Get Stop Payment Notice Form

In the complex landscape of construction projects, the Stop Payment Notice form serves as a vital legal tool for individuals and businesses seeking to protect their financial interests. Originating under California Civil Code Sections 8520, 8530, and 9350, this document is designed to notify relevant parties—be it the owner of the project, a public entity, or a construction lender—of an outstanding payment claim for labor or materials provided. It sets into motion a legal obligation for these parties to withhold sufficient funds to satisfy the claim, effectively placing an equitable lien against any construction funds currently held. The notice is comprehensive, requiring the claimant to detail their relationship to the project, the nature of the work or materials provided, and the financial specifics of their claim, including the total value and the amount unpaid. Additionally, it outlines the protocol for its delivery to ensure proper notice, and for private works, it includes provisions for a response regarding the election not to withhold funds due to a payment bond. Serving this notice is a crucial step in securing payment, backed by stringent legal verification processes to affirm the accuracy and truthfulness of the claim. This procedure not only underscores the claimant's rights but also underscores the structured approach California law provides for resolving such disputes.

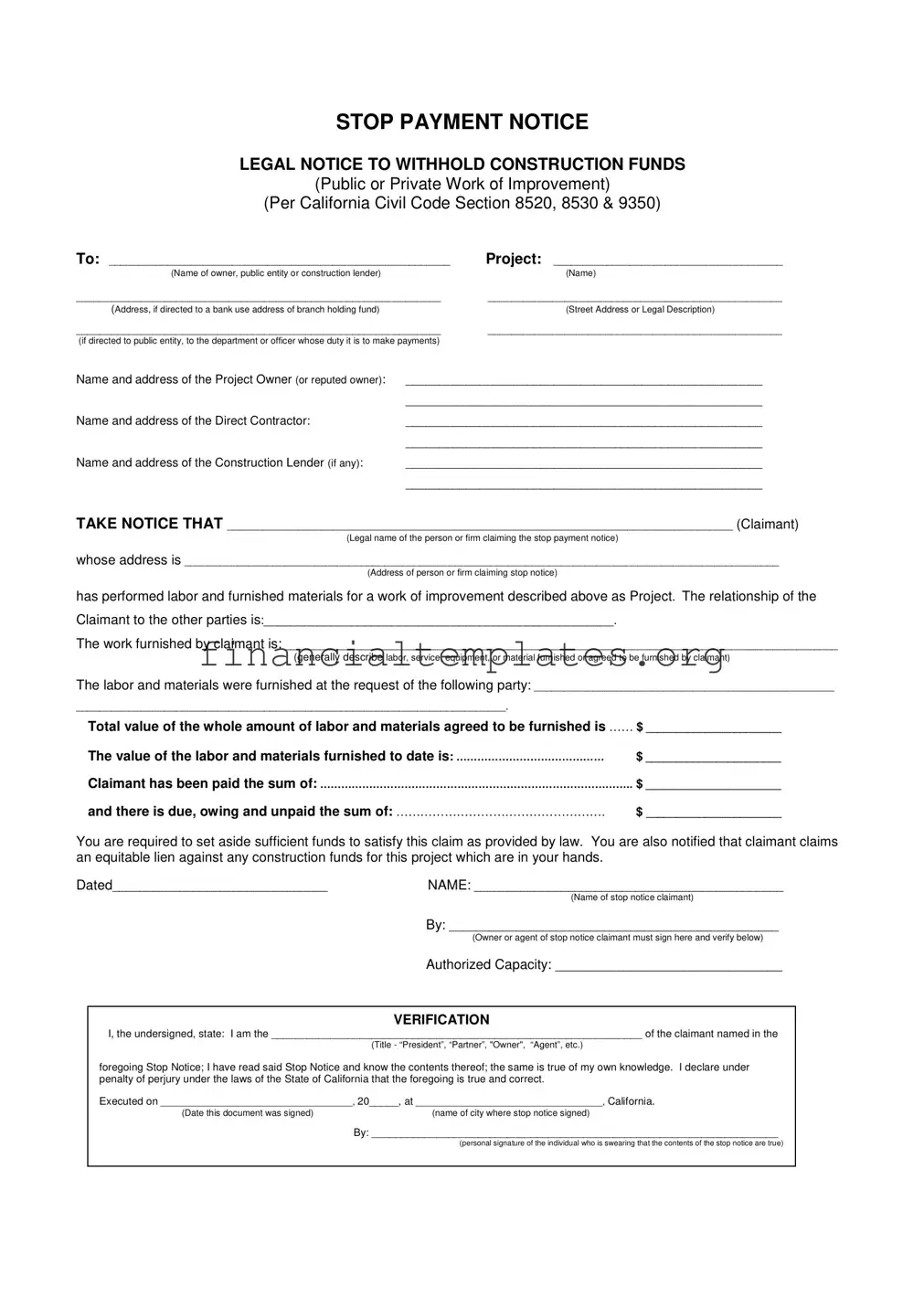

Stop Payment Notice Example

STOP PAYMENT NOTICE

LEGAL NOTICE TO WITHHOLD CONSTRUCTION FUNDS

(Public or Private Work of Improvement)

(Per California Civil Code Section 8520, 8530 & 9350)

To: __________________________________________________________ |

Project: _______________________________________ |

|

(Name of owner, public entity or construction lender) |

|

(Name) |

______________________________________________________________ |

__________________________________________________ |

|

(Address, if directed to a bank use address of branch holding fund) |

|

(Street Address or Legal Description) |

______________________________________________________________ |

__________________________________________________ |

|

(if directed to public entity, to the department or officer whose duty it is to make payments) |

|

|

Name and address of the Project Owner (or reputed owner): |

_____________________________________________________ |

|

|

_____________________________________________________ |

|

Name and address of the Direct Contractor: |

_____________________________________________________ |

|

|

_____________________________________________________ |

|

Name and address of the Construction Lender (if any): |

