Get Tax 128 Form

The Tax 128 form serves as a crucial document for property owners in Massachusetts looking to contest their property or personal tax assessments through an abatement application. Issued by the Commonwealth of Massachusetts, the form was revised in November 2016 to streamline the abatement application process. Designed for use by both assessed and subsequent property owners, personal representatives of the owner’s estate, tenants responsible for a significant portion of the property tax, or any interested party with a claim to the property, the Tax 128 form accommodates a wide array of applicants. Applicants are required to clearly stipulate the reason for seeking an abatement, whether it is due to overvaluation, incorrect usage classification, disproportionate assessment, or claims of exemption, making a straightforward case for the reduction of their tax burden. The form outlines the necessity of adhering to strict deadlines for submission to ensure consideration by the Board of Assessors, highlighting the importance of timely action and compliance with the specified requirements, including the continuation of tax payments to avoid penalties. This application process underscores the rights of property owners to challenge their assessments while emphasizing the structured procedures in place to maintain fairness and accuracy in property tax obligations.

Tax 128 Example

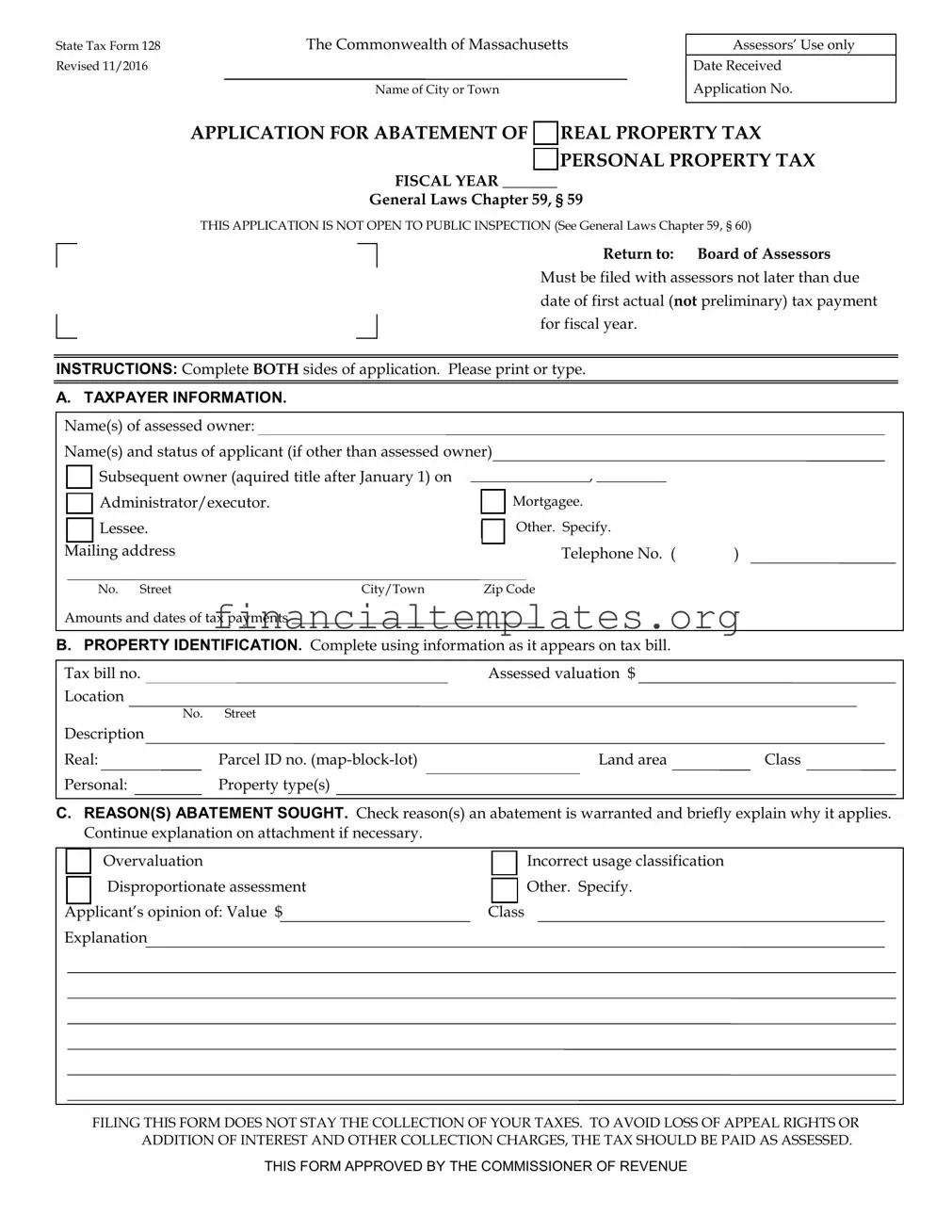

State Tax Form 128 |

The Commonwealth of Massachusetts |

Revised 11/2016 |

|

|

Name of City or Town |

Assessors’ Use only

Date Received

Application No.

APPLICATION FOR ABATEMENT OF

REAL PROPERTY TAX

REAL PROPERTY TAX

PERSONAL PROPERTY TAX

PERSONAL PROPERTY TAX

FISCAL YEAR _______

General Laws Chapter 59, § 59

THIS APPLICATION IS NOT OPEN TO PUBLIC INSPECTION (See General Laws Chapter 59, § 60)

