Get Tax 1488 Form

Navigating the complexities of unemployment insurance can be challenging for employers and individuals alike in Michigan. Enter the Tax 1488 form, an essential tool authorized by the Michigan Department of Labor and Economic Opportunity Unemployment Insurance Agency, serving a pivotal role in empowering entities to appoint or change their representation in matters concerning unemployment insurance. Framed within the confines of legal and regulatory guidelines, this form, bearing the full designation UIA 1488 (Rev. 02-20), facilitates a streamlined process for entities to outline their preferred parameters of representation, covering a broad spectrum from general to limited authorizations. Significantly, it not only enables the designation of representatives—be they organizations, firms, or individuals—but also specifies the extent of the powers granted, encompassing the inspection or receipt of confidential information, direct representation, and the execution of filings and agreements. Crucially, the Tax 1488 form caters to both the initiation and revocation of Power of Attorney (POA) delegations, thereby ensuring flexibility and control over who handles sensitive unemployment insurance affairs. This form's importance is further magnified by its requirement for explicit employer endorsement, underscoring the legal implications and the need for thoughtful consideration when appointing representatives. Additionally, it introduces an accessible avenue for participating in federal incentives like the Work Opportunity Tax Credit (WOTC), thus expanding its utility beyond administrative convenience to potentially significant financial benefits. Through detailed instructions and designated sections for both employer and representative information, the Tax 1488 form stands as a critical instrument for managing unemployment insurance matters in Michigan with efficiency and legal compliance.

Tax 1488 Example

UIA 1488 |

Authorized by |

(Rev. |

MCL 421.1 et seq. |

STATE OF MICHIGAN

DEPARTMENT OF LABOR AND ECONOMIC OPPORTUNITY

UNEMPLOYMENT INSURANCE AGENCY

www.michigan.gov/uia

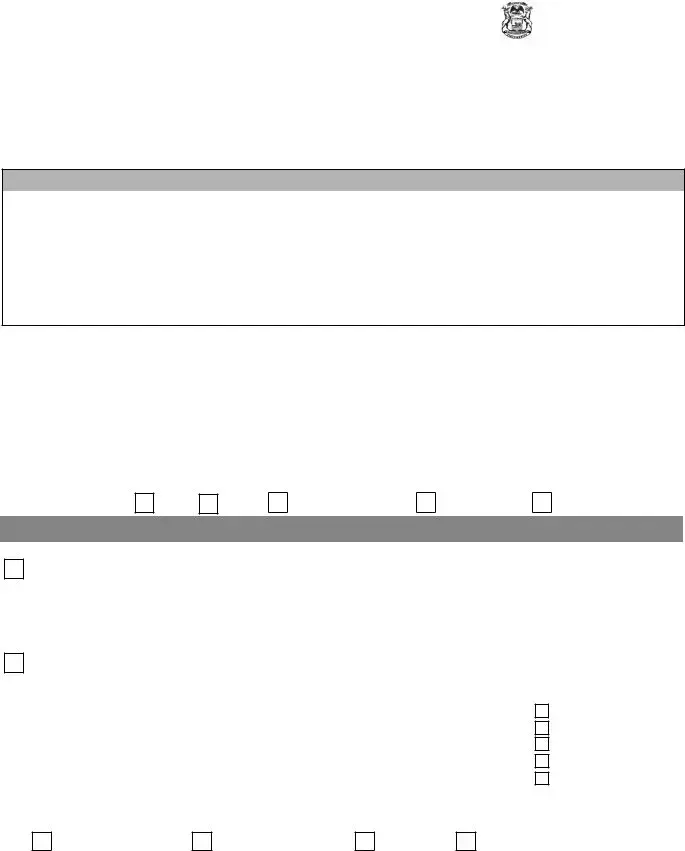

Power of Attorney (POA)

Complete this form if you wish to appoint someone to represent you with the State of Michigan Unemployment Insurance Agency (UIA), or if you wish to revoke or change your current Power of Attorney representation. Read the instructions on page 3 before completing this form.

