Get Tax Declaration Nat 3092 Form

Understanding the Tax Declaration NAT 3092 form is crucial for anyone entering the workforce, changing jobs, or needing to update their tax withholdings. This form plays a key role in the pay as you go (PAYG) withholding system, ensuring that payers—whether businesses or individuals—can accurately calculate the amount of tax to withhold from payments made to payees. It is designed to collect essential information from the payee, such as tax file number (TFN), residency status for tax purposes, and whether the payee wishes to claim the tax-free threshold. Importantly, it should be completed before receiving payments from a new payer, covering various payment types from employment income to superannuation benefits. Misinformation on this form can lead to incorrect tax withholdings, potentially affecting financial outcomes for the payee. The NAT 3092 form is not for TFN application; individuals without a TFN must apply through different channels. With segments devoted to both payer and payee information, this form acts as a cornerstone for tax-related communications between individuals and those from whom they receive payments, underscoring the importance of accurate, up-to-date tax information in the broader financial landscape.

Tax Declaration Nat 3092 Example

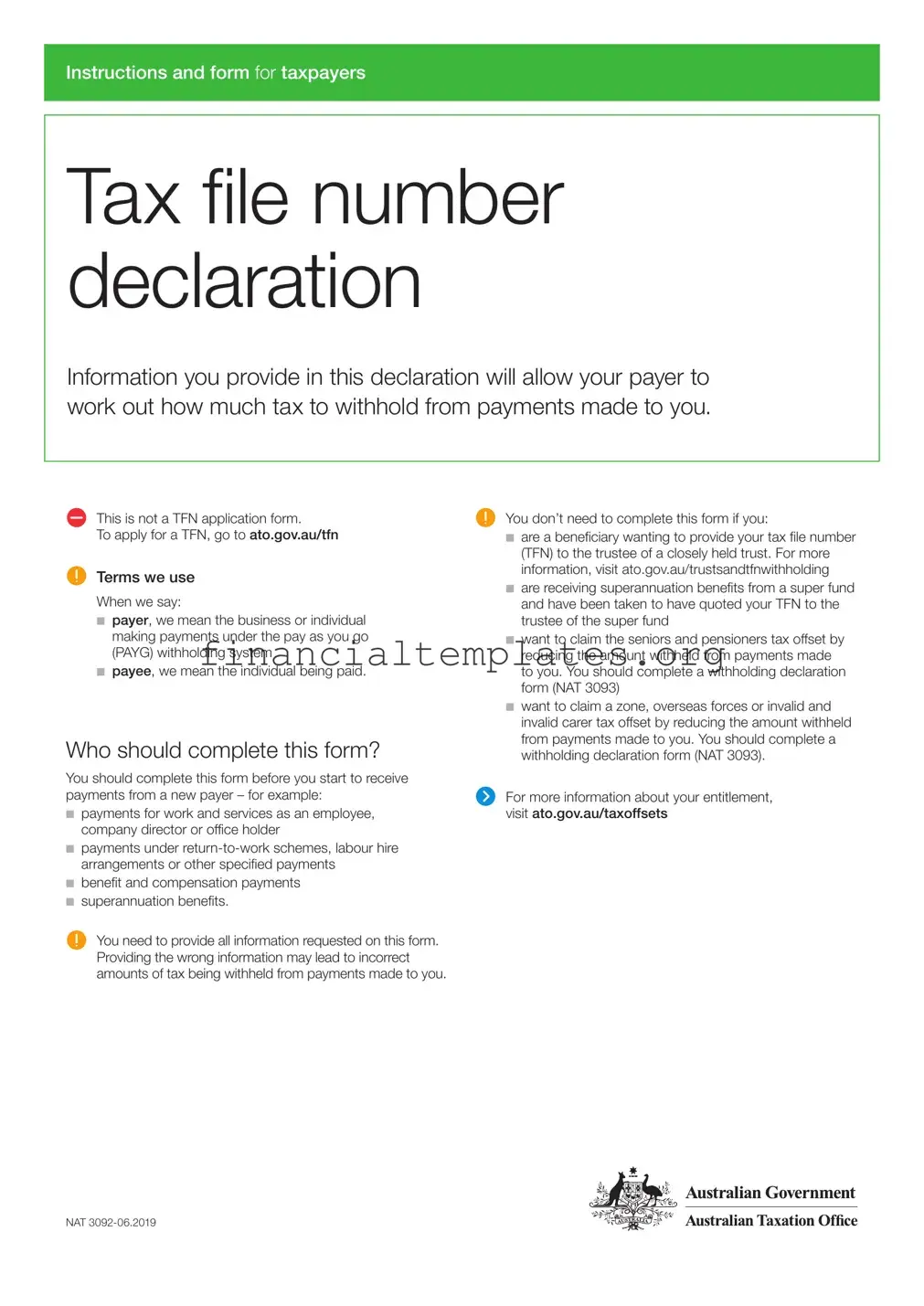

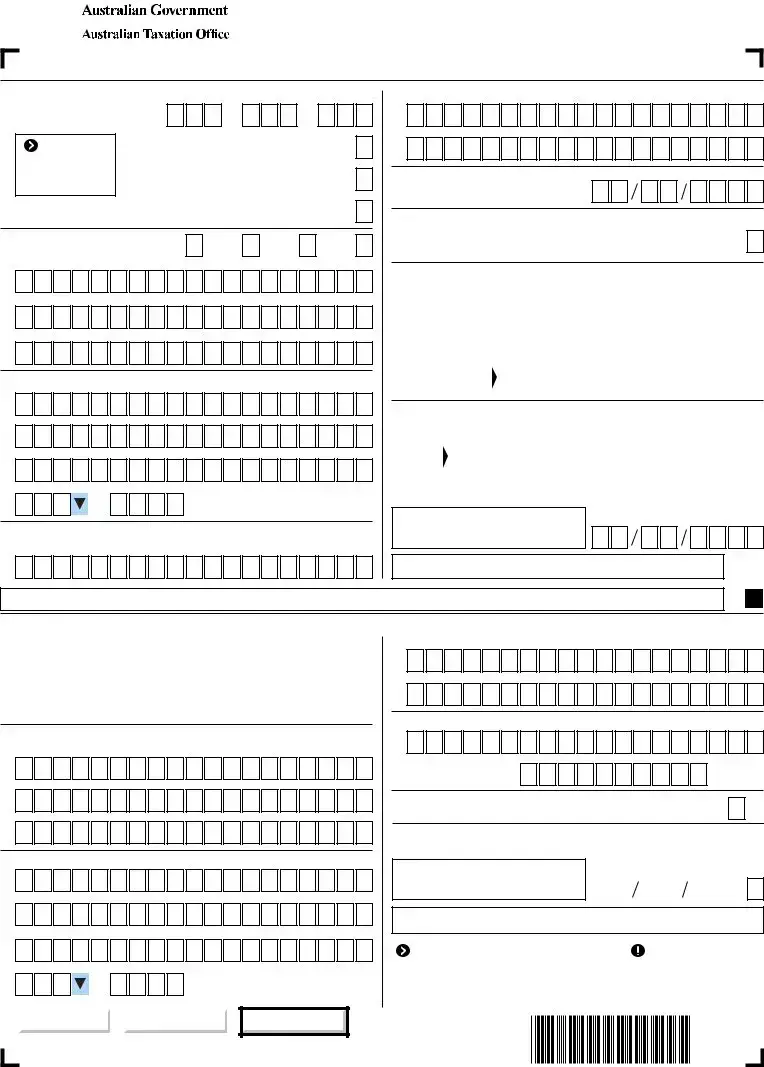

Instructions and form for taxpayers

Tax file number declaration

Information you provide in this declaration will allow your payer to work out how much tax to withhold from payments made to you.

This is not a TFN application form.

To apply for a TFN, go to ato.gov.au/tfn

Terms we use

When we say:

■■payer, we mean the business or individual making payments under the pay as you go (PAYG) withholding system

■■payee, we mean the individual being paid.

Who should complete this form?

You should complete this form before you start to receive payments from a new payer – for example:

■■payments for work and services as an employee, company director or office holder

■■payments under

■■benefit and compensation payments

■■superannuation benefits.

You need to provide all information requested on this form. Providing the wrong information may lead to incorrect amounts of tax being withheld from payments made to you.

