Get State Tax Cl 1 Form

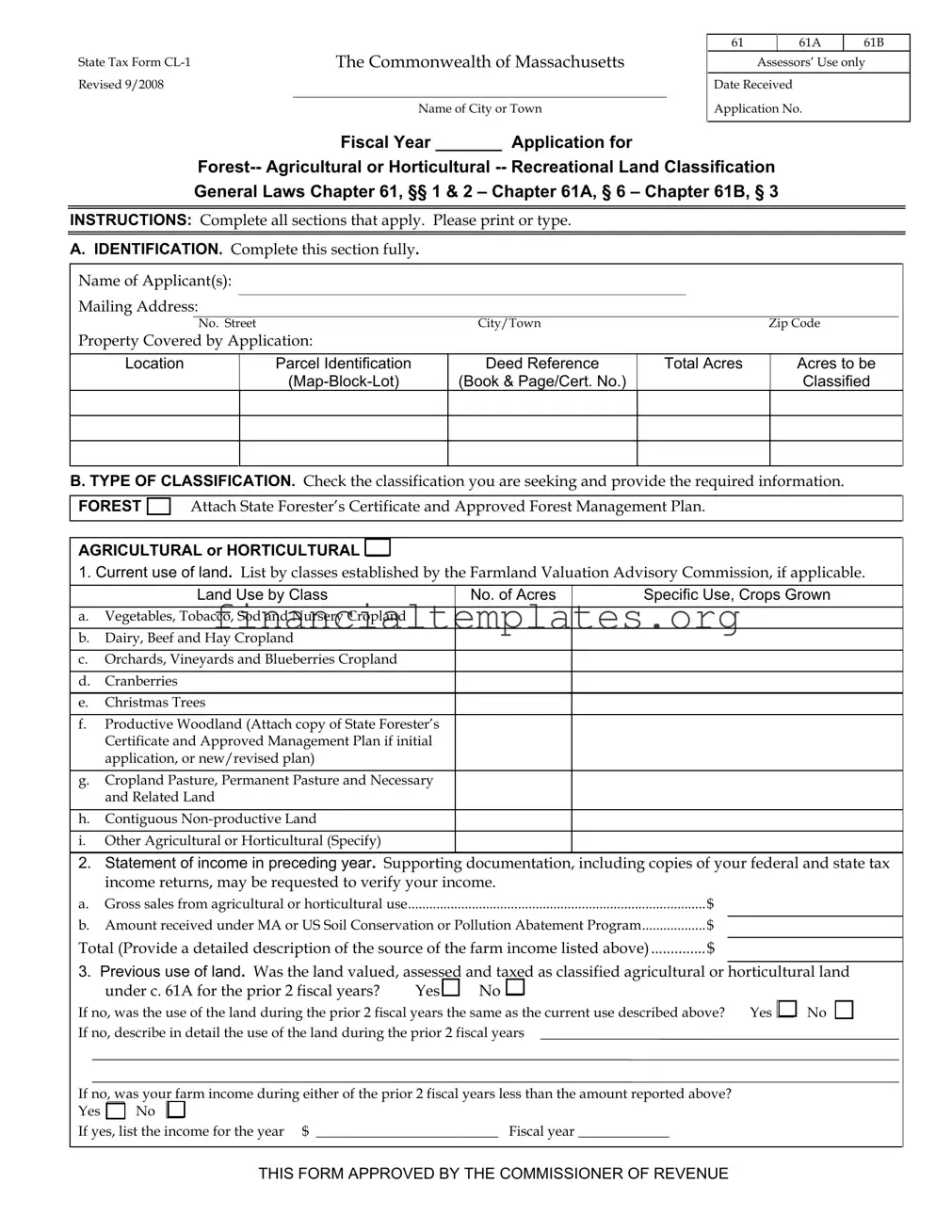

The State Tax Form CL-1, utilized within the Commonwealth of Massachusetts, presents a vital mechanism for property owners seeking classification under forest, agricultural or horticultural, or recreational land categories. Revised in September 2008, this form serves as an application for land classification under General Laws Chapter 61, §§ 1 & 2; Chapter 61A, § 6; and Chapter 61B, § 3. It requires detailed information including the applicant's identity, property designation, and the specific classification sought. Applicants must provide a comprehensive description of the land's current use, supported by documentation such as a state forester’s certificate, approved management plans, and evidence of farm income, if applicable. The form distinguishes between different types of land usage—ranging from agricultural activities like dairy, beef, and crop farming, to forestry and recreational uses. Additionally, it probes into the property's previous use, to ascertain continuity in its agricultural or horticultural role, and inquires about current recreational activities, if relevant, ensuring a thorough evaluation of the land’s eligibility for tax benefits associated with such classifications. It includes sections for lessee certification and owner signature, affirming the accuracy and completeness of the information provided. Ultimately, this form stands as a critical document for property owners aiming to leverage Massachusetts’ tax classifications for financial and operational benefits in forest, agricultural, horticultural, or recreational land management.

State Tax Cl 1 Example

State Tax Form |

The Commonwealth of Massachusetts |

Revised 9/2008 |

|

|

|

|

Name of City or Town |

61 |

61A |

61B |

Assessors’ Use only

Date Received

Application No.

Fiscal Year _______ Application for

General Laws Chapter 61, §§ 1 & 2 – Chapter 61A, § 6 – Chapter 61B, § 3

INSTRUCTIONS: Complete all sections that apply. Please print or type.

A.IDENTIFICATION. Complete this section fully.

Name of Applicant(s):