PART 1: EMPLOYER INFORMATION

Name and Address |

If business, enter DBA, Trade or Assumed Name |

||

|

|

|

|

|

Telephone Number |

Extension |

Fax Number |

|

|

|

|

|

FEIN Number |

UIA Account Number |

|

|

|

* |

|

|

|

|

|

|

|

|

|

|

|

|

|

PART 2: REPRESENTATIVE INFORMATION AND AUTHORIZATION DATES |

|||

|

|

|

|

Your authorized representative may be an organization, firm, or individual. If your representative is not an individual, designate a contact person.

Please ensure that you submit a separate form for each representative.

Representative Name and Address |

Contact Name |

|

|

|

|

|

|

|

Telephone Number |

Extension |

Fax Number |

|

|

|

|

|

Beginning Authorization Date |

|

Endiing Authorization Date |

|

(mm/dd/yyy) |

|

(mm/dd/yyy) ** |

|

|

|

|

|

Representative FEIN |

|

Representative UIA Account Number |

|

|

|

|

The representative is a(n):

PEO

CPA

Human Resources

Bookkeeper

Other Service Provider

PART 3: TYPES OF AUTHORIZATION

GENERAL AUTHORIZATION

Authorizes my representative to: (1) inspect or receive confidential information, (2) represent me and provide oral or written presentations of fact and/or argument, (3) sign quarterly reports or registration reports, (4) enter into agreements, and (5) receive mail from the UIA (includes forms, billings, and notices.) This authorization applies to all tax

LIMITED AUTHORIZATION

Select the type of authorization by checking the appropriate boxes to the right of each item listed below. You

may check up to 4 boxes. If 5 boxes apply, please complete the “General Authorization” section above.

1. Inspect or receive confidential information

2. Represent me and make oral or written presentation of facts or argument

3. Sign reports

4. Enter into agreements

5. Receive mail from the UIA (including forms, billings, and notices)

If the box for Line 5 above is checked, please select the category/categories of forms that you want mailed to this POA:

Tax

Claims Control

Contested Claims

All

UIA correspondence will be sent based on your selections above to the representative at the address indicated in Part 2.

UIA is an equal opportunity employer/program.

Auxiliary aids, services and other reasonable accommodations are available upon request to individuals with disabilities.

UIA 1488 |

|

|

(Rev. |

Letter ID: |

|

|

WORK OPPORTUNITY TAX CREDIT (WOTC) |

|

Select this box if you have been appointed to represent the taxpayer before the Internal Revenue Services (IRS) for the Work Opportunity Tax Credit.

Othorization Dates: _____________(Required Beginning Date) through ______________(Required End Date).

PART 4: CHANGE IN POWER OF ATTORNEY

CHANGE IN POWER OF ATTORNEY REPRESENTATION: This form replaces all earlier Powers of Attorney documents except those attached on file for the same tax

covered by this Power of Attorney.

REVOKE PREVIOUS AUTHORIZATION: I Revoke all Powers of Attorney submitted and will represent myself in all tax and benefit matters.

PART 5: EMPLOYER’S SIGNATURE

If signed by a corporate officer, partner or fiduciary on behalf of the employer, I certify that I have the authority to execute this Power of

Attorney.

Signature |

Name or Title Printed or Typed |

Date |

*The Unemployment Insurance Agency is abbreviated throughout this form as the “UIA.”

**If no ending Authorization Date is provided, the

UIA 1488 |

|

(Rev. |

Letter ID: |

INSTRUCTIONS FOR POWER OF ATTORNEY (FORM UIA 1488)

Complete and file Form UIA 1488, Power of Attorney, if you wish to appoint an individual, firm, or organization as your representative in tax or benefit matters before the UIA. Failure

to complete this form will prohibit the UIA from discussing your information with another person or releasing your information to another person, to protect your Firm’s

confidential information.

PART 1: EMPLOYER INFORMATION

Enter the employer’s name, address, telephone number, fax number, and email address. If the taxpayer is a business operating under another name, enter the doing business as, trade or assumed name. Enter the Federal Employer

Identification Number (FEIN), any other applicable FEIN, and

the UIA Account Number, leave the indicated space blank.

