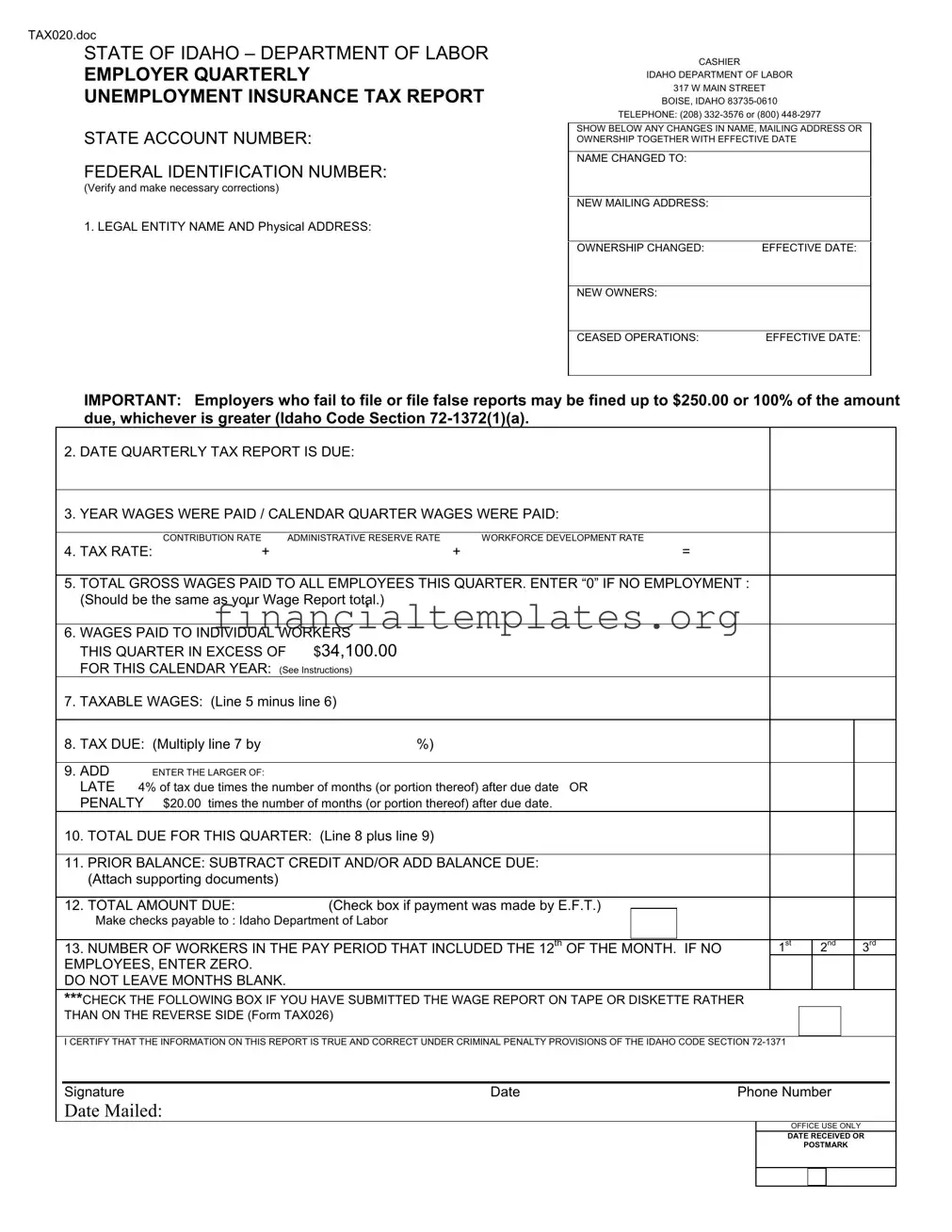

Get Tax 020 Form

The Tax 020 form, as outlined by the State of Idaho Department of Labor, serves a crucial function in the landscape of employment-related fiscal responsibilities, specifically targeting the domain of unemployment insurance tax reporting for employers within the state. This comprehensive document necessitates the meticulous provision of various pieces of information, including but not limited to the employer's state account and federal identification numbers, the legal entity name, and physical address, alongside any pertinent alterations in name, mailing address, or ownership, complete with effective dates of such changes. Critical also is the detailing of the total gross wages paid to employees within the quarter, the identification of wages paid in excess of the state's threshold for individual workers, and the subsequent calculation of taxable wages from which the tax due is derived. Employers are further obligated to report the number of workers employed during a specified pay period, augmenting the form's scope in encapsulating employment trends. Additionally, the document delineates penalties for failing to file or the filing of false reports, underscored by Idaho Code Section 72-1372(1)(a), indicating potential fines that bolster the form's exigency. The amalgamation of these elements within the Tax 020 form underscores its significance in facilitating the accurate assessment and collection of unemployment insurance taxes, ensuring employers' compliance with state mandates, and supporting the broader framework of unemployment benefits administration.

Tax 020 Example

TAX020.doc

STATE OF IDAHO – DEPARTMENT OF LABOR

EMPLOYER QUARTERLY

UNEMPLOYMENT INSURANCE TAX REPORT

STATE ACCOUNT NUMBER:

FEDERAL IDENTIFICATION NUMBER:

(Verify and make necessary corrections)

1. LEGAL ENTITY NAME AND Physical ADDRESS:

CASHIER

IDAHO DEPARTMENT OF LABOR

317 W MAIN STREET

