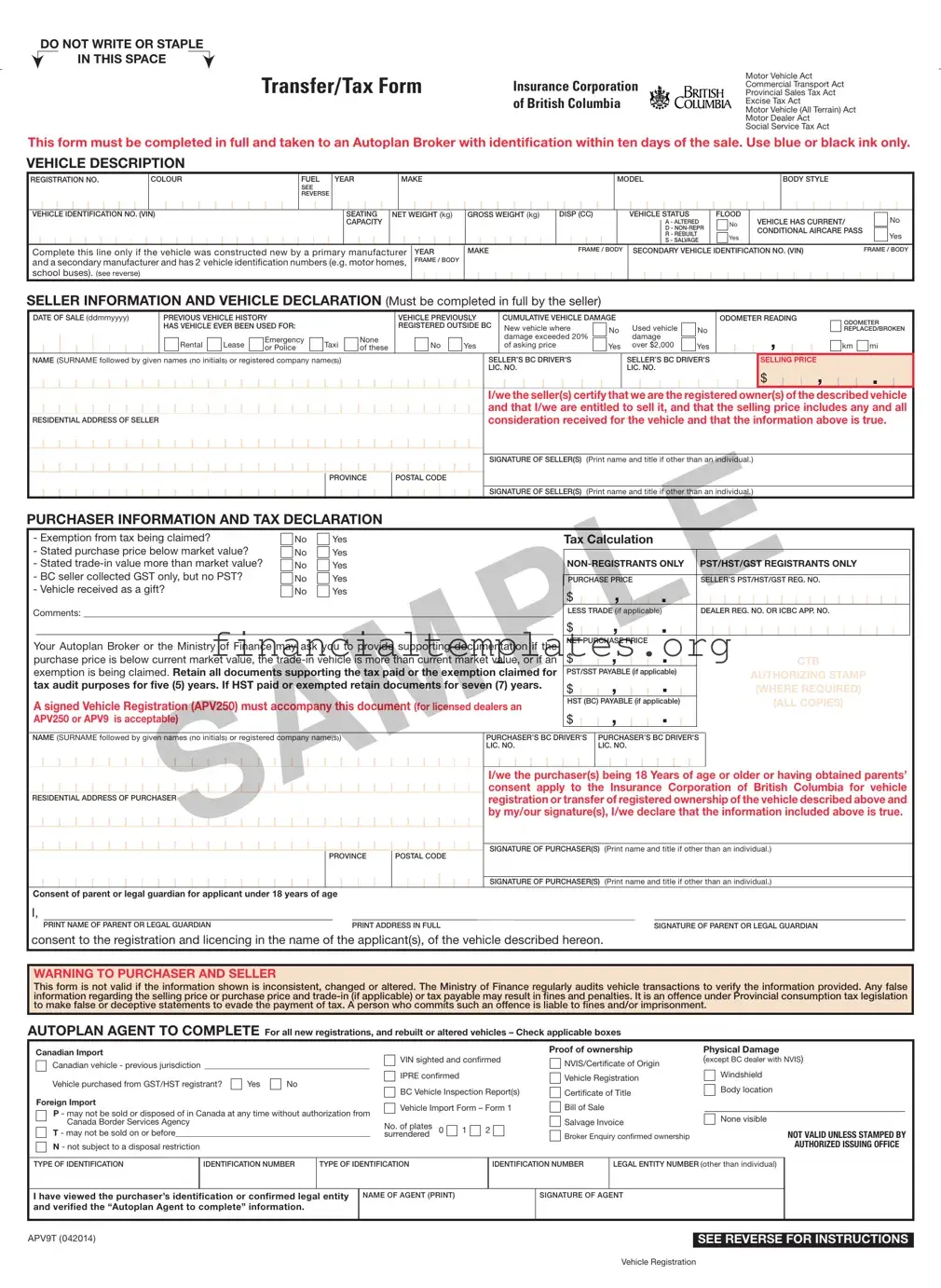

Get Tax Apv9T Form

The Tax APV9T Form is a comprehensive document integral to the process of motor vehicle sales, transfers, and registration within British Columbia, Canada, governed by various provincial legislation including the Motor Vehicle Act, Commercial Transport Act, Provincial Sales Tax Act, amongst others. It is designed to ensure the accurate recording of transaction details, vehicle information, seller and purchaser declarations, alongside tax declarations and calculations pertinent to a vehicle’s sale or transfer. Critical to its completion are details such as vehicle description, registration number, seller and purchaser information, and a declaration section for tax purposes, which also addresses exemptions and conditions under which taxes may be varied. By employing this form, parties involved in the vehicle transaction are obligated to provide truthful and full disclosure of the vehicle’s condition, history, and any monetary considerations involved in the transaction. The form also touching upon scenarios like vehicle gift-receiving, mandates for supporting documentation for tax-related matters, and specific guidelines regarding new or altered vehicle registrations. Moreover, it outlines the responsibilities of Autoplan brokers in verifying the information and ensuring compliance with regulatory requirements. Completion and submission of this form within the stipulated timeframe is crucial, as it affects the legality and taxation of the vehicle transaction, underscoring the form’s role in maintaining a transparent, accountable, and lawful vehicle transfer process in British Columbia.

Tax Apv9T Example

DO NOT WRITE OR STAPLE

IN THIS SPACE

Transfer/ Tax Form |

Insurance Corporation |

|

of British Columbia |

Motor Vehicle Act

Commercial Transport Act

Provincial Sales Tax Act

Excise Tax Act

Motor Vehicle (All Terrain) Act

Motor Dealer Act

Social Service Tax Act

This form must be completed in full and taken to an Autoplan Broker with identification within ten days of the sale. Use blue or black ink only.

VEHICLE DESCRIPTION

REGISTRATION NO.

