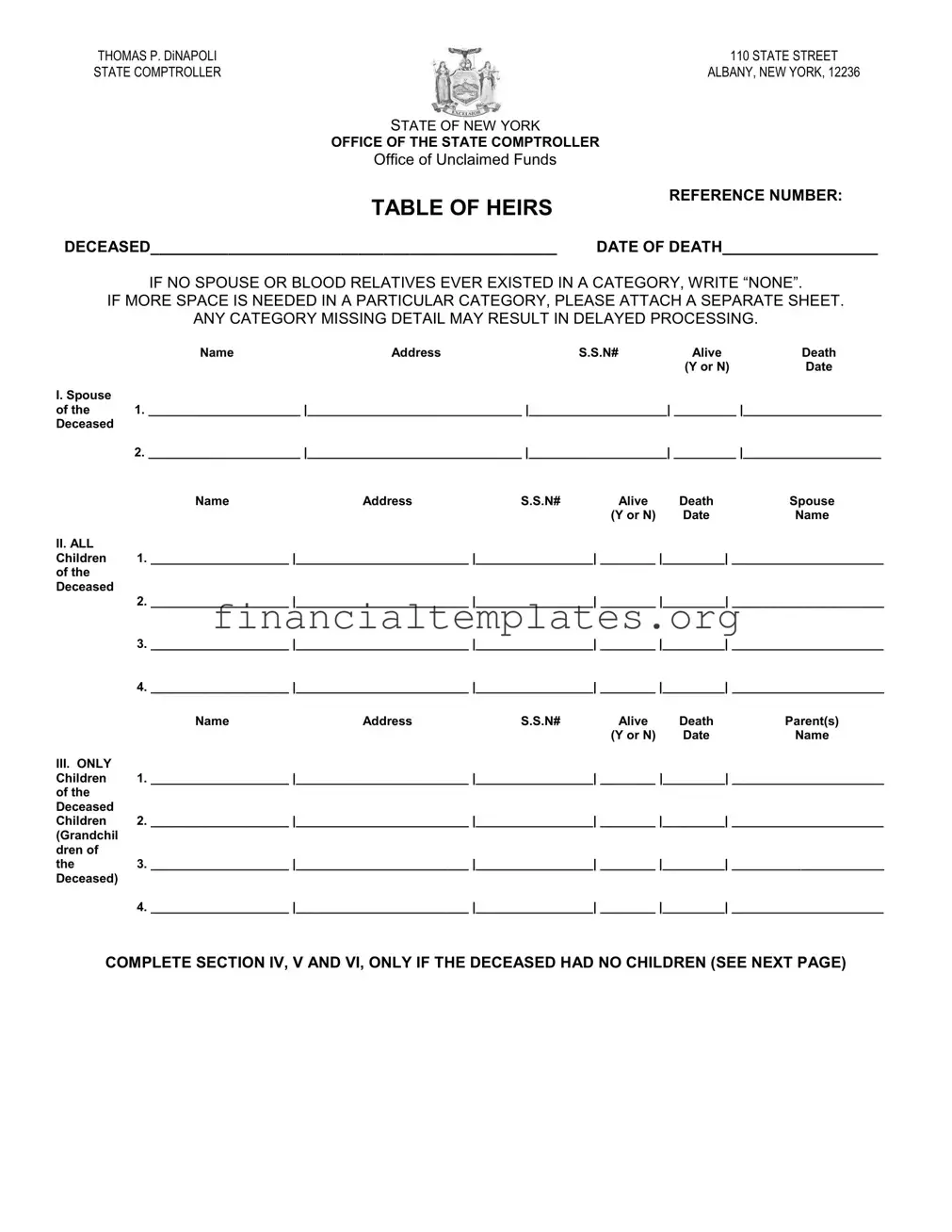

Get Table Of Heirs Form

In the case of managing a deceased individual's unclaimed funds, the Table of Heirs form serves as a critical instrument for both legal professionals and family members navigating the complexities of estate settlement. Created by the Office of the State Comptroller in New York, under the leadership of Thomas P. DiNapoli, this document meticulously outlines the necessary information to accurately identify rightful heirs. Through sections dedicated to spouses, children (including both direct and those of deceased siblings), and parents, along with directives for detailing brothers, sisters, and their offspring, the form is comprehensive. It emphasizes the inclusion of all possible claimants by instructing users to declare 'NONE' if no relatives exist within a given category and accommodates extensive familial networks by allowing the addition of supplementary sheets. Prompt and thorough completion, including the option to furnish Social Security Numbers or Taxpayer Identification Numbers to expedite processing, can significantly reduce potential delays. Furthermore, it concludes with a solemn declaration by the informant, underscoring the document's legal significance. By navigating to the comptroller's website or contacting them directly, claimants can find assistance and guidance on how to proceed with their submissions. This form not only facilitates the efficient transfer of unclaimed assets but also safeguards the rights of heirs, ensuring a fair and just distribution in accordance with New York State's Abandoned Property Law.

Table Of Heirs Example

THOMAS P. DINAPOLI |

|

|

|

|

110 STATE STREET |

|

STATE COMPTROLLER |

|

|

|

ALBANY, NEW YORK, 12236 |

||

|

|

STATE OF NEW YORK |

|

|

|

|

|

|

OFFICE OF THE STATE COMPTROLLER |

|

|

||

|

|

Office of Unclaimed Funds |

|

|

|

|

|

|

TABLE OF HEIRS |

|

REFERENCE NUMBER: |

||

|

|

|

|

|

||

DECEASED_______________________________________________ |

DATE OF DEATH__________________ |

|||||

|

IF NO SPOUSE OR BLOOD RELATIVES EVER EXISTED IN A CATEGORY, WRITE “NONE”. |

