Refundable Credits (see instructions; enclose Schedule M1REF) . . . . 22

23 Total payments. Add lines 20 through 22 |

23 |

24REFUND. If line 23 is more than line 19, subtract line 19 from line 23 (see instructions).

For direct deposit, complete line 25 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24  25 Direct deposit of your refund (you must use an account not associated with a foreign bank):

25 Direct deposit of your refund (you must use an account not associated with a foreign bank):

Checking

Savings |

Account Number |

Routing Number |

26 |

AMOUNT YOU OWE. If line 19 is more than line 23, subtract line 23 from line 19 (see instructions) |

26 |

|

27 |

Penalty amount from Schedule M15 (see instructions). Also subtract |

|

|

|

this amount from line 24 or add it to line 26 (enclose Schedule M15) |

27 |

|

IF YOU PAY ESTIMATED TAX and want part of your refund credited to estimated tax, complete lines 28 and 29. |

|

||

28 |

Amount from line 24 you want sent to you |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

28 |

29 |

Amount from line 24 you want applied to your 2023 estimated tax |

29 |

|

Taxpayer(s): I declare that this return is correct and complete to the best of my knowledge and belief. |

|

||

Your Signature |

Spouse’s Signature (If Filing Jointly) |

Date (MM/DD/YYYY) |

|

Daytime Phone |

Email Address |

|

|

Paid Preparer’s Signature |

Date (MM/DD/YYYY) |

PTIN or VITA/TCE # (required) |

|

Preparer’s Daytime Phone |

Preparer’s Email Address |

|

|

|

I do not want my paid preparer to file my return electronically. |

I authorize the Minnesota Department of Revenue to discuss this tax return |

|

|

Include a copy of your 2022 federal return and schedules. |

with the preparer or the |

|

|

Mail to: Minnesota Individual Income Tax, Mail Station 0010, 600 N. Robert St., St. Paul, MN |

|

|

9995

Document Specifics

| Fact | Detail |

|---|---|

| Purpose | 2020 Form M1 is for filing individual income tax. |

| Required Information | Includes personal details, federal filing status, social security numbers, and dates of birth for the taxpayer and spouse, if applicable. |

| Address Information | Requires current home address, including an option to indicate a new or foreign address. |

| Dependent Information | Information about dependents, including names, social security numbers, and their relationship to you. |

| Political Contributions | Option to contribute to the State Elections Campaign Fund, with political party code numbers provided. |

| Income Reporting | Details from the federal return are needed, such as wages, IRA, pensions, unemployment, and federal taxable income. |

| Calculations for Tax Due | Includes steps to determine Minnesota taxable income, taxes owed, and any applicable alternative minimum tax. |

| Governing Law | Governed by Minnesota state law. |

| Submission Details | Includes sections for taxpayer and preparer signatures, the requirement of a daytime phone number, and mailing instructions. |

Guide to Writing Tax M1

Filling out tax forms can be a vital step in ensuring that your tax obligations are met accurately and on time. The Form M1 for Individual Income Tax is no different, requiring detailed information about your income, deductions, and personal details to accurately calculate your tax for the year. It is important to approach this task with careful attention to detail to avoid mistakes that could lead to delays or audits.

- Start by entering Your First Name and Initial, Your Last Name, and if applicable, Spouse’s First Name and Initial and Spouse’s Last Name at the top of the form.

- Fill in Your Current Home Address, including city, state, ZIP Code, and check if the address is new or foreign.

- Select your 2020 Federal Filing Status by placing an X in the appropriate box.

- Enter Your Social Security Number (SSN), Your Date of Birth, and if applicable, Spouse’s Social Security Number and Spouse’s Date of Birth.

- List dependents, if any, including their names, relationships to you, and Social Security Numbers.

- For the section labeled State Elections Campaign Fund, enter your code and, if filing jointly, your spouse's code to allocate $5 to your selected political party.

- Under From Your Federal Return, report various incomes such as A. Wages, salaries, tips, etc., B. IRA, pensions, and annuities, and other relevant income types. This section requires entering amounts from your federal tax return.

- Calculate your Minnesota taxable income and Tax from the table in the Form M1 instructions, including alternative minimum tax if applicable.

- Enter any additional taxes from schedules such as Schedule M1HOME, and calculate your Tax before credits.

- Deduct any nonrefundable credits from Schedule M1C to find the subtotal before adding contributions to the nongame wildlife fund or other specified contributions.

- Detail any Minnesota income tax withheld and estimated tax payments, then calculate your total payments and either your refund or amount you owe.

- Indicate whether you're choosing direct deposit for your refund by providing checking or savings account details.

- Fill out the penalty amount from Schedule M15 if applicable.