PART 2: REPRESENTATIVE INFORMATION

AND AUTHORIZATION DATES

You must submit a separate Power of Attorney form for each representative. Enter the authorized representative’s telephone number, fax number, and email address. If your representative is not an individual, please designate a contact person. Make sure to indicate the beginning and end ending dates of authorization. Provide the FEIN associated with the representative and the representative’s UIA account number,

if available. In addition, indicate whether the representative is a professional employer organization (PEO), certified public

accountant (CPA), human resources specialist, bookkeeper, or other service provider. More than one box may be checked, if applicable.

PART 3: TYPE OF AUTHORIZATION

Check the General Authorization box to allow your representative to act on your behalf to do all of the following:

(1)inspect and receive confidential information, (2) represent you and provide oral or written presentations of fact and/or argument, (3) sign reports, (4) enter into agreements, and (5) receive all mailings (including forms, billings, and payment notices). This authorization applies to all

You may restrict your representative’s authorization to act on

your behalf by checking the Limited Authorization box, and then checking the appropriate specific powers boxes. The

authorizations selected apply to all tax

complete the “General Authorization” section only. If you check the box for line five, you may select the category/categories of

forms that you want mailed to the Power of Attorney indicated on this form. The categories of forms are: (1) Tax, (2) Claims Control, (3) Contested Claims or (4) All.

All mail will be sent to the address you entered in Part 2 of this form. To change the mailing address after submission of this

form, use your Michigan Web Account Manager (MiWAM) at www.michigan.gov/uia.

WORK OPPORTUNITY TAX CREDIT (WOTC):

The Work Opportunity Tax Credit (WOTC) is a Federal tax credit incentive that Congress provides to the

businesses for hiring individuals from nine target groups who have consistently faced significant barriers to employment. To

learn more about WOTC and how to apply, visit

www.doleta.gov.

PART 4: CHANGE IN POWER OF ATTORNEY

Unless otherwise specified, this Power of Attorney replaces or revokes any previous Power of Attorney form on file with the Michigan UIA for the same tax matters identified on this form.

You must identify any previous authorizations to this form when filed.

PART 5: EMPLOYER SIGNATURE

Sign and date the form if you have the authority to execute the Power of Attorney on behalf of an employer.

FILING POWER OF ATTORNEY

To file this form, mail or fax it to:

UIA TAx Office, P.O. Box 8068, Royal Oak, MI

Fax (517)

Direct any questions to the Office of Employer Ombudsman

(OEO) through your MiWAM account at www.michigan.gov/uia or call

Document Specifics

| Fact Number | Fact Detail |

|---|---|

| 1 | The form is authorized by the Michigan Compiled Laws (MCL) 421.1 et seq. |

| 2 | The form is issued by the State of Michigan Department of Labor and Economic Opportunity Unemployment Insurance Agency. |

| 3 | The form's official title is Power of Attorney (POA). |

| 4 | This form is used for appointing a representative for dealing with the Unemployment Insurance Agency, or for revoking or changing a current Power of Attorney. |

| 5 | Part 1 of the form requires employer information such as name, address, telephone, fax, FEIN, UIA Account Number, and email. |

| 6 | Part 2 requires information about the representative, including name, address, contact name, email, telephone, fax, representative FEIN, and UIA Account Number if applicable. |

| 7 | The form allows for both general and limited types of authorization, detailing the scope of authority granted to the representative. |

| 8 | It includes an option to appoint a representative for the Work Opportunity Tax Credit (WOTC) before the IRS. |

| 9 | Changes in Power of Attorney must be reported on this form, which can revoke or replace previous authorizations. |

| 10 | To file, the form must be mailed or faxed to the UIA Tax Office with the address and fax number provided on the form. |

Guide to Writing Tax 1488

Filing the UIA 1488 Power of Attorney (POA) form is a necessary step for appointing a representative to handle tax or benefit matters on your behalf with the State of Michigan Unemployment Insurance Agency (UIA). This process secures your right to have someone else interact with the UIA, managing your confidential information and making decisions in your stead. It's crucial for those who either cannot manage these tasks on their own or prefer a professional to take on this responsibility. The form also allows for the revocation of a current representative’s authority, enabling the employer or individual to make changes as needed. The instructions provided below aim to guide you through completing this form effectively and correctly.