COLOUR

FUEL YEAR

SEE

REVERSE

MAKE

MODEL

BODY STYLE

VEHICLE IDENTIFICATION NO. (VIN)

SEATING |

NET WEIGHT (kg) |

CAPACITY |

|

|

|

GROSS WEIGHT (kg)

DISP (CC)

VEHICLE STATUS

A - ALTERED

D -

R - REBUILT

S - SALVAGE

FLOOD

No

Yes

VEHICLE HAS CURRENT/ CONDITIONAL AIRCARE PASS

No

Yes

Complete this line only if the vehicle was constructed new by a primary manufacturer and a secondary manufacturer and has 2 vehicle identification numbers (e.g. motor homes, school buses). (see reverse)

YEAR

FRAME / BODY

MAKE |

FRAME / BODY |

SECONDARY VEHICLE IDENTIFICATION NO. (VIN) |

FRAME / BODY |

SELLER INFORMATION AND VEHICLE DECLARATION (Must be completed in full by the seller)

DATE OF SALE (ddmmyyyy) |

PREVIOUS VEHICLE HISTORY |

|

|

|

|

|

|

VEHICLE PREVIOUSLY |

|

CUMULATIVE VEHICLE DAMAGE |

|

|

|

|

|

|

ODOMETER READING |

ODOMETER |

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

HAS VEHICLE EVER BEEN USED FOR: |

|

|

|

|

|

|

REGISTERED OUTSIDE BC |

|

New vehicle where |

|

|

No |

Used vehicle |

|

|

No |

|

|

|

|

|

|

|

|

REPLACED/BROKEN |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease |

|

|

Emergency |

|

Taxi |

|

None |

|

|

|

|

|

|

|

|

|

|

|

|

damage exceeded 20% |

|

|

|

damage |

|

|

|

|

|

, |

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

Rental |

|

|

|

|

|

|

|

|

|

No |

|

|

Yes |

|

|

of asking price |

|

|

Yes |

over $2,000 |

|

|

Yes |

|

|

|

|

|

|

km |

mi |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or Police |

|

|

of these |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

NAME (SURNAME followed by given names (no initials) or registered company name(s)) |

|

|

|

|

|

|

|

|

|

|

|

|

|

SELLER’S BC DRIVER'S |

|

|

SELLER’S BC DRIVER'S |

|

SELLING PRICE |

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIC. NO. |

|

|

LIC. NO. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I/we the seller(s) certify that we are the registered owner(s) of the described vehicle |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and that I/we are entitled to sell it, and that the selling price includes any and all |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

RESIDENTIAL ADDRESS OF SELLER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

consideration received for the vehicle and that the information above is true. |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE OF SELLER(S) (Print name and title if other than an individual.) |

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROVINCE |

|

POSTAL CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE OF SELLER(S) (Print name and title if other than an individual.) |

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

PURCHASER INFORMATION AND TAX DECLARATION

- Exemption from tax being claimed? |

No |

Yes |

- Stated purchase price below market value? |

No |

Yes |

- Stated |

No |

Yes |

- BC seller collected GST only, but no PST? |

No |

Yes |

- Vehicle received as a gift? |

No |

Yes |

Comments: _______________________________________________________________________________________________________

Your Autoplan Broker or the Ministry of Finance may ask you to provide supporting documentation if the purchase price is below current market value, the

A signed Vehicle Registration (APV250) must accompany this document (for licensed dealers an APV250 or APV9 is acceptable)

Tax Calculation

PST/HST/GST R GISTRANTS ONLY |

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||||||

URCHASE PRICE |

|

|

S LL R’S PST/HST/GST REG. NO. |

|

|

|

|

|||||||||||||||||||||

$ |

|

, |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

ESS TRADE (if applicable) |

DEALER REG. NO. OR ICBC APP. NO. |

|

|

|

|

|||||||||||||||||||||||

$ |

|

, |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

NET |

URCHASE PRICE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

$ |

|

, |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

CTB |

|

|

|

|

|||||||

|

|

|

|

|

|

|

||||||||||||||||||||||

ST/SST AYABLE (if applicable) |

|

|

|

|

|

AUTHORIZING STAMP |

|

|

|

|

||||||||||||||||||

|

|

, |

|

. |

|

|

|

|

|

|

|

|

|

|

||||||||||||||

$ |

|

|

|

|

|

|

|

|

|

(WHERE REQUIRED) |

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

||||||||||||||||||||||

HST (BC) PAYABLE (if applicable) |

|

|

|

|

|

|

|

|

(ALL COPIES) |

|

|

|

|

|||||||||||||||

$ |

|

, |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

NAME (SURNAME followed by given names (no initials) or registered company name(s))

RESIDENTIAL ADDRESS OF PURCHA ER

PURCHASER’S BC DRIVER'S |

PURCHASER’S BC DRIVER'S |

||||||||||||

LIC. NO. |

LIC. NO. |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I/we the purchaser(s) being 18 Years of age or older or having obtained parents’ consent apply to the Insurance Corporation of British Columbia for vehicle registration or transfer of registered ownership of the vehicle described above and by my/our signature(s), I/we declare that the information included above is true.

PROVINCE

POSTAL CODE

SIGNATURE OF PURCHASER(S) (Print name and title if other than an individual.)

SIGNATURE OF PURCHASER(S) (Print name and title if other than an individual.)

Consent of parent or legal guardian for applicant under 18 years of age

I,

PRINT NAME OF PARENT OR LEGAL GUARDIAN |

PRINT ADDRESS IN FULL |

SIGNATURE OF PARENT OR LEGAL GUARDIAN |

consent to the registration and licencing in the name of the applicant(s), of the vehicle described hereon.

WARNING TO PURCHASER AND SELLER

This form is not valid if the information shown is inconsistent, changed or altered. The Ministry of Finance regularly audits vehicle transactions to verify the information provided. Any false information regarding the selling price or purchase price and

AUTOPLAN AGENT TO COMPLETE For all new registrations, and rebuilt or altered vehicles – Check applicable boxes

Canadian Import

Canadian vehicle - previous jurisdiction _______________________________________

Vehicle purchased from GST/HST registrant? |

Yes |

No |

Foreign Import

P - may not be sold or disposed of in Canada at any time without authorization from Canada Border Services Agency

T - may not be sold on or before______________________________________________

N - not subject to a disposal restriction

|

|

|

Proof of ownership |

Physical Damage |

VIN sighted and confirmed |

NVIS/Certificate of Origin |

(except BC dealer with NVIS) |

||

|

|

|

|

|

IPRE confirmed |

|

|

Vehicle Registration |

Windshield |

|

|

|

|

|

BC Vehicle Inspection Report(s) |

Certificate of Title |

Body location |

||

Vehicle Import Form – Form 1 |

Bill of Sale |

|

||

No. of plates 0 |

|

|

Salvage Invoice |

None visible |

1 |

2 |

|

||

|

|

|||

surrendered |

|

|

Broker Enquiry confirmed ownership |

NOT VALID UNLESS STAMPED BY |

|

|

|

AUTHORIZED ISSUING OFFICE |

|

|

|

|

|

|

TYPE OF IDENTIFICATION

IDENTIFICATION NUMBER

TYPE OF IDENTIFICATION

IDENTIFICATION NUMBER

LEGAL ENTITY NUMBER (other than individual)

Ihave viewed the purchaser’s identification or confirmed legal entity and verified the “Autoplan Agent to complete” information.

