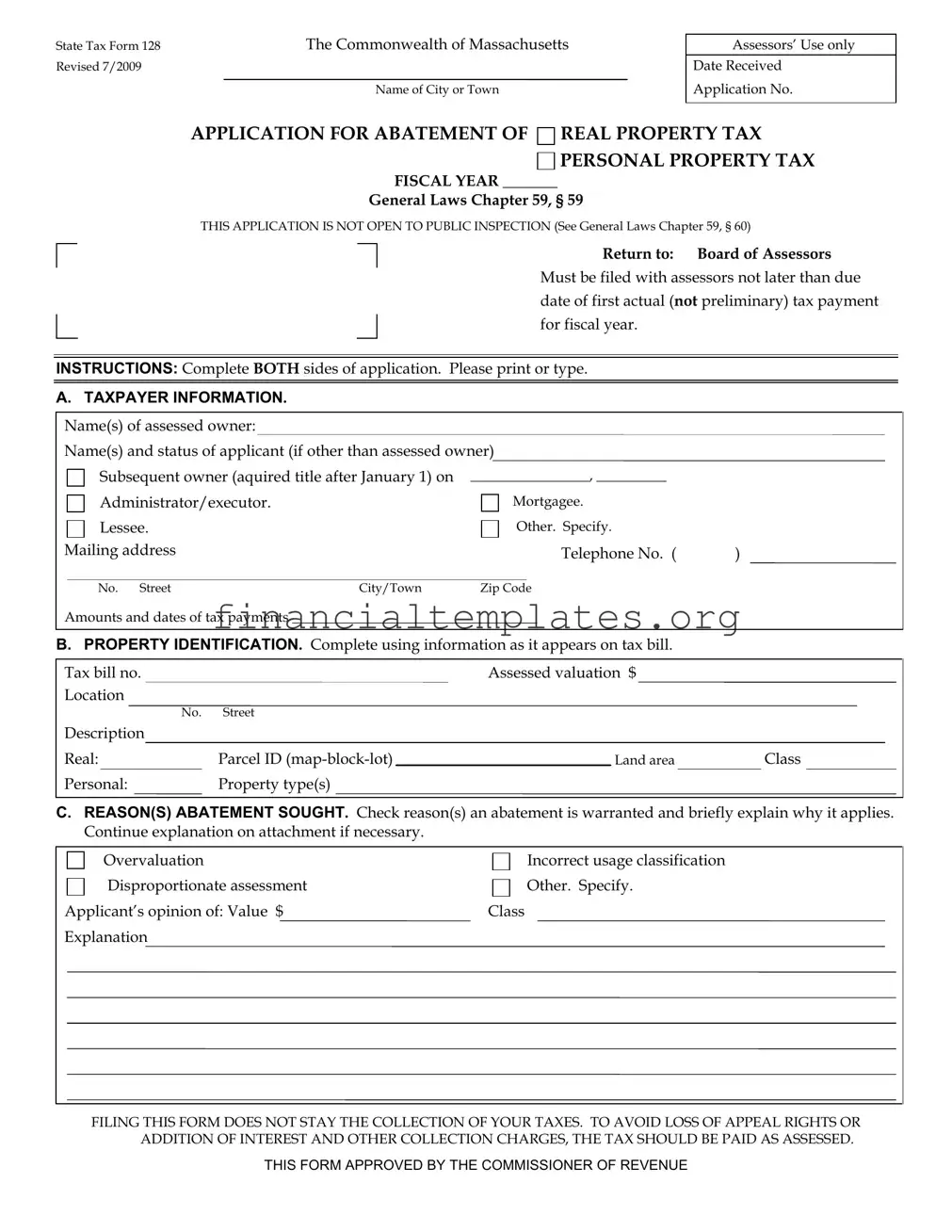

Get State Tax 128 Form

The State Tax Form 128, essential for Massachusetts residents seeking an abatement of real or personal property tax, encompasses a comprehensive procedure designed to correct overvaluations, errors, or discrepancies in tax assessments. Intended for various applicants including property owners, administrators, or those with a significant interest in the property, this form must be submitted within a strict deadline tied to the fiscal year's first actual tax bill payment. With stipulations on who may file and the timing of such filings clearly defined, the importance of adhering to the Board of Assessors' guidelines cannot be overstated. Each section of the form, from taxpayer information to property identification and the reason for the abatement request, must be meticulously completed. Additionally, the form emphasizes that filing does not halt the tax collection process, thus prompt payment is advisable to avoid additional charges or loss of appeal rights. The process after submission includes a possible request for more information or property inspection by the assessors, leading to a formal decision that could result in a denied, granted, or adjusted claim. Those disagreeing with the assessors' decision have the option to appeal. The detailed instructions and legal stipulations indicated on the form underscore the necessity of careful completion and timely filing to ensure a fair assessment and the possibility of a tax abatement.

