Get Stax 1 Form

The Illinois Department of Revenue introduces an essential tool for organizations aiming to navigate the complexities of sales tax exemption through the STAX-1 Application for Sales Tax Exemption. This form offers a pathway for both new applicants and those seeking renewal of their exemption status, emphasizing the significance of adhering to all procedural steps to avoid potential denial. Organizations have the opportunity to present their purpose and affirm their eligibility across various categories, such as governmental entities, charitable groups, educational establishments, and religious organizations, to name a few. Detailed documentation, ranging from Articles of Incorporation for incorporated bodies to IRS letters affirming tax-exempt status, constitutes a critical component of the application process, underpinning the rigorous validation of each organization’s claim for exemption. A thorough completion and submission of the STAX-1 form, accompanied by requisite evidence, sets the stage for organizations to potentially secure relief from sales tax, thereby channeling more resources towards their core missions and services. The Illinois Department of Revenue emphasizes the importance of this process through a structured application form, ensuring organizations clearly articulate their functional and financial narratives, underlining the state’s commitment to supporting the diverse and crucial roles these bodies play within the community.

Stax 1 Example

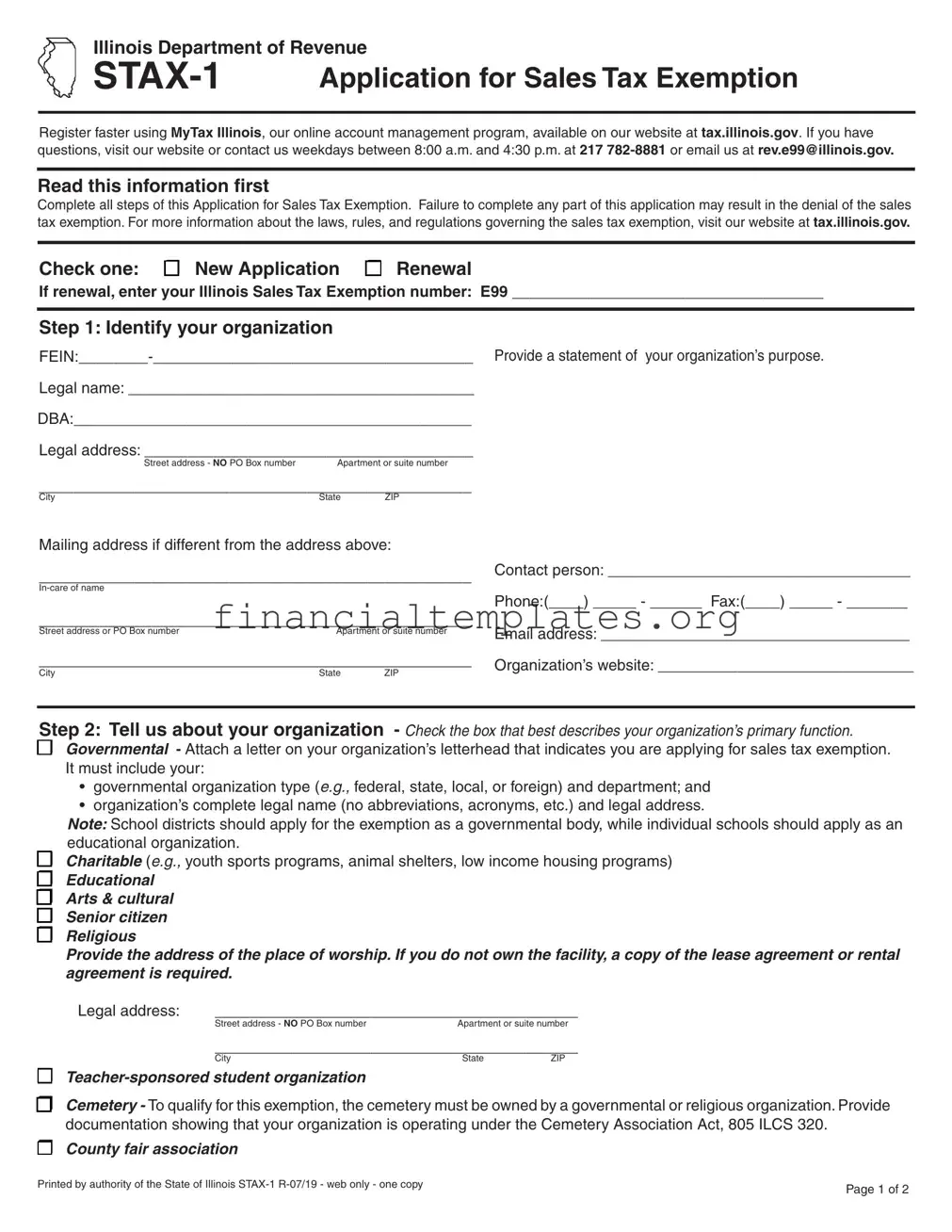

Illinois Department of Revenue

Application for Sales Tax Exemption |

Register faster using MyTax Illinois, our online account management program, available on our website at tax.illinois.gov. If you have questions, visit our website or contact us weekdays between 8:00 a.m. and 4:30 p.m. at 217

Read this information first

Complete all steps of this Application for Sales Tax Exemption. Failure to complete any part of this application may result in the denial of the sales tax exemption. For more information about the laws, rules, and regulations governing the sales tax exemption, visit our website at tax.illinois.gov.

Check one:

New Application

Renewal

If renewal, enter your Illinois Sales Tax Exemption number: E99 ____________________________________

Step 1: Identify your organization

Legal name: ________________________________________

DBA:______________________________________________

Legal address: ______________________________________

Street address - NO PO Box numberApartment or suite number

__________________________________________________

City |

State |

ZIP |

Mailing address if different from the address above:

__________________________________________________

__________________________________________________

Street address or PO Box numberApartment or suite number

__________________________________________________

City |

State |

ZIP |

Provide a statement of your organization’s purpose.

Contact person: ___________________________________

Phone:(____) _____ - ______ Fax:(____) _____ - _______

Email address: ___________________________________

Organization’s website: _____________________________

