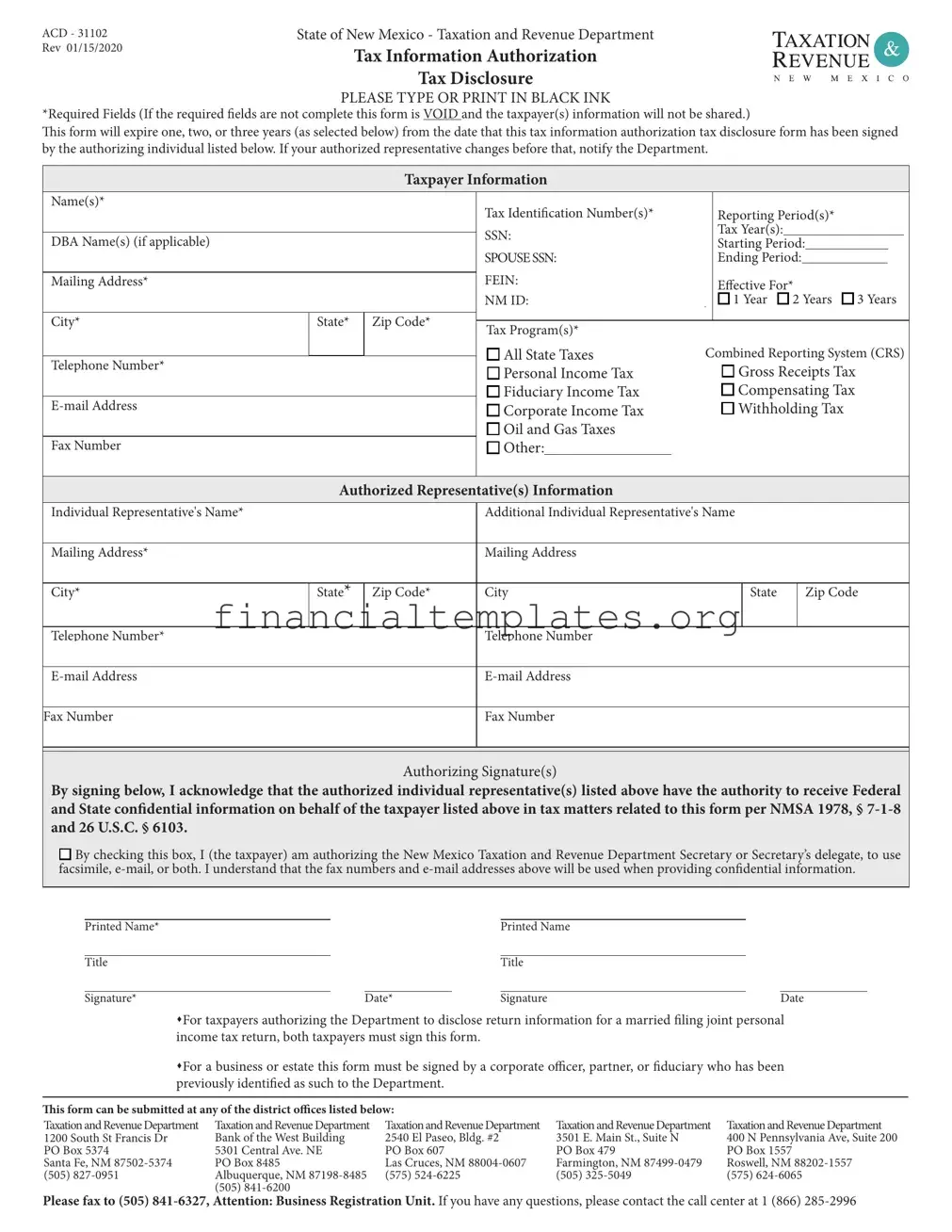

Get Tax Information Authorization Form

The Tax Information Authorization form, as provided by the State of New Mexico's Taxation and Revenue Department, is a crucial document for individuals and businesses needing to grant access to their confidential tax information to representatives. Highlighting the necessity of typing or printing in black ink, this form emphasizes the importance of filling out the *required fields; failing to do so voids the form, ensuring that taxpayer information remains secured unless properly authorized. This eligible document for authorization can extend up to one, two, or three years from its signing date, protecting the taxpayer’s information for the duration chosen. It encompasses a wide range of tax-related areas such as personal income tax, corporate taxes, and more, ensuring comprehensive coverage. Additionally, the form acknowledges the necessity for the taxpayer to notify the Department if there’s a change in their authorized representative, maintaining the integrity and relevance of the authorization. The document also outlines the authentication process for the information to be shared, requiring the signature of the authorizing individual, while also accommodating joint filings and representations by businesses or estates. The form's thorough approach not only facilitates the authorized sharing of sensitive tax information but also reinforces the procedural safeguards the Department places on taxpayer privacy and information security.