NAME OF AGENT (PRINT)

SIGNATURE OF AGENT

APV9T (042014)

SEE REVERSE FOR INSTRUCTIONS

Vehicle Registration

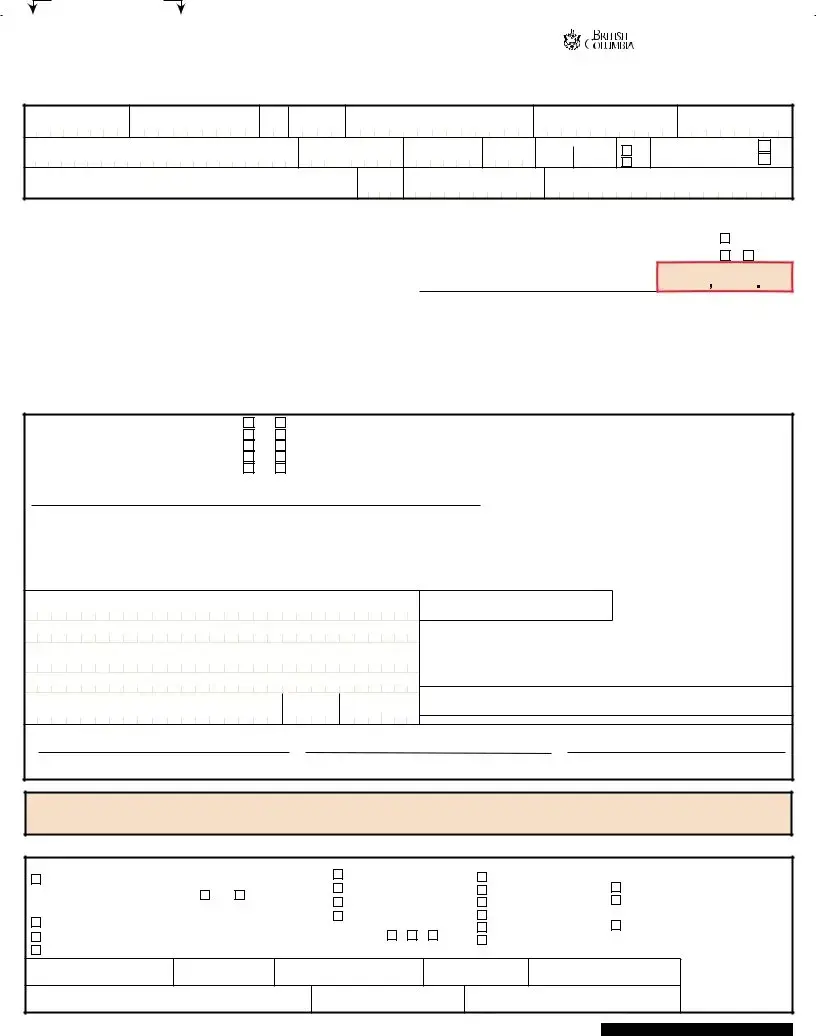

DO NOT WRITE OR STAPLE

IN THIS SPACE

Transfer/ Tax Form |

Insurance Corporation |

|

of British Columbia |

Motor Vehicle Act

Commercial Transport Act

Provincial Sales Tax Act

Excise Tax Act

Motor Vehicle (All Terrain) Act

Motor Dealer Act

Social Service Tax Act

This form must be completed in full and taken to an Autoplan Broker with identification within ten days of the sale. Use blue or black ink only.

VEHICLE DESCRIPTION

REGISTRATION NO.

COLOUR

FUEL YEAR

SEE

REVERSE

MAKE

MODEL

BODY STYLE

VEHICLE IDENTIFICATION NO. (VIN)

SEATING |

NET WEIGHT (kg) |

CAPACITY |

|

|

|

GROSS WEIGHT (kg)

DISP (CC)

VEHICLE STATUS

A - ALTERED

D -

R - REBUILT

S - SALVAGE

FLOOD

No

Yes

VEHICLE HAS CURRENT/ CONDITIONAL AIRCARE PASS

No

Yes

Complete this line only if the vehicle was constructed new by a primary manufacturer and a secondary manufacturer and has 2 vehicle identification numbers (e.g. motor homes, school buses). (see reverse)

YEAR

FRAME / BODY

MAKE |

FRAME / BODY |

SECONDARY VEHICLE IDENTIFICATION NO. (VIN) |

FRAME / BODY |

SELLER INFORMATION AND VEHICLE DECLARATION (Must be completed in full by the seller)

DATE OF SALE (ddmmyyyy) |

PREVIOUS VEHICLE HISTORY |

|

|

|

|

|

|

VEHICLE PREVIOUSLY |

|

CUMULATIVE VEHICLE DAMAGE |

|

|

|

|

|

|

ODOMETER READING |

ODOMETER |

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

HAS VEHICLE EVER BEEN USED FOR: |

|

|

|

|

|

|

REGISTERED OUTSIDE BC |

|

New vehicle where |

|

|

No |

Used vehicle |

|

|

No |

|

|

|

|

|

|

|

|

REPLACED/BROKEN |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease |

|

|

Emergency |

|

Taxi |

|

None |

|

|

|

|

|

|

|

|

|

|

|

|

damage exceeded 20% |

|

|

|

damage |

|

|

|

|

|

, |

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

Rental |

|

|

|

|

|

|

|

|

|

No |

|

|

Yes |

|

|

of asking price |

|

|

Yes |

over $2,000 |

|

|

Yes |

|

|

|

|

|

|

km |

mi |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or Police |

|

|

of these |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

NAME (SURNAME followed by given names (no initials) or registered company name(s)) |

|

|

|

|

|

|

|

|

|

|

|

|

|

SELLER’S BC DRIVER'S |

|

|

SELLER’S BC DRIVER'S |

|

SELLING PRICE |

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIC. NO. |

|

|

LIC. NO. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I/we the seller(s) certify that we are the registered owner(s) of the described vehicle |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and that I/we are entitled to sell it, and that the selling price includes any and all |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

RESIDENTIAL ADDRESS OF SELLER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

consideration received for the vehicle and that the information above is true. |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE OF SELLER(S) (Print name and title if other than an individual.) |

