Get Tax 214 Form

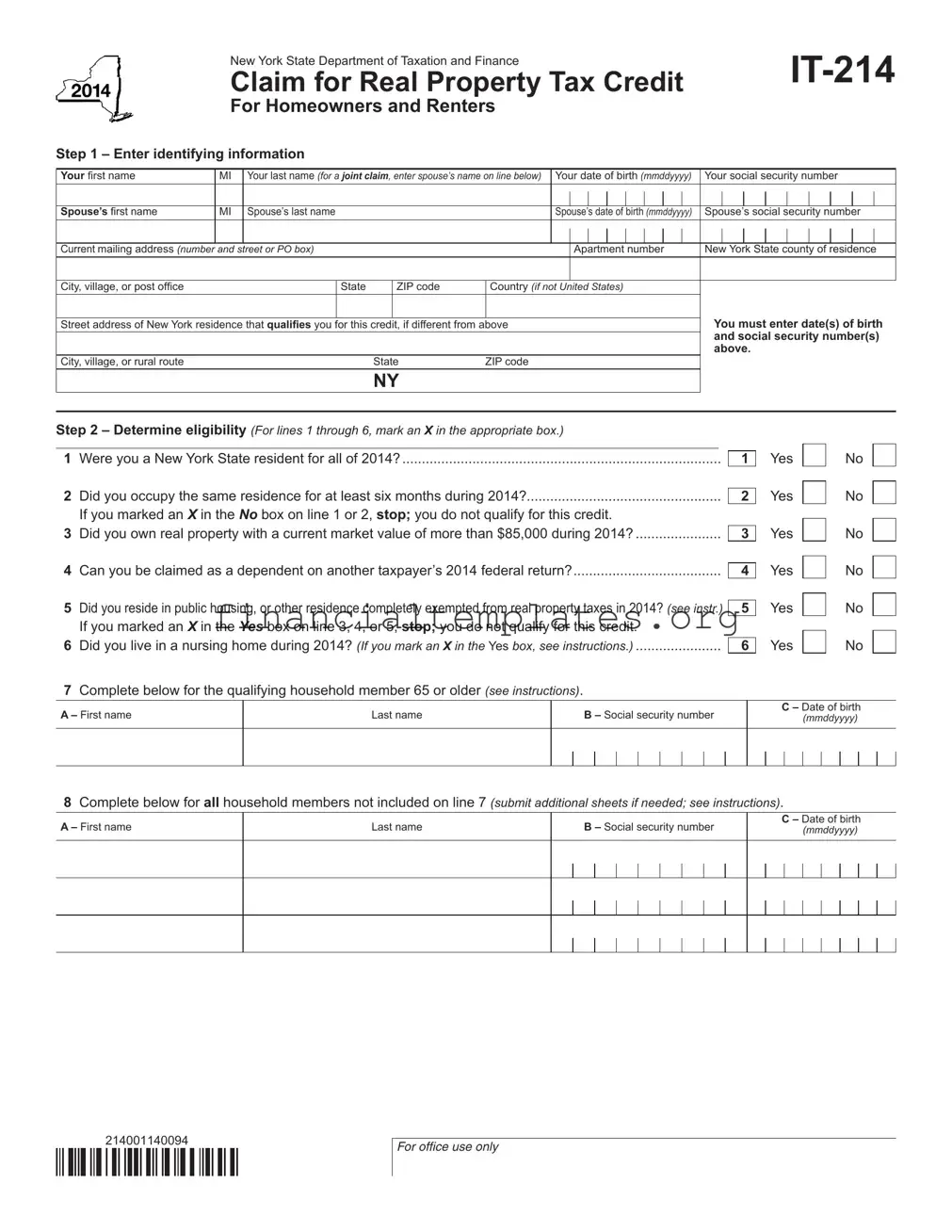

When homeowners and renters in New York State find themselves navigating the realm of property tax credits, the IT-214 form, Claim for Real Property Tax Credit, emerges as a crucial document. This form, diligently prepared by the New York State Department of Taxation and Finance, is designed to guide individuals through claiming their rightful real property tax credit. It starts with basic identifying information, moving through eligibility criteria that include residency requirements, property value thresholds, and dependency status, to calculating household gross income with inclusivity of all possible income sources. The form takes homeowners and renters alike through a detailed process to compute real property tax or adjusted rent, setting specific ceilings that determine eligibility for the credit. Additionally, it extends into the computation of the credit amount, linking the calculated sum to either rent paid or real property taxes, thereby unveiling a path to financial relief. For those who clear the eligibility hurdles, the IT-214 form closes with options for receiving the claimed credit, including direct deposit, thereby weaving through the complexities of tax credit eligibility with the goal of providing New Yorkers with a tangible financial benefit.

Tax 214 Example

New York State Department of Taxation and Finance

Claim for Real Property Tax Credit

For Homeowners and Renters

Step 1 – Enter identifying information

Your irst name |

MI |

Your last name (for a joint claim, enter spouse’s name on line below) |

Your date of birth (mmddyyyy) |

Your social security number |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s irst name |

MI |

Spouse’s last name |

|

|

|

|

Spouse’s date of birth (mmddyyyy) |

Spouse’s social security number |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current mailing address (number and street or PO box) |

|

|

|

|

|

Apartment number |

New York State county of residence |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, village, or post ofice |

|

|

State |

|

ZIP code |

Country (if not United States) |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street address of New York residence that qualiies you for this credit, if different from above |

You must enter date(s) of birth |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and social security number(s) |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

above. |

||||||||

City, village, or rural route |

|

|

|

State |

ZIP code |

|

|

|

|

|

|

|

|

|

|||||||||

NY

Step 2 – Determine eligibility (For lines 1 through 6, mark an X in the appropriate box.)

