Get Tax 531 Form

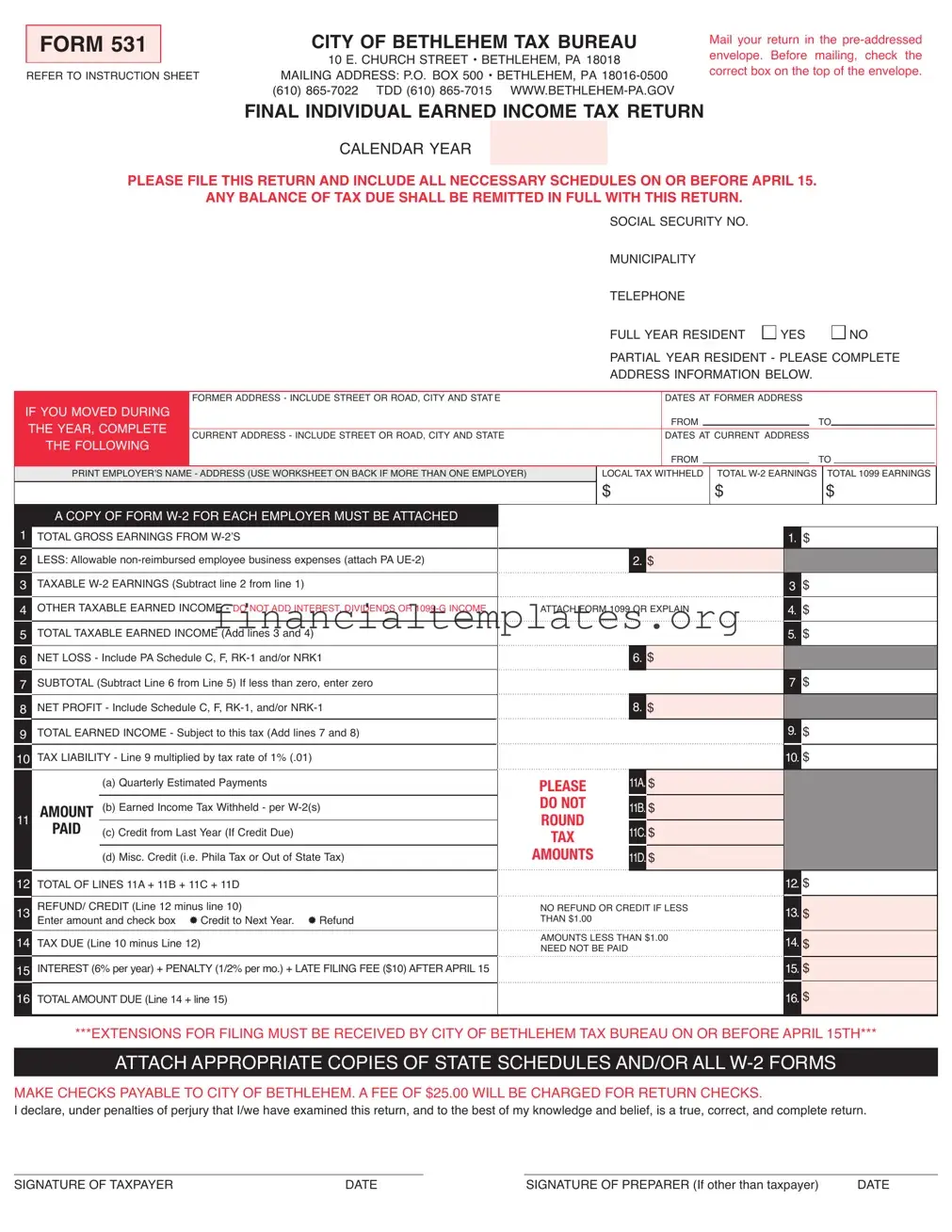

In the heart of Bethlehem, Pennsylvania, residents and workers navigate their financial responsibilities through a variety of forms, among which the Form 531, issued by the City of Bethlehem Tax Bureau, plays a crucial role. This form, designed for the final individual earned income tax return, demands careful attention as it encompasses various aspects of an individual's earnings and possible deductions within a calendar year. Its structure guides taxpayers through the process of declaring W-2 and 1099 earnings, alongside allowable non-reimbursed employee business expenses, ultimately leading to the calculation of taxable earned income. The form also addresses situations unique to partial year residents, accommodating changes in address and employment. Furthermore, it provides avenues for accounting for net losses, net profit, and tax liabilities calculated at the city’s stipulated rate, while allowing for estimated payments and credits to be factored into the final financial equation. With a deadline set firmly on April 15th, unless an extension is filed, it encapsulates a critical precept of civic duty: contributing to the community’s welfare through taxes. Importantly, it mandates the attachment of crucial documents such as W-2 forms and elaborates on penalties for late submissions, underscoring the city’s commitment to thorough and timely financial disclosure.