You don’t need to complete this form if you:

■■are a beneficiary wanting to provide your tax file number (TFN) to the trustee of a closely held trust. For more information, visit ato.gov.au/trustsandtfnwithholding

■■are receiving superannuation benefits from a super fund and have been taken to have quoted your TFN to the trustee of the super fund

■■want to claim the seniors and pensioners tax offset by reducing the amount withheld from payments made to you. You should complete a withholding declaration form (NAT 3093)

■■want to claim a zone, overseas forces or invalid and invalid carer tax offset by reducing the amount withheld from payments made to you. You should complete a withholding declaration form (NAT 3093).

For more information about your entitlement, visit ato.gov.au/taxoffsets

NAT

Section A: To be completed by the payee

Question 1

What is your tax file number (TFN)?

You should give your TFN to your employer only after you start work for them. Never give your TFN in a job application or over the internet.

We and your payer are authorised by the Taxation Administration Act 1953 to request your TFN. It’s not an offence not to quote your TFN. However, quoting your TFN reduces the risk of administrative errors and having extra tax withheld. Your payer is required to withhold the top rate of tax from all payments made to you if you do not provide your TFN or claim an exemption from quoting your TFN.

How do you find your TFN?

You can find your TFN on any of the following:

■■your income tax notice of assessment

■■correspondence we send you

■■a payment summary your payer issues to you.

If you have a tax agent, they may also be able to tell you. If you still can’t find your TFN, you can:

■■phone us on 13 28 61 between 8.00am and 6.00pm, Monday to Friday.

If you phone or visit us, we need to know we are talking to the correct person before discussing your tax affairs. We will ask you for details only you, or your authorised representative, would know.

You don’t have a TFN

If you don’t have a TFN and want to provide a TFN to your payer, you will need to apply for one.

For more information about applying for a TFN, visit ato.gov.au/tfn

You may be able to claim an exemption from quoting your TFN.