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROVINCE |

|

POSTAL CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE OF SELLER(S) (Print name and title if other than an individual.) |

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

PURCHASER INFORMATION AND TAX DECLARATION

- Exemption from tax being claimed? |

No |

Yes |

- Stated purchase price below market value? |

No |

Yes |

- Stated |

No |

Yes |

- BC seller collected GST only, but no PST? |

No |

Yes |

- Vehicle received as a gift? |

No |

Yes |

Comments: _______________________________________________________________________________________________________

Your Autoplan Broker or the Ministry of Finance may ask you to provide supporting documentation if the purchase price is below current market value, the

A signed Vehicle Registration (APV250) must accompany this document (for licensed dealers an APV250 or APV9 is acceptable)

Tax Calculation

PST/HST/GST R GISTRANTS ONLY |

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||||||

URCHASE PRICE |

|

|

S LL R’S PST/HST/GST REG. NO. |

|

|

|

|

|||||||||||||||||||||

$ |

|

, |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

ESS TRADE (if applicable) |

DEALER REG. NO. OR ICBC APP. NO. |

|

|

|

|

|||||||||||||||||||||||

$ |

|

, |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

NET |

URCHASE PRICE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

$ |

|

, |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

CTB |

|

|

|

|

|||||||

|

|

|

|

|

|

|

||||||||||||||||||||||

ST/SST AYABLE (if applicable) |

|

|

|

|

|

AUTHORIZING STAMP |

|

|

|

|

||||||||||||||||||

|

|

, |

|

. |

|

|

|

|

|

|

|

|

|

|

||||||||||||||

$ |

|

|

|

|

|

|

|

|

|

(WHERE REQUIRED) |

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

||||||||||||||||||||||

HST (BC) PAYABLE (if applicable) |

|

|

|

|

|

|

|

|

(ALL COPIES) |

|

|

|

|

|||||||||||||||

$ |

|

, |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

NAME (SURNAME followed by given names (no initials) or registered company name(s))

RESIDENTIAL ADDRESS OF PURCHA ER

PURCHASER’S BC DRIVER'S |

PURCHASER’S BC DRIVER'S |

||||||||||||

LIC. NO. |

LIC. NO. |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I/we the purchaser(s) being 18 Years of age or older or having obtained parents’ consent apply to the Insurance Corporation of British Columbia for vehicle registration or transfer of registered ownership of the vehicle described above and by my/our signature(s), I/we declare that the information included above is true.

PROVINCE

POSTAL CODE

SIGNATURE OF PURCHASER(S) (Print name and title if other than an individual.)

SIGNATURE OF PURCHASER(S) (Print name and title if other than an individual.)

Consent of parent or legal guardian for applicant under 18 years of age

I,

PRINT NAME OF PARENT OR LEGAL GUARDIAN |

PRINT ADDRESS IN FULL |

SIGNATURE OF PARENT OR LEGAL GUARDIAN |

consent to the registration and licencing in the name of the applicant(s), of the vehicle described hereon.

WARNING TO PURCHASER AND SELLER

This form is not valid if the information shown is inconsistent, changed or altered. The Ministry of Finance regularly audits vehicle transactions to verify the information provided. Any false information regarding the selling price or purchase price and

AUTOPLAN AGENT TO COMPLETE For all new registrations, and rebuilt or altered vehicles – Check applicable boxes

Canadian Import

Canadian vehicle - previous jurisdiction _______________________________________

Vehicle purchased from GST/HST registrant? |

Yes |

No |

Foreign Import

P - may not be sold or disposed of in Canada at any time without authorization from Canada Border Services Agency

T - may not be sold on or before______________________________________________

N - not subject to a disposal restriction

|

|

|

Proof of ownership |

Physical Damage |

VIN sighted and confirmed |

NVIS/Certificate of Origin |

(except BC dealer with NVIS) |

||

|

|

|

|

|

IPRE confirmed |

|

|

Vehicle Registration |

Windshield |

|

|

|

|

|

BC Vehicle Inspection Report(s) |

Certificate of Title |

Body location |

||

Vehicle Import Form – Form 1 |

Bill of Sale |

|

||

No. of plates 0 |

|

|

Salvage Invoice |

None visible |

1 |

2 |

|

||

|

|

|||

surrendered |

|

|

Broker Enquiry confirmed ownership |

|

|

|

|

|

|

TYPE OF IDENTIFICATION

IDENTIFICATION NUMBER

TYPE OF IDENTIFICATION

IDENTIFICATION NUMBER

LEGAL ENTITY NUMBER (other than individual)

Ihave viewed the purchaser’s identification or confirmed legal entity and verified the “Autoplan Agent to complete” information.

NAME OF AGENT (PRINT)

SIGNATURE OF AGENT

APV9T (042014)

