Get Tax Ar1000F Form

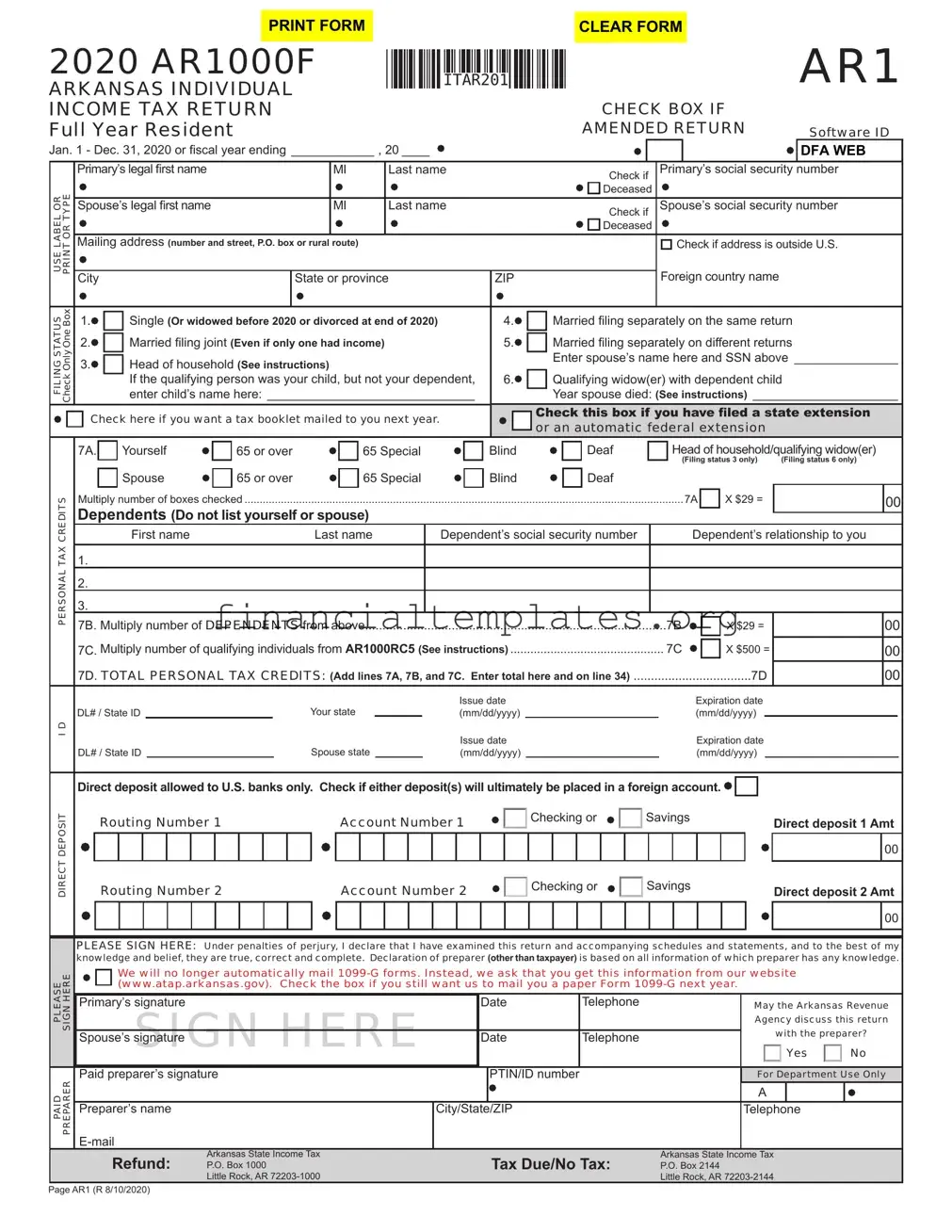

The AR1000F form, integral to the Arkansas taxation landscape, encapsulates a comprehensive process for individuals to submit their annual income tax returns to the state's Department of Finance and Administration. Stretched across the calendar year, or a fiscal period as applicable, it caters to a wide demographic, including full-year residents, with provisions for amended returns, highlighting its flexibility and consideration for varied taxpayer circumstances. The form distinguishes between multiple filing statuses—such as single, married (joint or separate), head of household, and qualifying widow(er)—adapting to the filer's life changes and financial situations. It introduces a systematic approach to documenting personal data, dependent information, and intricate financial details ranging from wages and dividends to capital gains and IRA distributions. Additionally, it underscores tax computation through detailed sections on income, adjustments, credits, and payments, allowing for direct deposit requests and reinforcing accuracy and honesty through required signatures. The AR1000F form also stands as a testament to technological adaptation, steering taxpayers towards online platforms for information and payments, while still acknowledging traditional methods. Its built-in flexibility for special credits and attention to details, such as personal tax credits and care for dependents, demonstrates a tailored approach to individual financial circumstances, embodying both administrative efficiency and taxpayer convenience.

