Get Suntrust Marine Loan Application Form

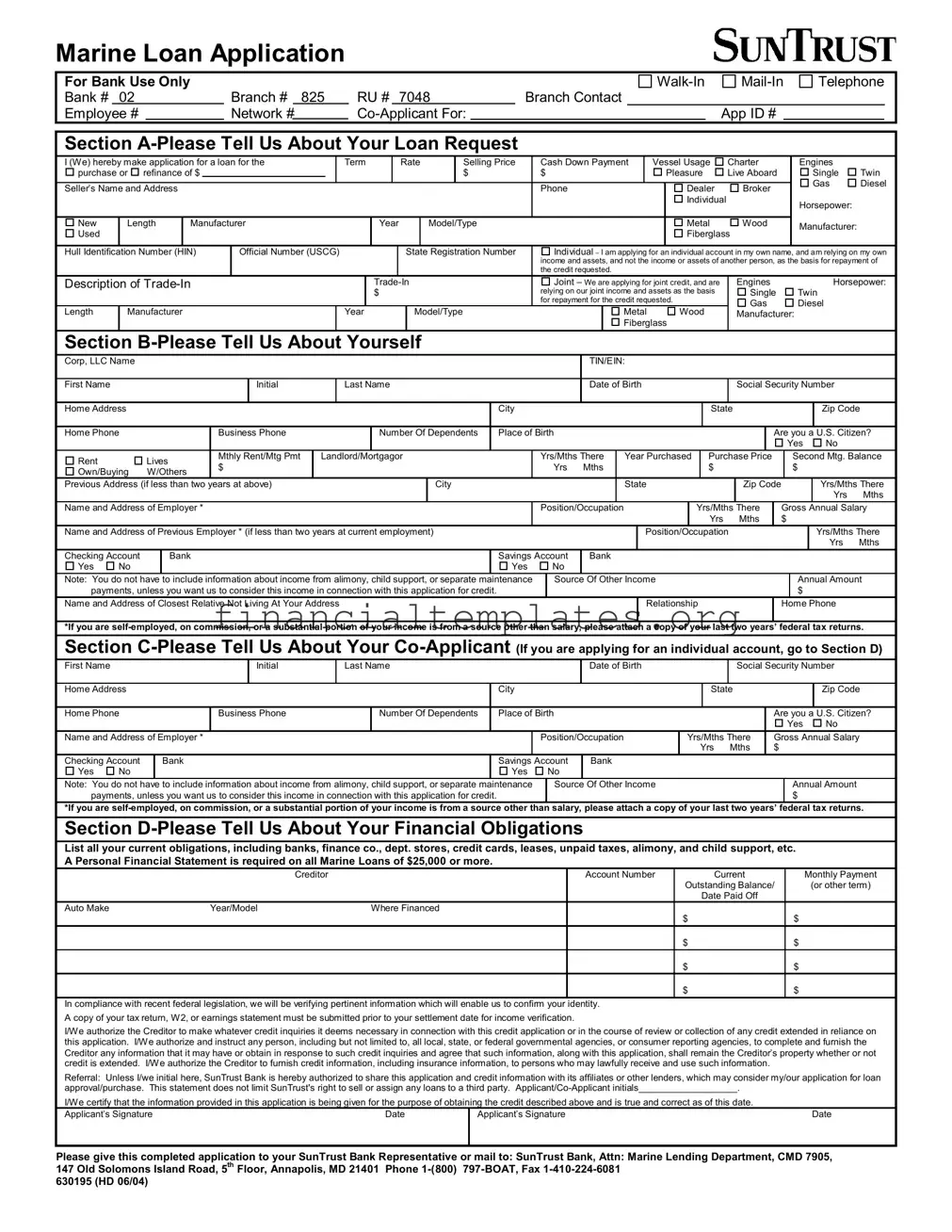

Navigating through the SunTrust Marine Loan Application form can seem daunting, but it's designed to gather comprehensive information to evaluate your loan request efficiently. This form covers everything from personal details to financial obligations, ensuring SunTrust has a holistic view of your financial situation. Applicants start by detailing their loan request, including the amount, term, and purpose, whether it's for buying a new vessel or refinancing an existing one. It's crucial for individuals or joint applicants to specify the type of boat, engine, and usage intentions, as these factors significantly influence the loan's terms. The form then transitions into personal information, such as employment history, income sources, and residency status, further supported by financial declarations encompassing assets, liabilities, and a personal financial statement for loans exceeding $25,000. Identification verification and credit inquiry authorizations are mandatory to comply with federal legislation, aiming to prevent fraud and ensure responsible lending. The form also includes sections for detailed information about co-applicants, should one be involved in the loan process, and concludes with a stipulation for a personal financial statement to offer a clearer financial picture of the applicant. By providing a thorough and accurate application, applicants pave the way for a smoother loan approval process.