|||||

IF MORE SPACE IS NEEDED IN A PARTICULAR CATEGORY, PLEASE ATTACH A SEPARATE SHEET. |

||||||

|

ANY CATEGORY MISSING DETAIL MAY RESULT IN DELAYED PROCESSING. |

|||||

|

Name |

Address |

|

S.S.N# |

Alive |

Death |

|

|

|

|

|

(Y or N) |

Date |

I. Spouse |

|

|

|

|

|

|

of the |

1. ______________________ |_______________________________ |____________________| _________ |____________________ |

|||||

Deceased |

|

|

|

|

|

|

|

2. ______________________ |_______________________________ |____________________| _________ |____________________ |

|||||

|

Name |

Address |

S.S.N# |

Alive |

Death |

Spouse |

|

|

|

|

(Y or N) |

Date |

Name |

II. ALL |

|

|

|

|

|

|

Children |

1. ____________________ |_________________________ |_________________| ________ |_________| ______________________ |

|||||

of the |

|

|

|

|

|

|

Deceased |

|

|

|

|

|

|

2.____________________ |_________________________ |_________________| ________ |_________| ______________________

3.____________________ |_________________________ |_________________| ________ |_________| ______________________

4.____________________ |_________________________ |_________________| ________ |_________| ______________________

|

Name |

Address |

S.S.N# |

Alive |

Death |

Parent(s) |

|

|

|

|

(Y or N) |

Date |

Name |

III. ONLY |

|

|

|

|

|

|

Children |

1. ____________________ |_________________________ |_________________| ________ |_________| ______________________ |

|||||

of the |

|

|

|

|

|

|

Deceased |

|

|

|

|

|

|

Children |

2. ____________________ |_________________________ |_________________| ________ |_________| ______________________ |

|||||

(Grandchil |

|

|

|

|

|

|

dren of |

|

|

|

|

|

|

the |

3. ____________________ |_________________________ |_________________| ________ |_________| ______________________ |

|||||

Deceased) |

|

|

|

|

|

|

4. ____________________ |_________________________ |_________________| ________ |_________| ______________________

COMPLETE SECTION IV, V AND VI, ONLY IF THE DECEASED HAD NO CHILDREN (SEE NEXT PAGE)