Return to: Board of Assessors

Must be filed with assessors not later than due date of first actual (not preliminary) tax payment for fiscal year.

INSTRUCTIONS: Complete BOTH sides of application. Please print or type.

A. TAXPAYER INFORMATION.

Name(s) of assessed owner: |

|

|

|

|

|

||

Name(s) and status of applicant (if other than assessed owner) |

|

||||||

|

|

Subsequent owner (aquired title after January 1) on |

_________________, __________ |

|

|||

|

|

|

|||||

|

|

Administrator/executor. |

|

|

|

Mortgagee. |

|

|

|

|

|

|

|

||

|

|

Lessee. |

|

|

|

Other. Specify. |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

Mailing address |

|

|

|

Telephone No. ( |

) |

||

|

|

No. Street |

City/Town |

|

Zip Code |

|

|

Amounts and dates of tax payments ___________________________________

B.PROPERTY IDENTIFICATION. Complete using information as it appears on tax bill.

Tax bill no. |

|

Assessed valuation $ |

|

|

Location |

|

|

|

|

No. |

Street |

|

|

|

Description |

|

|

|

|

Real: |

Parcel ID no. |

|

Land area |

Class |

Personal: |

Property type(s) |

|

|

|

|

|

|

||

C.REASON(S) ABATEMENT SOUGHT. Check reason(s) an abatement is warranted and briefly explain why it applies. Continue explanation on attachment if necessary.

|

|

|

Overvaluation |

|

|

Incorrect usage classification |

|

|

|

|

|

||

|

|

|

Disproportionate assessment |

|

|

Other. Specify. |

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

|

|

|

Applicant’s opinion of: Value $ |

Class |

||||

Explanation |

|

|

|

|||

|

|

|

|

|

|

|

FILING THIS FORM DOES NOT STAY THE COLLECTION OF YOUR TAXES. TO AVOID LOSS OF APPEAL RIGHTS OR ADDITION OF INTEREST AND OTHER COLLECTION CHARGES, THE TAX SHOULD BE PAID AS ASSESSED.