- If you are applying part of your refund to next year's estimated tax, complete lines 28 and 29 accordingly.

- Finally, sign and date the form. If a paid preparer completed the form, ensure their signature, contact information, and PTIN or VITA/TCE # are included. Spouses filing jointly should both sign and date the form.

Remember, this completed Form M1, along with any applicable schedules and a copy of your 2020 federal return, should be mailed to the Minnesota Individual Income Tax office. Accuracy and completeness are crucial to avoid any potential issues with your tax return.

Understanding Tax M1

What is the 2020 Form M1, Individual Income Tax?

The 2020 Form M1, Individual Income Tax, is a document required by the state of Minnesota for residents, part-year residents, and non-residents who need to report their income and determine their tax liability for the state. This form requires taxpayers to provide information about their earnings, deductions, exemptions, and credits to calculate the amount of state income tax they owe or the refund they are due.

Who needs to file the Form M1?

Form M1 must be filed by full-year residents, part-year residents, and non-residents of Minnesota who have earned income from Minnesota sources or who are required to report income on a federal return. This includes individuals who are working, unemployed but receiving income such as unemployment benefits, and retirees receiving pensions or annuities that are taxable at the state level.

How do I determine my federal filing status for the Form M1?

Your federal filing status is a crucial piece of information on Form M1. It should match the status you selected on your federal income tax return. The options include Single, Married Filing Jointly, Married Filing Separately, Head of Household, or Qualifying Widow(er). Mark the box next to the status that applies to you, ensuring consistency with your federal tax return to avoid discrepancies.

Can I contribute to the State Elections Campaign Fund through the Form M1?

Yes, the Form M1 provides an option for taxpayers to support the State Elections Campaign Fund. This fund helps candidates for state offices with their campaign expenses. Taxpayers can contribute $5 to this fund by entering a code for their party of choice on their return. This contribution will not affect the taxpayer’s owed tax or refund amount. The form lists codes for several political parties, including the Republican, Democratic/Farmer-Labor, and others.

What is the direct deposit option on the Form M1?

The direct deposit option on Form M1 allows taxpayers to receive their refunds directly into a checking or savings account, rather than waiting for a check to arrive by mail. This method is faster, more secure, and reduces the risk of lost or stolen refund checks. Taxpayers must provide their bank routing number and account number to use this option and make sure the account is not associated with a foreign bank.

Common mistakes

When filling out the 2020 Form M1 for Individual Income Tax, attention to detail is paramount. However, mistakes can easily occur without careful review. Here are seven common errors to avoid:

-

Inaccurate personal information: Individuals often mishandle the basics like their name, social security number (SSN), or date of birth. It’s crucial to double-check these details, as discrepancies can lead to processing delays or issues with your tax records.

-

Incorrect filing status: Selecting the wrong filing status is a frequent error. Your choice among Single, Married Filing Jointly, Married Filing Separately, Head of Household, or Qualifying Widow(er) impacts your tax bracket and eligibility for certain deductions and credits.

-

Errors in dependent information: Failing to accurately report dependents, including their names, relationships, and social security numbers, can affect eligibility for exemptions and credits, such as the Child Tax Credit.

-

Omitting or misreporting income: All income sources, including wages, salaries, tips, and unemployment compensation, must be accurately reported. Overlooking or misreporting can result in underpayment of taxes and penalties.

-

Miscalculating deductions: Whether you choose to itemize deductions or take the standard deduction, errors in calculation can significantly affect your taxable income and overall tax liability.

-

Ignoring credits and contributions: Not taking advantage of eligible credits or forgetting to declare contributions to funds like the Nongame Wildlife Fund can mean missing out on refund opportunities or failing to fulfill intended donations.

-

Incorrectly calculating tax owed or refund due: Line 24 (refund) and Line 26 (amount owed) are critical figures that stem from previous calculations. Errors here could either cost you extra or diminish your rightful refund.

To ensure accuracy and compliance, reviewing each section of the Form M1 carefully is advised. Utilizing the detailed instructions provided for the form can also help in avoiding common pitfalls. When in doubt, consulting with a tax professional can provide clarity and assurance.

Documents used along the form

When filing the 2020 Form M1, Individual Income Tax, it's important to include all necessary documents to ensure accurate processing and to comply with tax regulations. Besides the primary form, several other documents might be needed, depending on your situation. Understanding these forms helps streamline the process and avoid potential delays.

- Schedule M1W: This schedule is essential for reporting Minnesota income tax withheld from your earnings. It accompanies the Form M1 and requires details from Forms W-2, 1099, and W-2G that show income and tax withheld by employers or other payers.

- Schedule M1M: This document is required for any additions or subtractions to your Minnesota income. If you have specific types of income or deductions that differ from your federal tax return, you'll detail them here to adjust your Minnesota taxable income accurately.