1 Were you a New York State resident for all of 2014?..................................................................................

2Did you occupy the same residence for at least six months during 2014?..................................................

If you marked an X in the No box on line 1 or 2, stop; you do not qualify for this credit.

3 Did you own real property with a current market value of more than $85,000 during 2014? ......................

4 Can you be claimed as a dependent on another taxpayer’s 2014 federal return?......................................

5Did you reside in public housing, or other residence completely exempted from real property taxes in 2014? (see instr.) If you marked an X in the Yes box on line 3, 4, or 5, stop; you do not qualify for this credit.

6 Did you live in a nursing home during 2014? (If you mark an X in the Yes box, see instructions.) ......................

7Complete below for the qualifying household member 65 or older (see instructions).

1

2

3

4

5

6

Yes

Yes

Yes

Yes

Yes

Yes

No

No

No

No

No

No

A – First name

Last name

B – Social security number

C – Date of birth

(mmddyyyy)

8Complete below for all household members not included on line 7 (submit additional sheets if needed; see instructions).

A – First name

Last name

B – Social security number

C – Date of birth

(mmddyyyy)

214001140094

For office use only

Page 2 of 3

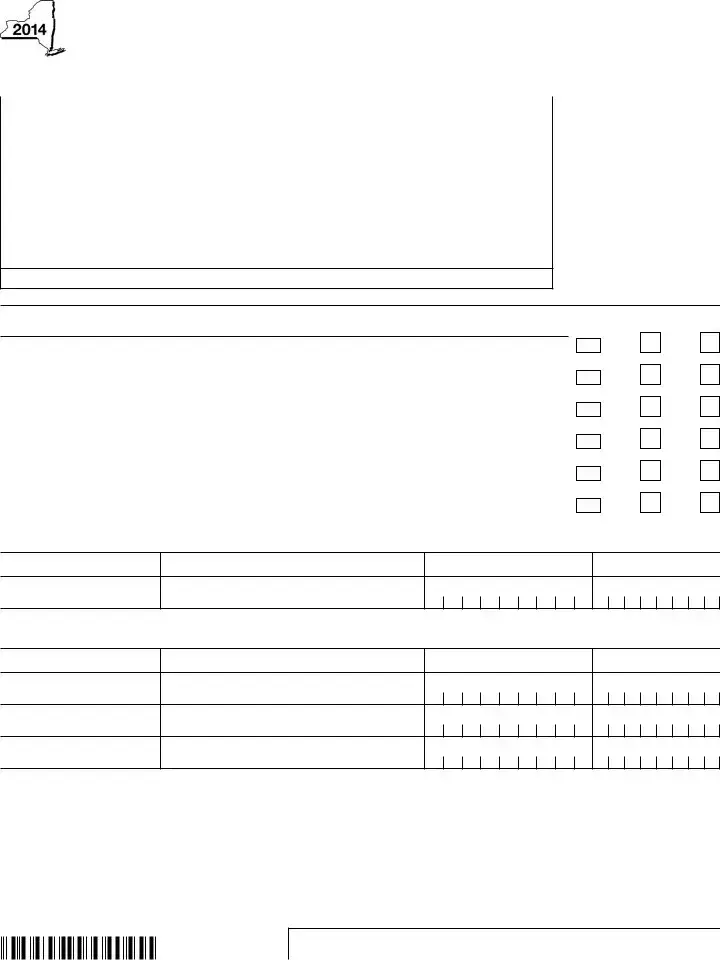

Step 3 – Determine household gross income

Enter the total of all amounts, even if not taxable, that you, your spouse (if married), and all other household members received during 2014.

9 |

Federal adjusted gross income |

|

|

|

|

|

If any household members do not have to ile a federal return, see instructions |

9 |

|

00 |

|

10 |

New York State additions to federal adjusted gross income |

10 |

|

00 |

|

11 |

Social security payments not included on line 9 |

11 |

|

00 |

|

12 |

Supplemental security income (SSI) payments |

12 |

|

00 |

|

13 |

Pensions and annuities (including railroad retirement beneits) not included on lines 9 through 12 |

13 |

|

00 |

|

14 |

Cash public assistance and relief |

14 |

|

00 |

|

15 |

Other income |

15 |

|

00 |

|

16 |

Household gross income (add lines 9 through 15) |

16 |

|

00 |

|

|

If line 16 is more than $18,000, stop; you do not qualify for this credit. |

|

|

|

|

17 |

Enter rate from Table 1 (see instructions) |

17 |

|

|

|

18 Multiply line 16 by line 17 ...........................................................................................................................