Tax Ar1000F Example

|

PRINT FORM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CLEAR FORM |

AR1 |

2020 AR1000F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ITAR201 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

ARKANSAS INDIVIDUAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

INCOME TAX RETURN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CHECK BOX IF |

|||

Full Year Resident |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AMENDED RETURN Software ID |

|||

Jan. 1 - Dec. 31, 2020 or fiscal year ending ____________ , 20 ____

|

|

Primary’s legal first name |

|

|

|

MI |

Last name |

|

TYPEOR |

|

|||||||

|

Spouse’s legal first name |

|

|

MI |

Last name |

|||

OR |

|

|

|

|||||

LABEL |

Mailing address (number and street, P.O. box or rural |

|

route) |

|

||||

|

|

|||||||

|

|

|

|

|

|

|

|

|

USE |

|

City |

|

|

State or province |

|||

|

|

|

||||||

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

Box |

1. |

Single (Or widowed before 2020 or divorced at end of 2020) |

||||||

STATUS |

2. |

Married filing joint (Even if only one had income) |

|

|||||

One |

|

|||||||

Only |

3. |

Head of household (See instructions) |

|

|||||

FILING |

|

|

If the qualifying person was your child, but not your dependent, |

|||||

Check |

|

|

||||||

|

|

enter child’s name here: ______________________________ |

||||||

Check here if you want a tax booklet mailed to you next year.

|

DFA WEB |

Check if |

Primary’s social security number |

Deceased |

|

Check if |

Spouse’s social security number |

Deceased |

|

Check if address is outside U.S.

Check if address is outside U.S.

ZIP |

Foreign country name |

|

|

Married filing separately on the same return |

|

4. |

||

5. |

Married filing separately on different returns |

|

|

|

Enter spouse’s name here and SSN above _______________ |

6. |

Qualifying widow(er) with dependent child |

|

|

|

Year spouse died: (See instructions) _____________________ |

|

|

&KHFNWKLVER[LI\RXKDYHÀOHGDVWDWHH[WHQVLRQ |

|

|

|

|

|

or an automatic federal extension |

|

|

|

PERSONAL TAX CREDITS

I D

DIRECT DEPOSIT

PLEASE SIGN HERE

7A. |

|

Yourself |

|

|

65 or over |

|

|

65 Special |

|

|

|

|

Blind |

|

|

|

|

Deaf |

|

|

|

|

Head of household/qualifying widow(er) |

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deaf |

|

|

|

|

(Filing status 3 only) |

(Filing status 6 only) |

||||||||||||

|

|

|

Spouse |

|

|

65 or over |

|

|

65 Special |

|

|

|

|

Blind |

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

Multiply number of boxes checked |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7A |

|

X $29 = |

|

00 |

||||||||||||||||||||||

Dependents (Do not list yourself or spouse) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

First name |

|

|

|

|

|

Last name |

|

Dependent’s social security number |

|

|

|

|

Dependent’s relationship to you |

||||||||||||||||||||||||||||||||||||||

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.......................................................................................7B. Multiply number of DEPENDENTS from above |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7B |

|

X $29 = |

|

00 |

||||||||||||||||||||||||||||||||

7C. Multiply number of qualifying individuals from AR1000RC5 (See instructions) |

|

|

|

|

|

|

|

|

|

|

7C |

|

X $500 = |

|

00 |

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

7D. TOTAL PERSONAL TAX CREDITS: (Add lines 7A, 7B, and 7C. Enter total here and on line 34) |

|

|

|

|

|

|

|

|

7D |

|

00 |

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your state |

|

|

|

|

|

|

|

|

Issue date |

|

|

|

|

|

|

|

|

|

|

|

Expiration date |

|

|

|

||||||||||||||

DL# / State ID |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(mm/dd/yyyy) |

|

|

|

|

|

|

|

|

|

|

|

(mm/dd/yyyy) |

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse state |

|

|

|

|

|

|

|

Issue date |

|

|

|

|

|

|

|

|

|

|

|

|

Expiration date |

|

|

|

||||||||||||||

DL# / State ID |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(mm/dd/yyyy) |

|

|

|

|

|

|

|

|

|

|

|

|

(mm/dd/yyyy) |

|

|

|

|

|||||||||||||||||||||

Direct deposit allowed to U.S. banks only. Check if either deposit(s) will ultimately be placed in a foreign account. |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

Routing Number 1 |

|

|

|

|

|

|

Account Number 1 |

|

|

Checking or |

Savings |

|

|

|

|

|

|

Direct deposit 1 Amt |

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

Routing Number 2 |

|

|

|

|

|

|

Account Number 2 |

|

Checking or |

Savings |

|

|

|

|

|

|

Direct deposit 2 Amt |

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PLEASE SIGN HERE: Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

