Get Tax Certificate Pa Form

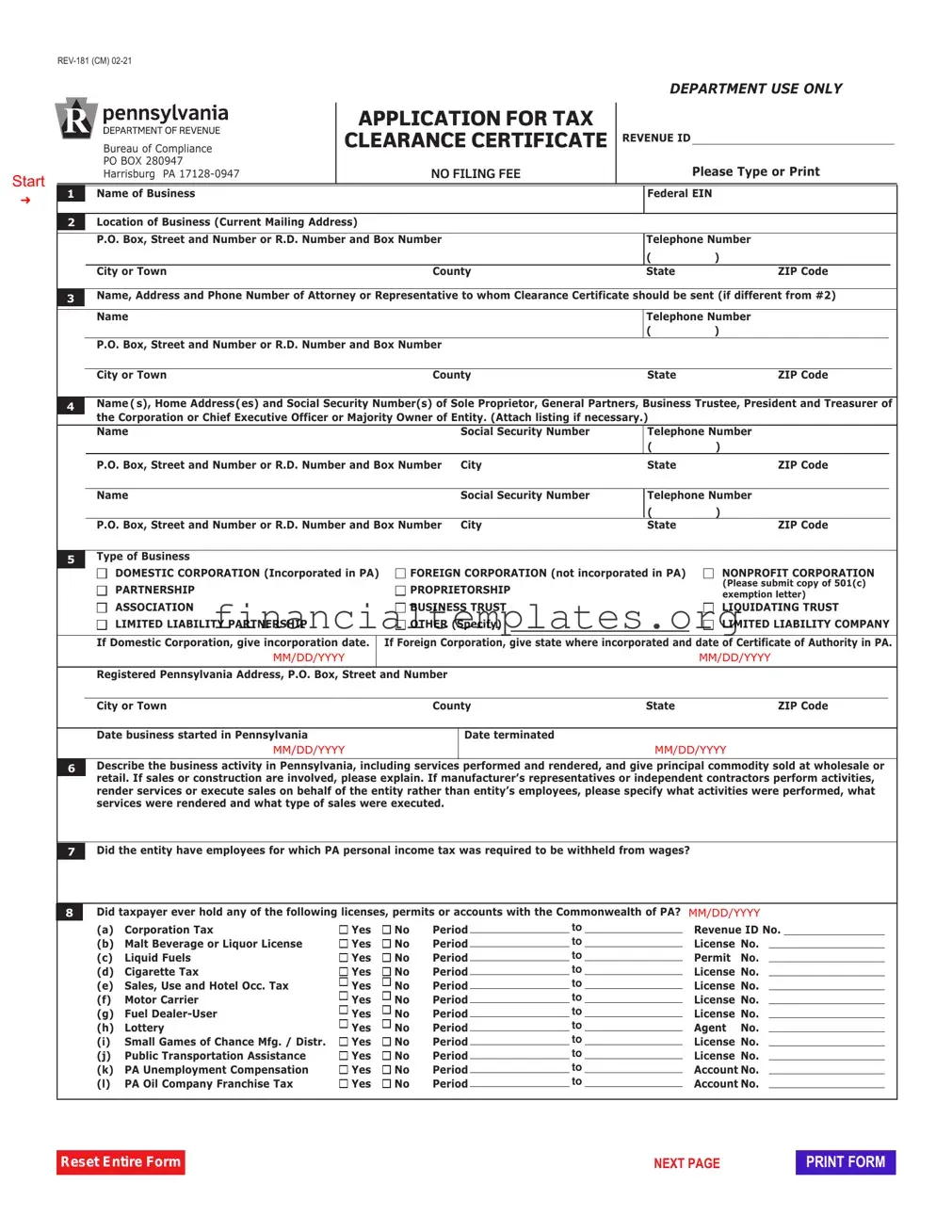

Embarking on a business journey often involves navigating through a labyrinth of legal and bureaucratic requirements, one of which is the Tax Certificate Pa form, officially recognized as the Application for Tax Clearance Certificate (REV-181). This comprehensive document serves a pivotal role for businesses operating within Pennsylvania, offering a concise overview of the company's tax obligations and compliance status. It is imperative for various business transactions, such as dissolutions, mergers, acquisitions, and sales, ensuring that all state tax liabilities are settled. Structured meticulously, the form demands detailed business information, including the business name, Federal EIN, business location, and the specifics of the authorized representative or attorney. Moreover, it delves into the type of business entity, sheds light on the business activities conducted within Pennsylvania, and explores any licensures held by the entity in question. The necessity for such a form stems from the Pennsylvania Department of Revenue's and Department of Labor & Industry's requirements to clear any outstanding tax liabilities before any major business transaction. This not only facilitates smoother business operations but also safeguards against potential legal complications that might arise from unresolved tax issues. Indeed, the Tax Certificate Pa form is an essential document that underscores the importance of tax compliance within the intricate framework of business dealings in Pennsylvania.