THIS FORM APPROVED BY THE COMMISSIONER OF REVENUE

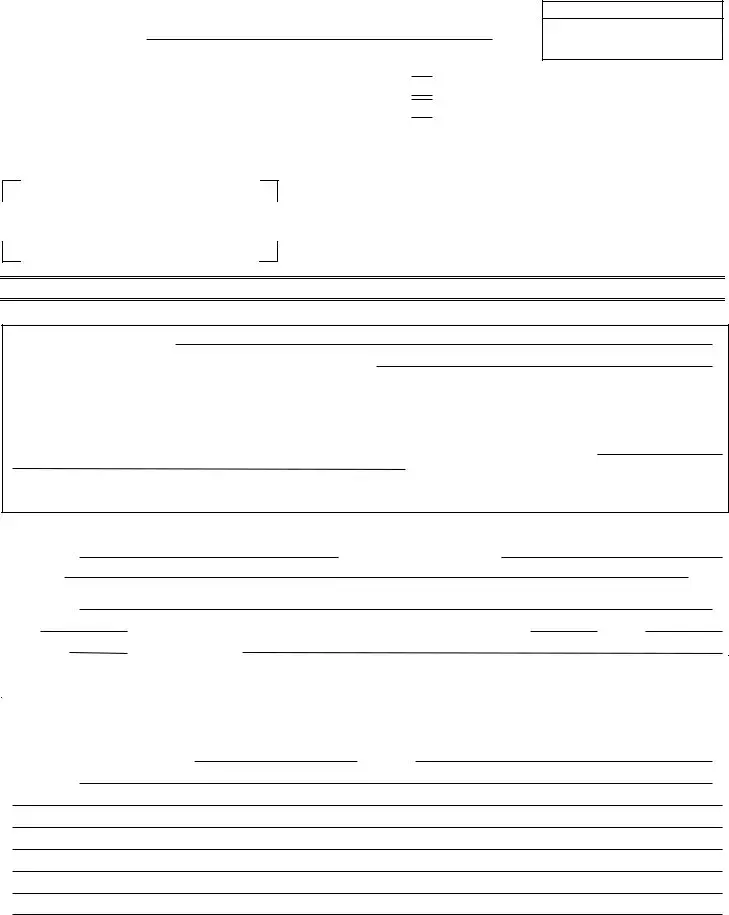

D. SIGNATURES.

Subscribed this |

day of |

, |

Under penalties of perjury. |

Signature of applicant

If not an individual, signature of authorized officer

Title

( )

(print or type) Name |

Address |

Telephone |

If signed by agent, attach copy of written authorization to sign on behalf of taxpayer.

TAXPAYER INFORMATION ABOUT ABATEMENT PROCEDURE

REASONS FOR AN ABATEMENT. An abatement is a reduction in the tax assessed on your property for the fiscal year. To dispute your valuation or assessment or to correct any other billing problem or error that caused your tax bill to be higher than it should be, you must apply for an abatement.

You may apply for an abatement if your property is: 1) overvalued (assessed value is more than fair cash value on January 1 for any reason, including clerical and data processing errors or assessment of property that is

WHO MAY FILE AN APPLICATION. You may file an application if you are:

the assessed or subsequent (acquiring title after January 1) owner of the property,

the personal representative of the assessed owner’s estate or personal representative or trustee under the assessed owner’s will,

a tenant paying rent who is obligated to pay more than

a person owning or having an interest or possession of the property, or

a mortgagee if the assessed owner has not applied.

In some cases, you must pay all or a portion of the tax before you can file.

WHEN AND WHERE APPLICATION MUST BE FILED. Your application must be filed with the assessors on or before the date the first installment payment of the actual tax bill mailed for the fiscal year is due, unless you are a mortgagee. If so, your application must be filed during the last 10 days of the abatement application period. Actual tax bills are those issued after the tax rate is set. Applications filed for omitted, revised or reassessed taxes must be filed within 3 months of the date the bill for those taxes was mailed. THESE DEADLINES CANNOT BE EXTENDED OR WAIVED BY THE ASSESSORS FOR ANY REASON. IF YOUR APPLICATION IS NOT TIMELY FILED, YOU LOSE ALL RIGHTS TO AN ABATEMENT AND THE ASSESSORS CANNOT BY LAW GRANT YOU ONE. TO BE TIMELY FILED, YOUR APPLICATION MUST BE (1) RECEIVED BY THE ASSESSORS ON OR BEFORE THE FILING DEADLINE OR (2) MAILED BY UNITED STATES MAIL, FIRST CLASS POSTAGE PREPAID, TO THE PROPER ADDRESS OF THE ASSESSORS ON OR BEFORE THE FILING DEADLINE AS SHOWN BY A POSTMARK MADE BY THE UNITED STATES POSTAL SERVICE.

PAYMENT OF TAX. Filing an application does not stay the collection of your taxes. In some cases, you must pay all preliminary and actual installments of the tax when due to appeal the assessors’ disposition of your application. Failure to pay the tax assessed when due may also subject you

to interest charges and collection action. To avoid any loss of rights or additional charges, you should pay the tax as assessed. If an abatement is granted and you have already paid the entire year’s tax as abated, you will receive a refund of any overpayment.