We will no longer automatically mail

|

Primary’s signature |

Date |

Telephone |

May the Arkansas Revenue |

||||

|

SIGN HERE |

|

|

|

|

Yes |

|

No |

|

|

|

|

Agency discuss this return |

||||

|

Spouse’s signature |

Date |

Telephone |

|

with the preparer? |

|||

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paid preparer’s signature

PTIN/ID number

For Department Use Only

PREPARER |

|

|

|

|

|

A |

|

|

PAID |

|

|

|

|

|

|

|

|

|

Preparer’s name |

|

City/State/ZIP |

|

|

Telephone |

|

|

|

|

|

|

|

|

|

|

|

|

Refund: |

Arkansas State Income Tax |

Tax Due/No Tax: |

Arkansas State Income Tax |

||||

|

P.O. Box 1000 |

P.O. Box 2144 |

||||||

|

|

Little Rock, AR |

|

Little Rock, AR |

||||

Page AR1 (R 8/10/2020)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

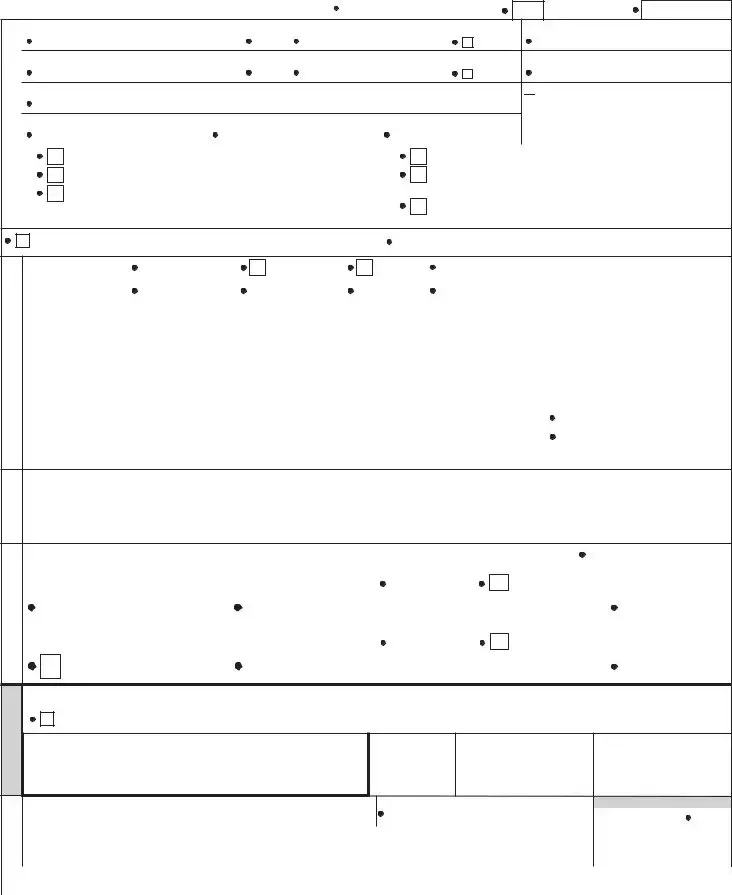

AR2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ITAR202 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Primary SSN _______- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ROUND ALL AMOUNTS TO WHOLE DOLLARS |

|

|

|

|

|

|

|

|

|

|

|

(A) Primary/Joint |

|

|

(B) Spouse’s Income |

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Income |

|

|

|

Status 4 Only |

||||||||||||||||||||||||||||||||||||||||

2(s)/1099(s) |

8. |

Wages, salaries, tips, etc: (Attach |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

00 |

|

|

00 |

|||||||

9. |

Military pay: |

|

Primary |

|

|

|

|

|

00 |

|

Spouse |

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

10. |

Interest income: (If over $1,500, Attach AR4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

00 |

|

|

00 |

||||||||

11. |

Dividend income: (If over $1,500, Attach AR4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

00 |

|

|

00 |

||||||||

W- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

12. |

Alimony and separate maintenance received: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

00 |

|

|

00 |

||||||||

of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

13. |

Business or professional income: (Attach federal Schedule C) |

|

|

|

|

|

|

|

13 |

|

|

|

|

|

|

00 |

|

|

00 |

||||||||||||||||||||||||||||||||||||||

on top |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

14. |

Capital gains/(losses) from stocks, bonds, etc: (See instructions, Attach federal Schedule D) |

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

00 |

|

|

00 |

||||||||||||||||||||||||||||||||||||||

check |

15. |

Other gains or (losses): (Attach federal Form 4797 and/or AR4684 if applicable) |

|

|

|

|

|

|

|

15 |

|

|

|

|

|

|

00 |

|

|

00 |

|||||||||||||||||||||||||||||||||||||

16. |

|

|

|

|

|

|

|

16 |

|

|

|

|

|

|

00 |

|

|

00 |

|||||||||||||||||||||||||||||||||||||||

INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17. |

Military retirement: Primary |

|

|

|

|

|

|

00 |

|

Spouse |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18A. Primary employer pension plan(s)/qualified IRA(s): (See instructions, Attach all 1099Rs) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

Attach |

|

|

|

|

|

Less |

|

|

|

|

|

|

|

00 |

|

|

|

||||||||||||||||||||||||||||||||||||||||

/ |

|

Gross distribution |

|

|

|

|

00 |

|

Taxable amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

18A |

|

|

|

|

|

|

|||||||||||||||||

here |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$6,000 |

|

|

|

|

|

|

|||||||||||||||||||||||

18B. Spouse employer |

pension plan(s)/qualified |

IRA(s): (See instructions, Attach all 1099Rs) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