Tax 531 Example

FORM 531 |

|

CITY OF BETHLEHEM TAX BUREAU |

|

|

10 E. CHURCH STREET • BETHLEHEM, PA 18018 |

REFER TO INSTRUCTION SHEET |

MAILING ADDRESS: P.O. BOX 500 • BETHLEHEM, PA |

|

|

|

(610) |

Mail your return in the

FINAL INDIVIDUAL EARNED INCOME TAX RETURN

CALENDAR YEAR

PLEASE FILE THIS RETURN AND INCLUDE ALL NECCESSARY SCHEDULES ON OR BEFORE APRIL 15.

ANY BALANCE OF TAX DUE SHALL BE REMITTED IN FULL WITH THIS RETURN.

SOCIAL SECURITY NO.

MUNICIPALITY

TELEPHONE

FULL YEAR RESIDENT

YES

NO

|

|

PARTIAL YEAR RESIDENT - PLEASE COMPLETE |

||||||||

|

|

ADDRESS INFORMATION BELOW. |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

FORMER ADDRESS - INCLUDE STREET OR ROAD, CITY AND STATE |

|

DATES AT FORMER ADDRESS |

|

|

|

|

|||

IF YOU MOVED DURING |

|

|

FROM |

|

|

|

TO |

|

|

|

THE YEAR, COMPLETE |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

CURRENT ADDRESS - INCLUDE STREET OR ROAD, CITY AND STATE |

|

DATES AT CURRENT ADDRESS |

|

|

|

|

||||

THE FOLLOWING |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FROM |

|

|

|

TO |

|

||

|

|

|

|

|

|

|

|

|

|

|

PRINT EMPLOYER’S NAME - ADDRESS (USE WORKSHEET ON BACK IF MORE THAN ONE EMPLOYER) |

LOCAL TAX WITHHELD |

TOTAL |

|

TOTAL 1099 EARNINGS |

||||||

|

|

$ |

|

|

$ |

|

|

$ |

||

|

|

|

|

|

|

|

|

|

|

|

A COPY OF FORM

1TOTAL GROSS EARNINGS FROM

2LESS: Allowable

3TAXABLE

4OTHER TAXABLE EARNED INCOME - DO NOT ADD INTEREST, DIVIDENDS OR

5TOTAL TAXABLE EARNED INCOME (Add lines 3 and 4)

6NET LOSS - Include PA Schedule C, F,

7SUBTOTAL (Subtract Line 6 from Line 5) If less than zero, enter zero

8NET PROFIT - Include Schedule C, F,

9TOTAL EARNED INCOME - Subject to this tax (Add lines 7 and 8)

10TAX LIABILITY - Line 9 multiplied by tax rate of 1% (.01)

(a)Quarterly Estimated Payments

11AMOUNT (b) Earned Income Tax Withheld - per

PAID (c) Credit from Last Year (If Credit Due)

(d) Misc. Credit (i.e. Phila Tax or Out of State Tax)

12TOTAL OF LINES 11A + 11B + 11C + 11D REFUND/ CREDIT (Line 12 minus line 10)

13Enter amount and check box ® Credit to Next Year. ® Refund

14TAX DUE (Line 10 minus Line 12)

15INTEREST (6% per year) + PENALTY (1/2% per mo.) + LATE FILING FEE ($10) AFTER APRIL 15