Suntrust Marine Loan Application Example

Marine Loan Application

For Bank Use Only |

|

|

|

|

|

||

Bank # 02 |

Branch # 825 |

RU # 7048 |

Branch Contact |

||||

|

|

|

|

|

|

|

|

Employee # |

|

Network # |

|

||||

|

|

|

|

|

|

|

|

Telephone

Telephone

App ID #

Section

I (We) hereby make application for a loan for the |

|

|

|

Term |

|

|

Rate |

|

Selling Price |

Cash Down Payment |

|

Vessel Usage |

Charter |

|

|

Engines |

|

|||||||||||||||||||||||||||||||

purchase or |

refinance of $ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

Pleasure |

|

Live Aboard |

|

|

|

|

Single |

Twin |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gas |

Diesel |

Seller’s Name and Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone |

|

|

|

|

|

|

|

Dealer |

|

Broker |

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Individual |

|

|

|

|

|

|

Horsepower: |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

New |

Length |

|

Manufacturer |

|

|

|

|

|

Year |

|

|

|

Model/Type |

|

|

|

|

|

|

|

|

|

|

Metal |

|

Wood |

|

|

Manufacturer: |

|

||||||||||||||||||

Used |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiberglass |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Hull Identification Number (HIN) |

|

Official Number (USCG) |

|

|

|

|

|

|

State Registration Number |

|

Individual – I am applying for an individual account in my own name, and am relying on my own |

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

income and assets, and not the income or assets of another person, as the basis for repayment of |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

the credit requested. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Description of |

|

|

|

|

|

|

|

|

|

|

|

|

Joint – We are applying for joint credit, and are |

|

Engines |

|

|

|

|

Horsepower: |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

relying on our joint income and assets as the basis |

|

Single |

|

|

Twin |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

for repayment for the credit requested. |

|

|

Gas |

|

|

Diesel |

|

|||||||||||||||

Length |

Manufacturer |

|

|

|

|

|

|

|

|

Year |

|

Model/Type |

|

|

|

|

|

|

|

|

Metal |

|

Wood |

|

|

Manufacturer: |

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiberglass |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Section |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

Corp, LLC Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TIN/EIN: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

First Name |

|

|

|

|

|

|

|

|

Initial |

|

|

|

Last Name |

|

|

|

|

|

|

|

|

|

|

Date of Birth |

|

|

|

|

|

|

Social Security Number |

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Home Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

|

|

Zip Code |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Home Phone |

|

|

|

|

|

Business Phone |

|

|

|

|

|

Number Of Dependents |

|

Place of Birth |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Are you a U.S. Citizen? |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

||

Rent |

|

Lives |

|

|

Mthly Rent/Mtg Pmt |

Landlord/Mortgagor |

|

|

|

Yrs/Mths There |

|

Year Purchased |

|

Purchase Price |

|

|

Second Mtg. Balance |

|||||||||||||||||||||||||||||||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yrs |

Mths |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

||||||

Own/Buying |

W/Others |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Previous Address (if less than two years at above) |

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

State |

|

|

|

|

|

|

Zip Code |

|

|

|

|

Yrs/Mths There |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yrs |

Mths |

Name and Address of Employer * |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Position/Occupation |

|

|

|

|

|

Yrs/Mths There |

|

Gross Annual Salary |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yrs |

|

Mths |

|

$ |

|

|

|

|

||

Name and Address of Previous Employer * (if less than two years at current employment) |

|

|

|

|

|

|

|

|

|

|

Position/Occupation |

|

|

|

|

Yrs/Mths There |

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yrs |

Mths |

Checking Account |

|

Bank |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Savings Account |

Bank |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: You do not have to include information about income from alimony, child support, or separate maintenance |

|

Source Of Other Income |

|

|

|

|

|

|

|

Annual Amount |

||||||||||||||||||||||||||||||||||||||

payments, unless you want us to consider this income in connection with this application for credit. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|||||||||||||||||||||||||