18

00

Step 4 – Compute real property tax

Renters |

19 |

Enter the total amount of rent you and all members of your household paid |

|

|

|

|||

|

|

|

||||||

only |

|

during 2014. (Do not include any subsidized part of your rental charge.) |

19 |

|

00 |

|||

20 |

Adjusted rent – If line 19 includes charges for: |

Enter on line 20 |

|

|

|

|||

|

|

|

|

|||||

|

|

heat, gas, electricity, furnishings, and board |

50% |

(.5) of line 19 |

|

|

|

|

|

|

heat, gas, electricity, and furnishings |

75% |

(.75) of line 19 |

|

|

|

|

|

|

heat, gas, and electricity |

80% |

(.8) of line 19 |

|

|

|

|

|

|

heat or heat and gas |

85% |

(.85) of line 19 |

|

|

|

|

|

|

|

|

|

||||

|

|

none of the above |

100% of line 19 |

20 |

|

00 |

||

|

|

Average monthly adjusted rent (divide line 20 by the number of months you paid rent) |

|

|

|

|||

|

21 |

21 |

|

00 |

||||

|

|

If line 21 is more than $450, stop; you do not qualify for this credit. |

|

|

|

|||

|

|

|

|

|

||||

|

22 |

Multiply line 20 by 25% (.25); enter here and on line 28 |

.................................................. |

|

22 |

|

00 |

|

|

|

|

|

|

|

|

|

|

Homeowners |

|

Real property taxes paid during 2014 (see instructions) |

|

|

|

|

|

|

23 |

|

|

23 |

|

00 |

|||

only |

|

|

|

|||||

24 |

Special assessments |

|

|

24 |

|

00 |

||

|

|

|

|

|||||

|

25 |

Add lines 23 and 24 |

|

|

25 |

|

00 |

|

|

26 |

..................................Exemption for homeowners 65 and over (optional - see instructions) |

26 |

|

00 |

|||

|

27 |

Add lines 25 and 26; enter here and on line 28 |

|

|

27 |

|

|

|

|

|

|

|

00 |

||||

|

|

|

|

|

|

|

|

|

214002140094

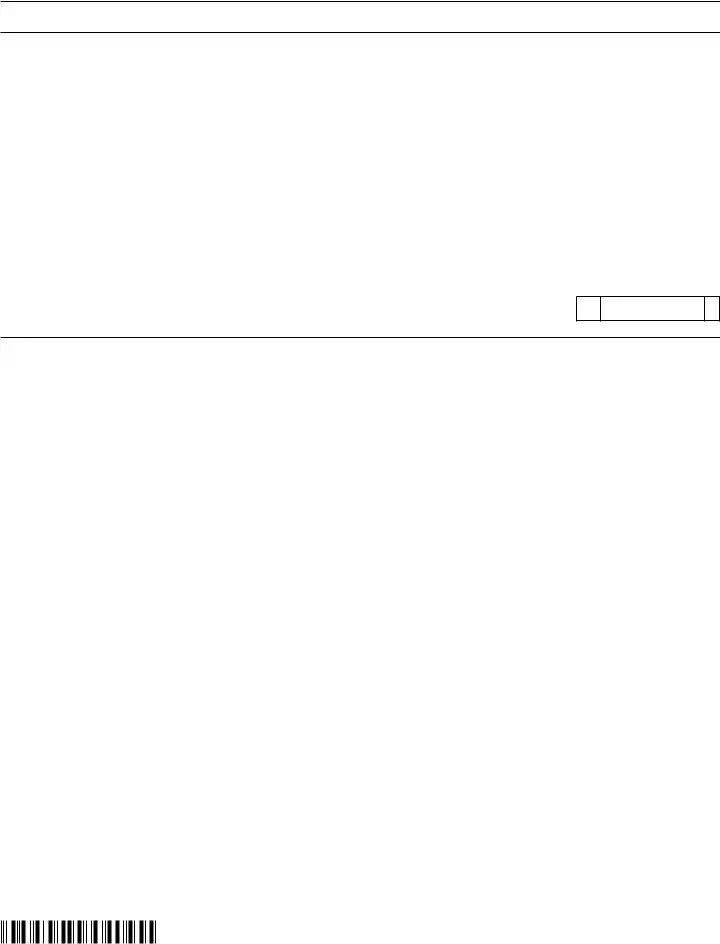

Your social security number

Step 5 – Compute credit amount |

|

|

28 |

Renters: Enter amount from line 22. Homeowners: Enter amount from line 27 (see instructions) |

28 |

|

If line 28 is zero or less, stop; no credit is allowed. |

|

29 |

Enter amount from line 18 |

29 |

|

If line 29 is equal to or more than line 28, stop; you do not qualify for this credit. |

|

00

00

30 |

Subtract line 29 from line 28 |

30 |

31 |

Multiply line 30 by 50% (.5) (However, if you entered an amount on line 26, multiply line 30 by 25% (.25).) |

31 |

32 |

Credit limit (see instructions; enter amount from chart) |

32 |

33Enter the amount from line 32 or 31, whichever is less. This is the credit for your household.

(If more than one member of your household is iling Form |

33 |

•If you are iling this claim with your New York State income tax return:

Enter the line 33 amount on Form

•If you are not iling this claim with a New York State income tax return (see instructions):

Mark one refund choice: |

|

direct deposit (ill in line 34) - or - |

|

debit card - or - |

|

paper check |

00

00

00

00

Step 6 – Enter account information (see instructions)

If the funds for your refund would go to an account outside the U.S., mark an X in this box (see instructions) .......................................

34Direct deposit (see instructions): Complete the following to have your refund deposited directly to your bank account.