16TOTAL AMOUNT DUE (Line 14 + line 15)

|

|

|

1. |

$ |

|

|

|

|

|

|

2. $ |

2 |

|

|

|

|

|

3 |

$ |

|

|

|

|

|

ATTACH FORM 1099 OR EXPLAIN |

4. |

$ |

||

|

|

|

|

|

|

|

|

5. |

$ |

|

|

|

|

|

|

6. $ |

6. |

|

|

|

|

|

7 |

$ |

|

|

|

|

|

|

8. |

$ |

|

|

|

|

|

9. |

$ |

|

|

|

|

|

|

|

|

10. |

$ |

|

|

|

|

|

PLEASE |

11A. |

$ |

11. |

|

DO NOT |

11B. |

$ |

|

|

ROUND |

|

|

||

11C. |

$ |

12 |

|

|

TAX |

|

|||

|

|

|

|

|

AMOUNTS |

11D. |

$ |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

12. |

$ |

|

|

|

|

|

NO REFUND OR CREDIT IF LESS |

13. |

$ |

||

THAN $1.00 |

|

|

||

|

|

|

|

|

|

|

|

|

|

AMOUNTS LESS THAN $1.00 |

14. |

$ |

||

NEED NOT BE PAID |

|

|

||

|

|

|

|

|

|

|

|

15. |

$ |

|

|

|

16. |

$ |

|

|

|

|

|

|

|

|

|

|

***EXTENSIONS FOR FILING MUST BE RECEIVED BY CITY OF BETHLEHEM TAX BUREAU ON OR BEFORE APRIL 15TH***

ATTACH APPROPRIATE COPIES OF STATE SCHEDULES AND/OR ALL

MAKE CHECKS PAYABLE TO CITY OF BETHLEHEM. A FEE OF $25.00 WILL BE CHARGED FOR RETURN CHECKS.

I declare, under penalties of perjury that I/we have examined this return, and to the best of my knowledge and belief, is a true, correct, and complete return.

