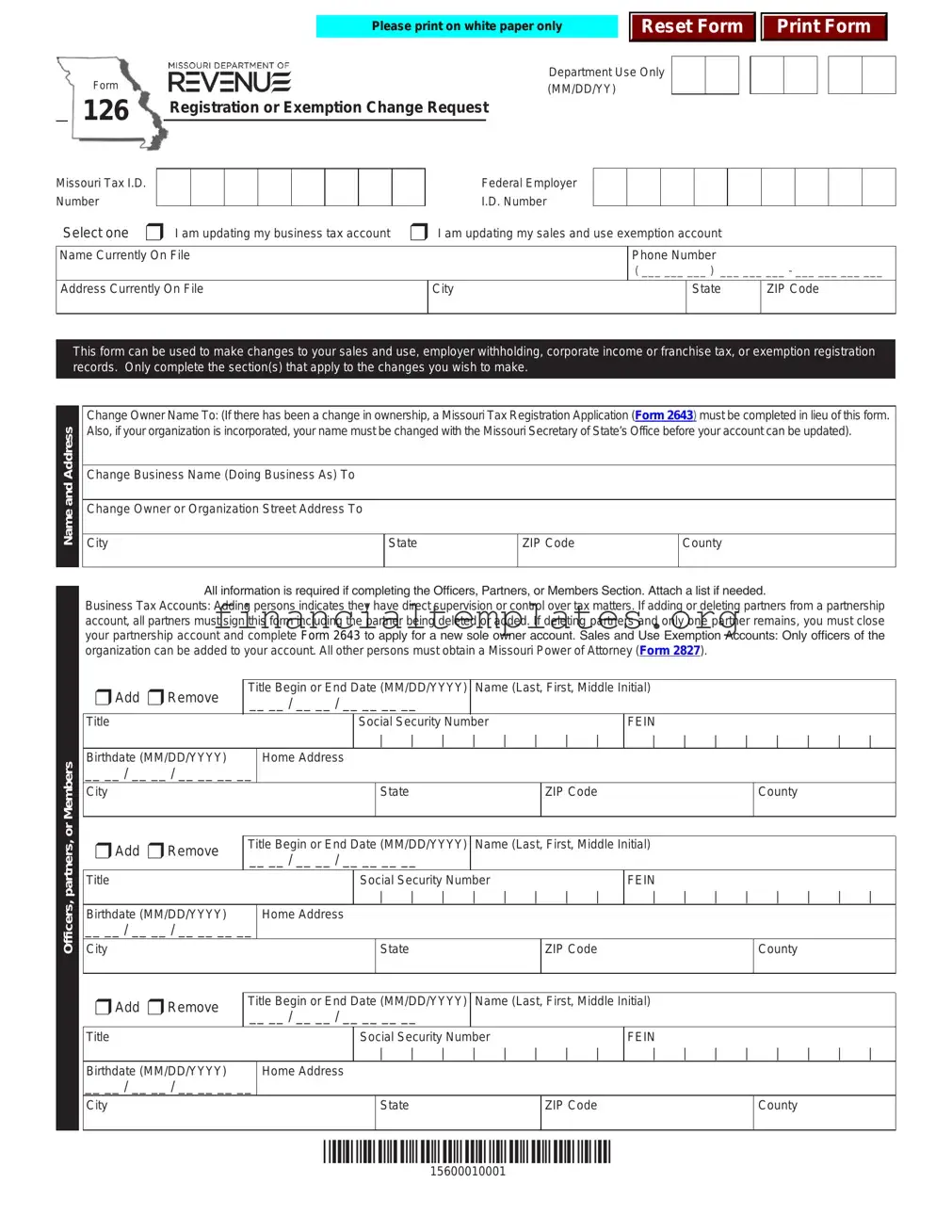

Get State Tax 126 Form

The State Tax 126 form serves as a vital tool for businesses and organizations in Missouri, facilitating the process of making essential updates to their registration or exemption status with the Department of Revenue. Designed with flexibility in mind, this form addresses various changes, such as updates to business tax accounts, sales and use, employer withholding, corporate income, or franchise tax records, and also caters to adjustments in exemption registration records. By meticulously completing only the relevant sections, entities can efficiently communicate alterations in officer or partner information, name changes, or address adjustments. Furthermore, it simplifies the process for adding or removing authorized representatives who have direct supervision or control over tax matters, thereby ensuring these significant updates are accurately reflected in the state's records. Additionally, the form accommodates for the closure or opening of business locations, changes in tax filing frequency, and updates in the nature of the business like the sale of specific taxable items or engaging in activities that affect how taxes are calculated and filed. Businesses are also provided with a section to transition between being a transient and regular employer within the withholding tax system based on their filing history. This comprehensive form, when properly utilized, not only streamlines administrative tasks but also ensures compliance with Missouri's tax laws, thus supporting businesses in maintaining an up-to-date status with the state.