Print X in the appropriate box if you:

■■have lodged a TFN application form or made an enquiry to obtain your TFN. You now have 28 days to provide your TFN to your payer, who must withhold at the standard rate during this time. After 28 days, if you haven’t given your TFN to your payer, they will withhold the top rate of tax from future payments

■■are claiming an exemption from quoting a TFN because you are under 18 years of age and do not earn enough to pay tax, or you are an applicant or recipient of certain pensions, benefits or allowances from the:

––Department of Human Services – however, you will need to quote your TFN if you receive a Newstart, Youth or sickness allowance, or an Austudy or parenting payment

––Department of Veterans’ Affairs – a service pension under the Veterans’ Entitlement Act 1986

––Military Rehabilitation and Compensation Commission.

Providing your TFN to your super fund

Your payer must give your TFN to the super fund they pay your contributions to. If your super fund doesn’t have your TFN, you can provide it to them separately. This ensures:

■■your super fund can accept all types of contributions to your accounts

■■additional tax will not be imposed on contributions as a result of failing to provide your TFN

■■you can trace different super accounts in your name.

For more information about providing your TFN to your super fund, visit ato.gov.au/supereligibility

Question

Complete with your personal information.

Question 7

On what basis are you paid?

Check with your payer if you’re not sure.

Question 8

Are you an Australian resident for tax purposes or a working holiday maker?

Generally, we consider you to be an Australian resident for tax purposes if you:

■■have always lived in Australia or you have come to Australia and now live here permanently

■■are an overseas student doing a course that takes more than six months to complete

■■migrate to Australia and intend to reside here permanently.

If you go overseas temporarily and don’t set up a permanent home in another country, you may continue to be treated as an Australian resident for tax purposes.

If you are in Australia on a working holiday visa (subclass 417) or a work and holiday visa (subclass 462) you must place an X in the working holiday maker box. Special rates of tax apply for working holiday makers.

For more information about working holiday makers, visit ato.gov.au/whm

If you’re not an Australian resident for tax purposes or a working holiday maker, place an X in the foreign resident box, unless you are in receipt of an Australian Government pension or allowance.

Temporary residents can claim super when leaving Australia, if all requirements are met. For more information, visit ato.gov.au/departaustralia

Foreign resident tax rates are different

A higher rate of tax applies to a foreign resident’s taxable income and foreign residents are not entitled to a tax‑free threshold nor can they claim tax offsets to reduce withholding, unless you are in receipt of an Australian Government pension or allowance.

To check your Australian residency status for tax purposes or for more information, visit ato.gov.au/residency

2 |

Tax file number declaration |

Question 9

Do you want to claim the tax‑free threshold from this payer?

The

Answer yes if you want to claim the tax‑free threshold, you are an Australian resident for tax purposes, and one of the following applies:

■■you are not currently claiming the tax‑free threshold from another payer

■■you are currently claiming the tax‑free threshold from another payer and your total income from all sources will be less than the tax‑free threshold.

Answer yes if you are a foreign resident in receipt of an Australian Government pension or allowance.

Answer no if none of the above applies or you are a working holiday maker.

If you receive any taxable government payments or allowances, such as Newstart, Youth Allowance or Austudy payment, you are likely to be already claiming the tax‑free threshold from that payment.

For more information about the current tax‑free threshold, which payer you should claim it from, or how to vary your withholding rate, visit ato.gov.au/taxfreethreshold

Question 10

Do you have a Higher Education Loan Program (HELP), VET Student Loan (VSL), Financial Supplement (FS), Student Start‑up Loan (SSL) or Trade Support Loan (TSL) debt?

Answer yes if you have a HELP, VSL, FS, SSL or TSL debt.

Answer no if you do not have a HELP, VSL, FS, SSL or TSL debt, or you have repaid your debt in full.

You have a HELP debt if either:

■■the Australian Government lent you money under HECS‑HELP, FEE‑HELP, OS‑HELP, VET FEE‑HELP, VET Student loans prior to 1 July 2019 or SA‑HELP.

■■you have a debt from the previous Higher Education Contribution Scheme (HECS).

You have a SSL debt if you have an ABSTUDY SSL debt.

You have a separate VSL debt that is not part of your HELP debt if you incurred it from 1 July 2019.

For information about repaying your HELP, VSL, FS, SSL or TSL debt, visit ato.gov.au/getloaninfo

Have you repaid your HELP, VSL, FS, SSL or TSL debt?

When you have repaid your HELP, VSL, FS, SSL or TSL debt, you need to complete a Withholding declaration (NAT 3093) notifying your payer of the change in your circumstances.

Sign and date the declaration

Make sure you have answered all the questions in section A, then sign and date the declaration. Give your completed declaration to your payer to complete section B.

Section B: To be completed by the payer

Important information for payers – see the reverse side of the form.

Lodge online

Payers can lodge TFN declaration reports online if you have software that complies with our specifications.

