Get T2201 Tax Credit Form

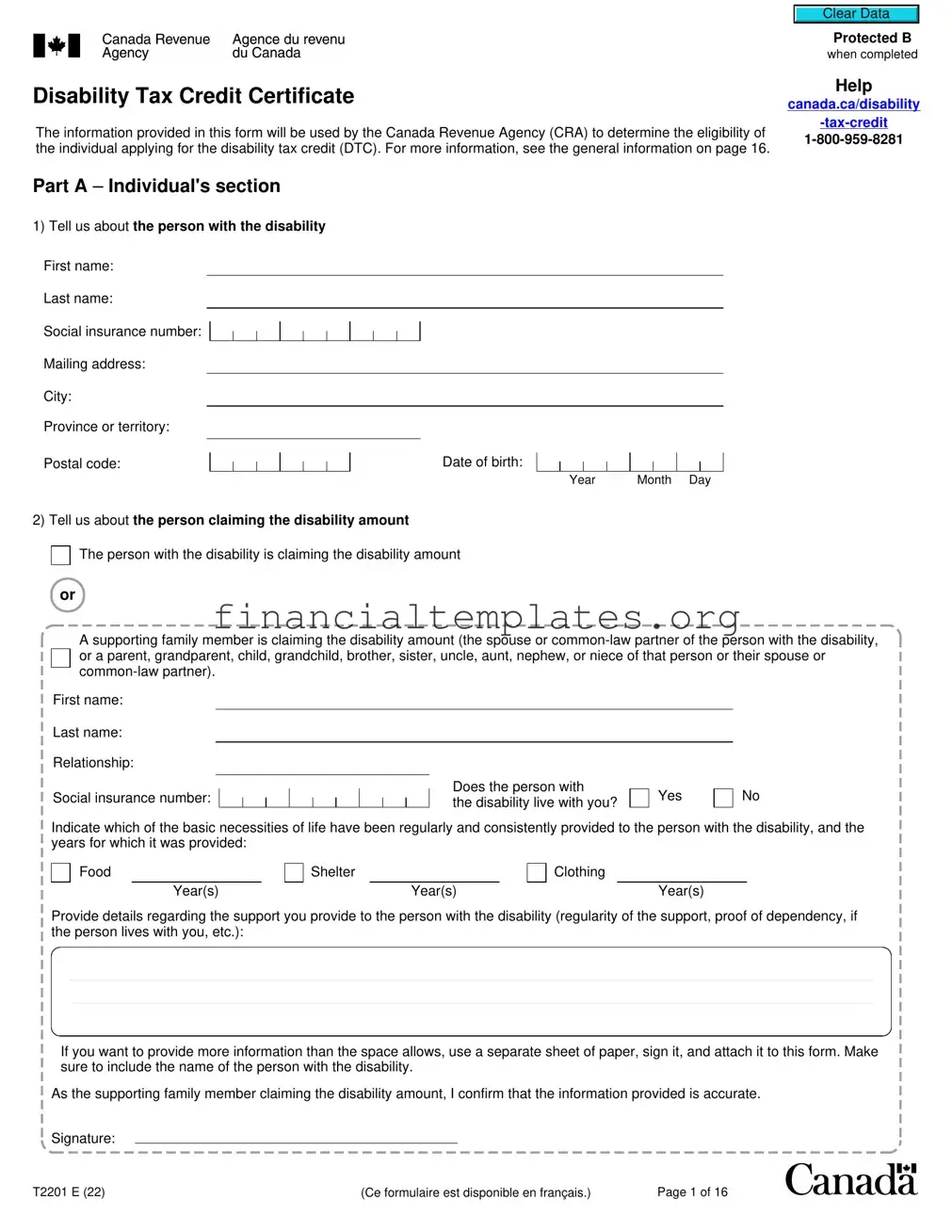

The T2201 Tax Credit form, formally known as the Disability Tax Credit Certificate, is a crucial document for individuals in Canada navigating the complexities of claiming the disability tax credit (DTC). Designed by the Canada Revenue Agency (CRA), this form serves as the primary vehicle to apply for the DTC—a beneficial tax relief aimed at alleviating the financial pressures on those with significant disabilities or the families supporting them. Completing the form involves a collaborative effort between the taxpayer and a qualified medical practitioner, requiring detailed sections to be filled out that outline the nature and extent of the disability. Part A seeks personal information from the applicant, setting the stage for a detailed examination of the disability and its impact on the individual's everyday life, while Part B mandates certification from healthcare professionals regarding the severity and duration of the condition. Besides assessing eligibility, the form also opens discussions on adjusting past tax returns to reflect the individual's entitled credits, underscoring the importance of precise documentation and authentic representation of the disability's effects on daily living. The T2201 form emphasizes not only the condition itself but also the significant enduring impacts on the individual’s basic activities, thus shaping a comprehensive framework for support through the tax system.

T2201 Tax Credit Example

Disability Tax Credit Certificate

The information provided in this form will be used by the Canada Revenue Agency (CRA) to determine the eligibility of the individual applying for the disability tax credit (DTC). For more information, see the general information on page 16.

Clear Data

Protected B

when completed

Help

canada.ca/disability

Part A – Individual's section

1)Tell us about the person with the disability

First name:

Last name:

Social insurance number:

Mailing address:

City:

Province or territory:

Postal code:

Date of birth:

Year |

Month Day |

2)Tell us about the person claiming the disability amount

The person with the disability is claiming the disability amount

or

A supporting family member is claiming the disability amount (the spouse or

First name:

Last name:

Relationship:

Social insurance number:

Does the person with

the disability live with you?

Yes

No

Indicate which of the basic necessities of life have been regularly and consistently provided to the person with the disability, and the years for which it was provided:

Food

Year(s)

Shelter

Year(s)

Clothing

Year(s)

Provide details regarding the support you provide to the person with the disability (regularity of the support, proof of dependency, if the person lives with you, etc.):

If you want to provide more information than the space allows, use a separate sheet of paper, sign it, and attach it to this form. Make sure to include the name of the person with the disability.

As the supporting family member claiming the disability amount, I confirm that the information provided is accurate.