Tax Information Authorization Example

ACD - 31102 Rev 01/15/2020

State of New Mexico - Taxation and Revenue Department

Tax Information Authorization

Tax Disclosure

PLEASE TYPE OR PRINT IN BLACK INK

*Required Fields (If the required fields are not complete this form is VOID and the taxpayer(s) information will not be shared.)

This form will expire one, two, or three years (as selected below) from the date that this tax information authorization tax disclosure form has been signed by the authorizing individual listed below. If your authorized representative changes before that, notify the Department.

Taxpayer Information

|

|

Name(s)* |

|

|

|

Tax Identification Number(s)* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

Reporting Period(s)* |

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax Year(s): |

||||||||||||||||||

|

|

|

|

|

|

SSN: |

|

|

|

- |

- |

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

DBA Name(s) (if applicable) |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

Starting Period: |

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

SPOUSE SSN: |

|

- |

- |

|

|

|

|

|

Ending Period: |

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FEIN: |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

Mailing Address* |

|

|

|

|

|

|

|

|

|

|

|

|

|

Effective For* |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

- |

|

- |

|

|

|

|

|

|

|

|

|

|

|

2 Years |

|

3 Years |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

q |

|||||||||||||||

|

|

|

|

|

|

NM ID: |

|

|

|

|

|

|

q |

1 Year |

q |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City* |

State* |

Zip Code* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax Program(s)* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

All State Taxes |

|

|

|

|

|

Combined Reporting System (CRS) |

|||||||||||||||||||||||||

|

|

|

|

|

|

q |

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

Telephone Number* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

q |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

q |

Personal Income Tax |

|

|

|

|

|

|

|

|

|

Gross Receipts Tax |

||||||||||||||||||||||||

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensating Tax |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

Fiduciary Income Tax |

|

|

|

|

q |

||||||||||||||||||||||||||||||

|

|

|

|

q |

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Withholding Tax |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

Corporate Income Tax |

|

|

|

|

q |

|||||||||||||||||||||||||||||

|

|

|

|

|

q |

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

Oil and Gas Taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

q |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fax Number |

|

|

|

|

|

Other: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

q |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

Authorized Representative(s) Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

Individual Representative's Name* |

|

|

|

Additional Individual Representative's Name |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address* |

|

|

|

Mailing Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City* |

State* |

Zip Code* |

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

|

|

|

Zip Code |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Telephone Number* |

|

|

|

Telephone Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Fax Number |

|

|

|

Fax Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Authorizing Signature(s)

By signing below, I acknowledge that the authorized individual representative(s) listed above have the authority to receive Federal and State confidential information on behalf of the taxpayer listed above in tax matters related to this form per NMSA 1978, §

q

By checking this box, I (the taxpayer) am authorizing the New Mexico Taxation and Revenue Department Secretary or Secretary’s delegate, to use facsimile,

By checking this box, I (the taxpayer) am authorizing the New Mexico Taxation and Revenue Department Secretary or Secretary’s delegate, to use facsimile,

Printed Name*

Title

Printed Name

Title

Signature* |

|

Date* |

|

Signature |

|

Date |

sFor taxpayers authorizing the Department to disclose return information for a married filing joint personal income tax return, both taxpayers must sign this form.

sFor a business or estate this form must be signed by a corporate officer, partner, or fiduciary who has been previously identified as such to the Department.