Step 2: Tell us about your organization - Check the box that best describes your organization’s primary function.

Governmental - Attach a letter on your organization’s letterhead that indicates you are applying for sales tax exemption. It must include your:

•governmental organization type (e.g., federal, state, local, or foreign) and department; and

•organization’s complete legal name (no abbreviations, acronyms, etc.) and legal address.

Note: School districts should apply for the exemption as a governmental body, while individual schools should apply as an educational organization.

Charitable (e.g., youth sports programs, animal shelters, low income housing programs)

Educational Arts & cultural Senior citizen Religious

Provide the address of the place of worship. If you do not own the facility, a copy of the lease agreement or rental agreement is required.

Legal address: |

__________________________________________ |

||

|

Street address - NO PO Box number |

Apartment or suite number |

|

|

__________________________________________ |

||

|

City |

State |

ZIP |

Cemetery - To qualify for this exemption, the cemetery must be owned by a governmental or religious organization. Provide documentation showing that your organization is operating under the Cemetery Association Act, 805 ILCS 320.

County fair association

Printed by authority of the State of Illinois |

Page 1 of 2 |

|

Step 3: Required documentation - All organizations, except governmental organizations, must provide copies of the following documentation when submitting your application.

•If incorporated, your organization’s Articles of Incorporation;

•If unincorporated, your organization’s constitution;

•Your organization’s

•A detailed narrative explaining the purposes, functions, and activities of your organization;

•Brochures or other printed material explaining the purposes, functions, and activities of your organization;

•A copy of the Internal Revenue Service (IRS) letter, regarding federal

Note: Exemption from federal income taxes under section 501(c)3 does not automatically grant your organization tax exempt status under Illinois law;

•A copy of the most recent

Note: If you are applying as a religious organization you are not required to provide a financial statement (with the intial application), but you must provide a copy of your lease or rental agreement if you do not own the place of worship; and

•Any other information that describes the purposes, functions, and activities of your organization.

Step 4: Sign below

Under the penalties of perjury, I state that I have examined this application and all attachments and other information required and to the best of my knowledge, it is true, correct, and complete.

________________________________________________________________________________________________________________

Signature |

Printed name |

Date |

Mail your completed application and any required documentation to:

EXEMPTION SECTION MC

ILLINOIS DEPARTMENT OF REVENUE 101 WEST JEFFERSON STREET SPRINGFIELD IL 62702

This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed. Disclosure of this information is required. Failure to provide information may result in this form not being processed and may result in a penalty.