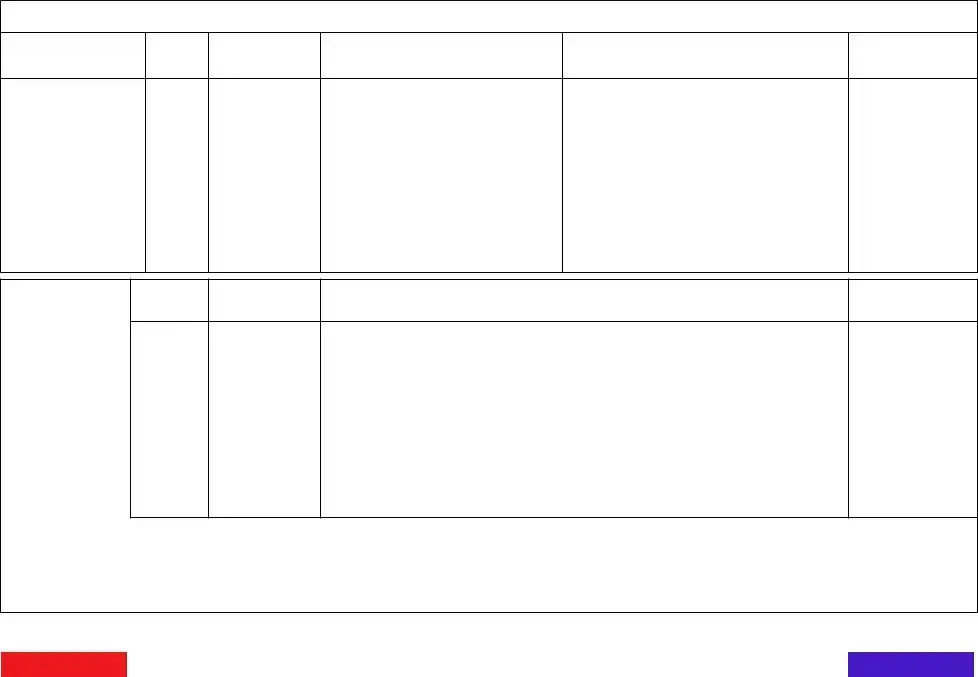

Tax Certificate Pa Example

Start

➜

Department Use Only

|

|

APPLICATION FOR TAX |

|

|

|

|

|

Bureau of Compliance |

CLEARANCE CERTIFICATE |

Revenue id |

|

|

|

|

|

|||||

|

PO BOX 280947 |

NO FILING FEE |

|

Please Type or Print |

|

|

|

Harrisburg PA |

|

|

|||

1 |

name of Business |

|

|

Federal ein |

|

|

|

|

|

|

|

|

|

2Location of Business (Current Mailing Address)

|

|

P.O. Box, Street and number or R.d. number and Box number |

|

|

|

|

|

Telephone number |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

City or Town |

|

|

|

County |

|

|

State |

|

|

ZiP Code |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

3 |

name, Address and Phone number of Attorney or Representative to whom Clearance Certificate should be sent (if different from #2) |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

name |

|

|

|

|

|

|

|

|

|

Telephone number |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

P.O. Box, Street and number or R.d. number and Box number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

City or Town |

|

|

|

County |

|

|

State |

|

|

ZiP Code |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

4 |

name(s), Home Address(es) and Social Security number(s) of Sole Proprietor, General Partners, Business Trustee, President and Treasurer of |

||||||||||||||||||||||||

|

|

the Corporation or Chief executive Officer or Majority Owner of entity. (Attach listing if necessary.) |

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

name |

|

|

|

|

Social Security number |

Telephone number |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

P.O. Box, Street and number or R.d. number and Box number |

City |

|

|

State |

|

|

ZiP Code |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

name |

|

|

|

|

Social Security number |

Telephone number |

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

P.O. Box, Street and number or R.d. number and Box number |

City |

|

|

State |

|

|

ZiP Code |

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

Type of Business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

dOMeSTiC CORPORATiOn (incorporated in PA) |

|

FOReiGn CORPORATiOn (not incorporated in PA) |

nOnPROFiT CORPORATiOn |

|||||||||||||||||||

|

|

|

PARTneRSHiP |

|

|

|

PROPRieTORSHiP |

|

|

|

|

|

(Please submit copy of 501(c) |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

exemption letter) |

||||||||||||||

|

|

|

ASSOCiATiOn |

|

|

|

BuSineSS TRuST |

|

|

|

|

|

LiquidATinG TRuST |

||||||||||||

|

|

|

LiMiTed LiABiLiTy PARTneRSHiP |

|

|

|

OTHeR (Specify) |

|

|

|

|

|

LiMiTed LiABiLiTy COMPAny |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

if domestic Corporation, give incorporation date. |

if Foreign Corporation, give state where incorporated and date of Certificate of Authority in PA. |

||||||||||||||||||||||

|

|

|

MM/DD/YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

MM/DD/YYYY |

|||||||||

|

|

Registered Pennsylvania Address, P.O. Box, Street and number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