For more information about lodging the TFN declaration report online, visit ato.gov.au/lodgetfndeclaration

Tax file number declaration |

3 |

More information

Internet

■■For general information about TFNs, tax and super in Australia, including how to deal with us online, visit our website at ato.gov.au

■■For information about applying for a TFN on the web, visit our website at ato.gov.au/tfn

■■For information about your super, visit our website at ato.gov.au/checkyoursuper

Useful products

In addition to this TFN declaration, you may also need to complete and give your payer the following forms which you can download from our website at ato.gov.au:

■■Medicare levy variation declaration (NAT 0929), if you qualify for a reduced rate of Medicare levy or are liable for the Medicare levy surcharge. You can vary the amount your payer withholds from your payments.

■■Standard choice form (NAT 13080) to choose a super fund for your employer to pay super contributions to. You can find information about your current super accounts and transfer any unnecessary super accounts through myGov after you have linked to the ATO. Temporary residents should visit ato.gov.au/departaustralia for more information about super.

Other forms and publications are also available from our website at ato.gov.au/onlineordering or by phoning 1300 720 092.

Phone

■■Payee – for more information, phone 13 28 61 between 8.00am and 6.00pm, Monday to Friday. If you want to vary your rate of withholding, phone 1300 360 221 between 8.00am and 6.00pm, Monday to Friday.

■■Payer – for more information, phone 13 28 66 between 8.00am and 6.00pm, Monday to Friday.

If you phone, we need to know we’re talking to the right person before we can discuss your tax affairs. We’ll ask for details only you, or someone you’ve authorised, would know. An authorised contact is someone you’ve previously told us can act on

your behalf.

If you do not speak English well and need help from the ATO, phone the Translating and Interpreting Service on 13 14 50.

If you are deaf, or have a hearing or speech impairment, phone the ATO through the National Relay Service (NRS) on the numbers listed below:

■■TTY users – phone 13 36 77 and ask for the ATO number you need (if you are calling from overseas, phone +61 7 3815 7799)

■■Speak and Listen (speech‑to‑speech relay) users – phone 1300 555 727 and ask for the ATO number you need (if you are calling from overseas, phone +61 7 3815 8000)

■■Internet relay users – connect to the NRS on relayservice.gov.au and ask for the ATO number you need.

If you would like further information about the National Relay Service, phone 1800 555 660 or email helpdesk@relayservice.com.au

Privacy of information

Taxation law authorises the ATO to collect information and to disclose it to other government agencies. For information about your privacy, go to ato.gov.au/privacy

Our commitment to you

We are committed to providing you with accurate, consistent and clear information to help you understand your rights and entitlements and meet your obligations.

If you follow our information in this publication and it turns out to be incorrect,

or it is misleading and you make a mistake as a result, we must still apply the law correctly. If that means you owe us money, we must ask you to pay it but we will not charge you a penalty. Also, if you acted reasonably and in good faith we will not charge you interest.

If you make an honest mistake in trying to follow our information in this publication and you owe us money as a result, we will not charge you a penalty. However, we will ask you to pay the money, and we may also charge you interest. If correcting the mistake means we owe you money, we will pay it to you. We will also pay you any interest you are entitled to.

If you feel that this publication does not fully cover your circumstances, or you are unsure how it applies to you, you can seek further assistance from us.

We regularly revise our publications to take account of any changes to the law, so make sure that you have the latest information. If you are unsure, you can check for more recent information on our website at ato.gov.au or contact us.

This publication was current at June 2019.

© Australian Taxation Office for the Commonwealth of Australia, 2019

You are free to copy, adapt, modify, transmit and distribute this material as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).

Published by

Australian Taxation Office

Canberra

June 2019

4 |

Tax file number declaration |

|

|

Tax file number declaration |

|

|

This declaration is NOT an application for a tax file number. |

|

|

■ Use a black or blue pen and print clearly in BLOCK LETTERS. |

|

|

■ Print X in the appropriate boxes. |

ato.gov.au |

■ Read all the instructions including the privacy statement before you complete this declaration. |

|

Section A: To be completed by the PAYEE

5 What is your primary

1What is your tax file number (TFN)?

For more information, see question 1 on page 2 of the instructions.

OR I have made a separate application/enquiry to the ATO for a new or existing TFN.

OR I am claiming an exemption because I am under 18 years of age and do not earn enough to pay tax.

OR I am claiming an exemption because I am in receipt of a pension, benefit or allowance.

Day |

Month |

Year |

6 What is your date of birth?

7 On what basis are you paid? (select only one)

2 What is your name? |

Title: Mr |

Mrs |

Miss |

Ms |

Surname or family name |

|

|

|

|

First given name |

|

|

|

|

Other given names |

|

|

|

|

3 What is your home address in Australia?

Suburb/town/locality

State/territory Postcode

4If you have changed your name since you last dealt with the ATO, provide your previous family name.

Full‑time |

|

Part‑time |

|

Labour |

|

Superannuation |

|

Casual |

|

|

|

|

|||||

employment |

|

employment |

|

hire |

|

or annuity |

|

employment |

|

|

|

income stream |

|

||||

|

|

|

|

|

|

|

|

8Are you: (select only one)

An Australian resident |

|

A foreign resident |

|

OR |

A working |

|

|

|

|

||||

for tax purposes |

|

for tax purposes |

|

holiday maker |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

9 Do you want to claim the tax‑free threshold from this payer?

Only claim the tax‑free threshold from one payer at a time, unless your total income from all sources for the financial year will be less than the tax‑free threshold.

|

|

|

|

Answer no here if you are a foreign resident or working holiday |

Yes |

|

No |

|

maker, except if you are a foreign resident in receipt of an |

|

|

|

|

Australian Government pension or allowance. |

|

|

|

|

10Do you have a Higher Education Loan Program (HELP), VET Student Loan (VSL), Financial Supplement (FS), Student Start‑up Loan (SSL) or

Trade Support Loan (TSL) debt?