34a Account type:

34b Routing number

Personal checking - or -

Personal savings - or -

34c Account number

Business checking - or -

Business savings

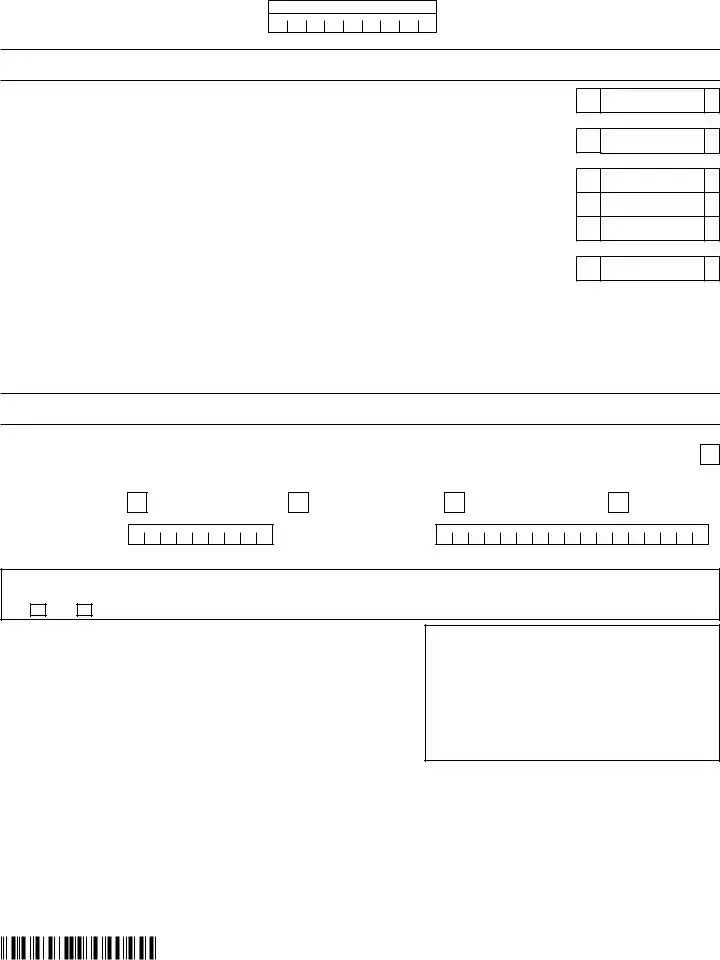

designee? (see instr.)

Yes |

No |

Print designee’s name |

Designee’s phone number |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

Personal identiication

number (PIN)

Paid preparer must complete (see instr.) |

Date |

||||

|

|

|

|

|

|

Preparer’s signature |

|

Preparer’s NYTPRIN |

|||

|

|

|

|

|

|

Firm’s name (or yours, if |

Preparer’s PTIN or SSN |

||||

|

|

|

|

|

|

Address |

Employer identiication number |

||||

|

|

|

|

|

|

|

|

|

NYTPRIN |

||

|

|

|

excl. code |

|

|

|

|

|

|

|

|

|

Taxpayer(s) must sign here |

|

||

|

|

|

|

|

Your signature |

|

|

|

|

|

|

|

|

|

Your occupation |

|

|

||

|

|

|

||

Spouse’s signature and occupation (if joint claim) |

|

|||

|

|

|

|

|

Date |

|

Daytime phone number |

|

|

|

|

( |

) |

|

|

|

|

|

|

•If you are iling a NYS income tax return, submit this form with your return.

•If you are not iling a NYS income tax return, mail this form to:

NYS TAX PROCESSING, PO BOX 22017, ALBANY NY

214003140094

New York State Department of Taxation and Finance |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

Claim for New York City School Tax Credit |

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your irst name |

MI |

Your last name (for a combined claim, enter spouse’s name on line below) |

Your date of birth (mmddyyyy) |

Your social security number |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s irst name |

MI |

Spouse’s last name |

|

|

Spouse’s date of birth (mmddyyyy) |

Spouse’s social security number |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing address (number and street or PO box) |

|

|

|

Apartment number |

You must enter your date(s) of |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

birth and social security number(s) |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

above. |

|||||||||||||||

City, village, or post ofice |

|

|

State |

ZIP code |

Country (if not United States) |

NYS county of residence while living in NY City |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address of New York City residence that qualiies you for this credit, if different from above |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

State |

ZIP code |

|

Taxpayer’s date of death (mmddyyyy) |

Spouse’s date of death (mmddyyyy) |

||||||||||||||||||||||

|

|

|

NY |

|

Decedent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: Use this form only if you are not required to ile a 2014 Form

2014. You lived in New York City if you lived in any of the following counties during 2014: Kings County (Brooklyn), Bronx, New York County (Manhattan), Richmond County (Staten Island), or Queens. If you did not live in any of these counties for all or part of the year, stop; you do not qualify for this credit.