State Tax 126 Example

Please print on white paper only

Reset Form

Print Form

|

Form |

|

|

|

|

|

|

|

|

|

Department Use Only |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

(MM/DD/YY) |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

126 |

|

Registration or Exemption Change Request |

|||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Missouri Tax I.D. |

|

|

|

|

|

|

|

|

|

Federal Employer |

|

|

|

|

|

|

|

|

|

||||||||

Number |

|

|

|

|

|

|

|

|

|

I.D. Number |

|

|

|

|

|

|

|

|

|

||||||||

Select one r I am updating my business tax account |

r I am updating my sales and use exemption account |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name Currently On File |

|

|

|

|

Phone Number |

||||||||||||||||||||||

( ___ ___ ___ ) ___ ___ ___ - ___ ___ ___ ___

Address Currently On File

City

State

ZIP Code

This form can be used to make changes to your sales and use, employer withholding, corporate income or franchise tax, or exemption registration records. Only complete the section(s) that apply to the changes you wish to make.

Officers, partners, or MembersName and Address

Officers, partners, or MembersName and Address

Change Owner Name To: (If there has been a change in ownership, a Missouri Tax Registration Application (Form 2643) must be completed in lieu of this form. Also, if your organization is incorporated, your name must be changed with the Missouri Secretary of State’s Office before your account can be updated).

Change Business Name (Doing Business As) To

Change Owner or Organization Street Address To

City |

State |

ZIP Code |

County |

|

|

|

|

All information is required if completing the Officers, Partners, or Members Section. Attach a list if needed.

Business Tax Accounts: Adding persons indicates they have direct supervision or control over tax matters. If adding or deleting partners from a partnership account, all partners must sign this form including the partner being deleted or added. If deleting partners and only one partner remains, you must close your partnership account and complete Form 2643 to apply for a new sole owner account. Sales and Use Exemption Accounts: Only officers of the organization can be added to your account. All other persons must obtain a Missouri Power of Attorney (Form 2827).

r Add r Remove |

Title Begin or End Date (MM/DD/YYYY) |

Name (Last, First, Middle Initial) |

|

|

|

|

|

|

|

||||||||||

__ __ / __ __ / __ __ __ __ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Title |

|

|

Social Security Number |

|

|

|

|

FEIN |

|

|

|

|

|

|

|

||||

|

|

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

Birthdate (MM/DD/YYYY) |

|

Home Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

__ __ / __ __ / __ __ __ __ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

State |

|

|

|

|

|

ZIP Code |

|

|

|

|

County |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

||||||||||

r Add r Remove |

Title Begin or End Date (MM/DD/YYYY) |

Name (Last, First, Middle Initial) |

|

|

|

|

|

|

|

||||||||||

__ __ / __ __ / __ __ __ __ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title |

|

|

Social Security Number |

|

|

|

|

FEIN |

|

|

|

|

|

|

|

||||

|

|

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

Birthdate (MM/DD/YYYY) |

|

Home Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

__ __ / __ __ / __ __ __ __ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

State |

|

|

|

|

|

ZIP Code |

|

|

|

|

County |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

r Add r Remove |

Title Begin or End Date (MM/DD/YYYY) |

Name (Last, First, Middle Initial) |

|

|

|

|

|

|

|

||||||||||

__ __ / __ __ / __ __ __ __ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title |

|

|

Social Security Number |

|

|

|

|

FEIN |

|

|

|

|

|

|

|

||||

|

|

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

Birthdate (MM/DD/YYYY) |

|

Home Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

__ __ / __ __ / __ __ __ __ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

State |

|

|

|

|

|

ZIP Code |

|

|

|

|

County |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*15600010001*

15600010001

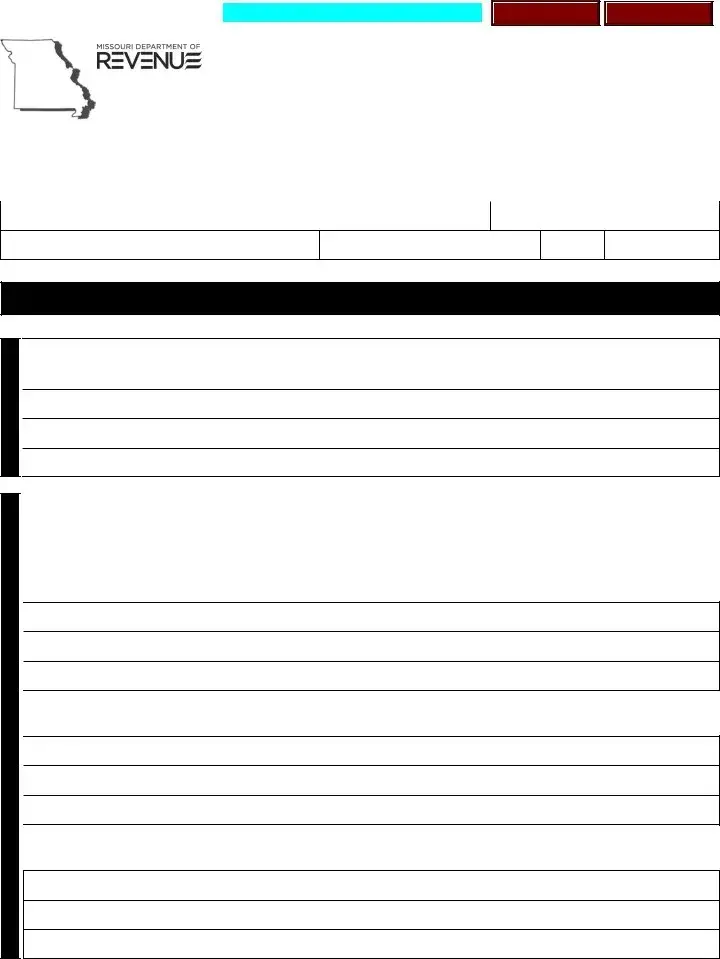

Authorized Representatives

Page 2

All information is required if completing the Authorized Representatives Section. Attach a list if needed.