SEE REVERSE FOR INSTRUCTIONS

Vehicle Registration

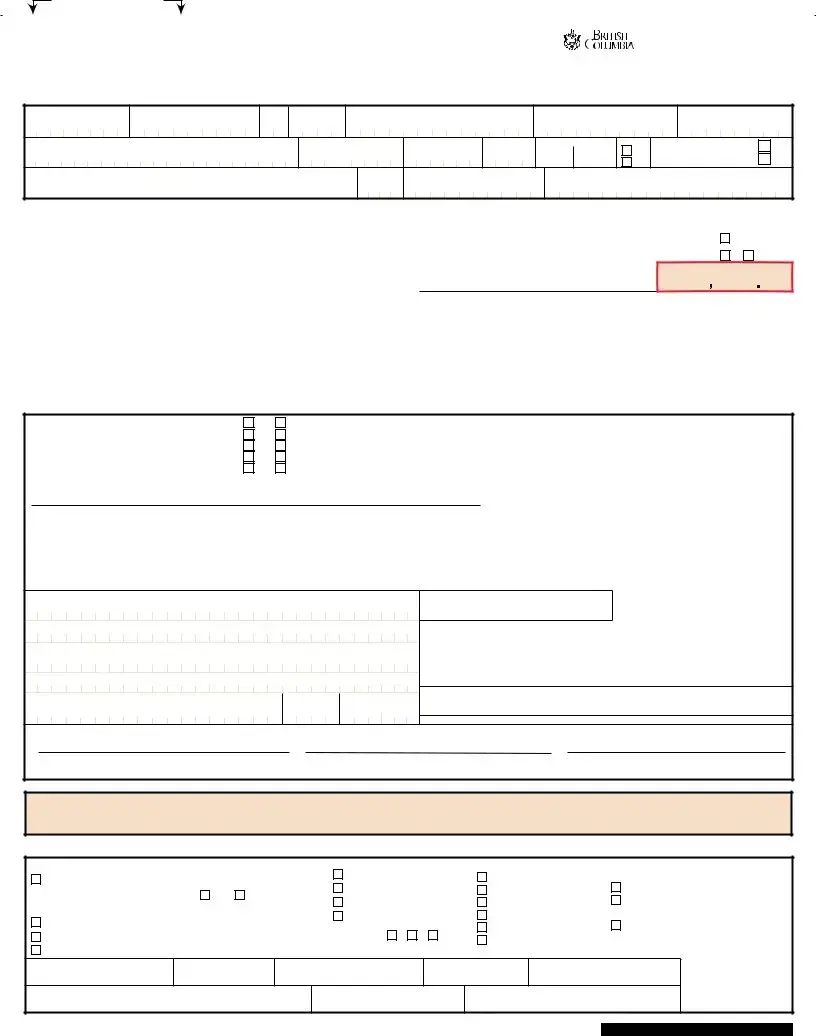

COMPLETION OF TRANSFER/TAX FORM (APV9T)

-The purchaser is advised to check for liens and encumbrances with the Personal Property Registry, Victoria, BC before finalizing the sale.

-The seller completes the ‘Seller’ section of the form including the price the vehicle was sold for and information from the Vehicle Registration, and signs the Seller’s Certification.

-The purchaser completes and signs the ‘Purchaser’ section.

-The seller retains the Seller copy of the form with the ‘Seller’ and ‘Purchaser’ sections completed.

-The purchaser must present the remaining copies of the Transfer/Tax Form (APV9T) and the Vehicle Registration (APV250 only, signed by the registered owner) to an Autoplan Broker for registration within 10 days of sale.

Signatures – where the seller or purchaser is a registered company, the signatures required are of signing officer(s) with official title(s) with the company. Note: Business names not registered with the Corporate Registry, Victoria, BC, may not be used.

TAX OWING

For vehicles that were purchased in BC or that entered BC April 1, 2013 or later, the following tax rules apply:

Vehicles Purchased in BC

1.Dealer and Vendor Sales: GST and Provincial Sales Tax (PST) will be collected by the dealer or vendor. ICBC requires the vendor’s PST number and proof PST paid. For Dealers, the Dealer number is required. If a seller collects GST only (and not PST) ICBC will collect PST on the purchase price.

2.Private Sales: PST is payable on the purchase price. Both the seller and purchaser must certify the price of the vehicle.

Vehicles Purchased Outside BC

1.Purchased in Canada, GST or HST Paid: PST is payable on the purchase price shown on the bill of sale.

2.Private Sales in Canada: Provincial Sales Tax (PST) is payable on the purchase price shown on the bill of sale.

3.Purchased Outside Canada: PST is payable on value for tax + excise tax + duty (if applicable) as shown on the Canada Border Services Agency (CBSA) B3 or B15 duty form.

Vehicles Received as Gifts

Gifts of vehicles in BC and vehicles brought into BC and received as gifts are subject to PST on the Fair Market Value unless a specific exemption applies.

Exemptions and Below Market Sales

The purchaser must provide supporting documentation if claiming an exemption, and may be asked to provide documentation if the purchase price is lower than current market value, or if the

NEW VEHICLE REGISTRATIONS — TWO VINs ON NEW VEHICLE INFORMATION STATEMENT (NVIS)

The year, make and vehicle identification numbers recorded on the NVIS will be entered on the Transfer/Tax Form as follows:

School Bus - Year and Make: Always record year and make of secondary manufacturer on the first line of the Transfer/Tax document. Record the year and make of the primary manufacturer on the third line of the Transfer/Tax document, circling the word “Frame”.

VIN: Record the secondary manufacturer’s VIN on the second line of the Transfer/Tax document only if the VIN is 17 digits long, otherwise record the primary manufacturer’s VIN. Record the alternate VIN on the third line of the Transfer/Tax document and circle “Frame” or “Body”.

Motor Home Class A: Follow Year and Make and VIN instructions as for school bus.

Motor Home Class C: Year and Make: Record year, make and VIN of primary manufacturer on the first line of the Transfer/Tax document. Record year and make of the secondary manufacturer on the third line of the Transfer/Tax document, circling the word “Body”.

SUBSTITUTE VEHICLE:

An owner of a

•the newly purchased vehicle is the same type and the plates are compatible (e.g., passenger plates on a passenger vehicle, commercial plates on a commercial vehicle); AND

•the newly purchased vehicle is a BC registered vehicle or is a new vehicle purchased from a BC registered dealer; AND

•title or interest in the original vehicle has been transferred.

During the

•the Purchaser’s copy of the completed, dated, and signed Transfer/Tax Form (APV9T); and

•the Purchaser’s Owner’s Certificate of Insurance and Vehicle Licence for the transferred original vehicle; and

•the previous owner’s Certificate of Registration for the

NOTE: If the original licence plates are not compatible with the

All newly purchased vehicles must be registered in the name of the licence holder at an Autoplan Agent within 10 days of purchase.

VEHICLES BROUGHT INTO BRITISH COLUMBIA FROM ANOTHER JURISDICTION:

Passenger vehicles, including small pickup trucks, motorcycles and trailers used for personal/pleasure use, must be registered by the owner within 30 days of entering the province. Cars, motor homes, vans and small trucks with a net weight of 3,500 kgs or less that have been previously registered, titled or licensed in another jurisdiction must pass a certified safety inspection before they can be registered and licensed in BC.

Commercial vehicles (except for commercial trailers) used for commercial purposes must be registered immediately. Commercial trailers that are licensed in compliance with their home jurisdiction may be operated on a BC highway.

All vehicles imported by the owner into BC must be taken to an Autoplan Broker by the owner, where the ownership, description of the vehicle, body style, vehicle identification number and odometer reading will be verified. Tax is payable unless the owner qualifies for an exemption under Provincial legislation.