_____________________________________________________ |

|

|

_____________________________________________________ |

|

TAKE NOTICE THAT ______________________________________________________________________________________ (Claimant)

(Legal name of the person or firm claiming the stop payment notice)

whose address is _____________________________________________________________________________________________________

(Address of person or firm claiming stop notice)

has performed labor and furnished materials for a work of improvement described above as Project. The relationship of the Claimant to the other parties is:____________________________________________________.

The work furnished by claimant is: ______________________________________________________________________________________________

(generally describe labor, service, equipment, or material furnished or agreed to be furnished by claimant)

The labor and materials were furnished at the request of the following party: ___________________________________________________

_________________________________________________________________________.

Total value of the whole amount of labor and materials agreed to be furnished is …… $ _______________________

The value of the labor and materials furnished to date is: …………………………………… $ _______________________

Claimant has been paid the sum of: …………………………………………………………………………….. $ _______________________

and there is due, owing and unpaid the sum of: ……………………………………………. $ _______________________

You are required to set aside sufficient funds to satisfy this claim as provided by law. You are also notified that claimant claims an equitable lien against any construction funds for this project which are in your hands.

Dated________________________________ |

NAME: ______________________________________________ |

|

|

|

(Name of stop notice claimant) |

|

|

By: _________________________________________________ |

|

|

(Owner or agent of stop notice claimant must sign here and verify below) |

|

|

Authorized Capacity: ______________________________ |

|

|

|

|

|

VERIFICATION |

|

I, the undersigned, state: I am the _______________________________________________________________ of the claimant named in the |

|

|

|

(Title - “President”, “Partner”, "Owner", “Agent”, etc.) |

foregoing Stop Notice; I have read said Stop Notice and know the contents thereof; the same is true of my own knowledge. I declare under penalty of perjury under the laws of the State of California that the foregoing is true and correct.

Executed on ______________________________________, 20_____, at _____________________________________, California.