This form can be submitted at any of the district offices listed below:

Taxation and Revenue Department |

Taxation and Revenue Department |

Taxation and Revenue Department |

Taxation and Revenue Department |

Taxation and Revenue Department |

1200 South St Francis Dr |

Bank of the West Building |

2540 El Paseo, Bldg. #2 |

3501 E. Main St., Suite N |

400 N Pennsylvania Ave, Suite 200 |

PO Box 5374 |

5301 Central Ave. NE |

PO Box 607 |

PO Box 479 |

PO Box 1557 |

Santa Fe, NM |

PO Box 8485 |

Las Cruces, NM |

Farmington, NM |

Roswell, NM |

(505) |

Albuquerque, NM |

(575) |

(505) |

(575) |

|

(505) |

|

|

|

Please fax to (505)

Document Specifics

| Fact Name | Description |

|---|---|

| Form Identification | The official name of the form is "Tax Information Authorization Tax Disclosure," identified by the form number ACD - 31102, revised on January 15, 2020. |

| Required Fields | All sections marked with an asterisk (*) are required. Failure to complete these fields will void the form, preventing the disclosure of taxpayer information. |

| Expiration | The authorization granted by this form will expire one, two, or three years from the date it is signed, based on the selection made by the authorizing individual. |

| Governing Laws | The form operates under the jurisdiction of New Mexico State Law, specifically NMSA 1978, § 7-1-8, as well as federal law under 26 U.S.C. § 6103. |

| Authorized Uses | This form permits the New Mexico Taxation and Revenue Department Secretary or designated delegate to use facsimile and email for sharing confidential information, conditional on authorizing taxpayer consent. |

Guide to Writing Tax Information Authorization

Filling out the Tax Information Authorization form is an important step for individuals and entities in the State of New Mexico who need to authorize someone else to handle their tax matters. This process allows a designated representative to have access to confidential tax information, thereby facilitating smoother interactions with the State’s Taxation and Revenue Department. This authorization is particularly useful for those who seek professional help with their taxes or for entities that need to delegate this responsibility to a specific individual within the organization.

Here are the necessary steps to accurately complete the Tax Information Authorization form:

- Ensure you’re using black ink to fill out the form or type the information if the form is in a fillable PDF format.

-

Fill in the Taxpayer Information section:

- Enter the taxpayer(s) name(s) in the required field.

- Provide the Tax Identification Number(s), which could be a Social Security Number (SSN), Federal Employer Identification Number (FEIN), or other applicable numbers.

- List the reporting period(s), specifying the start and end date,

- Specify the tax year(s).

- If applicable, include the DBA (Doing Business As) name(s).

- Complete the mailing address, city, state, and zip code.

- Indicate the duration for which the authorization will be effective (1, 2, or 3 years).

- Select the tax program(s) for which this authorization will apply.

- Provide a telephone number and an email address for contact purposes.

- In the Authorized Representative(s) Information section:

- Enter the full name of the individual representative authorized to receive tax information.

- If appointing an additional representative, include their name as well.

- Provide the mailing address, city, state, and zip code for each representative.

- Include telephone numbers and email addresses for both representatives.

- Under Authorizing Signature(s), read the declaration and:

- If you agree, check the box to authorize electronic communication (fax, email).

- Print the name(s) and title(s) of the authorizing taxpayer(s) or authorized person if it's a business or estate.

- Sign and date the form. If it’s for a joint tax return or an entity like a business or estate, the necessary parties must provide their signatures.

After completing the form, it should be submitted to one of the district offices listed in the document. It can also be faxed to the number provided, especially for business registrations. For any further assistance or clarification, the Taxation and Revenue Department has provided a contact number and encourages individuals or entities to reach out. This step-by-step guide should help in filling out the form correctly and ensuring that the tax information authorization process is completed without any issues.

Understanding Tax Information Authorization

-

What is the Tax Information Authorization form and why do I need it?

The Tax Information Authorization form, known as ACD - 31102, issued by the State of New Mexico - Taxation and Revenue Department, grants permission to an authorized representative to receive confidential tax information on behalf of the taxpayer. It is necessary for individuals or entities who wish to allow another person, such as a tax advisor or attorney, to access their tax details for specified tax matters. This authorization helps in tax planning, compliance, or resolving issues with the Taxation and Revenue Department.

-

What fields are required to be completed on the form?

Key fields that must be completed include: taxpayer information such as names and Tax Identification Numbers; mailing address; effective duration for the authorization (one, two, or three years); specified tax programs; telephone number; and the information of the authorized representative(s), including names, mailing addresses, and contact details. Importantly, the form must bear the signature(s) of the authorizing taxpayer(s), acknowledging the authority granted to the listed representative(s). Failure to complete these required fields will result in the form being void.

-

How long does the authorization last, and what if I change my representative within that period?

The form allows taxpayers to choose the duration of the authorization—either one, two, or three years, starting from the date it is signed. Should there be a need to change the authorized representative within the selected time frame, the taxpayer is responsible for notifying the Department about this change to ensure that tax information is shared with the correct individual. Keeping the Department updated helps maintain the security and privacy of sensitive tax information.