Type of claim – |

a |

mark an X in one box |

|

(see instructions) |

b |

Single

(complete lines 1, 2, and 5) |

c |

Married iling a combined claim |

d |

(complete lines 1 through 5) |

Married but iling a separate claim

(complete lines 1, 2, and 5)

Qualifying widow(er) with dependent child (complete lines 1, 2, and 5)

1 |

.............................Can you be claimed as a dependent on another taxpayer’s 2014 federal return? |

1 |

Yes |

|||||||

|

If you marked an X in box a, c, or d above, and marked the Yes box at line 1, stop; |

|

|

|

|

|

||||

|

you do not qualify for the credit. All other ilers continue with line 2. |

|

|

|

|

|

||||

2 |

Enter, in the box to the right, the number of months during 2014 that you lived in |

|

|

|

|

|

||||

|

...............................................................................New York City (see Note above; also see instructions) |

2 |

|

|

|

|||||

|

If you marked an X in box b above, continue with line 3. All other ilers continue with line 5. |

|

|

|

|

|||||

3 |

Can your spouse be claimed as a dependent on another taxpayer’s 2014 federal return? |

3 |

Yes |

|||||||

|

If you marked an X in the Yes box at both lines 1 and 3, stop; you do not qualify for this |

|

|

|

|

|

||||

|

credit. All other ilers continue with line 4. |

|

|

|

|

|

|

|

|

|

4 |

Enter, in the box to the right, the number of months during 2014 your spouse lived in |

|

|

|

|

|

||||

|

.......................................................................New York City (see Note above; also see instructions) |

4 |

|

|

|

|||||

5 |

Mark one refund choice (see instructions): |

|

direct deposit (ill in line 6) - or - |

|

|

debit card |

- or - |

|

||

|

|

|

|

|||||||

6Direct deposit (see instructions): Complete the following to have your refund deposited directly to your bank account.

No

months

No

months

paper check

6a |

Routing |

|

|

|

|

|

|

|

|

|

6b |

Account |

|

Personal |

- or - |

|

|

Personal |

- or - |

|

|

|

Business |

- or - |

|

|

|

Business |

||||||||||||||||||

|

number |

|

|

|

|

|

|

|

|

|

|

type: |

|

checking |

|

|

savings |

|

|

|

checking |

|

|

|

savings |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Note: If the funds for your refund would go to an account |

|

|

|

|

6c Account |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

outside the U.S., mark an X in this box (see instructions)... |

|

|

|

|

number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Print designee’s name |

|

|

|

|

|

Designee’s phone number |

|

|

|

|

|

|

|

Personal identiication |

|||||||||||||||||||||||||||||||

designee? (see instr.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

number (PIN) |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paid preparer must complete (see instr.) |

Date |

||||

|

|

|

|

|

|

Preparer’s signature |

|

Preparer’s NYTPRIN |

|||

|

|

|

|

|

|

Firm’s name (or yours, if |

Preparer’s PTIN or SSN |

||||

|

|

|

|

|

|

Address |

Employer identiication number |

||||

|

|

|

|

|

|

|

|

|

NYTPRIN |

||

|

|

|

excl. code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxpayer(s) must sign here |

|

||

|

|

|

|

|

Your signature |

|

|

|

|

|

|

|

|

|

Your occupation |

|

|

||

|

|

|

||

Spouse’s signature and occupation (if joint claim) |

|

|||

|

|

|

|

|

Date |

|

Daytime phone number |

|

|

|

|

( |

) |

|

210001140094

For office use only

When and where to ile Form

File your claim as soon as you can after January 1, 2015.

Mail your claim to:

NYS TAX PROCESSING

PO BOX 22017

ALBANY NY

Private delivery services

If you choose, you may use a private delivery service, instead of the U.S. Postal Service, to mail in your form and tax payment.

However, if, at a later date, you need to establish the date you iled or paid your tax, you cannot use the date recorded by a

private delivery service unless you used a delivery service that has been designated by the U.S. Secretary of the Treasury or the Commissioner of Taxation and Finance. (Currently

designated delivery services are listed in Publication 55,

Designated Private Delivery Services. See Need help? for information on obtaining forms and publications.) If you have

used a designated private delivery service and need to establish the date you iled your form, contact that private delivery service

for instructions on how to obtain written proof of the date your form was given to the delivery service for delivery. See

Publication 55 for where to send the forms covered by these

instructions.

Privacy notiication

New York State Law requires all government agencies that

maintain a system of records to provide notiication of the legal

authority for any request, the principal purpose(s) for which the information is to be collected, and where it will be maintained.

To view this information, visit our Web site, or, if you do not have Internet access, call and request Publication 54, Privacy Notiication. See Need help? for the Web address and telephone

number.

Need help?

Visit our Web site at www.tax.ny.gov

•get information and manage your taxes online

•check for new online services and features

Telephone assistance |

|

Automated income tax refund status: |

(518) |

Personal Income Tax Information Center: (518) |

|

To order forms and publications: |

(518) |

Text Telephone (TTY) Hotline (for persons with hearing and speech disabilities using a TTY): If you

have access to a TTY, contact us at (518)

If you do not own a TTY, check with independent

living centers or community action programs to ind

out where machines are available for public use.

Persons with disabilities: In compliance with the

Americans with Disabilities Act, we will ensure that our lobbies, ofices, meeting rooms, and other

facilities are accessible to persons with disabilities. If you have questions about special accommodations for persons with disabilities, call the information center.

210002140094

Document Specifics

| Fact Name | Description |

|---|---|

| Form Designation | IT-214 |

| Issuing Body | New York State Department of Taxation and Finance |

| Purpose | Claim for Real Property Tax Credit For Homeowners and Renters |

| Eligibility Requirement 1 | Must have been a New York State resident for all of the specified tax year |

| Eligibility Requirement 2 | Must have occupied the same residence for at least six months during the specified tax year |

| Governing Law(s) | New York State Tax Law |

| Income Threshold | Household gross income must not exceed $18,000 to qualify for the credit |

Guide to Writing Tax 214

Filling out the Tax 214 form is a necessary step for claiming real property tax credit in New York State for homeowners and renters. This process involves providing personal information, determining eligibility based on specific criteria, calculating household gross income, and if applicable, computing the credit amount and providing account information for a possible refund. Careful adherence to the instructions during this process ensures that the claim is processed accurately and efficiently.