Present Vehicle Registration, Certificate of Title and plates - must be surrendered. Owner(s) of a vehicle from another country must also produce a Vehicle Import Form - Form 1 and surrender it at the time of registration.

|

Code |

Fuel Type |

Code |

Fuel Type |

Code |

Fuel Type |

Code |

Fuel Type |

|

FUEL |

A |

Alcohol |

F |

Diesel - Butane |

N |

Natural Gas |

T |

Diesel - Propane |

|

B |

Butane |

G |

Gasoline |

P |

Propane |

U |

Gasoline - Natural Gas |

||

TYPE |

|||||||||

D |

Diesel |

H |

Gasoline - Alcohol |

R |

Diesel - Natural Gas |

W |

Gasoline - Propane |

||

CODES |

|||||||||

E |

Electric |

L |

Gasoline - Electric |

S |

Propane - Natural Gas |

Y |

Hydrogen |

||

|

|

|

|

|

|

|

Z |

||

|

|

|

|

|

|

|

|

|

PRIVACY NOTICE:

The personal information on this form is collected: (a) by ICBC for the purpose of considering the application by seller and purchaser of the initial vehicle registration or transfer of vehicle ownership and is authorized by the Motor Vehicle Act, the regulations thereunder and other related legislation; (b) by ICBC for the purpose of administering the Provincial Sales Tax Act and regulations thereunder, Excise Tax Act and the regulations thereunder, and (c) by the Ministry of Finance (“Ministry”) for the purpose of administering the Excise Tax Act and the regulations thereunder and Provincial tax legislation. Each of ICBC and the Ministry may use and disclose this information in accordance with the provisions of Part 3 of the Freedom of Information and Protection of Privacy Act. Questions about the collection of this information can be directed to: (a) for ICBC, to the Manager, Information and Privacy, by phone

Document Specifics

| Fact Name | Detail |

|---|---|

| Form Identification | APV9T |

| Associated Organizations | Insurance Corporation of British Columbia |

| Governing Laws | Motor Vehicle Act, Commercial Transport Act, Provincial Sales Tax Act, Excise Tax Act, Motor Vehicle (All Terrain) Act, Motor Dealer Act, Social Service Tax Act |

| Completion Requirement | The form must be completed in full and taken to an Autoplan Broker with identification within ten days of the sale. |

| Writing Instructions | Use blue or black ink only. |

| Documentation for Tax Purposes | Retain all documents supporting the tax paid or the exemption claimed for tax audit purposes for five (5) years; seven (7) years if HST paid or exempted. |

| Audit and Penalties | The Ministry of Finance regularly audits vehicle transactions. False information can result in fines and penalties. |

Guide to Writing Tax Apv9T

Filling out the Tax APV9T form is a crucial step in the vehicle sale process in British Columbia, ensuring all taxes are accurately declared and that the transfer of ownership is documented correctly. This form, necessary for the legal transfer and tax documentation of vehicles, requires careful attention to detail. Here is a step-by-step guide to help you complete the form without any hassle.

- Start by using blue or black ink only. This is essential for the form to be processed correctly.

- Under "VEHICLE DESCRIPTION," fill in the vehicle's registration number, color, fuel type, year, make, model, body style, and the Vehicle Identification Number (VIN). Also, specify the seating capacity, net and gross weight, displacement (CC), and the vehicle's status (e.g., altered, non-repairable, rebuilt, salvage, flood).

- If the vehicle has a secondary VIN due to being constructed by a primary and secondary manufacturer, complete the section about the year, frame/body make, and the secondary VIN.

- In the "SELLER INFORMATION AND VEHICLE DECLARATION" section, enter the date of sale, details about the vehicle's previous history including odometer reading, and check the appropriate boxes about the vehicle's past usage. Add the seller's name(s) or registered company name(s), driver's license number, residential address, and the selling price. Sellers must sign, indicating the information provided is accurate.

- For the "PURCHASER INFORMATION AND TAX DECLARATION," purchasers should fill in their information, decide if any tax exemptions are being claimed, and include their BC driver's license number. Check the boxes applicable to your purchase situation and comment if necessary. Purchaser(s) must sign this section.

- If applicable, have a parent or legal guardian complete the consent section for purchasers under 18 years of age.

- Review all the entered information for accuracy and completeness, as any inconsistency or alteration can invalidate the form, leading to potential fines and penalties.

- If the vehicle is newly registered, check the appropriate boxes in the "AUTOPLAN AGENT TO COMPLETE" section as per your vehicle's status. This may require additional documentation for validation.

- Remember to carry all necessary documents when finalizing the vehicle transfer with an Autoplan Broker, including this form, vehicle registration, and any documents that support your tax payment or exemption claim.

Once the form is fully completed, take it to an Autoplan Broker with all required identification and documents within ten days of the sale. This step is crucial for ensuring that all legal and tax responsibilities are met in the vehicle transfer process.

Understanding Tax Apv9T

What is the Tax Apv9T form used for?

The Tax Apv9T form is a document required by the Insurance Corporation of British Columbia (ICBC) for transferring the ownership or registering a vehicle. This document must be completed in its entirety and brought to an Autoplan Broker along with identification within ten days of the vehicle's sale. It is applicable to transactions involving vehicles under various acts, such as the Motor Vehicle Act, Commercial Transport Act, Provincial Sales Tax Act, Excise Tax Act, and others.

How soon after the sale of a vehicle must the Tax Apv9T form be submitted?

This form should be submitted to an Autoplan Broker with appropriate identification within ten days following the sale of the vehicle. This prompt submission ensures compliance with legal requirements and facilitates the smooth transition of vehicle ownership or registration.

Can I use any type of ink to fill out the Tax Apv9T form?

Only blue or black ink is permitted for completing the Tax Apv9T form. Using these ink colors ensures that the information is clearly visible and optimizes the document's legibility for processing.

What if the vehicle has two Vehicle Identification Numbers (VINs)?

For vehicles constructed by both a primary and a secondary manufacturer (e.g., motor homes, school buses) that have two VINs, specific instructions on the form guide you where to include each VIN. Typically, the year, make, and VINs from both manufacturers must be accurately recorded, with specific attention to the location designated for the secondary VIN.

What responsibilities do sellers have when completing the Tax Apv9T form?

Sellers must completely fill the seller's section, include the selling price and previous vehicle history information, and sign the seller's certification. This declaration affirms that the seller is the rightful owner, entitled to sell the vehicle, and acknowledges that the selling price encompasses all considerations received for the vehicle.

What are the tax implications associated with the Tax Apv9T form?

The form outlines the tax calculation for the vehicle based on whether the sale was private or through a dealer, and if the vehicle was previously registered in or outside British Columbia. GST/PST may be applicable, and specific rules apply for vehicles received as gifts. The purchaser might be liable for Provincial Sales Tax (PST) on the purchase price or the fair market value unless an exemption is valid.

