Get State Tax 2Hf Form

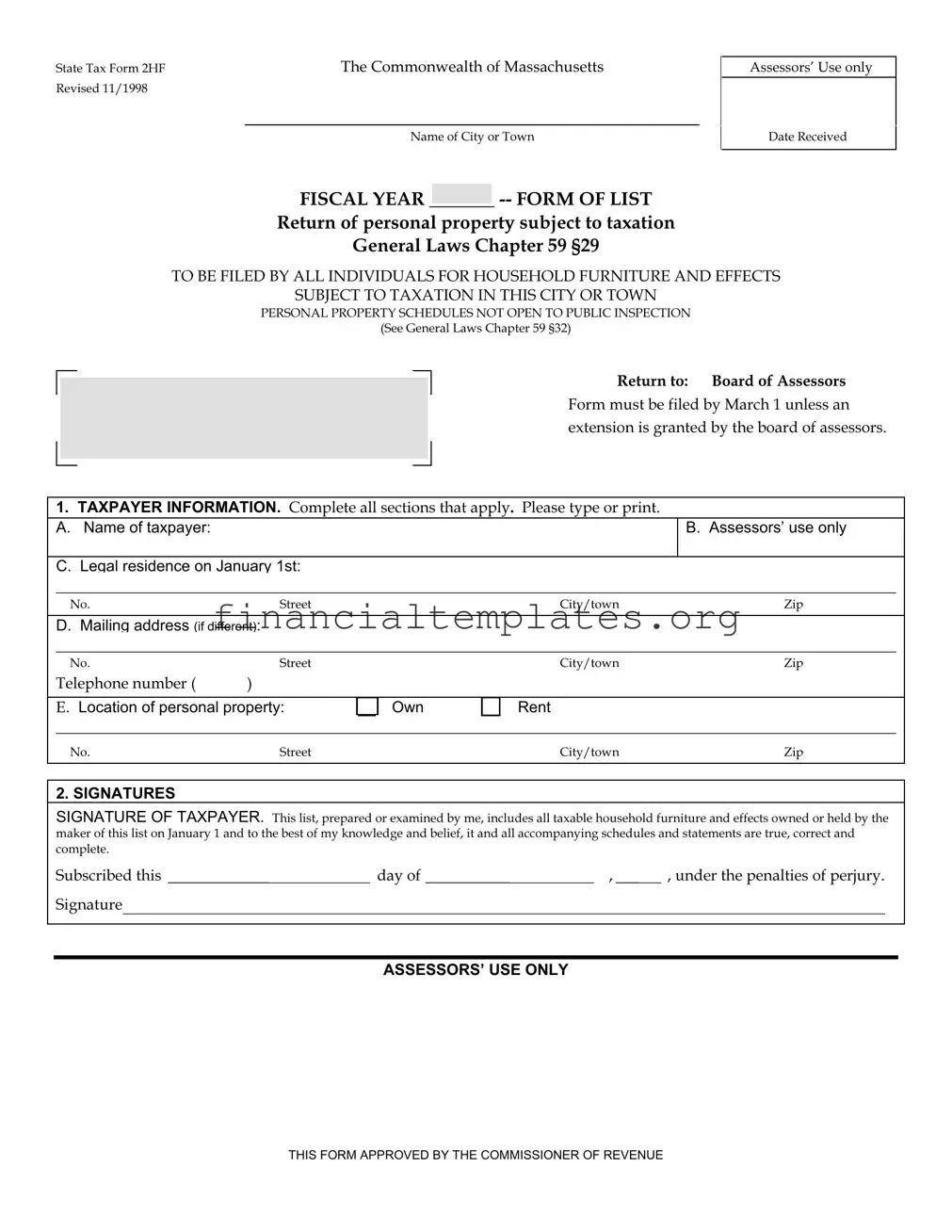

The Commonwealth of Massachusetts has designed the State Tax Form 2HF to facilitate the assessment and taxation of personal property held by individuals. Revised in November 1998, this form serves a critical function under the General Laws Chapter 59 §29, requiring the annual submission of a property list that includes household furniture and effects subject to taxation. The obligation to file this return extends to all individuals possessing taxable household items and effects not located at their primary residence on January 1 of the given year. Moreover, the form encompasses a range of personal belongings, from appliances and electronics to unregistered vehicles and trailers, necessitating detailed documentation of each item, including its description, year of purchase, and estimated market value. The meticulous recording and submission process, adhering to a March 1st deadline unless an extension is granted by the board of assessors, underscores the state's commitment to precise property valuation. Importantly, the information provided on Form 2HF remains confidential, with access strictly limited to assessment and revenue officials, thereby safeguarding taxpayer privacy while ensuring compliance with state tax laws. Failure to file or late submissions can incur penalties, highlighting the form's vital role in the equitable and effective administration of personal property taxes within Massachusetts.

State Tax 2Hf Example

State Tax Form 2HF |

The Commonwealth of Massachusetts |

Revised 11/1998 |

|

Name of City or Town

Assessors’ Use only

Date Received

FISCAL YEAR _______

Return of personal property subject to taxation

General Laws Chapter 59 §29

TO BE FILED BY ALL INDIVIDUALS FOR HOUSEHOLD FURNITURE AND EFFECTS

SUBJECT TO TAXATION IN THIS CITY OR TOWN

PERSONAL PROPERTY SCHEDULES NOT OPEN TO PUBLIC INSPECTION

(See General Laws Chapter 59 §32)

Return to: Board of Assessors

Form must be filed by March 1 unless an extension is granted by the board of assessors.

1.TAXPAYER INFORMATION. Complete all sections that apply. Please type or print.

A.Name of taxpayer:

B. Assessors’ use only C. Legal residence on January 1st:

B. Assessors’ use only C. Legal residence on January 1st:

|

No. |

|

|

Street |

|

|

|

|

City/town |

|

Zip |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D. Mailing address (if different): |

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No. |