Page 2 of 2 |

Document Specifics

| Fact Name | Detail |

|---|---|

| Form Type | STAX-1 Application for Sales Tax Exemption |

| Governing Agency | Illinois Department of Revenue |

| Online Registration Option | Available through MyTax Illinois |

| Contact Information | Phone: 217 782-8881, Email: rev.e99@illinois.gov |

| Application Requirement | Complete all steps of the application to avoid denial |

| Application Types | New Application and Renewal |

| Organization Information Required | FEIN, legal name, DBA, legal and mailing addresses, contact person, phone, fax, and email |

| Organization Types Eligible | Governmental, Charitable, Educational, Arts & Cultural, Senior Citizen, Religious, Cemetery, County Fair Association |

| Documentation Required for Application | Varies based on organization type; may include Articles of Incorporation, constitution, by-laws, narrative of purposes, IRS letter regarding tax-exempt status, financial statements, etc. |

| Signatory Requirement | Signature required under penalties of perjury, affirming information is true, correct, and complete |

| Governing Law for Cemeteries | Cemetery Association Act, 805 ILCS 320 |

Guide to Writing Stax 1

Completing the STAX-1 form is essential for organizations in Illinois seeking a sales tax exemption. This process involves identifying your organization, detailing its primary function, gathering required documents, and signing the application under oath. Ensuring accurate and complete information can assist in avoiding delays or denials from the Illinois Department of Revenue. Below are the steps to correctly fill out the STAX-1 Application for Sales Tax Exemption.

- Determine the type of application: Check the appropriate box for either a New Application or a Renewal. If renewing, enter your Illinois Sales Tax Exemption number where indicated.

- Identify your organization:

- Provide your Federal Employer Identification Number (FEIN).

- List your organization's legal name and any Doing Business As (DBA) names.

- Give the legal address and mailing address, if different. Remember, PO Box numbers are not acceptable for the legal address.

- Include a statement of your organization's purpose.

- Input contact information, including a phone number, fax (if available), email address, and organization’s website.

- Tell us about your organization: Check the box that best describes your organization’s primary function. If choosing "Governmental," attach a letter as instructed. Specify the organization type and provide the legal address and, if applicable, the address of your place of worship or additional documentation for other categories.

- Required documentation: Collect and attach all necessary documentation based on your organization's designation. This includes Articles of Incorporation, by-laws, a detailed narrative of your organization, brochures, IRS exemption letter if applicable, and audited financial statements. Governmental organizations are exempt from this step.

- Complete the signature section: Sign and print your name, alongside the date, to affirm the truthfulness and completeness of the application and accompanying documents.

- Mail the completed form along with all required attachments to the address provided: EXEMPTION SECTION MC 3-520 ILLINOIS DEPARTMENT OF REVENUE 101 WEST JEFFERSON STREET SPRINGFIELD, IL 62702

Upon submission, the Illinois Department of Revenue will review your STAX-1 form and attached documents. This review is crucial for determining your organization's eligibility for a sales tax exemption in Illinois. Ensuring your application is thoroughly and correctly filled can help facilitate a smoother review process.

Understanding Stax 1

What is the STAX-1 form and who needs to fill it out?

The STAX-1 form is an Application for Sales Tax Exemption provided by the Illinois Department of Revenue. It's designed for organizations seeking exemption from sales tax on their purchases. Organizations that should fill out this form include governmental bodies, charitable groups, educational institutions, arts & cultural organizations, senior citizen groups, religious organizations, teacher-sponsored student organizations, cemeteries owned by governmental or religious organizations, and county fair associations. Completing this application accurately is essential for those seeking sales tax exemption under Illinois law.

How does an organization apply for a sales tax exemption using the STAX-1 form?

To apply for a sales tax exemption using the STAX-1 form, the organization must first complete all the steps outlined on the form, including providing the organization's FEIN, legal name, and addresses. Then, they must identify the primary function of the organization by checking the appropriate box (e.g., Governmental, Charitable, Educational). The organization is also required to attach the necessary documentation, such as Articles of Incorporation, by-laws, narrative of purposes, IRS exemption letter if applicable, and financial statements unless exempted. For governmental organizations, a letter on official letterhead should be included specifying that they are applying for this exemption. Once completed, the form and all attachments should be mailed to the designated address of the Illinois Department of Revenue’s Exemption Section. It is crucial that the application is signed under the penalties of perjury, certifying the information as true, correct, and complete.

What are the required documents to be submitted along with the STAX-1 form?

