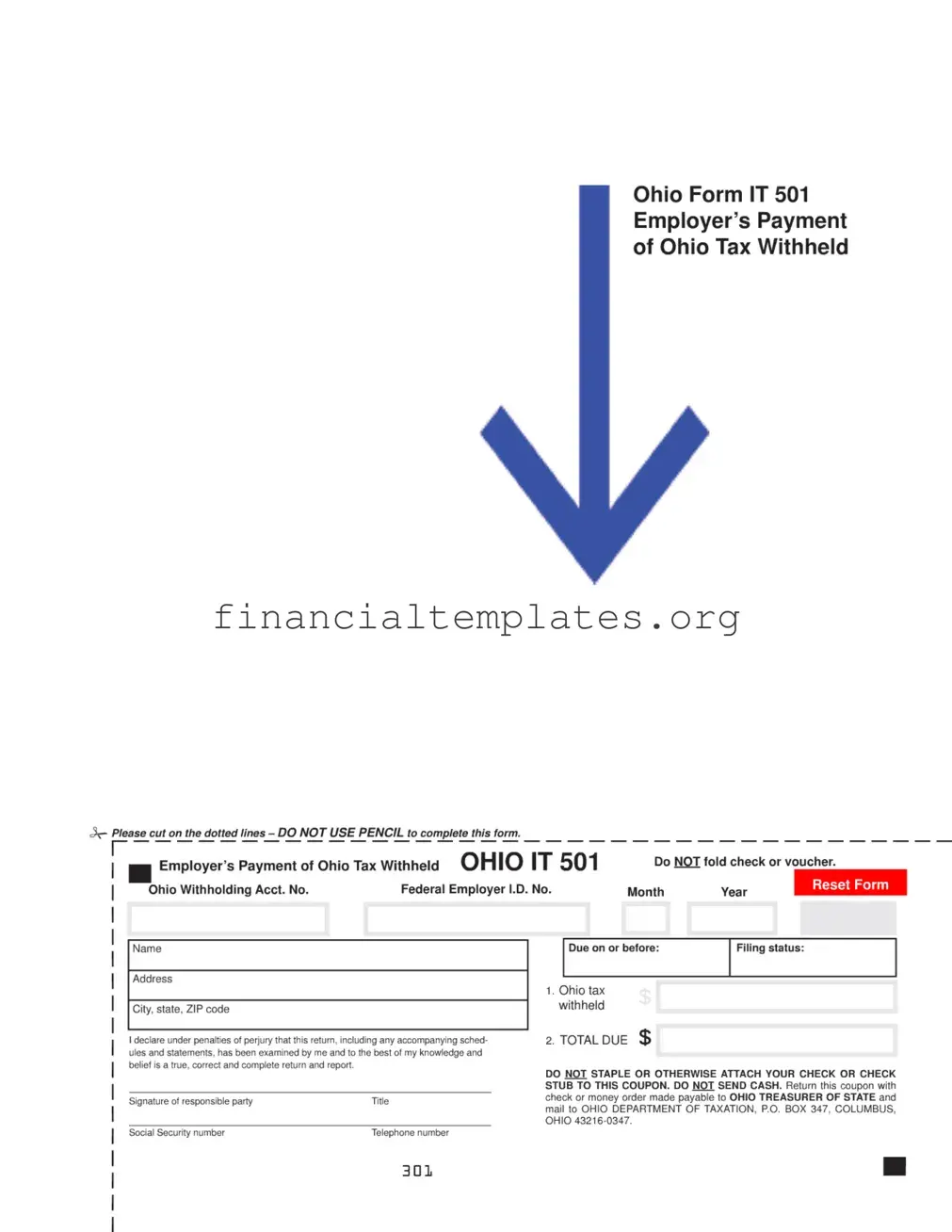

Get Tax It 501 Form

Navigating the complexities of tax compliance can be daunting, especially for employers responsible for withholding taxes from their employees' wages. Enter the Tax It 501 form, a key document for employers in Ohio. This crucial form serves as an official way to report and pay withheld taxes to the state, ensuring businesses stay on the right side of tax laws. It details important information such as the total Ohio tax withheld, the employer's Ohio Account Number, and the Federal Identification Number. Employers are reminded not to use pencil when completing the form and must adhere to specific instructions, like not folding checks or vouchers. The due date is prominently noted, underscoring the importance of timely submissions to avoid penalties. Interestingly, the document also underscores the gravity of the information being reported by including a declaration under penalties of perjury, ensuring that all reported figures are true and correct to the best of the filer's knowledge. Furthermore, the form provides clear instructions for payment, including the preferred method of submitting checks or money orders payable to the OHIO TREASURER OF STATE, and highlights the mailing address for the OHIO DEPARTMENT OF TAXATION. This form, while seemingly straightforward, encapsulates the essentials of tax compliance and reporting for Ohio employers, ensuring the state's fiscal operations run smoothly and efficiently.