BOISE, IDAHO

TELEPHONE: (208)

SHOW BELOW ANY CHANGES IN NAME, MAILING ADDRESS OR OWNERSHIP TOGETHER WITH EFFECTIVE DATE

NAME CHANGED TO:

NEW MAILING ADDRESS:

OWNERSHIP CHANGED: |

EFFECTIVE DATE: |

|

|

NEW OWNERS: |

|

|

|

CEASED OPERATIONS: |

EFFECTIVE DATE: |

IMPORTANT: Employers who fail to file or file false reports may be fined up to $250.00 or 100% of the amount due, whichever is greater (Idaho Code Section

2.DATE QUARTERLY TAX REPORT IS DUE:

3.YEAR WAGES WERE PAID / CALENDAR QUARTER WAGES WERE PAID:

|

CONTRIBUTION RATE |

ADMINISTRATIVE RESERVE RATE |

WORKFORCE DEVELOPMENT RATE |

4. TAX RATE: |

+ |

+ |

= |

5.TOTAL GROSS WAGES PAID TO ALL EMPLOYEES THIS QUARTER. ENTER “0” IF NO EMPLOYMENT : (Should be the same as your Wage Report total.)

6.WAGES PAID TO INDIVIDUAL WORKERS

THIS QUARTER IN EXCESS OF $34,100.00

FOR THIS CALENDAR YEAR:

7. TAXABLE WAGES: (Line 5 minus line 6)

8. TAX DUE: (Multiply line 7 by |

%) |

9. ADD

LATE 4% of tax due times the number of months (or portion thereof) after due date OR

PENALTY $20.00 times the number of months (or portion thereof) after due date.

10.TOTAL DUE FOR THIS QUARTER: (Line 8 plus line 9)

11.PRIOR BALANCE: SUBTRACT CREDIT AND/OR ADD BALANCE DUE: (Attach supporting documents)

12. TOTAL AMOUNT DUE: |

(Check box if payment was made by E.F.T.) |

|

|

|

|

Make checks payable to : Idaho Department of Labor |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

13. NUMBER OF WORKERS IN THE PAY PERIOD THAT INCLUDED THE 12th OF THE MONTH. IF NO |

1st |

2nd 3rd |

|||

EMPLOYEES, ENTER ZERO. |

|

|

|

|

|

DO NOT LEAVE MONTHS BLANK. |

|

|

|

|

|

***CHECK THE FOLLOWING BOX IF YOU HAVE SUBMITTED THE WAGE REPORT ON TAPE OR DISKETTE RATHER THAN ON THE REVERSE SIDE (Form TAX026)

I CERTIFY THAT THE INFORMATION ON THIS REPORT IS TRUE AND CORRECT UNDER CRIMINAL PENALTY PROVISIONS OF THE IDAHO CODE SECTION

Signature |

Date |

Phone Number |

DATE MAILED:

OFFICE USE ONLY

DATE RECEIVED OR

POSTMARK

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | This form is used by employers to file quarterly unemployment insurance tax reports in the State of Idaho. |

| Governing Law | The form is regulated under Idaho Code Section 72-1372(1)(a) for penalties concerning failure to file or false reporting. |

| Maximum Penalty | Employers may be fined up to $250.00 or 100% of the amount due, whichever is greater, for non-compliance. |

| Wage Reporting Threshold | Employers must report wages paid to individual workers in excess of $34,100.00 for the calendar year. |

| Payment Information | Payments made alongside this form should be payable to the Idaho Department of Labor. |

Guide to Writing Tax 020

Filling out the Tax 020 form is a crucial process for employers in the State of Idaho. This document, required by the Department of Labor, helps in the accurate calculation and reporting of unemployment insurance taxes. It's essential to approach this task with attention to detail to ensure compliance and avoid possible penalties. Below are step-by-step instructions to guide you through each section of the form efficiently.

- Start by verifying the State Account Number and Federal Identification Number at the top of the form. Make any necessary corrections to these numbers if they are incorrect.

- Under LEGAL ENTITY NAME AND Physical ADDRESS, confirm the current details. If there have been any changes in the name, mailing address, or ownership, fill in the new details in the sections provided, along with the effective date of each change.

- Note any changes in ownership or if operations have ceased, including the effective dates and details of new owners if applicable.

- Input the DATE QUARTERLY TAX REPORT IS DUE, and specify the YEAR and CALENDAR QUARTER wages were paid.

- Determine your TAX RATE by adding together the contribution rate, administrative reserve rate, and workforce development rate.

- Enter the TOTAL GROSS WAGES PAID TO ALL EMPLOYEES THIS QUARTER. If no wages were paid, enter “0”.

- List the wages paid to individual workers this quarter that are in excess of $34,100.00 for this calendar year.

- Calculate TAXABLE WAGES by subtracting line 6 from line 5.

- Determine the TAX DUE by multiplying the taxable wages (line 7) by the percentage calculated in step 4.

- Calculate any LATE PENALTY due by following the instructions provided, and add this to the tax due to find the TOTAL DUE FOR THIS QUARTER.

- If there is a PRIOR BALANCE, subtract any credit and/or add any balance due, attaching supporting documents as necessary.

- Confirm the TOTAL AMOUNT DUE, check the box if payment was made by Electronic Funds Transfer (E.F.T.), and make your check payable to the Idaho Department of Labor.

- Record the NUMBER OF WORKERS IN THE PAY PERIOD that included the 12th of the month for each month in the quarter. Enter zero if there were no employees.

- If you have submitted your wage report on tape or diskette, check the appropriate box.

- Finally, certify the accuracy of the information provided by signing and dating the form. Include your phone number for contact purposes.

- Make a note of the DATE MAILED, which is for office use and will be filled when your form is received or postmarked.

After completing these steps, review your form to ensure all information is accurate and complete. Submit the form by the due date to avoid any late penalties. Keeping accurate and timely records will help maintain compliance with Idaho's unemployment insurance tax requirements.

Understanding Tax 020

What is the Tax 020 form used for?

The Tax 020 form is an Employer Quarterly Unemployment Insurance Tax Report required by the State of Idaho Department of Labor. It is used by employers to report wages paid to employees, calculate unemployment insurance taxes due, and report any changes in business information, such as changes in ownership, name, or address. The form helps ensure that unemployment insurance funds are properly maintained and available to eligible unemployed workers.

When is the Tax 020 form due?

This form must be submitted quarterly. The due date for each quarter is determined by the State of Idaho Department of Labor. Employers should pay close attention to the specific deadline for each quarter to avoid late penalties. Generally, it is due shortly after the quarter ends.

What happens if I submit the Tax 020 form late?

If the Tax 020 form is submitted late, employers are subject to a late penalty. The penalty is calculated as 4% of the tax due times the number of months (or portion thereof) after the due date or a flat rate of $20.00 per month after the due date, whichever results in a greater penalty. It's important to file on time to avoid these additional charges.

How do I calculate the Taxable Wages on the Tax 020 form?

To calculate the taxable wages on the Tax 020 form, subtract the total wages paid to individual workers this quarter in excess of $34,100.00 for this calendar year (line 6) from the total gross wages paid to all employees this quarter (line 5). This will give you the amount of wages subject to unemployment insurance tax.