-

Who must sign the Tax Information Authorization form?

The requirement for signing depends on the tax situation. For taxpayers filing a joint personal income tax return, both individuals must sign the form. In the case of a business or estate, the form must be signed by an individual with proper authority, such as a corporate officer, partner, or fiduciary, who is already identified as such with the Department. Ensuring the correct party signs the form is crucial for its validity and the processing of the authorization.

Common mistakes

When filling out the Tax Information Authorization form for the State of New Mexico, accuracy and thoroughness are critical. However, several common mistakes can lead to the form being voided or the processing delayed. It's essential to avoid these pitfalls to ensure the taxpayer's information can be shared as intended.

- Not using black ink: The form specifies that all entries should be made in black ink. Failing to do so can result in the form not being processed properly.

- Missing required fields: If any required fields, marked with an asterisk (*), are left incomplete, the form is considered void. This includes taxpayer information, authorized representative details, and the authorizing signature and date.

- Incorrect Tax Identification Number(s): Entering the wrong Tax Identification Number, Social Security Number, or Employer Identification Number can lead to misidentification and processing errors.

- Inaccurate Reporting Period(s): Mistakes in listing the correct starting and ending periods for which authorization is given can affect the validity of the authorization.

- Not specifying duration effectively: The form expires one, two, or three years from the signing date, as selected. Failing to clearly mark the chosen duration can lead to uncertainties regarding the authorization's validity.

- Leaving the tax program(s) section incomplete: Not specifying which tax programs the authorization is for can lead to incomplete authority to access required tax information.

- Incorrect or omitted contact information: Missing or incorrect mailing addresses, email addresses, telephone numbers, or fax numbers can prevent effective communication.

- Signature and date issues: For married couples filing jointly, both must sign. Businesses or estates need signatures from an identified corporate officer, partner, or fidiciary. Absent or incorrect signatures and dates will invalidate the form.

To ensure smooth processing and valid authorization, it's crucial that every part of the Tax Information Authorization form is filled out correctly and completely. Double-checking all areas for accuracy can significantly reduce processing errors and ensure that tax matters are handled efficiently and correctly.

Documents used along the form

When dealing with the intricacies of tax affairs, particularly for those in the United States, the Tax Information Authorization form is a crucial document that enables designated representatives to access or request an individual's or entity’s tax information from the tax authorities. Alongside this form, several other documents are commonly used to ensure comprehensive tax management, compliance, and effective representation. The importance of these documents spans across various dimensions of the tax process, including verification of identity, financial analysis, and legal authorization. Here is a closer look at some of these vital documents.

- Form 2848, Power of Attorney and Declaration of Representative: Utilized to grant a specific individual the authority to represent the taxpayer before the IRS. It specifies the tax matters and periods for which authorization is given.

- Form 8821, Tax Information Authorization: Allows designated parties to receive and inspect a taxpayer’s confidential information for the types specified on the form but does not allow them to represent the taxpayer before the IRS.

- Form W-9, Request for Taxpayer Identification Number and Certification: Used by individuals and entities to provide their taxpayer identification number to entities which will pay them income during the tax year.

- Form 4506, Request for Copy of Tax Return: Enables individuals and businesses to request copies of previously filed tax returns and tax information from the IRS, including attachments and all forms.

- Form 4506-T, Request for Transcript of Tax Return: This form is for requesting tax return transcripts, tax account information, wage and income statements, and verification of non-filing.

- Form 433-A, Collection Information Statement for Wage Earners and Self-Employed Individuals: This document provides the IRS with information about the taxpayer’s financial situation to assist with tax debt resolution.

- Form 433-B, Collection Information Statement for Businesses: Similar to Form 433-A, but specifically designed for businesses, providing the IRS with detailed information about the business's financial condition.

- Form 9465, Installment Agreement Request: Used by taxpayers to request a monthly installment plan if they cannot pay the full amount of taxes they owe.

- Form SS-4, Application for Employer Identification Number: Required for businesses to apply for an employer identification number (EIN), used to identify the tax accounts of employers and certain others who have no employees.

Understanding and properly utilizing these forms, along with the Tax Information Authorization form, is essential for accurate and lawful handling of tax matters. Whether for individual taxpayers, businesses, or tax professionals, these documents are foundational to managing responsibilities and rights within the tax system. Each form serves a unique purpose, ensuring that individuals and entities can maintain compliance, authorize appropriate representatives, and effectively address their tax-related needs.