All organizations, except governmental bodies, must provide various documents when submitting the STAX-1 form. These documents include Articles of Incorporation for incorporated entities, the constitution for unincorporated entities, the organization's by-laws, a detailed narrative describing the organization's purposes, functions, and activities, along with brochures or printed materials that explain these details. If the organization has received a federal tax exemption under section 501(c)3, a copy of the IRS letter should be submitted. However, this does not automatically qualify the organization for a state exemption. Additionally, a recent full-year audited financial statement is required unless the entity is a religious organization applying for the first time. Religious organizations must submit a copy of their lease or rental agreement if they don’t own their worship place. These documents are essential to verify the organization's eligibility for sales tax exemption under Illinois law.

Can organizations renew their sales tax exemption using the STAX-1 form?

Yes, organizations can renew their sales tax exemption using the STAX-1 form. When filling out the form, there is an option to check either "New Application" or "Renewal." If the organization is renewing its sales tax exemption status, it must enter its Illinois Sales Tax Exemption number in the space provided. The renewal process involves providing updated information and documentation as required to ensure the organization still qualifies for the sales tax exemption. Therefore, organizations should carefully review all sections of the form to ensure compliance with current requirements and maintain their exemption status smoothly.

Common mistakes

Filling out the STAX-1 form, which is crucial for obtaining sales tax exemption in Illinois, often involves several common mistakes. To ensure that your application is processed smoothly, it's important to be mindful of these pitfalls:

- Not choosing between a "New Application" and "Renewal." It's important right at the start to clarify what you are applying for.

- Leaving the FEIN (Federal Employer Identification Number) section blank or not completing it correctly. This information is crucial for identification.

- Using a PO Box number instead of the required legal and street address. The form specifically states that a PO Box number is not acceptable for the legal or street address.

- Not providing a detailed statement of the organization's purpose. A vague or incomplete statement can result in the denial of your application.

- Incorrectly identifying the organization's primary function or not providing the necessary attachment for governmental organizations. This part requires careful attention to select the appropriate category.

- Forgetting to include the contact person's details or providing incomplete information. Every bit of contact information is necessary for further communications.

- For religious organizations, failing to provide a copy of the lease or rental agreement if the worship place is not owned. This is a commonly overlooked document.

- Omitting required documentation such as Articles of Incorporation for incorporated entities, or the organization's constitution and by-laws for unincorporated ones.

- Submitting an application without a signature, printed name, and date under Step 4. This mistake can invalidate the entire application.

- Assuming exemption from federal income taxes automatically grants Illinois tax exempt status. This misconception can lead to incomplete applications.

Avoiding these mistakes can greatly increase the likelihood of a successful application. Take your time, review each part of the application thoroughly, and make sure to include all necessary documents and accurate information.

If you have questions or uncertainties, don't hesitate to reach out to the Illinois Department of Revenue. They're there to help, ensuring that organizations like yours can achieve their tax-exempt status without unnecessary delay.

Documents used along the form

When completing and submitting the STAX-1 form for a sales tax exemption in Illinois, various additional documents may be required to support the application depending on the organization's nature and status. Familiarizing oneself with these accompanying forms and documents ensures a smoother application process.

- Articles of Incorporation: This document is vital for incorporated organizations. It provides the state with necessary information about the company, including its name, purpose, structure, and other essential details.

- Constitution for Unincorporated Organizations: Similar to the Articles of Incorporation, this document outlines the fundamental principles and policies guiding an unincorporated organization's operations.

- By-laws: The by-laws of an organization detail the rules under which the organization operates, including information on meetings, elections of officers, and other internal procedures.

- Narrative of Purpose: A detailed account explaining the organization's purposes, functions, and activities helps the Illinois Department of Revenue understand its operations better.

- Brochures or Printed Materials: These help in further clarifying the organization's purposes, functioning, and activities through visual and textual information.

- IRS Tax Exemption Letter: If the organization has been granted an exemption from federal income taxes under section 501(c)3, a copy of the IRS letter must be included.

- Audited Financial Statement: The most recent full-year audited financial statement showing income and expenses breakdown is required, except for religious organizations, which are exempt from this requirement with their initial application but must still provide a lease or rental agreement if they do not own their place of worship.

Accompanying documents complement the STAX-1 form by providing a comprehensive view of the organization's legal, operational, and financial status. Proper preparation and submission of these documents play a critical role in the successful processing of the sales tax exemption application.

Similar forms

The Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, bears a striking resemblance to the STAX-1 form in several aspects. Both forms are pivotal for organizations striving to secure tax-exempt status, albeit under different jurisdictions; the STAX-1 for Illinois state sales tax exemptions and the Form 1023 for federal income tax exemptions. Each form necessitates comprehensive organizational details, such as legal name, address, and a statement of purpose. Additionally, they require attachments that describe the organization's activities, governance documents, and a certification that the application is complete and accurate to the best of the applicant's knowledge.