- Step 1 - Enter Identifying Information:

- Write your first name, middle initial, and last name. If filing jointly, include your spouse's name on the designated line.

- Fill in your date of birth, social security number, and if applicable, your spouse’s social security number and date of birth.

- Provide your current mailing address, including the apartment number if relevant, county, city, state, ZIP code, and if outside the United States, the country.

- For the property qualifying you for this credit, if different from your mailing address, provide its street address, city, state, and ZIP code.

- Step 2 - Determine Eligibility:

- Mark an "X" in the appropriate box for questions 1 through 6 based on your residency and property ownership status throughout 2014.

- For any household member 65 or older, enter their first name, last name, social security number, and date of birth where indicated.

- For all other household members, provide their names, social security numbers, and dates of birth, using additional sheets if needed.

- Step 3 - Determine Household Gross Income:

- Enter the total amounts for federal adjusted gross income, New York State additions, social security payments not included in the federal adjusted gross income, supplemental security income (SSI), pensions and annuities not included elsewhere, cash public assistance, and any other income.

- Sum these amounts to calculate the total household gross income.

- Step 4 - Compute Real Property Tax: For renters and homeowners, calculate the applicable rent or real property taxes paid in 2014, adjust according to the instructions provided, and find the average monthly adjusted rent if renting.

- Step 5 - Compute Credit Amount:

- Renters should enter the amount from line 22, while homeowners should use the amount from line 27.

- Subtract the amount on line 29 from line 28 and multiply the result by the appropriate percentage to find the credit for your household.

- Enter the lesser amount from the credit limit or the previously calculated figure as your household credit.

- Step 6 - Enter Account Information: If you are eligible for a refund and prefer direct deposit, fill in your bank account type, routing number, and account number. Otherwise, indicate your preference between a debit card or paper check.

- Review the entire form for accuracy and completeness. Sign and date the form along with your spouse if filing jointly.

- Submit the completed form to the specified address, using a private delivery service if desired. Remember to keep a copy for your records.

Correctly completing and submitting the Tax 214 form is crucial in claiming your real property tax credit. The form collects necessary information to determine eligibility and calculate the potential credit for both homeowners and renters. Taking the time to accurately complete each step ensures that your claim is processed without delay.

Understanding Tax 214

What is the Tax Form IT-214 and who is eligible to file it?

The Tax Form IT-214, also known as the "Claim for Real Property Tax Credit," is a document provided by the New York State Department of Taxation and Finance. It is specifically designed for homeowners and renters residing in New York State who seek to claim a tax credit based on their real property taxes or rent paid during the tax year. Eligibility for filing this form revolves around several criteria: the claimant must have been a New York State resident for the entire tax year, occupied the same residence for a minimum of six months within the year, and meet certain income and property value thresholds. Specifically, the real property's market value must not exceed $85,000, and the household gross income should be $18,000 or less. This form also excludes individuals who can be claimed as dependents on another taxpayer’s federal return, residents of tax-exempt public housing, and those living in nursing homes.

How does one determine the amount of credit on the IT-214 form?

To determine the amount of credit on the IT-214 form, a claimant must first calculate their household gross income, which includes all incomes received by the household members during the tax year, such as federal adjusted gross income, social security payments not included in the federal income, and other income types like pensions and annuities. After establishing the household gross income, renters and homeowners proceed differently. Renters must enter their total paid rent, adjust it based on utility charges included, and compute 25% of the adjusted amount. Homeowners need to report the real property taxes paid. The final credit is either a portion of the computed amount or a limited value, depending on the instructions provided in the form.

What are the necessary steps for filing the IT-214 form?

Filing the IT-214 form involves a step-by-step approach: Beginning with entering personal and identifying information, followed by establishing eligibility through a series of yes/no questions. Claimants then determine their household gross income, compute their real property tax or rent amount, and calculate the applicable credit based on these amounts. The form also includes sections for direct deposit information if the claimant chooses to receive their refund through this method. Ultimately, the form must be signed and either submitted with the New York State income tax return or mailed directly to the specified address if not filing a state income tax return.

What are the implications if the calculated credit is zero or if the claimant does not qualify based on the income threshold?

If the calculated credit on the IT-214 form is zero or the claimant's household income exceeds the eligibility threshold, the claimant does not qualify for this tax credit for that tax year. In such cases, the form instructions advise to stop the process as no credit is allowed. This ensures that individuals or households that surpass certain income levels or do not have a tax liability do not receive the credit, aligning with the form's objective to provide relief to lower-income residents of New York State paying real property taxes or rent.

Can the IT-214 form be filed electronically, and are there any specific deadlines for submission?

While the IT-214 form is primarily designed for paper filing, electronic filing options may be available through certain tax software providers or tax professionals who are equipped to submit New York State tax documents electronically. Filing deadlines align with New York State's tax return deadlines, typically April 15th following the tax year. It is crucial to check the New York State Department of Taxation and Finance’s website or contact them directly for the most current information regarding electronic filing capabilities and specific submission deadlines.