What documentation must accompany the Tax Apv9T form for vehicle registration or transfer?

A signed Vehicle Registration (APV250) document must accompany the Tax Apv9T form. For licensed dealers, either an APV250 or APV9 document is acceptable. This requirement ensures that all necessary information for the vehicle's registration or ownership transfer is available and verified by the Autoplan Broker.

Common mistakes

Not using blue or black ink can result in the form being rejected. The instructions specify that only these ink colors are acceptable.

Filling in information in prohibited areas, such as "DO NOT WRITE OR STAPLE IN THIS SPACE," can make the form invalid.

Leaving mandatory fields blank, especially in the "VEHICLE DESCRIPTION" and "SELLER INFORMATION AND VEHICLE DECLARATION" sections, could delay processing.

Incorrectly completing the date of sale in the format other than ddmmyyyy may lead to misunderstanding or rejection of the form.

Failing to accurately report the odometer reading, or misstating whether it has been replaced or broken, can affect the vehicle's value and legality of the sale.

Not specifying the vehicle's condition, such as if it has been in a flood, or its current air care pass status, might result in future legal or financial issues.

Determining the sale price without including all considerations received for the vehicle can result in penalties or fines, especially if audited.

Claiming exemptions from tax without providing the necessary supporting documentation can lead to the denial of the exemption and possible fines.

Forgetting to get the form stamped by an authorized issuing office invalidates the document, making vehicle transfer or registration impossible.

Additionally, here are best practices to avoid these mistakes:

Before filling out the form, thoroughly read the instructions on both the front and reverse sides. Pay close attention to sections that require specific types of information.

Review each section as you complete it, double-checking that no fields are missed and that all data provided is accurate.

Keep records of all documents related to the sale or purchase of the vehicle, including bills of sale, loan documents, and proof of tax payments or exemptions claimed.

When in doubt, consulting with an Autoplan Broker or legal expert can save time and protect against errors that could result in legal or financial repercussions.

Documents used along the form

When handling vehicle transactions, particularly those involving the completion and submission of the Tax Apv9T form, several supplementary forms and documents often become necessary to ensure compliance with legal and procedural requirements. These documents play crucial roles in validating the information provided, setting the groundwork for taxation and registration processes, and adhering to specific legislative demands. Below are frequently used forms and documents alongside the Tax Apv9T form:

- Vehicle Registration (APV250) Form: Required to accompany the Tax Apv9T form for registration purposes. It verifies the legal ownership and eligibility to register the vehicle under the new owner’s name.

- Bill of Sale: This document serves as a record of the transaction, detailing the vehicle’s purchase price, date of sale, and information about the buyer and seller. It acts as proof of transaction for legal and tax purposes.

- Certificate of Title: Demonstrates the legal ownership of the vehicle. When a vehicle is sold, the title must be transferred to the new owner, who then must present it when completing the Tax Apv9T form.

- Vehicle Import Form – Form 1: Essential for vehicles imported into the region. It provides customs clearance and import details, necessary for registration and tax assessment.

- Proof of Insurance: Before a vehicle can be registered, proof of insurance is required. This document ensures that the vehicle is covered under the necessary insurance policies.

- Inspection Reports: For certain vehicles, a BC Vehicle Inspection Report or other certified safety inspection reports may be necessary to ensure the vehicle complies with safety standards before registration.

- Odometer Disclosure Statement: Required for vehicles of a certain age, this form verifies the accuracy of the vehicle's mileage, protecting buyers from potential fraud.

- Personal Property Registry Checks: Advisable to conduct a check for liens and encumbrances against the vehicle, to ensure that no outstanding debts or claims are associated with it before the sale is finalized.

- Parental Consent Form: For purchasers under the age of 18, a signed form from a parent or legal guardian consenting to the vehicle’s registration may be necessary.

Each document and form has its unique purpose and requirement in the vehicle sale, purchase, and registration processes. The correct and timely submission of these alongside the Tax Apv9T form ensures a smooth transition of ownership, adherence to legal standards, and proper tax and registration processing. It’s imperative for both sellers and buyers to understand the significance of these documents to navigate vehicle transactions effectively.

Similar forms

The Tax Apv9T form finds its similarities with a variety of other documents, primarily due to its nature of capturing information related to the transaction of vehicles, tax obligations, and changes in ownership. Each similar document, though distinct in its specific purpose, shares a common thread with the Apv9T form in terms of providing a structured way to report and record significant information to relevant authorities or parties involved.

One similar document is the Vehicle Registration Application (Form APV250), which is used when a vehicle is first registered or when a vehicle's registration is transferred to a new owner in British Columbia. Like the Apv9T, it collects detailed information about the vehicle and its owner but is specifically oriented towards the initial registration process or updating registration details rather than capturing the transactional details and tax implications of a sale.

The Bill of Sale is another document with similarities to the Tax Apv9T form. It serves as proof of purchase and transfer of ownership from the seller to the buyer. Both documents detail the vehicle, the parties involved, and the terms of the sale. However, the Bill of Sale primarily serves as a receipt and may not always detail the tax responsibilities or other statutory obligations.

The Odometer Disclosure Statement, required in many jurisdictions during the sale or transfer of a vehicle, is akin to the Apv9T form in that it includes critical information regarding the vehicle's condition. It focuses on providing an accurate reading of the vehicle's mileage to prevent odometer fraud, a piece of information that is also captured within the Apv9T document.

The Seller’s Report of Sale is a document submitted to the DMV by the seller of a vehicle, notifying the state of the change in ownership. While it shares the purpose of recording a transaction, like the Apv9T form, it is specifically meant to release the seller from liability associated with the vehicle after the sale is completed.

A Title Transfer Form is used to officially change the ownership of a vehicle as recorded on the vehicle's title. This form, while similar to the Apv9T in facilitating the transfer of ownership, is more focused on updating the legal documentation that officially denotes the vehicle's owner, rather than detailing the sales transaction or tax implications.

An Exemption Claim form, often associated with vehicle transactions, allows buyers to state reasons for tax exemption on their vehicle purchase. Similar to sections of the Apv9T form where tax exemptions can be declared, this form is solely focused on the tax status and does not cover the entirety of the vehicle transaction.