Mailing Address:

No. Street |

City/Town |

Zip Code |

Property Covered by Application:

Location

Parcel Identification

Deed Reference

(Book & Page/Cert. No.)

Total Acres

Acres to be

Classified

B. TYPE OF CLASSIFICATION. Check the classification you are seeking and provide the required information.

FOREST

Attach State Forester’s Certificate and Approved Forest Management Plan.

AGRICULTURAL or HORTICULTURAL

1.Current use of land. List by classes established by the Farmland Valuation Advisory Commission, if applicable.

Land Use by Class

No. of Acres

Specific Use, Crops Grown

a.Vegetables, Tobacco, Sod and Nursery Cropland

b.Dairy, Beef and Hay Cropland

c.Orchards, Vineyards and Blueberries Cropland

d.Cranberries

e.Christmas Trees

f.Productive Woodland (Attach copy of State Forester’s Certificate and Approved Management Plan if initial application, or new/revised plan)

g.Cropland Pasture, Permanent Pasture and Necessary and Related Land

h.Contiguous

i.Other Agricultural or Horticultural (Specify)

2.Statement of income in preceding year. Supporting documentation, including copies of your federal and state tax income returns, may be requested to verify your income.

a. Gross sales from agricultural or horticultural use |

$ |

b. Amount received under MA or US Soil Conservation or Pollution Abatement Program |

$ |

Total (Provide a detailed description of the source of the farm income listed above) |

$ |

3.Previous use of land. Was the land valued, assessed and taxed as classified agricultural or horticultural land

|

under c. 61A for the prior 2 fiscal years? |

Yes |

|

No |

|

|

|

|

|

|

|||

If no, was the use of the land during the prior 2 fiscal years the same as the current use described above? |

Yes |

No |

||||

If no, describe in detail the use of the land during the prior 2 fiscal years |

|

|

||||

If no, was your farm income during either of the prior 2 fiscal years less than the amount reported above? |

|

|

||||

Yes |

No |

|

|

|

|

|

If yes, list the income for the year $ __________________________ Fiscal year _____________