|

|

Street |

|

|

|

|

City/town |

|

Zip |

||||||||

|

Telephone number ( |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E. Location of personal property: |

|

Own |

|

|

Rent |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

No. |

|

|

Street |

|

|

|

|

City/town |

|

Zip |

||||||||

2. SIGNATURES

SIGNATURE OF TAXPAYER. This list, prepared or examined by me, includes all taxable household furniture and effects owned or held by the maker of this list on January 1 and to the best of my knowledge and belief, it and all accompanying schedules and statements are true, correct and complete.

Subscribed this

Signature

day of |

|

, |

|

, under the penalties of perjury. |

|

|

|||

|

|

ASSESSORS’ USE ONLY

THIS FORM APPROVED BY THE COMMISSIONER OF REVENUE

3. GENERAL INFORMATION

A.WHO MUST FILE A RETURN. This Form of List (State Tax Form 2HF) must be filed each year by all individuals owning or holding household furnishings and effects not located at their domicile on January 1. Individuals who own or hold other taxable property must also file State Tax Form 2. Literary, temperance, benevolent, charitable or scientific organizations that may be entitled to an exemption under G.L. Ch. 59 §5 Clause 3 must file State Tax Form 3ABC listing all property they own or hold for those purposes on January 1.

B.WHEN AND WHERE RETURN MUST BE FILED. Returns must be filed by March 1 with the board of assessors in the city or town where the household furnishings and effects are situated on January 1. A return is not considered filed unless it is complete.

C.EXTENSION OF FILING DEADLINE. The board of assessors may extend the filing deadline if you can show sufficient reason for not filing on time. The latest date the filing deadline can be extended is 30 days after the tax bills are mailed for the fiscal year. Requests for an extension must be made in writing to the assessors.

D.PENALTY FOR FAILURE TO FILE OR FILING LATE. If you do not file a return for the fiscal year, the assessors cannot grant an abatement for overvaluation of the personal property for that year. If the return is not filed on time, the assessors can only grant an abatement if you show a reasonable excuse for the late filing or the tax assessed is more than 150% of the amount that would have been assessed if the return had been timely filed. In that case, only the amount over that percentage can be abated. You can avoid this penalty by filing on time.