The Gift Letter for Vehicle Transfer is related to the Apv9T form in the context of vehicle transactions, especially in cases where a vehicle is received as a gift. It documents the transfer of vehicle ownership without a sale, emphasizing the non-commercial nature of the transfer, yet it must outline the vehicle's details and parties involved, similar to the Apv9T.

Finally, the Import Declaration Form is used when a vehicle is brought into British Columbia from another jurisdiction. This form resembles the Apv9T since it includes vehicle specifics and ownership details but focuses more on the import aspects, such as compliance with local requirements and possibly applicable taxes and duties, rather than a simple province-to-province sale or transfer.

Dos and Don'ts

When filling out the Tax APV9T form for vehicle transactions in British Columbia, it’s important to pay attention to the details and follow the guidelines provided. To help ensure the process is completed accurately and efficiently, here are things you should and shouldn't do:

Things You Should Do:

- Use blue or black ink only: This ensures that the information is legible and adheres to the requirements set by the Insurance Corporation of British Columbia (ICBC).

- Complete all sections in full: Provide all the necessary details in the seller information, vehicle description, and purchaser information sections to avoid delays or issues with the transfer or registration.

- Retain supporting documents: Keep all relevant documents for tax audit purposes, including proof of selling price or exemption claimed, for five years or seven years if HST was paid or exempted.

- Provide accurate information: Ensure all details regarding the vehicle’s condition, selling price, and purchaser’s information are truthful and accurate to avoid potential fines or penalties.

Things You Shouldn't Do:

- Alter the form after completion: Modifying information after the form has been finalized could invalidate it. Ensure all details are correct before submitting.

- Use the form beyond its valid period: The APV9T form must be taken to an Autoplan Broker with identification within ten days of the sale. Failing to do so could result in complications or delays.

- Overlook the requirement for proof of payment or exemption: If the selling price is below the market value or if an exemption from tax is being claimed, be prepared to provide supporting documentation upon request.

- Forget to check for liens or encumbrances: It's advised that purchasers check for any liens or encumbrances with the Personal Property Registry in Victoria, BC, before finalizing the sale to ensure clear ownership transfer.

Misconceptions

Understanding the Tax APV9T form can sometimes lead to misconceptions. Here, we look to clarify six common misunderstandings.

- It's only for vehicle sales.

- It's a complex legal document that requires a lawyer's assistance.

- All fields are mandatory for every vehicle.

- No supporting documentationis necessary for tax exemption claims.

- The APV9T is only about taxes.

- Any alterations or inconsistencies on the form will not impact the transaction.

While the Tax APV9T form is primarily used for the sale of vehicles, it encompasses more than just the exchange of cars. It's instrumental in the transfer of ownership, whether that's through a sale, a gift, or even a trade. This document is a multi-purpose tool within vehicle transactions, crucial for both buyers and sellers to accurately declare the vehicle's information and the transaction details.

Although the Tax APV9T form is an official document governed by various acts like the Motor Vehicle Act and the Provincial Sales Tax Act, it does not necessarily require legal assistance to complete. Detailed instructions are available on the reverse side of the form to guide individuals through the process. However, accuracy in filling out the form is critical to avoid any potential audits, penalties, and fines later on.

While the form must be completed in full, certain sections apply only to specific situations. For instance, vehicles constructed by both a primary and secondary manufacturer warrant additional identification details. It’s essential to carefully review the form and fill out sections that pertain to your vehicle’s circumstances.

Claiming an exemption from tax on a vehicle transaction requires proof. The Tax APV9T form highlights that supporting documentation is needed if the purchase price is below the current market value or if an exemption is being claimed. Keeping all relevant documents is advisable to facilitate a smooth process with the Ministry of Finance or Autoplan Broker.

Though taxes are a significant component of the Tax APV9T form, it serves various purposes. It records crucial details about the vehicle and the transaction, including the vehicle description, seller, and purchaser information. This comprehensive record-keeping aids in the proper transfer of ownership and ensures transparency in the vehicle's history, beyond just the calculation and payment of taxes.

The warning section of the form clearly states that alterations, inconsistencies, or providing false information can invalidate the form and may lead to fines, penalties, or even imprisonment. This highlights the importance of careful and accurate completion of the document as part of the vehicle transfer process.

In summary, the Tax APV9T form is a vital document for vehicle transactions in British Columbia, encapsulating not just the sale but the entire transfer process. Understanding its requisites can ensure a smoother, more compliant transaction.

Key takeaways

Filling out and using the Tax Apv9T form correctly is crucial for the transfer and taxation process of vehicles in British Columbia. Below are key takeaways to ensure a smooth transaction:

- The form must be completed in full using blue or black ink and submitted to an Autoplan Broker along with proper identification within ten days of the vehicle's sale.

- Sellers are responsible for accurately completing their section of the form, including the vehicle's selling price and pertinent vehicle information from the Vehicle Registration document, and must then sign the Seller's Certification.

- Purchasers must fill out their section, sign it, and declare the information provided is true. If under 18 years old, parent or guardian consent is necessary.

- It's important that information provided on the form remains consistent, unchanged, and unaltered to avoid being invalidated. Any inconsistency could lead to audits, fines, and penalties due to false reporting.

- Special attention must be given when calculating taxes owed. The form outlines specific instructions for vehicles purchased within BC, from outside BC, as a private sale, or received as a gift, including when GST or PST is applicable.

- The form accommodates vehicles with dual identification numbers (VINs), such as motor homes or school buses, with detailed instructions on how to accurately report this unique situation.

- For new vehicle registrations, it is imperative to report the year, make, and VINs as per the guidelines, especially when it involves primary and secondary manufacturers.

- A provision exists for the temporary use of transferred number plates on a newly purchased vehicle under specific conditions, including during a 10-day window from the purchase date, provided all listed criteria are met.

- Vehicles brought into British Columbia from another jurisdiction have distinct requirements for registration and licensing, including mandatory safety inspections for certain vehicle types and the need for original documentation.

Correctly completing and understanding the Tax Apv9T form plays a critical role in the legal and proper transfer of vehicle ownership in British Columbia, ensuring compliance with taxation and registration requirements.

Popular PDF Documents

Md Sales and Use Tax Form 202 - If you’ve sold your business, the Maryland Form 202 is necessary to provide the new owner's details and ensure a smooth transition.

1099s 2023 - Estate executors handling property sales must familiarize themselves with the 1099-S to correctly administer estate taxes.

Revenue Portal Login - An opportunity to claim extra credits for war time veterans is included, encouraging those with military service to apply.