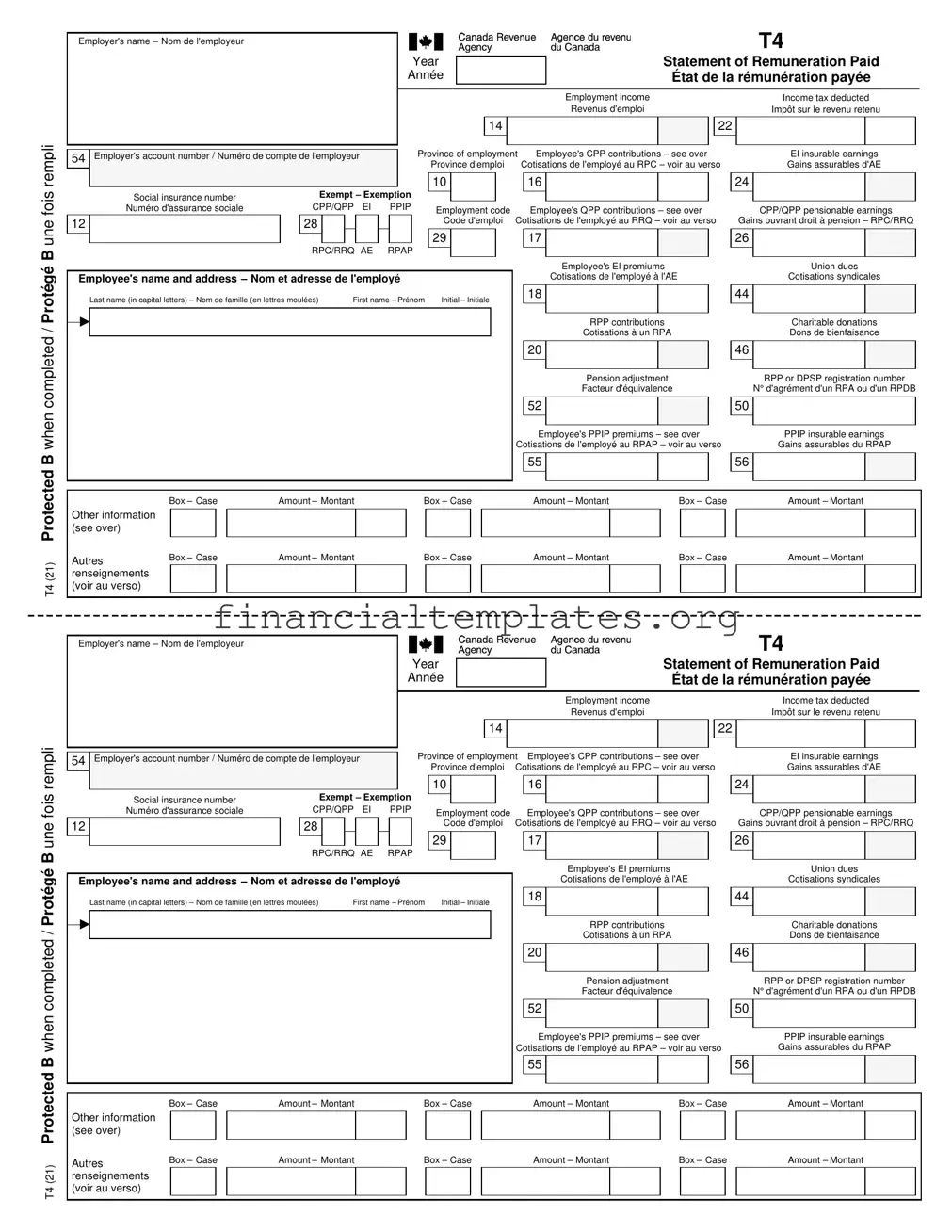

Get T4 Federal Tax Form

Navigating through the maze of tax documentation can be daunting, especially when it comes to understanding forms like the T4, officially known as the Statement of Remuneration Paid. This pivotal document serves multiple purposes, chiefly providing a detailed account of an employee's income from employment and deductions made over the year. It encapsulates various vital pieces of information, such as the employer's name, the employee's Social Insurance Number, and specifics on income and deductions, including employment income, federal and provincial taxes withheld, contributions to the Canada Pension Plan (CPP) or Quebec Pension Plan (QPP), Employment Insurance (EI) premiums, and even contributions to a Registered Pension Plan (RPP). Additionally, it addresses more specialized entries like union dues, charitable donations, and pension adjustments along with insurable earnings under the Provincial Parental Insurance Plan (PPIP) for residents in and outside Quebec. Not just limited to income and withholdings, the form also delves into specific areas such as security option deductions, employment commissions, Canadian Armed Forces personnel and police deductions among others, offering a comprehensive breakdown crucial for both employees and employers in the tax filing process. It's a critical piece of the fiscal puzzle, ensuring accuracy and transparency in reporting to the Canada Revenue Agency (CRA), thus facilitating a smoother tax return process.

T4 Federal Tax Example

|

|

|

|

|

|

|

|

|

|

|

|

T4 |

||

|

Employer's name – Nom de l'employeur |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

Year |

|

|

|

|

|

Statement of Remuneration Paid |

|||||

|

|

|

|

|

|

|

|

|||||||

|

|

|

Année |

|

|

|

|

|

État de la rémunération payée |

|||||

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employment income |

|

|

|

Income tax deducted |

||

|

|

|

|

|

|

|

|

Revenus d'emploi |

|

|

|

Impôt sur le revenu retenu |

||

|

|

|

|

|

14 |

|

|

|

|

|

22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

54 |

Employer's account number / Numéro de compte de l'employeur |

|

|

|

|

Province of employment Employee's CPP contributions – see over |

|||||||||||||||||||||

|

|

|

|

|

Province d'emploi |

Cotisations de l'employé au RPC – voir au verso |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

16 |

|

|

|

|

|

Social insurance number |

|

|

|

Exempt – Exemption |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

CPP/QPP EI |

|

PPIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

Numéro d'assurance sociale |

|

|

|

|

Employment code |

|

Employee's QPP contributions – see over |

||||||||||||||||||

12 |