Tax It 501 Example

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The Ohio IT 501 form is used by employers to make a payment of Ohio tax withheld from employees' wages. |

| Submission Requirement | Employers must not use pencil to complete the form, should not fold the check or voucher, and are advised against stapling or attaching the check to the coupon. |

| Due Date | Payment and the completed form are due on or before the date specified in the form's instructions. |

| Payment Recipient | Check or money order payments should be made payable to the OHIO TREASURER OF STATE and mailed to the OHIO DEPARTMENT OF TAXATION at the address provided on the form. |

Guide to Writing Tax It 501

Filling out the Ohio IT 501 form, known as the Employer’s Payment of Ohio Tax Withheld, is a crucial task for employers who withhold state taxes from their employees' wages. Properly completing and submitting this form ensures that these withheld taxes are accurately paid to the state, maintaining compliance and avoiding penalties. Below are step-by-step instructions designed to guide you through the process smoothly and efficiently.

- Start by ensuring that you are not using a pencil. All entries must be made with ink to ensure permanence and readability.

- Locate the section labeled "Ohio Acct. No." and enter your Ohio account number. This number is unique to your business and was assigned when you registered as an employer with the state.

- Next, fill in the "Federal I.D. No." field with your Federal Employer Identification Number (FEIN), which is used by the IRS to identify your business for tax purposes.

- In the "Name" field, write the legal name of your business exactly as it appears on your state tax registration documents.

- Indicate the due date of the form in the section marked "Due on or before:". This is a predetermined date by which the form must be filed.

- Select your filing status according to the instructions provided with the form. This will typically relate to how frequently you are required to file and pay withheld taxes.

- Enter your business address in the "Address" field, including city, state, and ZIP code, ensuring it matches the address on file with the Ohio Department of Taxation.

- In the section labeled "Ohio tax withheld," specify the total amount of Ohio state tax you withheld from your employees' wages during the filing period.

- Record the "TOTAL DUE," which should match the amount of Ohio tax withheld if you have no adjustments or corrections.

- Before signing the form, carefully read the declaration statement about perjury and the accuracy of the information provided on the form.

- Sign the form in the space provided under "Signature of responsible party." Print your title next to your signature to verify your position within the company.

- If applicable, fill in your Social Security Number (SSN) and telephone number in the designated areas. This information may be used for identification and contact purposes.

- Prepare a check or money order made payable to "OHIO TREASURER OF STATE". Remember, do not staple or otherwise attach your payment to the form, and do not send cash.

- Finally, mail the completed form along with your payment to: OHIO DEPARTMENT OF TAXATION, P.O. BOX 347, COLUMBUS, OHIO 43216-0347. Ensure the form is not folded and that the check or voucher is appropriately attached.

After submitting the Ohio IT 501 form, your responsibility as an employer for that filing period is complete. Ensure that you keep a copy of the completed form and proof of payment for your records. This documentation is essential for future reference and can serve as proof of compliance with state tax laws.

Understanding Tax It 501

What is Ohio Form IT 501?

Ohio Form IT 501, known as the Employer's Payment of Ohio Tax Withheld, is a document required by the Ohio Department of Taxation. Employers use it to remit the state income tax they've withheld from their employees' wages. This form accompanies the payment when employers send it to the state.

When is Ohio Form IT 501 due?

The due date for submitting Ohio Form IT 501 is based on the employer's filing status, which can vary. Typically, it is required to be filed and paid on or before a specified date that is determined by the Ohio Department of Taxation, often correlating with the end of the pay period.

Can I use a pencil to complete Ohio Form IT 501?

No, you should not use a pencil to complete Ohio Form IT 501. The form expressly states that pencils are not to be used. It's recommended to use ink to ensure the information is permanent and legible, reducing the risk of errors or alterations.

How should I attach my payment to the Ohio Form IT 501?

Do not staple or otherwise attach your check or money order to Ohio Form IT 501. Instead, simply enclose the payment along with the form in your mailing envelope. Make sure the check or money order is made payable to the "Ohio Treasurer of State."