Signature:

T2201 E (22) |

(Ce formulaire est disponible en français.) |

Page 1 of 16 |

Clear Data

Protected B when completed

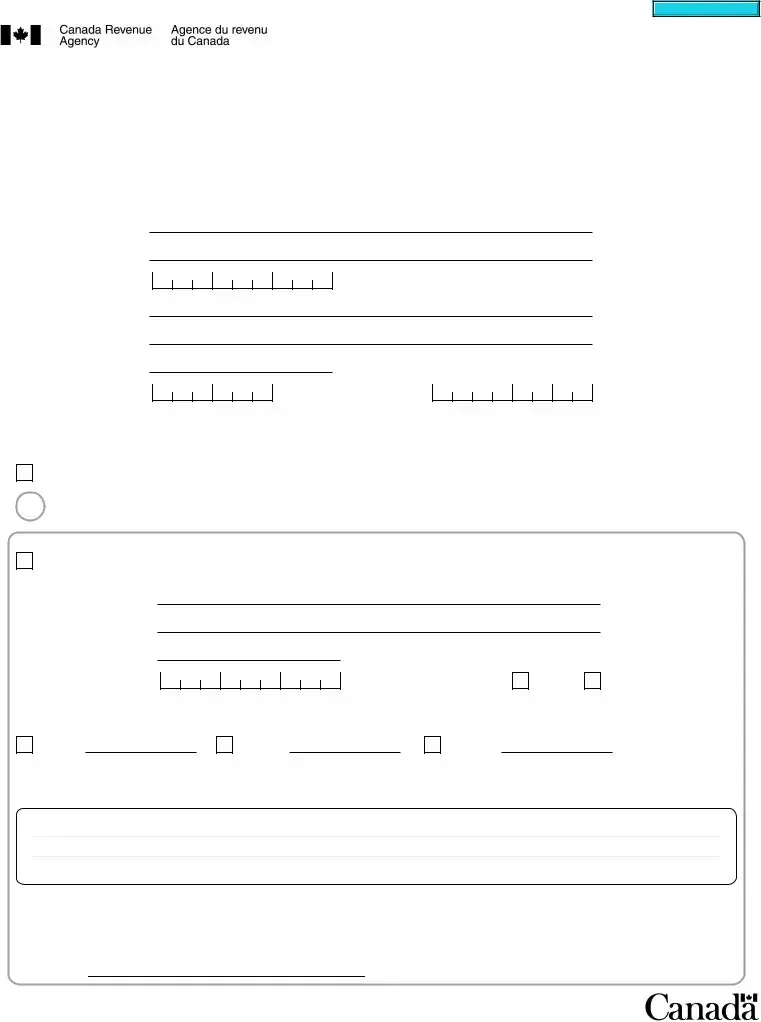

Part A – Individual's section (continued)

3) Previous tax return adjustments

Are you the person with the disability or their legal representative, or if the person is under 18, their legal guardian?

Yes |

No |

If eligibility for the disability tax credit is approved, would you like the CRA to apply the credit to your previous tax returns?

Yes, adjust my previous tax returns for all applicable years.

No, do not adjust my previous tax returns at this time.

4) Individual's authorization

As the person with the disability or their legal representative:

•I certify that the above information is correct.

•I give permission for my medical practitioner(s) to provide the CRA with information from their medical records in order for the CRA to determine my eligibility.

•I authorize the CRA to adjust my returns, as applicable, if I opted to do so in question 3.

Signature: |

|

Telephone number: |

Date: |

|

Year |

Month Day |

Personal information (including the SIN) is collected to administer or enforce the Income Tax Act and related programs and activities including administering tax, benefits, audit, compliance, and collection. The information collected may be used or disclosed for purposes of other federal acts that provide for the imposition and collection of a tax or duty. It may also be disclosed to other federal, provincial, territorial, or foreign government institutions to the extent authorized by law. Failure to provide this information may result in paying interest or penalties, or in other actions. Under the Privacy Act, individuals have a right of protection, access to and correction of their personal information, or to file a complaint with the Privacy Commissioner of Canada regarding the handling of their personal information. Refer to Personal Information Bank CRA PPU 218 on Info Source

at

This marks the end of the individual's section of the form. Ask a medical practitioner to fill out Part B (pages

Next steps:

Step 1 – Ask your medical practitioner(s) to fill out the remaining pages of this form.

Note

Your medical practitioner provides the CRA with your medical information but does not determine your eligibility for the DTC.

Step 2 – Make a copy of the filled out form for your own records.

Step 3 – Refer to page 16 for instructions on how to submit your form to the CRA.

T2201 E (22) |

Page 2 of 16 |

Clear Data

Protected B when completed

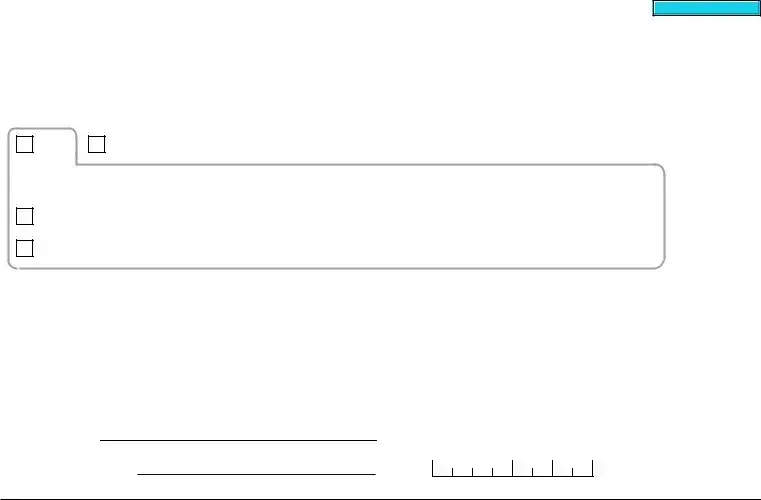

Part B – Medical practitioner's section

If you would like to use the digital application for medical practitioners to fill out your section of the T2201, it can be found at

Important notes on patient eligibility

•Eligibility for the DTC is not based solely on the presence of a medical condition. It is based on the impairment resulting from a condition and the effects of that impairment on the patient. Eligibility, however, is not based on the patient's ability to work, to do housekeeping activities, or to engage in recreational activities.