State Tax 128 Example

State Tax Form 128 |

The Commonwealth of Massachusetts |

Revised 7/2009 |

|

|

Name of City or Town |

Assessors’ Use only

Date Received

Application No.

APPLICATION FOR ABATEMENT OF

REAL PROPERTY TAX

REAL PROPERTY TAX

PERSONAL PROPERTY TAX

FISCAL YEAR _______

General Laws Chapter 59, § 59

THIS APPLICATION IS NOT OPEN TO PUBLIC INSPECTION (See General Laws Chapter 59, § 60)

Return to: Board of Assessors

Must be filed with assessors not later than due date of first actual (not preliminary) tax payment for fiscal year.

INSTRUCTIONS: Complete BOTH sides of application. Please print or type.

A. TAXPAYER INFORMATION.

Name(s) of assessed owner: |

|

|

|

Name(s) and status of applicant (if other than assessed owner) |

|

||

Subsequent owner (aquired title after January 1) on |

_________________, __________ |

|

|

Administrator/executor. |

|

Mortgagee. |

|

Lessee. |

|

Other. Specify. |

|

Mailing address |

|

Telephone No. ( |

) |

No. Street |

City/Town |

Zip Code |

|

Amounts and dates of tax payments ___________________________________

B.PROPERTY IDENTIFICATION. Complete using information as it appears on tax bill.

Tax bill no. |

|

Assessed valuation $ |

|

|

|

|

|

||||

Location |

|

|

|

|

|

|

|

|

|||

|

|

No. |

Street |

|

|

|

|

|

|

|

|

Description |

|

|

|

|

|

|

|

|

|

||

Real: |

Parcel ID |

|

Land area |

|

Class |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

Personal: |

Property type(s) |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

C.REASON(S) ABATEMENT SOUGHT. Check reason(s) an abatement is warranted and briefly explain why it applies. Continue explanation on attachment if necessary.

|

Overvaluation |

Incorrect usage classification |

|

|

Disproportionate assessment |

Other. Specify. |

|

Applicant’s opinion of: Value $ |

Class |

|

|

Explanation |

|

|

|

|

|

|

|

|

|

|

|

FILING THIS FORM DOES NOT STAY THE COLLECTION OF YOUR TAXES. TO AVOID LOSS OF APPEAL RIGHTS OR ADDITION OF INTEREST AND OTHER COLLECTION CHARGES, THE TAX SHOULD BE PAID AS ASSESSED.