- Schedule M1NR: Nonresidents or part-year residents of Minnesota use this schedule. It helps calculate the portion of income taxable by Minnesota when the taxpayer also has income from other states during the tax year.

- Schedule M1C: Taxpayers who qualify for nonrefundable credits use this form to list those credits. This includes but is not limited to credits for child care, education expenses, and contributions to retirement savings. The total from this schedule is then applied to the tax calculation on Form M1.

Submitting the right supporting documents alongside the Form M1 is crucial for accurate tax assessment and for taking advantage of any credits or adjustments you're entitled to. Each of these additional forms is designed to provide specific information that affects your Minnesota tax obligations, ensuring the tax calculation is as accurate and beneficial to you as possible. Understanding and correctly filling out these documents can significantly impact your tax outcome.

Similar forms

The 1040 Individual Income Tax Return form is quite similar to the Tax M1 form. Both documents are designed to collect income information and calculate the amount of tax owed or the refund due to the taxpayer. They gather personal details, including names, Social Security Numbers, and filing status, and they require information on income, deductions, and credits to determine the correct tax liability. Where the M1 form is specific to Minnesota, the 1040 serves as its federal counterpart, underlining their fundamental purpose of tax collection and compliance on different governmental levels.

Form W-2, Wage and Tax Statement, while primarily an information document provided by employers to employees, shares common ground with the M1 form. It details the employee's income and taxes withheld throughout the tax year, information that is crucial for correctly filling out the M1 form. This document directly influences the accuracy of the income and tax withholding sections on the M1, underscoring the interconnectedness of employment and personal income taxation processes.

The Schedule M1W, Minnesota Income Tax Withheld, is intricately linked to the M1 form, complementing it by providing detailed information about state income taxes withheld. This schedule is where taxpayers list out the specifics of their withheld taxes, paralleling the way federal withholdings are reported. It's necessary for taxpayers to ensure they receive credit for all state taxes withheld from their income, making the M1W a critical document in the state tax filing process.

Schedule M1M, Additions to and Subtractions from Minnesota Income, serves as an adjunct to the M1 form, allowing taxpayers to adjust their income for specific items that affect state tax differently from federal tax. This schedule is key to aligning state taxable income with federal guidelines while accounting for Minnesota-specific adjustments, illustrating the complexity of state-federal tax coordination.

The 1099 form, used to report various types of non-employment income, has a connection to the M1 form through its role in influencing the taxpayer's adjusted gross income. Different variants of the 1099 document income such as dividends, interest, or independent contractor earnings—each impacting the total income reported on the M1. The relationship showcases the broad spectrum of income sources considered in personal tax calculations.

Schedule M1SA, Minnesota Itemized Deductions, is akin to the itemized deductions schedule of the federal tax system, tailored to the state's tax code. This document provides a framework for Minnesota residents to detail deductible expenses that reduce taxable income, akin to its role on the federal level but within the state's specific allowances and limitations, emphasizing the customization of taxation by jurisdiction.

Schedule M1C, Nonrefundable Credits, similarly complements the M1 form by detailing the specifics of various tax credits taxpayers are eligible for, which directly decrease the amount of state tax due. This mirrors the process of claiming credits in the broader tax system—applying targeted financial incentives and relief within the calculated tax framework of the M1 document, illustrating the government's role in influencing taxpayer behaviors through fiscal policy.

Schedule M15, Underpayment of Estimated Tax by Individuals, might be required alongside the M1 form for those who didn't pay enough tax throughout the year through withholding or estimated tax payments. It emphasizes the necessity of accurate pre-payment throughout the tax year to avoid penalties, underlining the tax system's pay-as-you-go principle and its implications for individual tax planning and compliance.

Dos and Don'ts

When filling out the Tax M1 form, it's crucial to follow specific do's and don'ts to ensure accuracy and compliance with tax laws. Below are some essential tips to help guide you through the process:

- Do carefully read all instructions provided with the Tax M1 form to understand each section thoroughly before filling it out.

- Do double-check your Social Security Number (SSN) and that of your spouse (if filing jointly) to prevent any processing delays due to incorrect information.

- Do accurately report your income, deductions, and credits according to the instructions, using your federal tax return as a reference point where necessary.

- Do choose the correct filing status that applies to your situation for the tax year, as it will affect your tax calculation.

- Do consider direct deposit for your refund by providing your checking or savings account information; this method is faster and more secure than receiving a check by mail.

- Do sign and date the form, along with your spouse if filing jointly, to certify that the information provided is correct and complete to the best of your knowledge.

- Don't forget to attach a copy of your federal return and schedules, as they're required for processing your state return.

