Get Tax Exemption Certification Form

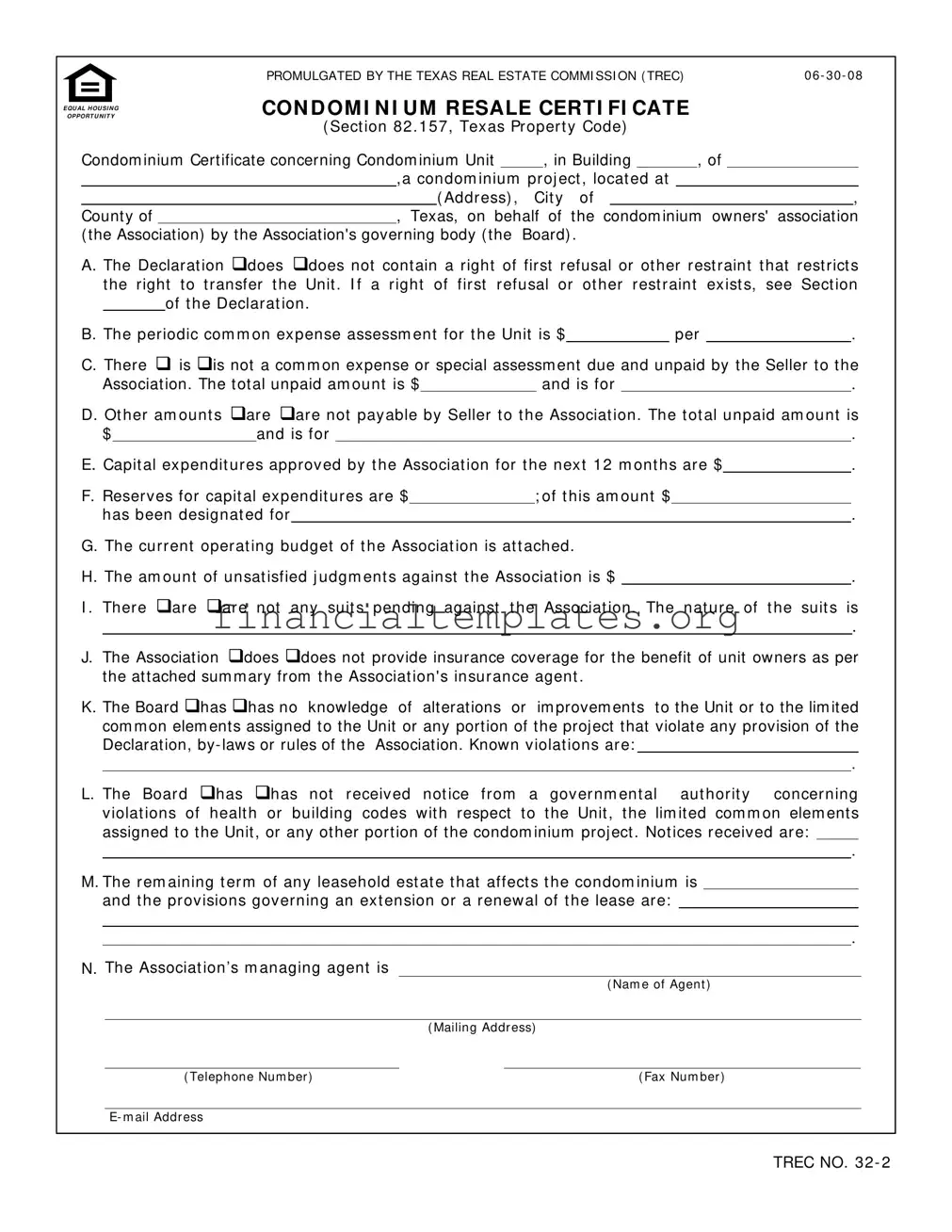

In the dynamic world of real estate transactions, the Tax Exemption Certification form, specifically designed by the Texas Real Estate Commission (TREC), serves a pivotal role, especially in the context of condominium resale. This form, identified as TREC NO. 32-2, official as of June 30, 2008, encapsulates critical information concerning the sale of condominium units. It offers a thorough overview on various elements including, but not limited to, any restrictions on the transfer of the unit, details about periodic common expense assessments, and the financial health of the condominium owners' association. Detailed sections cover outstanding payments due to the association by the seller, approved capital expenditures, reserve funds for future expenses, and the association’s current operating budget. Beyond finances, the document delves into insurance coverage provided for unit owners, potential alterations or improvements to the units that might breach the association’s regulations, and any notices from governmental authorities regarding health or building code violations. It also touches on the management of the condominium project, including disclosures about the association's managing agent and any fees associated with the transfer of the unit. Navigate through this intricacy, this form is indispensable for ensuring transparency and safeguarding the interests of all parties involved in the resale of a condominium unit, making it an essential tool for real estate professionals, buyers, and sellers alike in the state of Texas.

Tax Exemption Certification Example

PROMULGATED BY THE TEXAS REAL ESTATE COMMI SSI ON ( TREC) |

06 - 30- 08 |

|

|

|

|

|

|

|

|

|

|

CON D OM I N I U M RESALE CERTI FI CATE |

|

|

|

||||||||||||||||||||||

OPPORT U N I T Y |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

EQU AL H OU S I N G |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

( Sect ion 82 . 157, Texas Proper t y Code) |

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

Condom inium Certificate concerning Condom inium Unit |

|

|

|

, in Building |

|

|

, of |

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

,a condom inium proj ect , locat ed at |

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( Addr ess) , |

Cit y |

of |

|

|

|

|

|

|

|

, |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

County of |

|

|

|

|

|

|

|

, Texas, on behalf of the condom inium owners' association |

||||||||||||||||||||||||

|

|

|

( the Association) by the Association's governing body ( the Board) . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

A. The Declarat ion |

does |

does not cont ain a right |

of first refusal or ot her rest raint |