THIS FORM APPROVED BY THE COMMISSIONER OF REVENUE

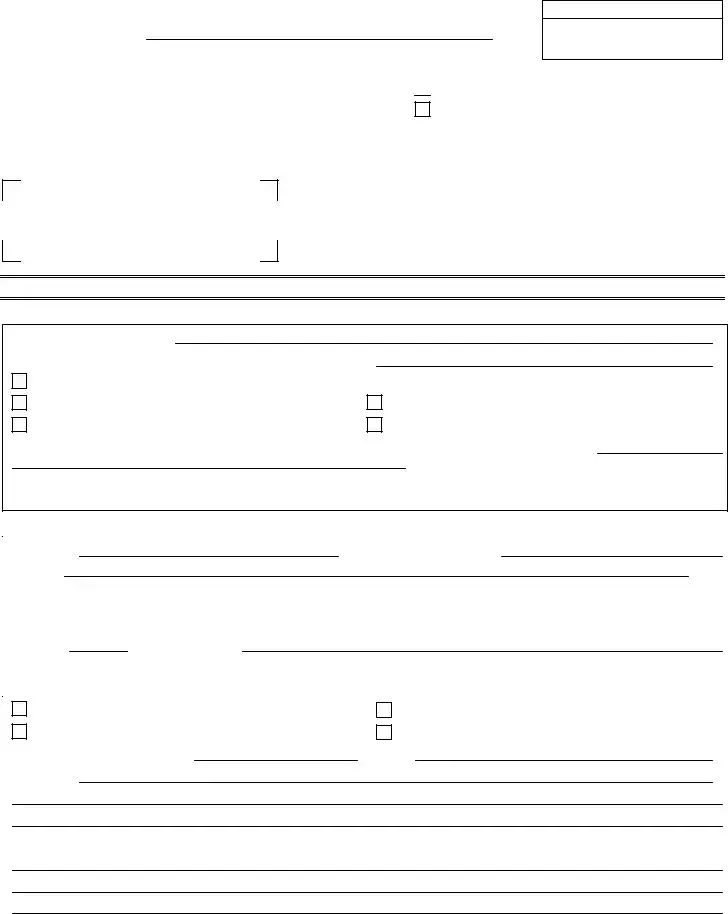

D. SIGNATURES.

Subscribed this |

day of |

, |

Under penalties of perjury. |

Signature of applicant

If not an individual, signature of authorized officer

Title

( )

(print or type) Name |

Address |

Telephone |

If signed by agent, attach copy of written authorization to sign on behalf of taxpayer.

TAXPAYER INFORMATION ABOUT ABATEMENT PROCEDURE

REASONS FOR AN ABATEMENT. An abatement is a reduction in the tax assessed on your property for the fiscal year. To dispute your valuation or assessment or to correct any other billing problem or error that caused your tax bill to be higher than it should be, you must apply for an abatement.

You may apply for an abatement if your property is: 1) overvalued (assessed value is more than fair cash value on January 1 for any reason, including clerical and data processing errors or assessment of property that is

WHO MAY FILE AN APPLICATION. You may file an application if you are:

•the assessed or subsequent (acquiring title after January 1) owner of the property,

•the owner’s administrator or executor,

•a tenant paying rent who is obligated to pay more than

•a person owning or having an interest or possession of the property, or

•a mortgagee if the assessed owner has not applied.

In some cases, you must pay all or a portion of the tax before you can file.

WHEN AND WHERE APPLICATION MUST BE FILED. Your application must be filed with the board of assessors on or before the date the first installment payment of the actual tax bill mailed for the fiscal year is due, unless you are a mortgagee. If so, your application must be filed between September 20 and October 1. Actual tax bills are those issued after the tax rate is set. Applications filed for omitted, revised or reassessed taxes must be filed within 3 months of the date the bill for those taxes was mailed. THESE DEADLINES CANNOT BE EXTENDED OR WAIVED BY THE ASSESSORS FOR ANY REASON. IF YOUR APPLICATION IS NOT TIMELY FILED, YOU LOSE ALL RIGHTS TO AN ABATEMENT AND THE ASSESSORS CANNOT BY LAW GRANT YOU ONE. TO BE TIMELY FILED, YOUR APPLICATION MUST BE (1) RECEIVED BY THE ASSESSORS ON OR BEFORE THE FILING DEADLINE OR (2) MAILED BY UNITED STATES MAIL, FIRST CLASS POSTAGE PREPAID, TO THE PROPER ADDRESS OF THE ASSESSORS ON OR BEFORE THE FILING DEADLINE AS SHOWN BY A POSTMARK MADE BY THE UNITED STATES POSTAL SERVICE.

PAYMENT OF TAX. Filing an application does not stay the collection of your taxes. In some cases, you must pay the tax when due to appeal the assessors’ disposition of your application. Failure to pay the tax assessed when due may also subject you to interest charges and collection action. To avoid any loss of rights or additional charges, you should pay the tax as assessed. If an abatement is granted and you have already paid the entire year’s tax as abated, you will receive a refund of any overpayment.

ASSESSORS DISPOSITION. and permit them to inspect it. appeal rights.

Upon applying for an abatement, you may be asked to provide the assessors with written information about the property Failure to provide the information or permit an inspection within 30 days of the request may result in the loss of your

The assessors have 3 months from the date your application is filed to act on it unless you agree in writing before that period expires to extend it for a specific time. If the assessors do not act on your application within the original or extended period, it is deemed denied. You will be notified in writing whether an abatement has been granted or denied.