E.USE OF AND ACCESS TO RETURN. The information in the return is used by the board of assessors to determine the taxable or exempt status of your personal property and, if taxable, its fair market value. You may also be required to provide the assessors with further information about the property in writing and asked to permit them to inspect it.

Personal property information listed in Schedules

4. INSTRUCTIONS FOR COMPLETING SCHEDULES

List all household items, furnishings and effects owned or held on January 1 in the appropriate schedules that follow, including those in your physical possession on that date under a lease, consignment, license, mortgage, pledge or other arrangement. For your return to be considered complete, all information specified in the schedules except the “Estimated Market Value” must be provided and all copies of leases, consignments, etc., for any property in your possession under such arrangements must be attached.

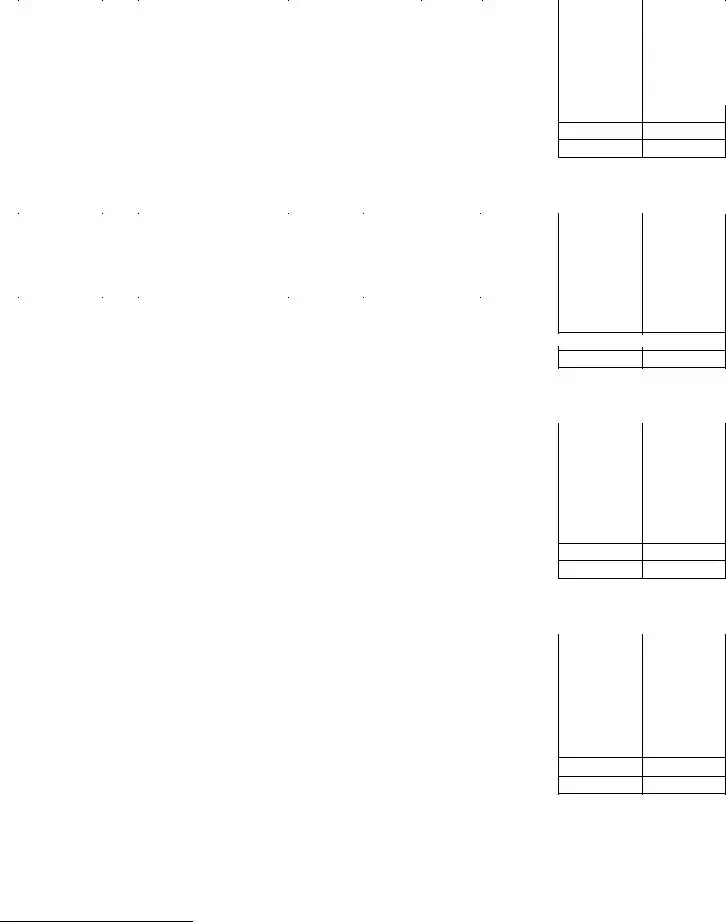

A.APPLIANCES AND SMALL ELECTRONICS. Includes all major appliances (refrigerators, freezers, washing machines), small appliances (microwave ovens, vacuum cleaners, coffee makers, blenders, food processors) and electronics (radios, stereos, televisions, video cassette recorders).

B.TOOLS AND EQUIPMENT. Includes all household tools and equipment (lawnmowers, etc.) not listed as appliances and small electronics.

C.FURNITURE AND ACCESSORIES. Includes all household furniture (desks, chairs, tables, couches, beds), lamps, rugs, floor coverings and draperies, specialized

D.PERSONAL EFFECTS. Includes all jewelry, china, glassware, linens, bedding and all other personal effects.

E.UNREGISTERED MOTOR VEHICLES AND TRAILERS. Includes motor vehicles not carrying Massachusetts registration plates under G.L. Ch. 90, and tractors, trailers, snowmobiles, motorized golf carts and all other kinds and types of unregistered vehicles.

F.OTHER TAXABLE PERSONAL PROPERTY. Includes all other household furniture and effects not located at your domicile that are not specifically exempt from taxation.