TABLE OF HEIRS

Page

|

Name |

Address |

|

S.S.N# |

Alive |

Death |

|

|

|

|

|

(Y or N) |

Date |

IV. |

|

|

|

|

|

|

Parents of |

1. ______________________ |_______________________________ |____________________| _________ |____________________ |

|||||

the |

|

|

|

|

|

|

Deceased |

|

|

|

|

|

|

|

2. ______________________ |_______________________________ |____________________| _________ |____________________ |

|||||

|

Name |

Address |

S.S.N# |

Alive |

Death |

Spouse |

|

|

|

|

(Y or N) |

Date |

Name |

V. ALL |

|

|

|

|

|

|

Brothers |

1. ____________________ |_________________________ |_________________| ________ |_________| ______________________ |

|||||

and |

|

|

|

|

|

|

Sisters of |

|

|

|

|

|

|

the |

2. ____________________ |_________________________ |_________________| ________ |_________| ______________________ |

|||||

Deceased |

|

|

|

|

|

|

3.____________________ |_________________________ |_________________| ________ |_________| ______________________

4.____________________ |_________________________ |_________________| ________|_________| ______________________

|

Name |

Address |

S.S.N# |

Alive |

Death |

Parent(s) |

|

|

|

|

(Y or N) |

Date |

Name |

VI. ONLY |

|

|

|

|

|

|

Children |

1. ____________________ |_________________________ |_________________| ________ |_________| ______________________ |

|||||

of the |

|

|

|

|

|

|

Deceased |

|

|

|

|

|

|

Brothers |

2. ____________________ |_________________________ |_________________| ________ |_________| ______________________ |

|||||

and |

|

|

|

|

|

|

Sisters |

|

|

|

|

|

|

3.____________________ |_________________________ |_________________| ________ |_________| ______________________

4.____________________ |_________________________ |_________________| ________ |_________| ______________________

This table was completed by ___________________________, who is related to the decedent as a __________________________,

and who resides at ________________________________________in the county of __________________________________ and

State of ________________________, and, who being duly sworn, declares under penalty of perjury that the above information is true

and correct to the best of her/his knowledge.

________________________________________________

Signature

*The Social Security Number / TIN is optional at this point, but including it may facilitate our research and may avoid a future request for the number.

Sworn to before me this _______________ day

of _________________________, 20 _______,

_____________________________________

Signature / Seal - Notary Public

Return this form by mail: Office of Unclaimed Funds 110 State Street Albany, NY 12236

Submit online:

https://ouf.osc.state.ny.us/ouf/cs

Contact us: nysouf@osc.ny.gov or

Visit our webpage at http://www.osc.state.ny.us/ouf/index.htm.

We invite you to like us on Facebook at facebook.com/nyscomptroller

and follow us on Twitter at @NYSComptroller

NYS Personal Privacy Protection Law Notification: The NYS Comptroller's Office of Unclaimed Funds (OUF) is requesting you to provide your Taxpayer Identification Number and/or

Date of Birth on this form in order to verify your identity and that you're entitled to claim the funds. OUF is authorized to collect this information under Section 1406 of the NYS

Abandoned Property Law. Disclosing this information is voluntary and we will process your claim without it. However, in certain cases OUF is required to report the transaction to the Internal Revenue Service and/or other taxing authorities. If your claim is subject to such a requirement, and you don’t provide the requested information at this time, we’ll require that

you provide such information prior to payment. The information provided will be maintained in the Unclaimed Funds Processing System which is under the direction of the Assistant

Director of Services of OUF, 110 State Street, Albany, NY 12236

Document Specifics

| Fact | Description |

|---|---|

| Form Title | Table of Heirs |

| Issuing Authority | Office of the State Comptroller, State of New York |

| Contact Address | 110 State Street, Albany, New York, 12236 |

| Document Purpose | To record details of heirs for the Office of Unclaimed Funds |

| Information Required | Name, Address, Social Security Number, Alive/Deceased Status, Death Date |

| Sections to Complete | Spouse, Children, Grandchildren, Parents, Siblings, Nieces/Nephews |

| Submission Methods | By mail to Office of Unclaimed Funds or online at the provided URL |