THIS FORM APPROVED BY THE COMMISSIONER OF REVENUE

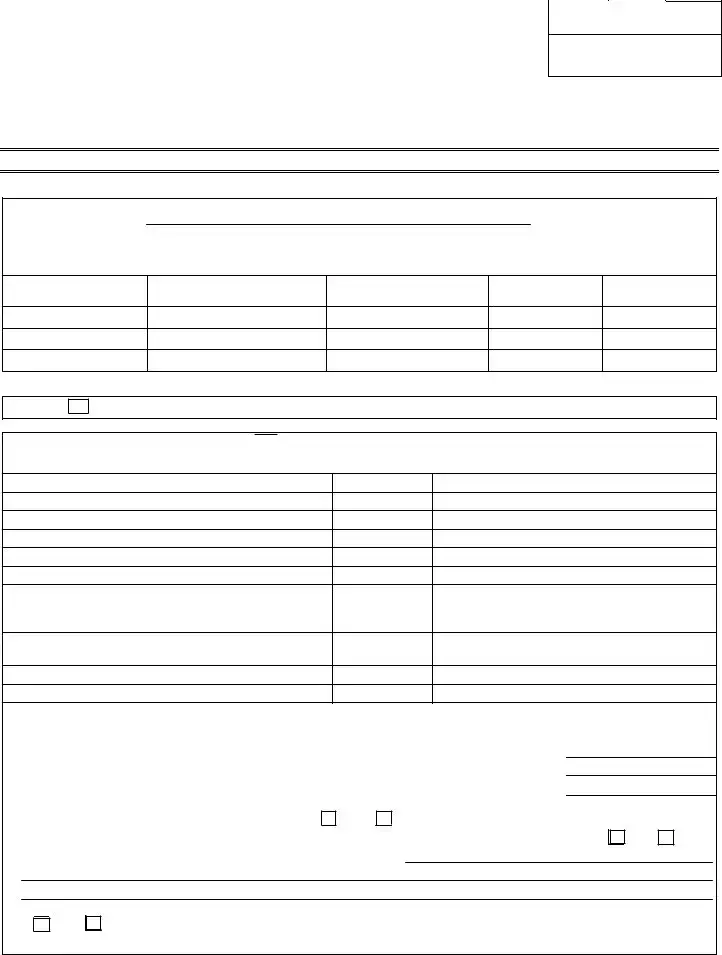

RECREATIONAL |

Land may qualify based on its condition or recreational use. |

|

|

1. Is the land retained in substantially a natural, wild or open condition? Yes |

No |

|

|

Is the land in a landscaped or pasture condition or managed forest condition? |

Yes |

No |

|

If managed forest, attach copy of State Forester’s Certificate and Approved Management Plan if initial application, or new/revised plan.

Does the land allow to a significant extent the preservation of wildlife and other natural resources? Yes |

No |

If yes, indicate which natural resources are preserved: |

|

Ground Water/Surface Water |

|

|

Clean Air |

Rare/Endangered Species |

|

|

Geologic Features |

High Quality Soils |

|

|

Other (specify) |

|

|

||

|

|

|

|

|

|

|

|

2. Is the land used primarily for recreational use? |

Yes |

No |

|||

If yes, indicate for which recreational activity: |

|

|

|||

Archery |

|

Picnicking |

|

|

Camping |

|

|

|

|||

Fishing |

Golfing |

Hang gliding |

Vegetation

Scenic Resources

Other (specify)

Nature Study & Observation

Hiking |

Target Shooting |

Hunting |

Private |

Boating |

Skiing |

Swimming |

Horseback Riding |

Commercial Horseback Riding &

Equine Boarding

How often is the land used for recreational activities?

How many people use the land for those activities?

Is the land open to the general public? Yes |

No |

If no, to whom is its use restricted? |

|

Is the land used for horse racing, dog racing or any sport normally undertaken in a stadium, gymnasium or

similar structure? Yes |

No |

C. LESSEE CERTIFICATION. If any portion of property is leased, the following statement must be signed by each lessee.

I hereby certify that the property I lease is being used as described in this application and that I intend to use the