00 |

|||||||||||||||||||||||||||||||||||||

|

Gross distribution |

|

|

|

|

00 |

|

Taxable amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

Less |

18B |

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$6,000 |

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

00 |

|

|

00 |

||||||||||||||||||||||||||||||||||||||||||||||||||

19. |

Rents, royalties, |

partnerships, estates, trusts, |

etc.: (Attach federal |

Schedule E) |

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

20. |

Farm income: (Attach federal Schedule F) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

00 |

|

|

00 |

||||||||

21. |

Unemployment: |

|

Primary/Joint |

|

|

|

|

|

00 |

|

Spouse |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

21 |

|

|

|

|

|

|

00 |

|

|

00 |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

00 |

||||||||||||||||||||||||||||||||||||||

Attach |

22. |

Other income/depreciation differences: (Attach Form AR |

|

.................................................................. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22 |

|

|

|

|

|

|

|

|

|||||||||||||||

23. |

TOTAL INCOME: (Add lines 8 through 22) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23 |

|

|

|

|

|

|

00 |

|

|

00 |

||||||||

24. |

TOTAL ADJUSTMENTS: (Attach Form AR1000ADJ) |

|

|

|

|

|

|

|

24 |

|

|

|

|

|

|

00 |

|

|

00 |

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

25. |

ADJUSTED GROSS INCOME: (Subtract line 24 from line 23) |

|

|

|

|

|

|

|

25 |

|

|

|

|

|

|

00 |

|

|

00 |

|||||||||||||||||||||||||||||||||||||

|

26. |

Select tax table: (Select only one) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26 |

|

|

|

|

|

|

|

|

|

|

||||||

|

27. |

Low income table ($0), For low income qualifications see line 26 instructions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

COMPUTATION |

|

Standard deduction ($2,200 or $4,400 for filing status 2 only) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

Itemized deductions (Attach AR3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27 |

|

|

|

|

|

|

00 |

|

|

00 |

|||||||

28. |

NET TAXABLE INCOME: (Subtract line 27 from line 25) |

|

|

|

|

|

|

|

28 |

|

|

|

|

|

|

00 |

|

|

00 |

||||||||||||||||||||||||||||||||||||||

29. |

TAX: (Enter tax from tax table) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29 |

|

|

|

|

|

|

00 |

|

|

00 |

||||||||

30. |

Combined tax: (Add amounts from line 29, columns A and B) |

|

|

|

|

|

|

|

|

|

|

|

|

|

30 |

|

|

00 |

|||||||||||||||||||||||||||||||||||||||

TAX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

31. |

Enter tax from Lump Sum Distribution Averaging Schedule: (Attach AR1000TD) |

|

|

|

|

|

|

|

|

|

|

|

|

|

31 |

|

|

00 |

|||||||||||||||||||||||||||||||||||||||

|

32. |

Additional tax on IRA and qualified plan withdrawal and overpayment: (Attach federal Form 5329, if required) |

|

|

32 |

|

|

00 |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

33. |

TOTAL TAX: (Add lines 30 through 32) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

33 |

|

|

00 |

||||||||

CREDITS |

34. |

Personal tax credit(s): (Enter total from line 7D) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34 |

|

|

|

|

|

|

00 |

|

|

|

|||||||

35. |

Child care credit: (20% of federal credit allowed; attach federal Form 2441) |

|

|

|

|

|

|

|

35 |

|

|

|

|

|

|

00 |

|

|

|

||||||||||||||||||||||||||||||||||||||

36. |

Other credits: (Attach AR1000TC) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

36 |

|

|

|

|

|

|

00 |

|

|

|

||||||||

TAX |

37. |

TOTAL CREDITS: (Add lines 34 through 36) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

37 |

|

|

00 |

||||||||

38. |

NET TAX: (Subtract line 37 from line 33. If line 37 is greater than line 33, enter 0) |

|

|

|

|

|

|

|

|

|

|

|

|

|

38 |

|

|

00 |

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

39. |

Arkansas income tax withheld: (Attach state copies of |

|

|

|

|

|

|

|

39 |

|

|

|

|

|

|

00 |

|

|

|

|||||||||||||||||||||||||||||||||||||

|

40. |

Estimated tax paid or credit brought forward from 2019: |

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

00 |

|

|

|

|||||||||||||||||||||||||||||||||||||

PAYMENTS |

41. |

Payment made with extension: (See instructions) |

|

|

|

|

|

|

|

41 |

|

|

|

|

|

|

00 |

|

|

|

|||||||||||||||||||||||||||||||||||||

42. |

AMENDED RETURNS ONLY - Previous payments: (See instructions) |

|

|

|

|

|

|

|

42 |

|

|

|

|

|

|

00 |

|

|

|

||||||||||||||||||||||||||||||||||||||

43. |

Early childhood program: Certification number: |

|

|

|

|

|

|

|

|

43 |

|

|

|

|

|

|

00 |

|

|

|

|||||||||||||||||||||||||||||||||||||

|

(20% of federal credit; Attach federal Form 2441 and Form AR1000EC) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