A. APPLIANCES AND SMALL ELECTRONICS |

|

|

|

|

|

|||

|

* Own/Other |

No. |

Description |

Manufacturer |

Model |

Year of |

Purchase |

Estimated |

|

|

|

|

|

|

purchase |

price |

market value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continue list on attachment, in same format, as necessary. |

Subtotal Schedule A |

|

Subtotal attachment |

|

TOTAL |

B. TOOLS AND EQUIPMENT |

|

|

|

|

|

|||

|

*Own/Other |

No. |

Description |

Nature of |

Type/model |

Year of |

Purchase |

Estimated |

|

|

|

|

use |

|

purchase |

price |

market value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continue list on attachment, in same format, as necessary. |

Subtotal Schedule B |

|

Subtotal attachment |

|

TOTAL |

C. FURNITURE AND ACCESSORIES

*Own/Other |

No. |

Description |

Year of |

Purchase |

Estimated |

|

|

|

purchase |

price |

market value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continue list on attachment, in same format, as necessary. |

Subtotal Schedule C |

|

Subtotal attachment |

|

TOTAL |

D. PERSONAL EFFECTS

*Own/Other |

No. |

Description |

Year of |

Purchase |

Estimated |

|

|

|

purchase |

price |

market value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continue list on attachment, in same format, as necessary. |

Subtotal Schedule D |

|

Subtotal attachment |

|

TOTAL |

*Specify if property owned, leased, consigned, etc. and attach copies of lease or other agreement with owner.

E. UNREGISTERED MOTOR VEHICLES AND TRAILERS

*Own/Other |

Year |

Model, |

Make |

Type: Describe sufficiently for identification |

No. of |

Purchase |

Estimated |

|

of |

name, |

|

giving number of passengers, number of |

cylinders |

price |

market value |

|

mfr. |

letter or |

|

doors, type of body. If not required to be |

or rated |

|

|

|

|

number |

|

registered, so state and name use. |

capacity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continue list on attachment, in same format, as necessary. |

Subtotal Schedule E |

|

Subtotal attachment |

|

TOTAL |

F. OTHER TAXABLE PERSONAL PROPERTY |

|

|

|

|||

|

*Own/Other |

No. |

Description |

Year of |

Purchase |

Estimated |

|

|

|

|

purchase |

price |

market value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continue list on attachment, in same format, as necessary. |

Subtotal Schedule F |

|

Subtotal attachment |

|

TOTAL |

Document Specifics

| Fact Name | Description |

|---|---|

| Governing Law | The Massachusetts General Laws Chapter 59 §29 and §32 guide the preparation and confidentiality aspects of State Tax Form 2HF. |

| Filing Deadline | State Tax Form 2HF must be filed by March 1st of each year, unless an extension is granted by the board of assessors. |

| Penalty for Late Filing | Late filing or failure to file can lead to the inability to obtain an abatement for overvaluation, unless a reasonable excuse for lateness is provided or the tax assessed is excessively high. |

| Confidentiality of Information | Information listed in personal property schedules A-F of the form is not open to public inspection, in accordance with state public records law, and is solely for use by the assessors and the Massachusetts Department of Revenue. |

Guide to Writing State Tax 2Hf

Filling out the State Tax 2HF form is a necessary step for individuals in Massachusetts with household furnishings and effects subject to taxation outside of their domicile as of January 1st. This form ensures that personal property is accurately listed for tax purposes, helping both the taxpayer and the Tax Commission to maintain fairness and transparency. Making sure to file this form by March 1st (unless an extension is granted) can avoid penalties for late or non-filing. Below are the steps to complete the State Tax 2HF form diligently and accurately.

- TAXPAYER INFORMATION:

- Enter the taxpayer's name in the designated space.

- Fill in the legal residence as of January 1, including street, city/town, and zip code.

- Provide the mailing address if it differs from the legal residence, including street, city/town, and zip code.

- Include a contact telephone number.

- Specify the location of the personal property, indicating whether it is owned or rented, along with the address details.

- SIGNATURES: Sign and date the form to declare that, to the best of your knowledge, the information provided is true, correct, and complete. Acknowledge the penalty for perjury.