|

|

|

|

|

SIGNATURE OF TAXPAYER |

DATE |

|

SIGNATURE OF PREPARER (If other than taxpayer) |

DATE |

|

|

|

|

|

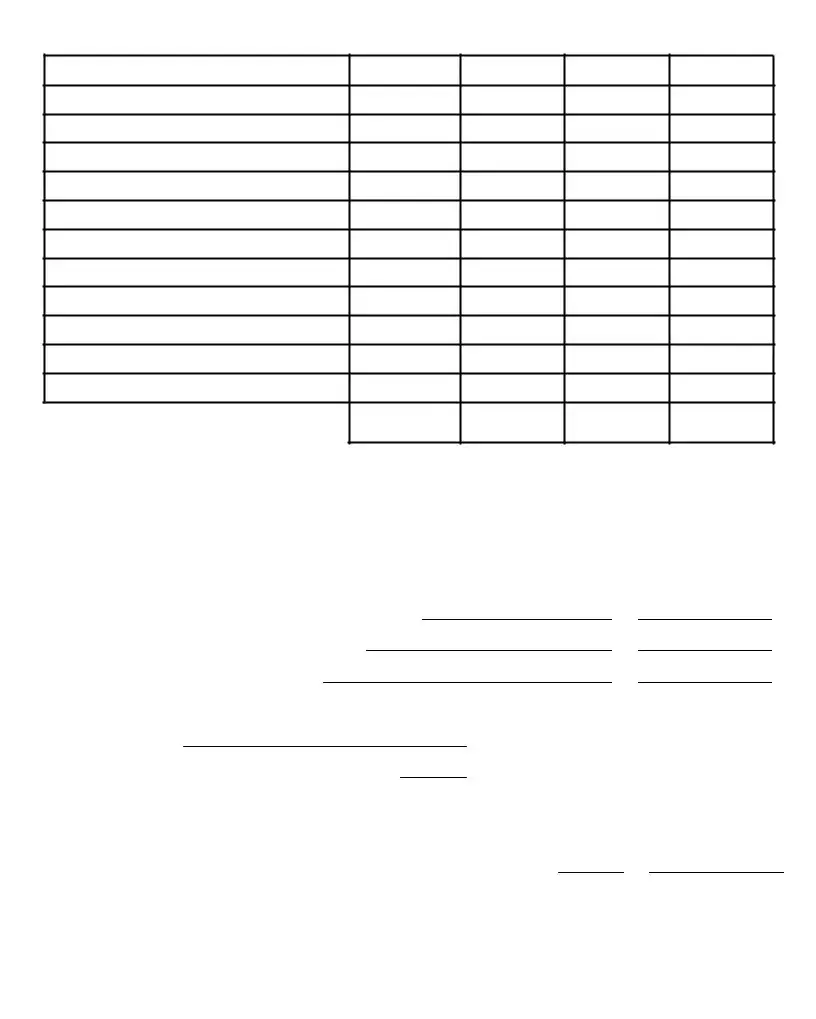

EMPLOYMENT WORKSHEET

Employer’s Name and Address

Dates Employed This Year

From To

Gross

Gross 1099 Earnings

Earned Income Tax

Withheld

TOTALS

WORKSHEET FOR INDIVIDUALS EMPLOYED IN DELAWARE AND/OR NEW YORK

(See Instructions line 12) |

|

EARNED INCOME: Taxed in other state as shown on the state tax return. |

(1) |

Credit will be disallowed if copy of state return is not attached |

X |

Local tax 1% or as specified on the front of this form |

(2) |

Tax Liability to other state |

(3) |

|

|

PA Income Tax (line 1 x PA Income Tax rate for year being reported) |

(4) |

|

|

CREDIT to be used against Local Tax |

|

|

|

(Line 3 minus line 4) On line 11D, enter this amount |

|

|

|

or the amount on the line 2 of worksheet, whichever is less. (If less than zero, enter zero) |

(5) |

||

COPIES OF THE CITY OF BETHLEHEM RULES AND REGULATIONS AND DISCLOSURE STATEMENT

ARE AVAILABLE FROM THE TAX BUREAU. CALL (610)

Rev. 12/07

Document Specifics

| Fact Number | Description |

|---|---|

| 1 | FORM 531 is a tax document specifically for the City of Bethlehem, Pennsylvania. |

| 2 | The form is used for filing Individual Earned Income Tax Returns to the Bethlehem Tax Bureau. |

| 3 | It must be filed by April 15th of the year following the taxable year. |

| 4 | Form 531 includes sections for reporting W-2 earnings, allowable non-reimbursed employee business expenses, and other taxable earned income. |

| 5 | Residents must attach Form W-2 from each employer and other relevant schedules as necessary. |

| 6 | The tax rate applied is 1% of the total earned income, as designated on the form. |

| 7 | Residents can receive a refund or credit for overpayment, or may owe additional tax plus interest and penalties for underpayment. |

| 8 | The governing law for Form 531 is under the jurisdiction of Bethlehem, PA, and specific instructions for residents working in Delaware and/or New York are provided. |

Guide to Writing Tax 531

Filling out the Tax 531 form for the City of Bethlehem involves a detailed process of entering personal and income information, calculating tax liabilities, and detailing payments or credits. Getting this right is crucial to ensure accurate reporting and compliance with local tax obligations. The steps outlined here aim to make this process as smooth as possible. Remember, all necessary schedules and forms should be included, and accurate calculations are essential to avoid errors.

- Start with providing your personal information. Enter your Social Security number, whether you were a full-year or partial-year resident, and your contact details including your telephone number.

- If you were a partial-year resident, fill in your former address including the street or road, city, and state, along with the dates you lived there during the year.

- Next, include your current address if different from above, with the street or road, city, and state, as well as the dates at this current address.

- Under the employment section, write down your employer’s name and address. If you had more than one employer, use the worksheet on the back of the form to list them all.

- Report your total W-2 earnings, total 1099 earnings, and any local tax withheld. Attach a copy of Form W-2 for each employer.

- Calculate your total gross earnings from W-2s. Then, deduct any allowable non-reimbursed employee business expenses (attach PA UE-2 form if applicable) to find your taxable W-2 earnings.

- Add any other taxable earned income, ensuring not to include interest, dividends, or 1099-G income. This gives you your total taxable earned income.

- Include any net loss from PA Schedule C, F, RK-1 and/or NRK1, leading to a subtotal. If this amount is less than zero, enter zero.

- Report any net profit with schedules C, F, RK-1, and/or NRK-1 included, to calculate your total earned income subject to tax.

- Determine your tax liability by multiplying the total earned income by the tax rate of 1%.

- Detail any quarterly estimated payments, earned income tax withheld per W-2(s), credit from last year, and misc. credit (e.g., Philly Tax or Out of State Tax).

- Calculate the total of the lines from the previous step, then subtract this from your tax liability to find out if you have a refund, credit, or owe additional tax.

- Enter the amount of any refund or credit, and check the appropriate box for credit to next year or refund.

- Calculate any tax due after considering refunds or credits.

- Add any interest, penalty, and late filing fee due after April 15.

- Sum up the total amount due, including any penalties and fees.

- Check the box if you are filing for an extension and ensure this request is received by the City of Bethlehem Tax Bureau on or before April 15.

- Sign and date the form. If someone other than you prepared the form, they must also sign and date it.