44. |

TOTAL PAYMENTS: (Add lines 39 through 43) |

|

|

|

|

|

|

|

|

|

|

|

|

|

44 |

|

|

00 |

||||||||||||||||||||||||||||||||||||||

|

45. |

AMENDED RETURNS ONLY - Previous refund: (See instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

45 |

|

|

00 |

||||||||||||||||||||||||||||||||||||||

|

46. |

|

|

|

|

|

|

|

|

................................................................................................................. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

46 |

|

|

|

|||

|

Adjusted total payments: (Subtract line 45 from line 44) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

||||||||||||||||||||||||||||||||||||||||

DUE |

47. |

AMOUNT OF OVERPAYMENT/REFUND: (If line 46 is greater than line 38, enter difference) |

|

|

|

|

|

47 |

|

|

00 |

||||||||||||||||||||||||||||||||||||||||||||||

48. |

Amount to be applied to 2021 estimated tax: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

48 |

|

|

|

|

|

00 |

|

|

|

|||||||||

TAX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

49. |

Amount of |

|

|

|

|

|

|

|

49 |

|

|

|

|

|

00 |

|

|

|

|||||||||||||||||||||||||||||||||||||||

OR |

50. |

AMOUNT TO BE REFUNDED TO YOU: (Subtract lines 48 and 49 from line 47) |

|

|

|

|

|

|

|

|

|

|

|

REFUND 50 |

- |

|

00 |

||||||||||||||||||||||||||||||||||||||||

REFUND |

51. |

AMOUNT DUE: (If line 46 is less than line 38, enter difference; If over $1,000, continue to 52A) |

|

|

|

TAX DUE |

51 |

/ |

|

00 |

|||||||||||||||||||||||||||||||||||||||||||||||

52A. UEP: Attach Form AR2210 or AR2210A. If required, enter exception in box 52A |

|

|

|

|

|

|

|

Penalty 52B |

|

|

|

00 |

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

52C.Add lines 51 and 52B: (See instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL DUE 52C |

|

|

00 |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

PAY ONLINE: Please visit our secure site ATAP (Arkansas Taxpayer Access Point) at www.atap.arkansas.gov. ATAP allows taxpayers or their representatives to |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

log on, make payments and manage their account online. ATAP is available 24 hours. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||

|

|

|

PAY BY CREDIT CARD: (See instructions) |

|

|

|

|

|

|

PAY BY MAIL: (See instructions) |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||

Page AR2 (R 3/2/2021)

Document Specifics

| Fact Name | Fact Detail |

|---|---|

| Form Title | Arkansas Individual Income Tax Return |

| Form Number | AR1000F |

| Applicable Tax Year | 2020 |

| Purpose | For filing individual state income tax in Arkansas |

| Filing Status Options | Single, Married filing jointly, Married filing separately, Head of household, Qualifying widow(er) with dependent child |

| Residency Status Options | Full-Year Resident, AMENDED RETURN |

| Tax Credits | Includes sections for personal tax credits, child care credit, and other credits |

| Income Reporting | Wages, salaries, tips, military pay, interest income, dividend income, and more |

| Direct Deposit | Allows for refunds to be directly deposited into U.S. bank accounts |

| Governing Law | Arkansas State Income Tax Laws |

Guide to Writing Tax Ar1000F

Filling out the Tax AR1000F form is a straightforward process that requires attention to detail to ensure that all information is accurate and complete. This form is used by Arkansas taxpayers to file their annual income tax return. Prior to starting, gather all necessary documentation such as W-2s, 1099s, federal income tax return, and any relevant deductions or credits information. Following these steps will help streamline the process and ensure that the filing is done correctly.

- Begin by checking the appropriate box to indicate if you are filing an amended return or if you are a full-year resident.

- Enter the fiscal year ending date if filing for a fiscal year different than the calendar year.

- Provide the primary taxpayer’s legal name, middle initial, and last name along with the spouse’s information if filing jointly.

- Fill in your mailing address, including city, state or province, and ZIP or postal code. If the address is outside the U.S., check the appropriate box and provide the foreign country name.

- Select your filing status by checking the appropriate box: Single, Married filing jointly, Head of household, Married filing separately on the same return, Married filing separately on different returns, or Qualifying widow(er) with dependent child.

- If you want a tax booklet mailed to you next year, check the indicated box.

- Enter the primary and spouse's social security numbers, checking the "Deceased" box if applicable.

- Under "PERSONAL TAX CREDITS," enter the applicable information for dependents, including their social security numbers and relationship to you, then calculate your total personal tax credits.

- For the "DIRECT DEPOSIT" section, fill out banking information for a refund, if you choose direct deposit.

- Complete the income and deductions sections, ensuring to attach any required forms such as W-2s, federal Schedule C for business income, Schedule D for capital gains, Form 4797 for other gains, and any other relevant forms.

- Calculate your adjusted gross income, select your tax table and compute taxable income, tax amount, and apply credits.

- Under "PAYMENTS," enter amounts for Arkansas income tax withheld, estimated tax payments, payments made with extension, and any amounts for amended returns if applicable.

- Sign and date the form. If a paid preparer completed the form, they should also sign and date it along with their PTIN/ID number.

- Review the entire form for accuracy and completeness. Attach any required documentation.