•A person may be eligible for the DTC if they have a severe and prolonged impairment in physical or mental functions resulting in a marked restriction. A marked restriction means that, even with appropriate therapy, devices, and medication, they are unable or take an inordinate amount of time in one impairment category, all or substantially all (generally interpreted as 90% or more) of the time. If their limitations do not meet the criteria for one impairment category alone, they may still be eligible if they experience significant limitations in two or more categories.

For more information about the DTC, including examples and eligibility criteria, see Guide RC4064,

Next steps

Step 1 – Fill out the sections of the form on pages

When considering your patient’s limitations, assess them compared to someone of similar age who does not have an impairment in that particular category. If your patient experiences limitations in more than one category, they may be eligible under the "Cumulative effect of significant limitations" section on page 14.

If you want to provide more information than the space allows, use a separate sheet of paper, sign it, and attach it to this form. Make sure to include the name of the patient at the top of all pages.

Step 2 – Fill out the "Certification" section on page 16 and sign the form.

Step 3 – You or your patient can send this form to the CRA when both Part A and Part B are filled out and signed (refer to page 16 for instructions).

The CRA will review the information provided to determine your patient's eligibility and advise your patient of our decision. If more information is needed, the CRA may contact you.

T2201 E (22) |

Page 3 of 16 |

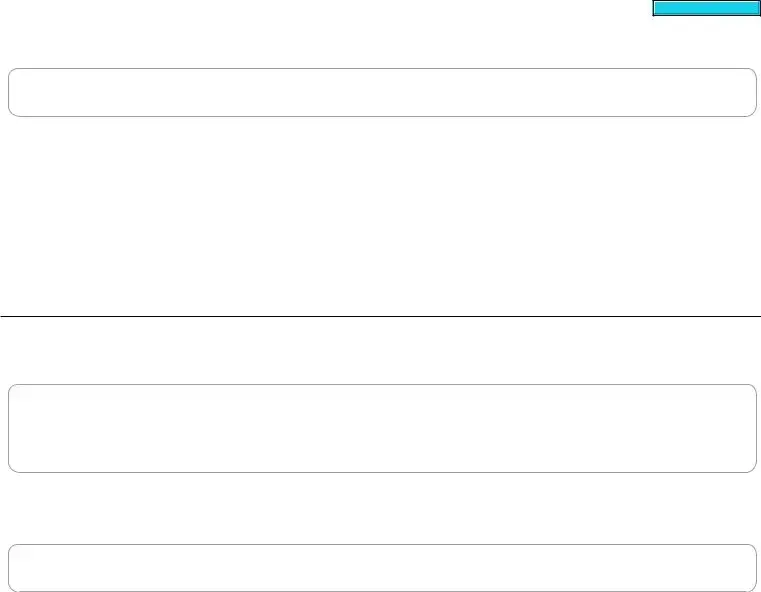

Patient's name:

Vision

|

|

|

|

|

|

|

|

Clear Data |

||

|

|

|

|

|

|

Protected B when completed |

||||

|

|

|

|

|

|

|

|

|

||

|

Initial your designation if this category is applicable to your patient: |

|||||||||

|

|

|

medical doctor |

|

nurse practitioner |

|

|

optometrist |

||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1) Indicate the aspect of vision that is impaired in each eye (visual acuity, field of vision, or both):

|

Left eye after correction |

|

|

|

Right eye after correction |

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Visual acuity |

|

|

|

|

Visual acuity |

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

Measurable on the Snellen chart (provide acuity) |

|

|

|

|

|

|

|

Measurable on the Snellen chart (provide acuity) |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

|

|

Example: 20/200, 6/60 |

|

|

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

Example: 20/200, 6/60 |

||||||||

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Count fingers (CF) |

|

|

|

|

|

|

|

|

Count fingers (CF) |

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

No light perception (NLP) |

|

|

|

|

|

|

|

No light perception (NLP) |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

Light perception (LP) |

|

|

|

|

|

|

|

|

Light perception (LP) |

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

Hand motion (HM) |

|

|

|

|

|

|

|

|

Hand motion (HM) |

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Field of vision (provide greatest diameter) |

|

|

|

Field of vision (provide greatest diameter) |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

degrees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

degrees |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2)Is the patient considered blind in both eyes according to at least one of the following criteria:

•The visual acuity is 20/200 (6/60) or less on the Snellen Chart (or an equivalent).

•The greatest diameter of the field of vision is 20 degrees or less.

Yes (provide the year they became blind)

Year

or

No (provide the year the vision limitations began)

Year

Medical doctors and nurse practitioners only: If your patient experiences limitations in more than one category, tell us more about the patient's limitations in vision. They may be eligible under the "Cumulative effect of significant limitations" section on page 14.

Provide examples of how their limited vision impacts other activities of daily living (for example, walking, feeding). Also provide any other relevant details such as devices the patient uses to aid their vision (for example, cane, magnifier, service animal).

3) |

Has the patient's impairment in vision lasted, or is it expected to last, for a continuous period of at least 12 months? |

||||||||||

|

|

Yes |

No |

|

|

|

|

|

|

|

|

4) |

Has the patient's impairment in vision improved or is it likely to improve to such an extent that they would no longer be impaired? |

||||||||||

|

|

Yes (provide year) |

|

|

|

|

|

|

No |

Unsure |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

T2201 E (22) |

Page 4 of 16 |

Patient's name:

Speaking

Clear Data

Protected B when completed

Initial your designation if this category is applicable to your patient:

|

|

medical doctor |

|

nurse practitioner |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1) List any medical conditions that impact the patient's ability to speak so as to be understood and provide the year of diagnosis (if available):

2) Does the patient take medication that aids their speaking limitations?