APPEAL. You may appeal the disposition of your application to the Appellate Tax Board, or if applicable, the County Commissioners. The appeal must be filed within 3 months of the date the assessors acted on your application, or the date your application was deemed denied, whichever is applicable. The disposition notice will provide you with further information about the appeal procedure and deadline.

|

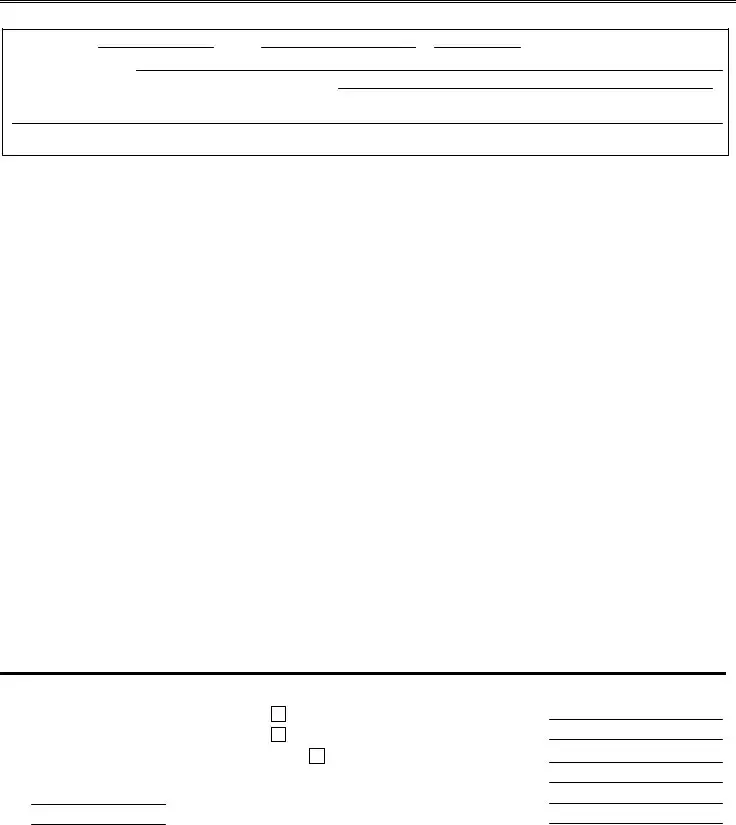

DISPOSITION OF APPLICATION (ASSESSORS’ USE ONLY) |

|

Ch 59, § 61A return |

GRANTED |

Assessed value |

Date sent _______________ |

DENIED |

Abated value |

Date returned ___________ |

DEEMED DENIED |

Adjusted value |

|

Assessed tax |

|

Date |

|

Abated tax |

By |

Date voted/Deemed denied _________ |

Adjusted tax |

|

Certificate No. _____________________ |

|

|

|

|

Date Cert./Notice sent ______________ |

|

Board of Assessors |

|

Data changed ___________ |

Appeal ___________________________ |

____________________________________________ |

||

|

Date filed ________________________ |

____________________________________________ |

||

Valuation ______________ |

Decision _________________________ |

____________________________________________ |

||

|

Settlement ________________________ |

Date: |

|

|

Document Specifics

| Fact Name | Fact Detail |

|---|---|

| Eligibility to File | Applications for abatement can be filed by assessed owners, subsequent owners, administrators or executors, tenants responsible for more than half the tax, parties with an interest or possession, or mortgagees if the assessed owner has not applied. |

| Filing Deadline | The application must be filed by the due date of the first actual tax payment for the fiscal year. For mortgagees, between September 20 and October 1. Late filings result in loss of rights to abatement. |

| Governing Law | The process and conditions for filing an abatement application are governed by General Laws Chapter 59, § 59, and the confidentiality of the application by General Laws Chapter 59, § 60. |

| Appeal Process | If an abatement is denied, or not acted upon within the designated period, applicants may appeal to the Appellate Tax Board or County Commissioners within three months from the decision or deemed denial date. |

Guide to Writing State Tax 128

Filling out the State Tax 128 Form, particularly for residents and property owners in Massachusetts, is a critical step in requesting an abatement of real or personal property tax. Such requests are based on a variety of factors including overvaluation, incorrect usage classification, or disproportionate assessment, among others. This process signifies the taxpayer's right to challenge the assessed value of their property or to correct a billing issue that could unfairly inflate their tax liability. Below is a step-by-step guide to accurately complete and submit this form.