Business Tax Accounts: Identify all persons who are not a partner, member (L.L.C), or officer of the business that have direct supervision or control over tax matters whom you authorize the Department to discuss your tax matters. All other persons must obtain a Missouri Power of Attorney (Form 2827). Attach a list if needed.

r Add r Remove |

Title Begin or End Date (MM/DD/YYYY) |

|

Name (Last, First, Middle Initial) |

|

|

|

|

||||||

__ __ / __ __ / __ __ __ __ |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||

Title |

|

|

Social Security Number |

|

|

|

|

Birthdate (MM/DD/YYYY) |

|||||

|

|

| |

| |

| |

| |

| |

| |

| |

| |

__ __ / __ __ / __ __ __ __ |

|||

Home Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

State |

|

|

ZIP Code |

|

|

|

|

County |

|||

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||||||

r Add r Remove |

Title Begin or End Date (MM/DD/YYYY) |

|

Name (Last, First, Middle Initial) |

|

|

|

|

||||||

__ __ / __ __ / __ __ __ __ |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||

Title |

|

|

Social Security Number |

|

|

|

|

Birthdate (MM/DD/YYYY) |

|||||

|

|

| |

| |

| |

| |

| |

| |

| |

| |

__ __ / __ __ / __ __ __ __ |

|||

Home Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

State |

|

|

ZIP Code |

|

|

|

|

County |

|||

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||||

r Add r Remove |

Title Begin or End Date (MM/DD/YYYY) |

|

Name (Last, First, Middle Initial) |

|

|

|

|

||||||

__ __ / __ __ / __ __ __ __ |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||

Title |

|

|

Social Security Number |

|

|

|

|

Birthdate (MM/DD/YYYY) |

|||||

|

|

| |

| |

| |

| |

| |

| |

| |

| |

__ __ / __ __ / __ __ __ __ |

|||

Home Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

State |

|

|

ZIP Code |

|

|

|

|

County |

|||

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Close Location Mailing Address

Open Location

Change For: r All Tax Types r Corporate Income and Franchise Tax r Employer Withholding Tax r Sales and Use Tax

In Care Of (Optional) |

|

Company Name if different from owner |

|

|

|

|

|

|

|

|

|

Address |

City |

|

State |

ZIP Code |

County |

|

|

|

|

|

|

Close the following business location for: r Consumer’s Use Tax r Employer Withholding Tax |

r Sales Tax r Vendor’s Use Tax |

||||||||

Business Name |

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

State |

|

|

|

|

|

|

|

|

|

|

|

|

|

ZIP Code |

County |

|

|

|

|

Date of Closing (MM/DD/YYYY) |

|||

|

|

|

|

|

|

__ __ / __ __ / __ __ __ __ |

|||

|

|

|

|

|

|

|

|||

Open the following new business location for: |

r Consumer’s Use Tax |

r Employer Withholding Tax r Sales Tax r Vendor’s Use Tax |

|||||||

|

|

|

|

|

|

|

|

|

|

Business Name |

|

|

|

|

|

|

Taxable Sales Begin Date (MM/DD/YYYY) |

||

|

|

|

|

|

|

___ ___ / ___ ___ / ___ ___ ___ ___ |

|||

Street or Highway Address (Do not use Rural Route or PO Box) |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

City |

|

|

State |

|

ZIP Code |

|

County |

||

|

|

|

|

|

|

|

|

|

|

*15600020001*

15600020001

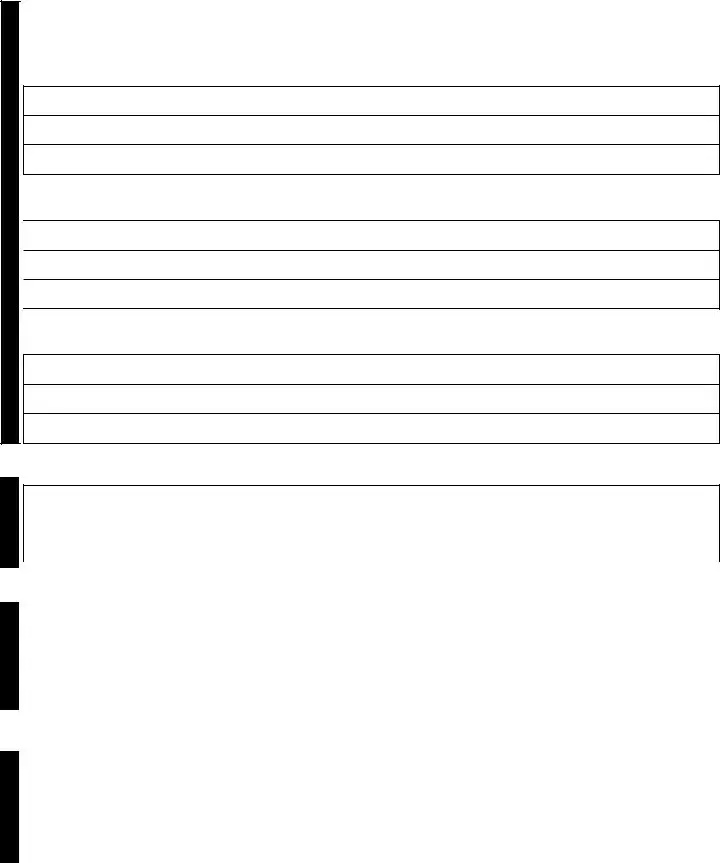

Sales and Use Tax

Page 3

Is this business located inside the city limits of any city or municipality in Missouri? For help determining this visit

mytax.mo.gov/rptp/portal/home/business/salesUseTaxRateInformation r No r Yes - Specify the city:

Is this business located inside a district(s)? For example, ambulance, fire, tourism, community, or transportation development.

rNo r Yes - Specify the district name(s):

Change Sales and Use Tax Filing Frequency To: r Monthly (Over $500 a month) r Quarterly ($500 or less a month)

r Annual (Less than $200 a quarter) |

*Continue current filing until this change is verified by the Department. |

||||

|

|

|

|||

Do you make retail sales of the following items? Select all that apply. |

|

|

|||

r Alcoholic Beverages r Alternative Nicotine r Cigarettes or Other Tobacco Products |

r Domestic Utilities |

||||

r |

r Food Subject to Reduced State Food Tax Rate r Items Qualifying for Show Me Green Sales Tax Holiday |

||||

r Items Qualifying for |

r |

r Lease or Rent Motor Vehicles |

|||

r New Tires |

r |

r Telecommunication Services |

|||

rQualifying Utilities or Items Used or Consumed in Manufacturing or Mining, Research and Development, or Processing Recovered Materials.

Do you make retail sales of aviation jet fuel to Missouri customers? |

r Yes r No |

If yes, are your sales made at: r A Missouri airport r A location outside Missouri and the fuel is transported into Missouri? |

|

If yes, is the airport located in Missouri and identified on the National Plan of Integrated Airport Systems (NPIAS)? |

r Yes r No |

If yes, provide a list of applicable locations. ________________________________________________________________________________

Do you use, store, or consume aviation jet fuel in Missouri where the seller does not collect tax? |

r Yes |

r No |

If yes, is the fuel stored, used, or consumed in an airport that is identified on the NPIAS? |

r Yes |

r No |

If yes, provide a list of applicable locations: ________________________________________________________________________________

|

|

|

|

r I would like to change from a transient employer to a regular employer. |

|

Tax |

|

|

(Must have filed 24 consecutive months in Missouri) |

|

|

|

|

|

|

Withholding |

|

|

Change* Withholding Tax Filing Frequency To: |

|

|

|

r Annually (less than $100 withholding tax per quarter) |

|

|

|

|

r Quarterly ($100 withholding tax per quarter to $499 per month) |

|

|

|

|

r Monthly ($500 to $9,000 withholding tax per month) |

|

|

|

|

|

|

|

|

|

|

r |

|

|

|

|

required to pay electronically) |

Comments

Corporate Income Tax

Change the corporation taxable year end to:

(MM/DD) __ __ / __ __

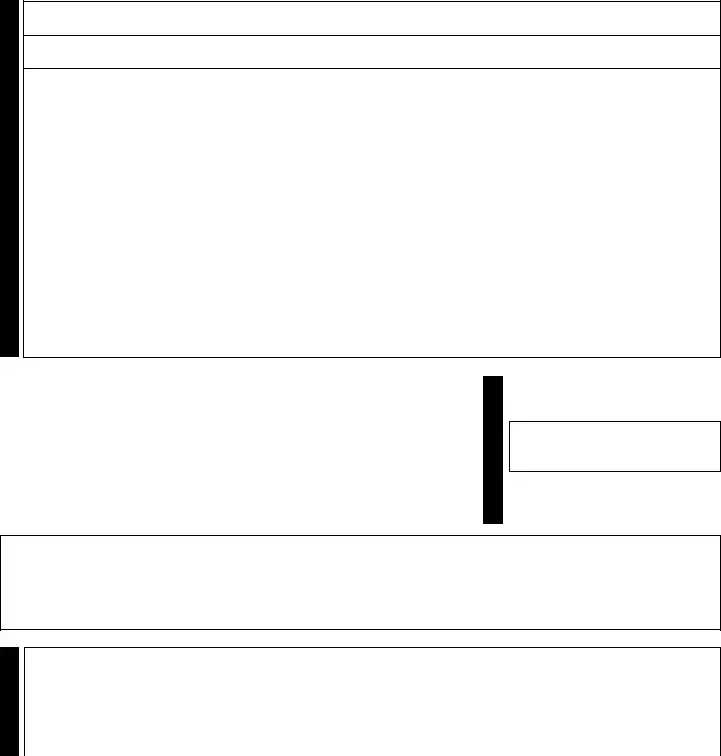

Signature

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct. This form must be signed by the owner, if the business is a sole ownership; partner, if the business is a partnership; reported officer, if the business is a corporation, or by a member, if the business is an L.L.C. as reported on the application.