Common mistakes

Filling out forms for tax purposes can be daunting, and the New York State Department of Taxation and Finance's IT-214 form is no exception. Designed for claiming a real property tax credit for homeowners and renters, this form requires meticulous attention to detail. Several common mistakes are frequently made during its completion:

- Incorrect or Incomplete Identifying Information: The form starts by requesting personal information. A frequent oversight here involves not filling in all required fields, such as entering only one name for a joint claim or omitting apartment numbers. It's also critical to double-check that social security numbers and dates of birth are entered correctly.

- Eligibility Errors: The eligibility section is crucial, yet often misunderstood. Failure to accurately respond to questions about residency duration, ownership value, dependent status, living situations (such as residing in completely tax-exempt property), or time spent in nursing homes can lead to incorrect eligibility determination.

- Income Reporting Mistakes: Step three asks for the household's gross income. People sometimes incorrectly report their income by either not including non-taxable income that should be counted, forgetting to add all household members' incomes, or inaccurately calculating New York State additions or subtractions to the federal adjusted gross income.

- Rental Information and Real Property Tax Calculations: Renters and homeowners must carefully compute their respective credits in step four but often miscalculate by misinterpreting what constitutes adjustable rent or incorrectly adding real property taxes and special assessments. Misapplication of the exemption rate for homeowners 65 and over is also common.

- Direct Deposit Information Incorrectly Completed: The final step involves specifying refund payment methods. Errors in bank routing or account numbers can delay refunds. Additionally, selecting an inappropriate refund option based on one's specific financial institution's requirements or international transfer needs can further complicate matters.

To mitigate these errors, individuals should thoroughly review the instructions provided with the form, double-check all entries before submission, and consider consulting with a tax professional if uncertainties arise. Ensuring accuracy in these areas is pivotal for the correct processing of the form and the successful claim of the real property tax credit.

Documents used along the form

When dealing with taxes, especially in the state of New York, the IT-214 form, titled "Claim for Real Property Tax Credit for Homeowners and Renters," is a crucial document for many individuals seeking to reduce their taxable income through real property or rent credits. However, to successfully navigate the tax season and maximize potential benefits, it's often necessary to be familiar with additional forms and documents that complement the IT-214 form.

- IT-201: This is the Resident Income Tax Return form. It's a comprehensive form used by New York State residents to file their annual income tax returns. For those claiming real property tax credits through IT-214, IT-201 becomes relevant because the credit amount from IT-214 may be reported on this form. It encompasses various aspects of an individual's financial year, including income, tax deductions, and credits.

- IT-203: Nonresident and Part-Year Resident Income Tax Return form. For individuals who were New York State residents for only part of the year or lived outside of New York yet earned income from New York State sources, IT-203 is the appropriate form to file. Just like IT-201, it's used to report income, deductions, and credits, including information relevant to IT-214 filers who might have relocated.

- NYC-210: Claim for New York City School Tax Credit. This form is specifically for residents of New York City, offering a tax credit for those who meet certain conditions. It's relevant for individuals who filled out IT-214 and are also looking to claim additional tax credits related to living in New York City, making their tax filing more advantageous.

- IT-2: Summary of W-2 Statements. While IT-2 is not directly related to property tax or rent credits, it summarizes an individual's W-2 Wage and Tax Statements, which are essential when accurately reporting income on the IT-201 or IT-203 forms. Since household income impacts eligibility and the credit amount on the IT-214, accurate income reporting with IT-2 becomes crucial.

Understanding and accurately completing the appropriate complementary forms can significantly impact an individual's tax situation. It's not just about reducing taxable income but also about taking advantage of the specific credits and deductions offered by New York State and City. Navigating through these documents efficiently requires a clear understanding of one's financial picture and how it aligns with the available tax benefits.

Similar forms

The Form IT-201, which is the New York State Resident Income Tax Return form, shares similarities with the Tax 214 form in several aspects. Both forms require filers to provide personal identification information, such as names, social security numbers, dates of birth, and addresses. They also include sections on income and tax credits, asking filers to report their earnings and calculate their eligibility for certain tax benefits based on guidelines provided within the forms. Like the IT-214, Form IT-201 serves the purpose of adjusting taxpayers' financial obligations or credits with the state.

Form IT-203, Nonresident and Part-Year Resident Income Tax Return, is another document similar to the IT-214 form. Although tailored for nonresidents or part-year residents of New York State, it requires similarly detailed personal and financial information from the filer. Both forms include sections where taxpayers must detail their income, deductions, and eligible tax credits, including residency information crucial for determining the correct tax treatment. The IT-203 form, like the IT-214, aims to ensure taxpayers accurately report their income and pay any taxes due or claim refunds.

The NYC-210, Claim for New York City School Tax Credit, is also akin to the IT-214 form in its purpose and structure. Designed for residents to claim eligible tax credits, this form requires taxpayers to provide personal identifiers and information about their residency and income level. It focuses on offering relief to eligible residents through tax credits, a core function shared with the IT-214 form. Both documents are crucial for individuals seeking to reduce their tax liability based on specific eligibility criteria set by the tax authority.

Form W-2, Wage and Tax Statement, is an essential document for employees, detailing their annual wages and the amount of taxes withheld from their paycheck. Though not a tax return form like the IT-214, it is directly related because information from the W-2 is used to fill out tax return documents, including the IT-214. The connection lies in the requirement to report income and withholdings accurately, foundational for determining eligibility and the correct amount of tax credits or refunds.