|

|

|

28 |

|

|

|

|

|

|

|

|

|

Code d'emploi |

Cotisations de l'employé au RRQ – voir au verso |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29 |

|

|

|

|

|

|

|

17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

RPC/RRQ AE |

RPAP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee's EI premiums |

|

|

Employee's name and address – Nom et adresse de l'employé |

|

|

|

|

|

|

|

|

|

|

Cotisations de l'employé à l'AE |

||||||||||||||||

|

|

Last name (in capital letters) – Nom de famille (en lettres moulées) |

|

|

First name – Prénom Initial – Initiale |

|

18 |

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RPP contributions |

||

◄ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cotisations à un RPA |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EI insurable earnings

Gains assurables d'AE

24

CPP/QPP pensionable earnings

Gains ouvrant droit à pension – RPC/RRQ

26

Union dues

Cotisations syndicales

44

Charitable donations

Dons de bienfaisance

46

T4 (21) Protected B when completed / Protégé B une fois rempli

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pension adjustment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RPP or DPSP registration number |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Facteur d'équivalence |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N° d'agrément d'un RPA ou d'un RPDB |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

52 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee's PPIP premiums – see over |

|

|

|

|

|

|

|

|

|

|

|

PPIP insurable earnings |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cotisations de l'employé au RPAP – voir au verso |

|

|

|

|

|

|

|

|

|

Gains assurables du RPAP |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

55 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Box – Case |

|

|

|

|

|

|

|

|

|

|

|

Amount – Montant |

|

|

|

|

|

|

|

|

|

|

Box – Case |

|

|

|

|

Amount – Montant |

Box – Case |

|

|

|

|

|

|

|

|

|

|

|

Amount – Montant |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Other information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

(see over) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Autres |

|

|

Box – Case |

|

|

|

|

|

|

|

|

|

|

|

Amount – Montant |

|

|

|

|

|

|

|

|

|

|

Box – Case |

|

|

|

|

Amount – Montant |

Box – Case |

|

|

|

|

|

|

|

|

|

|

|

Amount – Montant |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

renseignements |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

(voir au verso) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T4 |

||

|

Employer's name – Nom de l'employeur |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