Yes |

|

Your payer will withhold additional amounts to cover any compulsory |

No |

|

|

|

|||

|

repayment that may be raised on your notice of assessment. |

|

||

|

|

|

|

|

|

|

|

|

|

DECLARATION by payee: I declare that the information I have given is true and correct.

Signature

Date

Day |

Month |

Year |

You MUST SIGN here

There are penalties for deliberately making a false or misleading statement.

There are penalties for deliberately making a false or misleading statement.

Once section A is completed and signed, give it to your payer to complete section B.

Once section A is completed and signed, give it to your payer to complete section B.

Section B: To be completed by the PAYER (if you are not lodging online)

1 |

|

What is your Australian business number (ABN) or |

|

|

|

Branch number |

|||||||||||||||||

|

withholding payer number? |

|

|

|

(if applicable) |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

If you don’t have an ABN or withholding |

|

Yes |

|

|

|

No |

|

|

|||||||||||||

|

|

|

|

|

|

||||||||||||||||||

|

|

payer number, have you applied for one? |

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

3What is your legal name or registered business name (or your individual name if not in business)?

4What is your business address?

Suburb/town/locality

State/territory Postcode

5What is your primary

6Who is your contact person?

Business phone number

7 If you no longer make payments to this payee, print X in this box. DECLARATION by payer: I declare that the information I have given is true and correct.

Signature of payer

Date

Day |

|

Month |

|

|

Year |

|||

|

|

|

|

|

|

|

|

|

There are penalties for deliberately making a false or misleading statement.

There are penalties for deliberately making a false or misleading statement.

Return the completed original ATO copy to: |

|

IMPORTANT |

Australian Taxation Office |

|

See next page for: |

PO Box 9004 |

|

■ payer obligations |

PENRITH NSW 2740 |

|

■ lodging online. |

|

|

|

|

|

|

Print form |

|

Save form |

|

|

|

NAT

Reset form

Sensitive (when completed)

30920619

Payer information

The following information will help you comply with your pay as you go (PAYG) withholding obligations.

Is your employee entitled to work in Australia?

It is a criminal offence to knowingly or recklessly allow someone to work, or to refer someone for work, where that person is from overseas and is either in Australia illegally or is working in breach of their visa conditions.

People or companies convicted of these offences may face fines and/or imprisonment. To avoid penalties, ensure your prospective employee has a valid visa

to work in Australia before you employ them. For more information and to check a visa holder’s status online, visit the Department of Home Affairs website at homeaffairs.gov.au

Lodging the form

You need to lodge TFN declarations with us within 14 days after the form is either signed by the payee or completed by you (if not provided by the payee). You need to retain a copy of the form for your records. For information about storage and disposal, see below.

You may lodge the information:

■■online – lodge your TFN declaration reports using software that complies with our specifications. There is no need to complete section B of each form as the payer information is supplied by your software.

■■by paper – complete section B and send the original to us within 14 days.

For more information about lodging your

TFN declaration report online, visit our website at ato.gov.au/lodgetfndeclaration

Is your payee working under a working holiday visa (subclass 417) or a work and holiday visa (subclass 462)?

Employers of workers under these two types of visa need to register with the ATO, see ato.gov.au/whmreg

For the tax table “working holiday maker” visit our website at ato.gov.au/taxtables

Payer obligations

If you withhold amounts from payments, or are likely to withhold amounts, the payee may give you this form with section A completed. A TFN declaration applies to payments made after the declaration is provided to you. The information provided on this form is used to determine the amount of tax to be withheld from payments based on the PAYG withholding tax tables we publish. If the payee gives you another declaration, it overrides any previous declarations.

Has your payee advised you that they have applied for a TFN, or enquired about their existing TFN?

Where the payee indicates at question 1 on this form that they have applied for an individual TFN, or enquired about their existing TFN, they have 28 days to give you their TFN. You must withhold tax for 28 days at the standard rate according to the PAYG withholding tax tables. After 28 days, if the payee has not given you their TFN, you must then withhold the top rate of tax from future payments, unless we tell you not to.

If your payee has not given you a completed form you must:

■■notify us within 14 days of the start of the withholding obligation by completing as much of the payee section of the form as you can. Print ‘PAYER’ in the payee declaration and lodge the form – see ‘Lodging the form’.

■■withhold the top rate of tax from any payment to that payee.

For a full list of tax tables, visit our website at ato.gov.au/taxtables

Provision of payee’s TFN to the payee’s super fund

If you make a super contribution for your payee, you need to give your payee’s TFN to their super fund on the day of contribution, or if the payee has not yet quoted their TFN, within 14 days of receiving this form from your payee.