ASSESSORS DISPOSITION. and permit them to inspect it. appeal rights.

Upon applying for an abatement, you may be asked to provide the assessors with written information about the property Failure to provide the information or permit an inspection within 30 days of the request may result in the loss of your

The assessors have 3 months from the date your application is filed to act on it unless you agree in writing before that period expires to extend it for a specific time. If the assessors do not act on your application within the original or extended period, it is deemed denied. You will be notified in writing whether an abatement has been granted or denied.

APPEAL. You may appeal the disposition of your application to the Appellate Tax Board, or if applicable, the County Commissioners. The appeal must be filed within 3 months of the date the assessors acted on your application, or the date your application was deemed denied, whichever is applicable. The disposition notice will provide you with further information about the appeal procedure and deadline.

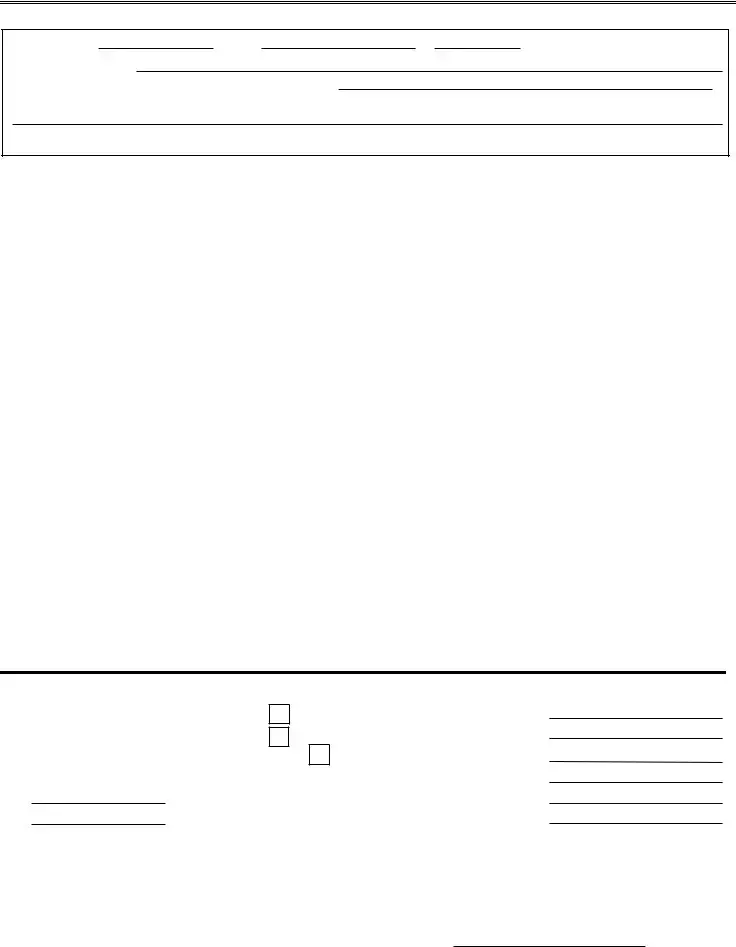

DISPOSITION OF APPLICATION (ASSESSORS’ USE ONLY)

Ch. 59, § 61A return |

GRANTED |

|

|

|

|

|

Assessed value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Date sent _______________ |

DENIED |

|

|

|

|

Abated value |

|

|

|

|

|

|

|

|

|

Date returned ___________ |

DEEMED DENIED |

|

|

Adjusted value |

|||

|

|

|

|

|

|

Assessed tax |

|

|

|

|

|

|

|

||

Date |

|

|

|

|

|

|

Abated tax |

By |

Date voted/Deemed denied _________ |

Adjusted tax |

|||||

|

Certificate No. _____________________ |

|

|

Date Cert./Notice sent ______________ |

Board of Assessors |

Data changed ___________ |

Appeal ___________________________ |

____________________________________________ |

|

Date filed ________________________ |

____________________________________________ |

Valuation ______________ |

Decision _________________________ |

____________________________________________ |

|

Settlement ________________________ |

Date: |

Document Specifics

| Fact | Detail |

|---|---|

| Type of Form | State Tax Form 128 - Application for Abatement of Real and Personal Property Tax |

| Governing Law | General Laws Chapter 59, § 59 |

| Confidentiality | This application is not open to public inspection, as per General Laws Chapter 59, § 60. |

| Filing Deadline | Must be filed with assessors not later than the due date of the first actual (not preliminary) tax payment for the fiscal year. |