Similar forms

The Power of Attorney (POA) form is closely related to the Tax Information Authorization form, serving a similar but broader purpose. While the Tax Information Authorization form focuses specifically on granting permission to access and discuss the taxpayer's confidential tax information, the POA goes a step further by allowing the appointed individual or organization to act on the taxpayer's behalf in a wide range of financial and legal matters beyond just tax issues. This distinction highlights the POA's broader scope of authority.

The Form 8821, Tax Information Authorization, issued by the IRS, shares a similar intention with its state-level counterpart, targeting the authorization to disclose tax information. Both forms serve the purpose of authorizing individuals or entities to receive confidential tax information, but the IRS's Form 8821 is utilized for federal tax matters. They align in function by enabling representation in discussions with tax authorities, though their jurisdictional scopes differ, one being federal and the other state-focused.

Third Party Designee Authorization, often included in the process of filing taxes, allows the tax preparer to discuss the filed tax return with the IRS. This form is somewhat like a narrower version of the Tax Information Authorization, as it is limited to discussions about the specific tax return it accompanies. It's the immediacy and specific context of the authorization that sets it apart, focusing solely on addressing issues or questions about a particular filing.

The Consent to Release form, prevalent in various bureaucratic and medical settings, echoes the intent behind the Tax Information Authorization form by allowing the release of personal or confidential information to a designated third party. Though similar in concept—granting permission to share personal information—the Consent to Release can encompass a broader range of information beyond taxes, including medical, educational, and financial records.

The Business Consent Form, commonly used when conducting transactions involving corporate entities, parallels the Tax Information Authorization form in its essence of permitting actions on one's behalf. This document enables businesses to authorize individuals or other companies to conduct specific actions or access certain information pertinent to the business. Its similarity lies in the empowerment of representation, albeit within the more focused realm of business operations.

The HIPAA Authorization Form, under the Health Insurance Portability and Accountability Act, authorizes healthcare providers to disclose an individual’s health information to specified parties. This form, while specific to medical information, parallels the Tax Information Authorization form in its fundamental function of granting permission to share confidential information with third parties, highlighting the importance of confidentiality across various sectors.

The Financial Information Release Form, often used in financial institutions and lending scenarios, permits the sharing of one's financial records with designated parties. Like the Tax Information Authorization form, this document is designed to allow third parties to access sensitive financial information, underpinning the principle of authorized disclosure for specified purposes, albeit in broader financial contexts than tax-specific matters.

The Student Information Release Form, found in educational institutions, serves a similar purpose by allowing the release of a student's academic records to specified individuals or entities. This authorization, much like the Tax Information Authorization, deals with the handling of personal information, though it focuses on educational records and achievements rather than tax details, emphasizing the theme of privacy and permission in information sharing.

The Records Release Authorization Form, utilized across various fields to authorize the sharing of different types of records, shares a core premise with the Tax Information Authorization form. Both forms are built around the concept of giving consent for third parties to access personal or confidential records, reinforcing the necessity of explicit authorization regardless of the type of information being disclosed.

Dos and Don'ts

When completing the Tax Information Authorization form, it's crucial to follow specific dos and don'ts to ensure the process is smooth and error-free. Observing these guidelines can prevent delays and ensure your information is accurately processed.

Do:- Use black ink: Whether you're filling out the form by hand or typing, ensure that all entries are made in black ink to ensure clarity and legibility.

- Complete all required fields: Mandatory fields are marked with an asterisk (*). Failure to complete these fields will result in the form being considered void, and the taxpayer's information will not be shared.

- Check the appropriate boxes: For selections such as the effective period of the authorization and the tax programs applicable to your situation, make sure to check the correct boxes that reflect your intentions and requirements accurately.

- Provide accurate contact information: Ensure that the telephone numbers, email addresses, and fax numbers provided are current and correct. This information will be used for sending confidential information.

- Sign and date the form: The form requires a signature and date to be valid. If filing for a joint personal income tax return, both taxpayers must sign. Businesses or estates must have the form signed by an authorized individual.

- Leave required fields blank: Ignoring fields marked with an asterisk (*) will render the form void, preventing the processing of your authorization.

- Use any ink color other than black: Submissions made in colors other than black may face issues in processing or legibility, potentially causing unnecessary delays.