| Submission URL | https://ouf.osc.state.ny.us/ouf/cs |

| Governing Law | Section 1406 of the NYS Abandoned Property Law |

| Privacy Notice | Information provided is maintained in the Unclaimed Funds Processing System and may be reported to the IRS or other authorities if required |

| Contact Information | Email: nysouf@osc.ny.gov or Phone: 800-221-9311 |

Guide to Writing Table Of Heirs

After a loved one has passed away, managing their estate often involves determining who their heirs are. This is a critical step in making sure that any unclaimed funds in the deceased’s name are properly distributed. The State of New York Office of the State Comptroller provides a Table of Heirs form to help in this process. Filling out this document requires accurate and clear information about the deceased’s relatives. It’s important to follow each step precisely to ensure that the processing of the form is not delayed.

- Collect all necessary information about the deceased’s relatives, including full names, addresses, social security numbers, and information regarding whether they are alive or deceased, including the death date if applicable.

- Start with section I. For the spouse(s) of the deceased, if any, fill in the required information in the provided spaces. If there are no spouses, write “NONE” in each field.

- Proceed to section II and list all children of the deceased in the spaces provided. Make sure to include each child’s full name, address, social security number, and note if they are alive or deceased with the corresponding date.

- In section III, only list the grandchildren of the deceased (who are the deceased children's children). Fill in their details similarly to how you filled in the children’s section.

- Sections IV, V, and VI should only be filled out if the deceased had no children. These sections are for listing the parents, all siblings, and nieces or nephews (children of the deceased’s siblings) respectively. Again, provide all requested details for individuals in these categories.

- If more space is needed for any category, attach a separate sheet with the continuation of the list following the same format.

- Complete the bottom declaration section by printing the name of the person filling out the form, their relation to the deceased, their address, county, and state. This asserts that the information provided is accurate to the best of their knowledge.

- Sign and date the form in the presence of a Notary Public, who will also sign and affix their seal.

- Choose whether to submit the completed form by mail to the Office of Unclaimed Funds at the provided address or submit it online via the provided URL. For any questions or further assistance, use the contact information listed on the form.

By carefully following these steps, you ensure that the process of identifying and notifying heirs can be conducted smoothly, paving the way for the rightful distribution of the deceased's unclaimed assets. Remember, providing complete and accurate information is crucial to avoid any delays in this sensitive process.

Understanding Table Of Heirs

What is the Table of Heirs form?

The Table of Heirs form is a document used by the New York State Comptroller's Office of Unclaimed Funds. It is designed to detail the living relatives of a deceased individual, including their spouse, children, parents, siblings, and any surviving descendants. This information helps in determining the rightful heirs to any unclaimed funds or properties.

How do I fill out the Table of Heirs form?

To fill out the form, you need to list all known living relatives of the deceased in the specific categories provided: spouse, children, grandchildren, parents, siblings, and nephews or nieces. For each relative, include their name, address, Social Security Number (SSN#, which is optional but recommended), their living status, and the date of death if they are deceased. If a category does not apply or if there are no known relatives in a category, write "NONE". If more space is needed, attach a separate sheet. Make sure no category is missing details to avoid processing delays.

Why is it important to include a Social Security Number or Taxpayer Identification Number?

Including the Social Security Number (SSN) or Taxpayer Identification Number (TIN) of the deceased or the heirs can facilitate research by the Office of Unclaimed Funds and may prevent future requests for these numbers. Though it's optional to include this at the initial submission, it can expedite the identification process and potential claim.

What happens if I don't provide a SSN or TIN?

If you choose not to provide a Social Security or Taxpayer Identification Number on the form, the Office of Unclaimed Funds can still process your claim. However, if your claim is subject to reporting to the Internal Revenue Service or other tax authorities, you will be required to provide this information before the claim can be paid out.

Who should complete and sign the Table of Heirs form?

The form should be completed and signed by an individual who is related to the deceased and has knowledge of the family's history and surviving relatives. This person must provide their relationship to the deceased, their contact information, and affirm under penalty of perjury that the information provided is true and correct to the best of their knowledge.