t hat |

rest rict s |

|||||||||||||||||||||||||||

|

|

|

|

t he right t o |

t ransfer t he Unit . I f a r ight of fir st r efusal or |

ot her r est r aint exist s, |

see |

Sect ion |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

of t he Declarat ion . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

B. The periodic com m on ex pense assessm ent for t he Unit is $ |

|

|

|

|

|

|

|

per |

|

|

. |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

C. There |

|

is |

is not a com m on expense or special assessm ent due and unpaid by t he Seller t o t he |

|||||||||||||||||||||||||||||

|

|

|

Associat ion. The t ot al unpaid am ount is $ |

|

|

and is for |

|

|

|

|

|

|

|

. |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

D. Ot her am ount s |

are |

are not payable by Seller t o t he Associat ion . The t ot al unpaid am ount is |

||||||||||||||||||||||||||||||

$ |

|

|

|

|

|

and is for |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

E. Capit al ex pendit ures approved by t he Associat ion for t he next 12 m ont hs are $ |

|

. |

||||||||||||||||||||||||||||||

|

|

|

F. Reserves for capit al expendit ur es are $ |

|

|

; of t his am ount $ |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

has been designat ed for |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

G. The current operat ing budget of t he Associat ion is at t ached. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

H. The am ount of unsat isfied j udgm ent s against t he Associat ion is $ |

|

|

|

|

|

|

|

. |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

I . There |

|

ar e |

ar e not |

any suit s pending against |

t he Associat ion . The |

nat ure of |

t he |

suit s is |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

J. The Association |

does |

does not provide insurance coverage for the benefit of unit owners as per |

||||||||||||||||||||||||||||||

|

|

|

the at tached sum m ary from t he Associat ion's insur ance agent . |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

K. The Board |

has |

has no knowledge of alterations |

or |

im provem ents to the Unit or to the lim ited |

||||||||||||||||||||||||||||

com m on elem ents assigned to the Unit or any portion of the project that violat e any provision of the Declarat ion, by- laws or rules of t he Associat ion. Known violat ions ar e:

|

|

|

|

|

|

|

. |

L. The Boar d |

has |

has not r eceived |

not ice from |

a |

gov er nm ent al aut horit y concer ning |

||

violat ions of |

healt h |

or building codes |

wit h respect |

t o |

t he Unit , t he lim it ed com m on elem ent s |

||

assigned to t he Unit , or any ot her port ion of the condom inium proj ect . Not ices r eceived ar e:

.