- Read the entire form carefully before entering any information. This ensures you understand all requirements and implications.

- In the "Name of City or Town" field at the top of the form, enter the name of the municipality where your property is located.

- Under "A. TAXPAYER INFORMATION," write your full name as the assessed owner. If you're filing on behalf of someone else or in another capacity (such as an administrator, executor, mortgagee, lessee, etc.), specify your status and include the name(s) as applicable.

- Provide your complete mailing address, including street number, city or town, and zip code. Also, enter your telephone number in the designated space.

- Document the amounts and dates of any tax payments already made in the corresponding section.

- For "B. PROPERTY IDENTIFICATION," use the information as it appears on your tax bill to fill out the tax bill number, assessed valuation, location, and description of the property. Include the real or personal property identifiers as required.

- In section "C. REASON(S) ABATEMENT SOUGHT," check the box that best describes the reason for your abatement request. Provide a brief explanation in the space provided and attach additional pages if more room is needed.

- Enter your opinion of the property's value and class, if applicable, which supports your abatement request.

- Sign and date the form under "D. SIGNATURES." If you're not signing as an individual but on behalf of an entity, include the appropriate title and contact information. Attach a copy of written authorization if signing as an agent.

- Ensure all the information is true and accurate to the best of your knowledge, understanding the penalties for perjury, and consider consulting with a tax professional or legal advisor if you have any doubts or need assistance.

- Last, check the form for any missed fields or mistakes, correct them, and then submit the form to the Board of Assessors by the due date. Remember, timely submission is crucial to preserve your rights to a potential abatement.

After submitting the form, the Board of Assessors will review your application and decide on your abatement request within three months. You will receive written notification of the decision. If your application is granted, and you have already paid the tax, a refund for the overpaid amount will be issued. Should the application be denied or deemed denied due to inaction, you have the option to appeal the decision to the Appellate Tax Board or County Commissioners within three months from the date of the decision notice. Thus, keeping informed and adhering to deadlines throughout this process is essential.

Understanding State Tax 128

Who needs to fill out the State Tax Form 128?

This form is necessary for anyone seeking an abatement, which is a reduction, of real or personal property taxes in Massachusetts. It is applicable for the assessed owners of the property, subsequent owners who acquired title after January 1, administrators, executors, tenants responsible for more than half the tax, interested parties, or mortgagees, given that the assessed owner has not applied.

What is the deadline for filing the State Tax Form 128?

The form must be filed with the Board of Assessors by the due date of the first actual tax payment for the fiscal year. This due date is crucial; missing it forfeits your right to an abatement. If you're a mortgagee, your filing window is between September 20 and October 1. Remember, the form can be considered timely filed if it's either received by the assessors by this deadline or mailed via United States Mail, first-class postage prepaid, with a postmark made by the United States Postal Service by the filing deadline.

Does filing the State Tax Form 128 stay the collection of my taxes?

No, filing this form does not halt the collection of your taxes. To avoid loss of appeal rights or the accrual of interest and other charges, it's advisable to pay the tax as assessed. If an abatement is granted after you've paid your taxes, and there's an overpayment, you will be eligible for a refund.

What happens after I file the form?

Upon receiving your application, the Board of Assessors may request additional written information about the property or permission to inspect it. Failing to comply within 30 days may result in the loss of your appeal rights. The assessors are given 3 months to act on your application, with the option to extend this period upon mutual agreement. Failure to act within this timeframe results in your application being deemed denied. You will receive written notification of the assessors’ decision.

Can I appeal if my application for abatement is denied?

Yes, if your application is denied or deemed denied, you may appeal the decision to the Appellate Tax Board, or in some cases, to the County Commissioners. The appeal must be filed within 3 months of the assessors' decision or the deemed denial date. The notice of disposition from the assessors will include further information on the appeal process and deadlines.

What are the reasons one might seek an abatement?

Abatement applications are typically submitted for overvalued property (assessed value is more than the fair cash value), disproportionate assessment compared to other properties, incorrect property classification, or issues leading to taxation higher than it should be. This can include clerical errors, data processing errors, assessment of non-existent property, or property not taxable to the applicant.