- Proceed to submission according to the instructions, choosing between online filing and mailing.

After completing and submitting the AR1000F form, it's important to keep a copy for your records. The next steps involve waiting for any applicable refund or preparing for any payment that might be due. For refunds, the method chosen on the form (direct deposit or check) will determine how and when you receive it. If you owe taxes, ensure they are paid by the deadline to avoid penalties and interest. For both cases, staying informed about the processing status of your return can be done through the Arkansas Department of Finance and Administration's website or contact center.

Understanding Tax Ar1000F

Frequently Asked Questions about the AR1000F Income Tax Return Form

Handling your taxes can be a bit overwhelming. To help, here are some answers to common questions about filling out the AR1000F form, the Arkansas Individual Income Tax Return form.

- Who needs to file the AR1000F form?

If you're an Arkansas resident who has earned income during the tax year, you'll likely need to fill out the AR1000F form. This applies whether you lived in Arkansas for the entire year (full-year resident) or part of the year. If you've earned income from sources within Arkansas but live in another state, you might need to file a different form.

- What information do I need to fill out the AR1000F form?

To complete the AR1000F form correctly, gather all your income-related documents for the tax year. This includes W-2 forms from your employer, 1099 forms if you're self-employed or have other sources of income, and any documents related to deductions or credits you plan to claim. Also, have your personal information ready, such as your Social Security number and your spouse's if filing jointly.

- Can I file the AR1000F form electronically?

Yes, Arkansas supports e-filing for the AR1000F form through authorized software. Filing electronically is quicker and can result in faster processing of your return and any potential refunds. To file electronically, choose an approved software provider and follow their instructions for submitting your tax return online.

- What if I need more time to file my AR1000F form?

If you can't file your AR1000F form by the due date, you can request an extension. Keep in mind, an extension to file is not an extension to pay any taxes owed. Estimate and pay any owed taxes by the original due date to avoid potential penalties and interest. To request an extension, you may need to complete a specific form or follow the procedures laid out by the Arkansas Department of Finance and Administration.

Remember, filing your taxes accurately and on time helps prevent potential issues with your return. If you have more complex situations or questions, consider reaching out to a tax professional for guidance.

Common mistakes

Filing tax forms can sometimes be a daunting task, and the Arkansas Individual Income Tax Return AR1000F form is no exception. People often make mistakes that can be easily avoided. Understanding these common errors can help ensure that the process goes more smoothly and may even help avoid unnecessary delays or audits. Here are nine mistakes to avoid:

- Not checking the appropriate filing status box. It's crucial to accurately select your filing status as it affects tax liability and potential deductions.

- Entering incorrect Social Security numbers. This can lead to processing delays or mismatch issues with the IRS.

- Forgetting to include all sources of income, such as W-2 and 1099 forms. This oversight can result in underreporting income.

- Omitting personal tax credits you're eligible for, leading to a higher tax due than necessary.

- Math errors in calculating adjusted gross income, taxable income, and tax due. These can affect refunds or amounts owed.

- Incorrectly calculating deductions, whether itemizing or taking the standard deduction, can alter tax liability.

- Forgetting to sign and date the form. An unsigned tax return is like an unsigned check – it's not valid.

- Not attaching required documentation, such as Schedule AR1000EC for early childhood program tax credits, which can result in denied credits.

- Choosing the wrong direct deposit option for your refund, or incorrectly entering your banking information, can delay or misdirect your refund.

Avoiding these common mistakes when filling out the AR1000F can help ensure a smoother tax return process. Always carefully review your return before submission to minimize errors and potential delays. Remember, accurate and complete information is crucial for a correct and timely processed tax return.

Documents used along the form

Filing tax returns involves meticulous detail and proper documentation. Beyond completing the AR1000F, individuals often need to manage several additional forms to accurately report their income, deductions, and credits. Each of these documents integrates with the primary tax return to present a comprehensive overview of the taxpayer's financial activities over the fiscal year.

- AR1000ADJ: This document is essential for detailing adjustments to income. Such adjustments could include contributions to an IRA, alimony payments, or education-related expenses. Adjusting your gross income can provide a more accurate representation of your taxable income.

- AR1000TC: For those eligible for various tax credits other than the standard personal and dependent credits, this form is critical. Credits for rehabilitation of historic structures, investments in targeted businesses, or contributions to the Arkansas Development Finance Authority are examples of what might be detailed on this form.

- AR4: Interest and Dividend Income Schedule, necessary when an individual's interest or dividend income exceeds $1,500. It ensures all income from such sources is reported accurately. Keeping track of these earnings is crucial for properly calculating tax liability.

- AR2210/AR2210A: These forms are used to document underpayment of estimated tax throughout the year or to highlight any exemptions to penalties incurred for underpayment. Proper completion helps manage potential penalties and ensures compliance with estimated tax payment regulations.

- AR1000EC: A necessary addition for those claiming credits for Early Childhood Program contributions. By attaching Federal Form 2441 along with this document, taxpayers validate their contributions towards these programs, potentially influencing their tax liability positively.