Guide to Writing Tax 128

Filling out the State Tax Form 128 is a crucial step for anyone seeking an abatement of real or personal property tax in Massachusetts. It's a formal way of asking for a reduction in your property tax, based on arguments like overvaluation or incorrect classification. But, navigating through the form can feel daunting. Here’s a straightforward guide to help you complete your application accurately. Remember, timing is key—make sure it’s submitted by the due date of your first actual tax bill payment of the fiscal year to ensure your request is considered.

- Begin with the “Taxpayer Information” section. Enter the name(s) of the assessed owner and indicate the status of the applicant if it's someone other than the owner, such as a subsequent owner, administrator, executor, mortgagee, lessee, or other (specify).

- Provide the mailing address, phone number, and document the amounts and dates of any tax payments made.

- Move on to the “Property Identification” section. Use info from your tax bill to complete this part. Input the tax bill number, assessed valuation, location, parcel ID (for real property), or property type (for personal property).

- In the “Reason(s) Abatement Sought” part of the form, check the appropriate box(es) that best describe why you’re seeking an abatement. You might think your property was overvalued, improperly classified, or disproportionately assessed. Provide a brief explanation and your opinion on what the value or classification should be.

- Signing the form is critical. The form must be signed under the penalties of perjury section. This attests to the truthfulness and accuracy of the information provided. If the application is being filed by someone other than the individual, such as an authorized officer or agent, their signature, title, printed name, address, and telephone number must also be included. Remember, if signed by an agent, a copy of the written authorization to sign on behalf of the taxpayer must be attached.

- Review your completed form for accuracy and completeness. Any missing or incorrect information can delay the process or lead to a denial of your application.

- Finally, ensure the form is filed by the appropriate deadline. It can either be hand-delivered to the Board of Assessors or mailed with first-class postage prepaid, evidenced by a postmark made by the United States Postal Service.

Once your application has been successfully submitted, the next steps are in the hands of the Board of Assessors. They may request additional information or conduct an inspection of the property to verify details of your application. It’s important to respond promptly to any such requests. If an abatement is granted, and you’ve already paid your tax as assessed, a refund for the overpayment will be issued. Should your application be denied, or if you disagree with the decision, you have the right to appeal. The letter detailing the disposition of your application will include information about the appeal process, including deadlines and where to file. Engaging with this process shows a proactive approach towards ensuring your tax obligations reflect the fair value and classification of your property.

Understanding Tax 128

-

What is the purpose of State Tax Form 128?

State Tax Form 128 is designed for taxpayers in Massachusetts to apply for an abatement of real or personal property taxes. An abatement is a reduction in the tax assessed on your property for a given fiscal year, which may be granted for reasons such as overvaluation, disproportionate assessment, incorrect usage classification, or partial or full exemption of the property.

-

Who is eligible to file an application for abatement?

Eligibility to file an application for abatement includes the assessed or subsequent owner of the property, the personal representative of the assessed owner’s estate, tenants who are obligated to pay more than half of the property tax, persons who own or have an interest or possession of the property, and mortgagees if the assessed owner has not applied.

-

When must the application be filed?

The application must be filed with the Board of Assessors on or before the due date of the first actual (not preliminary) tax payment for the fiscal year. For mortgagees, the filing period is during the last 10 days of the abatement application period. It is crucial to adhere to these deadlines as they cannot be extended or waived by the assessors under any circumstances.

-

What happens if I miss the filing deadline?

Missing the filing deadline means you forfeit all rights to an abatement for that fiscal year. The assessors cannot legally grant an abatement if the application is not timely filed, emphasizing the importance of meeting the specified deadline.