Yes

No

Unsure

3) Describe if the patient uses any devices or therapy to aid their speaking limitations (for example, voice amplifier, behavioural therapy):

4)Provide examples of the factors that limit the patient's ability to speak using the severity and frequency scales provided as a guide (for example, they often require repetition to be understood, always experience mild difficulty with articulation, selective mutism, they use sign language as their primary means of communicating):

|

|

Severity |

|

|

|

|

Frequency |

|

|

Mild |

Mild to |

Moderate |

Moderate to |

Severe |

Rarely |

Occasionally |

Often |

Usually |

Always |

|

moderate |

|

severe |

|

|

|

|

|

|

5)Tell us in the table below about the patient's ability to speak so as to be understood by a familiar person in a quiet setting (more than one answer may apply, given that the patient's ability may change over time). Evaluate their ability to speak so as to be understood when using the medication, devices, and therapy listed above, if applicable.

|

|

|

Limitations in speaking |

Is this the case all or substantially |

Year this began |

|

||||||

|

|

|

|

|||||||||

|

|

|

all of the time (see page 3)? |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The patient is unable to speak or takes an inordinate amount of |

|

|

|

|

|

|

|

|

|

||

|

time to speak so as to be understood (at least three times longer |

Yes |

No |

|

|

|

|

|

|

|

||

|

than someone of similar age without a speech impairment) by a |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||

|

familiar person in a quiet setting. |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The patient has difficulty, but does not take an inordinate amount |

|

|

|

|

|

|

|

|

|

||

|

of time to speak so as to be understood by a familiar person in a |

Yes |

No |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|||||

|

quiet setting.1 |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

1If your patient experiences limitations in more than one category, they may be eligible under the "Cumulative effect of significant limitations section" on page 14.

6) Has the patient's impairment in speaking lasted, or is it expected to last, for a continuous period of at least 12 months?

Yes

No

7) Has the patient's impairment in speaking improved or is it likely to improve to such an extent that they would no longer be impaired?

Yes (provide year)

Year

No

Unsure

T2201 E (22) |

Page 5 of 16 |

Patient's name:

Hearing

Clear Data

Protected B when completed

Initial your designation if this category is applicable to your patient:

|

|

medical doctor |

|

nurse practitioner |

|

audiologist |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1)Indicate the option that best describes the patient's level of hearing loss in each ear with any applicable devices (normal:

mild:

Left ear |

|

Right ear |

|

|

|

|

|

|

2) Provide the patient's overall word discrimination score in both ears:

%

Unknown

3) Describe if the patient uses any devices to aid their hearing (for example, cochlear implant, hearing aid):

4)Provide the medical condition causing hearing loss and examples of the impacts of hearing loss on your patient using the severity and frequency scales as a guide (for example, they often require the use of repetition,

|

|

Severity |

|

|

|

|

Frequency |

|

|

Mild |

Mild to |

Moderate |

Moderate to |

Severe |

Rarely |

Occasionally |

Often |

Usually |

Always |

|

moderate |

|

severe |

|

|

|

|

|

|

5)Tell us in the table below about the patient's ability to hear so as to understand a familiar person in a quiet setting (more than one answer may apply, given that the patient's ability may change over time). Evaluate their ability to hear when using the devices listed above, if applicable.

|

|

|

Limitations in hearing |

Is this the case all or substantially |

Year this began |

|

||||||

|

|

|

|

|||||||||

|

|

|

all of the time (see page 3)? |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The patient is unable to hear or takes an inordinate amount of |

|

|

|

|

|

|

|

|

|

||

|

time to hear so as to understand (at least three times longer than |

Yes |

No |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|||||

|

someone of similar age without a hearing impairment) a familiar |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||

|

person in a quiet setting. |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The patient has difficulty, but does not take an inordinate amount |

Yes |

No |

|

|

|

|

|

|

|

||

|

of time to hear so as to understand a familiar person in a quiet |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|||||

|

setting.1 |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

1If your patient experiences limitations in more than one category, they may be eligible under the "Cumulative effect of significant limitations" section on page 14.

6) Has the patient's impairment in hearing lasted, or is it expected to last, for a continuous period of at least 12 months?

Yes

No

7) Has the patient's impairment in hearing improved or is it likely to improve to such an extent that they would no longer be impaired?

Yes (provide year)

Year

No

Unsure

T2201 E (22) |

Page 6 of 16 |

Patient's name:

Walking

Clear Data

Protected B when completed

Initial your designation if this category is applicable to your patient:

|

|

medical doctor |

|

nurse practitioner |

|

occupational therapist |

|

physiotherapist |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1) List any medical conditions that impact the patient's ability to walk and provide the year of diagnosis (if available):

2) Does the patient take medication to aid their limitations in walking?

Yes

No

Unsure

3) Describe if the patient uses any devices or therapy to aid their limitation in walking (for example: cane, occupational therapy):

4)Provide examples of the factors that limit the patient's ability to walk using the severity and frequency scales provided as a guide (for example, they have severe pain in their legs, they often have moderately impaired balance, they experience shortness of breath upon mild exertion):

|

|

Severity |

|

|

|

|

Frequency |

|

|

Mild |

Mild to |

Moderate |

Moderate to |

Severe |

Rarely |

Occasionally |

Often |

Usually |

Always |

|

moderate |

|

severe |

|

|

|

|

|

|

5)Tell us in the table below about the patient's ability to walk, for example, a short distance such as 100 metres (more than one answer may apply, given that the patient's ability may change over time). Evaluate their ability to walk when using the devices and therapy listed above, if applicable.

|

|

|

Limitations in walking |

Is this the case all or substantially |

Year this began |

|

||||||

|

|

|

|

|||||||||

|

|

|

all of the time (see page 3)? |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The patient is unable or takes an inordinate amount of time to |

|

|

|

|

|

|

|

|

|

||

|

walk (at least three times longer than someone of a similar age |

Yes |

No |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|||||

|

without an impairment in walking). |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The patient has difficulty, but does not take an inordinate amount |

Yes |

No |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|||||

|

of time to walk.1 |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

1If your patient experiences limitations in more than one category, they may be eligible under the "Cumulative effect of significant limitations" section on page 14.

6) Has the patient's impairment in walking lasted, or is it expected to last, for a continuous period of at least 12 months?

Yes

No

7) Has the patient's impairment in walking improved or is it likely to improve to such an extent that they would no longer be impaired?

Yes (provide year)

Year

No

Unsure

T2201 E (22) |

Page 7 of 16 |

Patient's name:

Eliminating

Clear Data

Protected B when completed

Initial your designation if this category is applicable to your patient:

|

|

medical doctor |

|

nurse practitioner |

|

|

|

|

|

|

|

|

|

|

1)List any medical conditions that impact the patient's ability to personally manage bowel or bladder functions and provide the year of diagnosis (if available):

2) Does the patient take medication to aid their limitations in bowel or bladder functions?