- Attach all necessary forms, schedules, and W-2 forms required for filing.

- Make your check payable to the City of Bethlehem, noting that a fee will be charged for returned checks.

After diligently completing the Tax 531 form, review it to ensure all information is accurate and you've attached all required documentation. Mail your return using the pre-addressed envelope provided, selecting the correct box on the top of the envelope based on your filing status. It’s essential to file this return and remit any balance of tax due by April 15 to avoid potential penalties and interest charges for late filing.

Understanding Tax 531

Frequently Asked Questions about Form 531 for the City of Bethlehem Tax Return

-

What is Form 531 used for?

Form 531 is utilized by residents (or part-year residents) of the City of Bethlehem to file their individual earned income tax returns. This form helps report all taxable earnings and calculates the tax liability due to the city, based on those earnings.

-

When is the filing deadline for Form 531?

The deadline for filing Form 531 is April 15th of each year for the previous calendar year's earned income. If an extension is needed, it must be requested by this date from the City of Bethlehem Tax Bureau.

-

What documents need to be attached with Form 531?

When filing Form 531, you must attach a copy of Form W-2 for each employer from the tax year. If claiming allowable non-reimbursed employee business expenses, attach PA UE-2 form. For residents who have earned income in Delaware and/or New York, a completed worksheet and a copy of the state tax return are required if claiming a credit.

-

How is tax calculated on Form 531?

The tax is calculated by applying a rate of 1% to the total earned income subject to tax as determined on the form. This includes deducted allowable expenses and added net profits or subtracted net losses from self-employment or business operations.

-

What are the penalties for late filing or payment?

There are penalties for late filing or payment which include a late filing fee of $10, interest at 6% per year on the unpaid tax, and a penalty of 1/2% per month on the unpaid tax amount. These fees and penalties will be assessed after April 15th if the return and payment are not received by then.

-

What should I do if I discover an error on my filed Form 531?

If you discover an error on your filed return, you should promptly contact the City of Bethlehem Tax Bureau for guidance on how to amend your return. Generally, you would need to file an amended return correcting the information, attaching any required documentation.

Common mistakes

When filling out the Tax 531 form for the City of Bethlehem, individuals often make several common errors. These mistakes can range from simple oversights to misunderstandings about the form's requirements. Identifying and avoiding these errors can streamline the tax filing process, ensuring accuracy and compliance.

Incorrect or Incomplete Address Information: One of the first sections requires the taxpayer to provide both their current and former addresses if they moved during the tax year. People often forget to include complete details, such as the full street name, city, state, and the dates they lived at each address. This information is crucial for accurately assessing the tax liability based on residency.

Failing to Attach Form W-2 and/or Form 1099: Taxpayers must attach a copy of Form W-2 from each employer or Form 1099 if applicable. However, it's a common mistake to submit the Tax 531 form without these attachments. This oversight can lead to delays in processing the return because the tax bureau requires these documents to verify income and tax withholdings.

Miscalculations of Earned Income: The form requires taxpayers to calculate total gross earnings, taxable W-2 earnings, and other taxable earned income. Mistakes often arise in these calculations due to misunderstandings of what constitutes gross versus taxable earnings or failure to correctly subtract allowable business expenses. Such errors can result in either underpaying or overpaying taxes.

Incorrect Tax Amounts and Rounding Errors: The instructions explicitly state not to round tax amounts, yet rounding is a frequent mistake. Taxpayers sometimes inadvertently round the figures while calculating their tax liability, estimated payments, and withholdings. Precise amounts are necessary for the tax bureau to accurately assess and verify the tax owed or refund due.

Understanding and paying attention to these common mistakes can help taxpayers complete the Tax 531 form more accurately and efficiently. Proper completion of the form not only ensures compliance but also facilitates a smoother process for both the taxpayer and the City of Bethlehem Tax Bureau.

Documents used along the form

Filing taxes requires comprehensive documentation to ensure accuracy and compliance with tax laws. The Form 531 for residents of Bethlehem, Pennsylvania, serves as a primary document for reporting individual earned income tax. Alongside this form, individuals often need to submit additional forms and documents to complete their tax return properly. Here's an overview of such documents:

- Form W-2, Wage and Tax Statement: This form is issued by employers and reports an employee's annual wages and the amount of taxes withheld from their paycheck.