The SS-4 Form, Application for Employer Identification Number (EIN), is akin to the STAX-1 form in that both are initial steps for newly formed organizations setting their foundational compliance structures. While the SS-4 is focused on securing an EIN necessary for tax identification purposes at a federal level, the STAX-1 addresses state-specific sales tax exemption requirements. Each form requires basic identifiers like legal name, address, and contact information. However, the SS-4 emphasizes tax identity, and the STAX-1, tax exemption status.

Similarly, the Business License Application forms that various states offer share common ground with the STAX-1 form. These forms typically serve as a gateway for entities to legally operate within a state, encompassing a wide range of activities from sales to services. Like the STAX-1, state business license applications demand organizational details and the nature of the entity's activities. Both forms are crucial for compliance with state regulations, albeit serving different regulatory functions—one for licensing and the other for tax exemption.

The Form 990, Return of Organization Exempt from Income Tax, also parallels the STAX-1 form to a certain extent. Though the Form 990 is an annual filing for organizations to maintain their federal tax-exempt status, and the STAX-1 is an application for state sales tax exemption, both require detailed disclosures about the organization's operations, finances, and governance. Organizations must provide a narrative of their mission and activities, which is essential for both maintaining federal tax-exempt status and obtaining state sales tax exemptions.

The Charitable Organization Registration Form, required by many states' attorneys general, shares objectives similar to those of the STAX-1 form. It's designed for charitable entities to gain authorization to solicit donations within a state. Both forms necessitate detailed information about the organization, its purpose, and its activities. However, the focus diverges; the STAX-1 is tailored for sales tax exemption, whereas the charitable registration targets fundraising legality.

Unemployment Insurance registration forms, mandated by state employment departments, also resemble the STAX-1 form but cater to a different domain of organizational compliance. These forms ensure organizations contribute to the state's unemployment insurance fund, capturing organizational details similar to those on the STAX-1. Despite their different aims—one for tax exemption and the other for unemployment insurance—both are critical for operational legality in their respective areas.

The application for State Environmental Quality Permits often necessitates a detailed description of an organization’s operations similar to the STAX-1 form. Though primarily concerned with environmental impact and compliance, these applications require organizations to submit detailed information about their activities, premises, and purpose, analogous to the documentation required for sales tax exemption. The focus on regulatory compliance underlines the similarities between these forms.

The Zoning Permit application, another document with objectives that coincide with the STAX-1 form, is crucial for ensuring that an organization’s physical location and operations comply with municipal land-use regulations. Like the STAX-1, zoning permits require detailed information about the organization's premises and activities. While zoning permits focus on land use and structure, the STAX-1 focuses on tax exemption, yet both serve as essential compliance steps for organizations.

Corporate Income Tax Returns, while primarily focused on reporting income, expenses, and paying corporate income tax, demand detailed organizational and operational information akin to what is required on the STAX-1 form for sales tax exemption. Organizations must supply specifics about their identity, nature, and activities, underlying the commonality of requiring thorough organizational disclosures for compliance purposes, regardless of the tax-specific objective.

Finally, the Worker’s Compensation Insurance forms, necessary for organizations to comply with state laws regarding employee injury compensation, bear similarity to the STAX-1 form in requiring organizational details. Although their primary aim is to ensure coverage for workplace injuries, these forms, like the STAX-1, collect essential details about the organization, marking another intersection of compliance-focused documentation across different regulatory areas.

Dos and Don'ts

When filling out the STAX-1 Application for Sales Tax Exemption with the Illinois Department of Revenue, accuracy and thoroughness are paramount. To ensure a smooth process, here are essential dos and don'ts:

- Do gather all necessary documents before starting the application, including your FEIN, Articles of Incorporation, and IRS exemption letter, if applicable.

- Do read the instructions carefully to understand each step of the application and the specific requirements for your organization type.

- Do check the appropriate box to indicate whether you're filing a new application or a renewal, and include your Illinois Sales Tax Exemption number if renewing.

- Do provide complete and accurate information about your organization’s legal name, address, and contact person to avoid any delays.

- Do ensure that your organization’s statement of purpose is current and aligns with the criteria for sales tax exemption eligibility in Illinois.

- Do not use a P.O. Box number for the street address; a physical address is required for both the legal and mailing addresses.