(Date this document was signed)(name of city where stop notice signed)

By: _____________________________________________________________________

(personal signature of the individual who is swearing that the contents of the stop notice are true)

REQUEST FOR NOTICE OF ELECTION

(Private Works Only)

(Per California Civil Code Section 8536 & 8538)

If an election is made not to withhold funds pursuant to this stop notice by reason of a payment bond having been recorded, please send notice of such election and a copy of the bond within 30 days of such election in the enclosed preaddressed stamped envelope. This information must be provided by you under Civil Code Sections 8536 & 8538.

Signed: ____________________________________________________________________________________________

(Claimant must enclose

PROOF OF NOTICE DECLARATION

(Per California Civil Code Section 8118)

I, ____________________________________________, declare that I served a copy of the Stop Payment Notice on the party at the address

and on the date shown below:

To Construction Lender/Owner/Public Entity/Or Other Person Holding Construction Funds: (name) _________________________________________________________________

(title or capacity of individual given notice) ____________________________________

(address) _________________________________________________________________________________________

(date)__________________________________________

Stop Payment Notice should be served at the following location:

(a)To an owner other than a public entity, the owner’s address shown on the direct contract, the building permit or a construction trust deed;

(b)To a public entity, the office of the public entity or another address specified by the public entity in the contract or elsewhere for service of notices, papers or other documents. A Stop Payment Notice for a public works contract of the state, shall be given to the director of the department that awarded the contract; and to a public entity other than the state, to the office of the controller, auditor or other public disbursing officer whose duty it is to make payment pursuant to the contract (see Civil Code §9354 for more information).

(c)To a direct contractor, at the contractor’s address shown on the building permit, on the direct contract, or on the records of the Contractors’ State License Board.

In the following manner (check appropriate box):

[ ] By personal delivery

[ ] By Registered or Certified Mail (postage prepaid)

[ ] Express mail

[ ] Overnight delivery by ___________________________________, an express service carrier

I declare under penalty of perjury, that the foregoing is true and correct. Executed on _______________________, at

_____________________, California.

_______________________________________

(Signature of person making service)

C&B Forms (7/12)

Document Specifics

| Fact Name | Description |

|---|---|

| Governing Laws | California Civil Code Sections 8520, 8530, and 9350 govern the Stop Payment Notice for both public and private work of improvement. |

| Purpose of Notice | The Stop Payment Notice serves as a legal notification to withhold construction funds by the recipient, which can be an owner, public entity, or construction lender. |

| Recipient Information | Information required includes name, address, and, if applicable, the department or officer responsible for making payments. |

| Project Information | Details needed include the project's name, address or legal description, and the names and addresses of the project owner, direct contractor, and construction lender (if any). |

| Claimant Details | The claimant must provide their legal name, address, relationship to the project, description of labor or materials furnished, and the total value of the labor and materials. |

| Verification and Proof of Service | The document must be signed and verified by the claimant under the penalty of perjury, declaring the information provided is true and correct, including a proof of notice declaration. |

Guide to Writing Stop Payment Notice

Filling out a Stop Payment Notice form is a necessary step when you need to withhold construction funds due to unpaid labor or materials. This legal notice impacts various parties involved in a construction project, including project owners, public entities, or construction lenders. To ensure this process is done correctly, follow these step-by-step instructions carefully:

- At the top of the form, enter the name of the owner, public entity, or construction lender to whom the notice is directed.

- Fill in the project name or description in the designated space.

- Provide the complete address of the entity the notice is directed to. If it is a bank, include the branch address where the fund is held.

- If directed to a public entity, specify the department or officer responsible for payments.

- Enter the name and address of the project owner (or reputed owner).

- Include the name and address of the Direct Contractor on the project.

- If applicable, fill in the name and address of the Construction Lender.

- In the space provided, write the legal name of the person or firm claiming the stop payment notice and provide their address.

- Describe the relationship of the claimant to the other parties involved in the project.

- Generalize the labor, service, equipment, or materials furnished or agreed to be furnished by the claimant.

- Indicate the party at whose request the labor and materials were furnished.