property in that manner during the period to which the application applies. |

|

Lessee |

Date |

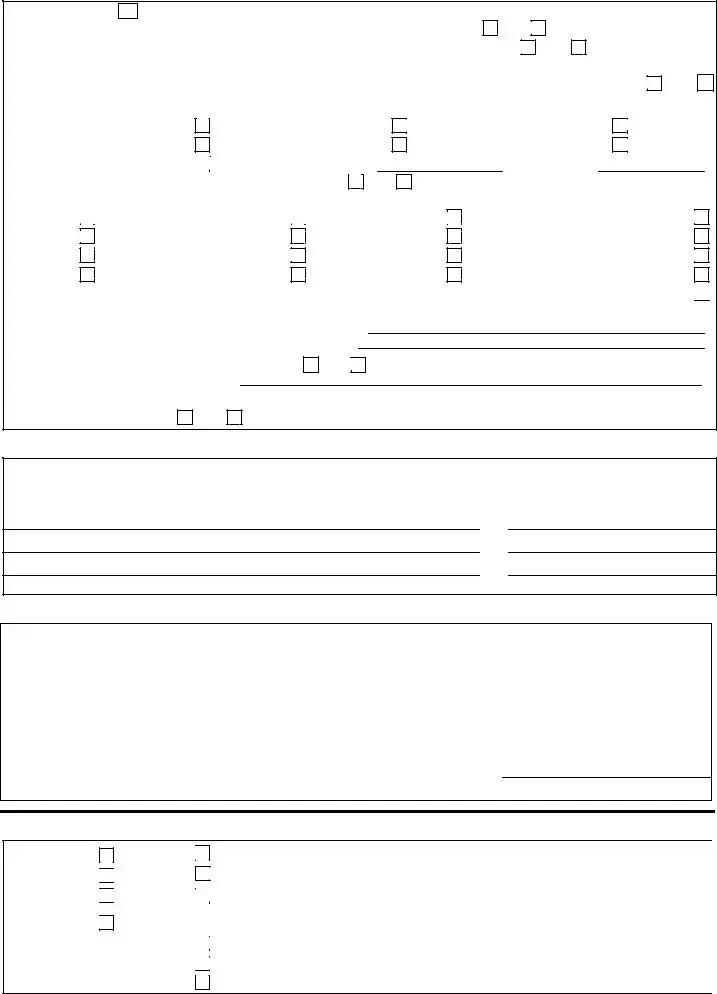

D.SIGNATURE. All owners must sign here to complete the application.

This application has been prepared or examined by me. Under the pains and penalties of perjury, I declare that to the best of my knowledge and belief, it and all accompanying documents and statements are true, correct and complete. I also certify that I have signed and attached a Property Owner’s Acknowledgement of Rights and Obligations under classified forest, agricultural or horticultural or recreational land programs, as part of this application.

Owner |

|

Date |

|

|

|

|

|

|

|

|

|

If signed by agent, attach copy of written authorization to sign on behalf of taxpayer.

DISPOSITION OF APPLICATION (ASSESSORS’ USE ONLY)

Ownership

Min. Acres

Use/Condition

Use/Condition

Gross Sales

All |

|

|

|

Date Voted/Denied |

|

Part |

|

|

GRANTED |

Date Notice Sent |

|

Deemed |

|

|

|

Board of Assessors |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All |

|

|

|

|

|

Part |

|

|

DENIED |

|

|

|

|

|

|

||

|

|

|

|

||

Deemed |

|

|

|

Date |

|

Document Specifics

| Fact | Detail |

|---|---|

| Form Title | State Tax Form CL-1 |

| State | Massachusetts |

| Revision Date | September 2008 |

| Purpose | Application for Forest, Agricultural or Horticultural, Recreational Land Classification |

| Governing Laws | General Laws Chapter 61, §§ 1 & 2 – Chapter 61A, § 6 – Chapter 61B, § 3 |

| Requirements for Use | Involves declaring the current use of land, the income derived from its use, and any relevant management plans or certifications. |

| Submission Instructions | Complete all applicable sections, print or type, and sign under the pains and penalties of perjury. |

| Assessors' Section | Includes space for application number, date received, fiscal year, and decisions on the application. |

Guide to Writing State Tax Cl 1

Completing the State Tax Form CL-1 is a critical step for landowners in Massachusetts looking to have their property classified under forest, agricultural, horticultural, or recreational land uses for tax purposes. Ensuring accurate and thorough completion of this form will set the foundation for potentially beneficial tax considerations. The process involves providing detailed information about the property, its current and previous uses, income generated from it, and future plans for its classification. Here's how to fill out the form:

- Under the IDENTIFICATION section, enter the full name of the applicant(s), complete mailing address (including city/town and zip code), and the detailed information about the property being applied for, including its location, parcel identification, and total acres. Fill out the deed reference as found on the property's deed.