- GENERAL INFORMATION: Review the sections covering who must file a return, when and where to file, possible extensions, penalties for failure to file or filing late, and the privacy of your submitted information.

- INSTRUCTIONS FOR COMPLETING SCHEDULES: Follow these steps to list all taxable personal property correctly.

- List all owned or held appliances, small electronics, and their details under Schedule A.

- For tools and equipment, furnish the required details under Schedule B.

- Describe all furniture and accessories with purchase details under Schedule C.

- Personal effects should be detailed under Schedule D.

- For unregistered motor vehicles and trailers, provide specifics including the make, model, and purchase year under Schedule E.

- List any other taxable personal property not previously covered under Schedule F.

- Double-check all the information provided for accuracy and completeness. Attach any required documents or additional sheets as per the instructions on the form.

- Submit the completed form and any attachments to the Board of Assessors of the city or town where the property is located by the filing deadline.

By following these steps carefully, you can ensure a thorough and accurate submission of the State Tax 2HF form, meeting legal requirements and maintaining the integrity of the tax system. Remember, timely filing is essential to avoid any penalties and to ensure your personal property is correctly assessed for tax purposes.

Understanding State Tax 2Hf

Who needs to file the State Tax Form 2HF?

This form must be filed by individuals owning or holding household furnishings and effects not located at their legal residence on January 1. This includes any other taxable property individuals might possess. Additionally, organizations seeking exemptions under specific clauses should file the appropriate forms listing all property owned or held for qualifying purposes as of January 1.

When and where should the State Tax Form 2HF be filed?

The form must be submitted by March 1 to the Board of Assessors in the city or town where the property is situated as of January 1. It's important to ensure the return is complete upon submission for it to be considered filed.

Can the filing deadline for the State Tax Form 2HF be extended?

Yes, the Board of Assessors may extend the filing deadline if a reasonable cause is shown for delay. The final extension cannot exceed 30 days after the fiscal year's tax bills are mailed. Extension requests must be made in writing to the Board of Assessors.

What are the penalties for failing to file or filing late?

Failing to file or filing late may result in the Board of Assessors being unable to grant an abatement for overvaluation. Late filings might only be considered for abatement if a reasonable excuse is provided or the assessed tax is significantly higher than it should be. Timely filing helps avoid these penalties.

How is the information on the form used?

The information provided is utilized by the Board of Assessors to determine the taxable status and fair market value of the personal property. Further documentation or inspection may be requested. Importantly, personal property information is not open to public inspection and is only available to assessors and the Massachusetts Department of Revenue for tax administration purposes.

What should be included in the schedules?

Items to be listed include all household items owned or held on January 1. This encompasses appliances, electronics, furniture, tools, personal effects, and other taxable personal property under various arrangements like leases or pledges. Comprehensive listing and corresponding documentation are required for completion.

What details are required for items listed under Appliances and Small Electronics?

For each appliance or electronic item, include the type, manufacturer, model, year of purchase, and the estimated purchase price or market value. If the list is extensive, continue on an attachment following the same format.

How about Tools and Equipment?

Describe each tool or piece of equipment, including the nature of use, type or model, year of purchase, and the estimated value. Continue on an attachment if necessary, maintaining uniformity in format.

What information is required for Furniture and Accessories?

List each item of furniture and accessory, specifying the year of purchase and estimated value. Additional lists should follow on attachments if space on the form runs short.

How are Unregistered Motor Vehicles and Trailers listed?

For each unregistered vehicle or trailer, provide sufficient details for identification, including year, model, make, type, capacity, and estimated value. State the use if not required to be registered, and continue on an attachment if necessary.

Common mistakes

When filling out the State Tax 2HF form, several common errors can lead to inaccuracies or even penalties. It is crucial to approach this task with attention to detail to ensure all information is correctly reported. Below are eight mistakes often made during this process:

- Not filing on time: The failure to submit by the March 1 deadline, without securing an extension, can result in penalties or disqualifications for tax abatements.

- Incomplete sections: Leaving sections partially filled or entirely blank can cause the form to be considered incomplete, potentially leading to penalties.