Signature |

Printed Name |

|

|

Title |

Date (MM/DD/YYYY) |

|

___ ___ / ___ ___ / ___ ___ ___ ___ |

|

|

Registration Change

Mail to: Taxation Division P.O. Box 3300

Jefferson City, MO

Exemption Change

Mail to: Taxation Division P.O. Box 358

Jefferson City, MO

|

Form 126 (Revised |

|

Phone: (573) |

*15600030001* |

|

TTY: (800) |

15600030001 |

|

Fax: (573) |

||

|

Phone: (573)

TTY: (800)

Fax: (573)

Ever served on active duty in the United States Armed Forces?

If yes, visit dor.mo.gov/military/ to see the services and benefits we offer to all eligible military individuals. A list of all state agency resources and benefits can be found at

Document Specifics

| Fact Name | Detail |

|---|---|

| Form Title | Registration or Exemption Change Request Form 126 |

| Purpose | To update business tax or sales and use exemption accounts |

| Acceptable Changes | Changes allowed for sales and use, employer withholding, corporate income or franchise tax, or exemption registration records |

| Relevant Sections to Complete | Only sections relevant to the changes being requested need to be completed |

| Ownership or Name Changes | Requires a Missouri Tax Registration Application (Form 2643) for ownership changes or if incorporated, name change must be done with the Missouri Secretary of State’s Office |

| Account Modifications | Addition or removal of individuals having direct supervision or control over tax matters, with specific guidance for business tax and sales and use exemption accounts |

| Location Changes | Options to close existing business locations for specific tax types, or open new ones |

| Governing Law | Missouri state law, as applied by the Missouri Department of Revenue |

Guide to Writing State Tax 126

Filling out the State Tax 126 form is a necessary process for businesses that need to update their tax account information with the Missouri Department of Revenue. This includes changes to sales and use, employer withholding, corporate income or franchise tax registrations, or updates to exemption records. It's essential to provide accurate and current information to ensure compliance with state tax laws. Below are the steps to complete this form correctly.

- Obtain a blank copy of the State Tax 126 form, ensuring it's printed on white paper.

- Enter the date on which you are filling out the form under "Form Department Use Only (MM/DD/YY)."

- Select the type of update you are making: updating your business tax account or your sales and use exemption account. Mark the appropriate box.

- Fill in the current information about your business, including the Missouri Tax I.D. Number, Federal Employer Number (I.D. Number), Name Currently On File, Phone Number, Address, City, State, and ZIP Code.

- In the section titled "Name and Address Change," update any changes to the owner's name, the business name (Doing Business As), or the business address. Include city, state, ZIP code, and county for the address changes.

- For the "Officers, Partners, or Members Section," add or remove any individuals as needed by marking the appropriate box and providing their titles, names, Social Security Numbers or FEIN, birthdates, and home addresses. Repeat these steps for each individual being added or removed.

- In the "Authorized Representatives Section," identify individuals not listed as partners, members, or officers who are authorized to discuss tax matters with the Department, providing their titles, names, Social Security Numbers, birthdates, and addresses as required. Attach a list if there are more than the form allows.

- Complete the "Location Changes" section if you are opening or closing a business location for any of the tax types listed, providing all requested details including business name, address, city, state, ZIP code, and the date of opening/closing.

- Under "Sales and Use Tax," answer questions regarding the business's location, applicable districts, filing frequency, types of items sold, and specifics about aviation jet fuel if relevant.

- For "Withholding Tax," indicate if you are changing from a transient employer to a regular employer and update the filing frequency as necessary.

- In the "Corporate Income Tax" section, update the corporation's taxable year-end if needed.

- Sign and date the form at the bottom, providing your printed name and title. Ensure that the person signing the form is authorized to do so by their position within the company.

- Review the form for accuracy, then mail it to the appropriate address listed at the bottom of the form based on the type of change you are making: Taxation Division for registration changes or Exemption changes.

By following these steps, you can successfully update your business's tax account or exemption records with the Missouri Department of Revenue. Ensure all information is complete and correct before submitting to avoid delays or issues with your tax status.

Understanding State Tax 126

What is the purpose of the State Tax 126 form in Missouri?

The State Tax 126 form is designed for businesses operating in Missouri to request changes to their registration or exemption details. This includes updates to sales and use, employer withholding, corporate income or franchise tax, or exemption registration records. It's a multipurpose form that caters to various adjustments a business might need to make, such as changes in business name, ownership, address, or adding and removing authorized representatives and partners.

Can the State Tax 126 form be used to register a new business?

No, the State Tax 126 form is specifically for updating information for existing registered businesses or organizations. If there's a change in ownership, a new Missouri Tax Registration Application (Form 2643) must be completed. For new business registrations, Form 2643 should be used instead.

How should changes in business ownership be reported on the State Tax 126 form?

If there's a change in the business ownership, the appropriate section in the form should be filled out. Notably, if the change involves a complete transfer of ownership, Form 2643 is required instead of the State Tax 126 form. Additionally, any changes in corporate names must be updated with the Missouri Secretary of State’s Office before the account can be updated.

Who is required to sign the State Tax 126 form?

The State Tax 126 form must be signed by a person with appropriate authority within the business. This could be the owner if the business is a sole proprietorship, a partner in a partnership, a reported officer in a corporation, or a member if the business is an LLC, as indicated on their application. This ensures that the person requesting the change has the authority to do so.

What is the procedure for adding or removing officers, partners, or members from a business's tax account using the State Tax 126 form?