Statement of Remuneration Paid |

|||||

|

|

|

|

|

|

|

|

|||||||

|

|

|

Year |

|

|

|

|

|

||||||

|

|

|

Année |

|

|

|

|

|

État de la rémunération payée |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employment income |

|

|

|

Income tax deducted |

||

|

|

|

|

|

|

|

|

Revenus d'emploi |

|

|

|

Impôt sur le revenu retenu |

||

|

|

|

|

|

14 |

|

|

|

|

|

22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

54 |

Employer's account number / Numéro de compte de l'employeur |

|

|

|

|

Province of employment Employee's CPP contributions – see over |

||||||||||||||||||||||

|

|

|

|

|

Province d'emploi |

Cotisations de l'employé au RPC – voir au verso |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

16 |

|

|

|

|

|

Social insurance number |

|

|

|

|

Exempt – Exemption |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

CPP/QPP EI |

|

PPIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

Numéro d'assurance sociale |

|

|

|

|

|

Employment code |

|

Employee's QPP contributions – see over |

||||||||||||||||||

12 |

|

|

|

28 |

|

|

|

|

|

|

|

|

|

Code d'emploi |

Cotisations de l'employé au RRQ – voir au verso |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29 |

|

|

|

|

|

|

|

17 |

|

|

|

|

|

|

|

|

|

|

RPC/RRQ AE |

RPAP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee's EI premiums |

|

|

Employee's name and address – Nom et adresse de l'employé |

|

|

|

|

|

|

|

|

|

|

Cotisations de l'employé à l'AE |

|||||||||||||||||

|

|

Last name (in capital letters) – Nom de famille (en lettres moulées) |

|

|

First name – Prénom Initial – Initiale |

|

18 |

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RPP contributions |

||

◄ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cotisations à un RPA |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EI insurable earnings

Gains assurables d'AE

24

CPP/QPP pensionable earnings

Gains ouvrant droit à pension – RPC/RRQ

26

Union dues

Cotisations syndicales

44

Charitable donations

Dons de bienfaisance

46

T4 (21) Protected B when completed / Protégé B une fois rempli

|

|

|

|

|

|

|

|

|

|

|

|

|

Pension adjustment |

|

|

|

|

|

|

|

RPP or DPSP registration number |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Facteur d'équivalence |

|

|

|

|

|

|

|

N° d'agrément d'un RPA ou d'un RPDB |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

52 |

|

|

|

|

|

|

|

|

50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee's PPIP premiums – see over |

|

|

PPIP insurable earnings |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

Cotisations de l'employé au RPAP – voir au verso |

|

|

Gains assurables du RPAP |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

55 |

|

|

|

|

|

|

|

|

56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Box – Case |

Amount – Montant |

Box – Case |

|

Amount – Montant |

Box – Case |

|

|

Amount – Montant |

|

||||||||||||||||

Other information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(see over) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Autres |

Box – Case |

Amount – Montant |

Box – Case |

|

Amount – Montant |

Box – Case |

|

|

Amount – Montant |

|

||||||||||||||||

renseignements |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(voir au verso) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