-

Does filing for an abatement stay the collection of taxes?

No, filing this form does not stop the collection of your taxes. To avoid losing appeal rights or incurring additional interest and other collection charges, tax should be paid as assessed. In some cases, you must pay all or a portion of the tax before filing an application.

-

How will I know if my application has been granted or denied?

The assessors have three months from the date your application is filed to make a decision, unless a written agreement to extend this period is made. If the assessors do not act within the original or extended period, the application is deemed denied. You will receive written notification of the assessors’ decision.

-

What can I do if my application is denied?

If your application is denied, you have the right to appeal the decision to the Appellate Tax Board or, if applicable, the County Commissioners. This appeal must be filed within three months of the date the assessors acted on your application or the date it was deemed denied. The notice of disposition will provide further details on the appeal process and deadlines.

-

Are there any specific requirements for the application?

Yes, you must complete both sides of the form, which includes providing taxpayer information, property identification details, and the reason(s) an abatement is sought. It’s essential to explain clearly why you believe an abatement is warranted, using the space on the form and attachments if necessary. Additionally, ensure that the application is signed under the penalties of perjury.

Common mistakes

Filling out the Tax 128 form might seem straightforward, but it's common for people to slip up in a few places. If you're aiming to get this task done right, it helps to know where others typically go wrong. Avoiding these mistakes can save you a great deal of time and possibly money.

- Incorrectly Filing as the Wrong Type of Applicant: One common mistake involves not properly identifying the applicant’s status. Whether you're the property owner, an executor, or another entity, your designation influences your application. Misidentifying yourself can delay the process or result in an outright denial.

- Not Providing Complete Property Identification: Filling out the property identification section with incomplete or inaccurate details is another mistake. This includes wrong parcel ID numbers or property types. These details must match those on your tax bill exactly to process your application correctly.

- Insufficient Explanation for Abatement Sought: When stating the reason for seeking an abatement, vague or incomplete explanations won’t do. The assessors need clear, concise reasons—be it overvaluation or incorrect usage classification—alongside a properly outlined justification to consider your request.

- Miscalculating Tax Payments: The section regarding tax payments often trips people up. Either they enter incorrect amounts, wrong dates, or sometimes, forget to include this information entirely. Accuracy here is crucial, as it reflects your tax payment history and compliance.

Steering clear of these errors can significantly smooth out your application process for a property tax abatement. Take your time, double-check your information, and ensure everything matches your tax documents accurately. A careful approach not only enhances your chances for a successful abatement but also minimizes back-and-forth communication with the assessors' office.

Documents used along the form

When dealing with the complexities of property taxes, the State Tax Form 128 (Application for Abatement of Real or Personal Property Tax) represents a crucial document for individuals seeking to adjust their tax assessments in Massachusetts. However, to effectively manage or contest one's property tax responsibilities, several additional forms and documents might be needed alongside the Tax 128 form. These documents play a support role, providing further information, verifying ownership or status, or fulfilling other requirements set by the taxing authority.

- Form 1 - Residential Property Income and Expense Report: This form is particularly relevant for property owners of rented residential buildings. It aids in detailing the income and expenses associated with the property, which can be crucial in supporting an abatement application by establishing the property's income-generating potential.

- Form 2 – Commercial, Industrial, and Personal Property Income and Expense Report: Similar to Form 1, this version is tailored for commercial, industrial, or leased properties. It provides a framework to document the financial operations of such properties, reinforcing arguments concerning property value and tax assessments.

- Form 3ABC - Charitable Organization Real and Personal Property Tax Exemption: This form is utilized by charitable organizations to claim tax exemptions on real or personal property. The documentation required supports the charitable status of the organization, potentially influencing the tax assessment process.

- Property Deed: A copy of the property deed is often required for either an abatement or exemption application to verify ownership. The deed is a legal document that conveys the title of the property and can clarify the owner's claim in abatement processes.

- Legal Affidavit: A legal affidavit might be requested to establish the truth of certain circumstances or claims made in the abatement application. A signed affidavit adds a level of verification and authenticity to the statements within the application.