Storing and disposing of TFN declarations

The TFN Rule issued under the Privacy Act 1988 requires a TFN recipient to use secure methods when storing and disposing of TFN information. You may store a paper copy of the signed form or electronic files of scanned forms. Scanned forms must be clear and not altered in any way.

If a payee:

■■submits a new TFN declaration (NAT 3092), you must retain a copy of the earlier form for the current and following financial year.

■■has not received payments from you for 12 months, you must retain a copy of the last completed form for the current and following financial year.

Penalties

You may incur a penalty if you do not:

■■lodge TFN declarations with us

■■keep a copy of completed TFN declarations for your records

■■provide the payee’s TFN to their super fund where the payee quoted their TFN to you.

Document Specifics

| Fact | Detail |

|---|---|

| Form Title | Tax file number declaration |

| Form Number | NAT 3092 |

| Purpose | Allows employers to determine the correct amount of tax to withhold from payments to employees. |

| Applicability | Before receiving payments from a new payer, such as wages or superannuation benefits. |

| Requirement of TFN | Providing a Tax File Number (TFN) is not mandatory but not providing it may result in higher tax withholding. |

| Exemption Claims | Special conditions allow for TFN exemption, such as individuals under 18 and certain pension, benefit, or allowance recipients. |

| Australian Residency | Determines tax status and applicable rates, including special conditions for working holiday makers. |

| Claiming the Tax-Free Threshold | Can be claimed from one payer at a time unless total income from all sources will be less than the tax-free threshold. |

| Debts and Obligations | Questions about education or trade support loans to ensure correct withholding rates. |

| Penalties | False or misleading statements can result in penalties. |

| Lodgment | Completed forms are to be returned to the Australian Taxation Office. |

Guide to Writing Tax Declaration Nat 3092

Properly filling out the Tax Declaration NAT 3092 form is crucial for ensuring the correct amount of tax is withheld from payments made to you. Providing accurate and complete information on this form will help avoid any unnecessary tax deductions or administrative errors. The following steps are designed to assist you in completing the form accurately.

- Find a black or blue pen, and make sure to use BLOCK LETTERS when filling out the form.

- For Question 1, enter your Tax File Number (TFN). If you do not have a TFN, check the appropriate box indicating that you have applied or are claiming an exemption.

- Complete Questions 2-6 with your name, home address in Australia, and other personal details as requested.

- In Question 7, select the basis on which you are paid (full-time, part-time, casual, superannuation, or annuity) by ticking the appropriate box.

- For Question 8, indicate your residency status for tax purposes by selecting 'An Australian resident for tax purposes,' 'A foreign resident for tax purposes,' or 'A working holiday maker.'

- In Question 9, decide if you want to claim the tax-free threshold from this payer and mark 'Yes' or 'No' accordingly.

- Answer Question 10 regarding any education or financial support debts such as HELP or VSL by marking 'Yes' or 'No.'

- Ensure all questions in Section A are answered, then sign and date the declaration at the bottom of the section.

- Hand the form to your payer for them to complete Section B.

After you have completed and signed the form, your role in this process is essentially done. It is your payer's responsibility to complete their part of the form and submit it to the relevant tax office. Be sure to keep a copy of the form for your records. Promptly addressing the completion of this form ensures that tax withholding is aligned with your correct status, preventing the hassle of having to claim back overpaid tax or facing unexpected tax bills later on.

Understanding Tax Declaration Nat 3092

-

What is a Tax Declaration Nat 3092 form?

This form is used by taxpayers to inform their payers of the tax amount to be withheld from payments made to them. It is essential for individuals starting with a new payer and is not for a TFN application. Accurate completion ensures correct tax withholding.

-

Who should complete the Tax Declaration Nat 3092 form?

If you're receiving payments from a new payer, such as wages, benefits, or superannuation benefits, you should complete this form. It is not required for beneficiaries providing a TFN to a trust or individuals receiving certain government payments seeking tax offsets.

-

How can I find my Tax File Number (TFN)?

Your TFN can be found on your income tax notice of assessment, official correspondence from the ATO, or a payment summary issued by your payer. Tax agents can also provide this information. If unavailable, the ATO's phone support is an option.

-

What if I do not have a TFN?

Applying for a TFN is necessary if you don't have one but wish to provide it to your payer. A 28-day grace period is available after application during which standard tax rates apply. In certain cases, such as being under 18 and not earning enough to pay tax, you might claim an exemption.

-

Are there specific situations where the Tax Declaration Nat 3092 form is not required?

Yes, individuals not needing to complete this form include closely held trust beneficiaries providing a TFN to the trustee and those claiming the seniors and pensioners tax offset with a different form, among others seeking specific tax offsets.

-

How do I declare my residency status for tax purposes?

Indicate on the form if you are an Australian resident for tax purposes, a foreign resident, or a working holiday maker. Your residency status affects your tax rates and eligibility for the tax-free threshold.

-

What should I do after completing the Tax Declaration Nat 3092 form?

After filling out the form, sign and date it before handing it over to your payer. Ensure all questions in Section A are answered. Your payer will then complete Section B.