For adding or removing individuals who have direct supervision or control over tax matters, the relevant sections of the form must be filled out. This includes providing their title, name, Social Security Number (SSN) or Federal Employer Identification Number (FEIN), and their home address. If removing partners from a partnership account, all partners, including the one being removed, must sign the form. If only one partner remains, the partnership account must be closed, and a new sole owner account needs to be opened with Form 2643.

When updating the Sales and Use Tax filing frequency on the State Tax 126 form, what options are available?

Businesses can choose to update their Sales and Use Tax filing frequency to monthly, quarterly, or annually based on their tax liability and the volume of their tax transactions. The form provides specific criteria for each frequency to guide businesses in making the right choice that matches their transaction volumes and tax owed.

Can the State Tax 126 form be submitted electronically?

Instructions for submitting the State Tax 126 form are not explicitly detailed in the provided content. Typically, state tax forms can be mailed or submitted online, depending on the state's procedures. It is advisable to contact the Missouri Department of Revenue or refer to their official website for specific submission guidelines and options, including whether electronic submission is available.

Is there a section on the State Tax 126 form to report changes in business locations?

Yes, the form includes sections for reporting the opening or closing of business locations. Businesses must provide details such as the type of tax the location was associated with, the address, and the date of closing or the beginning date for taxable sales at a new location. This ensures accurate tax reporting and compliance related to multiple business locations.

How does a business change its tax filing frequency for Employer Withholding Tax using the State Tax 126 form?

A section on the form allows businesses to select a new filing frequency for Employer Withholding Tax. The choices range from annually for businesses with less than $100 withholding tax per quarter to quarter-monthly for those with over $9,000 withholding tax per month. This lets businesses adjust their filing frequency to match their payroll tax responsibilities more accurately.

Where should one send the completed State Tax 126 form?

Completed forms should be mailed to specific addresses depending on the type of change being requested. For registration changes, the form should go to the Taxation Division P.O. Box 3300, Jefferson City, MO 65105-3300. For exemption changes, it should be sent to P.O. Box 358, Jefferson City, MO 65105-0358. This ensures that the form reaches the appropriate department for processing.

Common mistakes

Filling out the State Tax 126 form requires careful attention to detail. Mistakes on this form can lead to delays or issues with your registration or exemption status. Here are some common mistakes to avoid:

- Failing to use white paper for printing the form. The instruction clearly specifies the need for white paper, which is crucial for scanning and record-keeping purposes.

- Not completing the appropriate sections that apply to your specific changes. The form is designed to address multiple types of updates, and completing only the relevant parts ensures clarity and prevents processing delays.

- Omitting the signature and date at the end of the form. This form must be signed by an authorized individual, such as the business owner, partner, or reported officer, to verify the authenticity of the information provided.

- Forgetting to change the business name with the Missouri Secretary of State’s Office before submitting this form for businesses that are incorporated. This step is necessary for corporate entities to ensure consistency across government records.

- Inaccurately adding or removing officers, partners, or members without providing all required information or without ensuring that all changes are authorized and documented as per the guidelines outlined in the form.

- Neglecting to specify the correct address and contact information changes. It's essential to provide accurate and current details to ensure the Missouri Department of Revenue can communicate effectively with your business.

While these mistakes can be common, they are also avoidable. By closely reviewing the instructions and requirements on the State Tax 126 form, businesses can ensure their submissions are correct and complete. This attention to detail supports smoother updates to your tax account or exemption status and contributes to the efficient operation of your business affairs within the state.

Documents used along the form

When handling the State Tax 126 form, used for updating various business tax accounts or exemption registrations in Missouri, it's practical to be familiar with other forms and documents that are often needed to complete the process comprehensively. The ability to identify and prepare these additional documents ensures that all aspects of a business's tax or exemption status are accurately recorded and updated with the state authorities. Each document serves a specific purpose, contributing to the clarity and accuracy of a business's financial and operational records.

- Form 2643 - Missouri Tax Registration Application: Required when there is a change in business ownership. This form establishes a business's tax accounts under the new ownership.

- Form 2827 - Missouri Power of Attorney: Allows a business to authorize another person to discuss and handle its tax matters with the Department, necessary when adding individuals who are not officers or partners but have direct control over tax matters.

- Form MO-1NR - Income Tax Payments for Nonresident Individuals: Needed by nonresident individuals associated with the business, ensuring their tax payments are correctly allocated to Missouri.

- Form 126 (Page 2) - Authorized Representatives Section: Part of the State Tax 126 form itself, it is crucial for identifying who can represent the business in matters concerning its tax accounts.

- Form MO-W3 - Transmittal of Tax Statements: Provides a summary of wages and taxes withheld for employees, necessary for businesses with employer withholding tax obligations.

- Form 941 - Employer's Quarterly Federal Tax Return: While a federal form, it's essential alongside state documents to reconcile federal withholding responsibilities with state tax obligations.

- Form MO-PTS - Property Tax Credit Claim: Relevant for businesses that hold real estate property, offering a credit for a portion of the property taxes they've paid.

Collectively, these documents support and often complement the information provided in the State Tax 126 form, ensuring businesses not only comply with tax reporting and payment requirements but also take advantage of applicable exemptions and credits. Being adept at navigating these forms, understanding their relevance, and knowing when they are required is indispensable for maintaining good standing with tax authorities and for the smooth operation of businesses in Missouri.