Name and Address of Closest Relative Not Living At Your Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Relationship |

|

|

|

|

|

Home Phone |

|

||||||||||||||||||||

*If you are

Section

First Name |

|

|

|

Initial |

Last Name |

|

|

|

|

|

Date of Birth |

|

|

Social Security Number |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home Address |

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

State |

|

|

|

Zip Code |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Home Phone |

|

Business Phone |

|

Number Of Dependents |

|

Place of Birth |

|

|

|

|

|

Are you a U.S. Citizen? |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

No |

Name and Address of Employer * |

|

|

|

|

Position/Occupation |

Yrs/Mths There |

Gross Annual Salary |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yrs Mths |

$ |

|

|

|

||

Checking Account |

Bank |

|

|

|

Savings Account |

|

Bank |

|

|

|

|

|

|

|

|||||||

Yes |

No |

|

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

|

Note: You do not have to include information about income from alimony, child support, or separate maintenance |

|

Source Of Other Income |

|

|

|

|

Annual Amount |

||||||||||||||

payments, unless you want us to consider this income in connection with this application for credit. |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|||||||

*If you are |

salary, please attach a copy of your last two years’ |

federal tax returns. |

|||||||||||||||||||

Section |

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

||||||||||||||||

List all your current obligations, including banks, finance co., dept. stores, credit cards, leases, unpaid taxes, alimony, and child support, etc. |

|

|

|||||||||||||||||||

A Personal Financial Statement is required on all Marine Loans of $25,000 or more. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

Creditor |

|

|

|

|

|

|

|

|

Account Number |

|

|

Current |

|

|

Monthly Payment |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Outstanding Balance/ |

|

(or other term) |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date Paid Off |

|

|

|

|

|

Auto Make |

|

|

Year/Model |

|

Where Financed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

In compliance with recent federal legislation, we will be verifying pertinent information which will enable us to confirm your identity. |

|

|

|

|

|

|

|

||||||||||||||

A copy of your tax return, W2, or earnings statement must be submitted prior to your settlement date for income verification.

I/We authorize the Creditor to make whatever credit inquiries it deems necessary in connection with this credit application or in the course of review or collection of any credit extended in reliance on this application. I/We authorize and instruct any person, including but not limited to, all local, state, or federal governmental agencies, or consumer reporting agencies, to complete and furnish the Creditor any information that it may have or obtain in response to such credit inquiries and agree that such information, along with this application, shall remain the Creditor’s property whether or not credit is extended. I/We authorize the Creditor to furnish credit information, including insurance information, to persons who may lawfully receive and use such information.

Referral: Unless I/we initial here, SunTrust Bank is hereby authorized to share this application and credit information with its affiliates or other lenders, which may consider my/our application for loan approval/purchase. This statement does not limit SunTrust's right to sell or assign any loans to a third party.

I/We certify that the information provided in this application is being given for the purpose of obtaining the credit described above and is true and correct as of this date. |

|

||

Applicant’s Signature |

Date |

Applicant’s Signature |

Date |

Please give this completed application to your SunTrust Bank Representative or mail to: SunTrust Bank, Attn: Marine Lending Department, CMD 7905, 147 Old Solomons Island Road, 5th Floor, Annapolis, MD 21401 Phone

630195 (HD 06/04)