Finally, the 1099 form series, particularly the 1099-INT for interest income and 1099-MISC for miscellaneous income, shares a connection with the IT-214 form. Taxpayers use these forms to report various types of income that aren't part of regular wages, like interest earned on savings accounts or freelance income. While different in their specific purposes, these forms complement the IT-214 by providing a complete picture of an individual's annual income, essential for accurately determining tax liability and credit eligibility.

Dos and Don'ts

Do's and Don'ts for Filling Out Tax Form 214

- Do verify that you were a New York State resident for the entire year to qualify for this credit.

- Don't proceed with the form if you were not a resident for the full year or if you haven't occupied your residence for at least six months.

- Do ensure that your real property's current market value did not exceed $85,000 during the tax year.

- Don't claim the credit if you can be claimed as a dependent on another taxpayer's return.

- Do accurately enter all identifying information, including social security numbers and dates of birth for all relevant parties.

- Don't include income that is not applicable, such as public housing or living in a residence completely exempt from real property taxes.

- Do accurately calculate and enter your household gross income, including all sources of income as specified in the form instructions.

- Don't forget to include all household members in the gross income calculation if they earned income during the tax year.

- Do choose the correct refund option and provide accurate banking information for direct deposit to avoid delays.

Misconceptions

When it comes to understanding tax forms, misconceptions can lead to confusion, incorrect filings, and sometimes missed opportunities for tax credits. The New York State Department of Taxation and Finance's IT-214 form, which is a Claim for Real Property Tax Credit for Homeowners and Renters, is no exception. Below, we clarify seven common misunderstandings about this form:

- Eligibility is solely based on being a homeowner or renter in New York State. While being a homeowner or renter in New York is a requirement, eligibility also depends on factors such as residency duration, income, property value, dependency status, and whether the residence is exempt from real property taxes.

- The IT-214 form is complicated to fill out. Although tax forms can be intimidating, the IT-214 form guides applicants through a step-by-step process, asking for essential information about residency, income, and property taxes or rent paid. Following the instructions carefully can simplify the process.

- Only homeowners can benefit from this credit. Both homeowners and renters may qualify for the credit, provided they meet certain conditions regarding residency, income, and the amount of rent or property taxes paid.

- There is no income limit for eligibility. Contrary to this belief, there is an income threshold. If your household gross income exceeds a certain amount, you may not qualify for the credit.

- Only senior citizens are eligible. While there are special provisions for homeowners 65 and over, such as potential exemptions, the IT-214 form is not exclusively for seniors. Eligibility spans a broader range of applicants, including younger homeowners and renters.

- If you didn't file a state return, you can't claim this credit. Even if you are not required to file a New York State income tax return, you might still be eligible to file Form IT-214 to claim the real property tax credit.

- Residents of public housing are automatically disqualified. Residing in public housing or a residence completely exempt from real property taxes does disqualify you from claiming this credit. However, it's crucial to understand the specific conditions that apply to this rule and check if exceptions or other forms of eligibility may be relevant to your situation.

By dispelling these misconceptions, homeowners and renters become better equipped to accurately assess their eligibility for the real property tax credit and to correctly complete and submit the IT-214 form. It's always recommended to consult the detailed instructions provided by the New York State Department of Taxation and Finance or seek professional tax advice to ensure compliance and optimize tax credit opportunities.

Key takeaways

Understanding the Tax 214 form, officially designated for claiming real property tax credit in New York State, is crucial for homeowners and renters aiming to leverage this financial relief. Here are key takeaways to guide you through the process:

- Eligibility Criteria: The form commences by requiring filers to confirm their New York State residency for the entirety of the tax year in question, occupancy of the same residence for at least six months within that year, and other specific conditions influencing eligibility.

- Identification Details: Filers must provide comprehensive identifying information, including names, social security numbers, dates of birth for both themselves and, if applicable, their spouse.

- Address Information: It mandates detailing both the current mailing address and the specific address of the New York residence qualifying them for this credit, even if it differs from the mailing address.

- Determination of Household Gross Income: A critical part of the form is determining the household's total gross income. This includes income from various sources not limited to federal adjusted gross income, adding specific New York State additions, social security payments not included previously, and others.

- Real Property Tax Calculations: Homeowners and renters have different sections to complete, reflecting their respective payments towards real property taxes or rental charges, adjusted for certain utilities or services included in rent.

- Credit Computation: The form processes the computed real property tax or adjusted rent alongside household gross income to determine the potential credit amount. It requires understanding specific rates and calculations as outlined in the instructions.

- Refund Delivery Options: Filers have choices for how they wish to receive their refunds, between direct deposit, debit card, or paper check. This section requires banking details if direct deposit is chosen.

- Submission Guidelines: Finally, clear instructions are provided for where and how to submit the completed form, emphasizing the importance of timely filing and the options available for those using private delivery services or needing specific accommodations.

This overview of the Tax 214 form underscores the importance of accurately completing each section to qualify for and calculate the correct credit amount. It reflects the New York State Department of Taxation and Finance's effort to provide financial relief to eligible residents, making understanding and adherence to the form's requirements paramount for claimants.

Popular PDF Documents

Dwc 25 - Complete and official documentation required in Florida to report an employee’s injury or illness for workers' compensation.

Profit and Loss Form - The IRS Schedule C 1040 form is meant for reporting income or loss from a business you operated or a profession you practiced as a sole proprietor.