Yes

No

Unsure

3)Describe if the patient uses any devices or therapy to aid their limitations in bowel or bladder functions (for example, ostomy, biological therapy):

4)Provide examples of the factors that limit the patient's ability to personally manage their bowel or bladder functions using the severity and frequency scales provided as a guide (for example, they always require assistance from another person to manage bowel or bladder functions, they have chronic constipation or diarrhea, they often have fecal or urinary incontinence, they usually require intermittent catheterization):

|

|

Severity |

|

|

|

|

Frequency |

|

|

Mild |

Mild to |

Moderate |

Moderate to |

Severe |

Rarely |

Occasionally |

Often |

Usually |

Always |

|

moderate |

|

severe |

|

|

|

|

|

|

5)Tell us in the table below about the patient's ability to personally manage their bowel or bladder functions (more than one answer may apply, given that the patient's ability may change over time). Evaluate their ability to personally manage bowel or bladder functions when using the medication, devices, and therapy listed above, if applicable.

|

Limitations in eliminating |

Is this the case all or substantially |

Year this began |

|

|

||||||||

|

|

||||||||||||

|

all of the time (see page 3)? |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The patient is unable or takes an inordinate amount of time to |

|

|

|

|

|

|

|

|

|

|

||

|

personally manage bowel or bladder functions (at least three |

Yes |

No |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||||||

|

times longer than someone of similar age without an impairment |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|||

|

in these functions). |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The patient has difficulty, but does not take an inordinate amount |

Yes |

No |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||||||

|

of time to personally manage bowel or bladder functions.1 |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1If your patient experiences limitations in more than one category, they may be eligible under the "Cumulative effect of significant limitations" section on page 14.

6) Has the patient's impairment in bowel or bladder functions lasted, or is it expected to last, for a continuous period of at least 12 months?

Yes

No

7)Has the patient's impairment in bowel or bladder functions improved or is it likely to improve to such an extent that they would no longer be impaired?

Yes (provide year)

Year

No

Unsure

T2201 E (22) |

Page 8 of 16 |

Patient's name:

Feeding

Clear Data

Protected B when completed

Initial your designation if this category is applicable to your patient:

|

|

medical doctor |

|

nurse practitioner |

|

occupational therapist |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This impairment category includes the acts of feeding oneself as well as preparing food, except when the time spent on food preparation is related to a dietary restriction or regime. It does not include identifying, finding, shopping for, or obtaining food.

1) List any medical conditions that impact the patient's ability to feed themselves and provide the year of diagnosis (if available):

2) Does the patient take medication to aid their limitations in feeding themselves?

Yes

No

Unsure

3)Describe if the patient uses any devices or therapy to aid their limitations in feeding themselves (for example, assistive utensils, occupational therapy):

4)Provide examples of the factors that limit the patient's ability to feed themselves using the severity and frequency scales provided as a guide (for example, they often require assistance from another person to prepare their meals or feed themselves, their dexterity is always severely impaired, they have moderate tremors, they rely exclusively on tube feeding):

|

|

Severity |

|

|

|

|

Frequency |

|

|

Mild |

Mild to |

Moderate |

Moderate to |

Severe |

Rarely |

Occasionally |

Often |

Usually |

Always |

|

moderate |

|

severe |

|

|

|

|

|

|

5)Tell us in the table below about the patient's ability to feed themselves (more than one answer may apply, given that the patient's ability may change over time). Evaluate their ability to feed themselves when using the medication, devices, and therapy listed above, if applicable.

|

Limitations in feeding oneself |

Is this the case all or substantially |

Year this began |

|

|

||||||||

|

|

||||||||||||

|

all of the time (see page 3)? |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The patient is unable or takes an inordinate amount of time to |

|

|

|

|

|

|

|

|

|

|

||

|

feed themselves (at least three times longer than someone of |

Yes |

No |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||||||

|

similar age without an impairment in that ability). |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The patient has difficulty, but does not take an inordinate amount |

Yes |

No |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||||||

|

of time to feed themselves.1 |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1If your patient experiences limitations in more than one category, they may be eligible under the "Cumulative effect of significant limitations" section on page 14.

6) Has the patient's impairment in feeding themselves lasted, or is it expected to last, for a continuous period of at least 12 months?

Yes

No

7)Has the patient's impairment in feeding themselves improved or is it likely to improve to such an extent that they would no longer be impaired?

Yes (provide year)

Year

No

Unsure

T2201 E (22) |

Page 9 of 16 |

Patient's name:

Dressing

Clear Data

Protected B when completed

Initial your designation if this category is applicable to your patient:

|

|

medical doctor |

|

nurse practitioner |

|

occupational therapist |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This impairment category does not include identifying, finding, shopping for, or obtaining clothing.

1) List any medical conditions that impact the patient's ability to dress themselves and provide the year of diagnosis (if available):

2) Does the patient take medication to aid their limitations in dressing?

Yes

No

Unsure

3)Describe if the patient uses any devices or therapy to aid their limitations in dressing themselves (for example, button hook, occupational therapy):

4)Provide examples of the factors that limit the patient's ability to dress themselves using the severity and frequency scales provided as a guide (for example, they often require assistance from another person to dress themselves, they have severe pain in their upper extremities, they often have moderately limited range of motion):

|

|

Severity |

|

|

|

|

Frequency |

|

|

Mild |

Mild to |

Moderate |

Moderate to |

Severe |

Rarely |

Occasionally |

Often |

Usually |

Always |

|

moderate |

|

severe |

|

|

|

|

|

|

5)Tell us in the table below about the patient’s ability to dress themselves (more than one answer may apply, given that the patient's ability may change over time). Evaluate their ability to dress themselves when using the medication, devices, and therapy listed above, if applicable.

|

Limitations in dressing oneself |

Is this the case all or substantially |

Year this began |

|

|

||||||||

|

|

||||||||||||

|

all of the time (see page 3)? |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The patient is unable or takes an inordinate amount of time to |

|

|

|

|

|

|

|

|

|

|

||

|

dress themselves (at least three times longer than someone of |

Yes |

No |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||||||

|

similar age without an impairment in that ability). |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The patient has difficulty, but does not take an inordinate amount |

Yes |

No |

|

|

|

|

|

|

|

|

||

|

of time to dress themselves.1 |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1If your patient experiences limitations in more than one category, they may be eligible under the "Cumulative effect of significant limitations" section on page 14.