Section

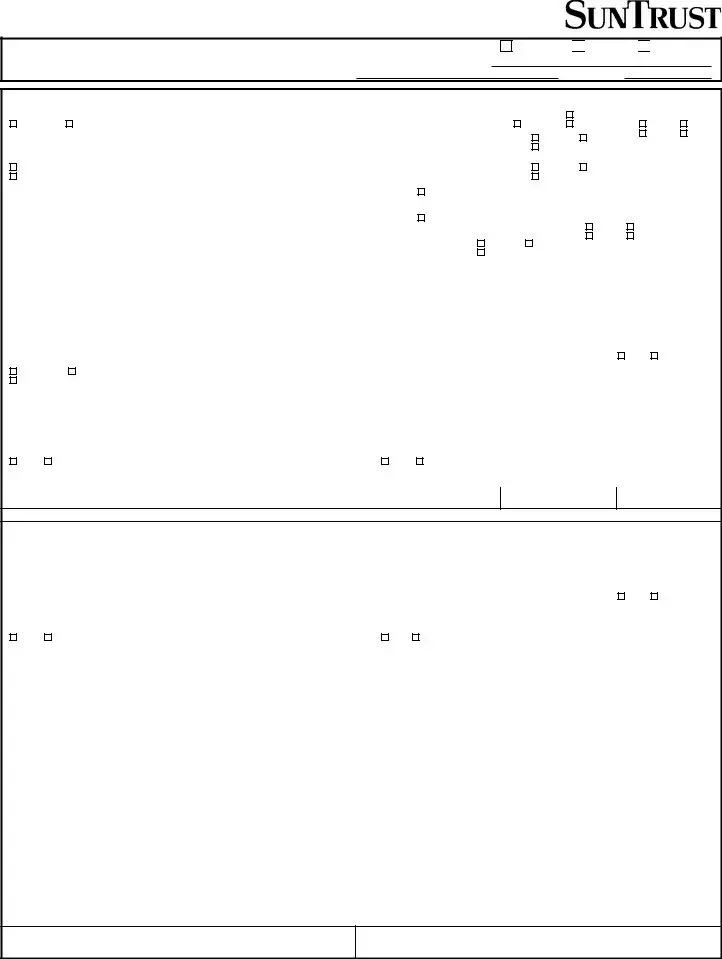

Important: Check box “J” if assets or liabilities are owned jointly or owed jointly.

Assets |

|

Amount |

J |

|

Cash on Hand, in Checking and in Savings (Sched 1) |

$ |

|

||

|

|

|

|

|

Retirement Accts (IRA, SEP, 401K, etc.) (Schedule 1) |

$ |

|

||

|

|

|

|

|

Accounts Receivable - Good |

|

$ |

|

|

|

|

|

|

|

Notes Receivable - Good |

|

$ |

|

|

|

|

|

|

|

Stocks, Bonds and Mutual Funds (Schedule 2) |

$ |

|

||

|

|

|

|

|

Cash Value Life Insurance (Schedule 3) |

|

$ |

|

|

|

|

|

|

|

Automobiles (Number Owned |

|

) |

$ |

|

|

|

|||

|

|

|

|

|

Real Estate (Schedule 4) |

|

$ |

|

|

|

|

|

|

|

Interest in Business Owned |

|

$ |

|

|

|

|

|

|

|

Boat Presently Owned |

|

$ |

|

|

|

|

|

|

|

Deposit on Boat Being Purchased |

|

$ |

|

|

|

|

|

|

|

Other Assets 1. |

|

$ |

|

|

|

|

|

|

|

2. |

|

|

$ |

|

|

|

|

|

|

3. |

|

|

$ |

|

|

|

|

|

|

4. |

|

|

$ |

|

|

|

|

|

|

5. |

|

|

$ |

|

|

|

|

|

|

Total Assets |

|

$ |

|

|

|

|

|

|

|

Liabilities |

Amount |

J |

Notes Payable to Banks (Section D) |

$ |

|

|

|

|

Notes Payable to Others |

$ |

|

|

|

|

Loans Against Life Insurance |

$ |

|

|

|

|

Accounts Payable 1. |

$ |

|

|

|

|

2. |

$ |

|

|

|

|

3. |

$ |

|

|

|

|

4. |

$ |

|

|

|

|

5. |

$ |

|

|

|

|

Loans Payable on Automobiles |

$ |

|

|

|

|

Loans Against Real Estate (Schedule 4) |

$ |

|

|

|

|

Other Liabilities 1. |

$ |

|

|

|

|

2. |

$ |

|

|

|

|

3. |

$ |

|

|

|

|

4. |

$ |

|

|

|

|

5. |

$ |

|

|

|

|

Total Liabilities |

$ |

|

|

|

|

Net Worth (Total Assets minus Total Liabilities) |

$ |

|

|

|

|

Please use the space below or a separate sheet if you need additional space.

Schedule 1 – Banks Where Accounts Are Maintained (Show joint accounts by checking Box “J”)

Name of Depository |

Name of Joint Owner |

Balance on |

|

|

Deposit |

|

|

|

J

Account

Type

J

Account Number

Schedule 2 – Stocks, Bonds and Mutual Funds

Describe and show number of shares or face value

Title in Name of

Current Market Value

Pledged?