- Form 1099, Various versions such as 1099-MISC, 1099-INT, and 1099-DIV report income from sources other than wages, salaries, and tips. This can include independent contractor income, interest, dividends, and other types of miscellaneous income.

- PA Schedule C, Profit or Loss From Business: For individuals who operate a business or practice a profession as a sole proprietor, this schedule reports income and expenses related to their business activity.

- PA Schedule UE, Allowable Employee Business Expenses: This form is used to deduct unreimbursed business expenses employees incurred while performing their job duties.

- PA Schedule F, Profit or Loss From Farming: Provides the specifics of income and expenses related to farming activities, for those who engage in such business operations.

These documents collectively provide a comprehensive overview of an individual's income and tax liabilities, helping the City of Bethlehem Tax Bureau accurately assess and process tax returns. Ensuring all relevant forms and documents are submitted with the Tax 531 form is crucial for timely and correct tax filing. It's important for taxpayers to closely review their tax situation each year to determine which specific forms are necessary for their personal and professional circumstances.

Similar forms

The Form 1040, officially the U.S. Individual Income Tax Return, shares core similarities with the Tax 531 form in that it is a comprehensive document utilized by individuals to report their annual income to a government agency, in this case, the Internal Revenue Service (IRS). Both forms require detailed income information, deductions, and applicable credits to accurately calculate tax liability. Like the Tax 531, Form 1040 includes sections for wages (similar to W-2 and 1099 income on the Tax 531), as well as deductions and tax credits, which influence the final tax amount owed or refund due.

Form W-2, also known as the Wage and Tax Statement, resembles the Tax 531 in its function of reporting an individual's annual wages and the taxes withheld by the employer. Taxpayers must attach a copy of their Form W-2 to both forms when filing. This ensures that the income reported matches the taxes withheld, aiding in the accurate computation of the taxpayer's final tax obligation or refund eligibility.

Form 1099, which encompasses a series of documents such as the 1099-MISC, 1099-INT, and 1099-DIV, is akin to the Tax 531 in that it also reports various types of income outside of wages, such as freelance earnings, interest, and dividends. Taxpayers using the Tax 531 form are required to disclose their total 1099 earnings, mirroring the process of how such earnings are reported to the federal government through different types of Form 1099.

The Schedule C (Profit or Loss from Business) plays a similar role to portions of the Tax 531 that deal with declaring net profit or loss from business activities. Individuals who own a business or work as independent contractors use Schedule C to detail their business income and expenses. This parallels the sections on the Tax 531 where taxpayers list their gross earnings and subtract allowable business expenses.

The Pennsylvania UE-2 form, used for reporting unreimbursed employee business expenses, bears resemblance to the Tax 531 in its purpose of adjusting taxable income. Like the allowance for non-reimbursed business expenses on the Tax 531, the UE-2 form allows taxpayers to claim legitimate business expenses not repaid by their employer, ultimately reducing their taxable income.

Schedule E (Supplemental Income and Loss) is another document similar to the Tax 531, particularly for renters, royalty earners, or individuals with income from trusts, estates, or S-corporations. It involves declaring additional types of income, akin to how the Tax 531 includes sections for reporting other taxable income beyond wages, emphasizing the comprehensive nature of income reporting for tax purposes.

The Earned Income Tax Credit (EITC) form is directly related to the Tax 531 in terms of tax relief opportunities for low- to moderate-income individuals and families. Though not a form per se, eligibility for the EITC affects the total tax liability or refund on tax returns, including the Tax 531. It reflects a crucial aspect of tax filing where qualifying for tax credits can significantly impact the outcome of one's tax situation.

Finally, the Schedule F (Profit or Loss from Farming) shares similarities with the Tax 531 for individuals engaged in agricultural business operations. It requires detailed accounting of farming income and expenses, comparable to the Tax 531's handling of special categories of work or business income, ensuring that all sources of revenue and deductible costs are thoroughly documented for tax assessment purposes.

Dos and Don'ts

When completing the Tax 531 form for the City of Bethlehem, it is essential to approach the process with care and accuracy to ensure compliance and avoid potential issues. Below are some dos and don'ts that can guide you through the process.

Do:- Review the instruction sheet carefully before starting to fill out the form. This step is crucial as it provides specific guidelines on how to correctly complete the form and avoid common mistakes.

- Gather all necessary documentation, such as W-2 forms from employers, 1099 forms, and any schedules for deductions or credits, before starting. This preparation will streamline the process and ensure you have all the information needed.