Common mistakes

Filling out State Tax Form 128 can be a daunting task. A simple mistake can lead to delays in processing or even the outright rejection of an application for abatement of real or personal property tax. Here are ten common mistakes people make when filling out this form:

- Not checking the box to indicate whether the application is for real property tax or personal property tax abatement. This simple oversight could lead to confusion and processing delays.

- Entering incorrect taxpayer information, such as misspelling the taxpayer's name or providing an outdated mailing address. Accurate information is crucial for communication and processing.

- Failing to accurately identify the property by not using the information as it appears on the tax bill. Each detail, including the tax bill number, assessed valuation, and parcel ID, must match the official records.

- Omitting the reason(s) for the abatement sought, thereby not providing the assessors with the necessary context for the application. The reason for seeking an abatement must be clear and justified.

- Miscalculating the amounts and dates of tax payments, or not listing them at all. This financial information is essential for assessors to review the application properly.

- Not signing the form or, if applicable, not attaching a copy of the written authorization for an agent to sign on behalf of the taxpayer. A valid signature is critical for the form's legality and validity.

- Missing the filing deadline, which is completely non-negotiable. Timeliness is a strict requirement; applications not filed by the due date are outright invalid.

- Forgetting to complete both sides of the application. Many applicants overlook this requirement, leading to incomplete submissions that cannot be processed.

- Omitting necessary attachments that provide additional explanations or details when more space is needed than what is available on the form itself. Supporting documentation can be crucial for a successful abatement application.

- Inattention to the instructions for when and where to file, especially for different applicant statuses (e.g., owners, mortgagees). Specific conditions apply for the timing and manner of filing based on the applicant's relation to the property.

While filling out State Tax Form 128 accurately requires attention to detail and a thorough understanding of one's circumstances concerning the property in question, avoiding these common mistakes can prevent unnecessary delays or denials. It's always recommended to review the form multiple times and, if possible, consult with a professional to ensure accuracy before submission.

Documents used along the form

When handling the application process for an abatement of real or personal property taxes, as outlined in the State Tax Form 128, applicants and professionals alike often find themselves in need of additional forms and documents to complete their submissions accurately and comprehensively. These materials range from supplementary forms required by the state or local tax authorities, to supporting documents that strengthen an abatement request. Understanding the purpose and necessity of each of these can significantly streamline the application process.

- Form 1: Real Estate Tax Commitment Book - Used by assessors to list all property tax commitments in the jurisdiction, serving as a reference for assessing property values and ownership data.

- Form 2: Application for Property Tax Exemption - Employed by owners of property that may qualify for tax exemptions, such as non-profit organizations or historical properties.

- Form 3: Income and Expense Report - Required for properties producing income, helping assessors determine value based on revenue generated.

- Form 4: Property Valuation Appeal Form - Allows taxpayers to contest the assessed value of their property if they believe it does not reflect its fair market value.

- Form 5: Certificate of Legal Residence - Sometimes necessary to establish eligibility for certain tax exemptions based on residency.

- Form 6: Property Tax Deferral Application - Utilized by eligible seniors or individuals with disabilities to defer property taxes under specific conditions.

- Form 7: Residential Taxpayer Declaration - Helps identify properties that are primary residences, potentially qualifying for lower tax rates or exemptions.

- Form 8: Change of Address Form - Ensures tax bills and correspondence are sent to the correct address.

- Form 9: Power of Attorney - Authorizes a representative to act on behalf of the taxpayer in tax matters, including the filing of abatement applications.

- Form 10: Municipal Lien Certificate - Provides a record of any taxes or assessments owed on the property, crucial for real estate transactions.

Collecting and submitting the appropriate forms and documentation is a pivotal step in the tax abatement process. Individuals looking to navigate this terrain more efficiently should consider utilizing this list as a guide to ensure no essential elements are overlooked. Furthermore, staying informed about local requirements and deadlines can prevent potential delays and enhance the likelihood of a successful abatement outcome.

Similar forms

The Federal Tax Return form is closely related to the State Tax 128 form in its primary function. Both are instrumental in the process of declaring taxes, yet they serve different jurisdictions. The Federal Tax Return concerns national taxes owed to the federal government, whereas the State Tax 128 form specifically pertains to local or state taxes. The Federal form collects income details to calculate federal taxes due, mirroring the State Tax 128's role in calculating property taxes owing at a state or local level.