Common mistakes

When individuals fill out the Tax Declaration NAT 3092 form, several common mistakes can impact the accuracy and processing of the form. These mistakes can lead to incorrect withholdings and potential issues with the Australian Taxation Office (ATO). It is crucial to avoid these errors when completing the form.

Not Providing the Tax File Number (TFN): The most crucial piece of information is the TFN. Failure to provide it can result in the highest rate of tax being withheld from payments.

Incorrectly claiming TFN exemptions: Some individuals may incorrectly claim an exemption for quoting a TFN. This is common among those who are not fully aware of the criteria for exemptions.

Incorrect Personal Details: Providing incorrect names, addresses, or date of birth can lead to issues in identifying the taxpayer’s records within the ATO system.

Failure to declare if they have a Higher Education Loan Program (HELP) or other study and training loan debts: Not acknowledging these debts can lead to insufficient tax withholding to cover annual obligations.

Residency Status Errors: Incorrectly indicating residency status for tax purposes can affect the amount of tax withheld. Working holiday makers and foreign residents are subject to different tax rates.

Not correctly indicating employment basis: Whether an individual is employed on a full-time, part-time, casual, or labour-hire basis affects tax withholding rates.

Failing to sign the declaration: The form is not valid unless signed. This oversight can delay processing.

Each of these mistakes can be avoided by thoroughly reviewing the form, understanding the criteria for each section, and double-checking the information provided before submission. It is also advisable to consult with the ATO or a tax professional if there are uncertainties.

Documents used along the form

When completing the Tax Declaration NAT 3092 form, several other documents and forms can streamline the process and ensure financial matters are well-organized and in compliance with current tax laws. Understanding these additional forms can help individuals and employers manage their tax-related obligations more effectively.

- Withholding Declaration (NAT 3093): This document is used to update your tax withholding preferences if your circumstances change. For example, if you've paid off your student loan or want to change the amount of tax withheld from your pay.

- Medicare Levy Variation Declaration (NAT 0929): This form is for individuals who are eligible for a reduction or exemption from paying the Medicare Levy. Completing this form can adjust the amount of tax withheld from your pay to account for your Medicare levy status.

- Standard Choice Form (NAT 13080): Required for selecting a superannuation fund for your employer's contributions. This form is crucial for ensuring your superannuation contributions are being directed to the correct account.

- Superannuation (Super) Standard Choice Form: While closely related to the NAT 13080, this document is used specifically within the context of superannuation to inform your employer of your chosen fund for super contributions. It’s an important part of managing your retirement savings.

These forms are integral to ensuring that your tax and superannuation affairs are in order. By familiarizing yourself with these documents, you can take proactive steps towards managing your income, investments, and long-term savings more efficiently. Remember, staying informed and up-to-date with your financial and tax-related obligations can help you avoid unnecessary penalties and make the most of potential benefits.

Similar forms

The W-4 Form, or Employee's Withholding Allowance Certificate, is quite similar to the Tax Declaration Nat 3092 form, primarily because it directs employers on how much federal income tax to withhold from an employee's paycheck in the United States. Like the Nat 3092, the W-4 is completed by the employee, providing crucial information such as marital status, number of allowances or dependents, and any additional amount to withhold. This information ensures that the employer can accurately withhold tax, preventing the employee from owing a significant amount when filing their annual tax return.

Another document resembling the Tax Declaration Nat 3092 is the State Tax Withholding Forms. These forms vary by state, reflecting each state’s income tax withholding requirements. Similar to the Nat 3092, these state-specific forms tell the employer the amount of state income tax to withhold from an employee's wages based on their residency, exemptions, and status. This process parallels how the Nat 3092 assists in determining federal tax withholdings, illustrating their foundational goal to streamline tax withholding processes for both employer and employee.

The IRS Form W-9, Request for Taxpayer Identification Number and Certification, also shares similarities with the Tax Declaration Nat 3092 form. The W-9 is utilized by individuals and entities to provide their Taxpayer Identification Number (TIN) to entities which will pay them income during the year. The purpose mirrors that of Nat 3092’s directive to supply a TFN, thereby ensuring the correct tax identification for efficient processing and reporting of taxes due or paid.

The Superannuation Standard Choice Form in Australia has its similarities as well, offering employees a way to select a superannuation fund for their compulsory employer contributions. While this form predominantly deals with retirement savings rather than tax withholdings, it aligns with the Tax Declaration Nat 3092 form in its aim to ensure individuals' financial affairs are in order, which includes proper handling of tax-related matters linked to superannuation contributions.

Lastly, the Medicare levy variation declaration (NAT 0929) bears resemblance to the Nat 3092 form. This form enables individuals to claim a reduction or exemption from the Medicare levy, depending on certain personal circumstances. It resembles the Nat 3092 form in its facilitation of a more personalized approach to individual financial obligations, specifically in relation to tax, allowing for adjustments based on personal conditions, like income, dependents, or health coverage. Both forms reflect the system’s flexibility in accommodating diverse taxpayer needs.

Dos and Don'ts

When filling out the Tax Declaration form NAT 3092, it is crucial to follow certain dos and don'ts to ensure accurate processing of your information. Below is a list of recommendations to guide you through this process.

- Do use a black or blue pen and print your answers clearly in BLOCK LETTERS.