6) Has the patient's impairment in dressing themselves lasted, or is it expected to last, for a continuous period of at least 12 months?

Yes

No

7)Has the patient's impairment in dressing themselves improved or is it likely to improve to such an extent that they would no longer be impaired?

Yes (provide year)

Year

No

Unsure

T2201 E (22) |

Page 10 of 16 |

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of T2201 Form | The T2201 Tax Credit form, named Disability Tax Credit Certificate, is used to apply for the Disability Tax Credit (DTC) by determining eligibility based on information provided by both the taxpayer and a certified medical practitioner. |

| Two-Part Process | Part A of the T2201 form is to be completed and signed by the taxpayer, while Part B requires completion and certification by a medical practitioner, establishing the extent of the disability and its impact on daily living. |

| Eligibility Criteria | Eligibility for the DTC is not determined by the diagnosis of a specific medical condition itself but by the effects of the impairment on the individual’s ability to perform basic activities of daily living, as assessed against criteria outlined in the form. |

| Adjustment of Tax Returns | Once approved for the DTC, the Canada Revenue Agency (CRA) can adjust the individual's tax returns for all applicable years to include the disability amount for either the individual or a dependant under the age of 18, depending on the case. |

Guide to Writing T2201 Tax Credit

The Disability Tax Credit (DTC) serves as a vital provision for individuals with disabilities, offering a tax break that acknowledges the added expenses they face. The completion process of the T2201 Tax Credit form, required to apply for the DTC, involves both the applicant and a certified medical practitioner. Once accurately filled, submitted to the Canada Revenue Agency (CRA), and approved, it may provide significant financial relief. The steps are enumerated for clarity and ease, ensuring applicants can confidently navigate the process.

- Part A – Completion by the Taxpayer

- Begin with your personal information in Section 1. This includes your first name, initial, last name, social insurance number, and contact details such as mailing address, city, province or territory, postal code, and your date of birth.

- In Section 2, if the person claiming the disability amount is different from the person with the disability, fill out their details including the relationship to the person with the disability and answer specific questions regarding living situations, financial dependence, and support provided for basic necessities.

- In Section 3, indicate whether you wish the CRA to adjust your tax returns to include the disability amount for previous years, if eligible.

- Complete the authorization in Section 4, allowing medical practitioners to share medical information with the CRA and permitting the CRA to adjust your tax returns as applicable.

- Part B – Completion by the Medical Practitioner

- The medical practitioner must fill out the section(s) relevant to the patient’s condition on pages 2 to 4. This includes checking boxes for specific capabilities like vision, speaking, hearing, walking, eliminating, feeding, dressing, and mental functions necessary for everyday life, and providing details on life-sustaining therapy if applicable.

- On page 5, detailed information regarding the effects of impairment, the duration, and certification must be completed. This includes specifying how the impairment affects the patient’s daily activities, confirming the impairment’s expected duration, and the medical practitioner’s certification that they provided accurate information regarding the patient’s condition.

- Sending the Form to the CRA

- After both parts of the form are filled, review it for accuracy and completeness. Ensure that all necessary signatures are in place.

- Send the completed form to the CRA. The mailing address can be found on the CRA website or by contacting their office directly.

Successfully submitting the T2201 form is the initial step towards obtaining the DTC. However, approval rests with the CRA, which evaluates the application based on the detailed information provided. Keep a copy of the filled form for your records, and be prepared to provide additional documentation if the CRA requests it. Ensuring that both the taxpayer and medical practitioner sections are meticulously completed will facilitate a smoother processing of the application.

Understanding T2201 Tax Credit

What is the T2201 Tax Credit form used for?

The T2201 Tax Credit form, officially known as the Disability Tax Credit Certificate, is an essential document for individuals applying for the disability tax credit (DTC) in Canada. The Canada Revenue Agency (CRA) uses the information provided through this form to determine whether an individual is eligible for the DTC. This tax credit is intended to provide financial relief for individuals or their supporting family members if they have a severe and prolonged impairment in physical or mental functions.

How do I fill out the T2201 form?

To complete the T2201 form, follow these steps:

- Part A must be filled out and signed by the person with a disability or their legal representative. It asks for personal details and the nature of the claim.

- Part B requires certification from a qualified medical practitioner who must fill out specific sections related to the patient's impairment, its effects, duration, and certify the form.

- Finally, send the completed form to the Canada Revenue Agency for assessment.

Who can certify Part B of the T2201 form?

Various medical practitioners are authorized to certify Part B, depending on the nature of the impairment. This includes medical doctors, nurse practitioners, optometrists, audiologists, physiotherapists, psychologists, speech-language pathologists, and occupational therapists. Each section of the form specifies which type of medical professional can certify the information.

Can the CRA adjust my tax returns based on the approval of my T2201 form?

Yes, once your eligibility for the DTC is approved, you can request the CRA to adjust your tax returns for all applicable years to include the disability amount for yourself or a dependent. You must indicate your consent for this adjustment in Section 3 of the form.

What is considered a "marked restriction" for the purpose of the DTC?

A "marked restriction" refers to an impairment that significantly restricts an individual's ability to perform one or more of the basic activities of daily living all or substantially all of the time (at least 90% of the time), even with therapy, medication, and devices. These activities include walking, speaking, hearing, feeding, dressing, eliminating (bowel or bladder functions), and mental functions necessary for everyday life.

What is "life-sustaining therapy" and how does it affect DTC eligibility?

Life-sustaining therapy is treatment required to support a vital function, which must be administered at least three times per week for an average of not less than 14 hours per week. To qualify for the DTC under this category, the therapy must be crucial for maintaining life, and the time requirement excludes the duration for activities related to dietary restrictions or regimes, exercise, travel time to receive the therapy, medical appointments, shopping for medication, or recuperation after therapy.

How long must an impairment last to qualify for the DTC?

An impairment must be long-term, lasting or expected to last for a continuous period of at least 12 months, to qualify for the DTC. This criterion is meant to ensure that the tax credit supports individuals with severe and prolonged impairments.

What if the medical practitioner needs more space to describe the effects of impairment?

If additional space is required to thoroughly describe the effects of an impairment, the medical practitioner is advised to use a separate sheet of paper. This supplementary document should be signed by the practitioner and attached to the T2201 form when submitted.