- In the TYPE OF CLASSIFICATION section, check the desired classification for the land. If choosing forest classification, attach the State Forester’s Certificate and Approved Forest Management Plan as indicated.

- For agricultural or horticultural classification, describe the current use of land by listing the acreage and specific crops or uses for each class of land. Required details include vegetables, cropland types, orchards, and any other relevant classifications. Attach any necessary documents if this is an initial application or if the plan is new or revised.

- Provide a statement of income from the previous year for the agricultural or horticultural land use, including gross sales and amount received from conservation programs. Detail the source of the farm income.

- Answer questions about the previous use of the land, including whether it was valued, assessed, and taxed under classified agricultural or horticultural land for the prior two fiscal years, and provide details as required.

- For recreational land classification, respond to questions regarding the land's condition, use, and how it contributes to the preservation of natural resources and wildlife. Include details about recreational activities, the number of people using the land, and public access.

- If any portion of the property is leased, the LESSEE CERTIFICATION must be signed by each lessee, certifying the use of the leased property.

- Finally, complete the application by having all owners sign the SIGNATURE section, declaring under penalty of perjury that all provided information and accompanying documents are true, correct, and complete. Attach a Property Owner’s Acknowledgement of Rights and Obligations under the specified land programs, if applicable. If the form is signed by an agent, a copy of the written authorization to sign on behalf of the taxpayer must be attached.

Once completed, the form should be submitted to the local assessors' office for processing and determination. It is important to retain a copy of the completed form and all attachments for your records.

Understanding State Tax Cl 1

What is the purpose of the State Tax Form CL-1?

The State Tax Form CL-1 is designed for property owners in Massachusetts to apply for their land to be classified under one of the following categories: Forest, Agricultural or Horticultural, or Recreational. This classification allows for potential tax benefits, acknowledging the property's use and conservation status under the stipulated General Laws Chapter 61, §§ 1 & 2 – Chapter 61A, § 6 – Chapter 61B, § 3.

Who needs to complete the State Tax Form CL-1?

Property owners seeking to have their land recognized and taxed as either forest, agricultural, horticultural, or recreational land must complete the form. This includes submitting detailed information about the current use of the land, income generated from it, and, for first-time applicants or changes in land use, providing supporting documents such as a State Forester’s Certificate and an approved management plan.

What documents are required alongside the State Tax Form CL-1?

The requirements may vary based on the type of classification you are applying for. Generally, if it's the first application or there has been a change in the land use, property owners need to attach a State Forester’s Certificate and an Approved Forest Management Plan for forest land, or provide detailed income statements and possibly tax returns for agricultural or horticultural land. For recreational land, detailed descriptions of the recreational use and any managing documents are necessary.

Is there a specific income requirement to qualify for agricultural or horticultural classification?

Yes, applicants for agricultural or horticultural classification must provide a statement of income generated from the land in the preceding year. This includes gross sales from agricultural or horticultural use and any amounts received under MA or US Soil Conservation or Pollution Abatement Programs. The application may request supporting documentation, such as federal and state income tax returns, to verify this income.

How does the recreational land classification work?

Land may qualify for recreational classification based on its condition or its primary use for recreational activities. Applicants must specify if the land is in a natural, wild, or open condition, if it supports wildlife and natural resource preservation, and outline the types of recreational activities it supports. It’s also necessary to indicate if the land is open to the public or if access is restricted. The form requires information on the frequency of recreational use and how many people engage in those activities.

What happens after submitting the State Tax Form CL-1?

After submission, the application is reviewed by the local assessors. They will make a determination based on the provided information and the alignment of the application with the requirements for the desired classification. Upon approval or denial, the applicant will be notified, with details including any granted classification, the effective date, and, if applicable, reasons for denial.