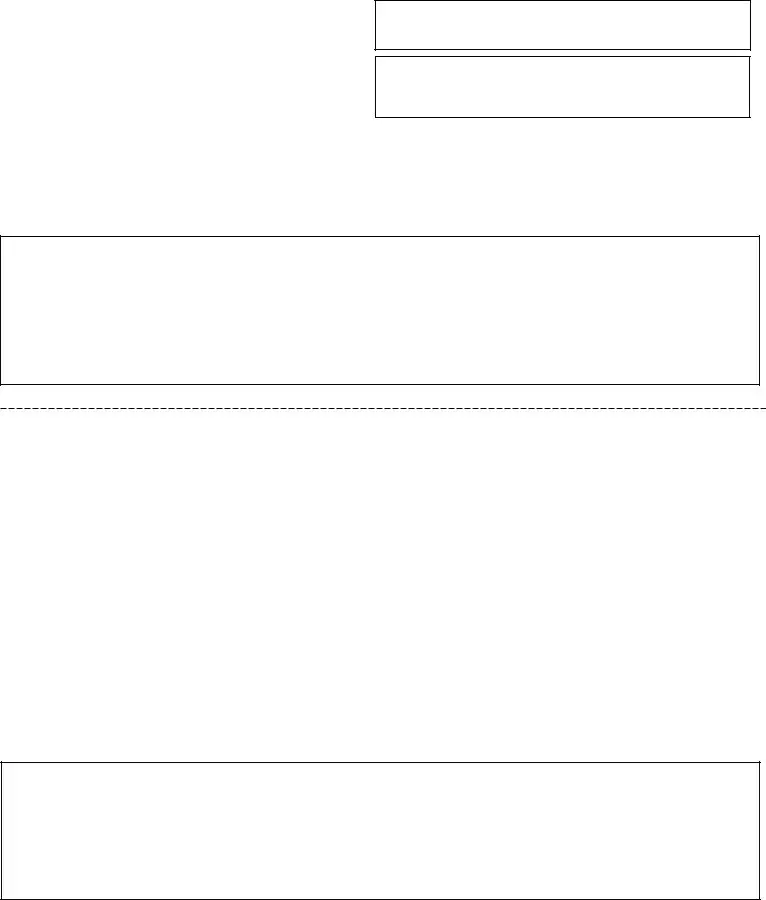

Report these amounts on your tax return.

14 – Employment income – Enter on line 10100.

16 – Employee's CPP contributions – See lines 30800 and 22215 in your tax guide.

17 – Employee's QPP contributions – See lines 30800 and 22215 in your

tax guide.

18 – Employee's EI premiums – See line 31200 in your tax guide.

20 – RPP contributions – Includes past service contributions. See line 20700 in your tax guide.

22 – Income tax deducted – Enter on line 43700.

39 – Security options deduction 110(1)(d) – Enter on line 24900. 41 – Security options deduction 110(1)(d.1) – Enter on line 24900.

42 – Employment commissions – Enter on line 10120. This amount is already included in box 14.

43 – Canadian Armed Forces personnel and police deduction – Enter on line 24400. This amount is already included in box 14.

44 – Union dues – Enter on line 21200.

46 – Charitable donations.

52 – Pension adjustment – Enter on line 20600.

55 – Provincial parental insurance plan (PPIP) – Residents of Quebec, see line 31205 in your tax guide. Residents of provinces or territories other than Quebec, see line 31200 in your tax guide.

66 – Eligible retiring allowances – See line 13000 in your tax guide.

67 –

74 – Past service contributions for 1989 or earlier years while a contributor

75 – Past service contributions for 1989 or earlier years while not a contributor – See line 20700 in your tax guide.

77 – Workers' compensation benefits repaid to the employer – Enter on line 22900.

78 – Fishers – Gross income

79 – Fishers – Net partnership amount

80 – Fishers – Shareperson amount

81 – Placement or employment agency workers

82 – Taxi drivers and drivers of other

83 – Barbers or hairdressers

85 –

87 – Emergency services volunteer exempt amount – See "Emergency services volunteers" at line 10100, and the information at lines 31220 and 31240 in your tax guide.

71 |

– Indian (exempt income) – Employment |

See Form T90. Do not enter |

|

88 |

– Indian (exempt income) – Self employed |

this amount on line 10100 or |

|

lines 13499 to 14300. |

|||

|

|

||

|

|

|

Do not report these amounts on your tax return. For Canada Revenue Agency use only. (Amounts in boxes 30, 32, 34, 36, 38, 40, 57, 58, 59, 60, and 86 are already included in box 14.)

30 – Board and lodging

31 – Special work site

32 – Travel in a prescribed zone

33 – Medical travel assistance

34 – Personal use of employer's automobile or motor vehicle 36 –

38 – Security options benefits

40 – Other taxable allowances and benefits

57 – Employment Income – March 15 to May 9, 2020 58 – Employment Income – May 10 to July 4, 2020

59 – Employment Income – July 5 to August 29, 2020

60 – Employment Income – August 30 to September 26, 2020 69 – Indian (exempt income) –

T4 (21)

Veuillez déclarer ces montants dans votre déclaration de revenus.

14 – Revenus d'emploi – Inscrivez à la ligne 10100.

16 – Cotisations de l'employé au RPC – Lisez les lignes 30800 et 22215 de votre guide d'impôt.

17 – Cotisations de l'employé au RRQ – Lisez les lignes 30800 et 22215 de votre guide d'impôt.

18 – Cotisations de l'employé à l'AE – Lisez la ligne 31200 de votre guide d'impôt.

20 – Cotisations à un RPA – Comprend les cotisations pour services passés. Lisez la ligne 20700 de votre guide d'impôt.

22 – Impôt sur le revenu retenu – Inscrivez à la ligne 43700.