- Start by entering the employer information in Part 1. This includes the name and address of the employer, telephone and fax numbers, the Federal Employer Identification Number (FEIN), the UIA Account Number, and an email address. If the business operates under a different name, include this as well.

- Move to Part 2 for Representative Information and Authorization Dates. Here, you must provide details about the representative, including their name, address, telephone and fax numbers, and email address. If the representative is not an individual, designate a contact person within the organization. Specify the start and end dates of the authorization. Enter the representative’s FEIN and UIA Account Number if available, and check the box that best describes the representative's role, such as CPA or HR specialist.

- In Part 3, choose between General Authorization and Limited Authorization. If you select General Authorization, this grants your representative extensive powers to act on your behalf across all matters and time periods. For Limited Authorization, check the appropriate boxes to specify the exact powers you are granting, which could include tasks like inspecting confidential information or signing reports. Should you choose to grant authorization for receiving mail, indicate the types of mail the representative should receive.

- If applicable, mark the option for the Work Opportunity Tax Credit (WOTC) in Part 3 to authorize the representative to act on your behalf for WOTC matters with the IRS. Remember to fill in the authorization dates for the WOTC representation.

- Should there be any Changes in Power of Attorney, indicate this in Part 4 by selecting the appropriate checkbox. You can either appoint a new representative, thereby revoking all previous authorizations, or simply revoke all POAs to represent yourself in all future matters.

- Finish by having an authorized individual (corporate officer, partner, or fiduciary) sign and date the form in Part 5, affirming their authority to execute this Power of Attorney on behalf of the employer.

After completing the form, submit it via mail or fax to the UIA Tax Office. The address and fax number are provided on the form itself. Should you have any questions during this process, assistance is available through the Office of Employer Ombudsman (OEO) via your Michigan Web Account Manager (MiWAM) or by contacting them directly by phone. Remember, this form plays a crucial role in managing your representation before the UIA, so ensure accuracy and completeness to avoid any delays or issues with your representation.

Understanding Tax 1488

Frequently Asked Questions About the UIA 1488 Power of Attorney Form

What is the UIA 1488 form?

The UIA 1488 form, also known as the Power of Attorney (POA) form, is a document used by individuals or businesses to grant another party the authority to represent them in matters related to the Michigan Unemployment Insurance Agency (UIA). This could involve discussing the account, accessing confidential information, or making decisions on behalf of the individual or business.

When should I use the UIA 1488 form?

You should complete and submit this form if you want to appoint an individual, firm, or organization to represent you in matters before the UIA. This is especially useful when dealing with complex tax or benefit issues, or when you cannot manage these tasks on your own.

Who can be appointed as a representative on this form?

You can appoint a wide range of representatives, including a Professional Employer Organization (PEO), Certified Public Accountant (CPA), human resources specialist, bookkeeper, or other service providers. Make sure the representative agrees to take on this responsibility before you appoint them.

How do I complete the UIA 1488 form?

To complete the form, fill out your employer information, designate your representative along with their contact information, and specify the authorization dates. You must decide whether to grant general or limited authorization, depending on what tasks you want the representative to perform. Finally, the form must be signed and dated to be valid.

What kind of authorizations can I grant with this form?

You can choose between granting a general authorization, which allows your representative to perform a broad range of actions on your behalf, or a limited authorization, where you specify certain tasks your representative is allowed to do. These tasks could include inspecting or receiving confidential information, making representations on your behalf, signing reports, entering into agreements, and receiving mail from the UIA.

Can I change or revoke the Power of Attorney?

Yes, you have the ability to change or revoke the Power of Attorney at any time. To do so, you must submit a new UIA 1488 form indicating the change or revocation of the previous authorization. Make sure to include any previous authorizations you want to keep in place when filing a new form.