Similar forms

The State Tax 126 form closely resembles the Federal Form W-4, Employee's Withholding Certificate, in function as both are instrumental in updating tax information. Just as Form W-4 allows employees to adjust their income tax withholding preferences based on marital status, dependents, and other income, Form 126 enables businesses to update their tax account or exemption details. These updates can cover a gamut of changes including but not limited to, business name, address, and the addition or removal of officers or partners who have significant control over the tax matters of the entity.

Similarly, Form 8822-B, Change of Address or Responsible Party — Business, issued by the IRS, shares a purpose with the State Tax 126 form. Both documents serve the role of officially communicating changes in address or in the individuals responsible for the entity. This ensures that tax documents and communications are properly directed, helping maintain compliance and streamline operations. The similarity underscores the necessity for businesses to keep tax authorities updated on their current operating status and contact information.

Form 2643, Missouri Tax Registration Application, is a precursor to Form 126 in many aspects. While Form 2643 is used for the initial application for tax registration in Missouri, Form 126 is utilized for subsequent amendments to that registration. If there's a change in ownership, for instance, Form 126 dictates that Form 2643 must be filled out anew, highlighting the interconnectedness of these forms in maintaining accurate tax records and accounts for business entities.

The Missouri Power of Attorney (Form 2827) shares a functional similarity with certain aspects of Form 126. Specifically, when updates require designating individuals other than partners, members, or officers to oversee tax matters, Form 2827 becomes necessary. This parallels the section in Form 126 for adding authorized representatives, signifying the trust placed in these individuals to manage sensitive tax-related duties and discussions on behalf of the business.

The Uniform Commercial Code (UCC) Financing Statement, although primarily relating to secured transactions, shares a common feature with Form 126 regarding the notification of changes. Just as amendments to a UCC filing alert parties about changes in collateral or debtor information, updates via Form 126 inform the tax authority about changes in business particulars or tax status, maintaining the clarity and accuracy of official records.

Business Registration forms across various states, akin to Form 126, serve to register or update information about businesses within a given jurisdiction. These forms often capture similar details such as changes in business name, address, and responsible parties, underscoring the universal need for governments to maintain current data on the businesses operating within their borders for regulatory and taxation purposes.

The Sales and Use Tax Exemption Certificate parallels Form 126's section on updating sales and use exemption accounts. Companies use these certificates to document their entitlement to exemption from sales tax on particular purchases. When there's a need to update the information related to such exemptions, Form 126 provides a streamlined method for businesses in Missouri to ensure their exemption status is accurately reflected in state records.

Form SS-4, Application for Employer Identification Number (EIN), shares similarities with parts of Form 126 concerning the Federal Employer Identification Number (FEIN). While Form SS-4 is used to initially apply for an EIN, businesses may need to reference their EIN on Form 126 when reporting changes to the Missouri Department of Revenue. This demonstrates the interaction between federal and state tax operations, with accurate identification numbers being crucial for tracking and compliance.

The Change of Registration Information (CORI) form, used in various contexts, functions much like the State Tax 126 form by allowing entities to update their registered information with an authoritative body. In the business context, such updates may relate to administrative changes that could affect regulatory compliance, much like how Form 126 enables updates for tax purposes.

Lastly, the Articles of Amendment forms, used by corporations and LLCs to officially update their formation documents, resemble the function of Form 126 in the context of updating a business's structural or operational details with the state. Both are pivotal in ensuring that the state holds the most current and correct information about a business, affecting everything from taxation to legal recognition and compliance.

Dos and Don'ts

When filling out the State Tax 126 form, certain practices can ensure the process is smooth and error-free. Below are detailed guidelines on what you should and shouldn't do:

Do:- Print on white paper only: This requirement ensures readability and consistency in the submission process.

- Complete only applicable sections: If a section doesn't apply to your situation, there's no need to fill it out. This keeps the form tidy and focused.

- Use accurate and current information: Ensure all details, including names and addresses, are current and correctly entered.

- Attach additional lists if needed: Some sections might require you to list multiple individuals or addresses. If space is insufficient, attach a separate list clearly labeled and referenced in the form.

- Sign the form: A signature is required to validate the form. Without it, your submission may be considered incomplete.

- Visit the website for help: For guidance on certain questions or sections, utilize the resources available on the official website.

- Check the filing requirements: Based on your business activity, ensure you're aware of the filing frequency and comply accordingly.

- Report accurate tax information: Whether it’s sales tax, use tax, or withholding tax, the numbers reported should be precise to avoid penalties.

- Mail to the correct address: Verify the correct mailing address for whether you're requesting a Registration Change or an Exemption Change.

- Keep a copy for your records: Before sending, make a copy of the completed form for your records. This can be helpful for future reference or in case of disputes.

- Fill out the form in a hurry: Take your time to read through each section carefully to avoid mistakes.

- Guess on dates or figures: Ensure all dates, figures, and other specifics are accurate. Guessing can lead to errors that might complicate your tax situation.

- Use pencil or non-permanent ink: All entries should be made in permanent ink to prevent alterations or fading over time.

- Omit the signature: Skipping the signature can invalidate your entire submission. Ensure the form is signed by the authorized individual.