M. The r em aining t er m of any leasehold est at e t hat affect s t he condom inium is and t he provisions governing an ex t ension or a renew al of t he lease are:

.

N. The Associat ion’s m anaging agent is

( Nam e of Agent )

( Mailing Addr ess)

( Telephone Num ber ) |

( Fax Num ber ) |

E- m ail Addr ess

TREC NO. 32 - 2

Condom inium Resale Cer t ificat e Concer ning |

Page 2 of 2 06 - 30 - 08 |

||||

|

|

|

|

|

|

|

( Addr ess of Pr oper t y ) |

|

|

|

|

O. Associat ion fees r esult ing fr om t he t r ansfer of t he unit described abov e $ |

|

. |

|

||

P. Required cont ribut ion, if any , t o t he capit al reser v es account $ |

|

|

. |

|

|

REQUI RED ATTACHMENTS: |

|

|

|

||

1 |

. Oper at ing Budget |

|

|

|

|

2 |

. I nsurance Sum m ary |

|

|

|

|

N OTI CE: Th e Ce r t if ica t e m u st b e p r e p a r e d n o m or e t h a n t h r e e m on t h s b e f or e t h e d a t e it is d e liv e r e d t o Bu y e r .

Nam e of Associat ion

By:

Nam e:

Tit le:

Dat e:

Mailing Address:

E- m ail:

This form has been appr ov ed by t he Tex as Real Est at e Com m ission for use wit h sim ilarly appr ov ed or prom ulgat ed

cont r act form s. Such |

approval |

r elat es t o t his form only . |

TREC for m s are int ended for |

use only by t rained r eal |

|

est at e licensees. No repr esent at ion is m ade as t o t he legal |

validit y or adequacy of any |

provision in any specific |

|||

t r ansact ions. I t is not |

suit able for com plex t ransact ions. Tex as Real Est at e Com m ission, P. O. Box |

12188, Aust in, TX |

|||

78711 - 2188, 1 - 80 0 - 250 - 8732 or |

( 512) 459 - 6544 ( ht t p: / / w w w . t r ec. st at e. t x . us) TREC No. |

32- 2. |

This form replaces |

||

TREC No. 32- 1. |

|

|

|

|

|

TREC NO. 32 - 2

Document Specifics

| Fact | Description |

|---|---|

| Promulgating Authority | The form is promulgated by the Texas Real Estate Commission (TREC). |

| Form Number and Replacement | TREC No. 32-2, replacing TREC No. 32-1. |

| Applicability Date | Dated June 30, 2008. |

| Governing Law | Governed by Section 82.157 of the Texas Property Code. |

| Preparation Timeframe | The certificate must be prepared no more than three months before it is delivered to the buyer. |

| Form Approval | Approved by the Texas Real Estate Commission for use with similarly approved or promulgated contract forms. Intended for use by trained real estate licensees only. |

| Contact Information for TREC | Texas Real Estate Commission, P.O. Box 12188, Austin, TX 78711-2188, 1-800-250-8732 or (512) 459-6544. Website: http://www.trec.state.tx.us |

Guide to Writing Tax Exemption Certification

Filling out a Tax Exemption Certification form, especially in the context of real estate transactions, demands attention to detail and an understanding of the specific condo unit in question. Each section of the form provides critical information about the condominium, its financial status, the owners' association actions, and the physical condition of the unit and the overall condominium project. Completing this form accurately ensures compliance with the Texas Property Code and facilitates a smooth transaction process by providing the buyer with essential information. Here are the steps to fill out the form correctly:

- Start by identifying the condominium unit and building within the condominium project. Fill in the condominium’s name, the unit number, the building designation, and the complete address including city, county, and state.

- In section A, indicate whether the Declaration includes a right of first refusal or other restraints that restrict the transfer of the Unit. If such a restraint exists, reference the specific section of the Declaration.