- Incorrect taxpayer information: Mistakes in the taxpayer's name, legal residence, or mailing address can lead to filing errors and misdirected tax bills.

- Failing to sign: The form requires the taxpayer's signature to be legally valid. An unsigned form is not considered filed and can lead to penalties.

- Misidentified personal property: Incorrectly identifying or failing to fully describe the personal property can affect the tax assessment.

- Omitting leased or loaned property: Not listing items in your possession under a lease or loan arrangement can result in an inaccurate return.

- Inaccurate valuation: Estimating the market value or purchase price incorrectly can lead to misassessment of taxes owed.

- Not attaching necessary documentation: For property held under any arrangement other than direct ownership, failing to attach copies of the relevant contracts (lease, consignment, etc.) can result in an incomplete filing.

Additionally, individuals make some common errors related to how they report specific categories of personal property, such as:

- Appliances and Electronics: Misclassifying appliances as furniture or vice versa can lead to inaccuracies in valuation.

- Tools and Equipment: Overlooking to specify the nature of use (personal vs. business) can mislead assessors.

- Furniture and Accessories: Not including specialized leasehold improvements or mistakenly reporting business assets as personal can affect tax responsibilities.

- Personal Effects: Underreporting items like jewelry or art due to vague descriptions or perceived market value underestimation.

- Unregistered Vehicles: Failing to report unregistered motor vehicles or trailers, assuming they are not subject to taxation.

- Other Taxable Property: Not realizing that certain possessions outside the domicile could still be taxable under state law.

Being diligent, thoroughly reviewing each section of the State Tax 2HF form, and ensuring all applicable documentation is attached will significantly reduce the risk of these common filing mistakes.

Documents used along the form

When filing the State Tax Form 2HF in Massachusetts, it's important to understand that this form is often not the only document needed to fully comply with state tax regulations. This form plays a crucial role for residents in reporting personal property subject to taxation, but it can require additional forms and documents to ensure a comprehensive and accurate tax filing. Below is a list of documents often used in conjunction with Form 2HF to provide a clearer picture of an individual's tax responsibilities.

- State Tax Form 1: This is the basic form for reporting individual income tax. It's crucial for taxpayers to file this form as it outlines all income received during the tax year, which is necessary for calculating total tax liability.

- State Tax Form 3ABC: Required for literary, temperance, benevolent, charitable, or scientific organizations seeking exemption under G.L. Ch. 59 §5 Clause 3. It lists all property owned or held for these purposes on January 1.

- Form M-4868: An application for an extension of time to file your Massachusetts income tax return. Individuals finding themselves unable to file by the deadline may need this form to avoid penalties.

- Schedule B: A schedule that must be attached to the main tax form reporting interest and dividend income. It's essential for taxpayers who receive such income to provide detailed information.

- Schedule C: This schedule is used by sole proprietors to report income or loss from a business they operated or a profession they practiced as a sole proprietor.

- Schedule E: Used to report income and losses from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs.

- Form 1040: While a federal form, the Form 1040 is often necessary alongside state tax forms, as information from the federal return is used in calculating state tax obligations.

- Proof of Estimated Tax Payments: Copies of check or electronic transfer confirmations showing any estimated tax payments made during the year. This helps in reconciling total tax due against what has already been paid.

- Documentation of Deductions and Credits: Receipts, letters of acknowledgment for charitable donations, and other documentation supporting deductions or credits claimed on the tax return.

Together with the State Tax Form 2HF, these documents provide a comprehensive structure for reporting and paying taxes in Massachusetts. Properly compiling and submitting these forms ensures individuals meet their legal obligations while potentially minimizing their tax liabilities through lawful deductions and credits. It's advisable for taxpayers to consult with tax professionals or use reputable tax filing software to navigate the complexities of state and federal tax systems efficiently.

Similar forms

The Federal Tax Form 1040, used for individual income tax returns, shares similarities with the State Tax Form 2HF. Both require taxpayers to report personal income or property and calculate tax liabilities based on that information. They also both provide sections for personal identification and specific deductions or credits that may apply. The key difference lies in the scope—Form 1040 addresses federal taxes while State Tax Form 2HF focuses on state-level personal property taxes.