- State the total value of the labor and materials agreed to be furnished, as well as the value of what has been furnished to date.

- Note the amount that has been paid to the claimant and the outstanding amount still owed.

- Date and sign the form, declaring the information provided is true, under penalty of perjury. Include the title of the person signing (e.g., President, Partner, etc.)

- If it applies to your situation (for private works only), fill in the REQUEST FOR NOTICE OF ELECTION section and provide a self-addressed stamped envelope.

- Complete the PROOF OF NOTICE DECLARATION section, entering details of how, to whom, and when the Stop Payment Notice was served.

After filling out and serving the Stop Payment Notice form properly, sufficient funds related to your claim should be withheld by the notified party as required by law. This action helps ensure that funds are available to satisfy the amount you're owed. It is important to follow up appropriately and stay informed on any responses or actions taken by the entity or individuals notified.

Understanding Stop Payment Notice

What is a Stop Payment Notice?

A Stop Payment Notice is a legal notification used in construction, requiring a project owner, public entity, or construction lender to withhold funds due to a dispute over payment. It is a claim made by a participant, such as a subcontractor or materials supplier, who has provided labor or materials but has not received payment. This notice aims to secure the claimant's right to be paid from the construction funds.

When should a Stop Payment Notice be used?

This form of notice is typically employed when a contractor or supplier on a construction project has performed work or supplied materials and is not paid. Before using a stop payment notice, it's crucial to understand the specific requirements and conditions that apply, as defined in the California Civil Code Sections 8520, 8530, and 9350 for different project types.

Who can issue a Stop Payment Notice?

The right to issue a Stop Payment Notice is generally held by subcontractors, material suppliers, laborers, or equipment rental companies that have a direct contractual relationship with the prime contractor or a subcontractor, but not with the project owner directly. It is their tool for claiming unpaid amounts for work performed or materials provided.

How is a Stop Payment Notice served?

A Stop Payment Notice must be served either by personal delivery or via Registered or Certified Mail, postage prepaid, to the construction lender, project owner, or the public entity controlling the project funds. The method of service ensures that the notice is received and documented, providing legal grounds for withholding funds.

What information is required in a Stop Payment Notice?

The notice must detail the claimant's name and address, a description of the labor or materials provided, the name of the party who requested the work, the total contract value, the amount already paid, and the outstanding balance. It also must include a declaration under penalty of perjury that the information is true and correct.

What are the possible outcomes after serving a Stop Payment Notice?

Once a Stop Payment Notice is served, the owner or lender is obliged to withhold enough funds to cover the claimed amount, providing a level of protection to the claimant. The matter may then proceed to be resolved through negotiation, arbitration, or litigation, depending on the involved parties’ agreements and the circumstances of the dispute.

Can a Stop Payment Notice be contested?

Yes, a Stop Payment Notice can be contested. The party receiving the notice may dispute the claim's validity, accuracy, or amount. The resolution process may involve supplying additional documentation, negotiation, or legal proceedings to determine whether the stop notice was rightfully issued and the appropriate amount to be paid, if any.

What is the effect of a Stop Payment Notice on a construction project?

The immediate effect is the requirement for the project owner, public entity, or lender to withhold sufficient funds to satisfy the claim. This can impact the project's cash flow and financial stability, potentially delaying progress if the funds are crucial for ongoing work. However, it also emphasizes the importance of fair and timely payment for all parties involved in a project.

Is a Stop Payment Notice relevant only to California?

While this document references California Civil Code and is specifically designed to comply with California law, similar legal mechanisms exist in other states, often under different names like Mechanic's Liens or Construction Liens. The principles behind the stop payment notice are widely applicable, but the exact requirements and procedures vary by jurisdiction.

Common mistakes

- Not correctly identifying the party the notice is directed to can compromise the whole process. Names and addresses must match official records to ensure the notice reaches the right hands. Whether it's directed to an owner, public entity, or construction lender, accuracy is key.

- Filling out the claimant’s information inaccurately is another common mistake. The legal name and address of the person or firm claiming the stop notice must be clear and precise. Mistakes here could lead to delays or the failure of the notice.