- In section B, state the periodic common expense assessment for the Unit, including the amount and the frequency (e.g., monthly, quarterly).

- For section C, disclose if there is a common expense or special assessment due and unpaid by the Seller to the Association. If applicable, specify the total unpaid amount and describe what the assessment is for.

- Section D requires indicating whether there are other amounts payable by the Seller to the Association. If so, list the total amount due and its purpose.

- In section E, report any capital expenditures approved by the Association for the next 12 months, including the total amount.

- Section F is for disclosing the reserves for capital expenditures, including the amount designated for specific purposes.

- Attach the current operating budget of the Association as required in section G.

- Section H asks for the amount of any unsatisfied judgments against the Association.

- Indicate in section I if there are any pending lawsuits against the Association and provide the nature of the suits.

- For section J, state whether the Association provides insurance coverage for the benefit of unit owners and attach a summary from the Association's insurance agent.

- In section K, disclose any knowledge of alterations or improvements to the Unit or to the limited common elements assigned to the Unit that violate the Declaration, by-laws, or rules of the Association. List any known violations.

- Section L requires indicating whether the Board has received notice from a governmental authority regarding violations of health or building codes, specifying the Unit, the limited common elements assigned to the Unit, or any other portion of the condominium project.

- Fill in the remaining term of any leasehold estate that affects the condominium in section M and describe the provisions governing an extension or a renewal of the lease.

- In section N, provide the name, mailing address, telephone number, fax number, and email address of the Association’s managing agent.

- Specify association fees resulting from the transfer of the unit and required contribution, if any, to the capital reserves account in sections O and P, respectively.

- Ensure all required attachments, such as the Operating Budget and Insurance Summary, are included with the form.

- Finally, have a representative of the Association fill in the Name of Association, their name, title, the date, and their contact information at the end of the form. Ensure the document is signed by the authorized person within the Association.

Upon completion, review the form thoroughly for accuracy. This document, once correctly filled out and submitted, plays a vital role in the real estate transaction process, providing transparency and vital details to the buyer. Proper completion and timely distribution of this form help avoid delays and ensure compliance with the relevant legal requirements.

Understanding Tax Exemption Certification

FAQ: Tax Exemption Certification Form

- What is the purpose of the Tax Exemption Certification Form?

- Who needs to complete the Tax Exemption Certification Form?

- When should the Tax Exemption Certification Form be prepared?

- What sections are included in the form?

- The existence of any rights of first refusal or other restrictions on the transfer of the unit.

- Details on periodic and special assessments, including any outstanding amounts.

- Capital expenditures and reserves for future expenses.

- Information about the current operating budget and any unsatisfied judgments against the association.

- Insurance coverage provided for the benefit of unit owners.

- Compliance with the declaration, by-laws, health, and building codes.

- Details about the association's managing agent.

- Are there any attachment requirements?

- What happens if alterations or violations are reported on the form?

- How does one obtain and submit the Tax Exemption Certification Form?

The Tax Exemption Certification Form is designed to provide comprehensive details about a condominium unit concerning its financial and legal status as required by the Texas Real Estate Commission (TREC). This includes information on fees, assessments, insurance, and compliance with local regulations, which is crucial for potential buyers and the condominium association.

This form must be completed by the condominium association's governing body, often referred to as the Board. It's meant to be filled out prior to the resale of a condominium unit to provide the buyer with important details about the unit and the overall project.

It is required that the form be prepared no more than three months before the date it is delivered to the buyer. This ensures that the information provided is current and accurately reflects the condominium's financial and legal standing.

The form includes various sections that detail:

Yes, the form requires attachments including the operating budget and an insurance summary. These attachments provide critical additional details that help in understanding the financial health and insurance protections of the condominium project.

If the Board is aware of any alterations, improvements, or violations that do not comply with the association's declaration, by-laws, or rules, these must be documented on the form. Potential buyers must be made aware of these issues as they could impact the legality and value of the property.