State Tax Form 1, often referred to as the Real Estate Property Tax Form, parallels State Tax Form 2HF in its purpose of assessing property for tax purposes, though it focuses on real estate rather than personal property. Both forms require detailed property descriptions and taxpayer information to ensure accurate assessment. However, Form 1 concerns itself with the valuation and taxation of real estate holdings, contrasting with the personal property emphasis of Form 2HF.

The Personal Property Tax Return form used by businesses for reporting company-owned personal property assets shares a common goal with State Tax Form 2HF—assessing tax based on property ownership. While the business form targets company assets like equipment and inventory, the 2HF form is designed for individual taxpayers reporting household items. Both necessitate detailed listings of property and its value as of a specific date for tax calculation purposes.

The State Tax Form 3ABC, designated for charitable, scientific, and other organizations claiming tax exemptions, intersects with Form 2HF in its requirement for detailed property listings. Both forms serve to inform tax authorities about property held within a jurisdiction, albeit with different end goals: Form 2HF for taxation of personal property and Form 3ABC for exemption qualification. Despite this divergence, each form plays a crucial role in the proper administration of tax law.

The Vehicle Registration Tax Form, while focused on the specific category of motor vehicles, shares with State Tax Form 2HF the principle of taxing property based on value and ownership. Each form requires owners to list pertinent details for tax assessment purposes—Form 2HF encompasses broader personal property categories, including unregistered vehicles, whereas vehicle registration forms are exclusively concerned with vehicles subject to state registration requirements.

The Estate Tax Return Form, required for the administration of an estate’s tax liabilities after an individual's death, parallels State Tax Form 2HF in its function of calculating taxes based on property value. While the Estate Tax Return deals with the transfer of assets and taxation in the context of inheritance, Form 2HF assesses taxes on personal property ownership annually. Both necessitate comprehensive listing and valuation of property for accurate tax determination.

The Inventory List Form used in both personal and business contexts for tracking assets mirrors the State Tax Form 2HF's approach to property enumeration. While the inventory list serves primarily as an organizational tool without direct tax implications, it similarly demands detailed reporting of property and its value, aligning in purpose with Form 2HF’s objective of enabling precise property tax assessment based on a thorough accounting of personal property.

Dos and Don'ts

When completing the State Tax Form 2HF, it's crucial to approach the task with diligence and accuracy. Below are essential guidelines to help ensure the process is smooth and compliant with the expectations of the Commonwealth of Massachusetts. Taking these steps can help avoid common pitfalls and provide peace of mind during tax season.

- Do ensure all personal information is accurate and up to date. This includes your legal residence, mailing address if different, and the correct location of the personal property.

- Do list all applicable household items and furnishings. Be thorough when detailing items in schedules A-F, as incomplete listings may lead to inaccuracies in assessment.

- Do provide all necessary documentation for non-owned items. If listing items not outrightly owned by you (e.g., leased or consigned), attach copies of the lease or other agreements as required.

- Do apply for an extension if necessary. If circumstances prevent you from filing by March 1, submit a written request for an extension to the Board of Assessors.

- Do sign the form under penalties of perjury. Affirm that all provided information and documents are true, correct, and complete to the best of your knowledge.

- Don't neglect the deadline for filing. Late submissions may lead to penalties and restrictions on abatements for overvaluation.

- Don't withhold required information or documentation. Failing to provide complete information or necessary attachments can result in the inability of assessors to accurately evaluate your personal property and may impact your tax obligations.

Following these guidelines can contribute to a more efficient and straightforward filing process. Attention to detail and adherence to the rules specified by the Massachusetts Department of Revenue can minimize complications and ensure that you meet your tax obligations accurately and promptly.

Misconceptions

There are several misconceptions about the State Tax Form 2HF that taxpayers may have. Understanding these misconceptions can help in accurately completing and filing the form. Here are seven common misunderstandings:

- Only homeowners need to file. Actually, any individual owning or holding taxable household furnishings and effects not located at their domicile on January 1 must file. This includes renters who possess taxable personal property.