- Do not leave any fields blank. If a section does not apply, indicate this with “N/A” or “None,” as appropriate.

- Do not forget to attach all required documentation, such as your Articles of Incorporation, by-laws, and narrative of your organization’s purpose, functions, and activities.

- Do not overlook the need to sign and date the application under the penalties of perjury statement, ensuring that your submission is complete.

- Do not send the application without double-checking all information for accuracy and completeness to prevent any unnecessary delays or denials due to errors.

Adhering to these guidelines will help ensure that your STAX-1 Application for Sales Tax Exemption is processed smoothly and efficiently, setting your organization up for a successful submission.

Misconceptions

There are several common misconceptions about the Illinois Department of Revenue STAX-1 form, which is necessary for applying for a sales tax exemption. Correcting these misunderstandings can streamline the application process and ensure organizations are properly prepared. Here are eight of these misconceptions explained:

- All organizations are automatically granted sales tax exemptions if they have nonprofit status. In reality, an exemption from federal income taxes under section 501(c)(3) does not automatically grant tax-exempt status under Illinois law. An application through the STAX-1 form is necessary to determine eligibility under state-specific criteria.

- The STAX-1 form is only for renewals of sales tax exemption. The form indeed has a section for renewals, but it is also designed for new applications. Organizations applying for the sales tax exemption for the first time need to fill out this form as meticulously as those applying for renewal.

- Governmental organizations must provide the same documentation as other organizations. There’s a misconception that all entities must submit extensive documentation. However, governmental organizations are only required to attach a letter on their official letterhead indicating their application for sales tax exemption, significantly simplifying their application process.

- Schools and school districts are treated the same in the application process. This is incorrect; while school districts should apply for the exemption as a governmental body, individual schools are advised to apply as educational organizations, which subjects them to different requirements.

- Electronic submissions are accepted for the STAX-1 form. The form and all required documentation must be mailed to the Illinois Department of Revenue. There is mention of the MyTax Illinois online account management program, but the STAX-1 form submission process is explicitly carried out through postal mail.

- All organizations must provide a financial statement with their initial application. While many organizations do need to provide a financial statement, religious organizations are not required to do so with their initial application. However, they must include a copy of their lease or rental agreement if they do not own the place of worship.

- Providing a PO Box as an address is acceptable for your organization’s application. The application specifically requires a legal and a street address for the organization, explicitly stating that PO Box numbers are not acceptable for either the legal address or the place of worship’s location.

- Any document related to the organization's activities can be submitted as supportive information. While it's encouraged to provide a detailed narrative and printed materials explaining the organization's purposes, functions, and activities, the application outlines specific documents that are required, such as the Articles of Incorporation for incorporated entities or a constitution for unincorporated ones. Simply submitting any document without ensuring it meets the form's requirements could lead to an incomplete application.

Understanding these nuances and correcting the aforementioned misconceptions can significantly improve the accuracy of the application submissions and help organizations in Illinois more effectively navigate the process of obtaining a sales tax exemption.

Key takeaways

Filling out the STAX-1 form correctly is essential for organizations in Illinois seeking a sales tax exemption. Here are some key takeaways to ensure proper completion and submission:

- Register online for a faster experience using MyTax Illinois, which is available on the Illinois Department of Revenue website.

- It is important to complete all steps of the application. Failing to complete parts of the application may lead to denial of the exemption.

- There is a distinction between New Applications and Renewals. If you are renewing, make sure you include your Illinois Sales Tax Exemption number.

- Organizations must identify themselves properly, providing details such as FEIN, legal name, DBA, legal and mailing addresses, and a statement of purpose.

- Clarify your organization’s primary function by checking the appropriate box and provide any required additional documentation, such as a letter for governmental organizations or lease agreements for religious organizations not owning their place of worship.

- Required documentation varies depending on the type of organization. Most will need to provide articles of incorporation, by-laws, a narrative of purposes, and financial statements, among others.

- The application must be signed under penalty of perjury, certifying the accuracy and completeness of the information provided.

- Finally, ensure all completed applications and required documents are mailed to the specified address of the Illinois Department of Revenue's Exemption Section.

Understanding and following these guidelines will help streamline the process of applying for a sales tax exemption in Illinois.

Popular PDF Documents

What Does a 1040 Look Like - It simplifies the tax filing process by focusing on the income types most common to seniors.

What Is a W4p Form - Submitting a revised W-4P after a life event, such as the birth of a child or divorce, ensures that your withholdings reflect your current tax situation.