Common mistakes

When completing the State Tax Form CL-1 for the classification of land in Massachusetts, applicants commonly encounter a few stumbling blocks. Recognizing and avoiding these mistakes can streamline the application process and enhance the chances of approval.

-

Failure to Complete All Relevant Sections: One of the primary errors is not filling out all sections that apply to the applicant's situation. The form requires comprehensive details under various headings like Identification, Type of Classification, and Lessee Certification. Omitting applicable sections or providing incomplete information can lead to delays or the rejection of the application.

-

Not Attaching Required Documents: Applicants often forget to attach necessary documentation such as the State Forester’s Certificate, Approved Forest Management Plan, and evidence of previous land use and income. These documents are crucial for the forest, agricultural, horticultural, and recreational land classifications and verify the information provided in the application.

-

Inaccurate or Inadequate Income Reporting: Correct and complete reporting of income derived from the land in the previous year is essential. Mistakes in this area, such as underreporting income, failing to provide a detailed description of income sources, or not being prepared to submit tax return copies when requested, can adversely affect the application’s outcome.

-

Misclassification of Land Use: Another common error is incorrectly classifying the land use under the Type of Classification section. This misstep can occur if applicants do not thoroughly understand the criteria for each classification or if they fail to check the appropriate box for the classification they are seeking. Understanding the distinctions between forest, agricultural, horticultural, and recreational land classifications and selecting the correct one based on current land use is critical.

To mitigate these errors, applicants should review the form carefully, ensure that all necessary sections are completed accurately, attach all required documents, and seek clarification on the classification criteria as needed.

Documents used along the form

When filing the State Tax Form CL-1, used for applying for forest, agricultural, horticultural, or recreational land classification in the Commonwealth of Massachusetts, applicants often need to prepare and submit additional documents to substantiate their application. These documents play a crucial role in ensuring the accuracy and completeness of the application process.

- State Forester’s Certificate: For forest land classification, this certificate from a state forester confirms the land’s eligibility and appropriate management practices.

- Approved Forest Management Plan: A detailed plan approved by a state forester illustrating the management practices to be implemented on the forestland.

- Farmland Valuation Advisory Commission Class Declarations: Documentation from this commission defines the classification of agricultural land, which is necessary for lands seeking agricultural status.

- Federal and State Income Tax Returns: These documents evidence the income generated from the agricultural, horticultural, or forest land and confirm the land's primary use for classification under the respective sections.

- Soil Conservation or Pollution Abatement Program Documentation: Proof of participation in these programs supports the application by demonstrating responsible land stewardship.

- Lease Agreements: For lands that are leased, current lease agreements are essential to confirm the terms of use consistent with the classification sought.

- Property Owner’s Acknowledgement of Rights and Obligations: A signed acknowledgment that the property owner understands the rights and responsibilities under the classified land programs.

- Written Authorization from Property Owner (if applicable): If the application is submitted by an agent, a written authorization from all property owners allowing the agent to act on their behalf is required.

Together with the State Tax Form CL-1, these documents form a comprehensive package that allows assessors to evaluate the application accurately. Being thorough and providing detailed, accurate documentation can facilitate a smoother assessment process and help ensure that the land classification application is processed efficiently.

Similar forms

The Schedule F form, used for reporting farm income and expenses to the IRS, is similar to the State Tax CL-1 form in purpose and content. The Schedule F form requires detailed income statements from agricultural operations - mirroring the CL-1's section on agricultural or horticultural income and uses. Both forms serve to validate the financial aspects of farming operations, essential for benefit eligibility or tax assessment.

Application for Agricultural, Horticultural, or Forest Land Assessment forms used by other states have similarities with the State Tax CL-1 form. These applications often require information about the land's use, the type of agriculture, horticulture, or forestry practiced, and specific management plans, similarly to how the CL-1 requires attachments like the State Forester’s Certificate for forest land classification. They are crucial for landowners seeking reduced property tax assessments based on current land use.