- The information I submit is publicly accessible. In fact, the personal property information listed in Schedules A-F is confidential. It is not open for public inspection and is available only to the assessors and Massachusetts Department of Revenue for tax administration purposes.

- There's no penalty for filing late. Contrary to this belief, failing to file or filing late can result in penalties. The assessors cannot grant an abatement for overvaluation if you do not file a return. If the return is filed late, abatement can only be granted under specific circumstances.

- I only need to report high-value items. This is incorrect. All household items, including furniture, electronics, and personal effects owned or held on January 1, must be listed, regardless of their value.

- Estimating the market value of items is optional. While it might seem this way, providing an estimated market value of each listed item is crucial for the assessors to determine the correct tax value. Although the form indicates that some information isn't required, providing as much detail as possible is always in your best interest.

- Requests for filing extensions are automatically granted. Actually, the board of assessors may extend the filing deadline, but only if you can show sufficient reason for not being able to file on time. Always request an extension in writing and well before the deadline.

- I can disregard the form if I didn't own the property on January 1. This misunderstands the purpose of the form. If you held or owned taxable property on January 1, you are obligated to file, regardless of whether you owned it the entire year or just on that date.

Understanding these misconceptions is important for accurately filing State Tax Form 2HF and avoiding potential penalties. If in doubt, consult directly with the Board of Assessors for guidance tailored to your specific situation.

Key takeaways

Understanding the State Tax Form 2HF is crucial for Massachusetts residents owning household items, furnishings, or other personal property that might be taxable outside of their domicile as of January 1. Here are 10 key takeaways to help guide you through filling out and using this form effectively:

- Filing Deadline: The State Tax Form 2HF must be submitted to the Board of Assessors in the city or town where the property is located by March 1 of each year, unless you've been granted an extension.

- Who Must File: This form is required for all individuals who own or hold household furniture and effects not located at their legal residence on January 1 of the filing year. Additionally, other types of personal property may necessitate filing this form.

- Extension Requests: If circumstances prevent you from meeting the filing deadline, you can request an extension from the board of assessors. Make sure to submit your request in writing.

- Penalties for Late Filing: Failing to file or filing late can result in the loss of eligibility for an abatement for overvaluation. However, if your return is filed late due to a valid reason, or if your assessed tax exceeds 150% of the correct amount, you may still qualify for abatement on the overage.

- Confidentiality: Information listed in Schedules A-F of your return is not open for public inspection, ensuring your privacy is maintained. This information is accessible only to assessors and the Massachusetts Department of Revenue for tax administration purposes.

- Completeness of Form: To be considered complete, you must list all taxable items in the appropriate schedules and attach any relevant documents like leases, consignments, or agreements for items not outright owned by you.

- Property Categories: The form breaks down personal property into several categories, including appliances and small electronics, tools and equipment, furniture and accessories, personal effects, unregistered motor vehicles and trailers, and other taxable personal property.

- Documentation of Ownership and Value: When listing an item, provide detailed information including a description, year of purchase, and either the estimated purchase price or market value. This helps the Board of Assessors accurately assess your property's value and taxability.

- How to List Multiple Items: If you have more items than can fit on the form, continue the list on an attachment following the same format. Make sure to include subtotal amounts from both the form and attachments.

- Legal Implications of Signature: By signing the form, you declare under penalty of perjury that all information provided is true, correct, and complete to the best of your knowledge. This underscores the importance of accuracy and honesty in your reporting.

Adhering to these guidelines ensures that the process of reporting household furnishings and effects for tax purposes is both smooth and in compliance with Massachusetts state law. It's important to approach this task with attention to detail and an understanding of the deadlines and requirements to avoid any potential penalties.

Popular PDF Documents

How to File Power of Attorney in California - By executing the DO-10 form, you ensure your tax issues are managed by someone you trust.

Irs Hardship Requirements - Get personalized assistance and address any concerns with the Hardship Withdrawal Request by contacting AXA Equitable directly.

W-8ben Sample - This form serves as a declaration by foreign individuals that they are not subject to standard U.S. tax withholding.