How is the tax due on the Tax 020 form calculated?

The tax due is calculated by multiplying the taxable wages (the result from line 7) by the tax rate (from line 4). The tax rate is a sum of three rates: the contribution rate, the administrative reserve rate, and the workforce development rate. These rates are provided by the Idaho Department of Labor.

What should I do if there were changes in my business's ownership or address?

If there have been changes in your business's name, mailing address, or ownership, you must report these changes on the Tax 020 form in the provided section. Include the effective date and the details of the new owners if ownership has changed. This ensures that all your business information is up to date with the Idaho Department of Labor.

Where do I send my completed Tax 020 form and payment?

Completed Tax 020 forms and any payments due should be made payable to the Idaho Department of Labor and mailed to: Idaho Department of Labor

317 W Main Street

Boise, Idaho 83735-0610

Ensure that checks or other forms of payment include accurate business identifiers, such as your State Account Number and Federal Identification Number to correctly apply your payment.

Common mistakes

Filing the Tax 020 form, otherwise known as the Employer Quarterly Unemployment Insurance Tax Report in the State of Idaho, is a crucial task for employers. It's key to maintaining compliance with state labor laws. Unfortunately, there are common errors that can occur when filling it out. Being aware of these mistakes can save time, prevent penalties, and ensure accuracy in reporting. Here are nine mistakes to watch out for:

Failing to verify and correct the State Account Number and Federal Identification Number. Accuracy here is crucial for your report to be correctly associated with your business.

Not updating changes in the Legal Entity Name, Physical Address, Mailing Address, or Ownership. Keeping this information current is essential for proper communication and record-keeping.

Omitting or inaccurately noting the effective date of changes. This date is essential for records, particularly if ownership has changed or operations have ceased.

Miscalculating the total gross wages paid to all employees for the quarter, or erroneously entering “0” when wages were paid. This line should match your Wage Report total exactly.

Incorrectly reporting wages paid to individual workers this quarter in excess of $34,100. This calculation is a key factor in determining your taxable wages and must be accurate.

Misjudging the taxable wages by not properly subtracting line 6 from line 5. This common mistake can lead to an incorrect tax calculation.

Erring in the multiplication to find the Tax Due. This often happens by applying the wrong tax rate or miscalculating the product.

Forgetting to add late fees or penalties correctly under the Late Penalty section. This oversight can lead to underpayment and additional penalties.

Not accurately calculating the Total Amount Due, forgetting to include prior balances or credits properly. This final step is crucial for ensuring the correct payment is made.

It's vital for employers to approach form Tax 020 with diligence and attention to detail. Beyond avoiding these common mistakes, always double-check calculations, keep abreast of any changes in taxation law or reporting standards, and consult with a professional if you're unsure about any part of the process. Proper filing supports your business’s compliance and contributes to the smooth operation of unemployment insurance processes in Idaho.

Documents used along the form

When businesses engage with the complexities of unemployment insurance taxes, the Tax 020 form, formally recognized as the Employer Quarterly Unemployment Insurance Tax Report, is a cornerstone document in the State of Idaho. However, navigating the administrative responsibilities doesn't end with this single form. Several other documents play crucial roles in ensuring compliance, accuracy, and thoroughness in reporting and managing tax-related obligations. Each of these documents complements the Tax 020 form, enabling employers to provide a comprehensive account of their payroll expenses, tax liabilities, and employee statistics.

- Form TAX026 - Wage Report: This form accompanies the Tax 020 and is used to report individual employee wages for the quarter. It provides a detailed breakdown of the total gross wages reported in the Tax 020 form, ensuring that the state has an accurate record of all taxable earnings within a business.

- Form ICESA – Federal Unemployment Tax Act (FUTA) Report: Often required alongside state unemployment filings, this federal document details an employer's quarterly unemployment tax liability at the federal level, ensuring compliance with both state and federal tax regulations.

- Form I-9 Employment Eligibility Verification: While not directly related to tax reporting, the Form I-9 is essential in verifying the eligibility of employees to work in the United States. This verification impacts an employer's legal standing and ability to accurately report employee information on tax documents.

- Form W-4 Employee's Withholding Certificate: This form is key for determining the amount of federal income tax to withhold from employees' wages. The information from Form W-4 influences an employer's payroll calculations and tax withholdings, indirectly affecting the unemployment insurance tax report.