- Ignore the requirements for additional signatures: If adding or removing partners, all must sign the form to validate the change.

- Use outdated information: Using old addresses or incorrect ID numbers can lead to processing delays or other issues.

- Submit incomplete forms: Leaving sections incomplete, when applicable, can cause your form to be returned for corrections.

- Forget to attach required lists: If the form instructs you to attach a list, failure to do so can result in incomplete processing.

- Overlook the change verification process: After submitting changes, there may be a verification process before they take effect.

- Fail to review the entire form before submission: A quick review can catch errors or omissions that could complicate your tax filings.

Misconceptions

When dealing with the State Tax 126 form, specifically in Missouri, it's easy to find oneself entangled in a web of misconceptions. These misunderstandings can complicate the process of updating or altering business and exemption registration records. Let's clear the air on some of these common misconceptions:

- Misconception 1: The State Tax 126 form is only for updating business names or addresses.

- Misconception 2: Completing all sections of the form is required for any change request.

- Misconception 3: Changes in ownership do not require any additional paperwork beyond the State Tax 126 form.

- Misconception 4: Any individual related to the business can be added to or removed from sales and use exemption accounts.

- Misconception 5: Social Security Numbers (SSNs) and FEINs are optional for officer, partner, or member changes.

- Misconception 6: The form is only submitted to one location, regardless of the type of change.

- Misconception 7: Only businesses located outside city limits need to specify their location regarding sales tax questions.

This is incorrect. While the form is indeed used for updating business names and addresses, its purposes extend much further. It covers changes across sales and use, employer withholding, corporate income or franchise tax, and exemption registration records. Every section is designed for specific updates, indicating the form’s comprehensive utility.

Actually, only the sections relevant to the specific changes you wish to make need to be completed. This modular design allows for a streamlined process, focusing only on applicable updates without the need for unnecessary information.

Contrary to this belief, a change in ownership necessitates completing a Missouri Tax Registration Application (Form 2643), rather than merely updating the 126 form. Furthermore, for incorporated organizations, the business name must be changed with the Missouri Secretary of State’s Office before account updates can occur.

This is not entirely accurate. The form specifies that only officers of the organization can be directly added to these accounts. All other individuals must obtain a Missouri Power of Attorney (Form 2827) to be authorized for addition or removal.

In reality, the form requires SSNs and FEINs (if applicable) when adding or removing officers, partners, or members from a business’s tax accounts. This policy ensures accurate identification and verification of individuals for tax purposes.

There are actually two separate mailing addresses: one for registration changes and another for exemption changes. This distinction helps direct the form to the appropriate department, facilitating a quicker and more efficient update process.

Both businesses inside and outside city limits must address location-specific questions on the form, especially regarding sales and use tax. This information aids in determining the correct tax obligations, including applicable city or district taxes.

Understanding the actual procedures and requirements can significantly streamline the process of filling out the State Tax 126 form. By dispelling these misconceptions, businesses can ensure their records are accurately and efficiently updated, facilitating smoother operations and compliance with Missouri’s tax regulations.

Key takeaways

The State Tax 126 form is an essential document for businesses in Missouri to update various tax records. Here are some key takeaways regarding the use and filling out of this form:

- It is necessary to use white paper only when printing this form to ensure that all the details are legible and that the form is processed accurately by the taxation department.

- Form 126 is versatile and can be used for changes to your sales and use, employer withholding, corporate income or franchise tax, or exemption registration records. This means you do not need separate forms for each tax change, simplifying the process.

- Specific sections of the form should be completed based on the changes you want to make. Therefore, it's crucial not to fill out the entire form but only the parts that apply to your specific update requirements.

- If there has been a change in ownership, a different form, the Missouri Tax Registration Application (Form 2643), must be filled out instead. This highlights the need to understand the nature of your update to select the correct form.

- Updating your business name with the Missouri Secretary of State’s Office is required before submitting this form for a name change. This ensures that all legal documents and registrations reflect the current name of your business.

- You can add or remove officers, partners, or members for your business tax accounts by completing the relevant section, signifying any new people having direct supervision or control over tax matters.

- To authorize other individuals who are not partners, members, or officers but have direct supervision or control over tax matters, you must fill out the Authorised Representatives Section or obtain a Missouri Power of Attorney (Form 2827).

- The form allows for changes to be made for specific tax types, including closing or opening a business location for various taxes such as Consumer’s Use Tax, Employer Withholding Tax, Sales Tax, and Vendor’s Use Tax. This is particularly important for businesses undergoing structural changes, relocations, or expansions.

Upon completing the form, it must be signed by the appropriate representative of the business based on its structure, such as an owner, partner, reported officer, or member. This ensures that the information provided is verified and legally binding. Additionally, there are different mailing addresses for registration changes and exemption changes, so it's crucial to send your completed form to the correct address to avoid any processing delays.

In conclusion, the State Tax 126 form is a critical document for maintaining accurate and up-to-date tax records for businesses in Missouri. Understanding how to correctly fill out and use this form is fundamental for compliance with state taxation requirements.

Popular PDF Documents

Non Profit Donation Receipt Example - Facilitates donations in memory of or in honor of individuals, adding a personal dimension to the act of giving.

Arizona Tpt - Businesses involved in advertising have a dedicated section ensuring they meet their specific tax reporting obligations.