- Do read all instructions, including the privacy statement, before completing the declaration.

- Do provide your tax file number (TFN) if you have one to avoid any unnecessary withholding tax.

- Do check the correct boxes that apply to your situation, especially when it comes to your residency status for tax purposes.

- Do claim the tax-free threshold from this payer only if you are not claiming it from another payer and you meet the eligibility requirements.

- Do accurately declare if you have a Higher Education Loan Program (HELP) or other loan debt.

- Do sign and date the declaration in Section A after ensuring all information provided is true and correct.

- Don't provide your TFN before you start your employment or in any insecure manner like over the internet or in a job application.

- Don't forget to apply for a TFN if you don't have one and wish to provide it to your payer.

- Don't leave any questions unanswered; incomplete forms may lead to processing delays or incorrect tax withholding.

Following these guidelines will help ensure that your tax details are accurately recorded and that the correct amount of tax is withheld from your payments, minimizing any issues when you lodge your tax return.

Misconceptions

There are several misconceptions about the Tax Declaration NAT 3092 form, which might lead to confusion or errors when individuals are completing it. Understanding these misconceptions is crucial to ensure accurate compliance with tax reporting requirements.

Many people believe that the Tax Declaration NAT 3092 is an application form for a Tax File Number (TFN), but this is incorrect. The form is actually used to declare your TFN to a new payer so they can withhold the correct amount of tax from payments made to you. To apply for a TFN, you need to go through a different process on the Australian Taxation Office (ATO) website.

There's a common misconception that filling out the NAT 3092 form is compulsory for all employees. In fact, there are certain situations where you are not required to complete this form. For example, if you are a beneficiary wishing to provide your TFN to the trustee of a closely held trust, this form does not apply.

Some people mistakenly think that they should give their TFN to their employer as soon as they apply for a job or during the application process. However, it's recommended to provide your TFN only after you start working for them to protect your privacy and reduce the risk of identity theft.

A notable misunderstanding is regarding who should claim the tax-free threshold. You should only claim the tax-free threshold from one payer at a time unless you are certain your total income from all sources for the financial year will be less than the tax-free threshold. Incorrectly claiming the tax-free threshold from more than one payer could lead to a tax debt at the end of the financial year.

Another misconception is related to declaring a Higher Education Loan Program (HELP) or similar debt. It's crucial to indicate whether you have such a debt on the NAT 3092 form as it affects the rate at which your payer will withhold tax. Failing to declare this could result in you having to repay a larger sum when you lodge your annual tax return.

Last but not least, there's confusion about what constitutes an Australian resident for tax purposes when filling out the NAT 3092. Being an Australian resident for tax purposes is not solely based on citizenship or permanent residency status; it also considers factors such as your physical presence in Australia and the nature of your accommodation and employment. Thus, getting your residency status wrong can significantly affect the amount of tax you're required to pay.

Correcting these misconceptions and ensuring accurate information when completing the NAT 3092 form is fundamental for effective tax management and compliance. When in doubt, consulting the ATO's guidelines or seeking professional advice can help clarify these issues.

Key takeaways

When filling out and using the Tax Declaration NAT 3092 form, individuals and their employers should pay close attention to the following key takeaways to ensure accurate and compliant handling of tax-related information:

- Provision of Tax File Number (TFN): Individuals are advised to provide their TFN after starting work with an employer to prevent excessive tax withholdings. While it is not mandatory to quote a TFN, failing to do so results in the highest tax rate being applied to payments.

- TFN application and exemption claims: For those who do not have a TFN, an application needs to be lodged with the Australian Taxation Office (ATO), and they have 28 days to provide the new TFN to their payer. Exemptions can be claimed under certain conditions such as being under 18 and not earning enough to pay taxes, or receiving specific pensions, benefits, or allowances.

- Australian residency status for tax purposes: It is crucial for individuals to correctly state their residency status, as this determines the applicable tax rates and entitlements, such as the tax-free threshold and eligibility for specific offsets.

- Claiming the tax-free threshold: This form allows individuals to claim the tax-free threshold from their payer, aimed at reducing the amount of tax withheld from payments. Individuals should ensure they are not claiming the threshold from multiple payers simultaneously unless their total income is below the tax-free threshold.

- Debt declarations: Those with a Higher Education Loan Program (HELP), VET Student Loan (VSL), Financial Supplement (FS), Student Start-up Loan (SSL), or Trade Support Loan (TSL) debt must declare this on the form, affecting the calculation of their withholding amounts.

- Signature and submission: The declaration must be signed and dated by the employee (payee) and then given to the employer (payer) for completion of Section B. The form, once fully completed, should be submitted to the ATO if not lodged online, ensuring timely and accurate tax reporting.

Understanding these key points ensures that individuals provide all necessary information accurately, which facilitates correct tax withholdings by payers and compliance with Australian tax laws.

Popular PDF Documents

Employer's Annual Federal Unemployment (FUTA) Tax Return - A detailed instruction booklet is available to assist employers in completing the form correctly.

How to File Power of Attorney in California - By signing the Tax POA 3520-PIT, taxpayers can ensure that their tax obligations are managed efficiently, even in their absence.