Schedule 3 – Life Insurance

Name of Insurance Company

Name of Insured

Face Amount

Cash Value

Schedule 4 – Real Estate

Description and Location |

Title in Name of |

Market Value

Amount Owed

Monthly Payment

Payable to Whom

Monthly Rental

Income

Have either of you ever declared bankruptcy or had any judgments, repossessions or other legal proceedings filed against you? |

Yes |

No |

|

|

|

|

|||||

Have either of you obtained credit under any other name? |

Yes |

No If yes, what name? |

|

|

|

|

|

|

|

|

|

Are either of you obligated to make monthly alimony, child support or maintenance payments? |

Yes |

No If yes, show amount. |

|

|

|

|

|

|

|

||

Are you a |

Yes |

No Are you liable on debts not shown such as leases or unpaid taxes? |

Yes |

No If yes to either of these questions, please |

|||||||

provide details. |

|

|

|

|

|

|

|

|

|

|

|

Please Use This Space For Any Additional Information:

Document Specifics

| Fact Name | Description |

|---|---|

| Application Purpose | Used to apply for a loan to purchase or refinance a vessel. |

| Loan Details Required | Applicants must provide the term, rate, selling price, cash down payment, vessel usage, engine details, and seller information. |

| Account Type Options | Individuals can apply for an account in their own name or jointly, depending on their income and assets. |

| Applicant Information Needed | Personal details such as name, Social Security Number, birth date, citizenship, housing information, employment, and income sources are required. |

| Co-Applicant Information | If applying for a joint account, similar personal and financial information is required for the co-applicant. |

| Financial Obligations | Applicants must list all current financial obligations, and a personal financial statement is required for loans over $25,000. |

| Compliance and Verification | The application process includes verifying the applicant's identity and financial information as per federal legislation. |

| Submission Instructions | Completed applications can be submitted to SunTrust Bank's Marine Lending Department via mail, phone, or fax. |

Guide to Writing Suntrust Marine Loan Application

Filling out the Suntrust Marine Loan Application form is an important step towards financing the purchase or refinance of a marine vessel. This process requires attention to detail to ensure that all the necessary information is accurately provided. Here are the step-by-step instructions to guide you through this application.

- Start with Section A, where you will detail your loan request. Indicate the desired term, rate, and the selling price of the vessel. Specify the cash down payment and select the vessel's usage. Fill in the seller’s information or choose the appropriate option if you are dealing with a dealer or broker.

- If applicable, provide information about the vessel being purchased or refinanced, including engine type, horsepower, and vessel condition (new or used), among other details.

- Indicate whether the application is for an individual or joint account, and if there is a trade-in, provide details about the trade-in vessel.

- In Section B, share personal information including your name, date of birth, social security number, contact information, housing situation, employment details, and banking information. Remember, if your income includes non-salary sources or you’re self-employed, attach your last two years’ federal tax returns.

- If there's a co-applicant, repeat the personal information process in Section C for the co-applicant.

- Under Section D, list all current financial obligations such as loans, credit cards, and any other debts, along with the required personal financial statement if the marine loan is $25,000 or more.

- Regarding the authorization section at the end of the form, read carefully and sign to authorize the creditor to make necessary credit inquiries. If you prefer not to have your information shared with affiliates or other lenders for loan approval purposes, do not initial the referral section.

- Complete Section E with your personal financial statement. Include details about your assets and liabilities, ensuring to check the “J” box if any are jointly owned or owed.

- Review your application carefully. Once satisfied, sign and date the form. For joint applications, ensure the co-applicant signs as well.

- Submit the completed application and any required documents to SunTrust Bank either in person to a representative, or mail it to the address provided on the form.

After submitting your application, a representative from SunTrust Bank may reach out for additional information or clarification. It’s vital to have all supporting documentation prepared and readily available to avoid delays in the processing of your application. Such preparation not only reflects well on your creditworthiness but also helps streamline the approval process, bringing you one step closer to achieving your boating dreams.

Understanding Suntrust Marine Loan Application

- What types of marine loans does SunTrust offer?

SunTrust provides loans for the purchase or refinance of various vessels. Whether you’re looking to enjoy the pleasure of sailing, living aboard, charter services, or requiring engines for your vessel, SunTrust has options tailored for you. These loans cover new and used boats, including choices for single or twin engines, and preferences between gas and diesel. The range of material options for the vessel includes metal, wood, and fiberglass.

- How can I apply for a SunTrust Marine Loan?

You can submit your marine loan application through walk-in, mail-in, or telephone channels. Ensure you accurately fill out the application form, providing detailed information about the loan request, personal, and financial information. For applications involving sums of $25,000 or more, a personal financial statement must accompany your application. Remember to include your tax returns if your income is not primarily salary-based.

- What information is needed to apply for a loan?

The application requires detailed loan request information, including the selling price, down payment, and usage of the vessel. Personal information such as your social security number, date of birth, employment details, and financial obligations must also be provided. If applying jointly, similar details for the co-applicant are necessary. SunTrust also requires a personal financial statement for loans exceeding $25,000.