City or Town |

|

|

|

County |

|

|

State |

|

|

ZiP Code |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

date business started in Pennsylvania |

|

|

|

|

date terminated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

MM/DD/YYYY |

|

|

|

|

|

|

|

|

|

MM/DD/YYYY |

|

|

|

|

|

|

|

|

|

|||

6 |

describe the business activity in Pennsylvania, including services performed and rendered, and give principal commodity sold at wholesale or |

||||||||||||||||||||||||

|

|

retail. if sales or construction are involved, please explain. if manufacturer’s representatives or independent contractors perform activities, |

|||||||||||||||||||||||

|

|

render services or execute sales on behalf of the entity rather than entity’s employees, please specify what activities were performed, what |

|||||||||||||||||||||||

|

|

services were rendered and what type of sales were executed. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

7 |

did the entity have employees for which PA personal income tax was required to be withheld from wages? |

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

8 |

did taxpayer ever hold any of the following licenses, permits or accounts with the Commonwealth of PA? MM/DD/YYYY |

||||||||||||||||||||||||

|

|

(a) |

Corporation Tax |

yes |

no |

Period |

|

|

to |

|

|

|

|

Revenue id no. |

|

|

|||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

(b) |

Malt Beverage or Liquor License |

yes |

no |

Period |

|

|

to |

|

|

|

|

License no. |

|

|

|||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

(c) |

Liquid Fuels |

yes |

no |

Period |

|

|

to |

|

|

|

|

Permit |

no. |

|

|

||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

(d) |

Cigarette Tax |

yes |

no |

Period |

|

|

to |

|

|

|

|

License no. |

|

|

|||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

(e) |

Sales, use and Hotel Occ. Tax |

yes |

no |

Period |

|

|

to |

|

|

|

|

License no. |

|

|

|||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

(f) |

Motor Carrier |

yes |

no |

Period |

|

|

to |

|

|

|

|

License no. |

|

|

|||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

(g) |

Fuel |

yes |

no |

Period |

|

|

to |

|

|

|

|

License no. |

|

|

|||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

(h) |

Lottery |

yes |

no |

Period |

|

|

to |

|

|

|

|

Agent |

no. |

|

|

||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

(i) Small Games of Chance Mfg. / distr. |

yes |

no |

Period |

|

|

to |

|

|

|

|

License no. |

|

|

||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

(j) |

Public Transportation Assistance |

yes |

no |

Period |

|

|

to |

|

|

|

|

License no. |

|

|

|||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

(k) |

PA unemployment Compensation |

yes |

no |

Period |

|

|

to |

|

|

|

|

Account no. |

|

|

|||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

(l) PA Oil Company Franchise Tax |

yes |

no |

Period |

|

|

to |

|

|

|

|

Account no. |

||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reset Entire Form |

NEXT PAGE |

PRINT FORM |

Page 2

9Were the assets or activities of the business acquired in whole or in part from a prior business entity?  Yes

Yes  No ( If “Yes”, give predecessor’s name, address and acquisition date. )

No ( If “Yes”, give predecessor’s name, address and acquisition date. )

|

Name |

|

|

|

Acquisition Date |

|

|

|

|

|

|

MM/DD/YYYY |

|

|

P.O. Box, Street and Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

City or Town |

County |

State |

|

ZIP Code |

|

|

|

|

|

|

||

10 |

Has the business held title to any real estate in the last five years from the date of this application? |

Yes |

No |

|

||

|

|

|

|

|

|

|

lIf “Yes”, complete Schedule A (last page).

lIf you currently hold title to real estate in PA, complete Schedule B (last page).

11 |

Will the assets or activities of the business be transferred to another? |

|

|

|

If “Yes”, complete: |

|

|

|

||||||

|

A. |

Corporation |

Yes |

No |

F. Other |

Yes |

No |

|

|

|

Name of New Owner |

|

||

|

|

|

|

|

|

|

||||||||

|

B. |

Partnership |

Yes |

No |

Explain: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address of New Owner |

|

||||||

|

C. |

Proprietorship |

Yes |

No |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||||

|

D. |

Liquidating Trust |

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

State |

ZIP Code |

|

|||||

|

E. |

Association |

Yes |

No |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12Purpose of Clearance Certificate (check appropriate block):

A. Dissolution of Corporation or Association through Department of State.

A. Dissolution of Corporation or Association through Department of State.

B. Dissolution of Corporation or Association through Court of Common Pleas. Date Court was petitioned and county:

B. Dissolution of Corporation or Association through Court of Common Pleas. Date Court was petitioned and county:

(date) MM/DD/YYYY(county)

C. Withdrawal of Foreign Corporation through Department of State

C. Withdrawal of Foreign Corporation through Department of State

D. Merger or consolidation of two or more Corporations or Associations where surviving Corporation or Association is not subject to the