While the AR1000F serves as the foundation for an individual's income tax return in Arkansas, the companion documents play a critical role in shaping the final tax obligation. Together, these forms ensure taxpayers comply with state tax regulations while taking advantage of all available deductions and credits. Navigating through these forms may seem daunting, but each plays a vital part in the tax preparation process, ensuring accuracy and completeness.

Similar forms

The Form 1040, or U.S. Individual Income Tax Return, closely aligns with the AR1000F form in purpose and structure. Both forms are designed for individuals to report their annual income, calculate tax liability, and determine if a refund or additional payment is due. They also gather taxpayer information, dependents, income from various sources, and allow for deductions and credits to calculate the final tax liability. Each has specific sections dedicated to income adjustments, tax computation, and credits applicable to the fiscal year.

The Schedule C (Profit or Loss from Business) mirrors elements of the AR1000F form, particularly in sections where business or professional income is reported. Just like the AR1000F requests attachment of a federal Schedule C for business or professional income, the purpose of Schedule C is to report the income and expenses of the business operated by the filer. This ensures accurate calculation of taxable business income after adjustments, mirroring the objective of income reporting sections in the AR1000F form.

The 1099-R form, used for reporting distributions from pensions, annuities, retirement or profit-sharing plans, and IRAs, shares similarities with portions of the AR1000F that inquire about retirement income. Both documents are crucial for determining the tax implications of such distributions. The AR1000F specifically asks for attachment of all 1099-R forms when reporting primary and spouse’s pension plans or qualified IRA distributions, indicating their interconnectedness in accurately reporting and taxing retirement income.

Form W-2, the Wage and Tax Statement, and the AR1000F share the need for wage earners to report their income accurately. The AR1000F requires taxpayers to attach their W-2 forms as evidence of wages, salaries, tips, etc., reflecting how both forms are instrumental in calculating tax based on earned income. Detailed in each W-2 are key figures necessary for completing portions of the AR1000F, such as total wages earned and federal income tax withheld, foundational in determining state tax liability.

The Schedule E (Supplemental Income and Loss) bears resemblance to parts of the AR1000F form that deal with income from rents, royalties, partnerships, estates, and trusts. For those who need to report such income on the AR1000F, the federal Schedule E may provide the necessary detail and documentation. This reflects the broader concept of accurately reporting various income types for tax purposes, a principle that underlies both the AR1000F and Schedule E.

Form 2441, Child and Dependent Care Expenses, is related to the child care credit section on the AR1000F. Taxpayers can claim a percentage of the federal credit for child and dependent care expenses on the AR1000F, similar to how Form 2441 calculates the federal tax credit based on those same expenses. This demonstrates an interplay between federal and state tax filings where state credits may hinge on federal determinations.

The AR1000EC form (Early Childhood Program) pertains to specific state-level credits similar to the child care credit on the AR1000F. The requirement to attach Form AR1000EC for claiming the credit reflects targeted tax incentives much like those for general child care. It illustrates how various credits, each with its dedicated form and criteria, collectively reduce tax liability on the AR1000F.

Form AR4, related to interest and dividend income, parallels sections of the AR1000F where taxpayers must report such earnings. The necessity to attach Form AR4 for amounts over a threshold mirrors the way the tax system categorizes and scrutinizes different income types. This ensures thorough documentation and fair taxation of all income sources, aligning with the principles of comprehensive income reporting.

The Form AR-OI (Other Income/Depreciation Differences) is akin to the portion of the AR1000F that captures other income types not specified elsewhere. This attachment requirement highlights the need for a detailed account of varied income sources that may carry different tax implications. It underscores the comprehensive nature of income tax returns in capturing the full financial picture of the taxpayer.

Lastly, the Form AR2210 (Underpayment of Estimated Tax by Individuals) shares its rationale with parts of the AR1000F concerning underpayment penalties. Just as the AR2210 calculates penalties for underpayment of estimated tax, the AR1000F includes sections related to additional tax liabilities, such as penalties or specific tax adjustments. This reflects the broader requirement for timely and accurate tax payments and the potential consequences of failing to meet these obligations.

Dos and Don'ts

Filling out the Tax Form AR1000F correctly is crucial to ensure accurate reporting and to avoid delays or audits. Here are essential do's and don'ts to keep in mind:

- Do ensure all personal information is accurate, including your full name, address, and Social Security number. Mistakes in this area can lead to processing delays.

- Do report all income accurately, using the appropriate lines for wages, salaries, tips, and any other forms of income you received during the tax year.

- Do carefully determine your filing status. Whether you're filing singly, jointly with a spouse, or as head of household can significantly impact your tax liability.

- Do take advantage of all eligible deductions and credits to minimize your tax liability. This includes state income tax withheld, estimated tax payments, and any qualifying tax credits like child care or personal tax credits.

- Do double-check your math and the accuracy of all entered information before submitting your form. An error can delay processing or result in owing more tax than anticipated.

- Do sign and date the form. An unsigned tax return is like an unsigned check – it's not valid.

- Do keep a copy of your filed tax return for your records. It’s important to have this information on hand for future reference or amendments.

- Don't leave any fields blank. If a particular section does not apply, enter "0" or "N/A" to indicate the question was read but not applicable.