Is it possible to send cash as payment for Ohio Form IT 501?

No, cash payments are not accepted for Ohio Form IT 501. Payments should be made by check or money order only. This precaution ensures that your payment is secure and there is a documented trail for the transaction.

Where do I mail Ohio Form IT 501?

Ohio Form IT 501, along with your check or money order, should be mailed to the Ohio Department of Taxation at P.O. Box 347, Columbus, Ohio 43216-0347. It’s important to ensure that the address is correct to avoid delays or misplacement of your payment.

How do I complete the Ohio Account No. and Federal I.D. No. fields?

You should fill the Ohio Account No. and Federal I.D. No. fields with your assigned state tax account number and your federal employer identification number (EIN), respectively. These numbers are crucial for identifying your business and ensuring that your payment is credited to the correct account.

What should I do if I'm unsure about how to complete the form?

If you have doubts or questions about filling out Ohio Form IT 501, it's wise to consult with a tax professional or contact the Ohio Department of Taxation directly. They can provide guidance specific to your situation, ensuring that you complete the form accurately and comply with state tax regulations.

What declaration must be made when filing Ohio Form IT 501?

The responsible party must declare, under penalties of perjury, that the Ohio Form IT 501, including any accompanying schedules and statements, has been examined and to the best of their knowledge is true, correct, and complete. This declaration underscores the importance of accuracy and honesty in tax filings.

Common mistakes

Filling out the Ohio Form IT 501, essential for employers’ payment of Ohio tax withheld, often involves intricate details that demand attention. Missteps in this process can lead to delays, inaccuracies in records, or even penalties. Here are six common mistakes:

-

Using Pencil to Fill Out the Form: The instructions clearly state not to use pencil. All information should be recorded in ink to ensure permanence and readability.

-

Folding the Check or Voucher: This can damage the document, causing issues with processing. The payment and voucher should remain flat.

-

Incorrectly documenting the Ohio Account Number or Federal I.D. Number. Such inaccuracies can misdirect payments or delay processing.

-

Omitting the signature of the responsible party. This oversight can invalidate the submission, as the signature certifies the veracity of the information provided.

-

Attaching the check or check stub to the coupon. As per instructions, attachments are prohibited to ensure smooth processing.

-

Sending cash instead of a check or money order. This not only violates the submission guidelines but also poses a significant security risk.

In avoiding these mistakes, employers can ensure their Ohio Form IT 501 submissions are accurate, timely, and compliant. It's important to review all instructions carefully, double-check entries for accuracy, and always adhere to the specified guidelines.

Documents used along the form

When handling tax-related responsibilities, particularly for employers managing Ohio tax withholdings, the Ohio Form IT 501 is a critical document. However, this form often necessitates the inclusion of supplementary forms and documents to ensure comprehensive compliance and accurate tax filing. Understanding what these additional documents are and their purposes can significantly streamline the tax preparation and submission process.

- W-2 Forms: These are Wage and Tax Statements that employers must provide to each employee and the IRS at the end of the year. They detail the employee's annual wages and the amount of taxes withheld from their paycheck.

- W-3 Form: The Transmittal of Wage and Tax Statements summarizes the information on all the W-2s an employer has issued. This form is sent to the Social Security Administration along with a copy of all W-2s.

- 1099 Forms: For non-employee compensation, such as payments to independent contractors, Form 1099-NEC is used. Employers report any payment of $600 or more made to a non-employee over the fiscal year.

- Ohio IT 941: This form is the Employer’s Quarterly Return of Income Tax Withheld, required for reporting the total income taxes withheld from employees' wages each quarter.

- Ohio IT 3: The Transmittal of Wage and Tax Statements for Ohio requires employers to report the total number of W-2s issued, the total state wages paid, and the total Ohio tax withheld. This must be filed annually to accompany the W-2s submitted to the state.

In the world of tax compliance, being well-prepared means having all necessary documents and forms at the ready. Employers should maintain these forms and any supporting documentation in an organized manner to ensure a smooth tax filing process. Staying informed about the purposes and requirements of these documents protects employers from potential penalties and helps ensure that they meet their tax obligations accurately and on time.

Similar forms

The IRS Form 941, Employer’s Quarterly Federal Tax Return, is quite similar to the Ohio IT 501 form because both are essential for reporting taxes withheld from employees’ paychecks. While the IT 501 form deals with state tax withholdings in Ohio, Form 941 handles the federal aspect, including income, Social Security, and Medicare taxes. Both forms are critical for employers' compliance with tax withholding requirements and are submitted at regular intervals throughout the fiscal year.