- Form 940 - Employer's Annual Federal Unemployment (FUTA) Tax Return: This annual form complements the quarterly TAX026 by summarizing an employer's federal unemployment tax contributions for the year. It captures a broader financial snapshot, supporting the quarterly filings made with the Tax 020 form.

- State-Specific New Hire Reporting Forms: While these forms vary by state, Idaho employers must report newly hired or rehired employees to a state directory. This reporting is crucial for maintaining accurate and updated employee records, which in turn supports accurate unemployment insurance reporting and contributions.

In navigating the landscape of unemployment insurance tax reporting, employers must recognize the interconnectedness of these forms and documents. The successful management of these obligations requires attention to detail, timely reporting, and a comprehensive approach to each form's role in the broader tax reporting process. By understanding and utilizing each of these documents in conjunction with the Tax 020 form, employers can ensure compliance, contribute to the accuracy of their financial reporting, and uphold their responsibilities to both their employees and the state.

Similar forms

The Tax 020 form bears similarity to the Federal Employer's Quarterly Federal Tax Return, commonly known as Form 941, used by employers to report income taxes, social security tax, or Medicare tax withheld from employees' paychecks. Both require employers to detail wages paid and taxes owed for the quarter, making them key tools in ensuring compliance with respective tax obligations. While Tax 020 caters to state-level unemployment insurance requirements in Idaho, Form 941 addresses federal payroll taxes, highlighting their parallel roles in tax administration.

Likewise, the state-specific Unemployment Insurance Wage Report forms, found in various states, parallel the Tax 020 form by collecting information on wages employers have paid, which determines unemployment insurance contributions. These forms often require employers to report the total wages paid during the quarter and identify those exceeding the state's wage base limit for unemployment insurance. Both types of documents serve a critical role in financing the unemployment insurance system, albeit tailored to the unique regulations of each state.

The Employer’s Annual Federal Unemployment (FUTA) Tax Return, or Form 940, similarly echoes the functions of the Tax 020 form through its focus on unemployment. Form 940 is designed for employers to report annual federal unemployment taxes, with attention to wages subjected to FUTA tax. Although the Tax 020 form is more frequent and state-specific, both forms underscore the importance of supporting unemployment funds, albeit on different governmental levels.

The Quarterly Contribution Return and Report of Wages (Continuation) (Form DE 9C) is another document with a similar purpose, especially prevalent in states like California. This form captures detailed wage information for employees to calculate state unemployment insurance and employment training taxes. By focusing on quarterly wage reporting, both the DE 9C and Tax 020 form ensure accurate calculation of employer contributions towards unemployment and workforce development funds.

Another analogous form is the New York State Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return, NYS-45. This document, much like the Tax 020 form, consolidates the reporting of wages paid, taxes withheld, and unemployment insurance contributions into a single submission on a quarterly basis. It streamlines the process for New York State employers, mirroring the functionality of the Tax 020 form for Idaho employers, in maintaining tax and unemployment insurance compliance.

The Texas Workforce Commission’s Employer’s Quarterly Report (Form C-3) offers a close comparison too. Employers in Texas use this form to report wages for each employee, including those in excess of the unemployment tax wage base. Just as the Tax 020 form, the C-3 facilitates the funding of the state’s unemployment compensation system, reinforcing the shared goal of managing unemployment benefits through employer contributions.

Lastly, the Employer’s Quarterly Report for New Hire Reporting, a requirement in many states, shares the common goal of updating employment records, albeit for a different purpose. This report, although not focusing on taxation, complements the objectives of the Tax 020 form by ensuring timely updates on employment status which can impact unemployment insurance calculations and compliance with child support enforcement efforts.

Dos and Don'ts

Filling out the Tax 020 form, an Employer Quarterly Unemployment Insurance Tax Report for the State of Idaho, requires attention to detail. To ensure accuracy and compliance, here are some important dos and don’ts:

- Do verify and correct, if necessary, your State Account Number and Federal Identification Number at the top of the form.

- Do update any changes in your legal entity name, mailing address, ownership, or if operations have ceased, including the effective date of these changes.

- Do accurately calculate your total gross wages paid to all employees this quarter and enter “0” if no employment occurred.