39 – Déduction pour options d'achat de titres 110(1)d) – Inscrivez à la ligne 24900.

41 – Déduction pour options d'achat de titres 110(1)d.1) – Inscrivez à la ligne 24900.

42 – Commissions d'emploi – Inscrivez à la ligne 10120. Ce montant est déjà compris dans la case 14.

43 – Déduction pour le personnel des Forces armées canadiennes et des forces policières – Inscrivez à la ligne 24400. Ce montant est déjà compris

dans la case 14.

44 – Cotisations syndicales – Inscrivez à la ligne 21200. 46 – Dons de bienfaisance.

52 – Facteur d'équivalence – Inscrivez à la ligne 20600.

55 – Régime provincial d'assurance parentale (RPAP) – Résidents du Québec, lisez la ligne 31205 de votre guide d'impôt. Résidents des autres provinces ou territoires, lisez la ligne 31200 de votre guide d'impôt.

66 – Allocations de retraite admissibles – Lisez la ligne 13000 de votre guide d'impôt.

Privacy Act, personal information bank numbers CRA PPU 005 and CRA PPU 047

67 – Allocations de retraite non admissibles – Lisez la ligne 13000 de votre guide d'impôt.

74 – Services passés pour 1989 et les années précédentes pendant que l'employé cotisait

75 – Services passés pour 1989 et les années précédentes pendant que l'employé ne cotisait pas – Lisez la ligne 20700 de votre guide d'impôt.

77 – Indemnités pour accidents du travail remboursées à l'employeur – Inscrivez à la ligne 22900.

78 |

– Pêcheurs – Revenus bruts |

Consultez le formulaire T2121. |

|

79 |

– Pêcheurs – Montant net d'un associé |

||

N'inscrivez pas ce montant à |

|||

|

de la société de personnes |

la ligne 10100. |

|

80 |

– Pêcheurs – Montant du pêcheur à part |

|

|

|

|

|

|

|

|

|

|

81 |

– Travailleurs d'agences ou de |

Revenus bruts |

|

|

bureaux de placement |

||

|

Consultez le formulaire T2125. |

||

82 |

– Chauffeurs de taxi ou d'un autre |

||

N'inscrivez pas ce montant à |

|||

|

véhicule de transport de passagers |

||

|

la ligne 10100. |

||

83 |

– Barbiers et coiffeurs |

||

|

|||

|

|

|

85 – Primes versées par l'employé à un régime privé

ligne 33099 de votre guide d'impôt.

87 – Montant exempt d'impôt versé à un volontaire des services d'urgence –

Lisez « Volontaires des services d’urgence » à la ligne 10100, et les renseignements aux lignes 31220 et 31240 de votre guide d'impôt.

71 |

– Indien ayant un revenu exonéré – emploi |

Consultez le formulaire T90. |

|

88 |

– Indien ayant un revenu exonéré – travail |

N'inscrivez pas ce montant |

|

à la ligne 10100 ou aux |

|||

|

indépendant |

||

|

lignes 13499 à 14300. |

||

|

|

||

|

|

|

Ne déclarez pas ces montants à votre déclaration d'impôt. À l'usage de l'Agence du revenu du Canada seulement. (Les montants des cases 30, 32, 34, 36, 38, 40, 57, 58, 59, 60 et 86 sont déjà inclus à la case 14.)

30 – Pension et logement

31 – Chantier particulier

32 – Voyages dans une zone visée par règlement

33 – Aide accordée pour les voyages pour soins médicaux

34 – Usage personnel de l'automobile ou du véhicule à moteur de l'employeur 36 – Prêts sans intérêt ou à faible intérêt

38 – Avantages liés aux options d'achat de titres

40 – Autres allocations et avantages imposables

57 – Revenus d'emploi – Du 15 mars au 9 mai 2020

58 – Revenus d'emploi – Du 10 mai au 4 juillet 2020

59 – Revenus d'emploi – Du 5 juillet au 29 août 2020

60 – Revenus d'emploi – Du 30 août au 26 septembre 2020

69 – Indien ayant un revenu exonéré – Allocations de retraite non admissibles 86 – Choix liés aux options d'achat de titres

T4 (21) |

Loi sur la protection des renseignements personnels, fichiers de renseignements personnels ARC PPU 005 et ARC PPU 047 |