The Uniform Commercial Code (UCC) Financing Statement bears similarity to the State Tax 128 form in its specificity and legal implications. While the State Tax 128 form is concerned with the abatement of real or personal property taxes, the UCC Financing Statement is utilized to declare a security interest in personal property to the state, ensuring the interests of secured creditors are publicly recorded. Both documents serve to inform and protect financial interests within state jurisdiction.

State Tax Exemption forms also share parallels with the State Tax 128 form. These forms are used by individuals, businesses, or non-profit organizations to claim exemption from certain state taxes. Where the State Tax 128 form is used for seeking abatement on property taxes, exemption forms may apply to sales, use, or corporate income taxes, demonstrating a regulatory framework aimed at reducing or eliminating specific tax liabilities under particular conditions.

The Mortgage Interest Statement (Form 1098) issued by mortgage lenders to taxpayers has similarities with the State Tax 128 form in terms of property and taxation. Both forms involve real estate and financial obligations to governmental bodies, but they serve different purposes. Form 1098 helps taxpayers claim potential deductions on their federal tax returns for mortgage interest paid, contrasting the State Tax 128's function in addressing property tax concerns at a state or local level.

Local Property Tax Forms, specific to various municipalities, closely resemble the State Tax 128 form in their focus and utility. Both types of documents involve the assessment and adjustment of taxes on real property, providing a mechanism for property owners to contest or comply with their tax liabilities. Local forms vary by city or county, emphasizing the localized nature of property tax regulation similar to the State Tax 128 form's application within Massachusetts.

The Application for Property Tax Refund in many states is akin to the State Tax 128 form by offering a path for taxpayers to reduce their tax burdens. Though the State Tax 128 form specifically targets tax abatement for reasons such as overvaluation or incorrect classification, tax refund applications generally apply to taxpayers who believe they have overpaid taxes or qualify for a rebate, underscoring a shared goal of equitable tax assessment.

Business Personal Property Tax Statements, required by many local jurisdictions, share common ground with the State Tax 128 form in the realm of property taxation. These statements require businesses to report the value of their personal property for tax purposes, a process parallel to the property assessment adjustments sought through the State Tax 128 form, albeit focusing on the business sector's assets.

Homestead Exemption Applications offer another similarity to the State Tax 128 form, albeit with a focus on residential property. These applications allow homeowners to claim exemption from property taxes on their primary residence up to a certain amount, paralleling the State Tax 128 form's purpose in reducing property tax liability, but with a specific emphasis on homeowner relief.

The Vehicle Registration Tax Form, while primarily dealing with automobile registration fees, also touches on property tax themes akin to those in the State Tax 128 form. Registrants must often provide vehicle value and usage information, which can affect tax calculations, drawing a line to the property tax adjustments sought through the State Tax 128 form, though in a different asset category.

Last, Change of Address forms, commonly used in various administrative capacities, indirectly relate to the State Tax 128 form by impacting taxpayer information. While not a tax document per se, keeping address information current is crucial for receiving tax bills and related correspondence, indirectly supporting the taxpayer's ability to file for abatements or comply with tax liabilities similar to the procedural importance of the State Tax 128 form.

Dos and Don'ts

When engaging with State Tax Form 128, a document of notable importance for those seeking an adjustment in their property taxes within Massachusetts, it is paramount to approach the process with care and attention to detail. Below is a guide outlining crucial dos and don’ts to aid in the successful completion and submission of this form:

- Do ensure that all required sections of the form are meticulously completed. Leaving sections incomplete may lead to the rejection of your application.

- Do verify the accuracy of all personal and property information entered against official documents to prevent delays or denials based on inaccuracies.

- Don’t neglect the deadlines specified for submitting this form. Timing is essential as late submissions are not acceptable under Massachusetts law and will result in the forfeiture of your right to seek an abatement.

- Do utilize clear and concise language when explaining the reason(s) an abatement is sought, ensuring the rationale is compelling and supported by evidence if available.

- Don’t forget to sign the form. An unsigned form is considered invalid and cannot be processed, thus emphasizing the importance of this final but crucial step.