D. Merger or consolidation of two or more Corporations or Associations where surviving Corporation or Association is not subject to the

|

jurisdiction of Pennsylvania. (See 15 Pa C.S. § 139.) |

|

|

|

|||

E. Bulk Sale Clearance Certificate under Section 1403 of the Fiscal Code. Sale date: |

|

MM/DD/YYYY |

|||||

|

Copy of settlement statement: |

|

|

|

|

|

|

|

Corporation Tax Purposes |

|

Employer Withholding Tax Purposes |

|

Sales, Use and Hotel Occupancy Tax Purposes |

||

|

Unemployment Compensation Tax Purposes |

|

|

|

|||

|

|

|

STATEMENT OF AUTHORIZATION |

||||

I authorize the PA Department of Revenue to disclose, verbally or in written form, all tax filings, payments or delinquencies

requested by the buyer or his representatives for the bulk sale transfer provision. |

|

MM/DD/YYYY |

||

|

|

|

|

|

Authorized by |

|

|

Title |

Date |

F. Foreign Corporation Clearance Certificate under the provisions of the Act of 1947, P.L. 493, Contract Number and Political Subdivision:

F. Foreign Corporation Clearance Certificate under the provisions of the Act of 1947, P.L. 493, Contract Number and Political Subdivision:

13Location of business records, available for audit of Pennsylvania operations.

P.O. Box, Street and Number |

City |

State |

ZIP Code |

|

|

|

|

Telephone Number |

|

|

|

14List any matters pending with the PA Department of Revenue (e.g. petitions, appeals):

15 |

Did the business ever, within the Commonwealth of PA: |

|

|

|

|

MM/DD/YYYY |

|

||||

|

(a) |

........................................................Engage in the sale of soft drinks or soft drink syrup |

Yes |

No |

Period |

|

to |

|

|

||

|

(b) |

Own or lease and operate |

Yes |

No |

Period |

|

to |

|

|

||

|

(c) |

..........................Engage in the sale of diesel fuel to motor vehicles using PA highways? |

Yes |

No |

Period |

|

to |

|

|

||

|

(d) |

Engage in the sale or lease of tangible personal property since Sept. 1, 1953? |

Yes |

No |

Period |

|

to |

|

|

||

|

(e) |

File PA Unemployment Compensation Reports? |

Yes |

No |

Period |

|

to |

|

|||

|

|

If “Yes”, give Account Number |

(See question 8k.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16Have you terminated your business activities in Pennsylvania?

Yes

Yes

No

No

l |

If “Yes”, give distribution of assets date: |

MM/DD/YYYY |

|

|

|

l |

If “No”, explain: |

|

|

|

|

l |

If a Foreign Corporation, have you terminated business in the state of your incorporation? |

Yes No |

|

||

Reset Entire Form |

RETURN TO PAGE 1 |

NEXT PAGE |

PRINT FORM |

Page 3

17number of employees and total gross payrolls during the last five operating years (as reported to the Social Security Administration):

yeAR |

TOTAL eMPLOyeeS |

PA |

TOTAL GROSS |

|

PA |

|||

|

|

|

|

eMPLOyeeS |

PAyROLL |

|

GROSS PAyROLL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18Have the officers received any remuneration, in cash or other other form, for services performed in Pennsylvania during the current calendar year or during any of the preceding four calendar years?

yes

yes  no

no

19Were any remunerated services performed for the business in PA, which you believe did not constitute “employment” as defined in the PA unemployment Compensation Law?  yes

yes  no

no

if “yes”, explain:

20A. Average number of stockholders during the last five years:

B.number of stockholders as of this report:

C.List names and home addresses of stock transfer agents who have handled the corporation’s stock:

name:Address:

|

|

d. Were all shares presented and property redeemed from any stock called for redemption or retired? |

yes |

no |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

21 |

|

The figures below must agree with the last corporate tax report filed with the PA department of Revenue. |

|

|

|

|

|||||||||

|

|

date of Report: |

MM/DD/YYYY |

|

Total Liabilities: |

|

|

|

|

|

|

||||

|

|

Total Assets: |

|

|

|

|

Total equity (net worth): |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22 |

|

A. List the amount of corporate bonds issued and still outstanding as of this report. Show each issue separately and include name and |

|||||||||||||

|

|

|

address of any transfer or paying agents. |

Agent |

number of Outstanding Bonds |

Amount |

|||||||||

|

|

issue |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

B. List names and addresses of transfer or paying agents not listed above who have handled corporate bond issues. |

|

|

|

||||||||||

|

|

name: |

|

|

Address: |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23Have you consumed or used in Pennsylvania any tangible personal property or acquired such, after March 6, 1956, on which no PA sales or use tax was paid? if “yes”, please explain:

yes

yes  no

no

24do you have within your custody, possession or control any abandoned and unclaimed (escheatable) funds or assets such as dividends, payroll, deposits, outstanding checks, stock certificates, unidentified deposits, accounts payable debit balances, gift certificates, outstanding debentures or interest, royalties, mineral rights or funds due missing shareholders or other unclaimed amounts payable?

yes

yes  no

no

25Has the business filed a PA Abandoned and unclaimed Property Report for the preceding year?  yes

yes  no

no

26CeRTiFiCATiOn: i certify that the information provided (including Schedules, if applicable) on this application has been examined by me and is, to the best of my knowledge, true and correct. (Certification must agree with individuals listed in question 4.)