Form W-2, Wage and Tax Statement, shares a close similarity with the IT 501 form as well. This document is given to employees and the Social Security Administration, detailing the income earned and taxes withheld over the past year. Like the IT 501, the purpose of the W-2 is to report taxes withheld, although the W-2 serves more as an annual summary for employees rather than a payment form for employers.

The Form W-3, Transmittal of Wage and Tax Statements, complements the W-2 forms, akin to how the IT 501 functions. Employers use Form W-3 to submit all W-2 forms for their employees to the Social Security Administration. It serves as a summary form, similar to IT 501’s role in reporting total state tax withheld before sending the cumulative payment to the state treasury.

Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return, parallels the IT 501 with its focus on employer taxation. While Form 940 reports annual federal unemployment taxes, IT 501 is for state tax withholdings. Both are integral for employers to fulfill their tax obligations, just directed toward different governmental departments.

The Form 1099-MISC, Miscellaneous Income, also shares similarities with the IT 501 in its role in reporting certain types of payments. Although 1099-MISC is used primarily to report payments to non-employees, it emphasizes the importance of documenting and remitting taxes, aligning with the IT 501’s objective of tracking tax withholdings.

Form 1096, Annual Summary and Transmittal of U.S. Information Returns, is another document closely related to the IT 501. Employers use Form 1096 to summarize and send information returns like the 1099-MISC to the IRS. It serves a summary function similar to the IT 501, which aggregates state tax withholdings for Ohio before submission.

The Schedule B (Form 941), Report of Tax Liability for Semiweekly Schedule Depositors, echoes the periodic reporting nature of the IT 501. Schedule B breaks down an employer's tax liability further, catering to businesses with more complex tax withholding and deposit schedules, aligning with the IT 501's goal of ensuring timely and accurate tax remittance.

Form 945, Annual Return of Withheld Federal Income Tax, parallels the IT 501 by focusing on nonpayroll items. While the IT 501 form addresses taxes withheld from employees' wages, Form 945 covers withheld federal income tax on non-employee payments, highlighting the breadth of tax withholding and payment responsibilities for various incomes.

Form 944, Employer’s Annual Federal Tax Return, is designed for smaller employers to report federal tax withholdings annually, comparable to the IT 501's state-level counterpart. This form simplifies the tax reporting process, mirroring the IT 501’s aim of collecting tax withholdings for state taxation purposes.

The Ohio IT 4, Employee’s Withholding Exemption Certificate, although not a payment form, prefaces the relationship that culminates in the IT 501. Employees complete the IT 4 to determine state tax withholding levels, directly influencing the totals reported and paid via the IT 501. This connection highlights the interdependent nature of tax documentation and processing from exemption to payment.

Dos and Don'ts

When handling complex documents like the Ohio Form IT 501, which revolves around the Employer's Payment of Ohio Tax Withheld, precision and understanding are paramount. The implications of incorrect information can lead to unnecessary complications with the Ohio Department of Taxation. Therefore, ensuring accuracy and compliance with the official guidelines is not just recommended; it is essential. Here is a list of dos and don'ts when tackling the Ohio Form IT 501:

- Do use black or blue ink only when filling out the form manually. The instruction against using pencil is rooted in the need for permanence and legibility in official records.

- Do not fold the check or voucher. This preserves the integrity of these financial instruments, ensuring they are processed efficiently without any issues.

- Do double-check the Ohio Account No. and the Federal I.D. No. for accuracy. These identifiers are crucial for ensuring that your payment is properly credited to your account.

- Do not staple or otherwise attach your check or check stub to the coupon. This helps prevent damage to the documents and keeps them in a condition that allows for smooth processing.

- Do make sure the name, filing status, and address fields are filled out completely and accurately. This information is foundational, affecting how your payment is recorded and tied to your account.

- Do not send cash. For security and traceability, payments should be made via check or money order payable to the OHIO TREASURER OF STATE.

- Do review the entire form before submission to ensure all data entered is correct and complete, reflecting a true and accurate account of your tax withheld.

- Do sign the form. The signature of the responsible party adds a necessary layer of verification and accountability to the document.

- Do not forget to include your contact information, particularly your telephone number. This could be critical if there's a need to resolve issues or questions about your submission.

By following these guidelines, employers can help ensure their Ohio Form IT 501 submissions are free from errors and omissions, aiding in the smooth operation of payroll tax compliance. Remember, adherence to the guidelines not only benefits your business through the avoidance of penalties but also contributes to the overall efficiency of tax administration in Ohio.