This form is approved for use by the Texas Real Estate Commission and can be obtained from their website or through licensed real estate professionals. Once completed, it should be delivered to the buyer and any relevant parties involved in the transaction of the condominium unit.

Common mistakes

Filling out the Tax Exemption Certification form is crucial and requires your full attention. Unfortunately, small mistakes can lead to big headaches. To help you navigate this important document more effectively, let’s explore seven common mistakes people often make:

- Overlooking Required Attachments: Every form has its prerequisites, and this one demands an operating budget and insurance summary. Missing these attachments can render your certification incomplete.

- Inaccurate Financial Information: Financial details such as the periodic common expense assessment and any approved capital expenditures must be accurately reported. Mistakes here can mislead and result in financial discrepancies.

- Not Updating the Documentation Regularly: The certification must be prepared no more than three months before being delivered to the buyer. Outdated information can cause unnecessary delays or even jeopardize sales.

- Ignoring the Declaration Section: Whether the declaration contains a right of first refusal or other restrictions, this section cannot be skipped. It directly affects the transferability of the unit.

- Failure to Disclose Pending Legal Actions: If there are any suits pending against the Association, these must be outlined clearly. Overlooking or omitting this information can have legal ramifications.

- Neglecting to Verify Insurance Coverage: The form requires a summary of insurance coverage provided for the benefit of unit owners. Assuming or guessing instead of attaching verified information can lead to disputes.

- Incorrectly Listing the Association’s Managing Agent: The managing agent’s details including name, address, and contact information need to be filled out accurately. Any errors here can lead to communication issues.

Remember, filling out the Tax Exemption Certification form is more than just checking boxes and signing on the dotted line. It requires thorough verification and attention to detail. By steering clear of these common mistakes, you’re not only safeguarding yourself but also ensuring a smoother process for everyone involved.

Documents used along the form

When organizations or individuals apply for tax exemption, the Tax Exemption Certification form is a crucial document. However, it's often just one piece of the puzzle. To complete the application process or to manage tax-exempt transactions, several other forms and documents typically come into play. Below is a list of documents often used alongside the Tax Exemption Certification form, helping to streamline various procedures and ensure compliance.

- Articles of Incorporation: This document establishes the creation of a new corporation. It must be filed with the state's secretary of state and includes details like the corporation's name, purpose, and the type of corporate structure it will have.

- Bylaws: Bylaws outline the rules that govern the internal management of an organization. They are adopted by the board of directors and cover topics such as how meetings are held, the duties of officers, and the process for handling amendments to the bylaws.

- IRS Form 1023 or 1023-EZ: These forms are used by organizations seeking recognition of exemption under Section 501(c)(3) of the Internal Revenue Code. Form 1023-EZ is a streamlined version of Form 1023 and is designed for smaller organizations.

- IRS Determination Letter: Once an organization’s Form 1023 or 1023-EZ is approved, the IRS issues a Determination Letter, confirming the organization’s tax-exempt status.

- Annual Report: Many states require tax-exempt organizations to file an annual report. This may include financial statements and updates on the organization's governance and operations.

- W-9 Form: This form is requested by companies or individuals who are paying a tax-exempt entity. It provides the payor with necessary information, such as the organization's taxpayer identification number (TIN).

- Statement of Financial Activities: This financial statement, often necessary for auditors, donors, or grant applications, discloses the organization's revenues, expenses, and net assets. It's crucial for demonstrating how funds are used within the organization.

Together with the Tax Exemption Certification form, these documents form a comprehensive kit for managing a tax-exempt entity's administrative and compliance needs. Each serves a unique purpose, from establishing the legal basis for operation to ensuring ongoing compliance with tax and reporting requirements. Leveraging these documents effectively can significantly ease the administrative burdens of managing a tax-exempt organization and maintain its good standing with regulatory authorities.

Similar forms

The Tax Exemption Certification form shares similarities with the Form W-9, Request for Taxpayer Identification Number and Certification. Both forms require the provision of specific information that aids in tax identification and compliance. The W-9 form is used to provide a Taxpayer Identification Number (TIN) to entities that pay you income, ensuring proper reporting to the IRS. Similarly, the Tax Exemption Certification helps in identifying the tax status of the entity involved, contributing to tax compliance and the accurate processing of transactions.