How and where do I submit the completed form?

The completed Table of Heirs form can be submitted either by mail or online. To submit by mail, send the form to the Office of Unclaimed Funds at 110 State Street, Albany, NY 12236. To submit online, visit the provided URL and follow the submission instructions. Ensure that the form is signed and, if applicable, notarized before submission.

What is the role of the NYS Personal Privacy Protection Law Notification in this process?

The notification informs you that the New York State Comptroller's Office of Unclaimed Funds requests your Taxpayer Identification Number and/or Date of Birth primarily for identity verification purposes and to ensure you are entitled to claim the funds. Disclosing this information is voluntary but crucial for processing your claim and for compliance with legal reporting requirements in certain cases. The information provided will be maintained securely as per the guidelines.

Common mistakes

Failing to complete all required sections, especially when the deceased has no children, can significantly delay the processing of the form. It's crucial to address sections IV, V, and VI under these circumstances, ensuring no part of the form is overlooked.

Omitting or inaccurately entering Social Security Numbers (SSN) or Taxpayer Identification Numbers (TIN). While the form notes that including these is optional at the initial stage, providing them can expedite the research process and potentially avoid future requests for such information.

Not using additional sheets when extra space is needed, which can lead to cramped entries that are difficult to read or incomplete information. Attaching separate sheets helps in maintaining clarity and ensuring all relevant details are fully communicated.

Incorrectly addressing the "IF NO SPOUSE OR BLOOD RELATIVES EVER EXISTED IN A CATEGORY, WRITE 'NONE'" instruction, either by leaving such sections blank or filling them incorrectly. This precise instruction is designed to provide clear data regarding the deceased's familial connections and needs to be followed exactingly.

Misunderstanding the distinction between "ALL Children of the Deceased" and "ONLY Children of the Deceased Children" (Grandchildren). This differentiation is critical for accurately mapping the family tree and ensuring rightful heirs are identified.

Not adequately verifying the alive or deceased status of listed individuals or inaccurately noting the date of death. This attention to detail is vital for the accuracy of the heirs' table and for the appropriate parties to receive notification or claim.

-

Mistakes in the declaration section by the person completing the table, including incorrect relationship to the decedent or address details. An accurately completed declaration is legally binding and ensures the veracity of the information provided.

Redundancy or duplication in listing heirs, particularly in scenarios involving large families or multiple similar names, can create confusion and necessitate clarification, prolonging the process.

Ignoring the method of submission instructions, whether through mail or online platforms. Appropriate submission aligns with procedural requirements and aids in the seamless processing of the claim.

Documents used along the form

When handling the estate of someone who has passed away, a Table of Heirs form is one piece of the puzzle. This document helps identify and document the rightful heirs, which is crucial in the process of distributing the deceased's assets. However, other important documents often work alongside the Table of Heirs to ensure that the estate is managed and distributed correctly and legally. Here is a rundown of some of those key documents.

- Last Will and Testament: This legal document outlines how a person wants their assets distributed after they die. It may specify heirs, which could serve as a reference when filling out the Table of Heirs.

- Death Certificate: A certified document proving the death of the deceased. It is often required when filing claims or transferring assets and verifies the information entered in the Table of Heirs.

- Letters of Administration or Letters Testamentary: Issued by a probate court, these documents give an individual the authority to act as the executor or administrator of the deceased's estate.

- Trust Documents: If the deceased had a trust, these documents are crucial for understanding how the assets outside of the probate process should be handled and could impact the distribution to heirs.

- Inventory of Assets: This comprehensive list includes all assets of the deceased. It's essential for understanding what assets are involved and helps in accurately completing the Table of Heirs.

- Beneficiary Designation Forms: These forms, which are often found with life insurance policies, retirement accounts, and other financial accounts, designate who will receive these assets, possibly overriding what's stated in a will.

Together with the Table of Heirs, these documents form a network that supports the legal and proper handling of an estate. They ensure that the wishes of the deceased are honored and that the heirs receive their rightful shares, all while complying with state laws and regulations.