Print name |

|

Original Signature |

Signature of Officer – Please sign after printing |

Print name |

|

Original Signature |

Signature of Officer – Please sign after printing |

This form will serve as an application for clearances from both the PA department of Revenue and PA department of Labor & industry.

nOTe: l Submit typed original to the PA department of Revenue (address on Page 1) and one copy to the PA dePARTMenT OF LABOR & induSTRy, OFFiCe OF uneMPLOyMenT COMPenSATiOn TAX SeRviCeS,

ldirect telephone inquiries to the PA department of Revenue at

Reset Entire Form |

RETURN TO PAGE 1 |

NEXT PAGE |

PRINT FORM |

SCHEDULE A - STATEMENT OF ACQUISITION AND/OR DISPOSITION OF PENNSYLVANIA REAL ESTATE WITHIN FIVE YEARS FROM THE DATE OF THIS APPLICATION

Name of Transferee (EE) or Transferor (OR).

Indicate each by symbol EE or OR.

Date of Transfer

Property Location by

Local Political Subdivision

& County

Acquisition

Date

Original Cost |

County |

|

|

|

|

Land |

Building |

Assessed Value |

|

|

|

Actual Consider- |

Actual Monetary Worth |

Amount of PA Realty |

|

ation including |

|||

(Market Value) |

Stamps Affixed to |

||

Encumbrance |

|||

at Time of Transfer* |

Document** |

||

Assumed* |

|||

|

|

|

Explanation

SCHEDULE B STATEMENT OF ALL PENNSYLVANIA REAL ESTATE NOW OWNED

Property Location by Local Political Subdivision & County

Acquisition

Date

Original Cost |

County |

Actual Consider- |

Actual Monetary Worth |

Amount of PA Realty |

|

|

|

ation including |

(Market Value) |

Stamps Affixed to |

|

Land |

Building |

Assessed Value |

Encumbrance |

at Time of Transfer * |

Document** |

|

|

|

Assumed* |

||

|

|

|

|

|

|

Explanation

List all real estate now owned in PA that the business will dispose of prior to or at the time of the action for which a clearance is required. If under agreement of disposition, attach copy of executed agreement for each property so affected.

*Complete if applicable. If transfer represents less than a full

If application is for a Bulk Sale Clearance Certificate, attach a list of PA properties that will be retained. For each property, provide the complete address, including county, date of acquisition and nature of property (residential, industrial, acreage, commercial or farmland). If none, state none.

Document Specifics

| Fact | Description |

|---|---|

| Form Title | Application for Tax Clearance Certificate |

| Form Number | REV-181 (CM) 02-21 |

| Application Address | Bureau of Compliance, Revenue id PO BOX 280947, Harrisburg PA 17128-0947 |

| Filing Fee | No Filing Fee |

| Application Requirements | Includes business details, type of business, business activity description, and licenses/permits history |

| Governing Law for Specific Clauses | 15 Pa C.S. § 139 for mergers or consolidations, Act of 1947, P.L. 493 for foreign corporation clearance |

| Submission Instructions | Submit typed original to the PA Department of Revenue and a copy to the PA Department of Labor & Industry; retain a copy for records |

Guide to Writing Tax Certificate Pa

Filling out the Tax Certificate PA form is a crucial step in ensuring your business complies with Pennsylvania tax obligations, particularly when undergoing significant changes such as dissolution, merger, or transfer of assets. The process requires meticulous attention to detail, as the form covers various aspects of your business and its tax history. By following these steps carefully, you will provide the Department of Revenue and the Department of Labor & Industry with the necessary information to process your application smoothly.

- Begin with the Application Header: Write "REV-181 (CM) 02-21" at the top, indicating the form version you are using.

- Section 1: Enter the legal name of your business and the Federal Employer Identification Number (FEIN).

- Section 2: Provide the current mailing address of your business, including P.O. Box or street address, city, county, state, and ZIP code. Include the telephone number.

- Section 3: If applicable, fill in the name, address, and phone number of the attorney or representative who should receive the Clearance Certificate. If this information is the same as in Section 2, you may write "Same as above."

- Section 4: List the names, home addresses, and Social Security numbers of all key personnel associated with the business, like the sole proprietor, partners, or corporation officers. Provide telephone numbers and addresses for each.

- Section 5: Indicate the type of business. Check the appropriate box that reflects your business structure, such as Corporation, Partnership, or LLC, and provide additional requested information based on your selection, like incorporation dates or exemption letters if applicable.

- Section 6: Describe in detail the business activities conducted in Pennsylvania, including the principal commodities sold or services provided.

- Sections 7-8: Answer questions about employee tax withholdings, as well as any licenses, permits, or accounts your business held with the Commonwealth of Pennsylvania.