The IRS Form 4562 for Depreciation and Amortization reflects similarities with the CL-1 form in terms of its necessity for agricultural business owners to report significant financial details. While Form 4562 focuses on depreciation expenses, the CL-1 encompasses a broader range of agricultural activities but both ultimately contribute to the financial documentation required for tax purposes.

The Conservation Reserve Program (CRP) is facilitated by agreements akin to the legal documentation in the State Tax CL-1 form. The CRP documents outline a landowner’s commitment to conservation practices, paralleling the State Tax CL-1 form’s section on recreational land use aimed at preserving natural resources. Both sets of documents underscore the importance of land management in support of environmental stewardship and financial benefits.

Local Property Tax Abatement forms, similar to the State Tax CL-1, request information from property owners seeking a reduction in their property taxes. While the CL-1 form is tailored towards land classified for specific uses, abatement forms generally address broader reasons for seeking tax relief. Both, however, require detailed property and owner information to process the application.

The Land Use Change Tax forms, encountered in some jurisdictions, share objectives with the State Tax CL-1 form. These documents come into play when land previously benefiting from lower tax rates due to its agricultural, forest, or recreational designation is converted to a different use. Like the CL-1, they involve reporting past and intended land use but from a perspective of changing use and assessing related taxes.

Special Valuation Application forms for Historical Land also bear resemblance to the State Tax CL-1 form in their function of offering tax incentives. By declaring a property’s historical significance or its conservation status, these applications, much like the CL-1, support maintaining land in a state that benefits the community or the environment, in exchange for tax reductions or assessment adjustments.

Federal grant applications for agricultural or conservation projects share a common goal with the State Tax CL-1 form – supporting the sustainable management of land. Although federal grants often focus on funding specific projects rather than tax classification, both require detailed descriptions of current and planned land use, aligning with broader objectives of land preservation and responsible agriculture.

Water Management District applications for agricultural water use permits, while more specialized, also parallel the CL-1 form in outlining land-specific uses. These permits are crucial for agricultural operations that depend on irrigation, reflecting the CL-1’s emphasis on land use by class and specific agriculture or conservation practices.

The Farmland Preservation Agreement forms, aimed at protecting agricultural land from being developed, resonate with the essence of the State Tax CL-1 form. By agreeing to preserve land for farming, landowners can access various benefits, including potentially lower taxes akin to those seeking classification under the CL-1 form for agricultural or horticultural use. Both forms underscore a commitment to maintaining the land's character for future generations.

Dos and Don'ts

When preparing to fill out the State Tax Form CL-1 for land classification in the Commonwealth of Massachusetts, it is essential to follow best practices for a smooth application process. Below are guidelines to ensure that your form is properly filled out.

Things You Should Do:

- Ensure all sections that apply to your property are thoroughly completed. This includes providing accurate information about the property's identification, the type of classification you are seeking, and any relevant supporting documents.

- Print or type all information clearly to prevent any misunderstandings or processing delays caused by illegible handwriting.

- Attach all required documents, such as the State Forester’s Certificate and Approved Forest Management Plan for forest classification, or supporting documentation for your income in the preceding year if applying for agricultural or horticultural classification.

- Review the application for accuracy and completeness before submission. Double-check the details of the land use, classification sought, and previous use of the land to ensure all information is correct.

- Sign the form and, if applicable, ensure that any lessee certifies their statement in section C. LESSEE CERTIFICATION, if any portion of the property is leased.

Things You Shouldn't Do:

- Avoid leaving any applicable sections incomplete. Incomplete applications may be delayed or denied, requiring additional effort to resubmit.

- Do not guess or estimate information. Use accurate and verifiable information for all fields, including income details and land use classifications. Incorrect information can lead to misclassification or penalties.

- Refrain from submitting the form without the necessary support documents. Missing documents can lead to automatic denial or requests for resubmission, further delaying the classification process.

- Do not ignore the lessee certification section if it applies to your situation. Ensure that each lessee signs the form to confirm the use of the leased property.

- Avoid waiting until the last minute to submit your application. Providing ample time for review and possible correction can prevent processing delays.