Where do I file the UIA 1488 form?

Once completed, the form can be mailed or faxed to the UIA Tax Office. If you have any questions or need further guidance, you can contact the Office of Employer Ombudsman (OEO) through your MiWAM account or by calling their dedicated phone line.

Common mistakes

Filling out the UIA 1488 Power of Attorney form requires careful attention to detail. Here are seven common mistakes people make when completing this form:

- Not reading the instructions carefully - Before filling out the form, it’s crucial to read through the provided instructions on page 3 to ensure a thorough understanding of the process and requirements.

- Incorrect employer information - The employer’s name, address, contact details, and especially the FEIN and UIA Account Numbers must be accurate. Any errors can delay processing or lead to the form being rejected.

- Failing to designate a representative correctly - When appointing an organization or firm as a representative, a specific contact person must be designated. Omitting this detail can invalidate the representative's authority to act on your behalf.

- Leaving authorization dates blank - Both the beginning and ending authorization dates are critical. If no ending date is provided, the representative’s authorization continues indefinitely until formally revoked in writing.

- Improper selection of authorization type - It’s important to select the correct authorization type. Choosing “General Authorization” when “Limited Authorization” is more applicable, or vice versa, can lead to unintended representation scope.

- Not specifying form categories for mailing - If selecting to have mail received by the POA, failing to specify which categories of forms (Tax, Claims Control, Contested Claims, All) are to be mailed can lead to communication gaps.

- Omitting signature and date - The form must be signed and dated by the employer or an authorized representative. An unsigned form is incomplete and will not be processed.

Making any of these mistakes can result in delays, incorrect processing, or the outright rejection of your Power of Attorney form. To avoid these complications, take your time, double-check all provided information, and follow the instructions carefully.

Documents used along the form

When navigating the complexities of tax and legal documentation, especially in handling unemployment insurance matters with the State of Michigan, the Power of Attorney (POA) Form UIA 1488 serves as a critical tool. This form allows businesses and individuals to appoint a representative for their UIA dealings, ensuring that their legal and tax-related activities are managed efficiently and accurately. However, the UIA 1488 form often works in conjunction with several other forms and documents to provide a comprehensive approach to managing unemployment insurance matters. Understanding these associated documents can help streamline processes and compliance.

- UIA 1028: Employer's Quarterly Wage/Tax Report - This document is essential for reporting an employer's quarterly wages paid to employees and calculating the unemployment tax due.

- UIA 1020: Schedule of Taxable Wages - Used alongside UIA 1028, this form details the taxable wages per employee, ensuring accurate tax calculations.

- UIA 1711: Fact Finding Form - Often requested by the UIA to clarify or dispute claims made by former employees, providing essential information for resolving issues.

- UIA 1733: Protest of Determination and Request for Redetermination - This form allows employers to contest decisions made by the UIA regarding claims and benefits.

- IRS FORM W-4: Employee's Withholding Certificate - Although it's a federal form, Michigan employers might need this to accurately withhold the correct federal income tax from employees' paychecks.

- IRS FORM 940: Employer's Annual Federal Unemployment (FUTA) Tax Return - This form is crucial for reporting and paying unemployment taxes at the federal level, separate from the state UI tax.

- IRS FORM 941: Employer's Quarterly Federal Tax Return - Used to report federal withholdings from employee wages, as well as Social Security and Medicare taxes.

- MI-W4: Michigan Withholding Exemption Certificate - Similar to the IRS W-4 form but specific to Michigan's state income tax withholdings, this document ensures the correct state tax is withheld from employees' pay.

To ensure compliance and efficient handling of unemployment insurance matters, businesses and their representatives should familiarize themselves with these forms and documents. Together with the UIA 1488 form, they provide a framework for managing both state and federal tax obligations, thereby safeguarding against potential legal issues and streamlining the representation process. Proper management and understanding of these documents reflect a proactive approach to business operations, highlighting the importance of comprehensive documentation in unemployment insurance and tax matters.