- Section 9: Indicate whether your business acquired assets or activities from a prior entity and provide details if applicable.

- Section 10-11: Disclose any real estate ownership within the last five years and any plans to transfer business assets or activities.

- Section 12: Select the purpose of requesting the Clearance Certificate, and provide additional details as required by your selection.

- Section 13: List the location where business records are kept, including a complete address and telephone number.

- Section 14: Mention any ongoing matters with the PA Department of Revenue.

- Sections 15-25: Respond to specific inquiries about sales, employment, corporate remuneration, stockholders, tax liabilities, and asset disposition, among other fiscal responsibilities.

- Section 26: Certify the accuracy of the information on the form by providing the print name and original signatures of the authorized individuals.

- Schedules A & B (if applicable): Complete the Statements of Acquisition and/or Disposition of Pennsylvania Real Estate, and list all Pennsylvania real estate currently owned.

After completing the form, review it thoroughly to ensure all the information is accurate and complete. Submit the typed original to the Pennsylvania Department of Revenue at the address provided on the form and keep a copy for your records. Remember, accuracy and completeness are essential for a smooth processing of your application for a Tax Clearance Certificate.

Understanding Tax Certificate Pa

-

What is the purpose of the Application for Tax Clearance Certificate (REV-181 CM)?

The Application for Tax Clearance Certificate, also known as form REV-181 CM, is designed for businesses that aim to formalize certain operations like dissolution, withdrawal, or transfer of activities within Pennsylvania. It serves to verify that a business has fulfilled all its tax obligations to the state. Whether a business is dissolving, merging, or engaging in bulk sales, this form ensures that all tax liabilities have been addressed, allowing for a smooth transition of business activities.

-

Who needs to complete the Tax Certificate Pa form?

Any business entity, such as a corporation, partnership, limited liability company, or sole proprietorship, that is undergoing significant changes like dissolution, merging, or transferring assets within Pennsylvania, must complete this form. Additionally, if a business intends to cease operations or change ownership, this form is necessary to ensure compliance with Pennsylvania's tax laws.

-

How can a business complete the Tax Certificate Pa form?

- Fill in business details including the name, federal EIN, and location.

- Provide the name, address, and social security number of key stakeholders like the sole proprietor, general partners, or company officers.

- Select the type of business and describe its activities within Pennsylvania.

- Answer questions regarding employee tax withholding, possession of various Pennsylvania licenses, and whether the business operations or assets were inherited or will be transferred.

- Indicate the purpose for applying for the clearance certificate and detail any real estate transactions.

- Complete certification at the end of the form, confirming the accuracy of the provided information.

The application involves detailed disclosures of business operations and tax status to ensure comprehensive compliance review.

-

What documents need to be submitted with the Tax Certificate Pa form?

In addition to the completed form, businesses may need to attach specific documents depending on their circumstances:

- If asserting nonprofit status, include a copy of the 501(c) exemption letter.

- For real estate owned or disposed within the last five years in Pennsylvania, complete Schedules A and/or B as applicable.

- If involved in a bulk sale, include a copy of the settlement statement.

- Attach a listing of addresses for any property to be retained in the case of a bulk sale clearance.

- Any other documents necessary to substantiate the answers provided within the application, such as agreements of transfer or dissolution.

These documents provide additional context and evidence for the claims made in the application, ensuring a thorough review process.

Common mistakes

When people fill out the Tax Certificate PA form, they often make mistakes that can lead to delays in processing or even the rejection of their application. It's important to approach this form with care and attention to detail. Here are five common mistakes:

- Incorrect or Incomplete Business Information: One of the most common errors is not providing complete information about the business, such as the full name, Federal EIN, and accurate location details. This includes failing to specify the type of business correctly or omitting the incorporation date for domestic corporations.

- Errors in Representative Information: If the clearance certificate needs to be sent to an attorney or another representative, applicants often input incorrect contact details. Ensuring the correct name, phone number, and address is crucial for communication.

- Misidentifying the Purpose of the Clearance Certificate: The form requires the applicant to check the specific reason for requesting the certificate. Mistakes or ambiguity in this section can lead to processing errors, as the department needs clear information to handle the request appropriately.

- Omission of Required Attachments: Depending on the specific circumstances of the business (e.g., change of ownership, acquisition of real estate), additional documentation or schedules (Schedule A or B) are required but often forgotten. This oversight can significantly delay the processing time.

- Incorrect Financial Information: Accurately reporting financial information such as the number of employees, total gross payroll, and details regarding remuneration of officers is essential. Errors or inaccuracies in these sections can raise red flags during the review process.

To improve the chances of a smooth process:

- Double-check all entries for accuracy before submission.

- Ensure all required sections are filled based on the business type and purpose of the application.

- Attach all necessary documents and schedules as indicated by the instructions on the form.

- Review financial figures and the list of licenses, permits, or accounts held with the Commonwealth of PA for completeness and accuracy.

- Seek clarification on any section of the form that is not fully understood to avoid assumptions that lead to errors.