Document Specifics

| Fact Name | Description |

|---|---|

| Form Usage | The T4 form is used by employers in Canada to report the income they paid to employees. |

| Income Reporting | Employment income, including line 10100, must be reported on the T4 form. |

| Tax Deduction Reporting | Income tax deducted, represented by line 43700, shows the amount of federal income tax withheld from the employee's earnings. |

| CPP Contributions | Employee's Canada Pension Plan contributions are reported, which can affect future CPP benefits. |

| Province of Employment | The province of employment impacts the calculation of taxes and other deductions. |

| Social Insurance Number | Each employee's Social Insurance Number (SIN) is required for identification and tax reporting purposes. |

| Employment Income Details | Detailed information regarding employment income and deductions such as union dues, CPP/QPP pensionable earnings, and charitable donations are itemized. |

| Pension Adjustments | Pension adjustments are reported to ensure accuracy in retirement savings calculations. |

| Specific Taxable Benefits | Other taxable benefits, including employment commissions and security options deductions, are reported separately. |

Guide to Writing T4 Federal Tax

Filling out a T4 Federal Tax Form is an essential step for employees in reporting their annual income and deductions to the Canada Revenue Agency (CRA). This form outlines the income you've received from employment, including wages and any other compensations, along with deductions like income tax and contributions to the Canada Pension Plan or Employment Insurance. While the form might seem daunting at first, breaking down the process into manageable steps can make it a lot easier. Here's how to approach it:

- Start with the employer's details by entering the T4 Employer's name and the Employer's account number as indicated.

- Fill in the year for the Statement of Remuneration Paid to ensure the form corresponds to the correct tax year.

- Enter your Social Insurance Number accurately to ensure your income is correctly reported under your tax profile.

- Under the Employee's name and address section, provide your full name, including your last name in capital letters, first name, and initial, along with your current address.

- Detail your income in the Employment income – line 10100 section, which represents the total amount you earned from employment during the year.

- Record the amount of Income tax deducted in the section corresponding to line 43700 to report how much federal income tax has been withheld from your earnings.

- Input your contributions to the Canada Pension Plan (CPP) or Quebec Pension Plan (QPP) in the sections marked for employee contributions.

- For Quebec residents, include your contributions to the Quebec Parental Insurance Plan (PPIP) in the designated area.

- Don't forget to include any Employment Insurance (EI) premiums you've paid over the year on line 31200.

- If applicable, fill in your contributions to a Registered Pension Plan (RPP) and any Union dues you've paid.

- Report any Charitable donations you’ve made throughout the year in the section corresponding to line 34900.

- Finish by reviewing the other income and deduction sections, including items like pension adjustments, security options deductions, and other less common sources of income or deductions you may need to report.

After completing the form, double-check all the information for accuracy. Ensuring all your income and deductions are accurately reported is crucial for a correct assessment of your taxes. If you're unsure about any part of the form, consider seeking the assistance of a tax professional. Once you're satisfied that everything is in order, you can submit the form to the CRA as part of your tax return. Remember to keep a copy for your records.

Understanding T4 Federal Tax

-

What is a T4 Federal Tax Form?

The T4 Federal Tax Form, officially known as the Statement of Remuneration Paid, is a document that employers in Canada must provide to their employees and the Canada Revenue Agency (CRA). It outlines the employee's income from employment, taxes deducted, and contributions to the Canada Pension Plan (CPP), Quebec Pension Plan (QPP), and Employment Insurance (EI) over the tax year.

-

Who needs to file a T4 Federal Tax Form?

Employers must file a T4 form for each employee who received salary, wages, tips, bonuses, or any other remuneration during the year. Employees use the information from the T4 form to complete their personal income tax returns.

-

What are the key boxes in the T4 Form?

- Box 14 – Employment Income: Indicates the total income before deductions.

- Box 16 & 17 – Employee's CPP/QPP Contributions: Show the amount contributed to the pension plans.

- Box 18 – Employee's EI premiums: Reflects the total Employment Insurance premiums deducted.

- Box 20 – RPP Contributions: If applicable, shows contributions to a Registered Pension Plan.

- Box 22 – Income Tax Deducted: Indicates the total amount of federal income tax deducted from the employee's earnings.

-

How is the T4 Form used when filing a tax return?