Similar forms

The IRS Form 2848, "Power of Attorney and Declaration of Representative," shares notable similarities with the UIA 1488 form. Like the UIA 1488, Form 2848 allows individuals or businesses to appoint a representative to handle tax matters on their behalf. It covers the appointment of individuals, such as tax attorneys, CPAs, or other professionals authorized to represent taxpayers before the IRS. Both forms require detailed information about the appointee and specify the extent of their powers, including the ability to receive confidential tax information and to act on behalf of the taxpayer in discussions with the respective tax agency.

IRS Form 8821, "Tax Information Authorization," is another document similar to the UIA 1488 form, albeit with a narrower focus. While Form 8821 also permits the designation of a third party to receive and inspect confidential tax information, it does not authorize the appointed individual or entity to represent the taxpayer in tax matters or to act on their behalf. This form primarily facilitates transparency and the sharing of information between the taxpayer, their authorized appointee, and the IRS, akin to the information sharing aspect of the UIA 1488 form.

The SS-4 Application for Employer Identification Number (EIN) shares a procedural similarity with the UIA 1488, in that it involves the provision of essential business information to a tax authority, in this case, the IRS. While the SS-4's primary purpose is to obtain an EIN for tax reporting purposes, both it and the UIA 1488 require detailed business information, including business name, address, and type of entity. This parallel lies in the foundational step of establishing a formal recognition by tax agencies for new or existing entities.

Form W-7, Application for IRS Individual Taxpayer Identification Number (ITIN), although designed for a different purpose, intersects with the UIA 1488 in its role in the tax system. The W-7 facilitates individuals who are not eligible for a Social Security Number (SSN) to file taxes in the United States. Both the W-7 and the UIA 1488 cater to specific needs within the tax ecosystem, allowing for the proper identification and representation of taxpayers, albeit in different contexts.

The "Authorization to Release Unemployment Insurance Information" is a type of consent form used in many states, similar to the UIA 1488, which authorizes the release and sharing of unemployment insurance information. While not a standardized IRS form, this type of state-specific document functions similarly by permitting a third party to access confidential unemployment insurance records. The specificity and purpose align closely with the UIA 1488's intent of enabling representation in matters related to unemployment insurance.

Federal and state "Change of Address" forms for tax purposes, while administratively oriented, share a common administrative purpose with the UIA 1488 form. Updating address information is crucial for the accurate delivery of tax documents, bills, and notices. Similar to updating representation authorization with the UIA 1488 form, submitting a change of address ensures that the tax authority and the taxpayer or their representative maintain effective communication. This highlights the importance of accurate, updated information in taxpayer-agency correspondence.

Dos and Don'ts

Filling out the UIA 1488 form, known as the Power of Attorney (POA) for matters related to the State of Michigan Unemployment Insurance Agency (UIA), requires careful attention to detail. Below are key do's and don'ts to consider:

- Do read the instructions on page 3 of the form thoroughly before starting to fill it out.

- Do ensure that all employer information provided in Part 1 is accurate, including the business name, address, and contact details.

- Do complete a separate form for each individual, firm, or organization you wish to appoint as your representative.

- Do use the correct Federal Employer Identification Number (FEIN) and UIA Account Number where required.

- Do select the correct type of authorization in Part 3, clearly marking whether you grant general or limited authorization.

- Do not leave the ending authorization date blank in Part 2 unless you intend for the representation to continue indefinitely.

- Do not forget to specify the category/categories of forms you want mailed to your POA if you select limited authorization.

- Do not overlook the need to revoke previous authorizations explicitly if changing your POA.

- Do not sign and date the form without verifying that you have the authority to execute the Power of Attorney on behalf of the employer.

- Do not hesitate to contact the Office of Employer Ombudsman (OEO) for help if you have questions or concerns about completing or filing the form.

Following these guidelines can help ensure that the Power of Attorney form is completed accurately and effectively, enabling your appointed representatives to act on your behalf in matters related to Michigan's Unemployment Insurance Agency.