- Recent Property Tax Bill: Submitting a copy of the most recent property tax bill is generally necessary when applying for an abatement. It provides the assessors with the current assessed value, tax rate applied, and other relevant details specific to the fiscal year in question.

Together, these documents complement the Tax 128 form, offering a comprehensive picture of the property in question and the basis for the abatement request. Whether it's through financial reports, legal verification, or ownership confirmation, each document plays a part in building a strong case for the review by the Board of Assessors. Understanding and preparing these documents is key to navigating the property tax abatement process effectively.

Similar forms

The Form 1040, utilized for individual income tax returns by the U.S. Internal Revenue Service, shares similarities with the Massachusetts State Tax Form 128. Both involve declaring income or value, albeit for different purposes—personal income versus property assessment. The Form 1040 requires detailed information about an individual's earnings, deductions, and credits to calculate owed taxes, mirroring the detailed property information that Tax Form 128 requires for abatement applications.

The W-2 Form, which reports an employee's annual wages and the amount of taxes withheld from their paycheck, also parallels the State Tax Form 128 in its function of reporting financial information to tax authorities. While the W-2 communicates income and tax deductions directly from an employer to the government, and implicitly to the employee, Form 128 is used by property owners to report and dispute property assessments for potential abatement, essentially advocating for a possible deduction in taxes.

Schedule A (Form 1040), used for itemizing deductions on the individual tax return, is akin to State Tax Form 128 in the way it allows taxpayers to reduce their taxable income or property tax. Both documents provide a means to lower overall tax liability—Schedule A through various deductions like mortgage interest, charitable donations, and medical expenses, and Form 128 through appealing for property tax abatement based on overvaluation or other criteria.

Form 1099, which reports various types of income other than wages, salaries, and tips, can be likened to the State Tax Form 128 in its role in the tax reporting process. While the 1099 forms cover a wide array of income sources such as dividends, interest, and freelance income, the State Tax Form 128 addresses the specific area of property value and taxation. Both are essential for accurate tax billing and ensuring equitable treatment of taxpayers.

The Property Tax Appeal Form, used by property owners to challenge local property tax assessments, directly parallels the State Tax Form 128 in purpose and process. Both are employed by taxpayers to contest the assessed value of their property, seeking to reduce their tax burden by demonstrating overvaluation or misclassification. They serve as critical tools for property owners to ensure tax fairness.

The Local Business Tax Receipt Application, required in some jurisdictions for businesses to operate legally, shares similarities with State Tax Form 128 in its regulatory nature and financial implications. Though focusing on business operation rather than property taxation, both forms are fundamental in their respective domains for compliance with local statutes and financial liabilities.

The Homestead Exemption Application, available in some states to reduce property taxes on a homeowner's primary residence, is somewhat comparable to State Tax Form 128. Both offer tax relief opportunities under specific conditions—homestead exemption for residency and ownership status, and State Tax Form 128 for issues like overvaluation. Each form aims to ease the taxpayer's burden through legally sanctioned avenues.

Finally, the Real Estate Transfer Declaration form, used to document and calculate taxes due on the transfer of property, shares the real estate focus with State Tax Form 128. While serving different stages of property ownership and taxation—transfer versus assessment—they both deal with the valuation and fair taxation of real estate, ensuring proper dues are collected and, when appropriate, contested.

Dos and Don'ts

When completing the Tax 128 form for the Commonwealth of Massachusetts, it’s crucial to be thorough and accurate. Here are the best practices and pitfalls to avoid:

Do:- Read the instructions carefully before starting. The Tax 128 form provides specific guidelines for each section to ensure accurate completion.

- Provide accurate taxpayer information, including full name(s), mailing address, and telephone number. This information is essential for the assessors to contact you regarding your application.

- Make sure to include the property identification details as they appear on your tax bill, such as the tax bill number, assessed valuation, and parcel ID number.

- Clearly outline your reason(s) for seeking an abatement and back your claims with sufficient explanation. If necessary, attach additional documentation for support.

- Sign and date the application. If you're applying on behalf of a taxpayer, attach a copy of your written authorization.

- Miss the filing deadline. Your application must be received by the assessors on or before the due date of the first actual tax payment for the fiscal year. Late submissions lose all rights to an abatement.