Misconceptions

When discussing the Ohio Form IT 501, several misconceptions often arise, mainly because tax forms can be complex and details may be easily misunderstood or misinterpreted. Below are eight common misconceptions about this form, along with clarifications to help understand its purpose and requirements better.

- Any business can ignore this form if it doesn't operate in Ohio. This perception is incorrect. If a business employs individuals who reside in Ohio or conducts operations within the state that involves withholding Ohio state income tax from employees, it must complete the Ohio Form IT 501. This form is specifically designed for employers to report and pay withheld taxes to the Ohio Department of Taxation.

- The form can be filled out using a pencil for convenience. This is a misconception. The instructions clearly state that the form should not be completed in pencil. This is to ensure that the information is permanent and cannot be altered easily after submission, maintaining the integrity of the information provided.

- Filing electronically negates the need to mail in the Ohio Form IT 501. Even though electronic filing is encouraged and often more convenient, there might be circumstances requiring the physical mailing of this form. Always check the current filing requirements with the Ohio Department of Taxation.

- Payments can be sent in cash. This assumption is false. The form instructions explicitly advise against sending cash. Payments should be made via check or money order payable to the OHIO TREASURER OF STATE.

- Attaching the check or money order to the form is necessary. According to the instructions, you should not staple or otherwise attach your check or check stub to the coupon. This helps prevent any damage to the check or form and facilitates smoother processing.

- Any mistakes on the form cannot be corrected after submission. While it's true that accuracy is crucial when completing the form, if an error is discovered after submission, it's possible to rectify the error. This usually involves contacting the Ohio Department of Taxation directly and following their procedures for amending the information.

- The form is only due annually. The Ohio Form IT 501 is actually used for more frequent reporting. The due dates are based upon the employer’s withholding amount and can range from monthly to quarterly, depending on the volume of tax withheld. Employers should verify their filing frequency with the Ohio Department of Taxation.

- The Social Security Number (SSN) of the responsible party need not be provided. Misunderstanding about privacy concerns might lead some to believe that providing the SSN is optional. However, for identification and security purposes, the SSN of the person responsible for the form’s completion and the tax payment is required to ensure proper credit to the correct account.

Clarifying these misconceptions about the Ohio Form IT 501 is crucial for employers to comply accurately with state tax regulations and avoid potential penalties. Always refer to the latest guidelines issued by the Ohio Department of Taxation or seek professional advice when in doubt.

Key takeaways

Understanding the requirements and accurately completing the Ohio Form IT 501, Employer’s Payment of Ohio Tax Withheld, is essential for employers in managing state tax obligations. Below are four key takeaways to ensure compliance and accuracy when handling this form.

- Avoid Using Pencil: When filling out the Ohio IT 501 form, it is important not to use pencil. This instruction ensures that the information provided is permanent and not subject to alteration, which helps in maintaining the integrity of the tax document.

- Proper Attachment and Payment Methods: The form explicitly instructs not to staple or otherwise attach the check or check stub to the coupon. Additionally, cash payments are not accepted. Payments should be made through a check or money order payable to the OHIO TREASURER OF STATE. This precise way of handling documents and payments reduces processing errors and ensures the payment is correctly applied to the account.

- Timely Submission: The form requires submission by a specific due date. Adhering to this deadline is crucial to avoid any penalties or interest that may accrue from late payments. Timely filing is part of the employer's compliance with state tax laws, ensuring that withheld taxes are paid to the state treasury within the allotted timeframe.

- Accuracy and Accountability: The declaration section at the bottom of the form underscores the importance of accuracy and honesty in the completion of the return. The person responsible must sign the form, declaring under penalties of perjury that the information provided is correct to the best of their knowledge. This commitment to accuracy not only complies with legal standards but also promotes trust and integrity in the tax withholding process.

By carefully following these guidelines, employers can fulfill their tax withholding responsibilities effectively, ensuring compliance with Ohio state regulations. It emphasizes the importance of attention to detail and adherence to the state's tax filing procedures.

Popular PDF Documents

Alabama Tax Forms - Form 40A includes the option for taxpayers to indicate if they are not making a payment or if they owe, streamlining the payment process.

Broward Tax Collector Plantation - Designed with clarity and completeness in mind to avoid any potential legal misunderstandings or non-compliance issues.

Pa Sales Tax Exemption Number Lookup - Discover the critical details required about the institution's operations, including the date of first activities, for the exemption application.