Understanding and avoiding these common mistakes can streamline the process of obtaining a Tax Clearance Certificate in Pennsylvania, making it a smoother, more efficient process.

Documents used along the form

When completing the Tax Certificate PA form, namely the Application for Tax Clearance Certificate (REV-181), individuals and businesses often find the need to accompany this form with several other documents. These additional forms and documents play a crucial role in providing a comprehensive view of the financial and operational state of the business or entity applying for clearance. Here is a list of documents often used along with the Tax Certificate PA form, each described briefly:

- Schedule A & Schedule B: These are part of the Tax Certificate PA form, providing detailed information about any Pennsylvania real estate acquired or disposed of within five years from the date of application, as well as all Pennsylvania real estate currently owned.

- Articles of Incorporation: Required for corporations to prove the legality and validity of their business operations, as well as their registration details and the scope of the business.

- Bylaws or Operating Agreement: These documents outline the internal governance rules of a corporation (bylaws) or an LLC (operating agreement) and may be requested to understand the management and ownership structure of the entity.

- Financial Statements: Balance sheets, income statements, and statements of cash flow from recent fiscal years give a snapshot of the company’s financial health and are often needed for thorough tax clearance review.

- 501(c)(3) Exemption Letter: For nonprofit organizations, this IRS letter confirms the tax-exempt status of the entity and is critical for any tax-related processes.

- Power of Attorney (PA-8453): If an attorney or another individual is representing the business in its application for a tax clearance certificate, a Power of Attorney form may be needed to officially authorize this representation.

- Unemployment Compensation Tax Documents: Documents detailing unemployment tax status and compliance are crucial, especially if the entity has had employees.

- Sales, Use, and Hotel Occupancy Tax Documents: For businesses involved in retail, hospitality, or similar sectors, these documents verify compliance with relevant state tax laws.

Submitting these documents in conjunction with the Tax Certificate PA form streamlined processes by ensuring all relevant information is available for review. This approach not only enhances the efficiency of administrative procedures but also reinforces the commitment of businesses to transparency and regulatory compliance. It's always advisable to check with the Pennsylvania Department of Revenue or a legal advisor to ensure all required documents for your specific situation are accurately and fully provided.

Similar forms

A document similar to the Tax Certificate PA form is the Annual Report for corporations. Like the Tax Certificate application, the Annual Report requires detailed information about the business, including its principal address, officers, and activities within the state. Both documents are essential for compliance with state regulations, serving to update the state on the company's current status and ensuring that all necessary taxes and fees are properly assessed.

The Sales and Use Tax Exemption Certificate is another form with similarities to the Tax Certificate PA form. This exemption certificate allows businesses to purchase goods without paying sales tax, provided those goods are used in a manner that qualifies for exemption. Both forms require the business to provide specific details about their operations, including the type of business, location, and the nature of the goods or services provided. The key similarity lies in their use to ensure compliance with tax regulations, though one seeks exemption while the other verifies clearance.

The Employer Identification Number (EIN) Application (Form SS-4) shares common ground with the Tax Clearance Certificate form by requesting detailed information about the business’s identity and structure. Both forms require the business’s name, address, and the Social Security numbers or EINs of key officers. While the EIN Application is used for tax administration purposes on a federal level, allowing the IRS to identify business entities, the Tax Certificate is more focused on state-level compliance and clearances.

Business License Application forms, required for operating legally in many jurisdictions, also bear resemblance to the Tax Clearance Certificate form. These applications typically ask for detailed information about the business, including its physical location, type of business, owner information, and even details about the activities the business will undertake. Both are gatekeeping documents in their respective domains—licensing for operational legality in specific locales and tax clearance for state tax compliance.

Last but not least, the Change of Registered Agent form parallels the Tax Clearance Certificate form in several ways. It requires specific information about a business entity, including its name, type, and address. While its primary purpose is to update the state about who is authorized to receive legal documents on behalf of the company, it's similar in the sense that it involves formal notification to state authorities regarding important operational details. Both ensure that the state has current and accurate records for the business entities operating within its jurisdiction.

Dos and Don'ts

When filling out the Tax Certificate PA form, it's important to navigate the process with accuracy and attention to detail. Here’s a helpful guide to ensure you complete the form correctly and avoid common pitfalls:

- Do review the entire form before starting. This allows you to gather all the necessary information and documents beforehand, making the process smoother.

- Do use the correct business information, including the Federal EIN and the exact legal name of the business. This ensures that the form is processed without unnecessary delays.

- Do specify the type of business accurately. Whether it's a domestic corporation, partnership, or another type, selecting the right category is crucial for legal and tax purposes.

- Do provide clear descriptions of your business activities in Pennsylvania, including any sales or services performed. This detail is essential for determining your tax obligations accurately.

- Do check ‘Yes’ or ‘No’ appropriately in sections asking about previous business licenses or permits held in Pennsylvania. Being honest and accurate here is critical.

- Do sign and date the form where required. An unsigned form is considered incomplete and will return to you, causing delays.