Is it necessary for the medical practitioner to have medical information on file to support the application?

Yes, the medical practitioner certifying the form must have medical information on file supporting the restrictions for all the years they certify on the T2201 form. This ensures that there is adequate medical documentation to back up the claim for the DTC.

What happens if incorrect information is provided on the T2201 form?

Providing false or misleading information on the T2201 form is considered a serious offence. The form serves as a declaration that all the information given is correct and complete to the best of the medical practitioner’s and applicant's knowledge and belief. It is crucial to review all entries carefully to ensure accuracy and avoid potential legal consequences.

Common mistakes

When applying for the Disability Tax Credit (DTC) using the T2201 form, applicants and their medical practitioners must navigate several critical parts accurately to ensure eligibility is correctly assessed. However, even with clear instructions, mistakes can happen. Here are five common errors:

- Failing to Complete All Relevant Sections: Every part of the form that applies to the applicant's situation needs to be filled out. This includes both Part A, which is the responsibility of the applicant or their legal representative, and Part B, which must be completed by a qualified medical practitioner. Skipping sections or leaving fields blank can lead to incomplete submissions, delaying the process.

- Incorrect or Incomplete Information about Medical Practitioners: Part B of Form T2201 requires detailed information from a certified medical practitioner who can attest to the applicant's condition. Providing incorrect details or incomplete contacts for this practitioner can cause unnecessary delays. The Canada Revenue Agency (CRA) uses this information to verify the medical condition and may need to contact the practitioner for further details.

- Misunderstanding the Criteria for Marked Restrictions: The form assesses eligibility based on severe and prolonged impairments in basic activities of daily living. Applicants or their medical practitioners sometimes misunderstand what constitutes a "marked restriction" for the purposes of the DTC. For example, it’s not just about whether an individual has an impairment, but how it affects their daily life nearly all the time.

- Overlooking the Importance of Duration: The DTC requires that the impairment has lasted, or is expected to last, for a continuous period of at least 12 months. Sometimes, applicants neglect to provide clear information on the expected duration of the impairment, or mistakenly believe that short-term disabilities qualify, leading to rejected applications.

- Incorrectly Reporting the Effects of Impairments: Part B of the form asks for a mandatory description of how the impairment affects the applicant's basic activities of daily living. Vague or incomplete descriptions of these effects can hinder the CRA's ability to fully understand the extent of the disability, potentially resulting in the denial of the claim. It's crucial that this section includes detailed examples of the impairment's impact on the individual’s life.

Making mistakes on the T2201 form can be easily avoided with careful attention to detail and a clear understanding of the DTC requirements. Applicants are encouraged to consult with healthcare providers to ensure accurate and thorough documentation of their condition, and to review their application carefully before submission. Properly completed, the form facilitates a smoother review process by the CRA, helping eligible Canadians receive the support they need.

Documents used along the form

Applying for the Disability Tax Credit (DTC) using form T2201 can be a significant step for individuals or families managing disabilities. This process often requires additional documentation to support the application or further assist in financial planning and care management. Understanding these forms and documents can help in navigating through the systems and ensuring that all necessary information is provided for a successful application.

- Medical Expense Tax Credit (METC) Form: This form is used to claim medical expenses not covered by insurance or other programs. It includes a wide range of expenses, including those for treatment, equipment, and certain home modifications, providing financial relief for individuals with sustained medical expenses.

- Registered Disability Savings Plan (RDSP) Form: For those eligible for the DTC, opening an RDSP can be a valuable step. This savings plan is intended to help save for the long-term financial security of a person with a disability. Contributions to an RDSP are not tax-deductible, but the plan can grow tax-free until funds are withdrawn.

- Child Disability Benefit (CDB) Application: Families with a child under the age of 18 who qualifies for the DTC may also be eligible for the CDB, a tax-free monthly payment aimed at assisting with the costs of raising a child with a disability.

- CPP Disability Benefit Application: This form is for individuals who have contributed to the Canada Pension Plan and are unable to work regularly at any job due to a disability. The CPP Disability Benefit is a monthly payment available to qualifying individuals before they turn 65.

While each of these documents plays a unique role in the broader picture of care and financial planning for individuals with disabilities, together they form a comprehensive support system. Navigating these forms can be challenging, but understanding each one's purpose and how they interlink can offer substantial benefits and ensure that individuals and their families receive the support they need. The successful completion and submission of these documents can provide not only financial relief but also peace of mind during difficult times.

Similar forms

The T2201 Tax Credit form, specifically designed for disability tax credit applications in Canada, shares similarities with various other forms and documents across different jurisdictions and systems. These similarities range from the purpose of the form to the detailed information required from applicants.

One document similar to the T2201 is the Form 1040 Schedule R in the United States, used for calculating the Credit for the Elderly or the Disabled. Both forms require detailed personal information and medical certification to support claims of disability or impairment, underscoring the necessity to validate eligibility for tax benefits based on health conditions.

The SSA-16 form, used to apply for Social Security Disability Insurance (SSDI) in the U.S., also mirrors the T2201 in several aspects. Applicants must provide comprehensive personal and medical information, highlighting the severity and duration of their disability. This parallels the T2201’s requirements for detailed medical practitioner certification.

In the United Kingdom, the PIP (Personal Independence Payment) application process involves a form that requires detailed medical information similar to the T2201. Applicants must explain how their disability affects their daily life, akin to the T2201's emphasis on the effects of impairment on basic activities of daily living.

Australia's Disability Support Pension (DSP) application process likewise involves providing detailed personal and medical information to the Department of Human Services. Like the T2201, it necessitates a thorough medical report, reflecting the individual's functional limitations and how these impair their ability to work, akin to the T2201's approach in assessing eligibility for tax credits.

In the realm of education and accommodations, the 504 Plan application in the U.S. educational system also shares similarities with the T2201. Both require a delineation of an individual’s specific limitations and the accommodations or support needed, although the 504 Plan focuses more on educational adjustments rather than financial relief.

The Veterans Affairs Disability Compensation form, which allows veterans to claim benefits for disabilities related to their service, similarly necessitates comprehensive medical information and history, akin to the T2201. It underscores the importance of establishing a clear link between the disability and the claimant's needs.