- Don't use pencil or erasable ink when filling out the form. All entries should be made in permanent blue or black ink or typed to prevent alterations.

- Don't estimate numbers. Use exact amounts when reporting income, taxes withheld, deductions, and credits. Rounding to the nearest dollar is acceptable but be precise.

- Don't forget to attach all required documentation, such as W-2s, 1099s, and any schedules that support your entries on the form.

- Don't ignore the instructions for specific lines. The AR1000F instructions provide valuable details on how to accurately complete each part of the form.

- Don't send in your tax return without reviewing it thoroughly. A quick final check can catch mistakes that could otherwise go unnoticed.

- Don't hesitate to seek help if you're unsure about any aspect of your tax return. Professional advice can prevent mistakes and ensure you're taking advantage of all beneficial tax laws.

Misconceptions

When it comes to filing tax forms, it's easy to fall prey to misconceptions, especially with specific forms like the Arkansas Individual Income Tax Return, AR1000F. Here are eight common misunderstandings about this form:

Only for Full-Year Residents: A common mistake is thinking the AR1000F is exclusively for full-year Arkansas residents. While it is designed for residents, there's a checkbox for those amending their return, implying that changes in residency status during the tax year can affect how this form is used.

Married Filing Separately Requires Different Forms: Many believe if they are married but filing separately, they must use entirely separate forms. However, the AR1000F accommodates married filing separately on the same return, explicitly providing space to enter a spouse’s name and social security number.

Direct Deposits Limited to Single Accounts: The notion that refunds can only be deposited into a single account is incorrect. The form indeed allows for direct deposits to be split between two accounts, helping taxpayers manage their finances more efficiently.

No Special Provisions for Ages 65+ or the Disabled: Another misunderstanding is overlooking the form's provisions for individuals 65 and older or those who are blind or deaf. These special circumstances afford additional tax credits, clearly outlined in the form’s credits section.

Physical Printout Required for Filing: With the increasing shift toward digital, the belief that a printed form must be submitted is outdated. The form notes that electronic filing is an option, offering convenience and efficiency.

Complex Adjustments and Credits are Difficult to Claim: The AR1000F is designed with straightforward sections for adjustments and credits, including personal tax credits, child care credits, and other specific credits. This dispels the myth that claiming adjustments and credits is overly complex.

All Deductions Must Be Itemized: There's a misconception that taxpayers must itemize deductions. The form allows for standard deductions, simplifying the process for those who might not benefit from itemizing.

Filing Status is Fixed: Some believe once you choose a filing status, it cannot be amended. Yet, the AR1000F includes a checkbox for an amended return, acknowledging that taxpayer situations can change, leading to a different, more beneficial filing status.

Understanding these misconceptions about the AR1000F can lead to a smoother filing process and potentially maximize returns. It’s important for Arkansas taxpayers to review the form thoroughly and consider all available options to ensure accuracy and completeness when filing their state income tax return.

Key takeaways

Filling out the AR1000F form, also known as the Arkansas Individual Income Tax Return, is an essential task for residents of Arkansas to comply with state tax regulations. Understanding the key aspects of this form can help ensure accuracy and compliance. Here are some vital takeaways for successfully completing and using the AR1000F form:

- Before starting, verify that you're filling out the correct year's form to avoid any discrepancies with the Arkansas Department of Finance and Administration (DFA).

- Identify your filing status accurately, as it dictates your tax liability and potential deductions; options include Single, Married Filing Jointly, Head of Household, Married Filing Separately on the same or different returns, and Qualifying Widow(er) with Dependent Child.

- If you've experienced any life changes such as marriage, divorce, or the death of a spouse, ensure that your filing status reflects these changes accurately to prevent issues with your return.

- Report all sources of income accurately, including W-2s for wages, salaries, and tips, as well as other income sources such as military pay, interest, dividends, alimony, and business or professional incomes.

- Remember to attach all necessary documentation for certain types of income, such as AR4 for interest or dividends over $1,500, federal Schedule C for business or professional income, and federal Schedule D for capital gains or losses.

- Take advantage of personal tax credits and deductions where eligible, including credits for yourself or spouse if over 65, blind, deaf, or if you're filing as head of household or qualifying widow(er).

- Direct deposit for refunds is available and recommended for faster processing; ensure that banking details like routing and account numbers are correct to avoid delays.

- Sign the form—both the primary taxpayer and spouse (if filing jointly) must sign and date the return. If someone prepares your return, they must also sign and provide their Preparer Tax Identification Number (PTIN) or ID number.

- Stay informed about electronic filing options and online payment through the secure site ATAP (Arkansas Taxpayer Access Point), which provides a convenient way to manage your tax affairs 24/7.

Completing the AR1000F form with diligence and attention to detail can significantly ease the process of complying with state income tax obligations. Taking the time to understand these key points ensures that your tax return is accurate, complete, and filed in accordance with Arkansas tax laws.

Popular PDF Documents

941 Taxes - Apart from federal taxes, the information on the 941 form can assist employers in reconciling state unemployment insurance contributions, where applicable.

What Is Form 8962 Used for - Through this form, the government can provide targeted support to help individuals afford their health insurance premiums.