- Attach a copy of Form W-2 for each employer you worked for during the tax year. This is essential for verifying the income and tax withheld information you report on the form.

- Double-check all entries for accuracy, including calculations and the completeness of information, before mailing your return. This final review can help prevent errors that could delay processing or result in penalties.

- Rush through the form without understanding each section. Take the time to comprehend each part of the form to ensure that your entries are correct and applicable to your situation.

- Omit any relevant schedules or documentation that support your tax return. Failing to include necessary schedules or proof of income and deductions can lead to inaccuracies and potential audits.

- Round tax amounts. Ensure to report exact numbers as instructed on the form to maintain accuracy in your tax liability calculation.

- Ignore the deadline for filing. Submit your Tax 531 form on or before April 15th to avoid penalties, interest, and late fees. If an extension is needed, make sure to request it by the specified deadline.

Misconceptions

Misconceptions about tax forms can lead to costly errors, delays, and undue stress during filing seasons. The Form 531 for the City of Bethlehem is no exception, with its own set of myths that can confuse taxpayers. Here, we dispel some of the common misunderstandings associated with this form.

Only full-year residents need to file Form 531: A prevalent misconception is that only those who have lived in Bethlehem for the entire tax year need to file Form 531. In reality, both full-year and partial-year residents are required to submit this form. If you've moved in or out of Bethlehem during the tax year, you need to provide both your former and current addresses, along with the dates you lived at each, to accurately calculate your tax responsibility.

Form 531 is only for individuals with W-2 earnings: While W-2 earnings are a significant part of Form 531, it's a mistake to think they are the only income considered. Taxpayers must also report other taxable earned income, including net profits from self-employment (Schedule C), farming (Schedule F), and partnerships (Schedule RK-1 or NRK-1), as well as 1099 earnings. All these types of income contribute to the taxpayer's total earned income and potential tax liability on this form.

Tax amounts can be rounded to simplify the filing process: This misconception could lead to an incorrect tax return. The instructions explicitly request that filers do not round tax amounts. Ensuring the accuracy of all dollar amounts reported, down to the cent, is crucial for the proper assessment of taxes owed or refunds due.

If taxes owed are less than $1, no payment is necessary: It's true that the form states amounts less than $1 need not be paid. However, this does not absolve taxpayers of their responsibility to file the Form 531. Filing is required regardless of the amount owed to maintain tax compliance and ensure accurate records with the City of Bethlehem Tax Bureau.

Extensions for filing are automatic: Many may wrongly believe that extensions to file are granted automatically. To receive an extension, taxpayers must formally request it from the City of Bethlehem Tax Bureau on or before April 15th. Without this request, taxpayers are expected to file by the original due date to avoid penalties, including interest charges and late filing fees.

Understanding the requirements of Form 531 and confronting these misconceptions head-on can help taxpayers in Bethlehem navigate their tax obligations more smoothly and efficiently, ensuring compliance and minimizing errors.

Key takeaways

Filling out the Tax 531 form for the City of Bethlehem requires attention to detail and understanding some key elements that will ensure accuracy and compliance with local tax laws. Here are the major takeaways:

- Deadlines are crucial: The form must be submitted by April 15th to avoid any late filing fees, penalties, or interest charges. For those who need more time, an extension must be requested from the City of Bethlehem Tax Bureau before the filing deadline.

- Documentation is key: Attach all necessary documents, including a Form W-2 for each employer, Form 1099 for other sources of income, and any schedule outlining deductible expenses. This ensures that taxable income is reported accurately.

- Detail all income and deductions accurately: The form requires detailed information regarding total earnings, taxable income, and allowable deductions. Errors or omissions can result in incorrect tax calculations and potential issues with the tax bureau.

- Understand the tax calculations: The form calculates the tax liability based on the net profit and total earned income subject to tax at a rate of 1%. Ensuring that all income and deductions are accurately reported helps in computing the correct tax due or refund owed.

Completing the Tax 531 form correctly is important for full-year or partial-year residents of Bethlehem to comply with local tax obligations and avoid potential penalties.

Popular PDF Documents

1040 Irs Form - Fiscal year taxpayers must adhere to different payment deadlines for estimated taxes.

Pa Department of Revenue Tax Clearance - The form’s page on real estate transactions within the last five years or currently owned in PA is geared towards comprehensive tax accountability.

Navajo Nation Sales Tax - Details of any government service positions held must be included.