- Don't rush through filling out the form. Mistakes can lead to processing delays or even penalties for inaccurate information.

- Don't leave sections blank if they are applicable to your business. Incomplete forms can lead to processing issues or may require clarification, delaying the clearance.

- Don't guess on dates or figures. Ensure all dates (e.g., incorporation, business start/end dates) and financial data are accurate. Guesswork can lead to discrepancies and potential audits.

- Don't ignore the instructions for attaching additional documents, such as a copy of your 501(c) exemption letter if you're a nonprofit organization. These documents are often crucial for processing your application.

- Don't use incorrect or outdated form versions. Always download the latest form from the official website to ensure compliance with current laws and guidelines.

- Don't forget to keep a copy of the filled-out form and any attachments for your records. Having a copy can be incredibly helpful for reference or if any issues arise.

Misconceptions

When dealing with the Application for Tax Clearance Certificate, commonly referred to as the REV-181 form, there are several misconceptions that can lead to confusion for both individuals and businesses in Pennsylvania. Understanding the truth behind these misconceptions can help in correctly completing the form and ensuring compliance with state requirements.

Misconception 1: The tax clearance certificate is only for closing businesses.

While the form is often used in the process of dissolving a business, it's also necessary for various other transactions, such as mergers, consolidations, and transfers of ownership. It's a versatile document that serves multiple purposes beyond business closure.

Misconception 2: Any business type can file the REV-181 form directly online.

Although the digital age has allowed for many processes to be carried out online, the REV-181 form must be submitted through mail or in person, after being fully completed and typed, to the Pennsylvania Department of Revenue and the Department of Labor & Industry as required.

Misconception 3: There is a filing fee for the tax clearance certificate.

No filing fee is required to process the tax clearance certificate, making it accessible for all businesses that need to complete it for their respective reasons, whether for dissolution or other purposes outlined within the form.

Misconception 4: The form is only applicable to businesses with physical presence in Pennsylvania.

Even if a company is not physically located in Pennsylvania, they may still need to complete the form if they have conducted business activities within the state that necessitates clearance from the PA Department of Revenue and PA Department of Labor & Industry.

Misconception 5: Personal information is irrelevant for the tax clearance certificate.

The form requires detailed information about the business, including names, home addresses, and social security numbers of key individuals associated with the business, emphasising the importance of personal detail in the certification process.

Misconception 6: The application instantly grants a clearance certificate.

Completion and submission of the form begin the review process, which may take some time before the clearance is granted. The review involves checking for any outstanding liabilities or compliance issues under the business's name.

Misconception 7: All businesses must complete every section of the form.

The relevant sections of the form vary based on the business’s specific circumstances and transaction type for which they are seeking clearance. Therefore, not all sections will apply to every business.

Misconception 8: The form covers tax clearance at both state and federal levels.

The REV-181 form is specific to the State of Pennsylvania, dealing with state tax obligations and clearances. Federal tax clearances require a different process through the IRS.

Misconception 9: Only businesses in dissolution need to worry about past real estate ownership.

Whether a business is dissolving or not, any past or present real estate owned in Pennsylvania within the last five years must be disclosed if applying for certain types of clearance certificates, showing the breadth of information required beyond just current business operations.

Key takeaways

Filling out and using the Tax Certificate PA form is a critical step for businesses in Pennsylvania, especially for those going through significant changes or transactions. Here are five key takeaways to ensure compliance and smooth processing:

- Complete all required sections accurately: It is crucial to provide thorough and accurate information regarding your business, such as the name and address, type of business, description of business activity in Pennsylvania, and information about any licenses or permits held.

- Include detailed information about ownership and representation: The form requests names, home addresses, and social security numbers of key business individuals like sole proprietors, general partners, and corporate officers. If an attorney or representative will handle the Certificate, their contact information must be included.

- Understand the purpose of your application: Whether you're seeking a clearance certificate for dissolving a corporation, transferring assets, or another reason, clearly indicate the purpose on the form to direct it to the appropriate department and expedite its processing.

- Attach all necessary supplementary documents: Depending on your business’s circumstances, you may need to attach additional documents such as a Schedule A or B for real estate transactions or a copy of your 501(c) exemption letter if you’re a nonprofit. Always check the specific requirements related to your application's purpose.

- Keep records and understand the dual clearance aspect: Submitting the form requires sending a typed original to the PA Department of Revenue and a copy to the PA Department of Labor & Industry. Maintaining a copy for your records is also advised. Note that this form serves as an application for clearances from both entities, which is vital for comprehensive compliance with state regulations.

Attention to detail and understanding the form's broad implications help ensure that your filing process is completed efficiently and effectively, reflecting well on your business and supporting your regulatory compliance efforts in Pennsylvania.

Popular PDF Documents

W 3 Form - Being an annual requirement, the W-3 form preparation is a routine part of year-end financial and payroll closing processes for businesses.

How Long Does an Eviction Take - Final notice and legal backing for landlords to regain property from non-paying tenants.