Adhering to these dos and don'ts will facilitate a smoother application process, reduce the likelihood of errors, and help ensure that your application is processed efficiently by the assessors.

Misconceptions

There are common misunderstandings regarding the State Tax Form CL-1, particularly around its purpose and the processes involved. Clarifying these misconceptions is crucial for property owners considering applying for a special land classification in Massachusetts.

It's only for agricultural use: Many believe the CL-1 form is exclusive to agricultural land. In fact, it applies to three types of land classification: forest, agricultural or horticultural, and recreational land. This variety allows a broader range of property owners to benefit from potential tax relief under the respective classifications provided they meet certain criteria.

Income documentation is always required: While the form does request a statement of income from the preceding year to verify eligibility, particularly for agricultural or horticultural classification, it's a misconception that extensive financial documentation is always necessary. The requirements vary based on the type of classification you're applying for and the specifics of your situation, such as if it's a first-time application or a renewal under the same classification.

All land automatically qualifies: Some property owners might think that owning land in Massachusetts is enough to qualify for one of these classifications. However, eligibility is determined by specific use, management plans (particularly for forest land), and, in some cases, income generated from the land. Additionally, there are different acreage and use requirements that must be met to qualify.

Approval is guaranteed after submission: Filling out and submitting the State Tax Form CL-1 does not ensure approval. The local assessors' office thoroughly reviews each application against the legal criteria set by the Commonwealth of Massachusetts. This process includes verifying the land's current and previous use, the owner's management plans, and, for recreational land, the extent and nature of its use.

The form is complicated and requires professional help to complete: While legal or professional advice might be beneficial, especially in complex cases, the State Tax Form CL-1 is designed to be accessible to the general public. Instructions are provided with each section to help applicants understand what information is needed and how to properly document their land's classification status. Many landowners successfully complete the application without direct professional assistance.

In summary, the State Tax Form CL-1 offers a valuable opportunity for landowners to potentially reduce their tax burden through special land classifications. Understanding the form's actual requirements and processes can significantly impact an owner's ability to leverage these benefits correctly.

Key takeaways

Here are seven key takeaways about filling out and using the State Tax Form CL-1, specifically designed for individuals applying for Forest, Agricultural or Horticultural, and Recreational Land Classification in the Commonwealth of Massachusetts:

- Complete identification thoroughly: It's crucial to provide full details under the identification section, including the name of the applicant(s), mailing address, and specifics of the property covered by the application such as location, parcel identification, and total acres to be classified.

- Choose the correct classification: Applicants must check the classification they are seeking—Forest, Agricultural/Horticultural, or Recreational. Each classification requires different information and documentation, so selecting the right one is key.

- Attach required documentation: For a Forest classification, attaching a State Forester’s Certificate and an approved Forest Management Plan is mandatory. For initial applications in any category, or when new or revised plans are made, corresponding documentation must be attached.

- Provide detailed land use information: When applying for Agricultural or Horticultural classification, listing the current use of land by classes established by the Farmland Valuation Advisory Commission is necessary, along with specific usage and crops grown.

- Income verification may be required: Applicants must be prepared to submit supporting documentation for income generated from the land, including federal and state income tax returns, to verify the income stated in the application.

- Recreational land criteria: When applying for Recreational Land classification, it is important to clarify the condition of the land, types of recreational activities it supports, frequency of use, and accessibility to the general public.

- Lessee certification and owner signature: If any portion of the property is leased, each lessee must sign a certification statement included in the application. Furthermore, all owners must sign the application, certifying the accuracy and truthfulness of the information provided, under penalty of perjury. If an agent signs the application, a copy of the written authorization to sign on behalf of the taxpayer is required.

Following these guidelines carefully will help ensure that the application process is complete and accurate, providing the necessary details for a successful classification under the specific land use category.

Popular PDF Documents

City of Detroit Hope Program - A process designed by the City of Detroit for homeowners to request a property tax relief based on financial hardship, requiring detailed personal and hardship information for evaluation.

Acd 31102 - It delineates the scope of power given to the representative, including specific tax types and periods covered under the authorization.