- Do attach any necessary documentation or additional sheets if the space provided on the form is insufficient for your explanations or evidence supporting your claim for abatement.

- Don’t disregard the stipulation that filing the form does not stay the collection of your taxes. It is advised to pay your taxes as assessed to avoid interest, penalties, or the potential loss of abatement appeal rights.

- Do be prepared to provide further information or allow an inspection of the property if requested by the assessors. Non-compliance can lead to a denial of the abatement request.

Adhering to these guidelines will not only ensure that your request for abatement is duly considered but also help in navigating the complexities of the tax abatement application process with greater ease. Being thorough and timely in one's approach to completing and submitting State Tax Form 128 plays a crucial role in the pursuit of achieving a fair and just assessment of one's property taxes.

Misconceptions

There are several misconceptions about the State Tax Form 128, particularly regarding its purpose, filing requirements, and processing. Here are five common misunderstandings and the truths behind them:

- Only property owners can file Form 128: It's a common belief that only those who own property can file this form. However, not just the assessed owners, but also subsequent owners, administrators, executors, tenants (who are obligated to pay more than half of the tax), and mortgagees (if the assessed owner has not applied) are eligible to file.

- Filing the form automatically pauses tax collection: The misconception that filing an application for abatement will stop the collection of taxes is widespread. Nonetheless, the form clearly states that filing does not stay the collection of taxes. Taxes should be paid as assessed to avoid loss of appeal rights or the addition of interest and other charges.

- The form can be filed at any time: Many believe you can file Form 128 at any time during the fiscal year. This is incorrect. The form must be filed with the assessors not later than the due date of the first actual (not the preliminary) tax payment for the fiscal year. This deadline cannot be extended or waived by the assessors for any reason.

- Approval of abatement is guaranteed: There's a common perception that once Form 128 is filed, abatement approval is certain. This isn't true. The assessors review each application thoroughly and base their decision on various factors. An application could get approved, denied, or deemed denied if not acted upon within the stipulated time.

- Public inspection of filed forms is allowed: Another misunderstanding is that after filing, Form 128 becomes open to public inspection. In reality, the application is not open to public inspection, protecting the applicant's privacy and sensitive information contained within the form.

Understanding these common misconceptions about the State Tax Form 128 can help applicants navigate the process more effectively and set realistic expectations regarding their application for abatement.

Key takeaways

When dealing with the State Tax Form 128 in Massachusetts, understanding its purpose and process is crucial for effective handling of your property tax matters. Here are key takeaways to keep in mind:

- Objective: The form is an application for the abatement of real or personal property tax, under the guidelines outlined in General Laws Chapter 59, § 59.

- Privacy: Information provided in this application is not open to public inspection, ensuring your privacy is maintained as per General Laws Chapter 59, § 60.

- Deadline: It must be submitted to the Board of Assessors by the due date of the first actual (not preliminary) tax payment for the fiscal year in question.

- Completeness: Fill out both sides of the application thoroughly. This involves providing detailed taxpayer information, property identification, and the specific reasons abatement is sought.

- Eligibility: You may apply if you are the assessed or subsequent owner, the owner’s executor or administrator, a tenant obligated to pay more than half the tax, a party with an interest or possession of the property, or a mortgagee, under certain conditions.

- Filing: An application can be considered timely filed if it is either received by the assessors by the deadline or mailed via United States mail, first class postage prepaid, to the correct address of the assessors by the deadline, with the postmark made by the United States Postal Service serving as proof.

- Rights and Obligations: Filing this form does not pause the collection of your taxes. To avoid losing appeal rights or incurring additional charges, taxes should be paid as assessed.

- Response: The assessors are given 3 months to act on your application. Failure on your part to provide requested information or permit an inspection within 30 days may lead to loss of appeal rights. You will be notified in writing whether the abatement has been granted or denied.

Understanding these key points will ensure that individuals are better prepared to navigate the process of applying for a property tax abatement in Massachusetts, thereby potentially saving money and avoiding procedural missteps.

Popular PDF Documents

1040 Irs Form - Direct Pay is an IRS service that facilitates free electronic payment from a checking or savings account.

Medical Lab Results Template - Reminds of the need to update certain immunizations like Tuberculosis and Tetanus if they expire during the semester.

Nevada Income Tax Return - Email submission instructions are provided for businesses preferring to file their returns electronically.