Misconceptions

When it comes to dealing with any form related to taxes or legal representation, misinformation can easily spread. The Form UIA 1488, used for appointing a Power of Attorney (POA) for matters related to Unemployment Insurance Agency (UIA) in Michigan, is no exception. Here are ten common misconceptions about the Tax 1488 form and explanations to clear up the confusion:

- It's only for tax professionals: The UIA 1488 form can be used to appoint not just tax professionals but also any individual, firm, or organization you trust to represent you in matters before the UIA.

- It gives unlimited power: The form allows for both general and limited authorizations, meaning you can specify exactly what powers your representative has, from inspecting confidential information to signing reports on your behalf.

- It's complicated to fill out: While it does require detailed information, the form itself is straightforward. Clear instructions are provided to guide you through each section, ensuring that you can accurately appoint your representation.

- It's only necessary for businesses: Not only businesses can use this form. While the form is often associated with employers, any individual needing to authorize a representative for UIA matters can use it.

- It lasts indefinitely: When you appoint a representative on the UIA 1488 form, you must specify the beginning and the ending dates of authorization. If no ending date is provided, the authorization continues until you revoke it in writing.

- It cannot be revoked: You have the right to revoke the Power of Attorney at any time. You would do this by completing the change in Power of Attorney section of a new UIA 1488 form.

- You can only appoint one representative: You can appoint multiple representatives, but you must submit a separate UIA 1488 form for each representative you wish to authorize.

- It's a public document: The information provided on the UIA 1488 form is confidential and handled with the same level of privacy as all your UIA matters.

- All sections must be completed: Depending on your needs, you might not need to check every box in the type of authorization section. The form allows you to tailor the authorization to your specific requirements.

- It's the only way to communicate with the UIA: While the form is necessary to authorize a representative to handle matters on your behalf, individuals can still communicate with the UIA directly through their Michigan Web Account Manager (MiWAM) or by contacting the Office of Employer Ombudsman (OEO).

Understanding the UIA 1488 form is crucial for anyone who needs to appoint a representative for their UIA matters. Clearing up these misconceptions can help ensure that you are well-informed about how and when to use this form effectively.

Key takeaways

Filling out and using the Tax 1488 form correctly is crucial for anyone seeking to appoint a representative for tax or benefit matters related to the State of Michigan Unemployment Insurance Agency (UIA). Here are seven key takeaways to ensure the process goes smoothly:

- Understand the Purpose: The Tax 1488 form is designed to let you appoint or change a representative who can deal with the UIA on your behalf. This includes handling confidential information and making agreements.

- Complete Employer Information: The first part of the form requires detailed employer information. If you're representing a business, make sure to include the trade or assumed name alongside the necessary identification numbers.

- Representative Information is Key: A separate form is required for each representative. Ensure the contact details are correct, and specify the authorization start and end dates.

- Choose the Type of Authorization Wisely: You can opt for General Authorization, which covers all tax and non-tax matters, or Limited Authorization, which allows you to specify the exact powers your representative will have.

- Special Section for WOTC: If your representative is going to handle matters related to the Work Opportunity Tax Credit (WOTC), you must indicate this by checking the appropriate box and specifying authorization dates.

- Revoking or Changing Representation: This form can also be used to revoke a previous Power of Attorney or to change your representation for the same tax matters previously identified.

- Filing the Form: Once completed, the form should be mailed or faxed to the designated UIA Tax Office. If you have questions or need further assistance, you can contact the Office of Employer Ombudsman (OEO) via your Michigan Web Account Manager (MiWAM) or by phone.

Remember, accurately completing the Tax 1488 form is critical to ensuring that your representative can efficiently manage your UIA matters. Should you have any doubts or require additional information, visiting the official UIA website or reaching out to the OEO is highly recommended.

Popular PDF Documents

Tax Form 1040 - Designed for individuals to capitalize on less common tax benefits, improving the overall tax return outcome.

IRS 1040-NR - Understanding eligibility for various credits, such as the child tax credit, is crucial for nonresidents completing the 1040-NR.

IRS W-3 - Copies of the W-3, along with W-2 forms, should be kept in employer records for at least 4 years.