- Omitting or incorrectly describing the labor, services, equipment, or materials furnished can significantly weaken the claim. This section helps establish the claimant's contribution and basis for the claim, making it essential for the notice’s effectiveness.

- Failure to accurately account for and detail the payments made and the outstanding amount due. The total value of labor and materials, what has been paid, and what is still owed must be accurately reported to substantiate the claim.

- Not serving the stop payment notice correctly according to the instructions can render it ineffective. Whether it’s by personal delivery, registered or certified mail, express mail, or overnight delivery, following the specified method ensures that the notice is legally recognized.

Avoiding these mistakes can significantly influence the success of a Stop Payment Notice. Being thorough, accurate, and compliant with the specified requirements is crucial.

Documents used along the form

When dealing with construction projects, the Stop Payment Notice is a crucial document, especially in jurisdictions like California. It serves as a legal notification intended to preserve a claimant's right to payment by alerting relevant parties that funds should be withheld due to unpaid labor, services, or materials. However, this form typically doesn't stand alone. Several other documents are often used in conjunction with a Stop Payment Notice to ensure proper legal procedures are followed and to strengthen the claimant's position.

- Conditional Waiver and Release Upon Progress Payment: This document is used when a payment is made and confirms the receipt of funds up to a certain date. It conditional because it is only effective if the payment clears.

- Unconditional Waiver and Release Upon Progress Payment: Similar to its conditional counterpart, this release confirms the receipt of a progress payment but does so unconditionally, meaning it is effective immediately upon its execution, regardless of the funds clearing.

- Preliminary Notice: Required in many states, this notice is filed at the beginning of a project or within a specific period after the claimant starts work. Its purpose is to notify the property owner, general contractor, and lender that the claimant is working on the project and reserves the right to file a lien if not paid.

- Mechanic's Lien Claim: If a contractor, subcontractor, or supplier remains unpaid, they may file a mechanic's lien against the property. This claim is a legal claim against the property itself for unpaid labor, services, or materials, potentially forcing the sale of the property if the claim is not satisfied.

- Release of Stop Payment Notice: This form is used when a dispute has been resolved, and the claimant withdraws the Stop Payment Notice, releasing the withheld funds back to the property owner or general contractor.

- Proof of Service Affidavit: A legal document that serves as evidence that the Stop Payment Notice (and potentially other legal notices) was properly served to the involved parties, detailing how, when, and to whom the documents were delivered.

Each of these documents plays a specific role in the construction payment process, offering protections to various parties involved. Whether you’re a property owner, a general contractor, or a subcontractor, understanding when and how to use these forms can ensure that payments are properly managed and disputes are minimized. Utilizing the full array of legal documents available can provide clarity, security, and efficiency to the complex construction payment process.

Similar forms

The Mechanic's Lien is comparable to a Stop Payment Notice in that both are legal tools used by contractors, subcontractors, or suppliers to ensure payment for labor or materials provided on a construction project. A Mechanic's Lien secures the claimant's interest directly against the property in question, making the property itself collateral for the debt. This is a similarity in purpose, as both mechanisms aim to safeguard the interests of those contributing to a project, yet they differ in their method of doing so, with one targeting the property and the other targeting the project’s funds.

A Payment Bond is often used on construction projects alongside or as an alternative to a Stop Payment Notice. While a Stop Payment Notice requests that funds be withheld to satisfy a debt, a Payment Bond provides a guarantee of payment to subcontractors and suppliers. This bond is a form of insurance that promises the contractor or principal will fulfill payment obligations. In essence, both documents serve to protect the financial interests of those performing work or supplying materials, but they operate through different mechanisms.

The Notice to Owner (NTO) shares similarities with the Stop Payment Notice in that both documents are preliminary notices sent to notify relevant parties of the sender's involvement in a project and to preserve lien rights. An NTO is generally required in some states to be sent before filing a lien and makes the property owner aware of the contributions from subcontractors and material suppliers, thus preventing "hidden liens." Though their purposes align in safeguarding lien rights, the specific legal requirements and effects of these notices may differ.