Another closely related document is the 501(c)(3) determination letter from the Internal Revenue Service. This letter is a critical document for nonprofit organizations, certifying their tax-exempt status under section 501(c)(3) of the Internal Revenue Code. Like the Tax Exemption Certification form, it serves as formal recognition of an entity’s tax status, which is essential for exemption from federal income tax and eligibility to receive tax-deductible charitable contributions. Both documents validate the entity's tax-related privileges and obligations.

The Sales Tax Exemption Certificate operates in a parallel manner by allowing qualified individuals or organizations to purchase goods without paying the sales tax. This form, much like the Tax Exemption Certification, is used to formally certify that an entity is eligible for a tax exemption under specific circumstances. While each form applies to different tax types—sales tax versus various other exemptions—they both function as authoritative proof of eligibility for tax exemptions.

Uniform Commercial Code (UCC) financing statements also bear resemblance in function. These statements are filed to give notice of secured interest in personal property, securing the position of creditors. Although focusing on security interests rather than tax exemption, both UCC statements and Tax Exemption Certifications establish formal claims—whether on property for secured transactions or on tax-exempt status for transactions exempt from certain taxes.

Mortgage applications are similarly structured to require detailed information for transaction processing, akin to the Tax Exemption Certification form. While mortgage applications compile financial data and property information to assess creditworthiness and property value, the Tax Exemption Certification compiles details necessary for tax status verification. Each document gathers and verifies critical information for its specific transactional context.

Environmental impact assessments (EIAs) share the foundational principle of providing comprehensive insights into significant aspects of a specific activity, similar to Tax Exemption Certification forms. EIAs detail the environmental consequences of proposed projects, ensuring that decision-makers consider these impacts. The parallel lies in their purpose to inform and guide responsible decision-making, whether for environmental protection or tax compliance.

Building permits are issued by local government agencies to ensure that proposed construction complies with building codes. Like the Tax Exemption Certification form, a building permit is a necessary document that certifies approval to proceed with construction activities under specified conditions. Both documents facilitate regulatory compliance and official recognition of the entity’s right to proceed with certain activities.

The Business License application is another document with similarities. Required for legally operating a business within a specific jurisdiction, this application, when approved, results in a document that certifies the business’s compliance with local laws and regulations. Like the Tax Exemption Certification, it’s a form of official authorization, but for operating a business rather than for tax exemption purposes.

Lastly, the Employee Identification Number (EIN) application (Form SS-4) submitted to the Internal Revenue Service is akin to the Tax Exemption Certification. The EIN application is crucial for businesses to be properly identified for tax purposes. Both the EIN application and the Tax Exemption Certification form facilitate regulatory and tax compliance, ensuring that entities are appropriately categorized and processed in the tax system.

Dos and Don'ts

When you're filling out the Tax Exemption Certification form, especially one as detailed as the Condominium Resale Certificate provided by the Texas Real Estate Commission, there are important guidelines you should follow to ensure accuracy and compliance. Here’s a list of dos and don'ts to help guide you through the process.

- Do thoroughly review the entire form before you start filling it out to ensure you understand all the requirements and have all the necessary information at hand.

- Do provide accurate and complete information for every section to avoid delays or legal issues.

- Do use black ink or type the information if the form allows to ensure legibility.

- Do double-check the amounts listed for assessments, fees, and contributions to ensure they match the current figures.

- Do attach all required documents, such as the operating budget and insurance summary, as indicated in the form’s instructions.

- Don't leave any fields blank unless the form specifically instructs you to do so if certain conditions do not apply.

- Don't guess or approximate values. Ensure that all financial information is accurate and up to date.

- Don't alter or omit any pre-printed wording on the form, as this could invalidate your submission or cause legal troubles.

- Don't sign the document until you have filled in everything. Your signature certifies that you have provided complete and accurate information.

- Don't delay submitting the form beyond any deadlines, especially since the certificate must be prepared no more than three months before it is delivered to the buyer, as noted within the document.