- Don't overlook the importance of including Schedule M1W if you're reporting Minnesota income tax withheld, to ensure you receive credit for any taxes already paid.

- Don't leave mandatory fields blank; if a particular question does not apply to you, indicate this with a "N/A" or "0" as per the form's instructions.

- Don't neglect to report any changes in your address or personal information, as failing to do so may result in delays or misdirected tax correspondence.

- Don't send original documents when copies will suffice, to avoid the loss of important personal documents.

- Don't hesitate to consult a tax professional if you encounter sections of the form that are confusing or if you're unsure how to report certain income or deductions.

Misconceptions

Many individuals often have misconceptions about the Tax M1 form, which can lead to confusion and errors during the filing process. Understanding these misconceptions is crucial for accurate and stress-free tax filing. Here are seven common misunderstandings and the facts that dispel them:

- Only full-year residents need to file Form M1. This is incorrect. Both full-year and part-year residents, as well as nonresidents who have income from Minnesota sources, are required to file Form M1.

- Married couples can't file separately on the same form. Married individuals have the option to file jointly or separately. The form includes sections for spouse’s information, allowing couples to choose the filing status that is most beneficial for their situation.

- The M1 form is only for reporting wages. While wages are a significant component, the M1 form is more comprehensive. It includes various income types, such as IRAs, pensions, annuities, and unemployment compensation, among others.

- You must itemize deductions on your federal return to do so on your M1. Minnesota allows taxpayers to choose between itemized and standard deductions regardless of their choice on the federal return, offering flexibility in optimizing deductions.

- All political party contributions increase your tax or reduce your refund. By selecting to contribute to the State Elections Campaign Fund, a taxpayer can support a political party without affecting their tax owed or refund amount.

- Direct deposit is not available for tax refunds. Taxpayers can indeed opt for direct deposit to receive refunds, which is often faster than receiving a check by mail. They need to provide their bank account and routing number but must ensure the bank is not foreign affiliated.

- There's no option to apply a part of your refund to the next year's estimated tax. The form allows taxpayers to allocate a portion of their refund towards their estimated tax for the following year, aiding in future tax planning.

Understanding these key points can help individuals navigate the complexities of tax filing with more confidence and accuracy, ensuring compliance and possibly optimizing their tax situation.

Key takeaways

Filling out the Tax M1 form, crucial for reporting individual income taxes in Minnesota, requires careful attention to detail. Comprehending the nuances of the form ensures accurate submission, adhering to tax laws, and possibly maximizing refunds. Here are some key takeaways to guide you through this process:

- Complete personal information accurately, including all names and Social Security numbers, to avoid processing delays.

- Choosing the correct filing status is essential as it influences tax calculations. Whether single, married (filing jointly or separately), head of household, or a qualifying widow(er) with dependent child, each status has specific requirements and benefits.

- Report dependents correctly, including their relationship to you and their Social Security numbers, which could affect exemptions and credits you may claim.

- Participation in the State Elections Campaign Fund is optional but allows you to support political parties without affecting your tax refund or amount owed.

- Transcribe your Federal Adjusted Gross Income accurately from your federal return to ensure your state tax calculations start from the correct basis.

- Adjustments to your income may be required. Additions or subtractions to Minnesota income must be accurately reported using Schedule M1M and Schedule M1MA respectively, where applicable.

- Choose between itemized or standard deductions carefully, based on which option offers the larger deduction and therefore the lower taxable income, in line with Minnesota guidelines.

- Calculate your taxable income correctly by subtracting any eligible deductions and exemptions from your adjusted gross income. This determines the base amount on which your state income tax will be calculated.

- Be aware of additional taxes that may apply to your situation, including the alternative minimum tax or taxes on specific types of income, and report them using the appropriate schedules.

- Credit for taxes paid to other states is an essential consideration for part-year residents or those who earned income in other states. This ensures you're not taxed twice on the same income.

- Understand refundable versus nonrefundable credits to accurately calculate the amount of tax you owe or the refund due. Nonrefundable credits can reduce your tax liability to zero but won't result in a refund for the excess amount, while refundable credits can.

- Finally, if expecting a refund, consider having it directly deposited into your checking or savings account by providing accurate banking details, which speeds up the refund process.

Attention to these details not only simplifies the tax filing process but also secures compliance with tax laws, potentially optimizing tax benefits. Ensure all schedules and additional forms specific to your tax situation are completed and enclosed to prevent errors or delays. Remember, tax laws and forms change; always use the most current form and consult the instructions or a tax professional for guidance specific to your circumstances.

Popular PDF Documents

Schedule E Income - Filers need to indicate their role, if any, as a real estate professional to qualify for certain benefits.

Types of Non Profits - Form 8734 is critical for the IRS's final determination regarding an organization's public support status.