A Conditional Waiver and Release on Progress Payment resembles the Stop Payment Notice as it is used in the payment process during construction projects. It signifies that the claimant has received a progress payment and waives their right to file a mechanic's lien for that amount, contingent upon the payment clearing. While a Stop Payment Notice aims to secure funds to ensure payment, a Conditional Waiver and Release serves to document and release lien rights against the project up to the amount paid.

An Unconditional Waiver and Release upon Final Payment is used when a contractor or supplier has received full payment and wishes to waive their lien rights unconditionally. This document ensures the property owner that no further liens will be placed on the property for work done or materials supplied. The relationship with the Stop Payment Notice lies in the context of project payments; one document acts to secure payment while the other confirms payment completion and the relinquishment of lien rights.

The Preliminary Notice, also known as a Pre-Lien Notice in some jurisdictions, is akin to a Stop Payment Notice by serving as a prerequisite step in securing one's right to claim a lien. It's typically sent at the beginning of a project to notify owners, general contractors, and lenders that a subcontractor or supplier is providing labor or materials. This notice solidifies the sender's right to file a mechanic's lien if unpaid. Both notices are integral parts of the lien process, intended to make all parties aware of financial obligations and the potential for liens if those obligations are unmet.

A Demand Letter for Payment is similar to the Stop Payment Notice as both are formal requests for payment. The demand letter typically precedes more formal legal actions and outlines the amount due, the services rendered, and a deadline for payment. Though less specific to the construction industry and without the particular legal leverage entailed in a Stop Payment Notice, a demand letter serves a similar purpose of attempting to secure payment before proceeding to more serious legal remedies.

The Claim of Lien document is directly related to the Stop Payment Notice, as it is the formal declaration of a lien against a property for unpaid labor or materials. Where a Stop Payment Notice targets funds on a construction project, a Claim of Lien attaches to the property title, potentially hindering its sale or refinancing until the debt is settled. Both acts as leverage for claimants seeking compensation for their contributions to a project, through different means of legal pressure.

Dos and Don'ts

When filling out the Stop Payment Notice form, it's important to carefully follow guidelines and ensure the information you provide is accurate and comprehensive. Below are key dos and don'ts to consider:

Do:- Provide accurate information: Double-check that all personal and project-related information is correct. Mistakes can significantly delay or invalidate your notice.

- Describe the labor or materials furnished: Clearly specify the type of work performed or materials provided. A vague description can lead to disputes or confusion.

- Include the total value: Mention both the total agreed value and the value of labor and materials furnished to date. This helps in calculating the exact amount due.

- Sign and date the form: Ensure that the claimant or their authorized agent signs the form and fills out the date accurately. This is crucial for the document's legal validity.

- Follow the verification procedure: Completing the verification section correctly is mandatory, as it asserts the truthfulness of the information provided under penalty of perjury.

- Submit the proof of notice declaration: Fill out this section to officially declare that the Stop Payment Notice has been served to the appropriate party, ensuring legal compliance.

- Omit any required fields: Leaving out necessary information can render the notice ineffective. Make sure to fill out every relevant section of the form.

- Estimate values: Provide precise figures for the labor and materials. Estimates can lead to disputes and may affect the enforceability of your claim.

- Skip the verification section: Neglecting this crucial step can invalidate your notice. It's a legal assertion of the notice's authenticity and accuracy.

- Forget to check the service method: Be clear about how the notice was served, whether by personal delivery, registered or certified mail, express mail, or overnight delivery. This documentation is necessary for legal proceedings.

- Provide incorrect contact information: Errors in contact details can prevent the other party from responding to your notice, potentially complicating the situation.

- Delay submission: Timeliness is key. Submitting the notice late can affect your rights and the priority of your claim.

Misconceptions

Misconceptions about the Stop Payment Notice form are common, often leading to confusion about how it operates within the construction industry. Understanding these misconceptions is crucial for individuals and entities involved in construction projects.