- Omit necessary sections or information. Each part of the form, including taxpayer information and property identification, is crucial for a valid application.

- Forget to explain your reasons for seeking an abatement. Merely checking a reason without an explanation or supporting documents weakens your application.

- Fail to pay your taxes. Filing this form does not stay the collection of your taxes. Ensure you pay your taxes as assessed to avoid loss of appeal rights or additional charges.

- Ignore requests for further information or inspection. The assessors may ask for more details or to inspect the property. Non-compliance could result in the loss of your appeal rights.

Misconceptions

There are several misconceptions about the Tax 128 form, known as the Application for Abatement of Real Property Tax or Personal Property Tax in Massachusetts. Understanding these misconceptions can help taxpayers navigate the abatement process more effectively. Here are five common misunderstandings:

- Any taxpayer can file at any time during the fiscal year. In reality, the application must be filed with the assessors on or before the due date of the first actual tax payment for the fiscal year. This deadline is strict, and if missed, the taxpayer forfeits their right to an abatement.

- Filing an application for abatement will automatically stay the collection of taxes. This is not true. The instruction clearly states that filing this form does not stay the collection of your taxes. To avoid potential loss of appeal rights or the addition of interest and other charges, taxes should be paid as assessed.

- The application is open for public inspection. Contrary to this belief, the application is not open to public inspection, as stated under General Laws Chapter 59, § 60. This ensures the privacy of the taxpayer's information.

- Any discrepancies or errors on a tax bill cannot be contested once the bill is paid. This is incorrect. Taxpayers who believe their property has been overvalued, disproportionately assessed, or classified incorrectly have the right to apply for an abatement, even after payment, as long as they meet the filing deadlines.

- Only the owner of the property can file for an abatement. While it's commonly believed that only property owners can file, the form is actually broader in scope. Applications can be filed by the assessed or subsequent owner, a personal representative or trustee of the owner’s estate, a tenant responsible for more than half the tax, or even a mortgagee if the assessed owner has not applied, showcasing the inclusivity of this process.

Understanding the specifics of the Tax 128 form and rectifying these misconceptions can greatly aid taxpayers in effectively managing their property taxes and ensuring their rights are protected throughout the abatement process.

Key takeaways

When filling out and using the Tax 128 form for abatement of real or personal property tax in Massachusetts, there are several key takeaways to keep in mind:

- The purpose of the form is to apply for a reduction in your property tax if you believe your property has been overvalued, disproportionately assessed, incorrectly classified, or should be partially or fully exempt.

- Applicants can include the assessed owner, a subsequent owner who acquired the property after January 1st, personal representatives or trustees of the estate, tenants responsible for more than half of the property tax, or a mortgagee if the owner has not applied.

- The form must be filed with the Board of Assessors no later than the due date of the first actual (not preliminary) tax payment for the fiscal year.

- Filing the Tax 128 form does not pause the collection of taxes. To avoid losing appeal rights or accruing interest and other charges, taxes should be paid as assessed.

- The application must be fully completed, requiring both sides of the form to be filled out, and all necessary details regarding the taxpayer and the property must be included.

- If you are signing the form as an agent for the taxpayer, you must attach a copy of the written authorization to sign on the taxpayer's behalf.

- Providing a thorough explanation for the reason(s) an abatement is sought, including overvaluation, incorrect classification, or disproportionate assessment, is crucial. If necessary, continue your explanation on an attachment.

- The assessors have 3 months to act on your application from its filing date. If they have not acted within this period, or an agreed upon extension, the application is deemed denied. You will receive a written notification of the grant or denial of the abatement.

It's important to ensure that all information provided on the Tax 128 form is accurate and complete. Submitting an incomplete or inaccurately filled form may result in the denial of the abatement application.

Popular PDF Documents

Power of Attorney Form Virginia - An official document that delegates tax filing and dispute resolution tasks to a chosen representative.

Form 2848 Instructions 2023 - To revoke the powers granted, a new Form 2848-ME indicating revocation must be submitted to Maine Revenue Services.

Mortgage Modification Agreement - Allows non-borrowers to officially request their earnings be factored into a home loan modification application.