- Do ensure that the wages paid to individual workers this quarter exceeding the threshold are correctly reported.

- Do include the correct tax due, applying the sum of your tax rates to the taxable wages, and any late fees or penalties if applicable.

- Don't neglect to check and attach any supporting documents for prior balances, credits, or balance dues.

- Don't forget to sign and date the form, certifying that the information provided is true and correct under the criminal penalty provisions of the Idaho Code Section 72-1371.

By following these guidelines, you will help ensure the accurate and timely processing of your Tax 020 form. Missteps could result in fines or additional penalties. If in doubt, reach out to the Idaho Department of Labor directly for assistance.

Misconceptions

There are several common misconceptions about the Tax 020 form, used for Employer Quarterly Unemployment Insurance Tax Report in the State of Idaho. Understanding these misconceptions can help ensure accurate and timely filings.

- Misconception 1: Any business, regardless of size, doesn't need to file the Tax 020 form.

In reality, every employer operating in Idaho must file this form if they have paid wages to employees.

- Misconception 2: You only need to file if you owe taxes.

Even if no wages were paid during the quarter, employers must file the Tax 020 form with a "0" in the total gross wages section.

- Misconception 3: The form is the same for every business.

Different businesses might have different contribution rates depending on various factors like their industry and claims history.

- Misconception 4: You can file the form at any time during the year.

The form is due quarterly, and late filings can result in penalties.

- Misconception 5: Penalties are negligible.

Businesses can be fined up to $250 or 100% of the amount due, whichever is greater, for failures to file or filing false reports.

- Misconception 6: All wages paid are taxable.

Wages above a certain threshold ($34,100 for this calendar year) are not subject to additional contributions.

- Misconception 7: Manual submission is the only option.

Employers have the option to submit their wage report electronically, via tape or diskette.

- Misconception 8: The report doesn't need to be signed.

The form requires a signature to certify that the information provided is true and accurate under criminal penalty provisions.

- Misconception 9: Changes in ownership or address don't need to be reported immediately.

Employers must show any changes in name, mailing address, or ownership along with the effective date on the submitted form.

Correcting these misconceptions ensures compliance with Idaho's Department of Labor requirements, potentially avoiding unnecessary fines and penalties.

Key takeaways

When dealing with the Tax 020 form for Employer Quarterly Unemployment Insurance Tax Reporting in Idaho, there are several important takeaways to ensure accuracy and compliance. Here’s what employers need to know:

- The State Account Number and Federal Identification Number must be verified and corrected if necessary, emphasizing the importance of accurate identification for tax purposes.

- Any changes in legal entity name, mailing address, or ownership, including effective dates, must be reported, indicating that the state must be kept informed of organizational updates.

- The form outlines severe penalties for failure to file or filing false reports, including fines up to $250.00 or 100% of the amount due, showcasing the gravity of accurate reporting and the consequences of negligence.

- The due date for the quarterly tax report is specified, underlining the importance of timely submissions to avoid penalties.

- Detailed instructions on calculating taxes due, including total gross wages, taxable wages, and the tax due, provide a clear pathway for employers to determine their financial obligations.

- The formula for calculating the tax rate is provided, ensuring employers can accurately determine their tax liabilities based on their individual rates and contributed wages.

- Information on the inclusion of a late penalty clarifies the repercussions of late filings, emphasizing the need for promptness.

- The necessity to report the number of workers per pay period underscores the importance of accurate employment records for tax calculation.

- The certification section at the end of the form necessitates honesty and accuracy under the penalty of Idaho law, reinforcing the legal obligation of truthfulness in reporting.

Comprehensive attention to the details on the Tax 020 form ensures compliance with Idaho state laws and helps employers avoid unnecessary penalties by providing accurate and timely unemployment insurance tax reports.

Popular PDF Documents

Statement for Exempt Individuals and Individuals With a Medical Condition - Compliance with the filing requirements of IRS Form 8843 is pivotal for international students, researchers, and others seeking to avoid being taxed as U.S. residents.

5472 Instructions 2022 - Form 5472 is used by certain U.S.-based entities to report transactions with foreign related parties.

Can You Change Your Business Address - This form supports updates to both registration and exemption statuses under Missouri tax laws.