Individuals use the information provided on the T4 form to fill out their T1 General Income Tax and Benefit Return. The amounts reported on the T4 should be entered on the corresponding lines of the income tax return, ensuring all earnings and deductions are accurately reported to the CRA.

-

What if there are errors on my T4 Form?

If an employee discovers discrepancies or errors on their T4 form, they should first contact their employer to issue a corrected form. If adjustments are made after filing a tax return, it may be necessary to amend the return through the CRA to reflect the correct information.

-

Where can I get more information or assistance with my T4 Form?

For more guidance on understanding or using the T4 form, individuals can visit the Canada Revenue Agency's website, contact a CRA representative, or seek advice from a professional tax advisor. The CRA website provides comprehensive resources, including guides and contact information for assistance.

Common mistakes

Not reporting all sources of employment income: Taxpayers sometimes forget to include all their T4 slips, especially if they've worked multiple jobs within the year. Remember, every job you've worked where you received a T4 slip needs to be reported to accurately reflect your total employment income on line 10100.

Failing to deduct the correct amount of income tax: It's a common mistake to incorrectly report the income tax deducted by your employer on line 43700. This can result in either owing more tax or receiving a lower refund than expected. Be sure to double-check the amount reported on your T4 slip against your final submission.

Overlooking contributions and premiums: Employee contributions to the Canada Pension Plan (CPP), Quebec Pension Plan (QPP), and Employment Insurance (EI) are easily missed but crucial. These figures, found in the respective sections of your T4, are not only deductible but also influence other tax credits and benefits.

Incorrectly reporting pension adjustments: If you're part of a registered pension plan (RPP) or a deferred profit-sharing plan (DPSP), ensure the pension adjustment reported on line 20600 is accurate. This figure affects your RRSP contribution room.

Missing out on deductions such as union dues and charitable donations: These amounts, which can be found in boxes 44 and 46 of the T4 slip, respectively, are often overlooked. They are deductible and can significantly lower your taxable income.

Not utilizing all available tax credits and deductions: Beyond the T4, there are numerous deductions and credits available, such as for educational programs, children's activities, and medical expenses. Failing to include these where applicable can result in paying more tax than necessary.

Remember, avoiding these mistakes can not only prevent processing delays by the Canada Revenue Agency but also ensure you maximize your refund or minimize the balance owing. When in doubt, consulting with a tax professional can provide clarity and confidence in your tax filing process.

Documents used along the form

When filing taxes in Canada, especially when involving employment income as noted on the T4 form, individuals may need to complete additional forms and documents. These support or supplement the information on the T4, ensuring accurate and compliant tax filing.

- Form T2200 - Declaration of Conditions of Employment: This form is completed by employers for employees who may be able to claim employment expenses on their personal tax return.

- Form T2125 - Statement of Business or Professional Activities: Used by individuals who are self-employed or have business income to report their business earnings and expenses.

- Form T777 - Statement of Employment Expenses: Employees use this form to claim allowable work-related expenses.

- Form T5018 - Statement of Contract Payments: Issued to contractors, it reports the payment amount made to them during the fiscal period for tax purposes.

- RC62 - Universal Child Care Benefit Statement: This slip indicates the amount received in Universal Child Care Benefits, which must be reported as income.

- Receipts for Union Dues and Professional Membership Fees: While not a form, receipts for these payments are necessary for tax deductions if applicable.

- RRSP Contribution Receipts: Receipts for contributions to a Registered Retirement Savings Plan (RRSP) are crucial for claiming deductions on personal income tax returns.

These additional documents are vital for individuals to fully report their income and claim potential deductions. Completing and including them where applicable can lead to a more accurate tax return and potentially beneficial outcomes.

Similar forms

The W-2 form, commonly issued in the United States, shares many similarities with the T4 tax form, providing a statement of income and deductions from employment. Both forms report the employee's annual wages and the amount of taxes withheld by employers. They are critical for individuals when they file their annual tax returns, detailing earnings, income tax deductions, social security contributions, and other related financial data.

A 1099 form, widely used for reporting various types of non-employment income in the U.S., such as independent contractor earnings, is similar to the T4 in its function of reporting income to tax authorities. Although the 1099 series cater to a broader range of income sources beyond employment, like the T4, they serve the essential purpose of ensuring income is accurately reported for tax purposes.