- Are there any specific requirements for co-applicants?

Co-applicants must fill out their section of the application form, providing their personal and financial information similar to the principal applicant. This includes employment details, annual salary, and a record of financial obligations. If the co-applicant's income sources aren't primarily from salary, they must attach the last two years' federal tax returns.

- How does SunTrust verify my identity and financial information?

In compliance with federal legislation, SunTrust will conduct verifications to confirm your identity. This includes checking the information you've provided and may require submission of additional documentation like tax returns, W-2s, or earnings statements for income verification.

- Can I include income from alimony, child support, or separate maintenance payments?

Yes, you have the option to include these income sources in your application. However, it’s not a requirement unless you wish for it to be considered as part of your credit application.

- What happens to my application and information shared with SunTrust?

Upon submitting your application, SunTrust may perform necessary credit inquiries and share your credit application and information with its affiliates or other lenders for loan approval considerations. However, unless you opt out by initialing the specified section, SunTrust retains the right to sell or assign any loans to third parties. Your application and any information obtained in connection with it will remain the property of SunTrust, whether or not credit is extended.

- What is required if I’m self-employed or my income is not from a salary?

If a substantial portion of your income comes from self-employment, commission, or other non-salary sources, you must attach copies of your last two years’ federal tax returns to the application. This helps in providing a complete picture of your financial status for the loan assessment.

- What happens after I submit my application?

After submitting your application, it will be reviewed by SunTrust. You might be contacted for further information or documentation as part of the application review process. Upon approval, you will receive instructions regarding the next steps to finalize your loan.

- How do I submit my completed application to SunTrust?

You can give your completed application to a SunTrust Bank representative or mail it to the SunTrust Bank, Marine Lending Department. Alternatively, if you’ve arranged a phone application, follow the instructions provided by the SunTrust representative to ensure your application is correctly submitted.

Common mistakes

Filling out a loan application can be a daunting process, and when it comes to something specific like a marine loan, mistakes are not uncommon. Here are some of the most frequent errors individuals make when completing the Suntrust Marine Loan Application form:

Not specifying the type of application, whether it's for an individual or joint account. This detail is crucial as it influences the underwriting process and determines the income and assets that will be considered.

Omitting information about the vessel, such as its usage (Pleasure, Live Aboard, Charter), or the engines (Single, Twin, Gas, Diesel). These factors can affect loan terms and approval.

Failure to accurately disclose financial information, including the full details of income, debts, and obligations. Underestimating or omitting debts can significantly impact the decision on the loan application.

Not providing complete seller’s or dealer’s information. Whether purchasing from an individual, dealer, or broker, full contact details are necessary to verify the sale and secure the loan.

Incorrectly detailing the vessel’s information like the Hull Identification Number (HIN) or the State Registration Number. This information is critical for the bank to identify and register the lien correctly.

Forgetting to include previous employment history when current employment is less than two years. Lenders look for stability in employment as an indicator of consistent income.

Skipping the section on additional income sources or incorrectly assuming certain types of income (like alimony, child support, or separate maintenance payments) should not be included. These can enhance the application by demonstrating additional repayment capabilities.

Incomplete details about co-applicants, if applying for joint credit. Both applicants’ information, including employment and financial obligations, is pivotal in evaluating the joint application accurately.

Leaving the personal financial statement section incomplete or not providing it at all for loans of $25,000 or more. This section gives a comprehensive view of the applicant's financial health beyond the income stated and is often a critical component of the loan decision process.

These mistakes can slow down the application process or lead to an outright denial. Applicants should review their forms carefully, ensure every section is completed accurately, and provide all required supplemental documentation to bolster their application. Being thorough and transparent in the loan application process is paramount in securing a favourable outcome.

Documents used along the form

When applying for a marine loan through SunTrust, several other documents and forms are often required to support the application process. These documents provide the lender with comprehensive information regarding the borrower's financial status, the asset to be purchased or refinanced, and legal compliance aspects. Understanding these additional requirements can smooth the journey towards securing a marine loan.

- Proof of Income Documents: Applicants need to furnish documents such as recent pay stubs, tax returns for the last two years, or W-2 forms. These documents demonstrate the applicant's ability to repay the loan.

- Personal Financial Statement: This document outlines the applicant's assets and liabilities, providing a snapshot of their financial health. It is required for loans exceeding $25,000 to ensure that the borrower has the financial capability to undertake additional debt.