Following these guidelines can help you navigate the process of completing the Tax Exemption Certification form more smoothly and ensure that you are in compliance with the Texas Real Estate Commission regulations.

Misconceptions

When navigating through the nuances of real estate transactions, especially those involving condominiums in Texas, the Tax Exemption Certification form plays a crucial role. However, there's a host of misconceptions surrounding this form, which often lead to confusion. Let's clarify some common misunderstandings to ensure parties involved in such transactions are well-informed.

It's only about taxes: Despite the name, the Tax Exemption Certification form encompasses much more than just tax-related information. It provides a comprehensive overview of the financial and legal standing of a condominium unit, including assessments, capital expenditures, insurance, and legal actions involving the condominium association.

Anyone can prepare it: The preparation of this form is not something to be taken lightly. It must be prepared by or under the supervision of the condominium association's board or its designated manager. This ensures the information is accurate and up-to-date.

No legal review needed: Given that this form contains information critical to a condominium transaction, it's advisable to have it reviewed by a legal professional. This can help identify potential issues that may affect the transaction or the future of the property.

It's valid indefinitely: The form is only valid for a limited time, specifically, it must be prepared no more than three months before it is delivered to the buyer. This requirement ensures that buyers receive current information about the condominium's financial and legal status.

Insurance information is optional: The form must include a summary of the insurance coverage provided for the benefit of unit owners. This information is crucial as it affects the liability and financial security of the unit buyer.

All condominiums are the same: Every condominium project has unique features, rules, and financial standings. The form provides specific information about the unit in question and its associated project, highlighting the need for detailed review in each individual case.

It's merely a formality: The Tax Exemption Certification form is a critical document that protects the interests of buyers, sellers, and the condominium association. It ensures transparency and full disclosure, key to any real estate transaction's success.

In conclusion, understanding the Tax Exemption Certification form's significance and ensuring it is accurately prepared and reviewed can dramatically impact the smooth transition of property ownership within condominium transactions. By dispelling these misconceptions, parties involved can approach transactions with the correct knowledge and expectations.

Key takeaways

Filling out and using the Tax Exemption Certification form requires careful attention to detail and thorough understanding of your obligations and rights as part of a condominium owners' association. Here are seven key takeaways from reviewing the form:

- Timeliness is crucial: The certificate must be prepared no more than three months before the date it is delivered to the buyer. This ensures that the information is current and accurate, reflecting any recent changes that might affect the condominium unit's status or the association's financial health.

- Disclosure of rights and restrictions: The form requires disclosure of any right of first refusal or other restrictions that could affect the unit's transferability. It's important that these details are clearly understood and accurately reported to avoid any legal complications during the sale process.

- Financial obligations are outlined: The certificate details any common expense assessments, special assessments, and other amounts payable by the seller to the association. Understanding these financial obligations is essential for both parties to ensure all debts are settled at the time of sale.

- Reserve funds and capital expenditures: Information regarding the association's reserves for capital expenditures and any approved capital expenditures for the next 12 months must be provided. This gives buyers insight into the financial planning and potential future costs associated with maintaining the condominium project.

- Insurance coverage: The form specifies whether the association provides insurance coverage for the benefit of unit owners. This information helps buyers understand their potential liabilities and the extent of coverage provided by the association.

- Compliance with governing documents: It's critical to report any known violations of the condominium project's declaration, by-laws, or rules by the unit or common elements. This section highlights the association's governance and rule enforcement within the community.

- Government compliance and contacts: The form includes sections for reporting any governmental notices of code violations and listing the association's managing agent. This information is important for transparency and ensures that the buyer has contacts for future communications.

By carefully filling out the Tax Exemption Certification form and understanding its components, condominium owners' associations and potential buyers can navigate the transfer process more smoothly and with greater awareness of their rights and obligations within the transaction.

Popular PDF Documents

Form W-8eci - By filling out the W-8EXP, foreign entities can navigate U.S. tax laws more effectively.

Form 990 T - Aside from income reporting, the 990-T form also allows tax-exempt entities to claim deductions related to their unrelated business income.