- Forget to check the authorization box for electronic communication: If you prefer to receive information via fax or email, ensure you check the corresponding box authorizing this method of communication.

- Provide outdated or incorrect contact information: Double-check all contact details you provide. Incorrect information can lead to privacy breaches or delayed communications.

- Submit without verifying all details: Before submission, review the entire form to ensure that all information is accurate and no required fields have been missed.

Misconceptions

There are several misconceptions surrounding the Tax Information Authorization form, particularly when dealing with the State of New Mexico - Taxation and Revenue Department. Clarity on these issues is pivotal for taxpayers and their representatives to navigate the authorization process effectively. Here are six common misconceptions explained:

- Only the taxpayer needs to sign the form: A common misunderstanding is that only the individual or business entity directly involved needs to sign the Tax Information Authorization form. However, for married couples filing jointly, both individuals must sign. Additionally, in the case of a business or estate, a corporate officer, partner, or fiduciary, who has been identified as such to the Department, must sign the form.

- The form remains valid indefinitely: Another misconception is that once signed, the authorization does not expire. Contrary to this belief, the form expires one, two, or three years from the signing date, depending on the duration selected. Thus, it's essential to renew the authorization as needed.

- The form covers only federal tax matters: Some might think the authorization is solely for federal tax matters. However, the form grants authority to the representative to handle both federal and state tax matters as indicated, ensuring comprehensive coverage across different tax jurisdictions.

- All tax matters are automatically included: There's a belief that signing the form provides the representative access to all the taxpayer’s tax matters by default. In reality, the form allows for specific tax programs to be selected, which means only those checked will be covered. Taxpayers need to be precise about which taxes the authorization applies to.

- Any representative can be authorized regardless of their qualifications: Some people might assume that anyone can be authorized as a representative on the form without consideration of their qualifications. Factually, the authorized representative should be someone who is qualified to deal with tax matters, such as an accountant or tax attorney, to ensure proper handling of sensitive information and decisions.

- Email and fax are the default communication methods: Lastly, there is a notion that the Department will automatically use email or fax for communication once the form is submitted. This is not the case; the taxpayer must specifically opt-in by checking the appropriate box on the form to authorize communication via email and/or fax, which is crucial for ensuring the secure transmission of confidential information.

Understanding these aspects of the Tax Information Authorization form can significantly enhance the authorization process, providing clarity and efficiency for taxpayers and their representatives. It’s essential for all parties involved to be well-informed to facilitate the appropriate sharing and handling of tax information.

Key takeaways

Understanding the Tax Information Authorization form is crucial for those seeking to navigate their tax affairs with precision. It is designed to authorize the release of confidential tax information by the State of New Mexico. Here are key takeaways:

- Ensure all required fields are filled out using black ink, as incomplete forms will be considered void, halting the sharing of taxpayer information.

- The form's validity stretches up to one, two, or three years, based on the taxpayer's selection, from the signature date, necessitating timely updates for any changes in authorized representatives.

- Both individual taxpayers and businesses must provide comprehensive taxpayer information, including names, tax identification numbers, reporting periods, and precise mailing addresses.

- Selection of the tax program is mandatory, with options ranging from Personal Income Tax to Oil and Gas Taxes, highlighting the scope of information authorization.

- The authorized representative(s) must be meticulously identified with their full name, mailing address, and contact information to ensure proper communication channels.

- By signing the form, the taxpayer acknowledges that the listed individual representative(s) have the power to access confidential Federal and State tax information.

- If opting for communication via facsimile or email, taxpayers must explicitly authorize this by checking the designated box, agreeing that the provided contacts will be used for transmitting confidential information.

- For joint personal income tax returns, signatures from both spouses are mandatory. Similarly, a corporate officer, partner, or fiduciary must sign for businesses or estates, affirming their authority to request and receive tax information.

It is imperative to understand that accuracy and completeness when filling out this form directly impacts the efficiency and security of tax information handling. Taxpayers are encouraged to approach this task with careful attention to detail, ensuring that their rights and privacy are adequately safeguarded.

Popular PDF Documents

Saanich School First Aid Record - A structured tool for reporting injuries or illnesses within the school, ensuring accurate communication with human resources and health and safety managers.

IRS Schedule D 1040 or 1040-SR - Schedule D is essential for taxpayers who have sold assets and need to calculate their tax liability on these transactions.