- Photo Identification: A government-issued photo ID, such as a passport or driver’s license, is essential for identity verification as per federal laws.

- Proof of Residence: Utility bills or lease agreements serve as proof of the applicant's current address, which is necessary for credit and background checks.

- Vessel Documentation: For the purchase of a new or used boat, documentation such as the bill of sale, the vessel's registration, and, if applicable, the U.S. Coast Guard documentation are required. These documents confirm the legality and the specifics of the vessel being purchased.

- Marine Survey Report: For used boats, a marine survey report may be required to assess the vessel's condition and value. This report is conducted by a certified marine surveyor and provides a detailed analysis of the boat's structural integrity and equipment.

- Credit Authorization Form: This form allows the lender to perform a credit check, verifying the applicant's credit history as part of the application process.

- Insurance Quotation: Proof of a valid marine insurance quote or policy is often required before final approval, to ensure that the vessel will be fully insured upon purchase.

Collectively, these documents provide a thorough overview of the borrower's financial situation, the specifics of the marine asset being financed, and the legal compliance of the transaction. By preparing these documents in advance, applicants can expedite the review process and improve their chances of a favorable loan outcome. Each document plays a crucial role in illustrating not just the borrower's capacity to repay the loan, but also the viability and legality of the marine investment itself.

Similar forms

The Suntrust Marine Loan Application form shares similarities with a Mortgage Loan Application. Both applications require detailed personal information, including employment history, income details, and financial obligations such as existing loans and credit balances. They also ask about the property being financed, whether it's a boat or a home, including the purchase price and down payment. In both cases, this data helps the lender assess the borrower's ability to repay the loan.

Similarly, an Auto Loan Application form resembles the Marine Loan Application, as both involve financing for personal property and request information on the item being purchased or refinanced, such as make, model, and year. They also inquire about the applicant's financial status, including employment, income, and existing debts, to evaluate creditworthiness. Moreover, both forms might ask for information on a trade-in as part of the transaction.

A Business Loan Application is another document that bears similarities to the Marine Loan Application form, particularly in the requirement for detailed financial information. This would include the financial health of the business, ownership details, and the purpose of the loan. While the focus on business rather than personal finances distinguishes them, both applications necessitate a thorough examination of financial stability and the potential for repayment.

A Personal Loan Application also shares commonalities with the Marine Loan Application, as it gathers comprehensive personal and financial information from the applicant, such as income, employment history, and existing debts. The purpose of both forms is to assess an individual's ability to repay the borrowed amount, even though the specifics of what's being financed differ.

The Credit Card Application process is parallel to that of the Marine Loan Application in terms of requiring detailed personal financial information to assess creditworthiness. Applicants must disclose their income, existing debts, and sometimes assets, much like in loan applications. While one results in revolving credit and the other in installment credit, both involve a line of credit being extended based on the applicant's financial situation.

Lastly, the Student Loan Application shares a focus on the applicant's financial standing and the specifics of what the loan will finance, similar to the Marine Loan Application. It differs in that it often includes information regarding educational institutions and the estimated cost of attendance. Both, however, necessitate an analysis of the applicant's financial capacity to repay the loan.

Dos and Don'ts

When filling out the Suntrust Marine Loan Application form, it's important to be thorough and accurate to facilitate a smooth process. Here are some guidelines to follow:

Do:- Review the entire form before you start: Ensure you understand what's required and gather all necessary information ahead of time.

- Provide accurate information: This includes personal details, financial obligations, and specifics about the marine vessel.

- Include all requested financial details: Especially if you're applying for a loan of $25,000 or more, as a Personal Financial Statement will be required.

- Use exact figures where possible: Estimations can lead to delays, so try to be as precise as you can with financial details.

- Verify your identity and financial information: Attach copies of your tax returns if you are self-employed or your income is non-salary-based, as this supports the income verification process.

- Authorize credit inquiries: Completing the authorization allows the creditor to conduct necessary credit checks.

- Sign the application: Ensure that both the applicant and co-applicant, if applicable, sign the form to validate the information provided.

- Forget to list all financial obligations: Including any outstanding debts, leases, unpaid taxes, alimony, or child support, in the dedicated section.

- Omit any part of your financial statement: Incomplete information can result in application delays or denials.

By adhering to these guidelines, you'll be better prepared to fill out the Suntrust Marine Loan Application form accurately and efficiently, increasing your chances of a favorable outcome.