- It's only for public projects: A common misconception is that Stop Payment Notices can only be used on public works projects. However, they are applicable to both public and private construction projects under California Civil Code Sections 8520, 8530, and 9350.

- It freezes all project funds immediately: While a Stop Payment Notice requires the construction lender or owner to withhold a specific amount from the contractor, it does not freeze all funds for the project immediately. The withheld amount is to satisfy the claim stated in the notice.

- Anyone can file a Stop Payment Notice: Not everyone involved in a construction project can file a Stop Payment Notice. It is generally limited to those who have furnished labor, services, equipment, or materials directly to the project and have not been fully paid.

- It serves as a lien on the property: There is a common misconception that a Stop Payment Notice acts as a lien on the property. While similar in intent—to secure payment for services rendered—it actually creates an equitable lien on the construction funds, not the property itself.

- No legal action is required after filing: Simply filing a Stop Payment Notice does not guarantee payment. It is often a preliminary step that might need to be followed by legal action, such as a lawsuit, to enforce the claimant's right to payment.

- It guarantees full payment: Filing a Stop Payment Notice does not ensure that the claimant will receive full payment for claims. The outcome depends on various factors, including the availability of funds and the resolution of any disputes over the claim.

- Stop Payment Notices and Mechanics Liens are interchangeable: Though both are tools to secure payment, a Mechanics Lien attaches to the property itself, while a Stop Payment Notice affects the funds related to the construction project. Each has distinct legal and procedural requirements.

- A verbal notice is sufficient: Verbal notices are not recognized under California law for this purpose. A Stop Payment Notice must be served in writing and meet specific requirements as outlined in the Civil Code, including verification and service in a prescribed manner.

- There are no consequences for improperly filing a Stop Payment Notice: Improper filing of a Stop Payment Notice, such as filing without a valid basis or serving it incorrectly, can lead to legal and financial consequences, including potential liability for wrongful stop payment notice claims.

Addressing these misconceptions is key to effectively using Stop Payment Notices and navigating the complex landscape of construction law in California.

Key takeaways

Filing a Stop Payment Notice is a critical step for protecting your financial interests in a construction project. Here are key takeaways to guide you through the process:

- Understanding the Form: A Stop Payment Notice is a legal notice used to withhold construction funds on public or private projects, as mandated by the California Civil Code Sections 8520, 8530, & 9350.

- Address it Correctly: Specify the name and address of the owner, public entity, or construction lender holding the funds, ensuring accuracy to prevent any delays.

- Detail Project Information: Clearly define the project name, location, and the parties involved, including the project owner, direct contractor, and construction lender, if applicable.

- Claimant's Information is Crucial: As the claimant, provide your legal name, address, and the relationship to the project, ensuring all details are accurate for legitimacy.

- Describe the Work and Financials: Outline the labor, services, equipment, or materials provided, including the total agreed value and the outstanding amount owed.

- Legal Requirements: Understand that submitting this notice obligates the recipient to set aside sufficient funds to satisfy the claim, as outlined by law.

- Verification and Signature: The claimant (or authorized agent) must sign, verifying the contents under penalty of perjury, asserting the truthfulness and correctness of the information provided.

- Request for Notice of Election: For private works, include a request for notice and a copy of any payment bond if an election is made not to withhold funds because of such a bond.

- Proof of Notice: Provide documentation proving the Stop Payment Notice was served to the appropriate party, adhering to specified service methods, and confirming date and method of delivery.

By focusing on these key aspects when preparing and submitting a Stop Payment Notice, claimants can more effectively manage their rights and responsibilities, helping ensure that their financial interests are protected throughout the construction process.

Popular PDF Documents

Apply for Reseller Permit - The form is designed to be internet fillable, providing ease of use for businesses managing their sales tax electronically.

How to Get Hsa Tax Form - Anyone with a Medicare Advantage MSA or an Archer MSA will receive this form to confirm the amounts contributed by the tax deadline.