The Employment and Support Allowance (ESA) forms used within the UK's welfare system require detailed personal and medical information to assess an individual’s ability to work, aligning with the T2201's objective to ascertain how a disability impacts an individual's daily functions.

Lastly, the IRS Form 8857, Request for Innocent Spouse Relief in the U.S., while not directly related to disability, parallels the T2201 in requiring detailed personal narratives and documentation. Applicants must provide substantial proof of their situation, similar to how the T2201 demands comprehensive medical evidence to support a claim.

These documents, each from various domains such as social security, veterans' benefits, education, and tax systems across the globe, illustrate the universal need to substantiate claims for assistance or exemptions thoroughly. They all emphasize the necessity of detailed, accurate information to support the specific needs of individuals, whether for financial relief, educational accommodations, or welfare assistance.

Dos and Don'ts

Filing the T2201 Tax Credit form, also known as the Disability Tax Credit Certificate, requires careful attention to detail to ensure accuracy and completeness. Here are seven dos and don'ts to consider:

- Do carefully review the entire form before starting, paying close attention to the eligibility criteria outlined in the General Information section. This step ensures that you or the person you're applying for meets the necessary conditions for the Disability Tax Credit (DTC).

- Do ensure that all personal information about the person with the disability, including the Social Insurance Number (SIN), is accurately filled in. Errors in personal details can lead to unnecessary delays in the processing of your application.

- Do have a qualified medical practitioner fill out and certify Part B of the form. This part is crucial as it details the effects of the impairment and supports the eligibility for the DTC.

- Do provide detailed and clear descriptions of the effects of impairment in Part B, especially in the sections that require narrative answers. If necessary, attach separate sheets of paper for additional space, ensuring they are signed and dated.

- Do check the box in Section 3 if you want the Canada Revenue Agency (CRA) to adjust your returns to include the disability amount for the applicable years, once eligibility is approved. This can result in significant tax savings.

- Don't overlook the certification section at the end of Part B, which must be signed by the medical practitioner. Their declaration that the information provided is correct and complete is mandatory for the form’s acceptance.

- Don't send the form to the CRA without ensuring that all sections are properly filled out and that all necessary documents and attachments are included. Missing information can lead to your application being delayed or denied.

By following these guidelines, you can streamline the process of applying for the Disability Tax Credit, helping to ensure that it is as smooth and error-free as possible. Remember, the DTC is an important financial tool for individuals living with a disability, and accuracy in the application process is key to accessing its benefits.

Misconceptions

When dealing with the T2201 Tax Credit form, also known as the Disability Tax Credit Certificate, there are a number of misconceptions that can lead to confusion or even result in individuals not claiming a benefit they are entitled to. Here are four common misconceptions debunked:

- Only physical disabilities qualify for the credit. Many people wrongly believe the Disability Tax Credit (DTC) is reserved exclusively for individuals with physical impairments. In reality, the DTC covers a broad range of impairments, including mental functions necessary for everyday life. The key determinant for eligibility centers on the effect of the impairment on daily activities, not the type of impairment itself.

- The process is too complex to be worth it. Some individuals are deterred by what they perceive as a complicated application process. While it’s true that the T2201 form requires detailed information, breaking down the steps makes the process manageable. Furthermore, the financial benefits of having the DTC approved can be substantial, making the effort to apply worth considering.

- Only adults can be approved for the DTC. This misconception leaves out a significant portion of those who could benefit from the tax credit. Children with disabilities can also qualify for the DTC, which can then be transferred to a parent or guardian if the child has little or no income. Understanding that the DTC is not age-restricted opens the door for more families to receive support.

- If denied once, there’s no chance of approval in the future. It’s not uncommon for an initial application to be rejected. However, this does not mean that all hope is lost. Often, applications are denied due to insufficient or unclear information regarding the impairment’s effects on daily living. By gathering additional documentation or clarifying the existing information, many find success upon reapplying.

The T2201 Tax Credit form serves as a valuable tool for individuals with disabilities, offering financial relief that can help cover the cost of care, therapies, and other necessary services. Dispelling common misconceptions about the form and the application process can empower more eligible individuals to take advantage of the Disability Tax Credit.

Key takeaways

Understanding the T2201 Tax Credit form and its correct usage is crucial for individuals or their legal representatives looking to apply for the Disability Tax Credit (DTC) in Canada. Here are key takeaways about this form:

- The T2201 form, also known as the Disability Tax Credit Certificate, is used to apply for the DTC with the Canada Revenue Agency (CRA).

- Part A of the form is to be filled out by the person with the disability or their legal representative. This section collects basic personal and contact information.

- Part B requires certification from a qualified medical practitioner. This part assesses the effects of the impairment on the individual's ability to perform basic activities of daily living.

- If applying for someone else, information about the claimant (the person claiming the disability amount) must also be provided, including their relationship to the person with the disability.

- Eligibility for the DTC is not determined by the diagnosis but by how significantly the impairment affects the individual's life in areas such as vision, speaking, hearing, walking, eliminating (bodily functions), feeding, dressing, and performing the mental functions necessary for everyday life.

- The CRA may adjust previous tax returns to include the disability amount once eligibility is approved. Applicants can indicate on the form whether they want this adjustment.

- Consent is required to allow medical practitioners to discuss the applicant's information with the CRA and for the CRA to adjust tax returns based on the eligibility for the DTC.

- A key part of the application is the certification of the effects of impairment and the duration of the impairment. The condition must last or be expected to last for a continuous period of at least 12 months.

- Life-sustaining therapy qualifications require that the therapy is needed to support a vital function and is required at least 3 times per week for an average of at least 14 hours per week.

- Submitting the T2201 form includes agreeing to the collection and use of personal information under the Income Tax Act for administering tax, benefits, and related programs.

- The importance of accurate and complete information cannot be overstated, as providing false statements is considered a serious offence.

By accurately completing and submitting the T2201 form, individuals with disabilities or their legal representatives can ensure they receive the support and tax benefits to which they are entitled under the Canadian tax system.

Popular PDF Documents

W-9s - The W-9S form provides a standardized method for educational institutions to request and collect necessary tax information, streamlining the process and reducing errors.

2848 Poa - The power of attorney granted by the D-2848 form can be a valuable tool in resolving disputes or misunderstandings with the IRS.