Misconceptions

When navigating the complexities of securing a marine loan, applicants often confront a slew of misconceptions, especially regarding the Suntrust Marine Loan Application form. Clearing up these misunderstandings can vastly improve the accuracy and efficiency of the application process.

Personal Information is Optional: Many assume that providing detailed personal information is not mandatory. However, the form requires comprehensive data, including employment history, income sources, and personal financial obligations, to accurately assess the applicant's creditworthiness.

Income Verification is Always Required: It is often believed that all applicants must submit income verification documents like tax returns with their application. This requirement can vary; for instance, self-employed individuals or those with a significant portion of income from non-salary sources usually need to provide such documentation.

Joint Application Implies Joint Ownership: Applicants sometimes think filing jointly with a co-applicant means shared ownership of the marine vessel. In reality, the application for joint credit is about the joint evaluation of creditworthiness and potential shared liability for the loan, not necessarily mutual ownership of the asset.

Down Payment Amount Is Fixed: A common misconception is that the cash down payment is a fixed amount or percentage of the purchase price. The down payment can vary, depending on the lender's assessment of the loan-to-value ratio and the applicant's credit profile.

All Assets Must Be Disclosed: There's a belief that disclosing all assets is required when, in fact, applicants are encouraged to disclose those assets relevant to securing the marine loan. Strategically highlighting assets can strengthen the application, especially for loans exceeding $25,000 which require a personal financial statement.

Application Is Only for New Purchases: Some applicants mistakenly believe the form is solely for purchasing new vessels. This application is also relevant for refinancing options and used vessel purchases, offering flexibility according to the buyer's needs.

Business Information Is Irrelevant for Individual Applicants: Even if applying for an individual account, details about an applicant's business or self-employed status can be pertinent, especially if a substantial part of their income comes from these sources, affecting the overall credit decision.

Alimony or Child Support Must Be Disclosed: There is a misconception that information about alimony, child support, or separate maintenance payments is mandatory. Applicants can choose whether or not to disclose this information, depending on if they want it considered in their application.

Approval Is Based Solely on Credit Score: While credit history is crucial, approval for a marine loan involves a holistic review of the applicant’s financial situation, including income, existing debts, assets, and even the intended use of the vessel.

All Applicants Must Be U.S. Citizens: Though the application form asks about U.S. citizenship, it's a misconception that this is a strict requirement for approval. The key factor is the ability to demonstrate creditworthiness and meet the lender's terms and conditions.

Demystifying these misconceptions encourages a more informed approach to applying for a Suntrust Marine Loan, ensuring applicants provide the necessary information and documents, enhancing their chances for a favorable outcome.

Key takeaways

When approaching the Suntrust Marine Loan Application, it's essential to grasp the application's key aspects to ensure a smooth and correct submission process. Here are four principal takeaways that applicants should keep in mind:

- Detailed Personal and Co-Applicant Information is Required: The application form requires comprehensive personal information for both the applicant and, if applicable, the co-applicant. This includes but is not limited to, full names, dates of birth, Social Security numbers, employment details, and financial information. Accurate and complete filling of this section is crucial for the processing of the loan application.

- Financial Details and Obligations Must Be Disclosed: Applicants must provide detailed information about their financial situation. This includes current obligations such as loans, credit card debts, alimony, and any other financial responsibilities. For loans exceeding $25,000, a personal financial statement is mandatory, detailing assets, liabilities, and net worth.

- Income Verification Documentation is Required: The application highlights the need for income verification through documents such as tax returns, W2s, or earnings statements. This requirement underlines the importance of preparing and attaching these documents to corroborate the income stated in the application, ensuring a smoother verification process.

- Consent for Credit and Identity Verification: By submitting the application, applicants authorize Suntrust to perform necessary credit inquiries and identity verifications. This may include contacting governmental agencies, employers, and other relevant entities. Applicants also have the option to allow Suntrust to share their application and credit information with affiliates or other lenders for loan approval purposes.

Understanding these key elements and preparing accordingly can significantly enhance the accuracy and efficiency of the loan application process. It's important for applicants to review their application thoroughly, ensuring all information is current and correct, and required documents are attached before submission.

Popular PDF Documents

Sales and Use Tax License Maryland - This certificate acts as a pledge by Maryland businesses to the state, claiming tax exemption on purchases for resale or industrial production.

Dwc 25 - A standardized report for capturing essential accident details, ensuring employees receive appropriate workers' comp benefits.