Similar forms

The Affidavit of Heirship document shares similarities with the Table of Heirs form mainly in its purpose to identify and officially document the rightful heirs or beneficiaries of a deceased person's estate. Both documents are used to map out the family lineage and ensure that assets are distributed according to the state law or the decedent’s last wishes if a will is present. While the Affidavit of Heirship is typically filed with a court or used in financial institutions to establish ownership rights, the Table of Heirs serves a similar functional role in accurately identifying all possible claimants or heirs to unclaimed assets or properties.

Probate Letters or Letters of Administration are another set of documents similar to the Table of Heirs form. These are legal documents issued by a probate court that authorize an executor or administrator to manage and dispose of a deceased's estate. Like the Table of Heirs, they play a vital role in the estate settlement process by officially recognizing the person(s) entitled to handle the deceased’s affairs, including distributing their assets to the rightful heirs as identified in a Table of Heirs or equivalent documentation.

The Last Will and Testament, though distinct in its purpose as a directive for estate distribution, overlaps with the Table of Heirs form in context. It specifies how a person’s estate should be managed and distributed after death, potentially including detailed heir information similar to what is collected in the Table of Heirs. While the Last Will primarily serves to express the deceased's wishes, the Table of Heirs provides a factual listing of all heirs, which can be essential in the absence of a will or to clarify heirship in complex family situations.

The Death Certificate is a legally binding document verifying the death of an individual, which indirectly relates to the Table of Heirs form. While the Death Certificate primarily serves as proof of death for legal, financial, and personal reasons, it is often a prerequisite for completing a Table of Heirs. This form relies on the finality confirmed by a Death Certificate to activate processes related to inheritance claims and estate settlement, ensuring that the rights of heirs are properly acknowledged and acted upon.

Trust documents, establishing a trust to hold assets for beneficiaries, share a connection with the Table of Heirs form through their focus on asset distribution to rightful claimants. While trust documents directly control how and to whom the assets are distributed, akin to a will, the Table of Heirs identifies potential beneficiaries who may be entitled to assets not already governed by a trust or will, ensuring a comprehensive approach to estate planning and execution.

The Beneficiary Designation form, commonly used with life insurance policies, retirement accounts, and other financial instruments, is likewise akin to the Table of Heirs in its function of identifying the individuals who are entitled to receive assets upon the policyholder or account holder's death. Both documents are integral to the process of asset distribution, ensuring that financial benefits are transferred according to the deceased’s wishes or legal heirship, thereby reducing conflicts and confusion among potential claimants.

Dos and Don'ts

When filling out the Table of Heirs form, it's important to follow certain dos and don'ts to ensure accurate submission and to expedite the process. Here are key guidelines to consider:

- Do carefully review the entire form before you start filling it out to ensure you understand all the requirements.

- Do use black or blue ink for clarity if filling out the form by hand, ensuring that your handwriting is legible.

- Do provide the Social Security Numbers (SSN) for the heirs if available, as including this information may facilitate research and avoid future requests for it.

- Do attach additional sheets if more space is needed for any category, making sure to clearly indicate the category for which the additional information is provided.

- Don't leave any categories blank if applicable; instead, write "None" if no spouse, blood relatives, or heirs exist in a specific category.

- Don't rush through the form; take your time to ensure that all information provided is accurate and complete to the best of your knowledge.

- Don't forget to sign and date the form, as an unsigned form may be considered invalid and could delay processing.

- Don't hesitate to contact the Office of Unclaimed Funds for clarification or assistance if you have any questions or difficulties while filling out the form.

Following these guidelines closely will help in submitting a complete and accurate Table of Heirs form, thereby potentially speeding up the unclaimed funds claim process.

Misconceptions

When individuals encounter the Table of Heirs form, there are several misconceptions that can create confusion. Here's a clear explanation of some of these common misunderstandings:

It's only for traditional families: People often think the form is designed strictly for traditional nuclear families. However, it's actually meant to capture a wide range of familial relationships, including domestic partners, stepchildren, and adopted children, ensuring a comprehensive reflection of the decedent's family structure.

Social Security numbers are mandatory: Another misconception is the belief that providing Social Security numbers (SSNs) or Taxpayer Identification Numbers (TINs) is mandatory. While important for identification and to expedite the process, the form notes that this information is optional but highly recommended to avoid future requests for it.

Only blood relatives can be listed: Some individuals incorrectly assume that only blood relatives can be included. The form is designed to account for all legal heirs, which can include non-blood relatives, such as spouses or legally adopted children.

It must be filled out completely in one sitting: There's a notion that the form must be completed in one sitting, which isn't the case. It can be filled out in stages, and additional documents can be attached if more space is needed for any category.

The process is instantaneous: A common misconception is that submission of the form will result in immediate processing and dispersion of assets. In reality, the process can take time, as every detail is verified to ensure accuracy and rightful ownership.

Online submission is complicated: People often assume that submitting the Table of Heirs form online is complicated. However, the state comptroller’s office has made efforts to ensure that online submission is user-friendly and efficient, offering clear instructions and support.

A notary public's signature is always required: It's commonly misunderstood that a notary public's signature is necessary for all submissions. While having the form notarized can add an extra layer of legal validity, it isn’t always required for the form to be processed.

All heirs must sign the form: There's a belief that the form requires signatures from all listed heirs. In fact, the form only needs to be completed and signed by one individual who is related to the decedent and can attest to the accuracy of the information provided.

The form is the final step in claiming funds: Lastly, many think that once the Table of Heirs form is submitted, no further action is required. This isn't true, as additional documentation may be requested by the comptroller's office to verify the claimant's identity and relationship to the decedent.

Understanding the true nature of the Table of Heirs form can streamline the process of claiming unclaimed funds and ensure that all legal heirs are rightfully acknowledged.

Key takeaways

When tackling the Table of Heirs form, understanding its components and the intricacies of its completion are instrumental. Here are some key takeaways to guide you through this process:

- Accuracy is paramount: Ensure that all information provided, especially names, addresses, social security numbers, and dates of death or birth, is correct. Incorrect information can significantly delay the processing of the form.

- Complete all sections: Fill out every part of the form, even if it seems repetitive or unnecessary. Missing details can cause delays. If a section does not apply, clearly mark it as “NONE” to indicate nothing was overlooked.

- If more space is needed, attach additional sheets: Sometimes, the space provided might not be sufficient to list all heirs, especially in larger families. Attach extra pages as required, ensuring they are well-organized and clearly marked to match the sections on the form.

- Use the form to detail both living and deceased heirs: For each category (spouse, children, grandchildren, etc.), indicate whether they are alive or deceased and provide the date of death if applicable. This information is crucial for establishing the correct lineage and distribution of assets.

- Provide social security numbers if possible: While including Social Security numbers or Taxpayer Identification Numbers is optional at the initial stage, providing them can expedite the research process and might prevent future requests for additional information.

- Understand the importance of sworn accuracy: The person completing the form must attest to its accuracy under penalty of perjury. This underscores the importance of ensuring all information is true and correct to the best of your knowledge.

- Contact information and how to submit: It’s essential to know where and how to submit the finished form, either by mail or online, and understand whom to contact should you have any questions during the process.

- Privacy protection acknowledgment: The New York State Comptroller’s Office outlines how your information will be used and protected. Understanding these details ensures you’re informed about your privacy rights and the legal frameworks in place to protect your information.

Completing the Table of Heirs form accurately and thoroughly is crucial for the efficient handling of unclaimed funds and the rightful distribution of assets. It’s a process that demands attention to detail and an understanding of the importance of each piece of information requested.

Popular PDF Documents

Massachusetts Tax Exempt Form - Guides applicants through designating who should receive the response to the application.

Statement for Exempt Individuals and Individuals With a Medical Condition - Filing the IRS 8843 is an assertion of a nonresident's close ties to their home country, arguably one of the simplest yet most critical documents in their tax filing process.

What Is Commercial Lending - Details the preparation of essential documents for both owner-occupied and investment property commercial loans.